Global Construction Aggregates Market Size, Share, And Business Benefits By Product Type (Crushed Stone, Sand, Gravel, Slag, Recycled Aggregates, Others), By Application (Unbound Applications, Asphalt, Ready Mix, Mortar, Precast Concrete, Others), By End-use (Residential, Commercial, Infrastructure, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 145922

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

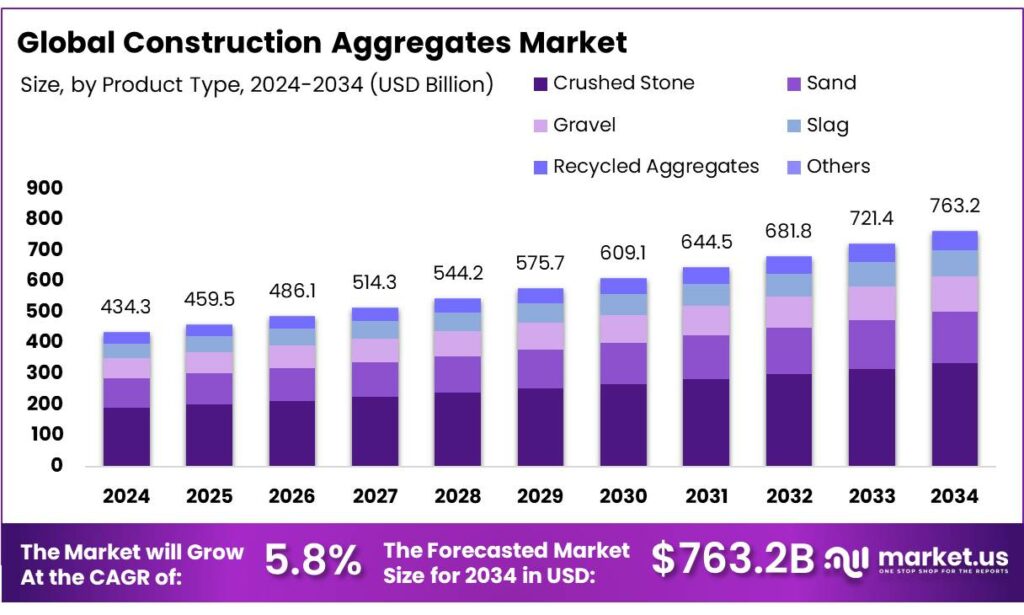

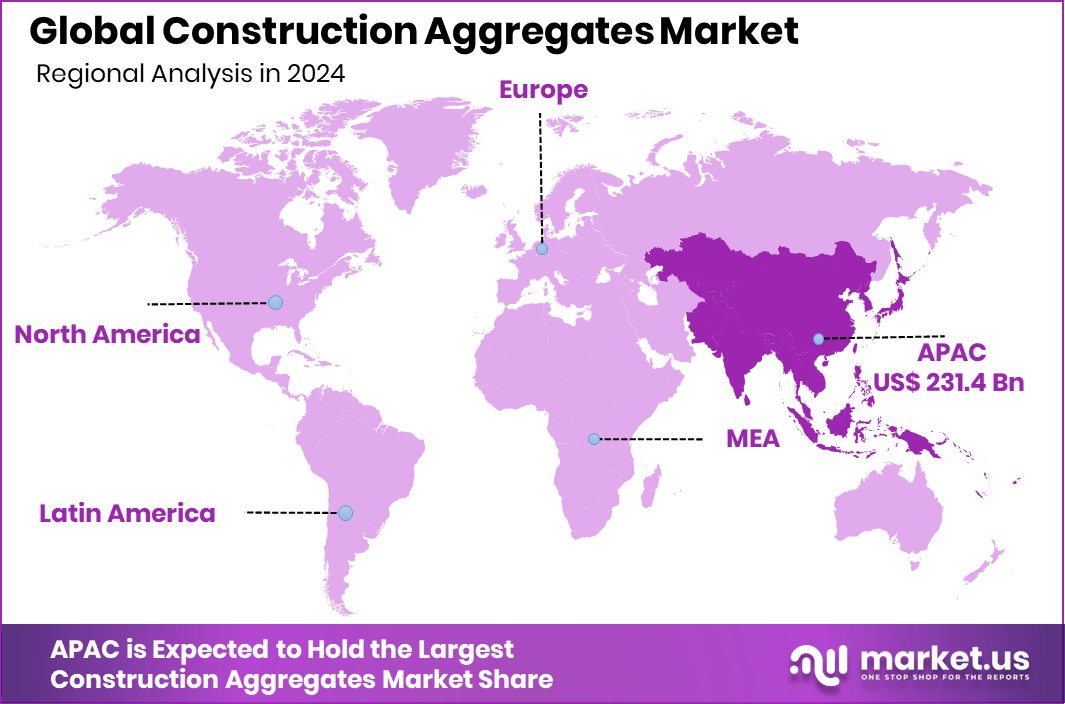

Global Construction Aggregates Market is expected to be worth around USD 763.2 billion by 2034, up from USD 434.3 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. With USD 231.4 Bn valuation, Asia-Pacific secures 53.30% construction aggregates market dominance.

Construction aggregates are raw materials used in building and infrastructure projects. These include crushed stone, sand, gravel, recycled concrete, and slag. Aggregates provide structural support, stability, and drainage in roads, bridges, buildings, and railways. They are fundamental to concrete, asphalt, and other construction mixtures.

This growth trajectory is primarily driven by the Indian government’s substantial investments in infrastructure. The National Infrastructure Pipeline (NIP), initiated in 2020, aims to invest USD 1.4 trillion across 9,142 projects spanning 34 sub-sectors, with a significant portion allocated to transportation infrastructure, including roads and bridges. Additionally, initiatives like the Pradhan Mantri Awas Yojana (PMAY) have facilitated the construction of over 20 million affordable housing units by 2023, further escalating the demand for construction aggregates.

The construction aggregates market refers to the global trade and consumption of various types of aggregates used in construction. This market is driven by construction activities in residential, commercial, and infrastructure projects. Urbanization, population growth, and government investments in roads and smart cities continue to increase the demand for these materials.

Infrastructure expansion is the leading growth factor for this market. Governments worldwide are investing in roads, highways, airports, and metros. Emerging economies are witnessing rapid urban development, increasing the need for raw materials like aggregates. Additionally, the push for smart cities and sustainable housing projects fuels aggregate demand further.

Key Takeaways

- Global Construction Aggregates Market is expected to be worth around USD 763.2 billion by 2034, up from USD 434.3 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- Crushed Stone held a dominant market position, capturing more than a 43.9% share of the construction aggregates market.

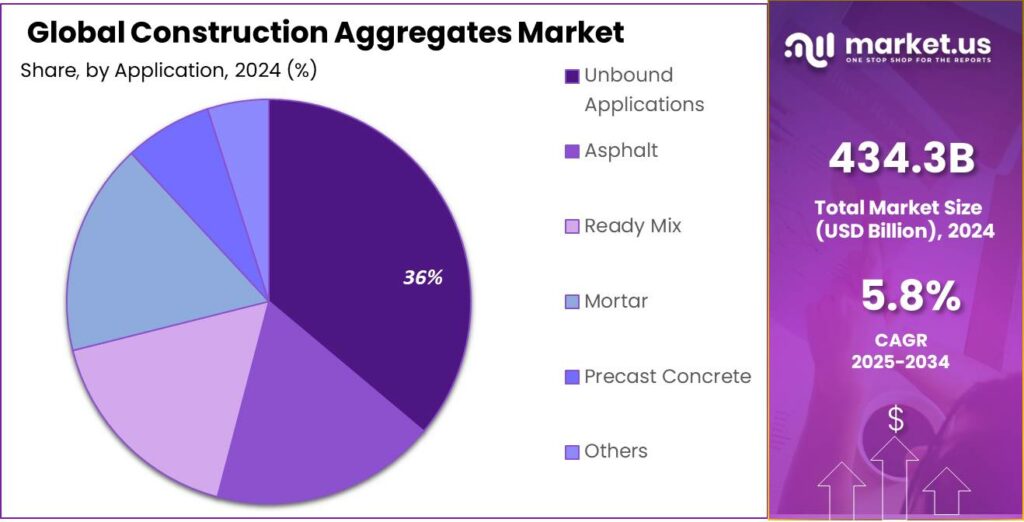

- Unbound Applications held a dominant market position, capturing more than a 36.1% share of the construction aggregates market.

- Infrastructure held a dominant market position, capturing more than a 54.2% share of the construction aggregates market.

- Holding 53.30% market share, Asia-Pacific leads construction aggregates at USD 231.4 Bn.

By Product Type Analysis

Crushed Stone Leads with 43.9% Market Share in 2024 Due to High Demand in Infrastructure Projects

In 2024, Crushed Stone held a dominant market position, capturing more than a 43.9% share of the construction aggregates market. This dominance is primarily driven by the increased demand for crushed stone in large-scale infrastructure projects such as roads, bridges, and buildings.

Crushed stone is preferred for its durability, versatility, and availability, making it a go-to material for construction and civil engineering projects worldwide. With rapid urbanization and growing infrastructure development, particularly in emerging markets, the demand for crushed stone is expected to continue rising through 2025. Its affordability and wide application in both commercial and residential construction further solidify its leading position in the market.

By Application Analysis

Unbound Applications Dominates with 36.1% Share in 2024 Due to High Demand in Road and Pavement Projects

In 2024, Unbound Applications held a dominant market position, capturing more than a 36.1% share of the construction aggregates market. This sector benefits greatly from the use of aggregates in road base construction, pavements, and other infrastructure projects where materials are laid without binding agents. Unbound applications are favored for their cost-effectiveness and ease of installation, making them essential in large-scale construction projects, especially in regions undergoing rapid urbanization and infrastructural development.

As transportation networks expand and urbanization continues to grow, the demand for unbound aggregates is expected to increase steadily through 2025, maintaining a strong market share. These applications are also seen as more sustainable in certain settings, which aligns with the growing focus on environmentally conscious building practices.

By End-use Analysis

Infrastructure Dominates with 54.2% Share in 2024, Driven by Strong Demand for Roads and Bridges

In 2024, Infrastructure held a dominant market position, capturing more than a 54.2% share of the construction aggregates market. The growing demand for aggregates in infrastructure projects, particularly in the construction of roads, bridges, highways, and public utilities, has been a major driver of this segment’s growth. As global urbanization accelerates, the need for improved transportation networks and essential infrastructure continues to rise, propelling the consumption of aggregates.

This sector remains the largest end-use for construction aggregates, as governments and private companies focus on expanding and upgrading infrastructure to meet the needs of growing populations. The dominance of infrastructure is expected to continue through 2025, with significant investments in construction and urban development projects worldwide.

Key Market Segments

By Product Type

- Crushed Stone

- Sand

- Gravel

- Slag

- Recycled Aggregates

- Others

By Application

- Unbound Applications

- Asphalt

- Straight-run Asphalt

- Hard Grade Asphalt

- Oxidized Asphalt

- Cutback Asphalt

- Emulsion Asphalt

- Polymer Modified Asphalt

- Others

- Ready Mix

- Transit Mixed Concrete

- Shrink Mixed Concrete

- Central Mixed Concrete

- Mortar

- Precast Concrete

- Others

By End-use

- Residential

- Single Family

- Multi Family

- Commercial

- Office Buildings

- Retail Spaces

- Hospitality

- Healthcare

- Others

- Infrastructure

- Roadways

- Roads

- Bridges

- Tunnels

- Others

- Aviation

- Railroad

- Water Supply and Resources

- Power and Energy

- Waste Management

- Others

- Roadways

- Industrial

- Manufacturing

- Warehouse and Distribution

- Flex Space

Driving Factors

Growing Infrastructure Projects Fuel Aggregate Demand

One of the key driving factors for the Construction Aggregates Market is the growing number of infrastructure development projects around the world. Governments are spending more on building roads, highways, railways, airports, and bridges to boost economic growth and improve connectivity. These projects require huge quantities of crushed stone, sand, and gravel for foundations, concrete mixing, and road layers.

Emerging economies like India, China, and Brazil are especially investing in urban development and smart city plans, which further push the demand. With population growth and rapid urbanization, the need for strong, durable, and cost-effective materials like construction aggregates is increasing, making infrastructure growth a major force behind the market’s steady expansion.

Restraining Factors

Environmental Concerns Limit Aggregate Extraction Activities

One major restraining factor for the Construction Aggregates Market is rising environmental concerns and strict mining regulations. The extraction of natural aggregates like sand, gravel, and crushed stone often leads to land degradation, deforestation, water pollution, and loss of biodiversity. As a result, many governments and environmental bodies are tightening regulations around quarrying and mining operations.

Delays in getting environmental clearances and increased compliance costs are making it difficult for companies to operate freely. These restrictions can limit supply and increase operational costs. Additionally, local opposition to mining activities near residential or protected areas adds further challenges.

Growth Opportunity

Rising Use of Recycled Aggregates Boosts Growth

A major growth opportunity in the Construction Aggregates Market is the increasing use of recycled aggregates. As environmental awareness grows and natural resources become limited, many construction companies are turning to sustainable options. Recycled aggregates, made from crushed concrete, asphalt, and demolition waste, offer a cost-effective and eco-friendly alternative to traditional materials.

These recycled materials help reduce the need for new mining operations, lower transportation costs, and cut down on landfill waste. Governments in several countries are also encouraging the use of recycled aggregates in public infrastructure projects through favorable policies and incentives.

Latest Trends

Smart Technologies Transform Aggregate Production Processes

A significant trend in the Construction Aggregates Market is the adoption of smart technologies to enhance production efficiency and sustainability. Companies are increasingly integrating automation, artificial intelligence (AI), and digital tools into their operations.

For instance, the use of AI and Building Information Modeling (BIM) is becoming more prevalent, allowing for better planning and resource management in construction projects. Additionally, technologies like Virtual and Augmented Reality (VR/AR) are being utilized to improve design accuracy and worker training.

These advancements not only streamline operations but also contribute to reducing environmental impact. The shift toward digitalization is driven by the need to improve productivity, reduce costs, and meet environmental regulations. As the industry continues to evolve, the integration of smart technologies is expected to play a crucial role in shaping the future of aggregate production and the broader construction sector.

Regional Analysis

Asia-Pacific dominates the construction aggregates market with a 53.30% share, worth USD 231.4 Bn.

In 2024, Asia-Pacific held a dominant position in the global Construction Aggregates Market, accounting for 53.30% of the total market share and reaching a valuation of USD 231.4 billion. This strong regional lead is primarily driven by rapid urbanization, population growth, and large-scale infrastructure development across countries like China, India, and Southeast Asian nations. Continuous investments in highways, smart cities, metro rail projects, and commercial real estate have significantly increased the demand for construction aggregates.

North America and Europe also contributed notable shares, driven by infrastructure repair, modernization of transport systems, and housing redevelopment. The Middle East & Africa region witnessed moderate growth, supported by new construction projects in the UAE, Saudi Arabia, and South Africa. Meanwhile, Latin America showed gradual expansion due to increased investment in urban infrastructure and road connectivity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Martin Marietta Materials is a prominent supplier of construction aggregates and heavy building materials, with operations across 28 U.S. states, Canada, the Bahamas, and the Caribbean Islands. While the company primarily focuses on infrastructure and building materials, it has diversified interests in specialty chemicals, including magnesia-based products. However, there is no publicly available information indicating Martin Marietta’s direct involvement in the caprylic acid market.

Vulcan Materials Company is a leading producer of construction aggregates and materials in the United States. The company operates over 300 facilities across 22 states, providing essential materials for infrastructure projects. Despite its significant presence in the building materials sector, there is no publicly available information suggesting Vulcan Materials’ direct participation in the caprylic acid market.

Heidelberg Materials is a leading global building materials company, operating in over 50 countries. The company produces cement, aggregates, and ready-mix concrete, serving the construction industry. While Heidelberg Materials is a significant player in the building materials sector, there is no publicly available information indicating its direct participation in the caprylic acid market.

Top Key Players in the Market

- Martin Marietta Materials, Inc.

- Vulcan Materials Company

- Holcim Group

- CEMEX S.A.B. de C.V.

- Heidelberg Materials

- CRH Americas Materials, Inc.

- Rogers Group Inc

- Colas Group

- Knife River Corporation

- Mulzer Crushed Stone, Inc.

- Boral Industries Inc.

- Stalite

- Arcosa, Inc.

- Vicat

- Granite Infrastructure Canada, Ltd.

- Other Key Players

Recent Developments

- In July 2024, CEMEX entered into a joint venture to produce and distribute aggregates like sand, gravel, and limestone in the U.S. Mid-South region. This partnership aims to bolster CEMEX’s aggregate reserves and support its growth strategy in the U.S. market.

- In 2024, Heidelberg Materials reported a revenue of approximately €22.5 billion, with a net profit of €1.2 billion. The company is actively involved in carbon capture and utilization projects, such as the joint venture with Linde to build the world’s first large-scale carbon capture facility at its Lengfurt cement plant in Germany, scheduled to start operations in 2025.

Report Scope

Report Features Description Market Value (2024) USD 434.3 Billion Forecast Revenue (2034) USD 763.2 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Crushed Stone, Sand, Gravel, Slag, Recycled Aggregates, Others), By Application (Unbound Applications, Asphalt, Ready Mix, Mortar, Precast Concrete, Others), By End-use (Residential, Commercial, Infrastructure, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Martin Marietta Materials, Inc., Vulcan Materials Company, Holcim Group, CEMEX S.A.B. de C.V., Heidelberg Materials, CRH Americas Materials, Inc., Rogers Group Inc, Colas Group, Knife River Corporation, Mulzer Crushed Stone, Inc., Boral Industries Inc., Stalite, Arcosa, Inc., Vicat, Granite Infrastructure Canada, Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Aggregates MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Aggregates MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Martin Marietta Materials, Inc.

- Vulcan Materials Company

- Holcim Group

- CEMEX S.A.B. de C.V.

- Heidelberg Materials

- CRH Americas Materials, Inc.

- Rogers Group Inc

- Colas Group

- Knife River Corporation

- Mulzer Crushed Stone, Inc.

- Boral Industries Inc.

- Stalite

- Arcosa, Inc.

- Vicat

- Granite Infrastructure Canada, Ltd.

- Other Key Players