Global Compressor Oil Market Size, Share, And Enhanced Productivity By Base Oil (Mineral Oil, Synthetic Oil (PAO, PAG, Esters)Semi-synthetic Oil, Bio-based Oil), By Compressor Type (Dynamic Compressor (Centrifugal Compressor, Axial Compressor), Positive Displacement Compressor (Rotary Screw Compressor, Reciprocating Compressor)), By Application (Gas Compressor, Air Compressor), By End-use (General Manufacturing (Transportation Equipment, Metal Production, Commercial Machinery, Food and Beverage, Rubber and Plastics), Construction, Oil and Gas, Chemical and Petrochemical, Mining, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175115

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

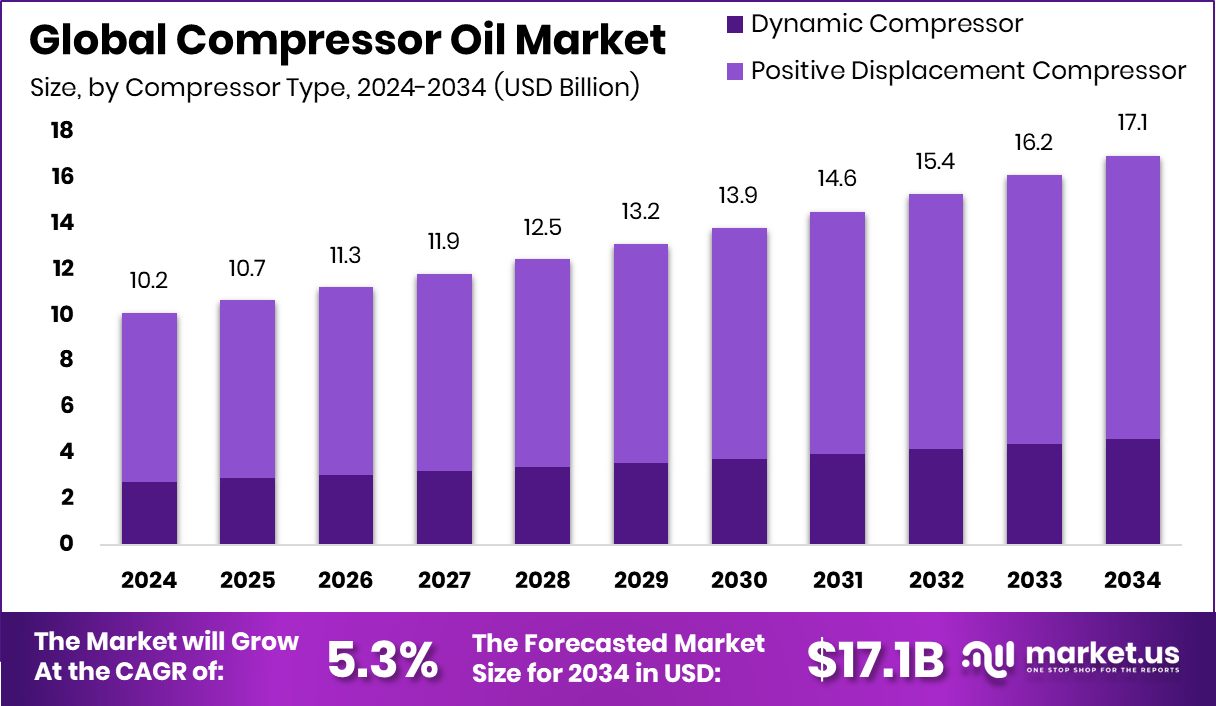

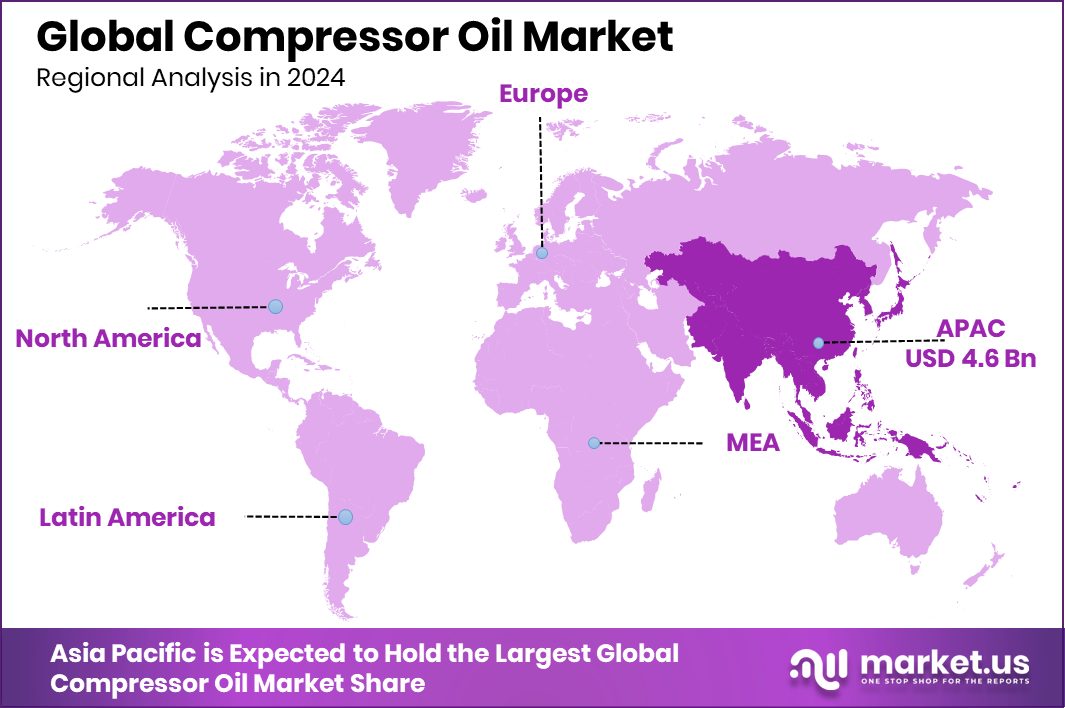

The Global Compressor Oil Market is expected to be worth around USD 17.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Asia Pacific records compressor oil market expansion with 45.5%, touching USD 4.6 Bn.

Compressor oil is a specialized lubricant designed to reduce friction, manage heat, and protect internal parts of air and gas compressors. It keeps the system running smoothly by preventing wear, controlling deposits, and improving sealing. These oils are essential for extending compressor life, lowering maintenance needs, and supporting stable performance in industries that rely on continuous compressed air or gas operations. Different formulations are used depending on temperature, pressure, and the type of compressor.

The Compressor Oil Market includes the production and supply of oils used in industrial compressors across manufacturing, energy, chemicals, automotive, and construction activities. This market supports factories, processing units, and power systems by ensuring reliable lubrication. Growth is shaped by rising industrial automation and a broader shift toward efficient mechanical systems. As industries expand their equipment fleets, demand for compressor oils grows due to their role in reducing energy loss and protecting machinery under continuous workloads.

Growing industrial activity, renewable expansion, and energy projects are major growth factors. Funding such as Constant Energy receiving THB 300 million in green funding from HSBC and the Taqa consortium securing $4 billion for Saudi power plants indirectly pushes demand for compressors used in power and infrastructure sites. More projects mean higher lubricant consumption.

Market demand also benefits from investments in advanced clean-energy technologies. Funding like Helical Fusion, completing a USD 5.5 million Series A extension round, and X-energy raising $700 million support new energy systems that require reliable compressed air processes in testing, cooling, and material handling. These expansions strengthen long-term lubricant needs.

New opportunities are emerging with policy shifts and financial interventions. The U.S. canceling $13 billion in green energy funds creates uncertainty, yet other regions are stepping in with new initiatives. The US$500 million DRE Nigeria Fund by NSIA, SEforALL, ISA, and Africa50 is a strong example of new distributed energy investments where compressors and lubrication systems play supportive operational roles.

Key Takeaways

- The Global Compressor Oil Market is expected to be worth around USD 17.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- The Compressor Oil Market sees Mineral Oil at 49.2%, driving strong lubrication demand globally.

- In the Compressor Oil Market, Positive Displacement Compressors lead with 72.3%, shaping major consumption trends.

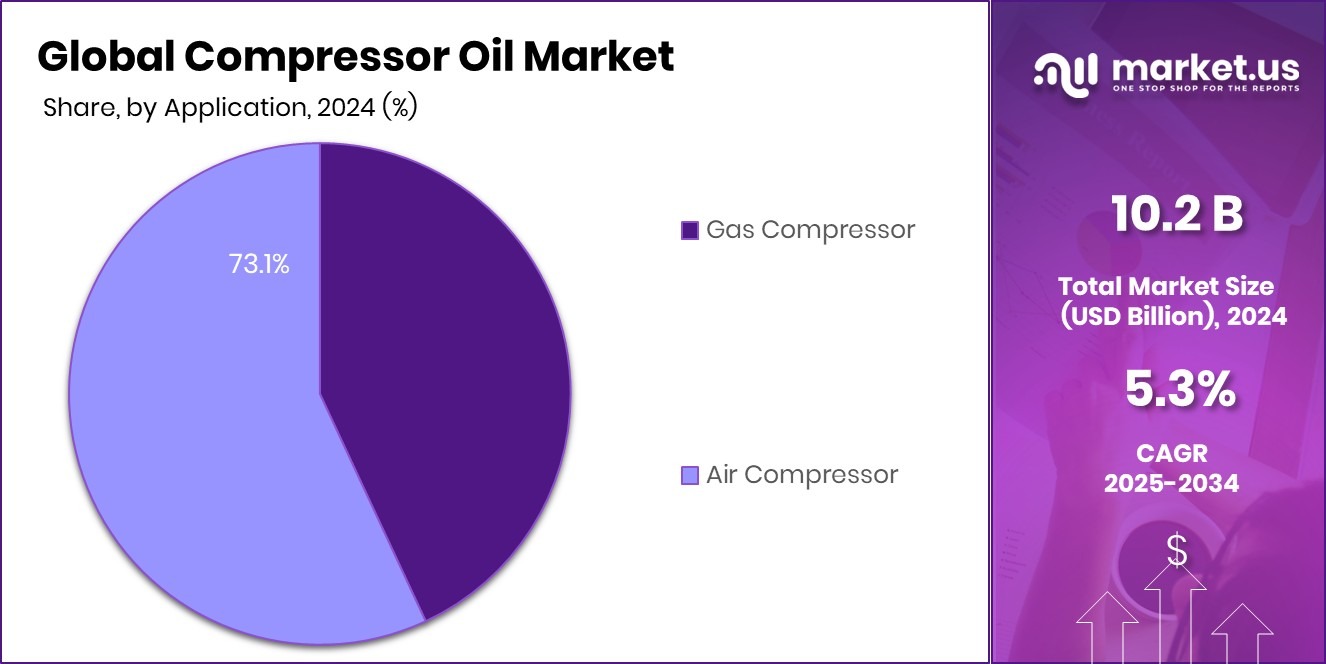

- The Compressor Oil Market reports Air Compressors dominating at 73.1%, supporting

- widespread industrial operations.

- Within the Compressor Oil Market, General Manufacturing holds 31.7%, reflecting a consistent need for reliable compressor lubrication.

- In the Asia Pacific, the Compressor Oil Market strengthens at 45.5%, achieving USD 4.6 Bn.

By Base Oil Analysis

Mineral oil holds 49.2% in the Compressor Oil Market, driving strong demand.

In 2024, the Compressor Oil Market saw strong dominance of mineral oil, holding a 49.2% share. This category remained the most widely used because it offers dependable lubrication at a cost-effective price, making it suitable for industries with large fleets of compressors. Many manufacturing plants, workshops, and processing units preferred mineral-based compressor oils due to their availability, stable performance, and suitability for moderate operating conditions.

As industrial operations expanded across developing regions, demand for mineral oils increased further. Companies continued adopting these oils for routine operations where high-temperature synthetic formulations were not required. This steady use kept mineral oil at the forefront of the market throughout 2024.

By Compressor Type Analysis

Positive displacement compressors dominate 72.3% of the Compressor Oil Market applications globally.

In 2024, the market was significantly shaped by positive displacement compressors, which captured a remarkable 72.3% share. These compressors are widely used in manufacturing, automotive services, construction, and workshop applications due to their simple design, high reliability, and ability to deliver consistent airflow. Their strong presence across small and large industries boosted the need for compressor oils designed for piston and rotary screw systems.

The rise in industrial automation, the expansion of small fabrication units, and the growth of equipment rental businesses further supported their dominance. As a result, positive displacement compressors continued to drive the majority of lubrication demand in the year.

By Application Analysis

Air compressors lead the Compressor Oil Market with a significant 73.1% share.

In 2024, air compressors accounted for the largest portion of compressor oil consumption, representing 73.1% of the market. Air compressors are essential to everyday industrial tasks such as powering tools, supporting assembly lines, packaging operations, material handling, and process cooling. Their widespread use across factories, workshops, and service industries ensured uninterrupted demand for high-quality compressor oils.

The rising need for energy-efficient air systems in both developed and emerging economies strengthened this trend. With many industries relying on continuous airflow for productivity, maintaining compressor performance through reliable lubrication remained a priority, keeping air compressor applications at the top of the market.

By End-use Analysis

General manufacturing captures 31.7% within the Compressor Oil Market, supporting steady growth.

In 2024, general manufacturing emerged as a key end-use sector, contributing 31.7% to the Compressor Oil Market. This segment includes metal fabrication, machinery production, food processing, electronics assembly, and various small-scale industrial units. These industries depend heavily on compressors for powering pneumatic tools, operating machinery, and running automated lines. This consistent usage creates steady demand for compressor oils that ensure durability, reduced downtime, and smoother operations.

As global manufacturing activities increased and more facilities adopted modern production systems, the need for high-performance lubricants also grew. The general manufacturing sector, therefore, maintained a strong and stable influence on compressor oil consumption throughout the year.

Key Market Segments

By Base Oil

- Mineral Oil

- Synthetic Oil

- PAO

- PAG

- Esters

- Semi-synthetic Oil

- Bio-based Oil

By Compressor Type

- Dynamic Compressor

- Centrifugal Compressor

- Axial Compressor

- Positive Displacement Compressor

- Rotary Screw Compressor

- Reciprocating Compressor

By Application

- Gas Compressor

- Air Compressor

By End-use

- General Manufacturing

- Transportation Equipment

- Metal Production

- Commercial Machinery

- Food and Beverage

- Rubber and Plastics

- Construction

- Oil and Gas

- Chemical and Petrochemical

- Mining

- Power Generation

- Others

Driving Factors

Strong Industrial Investments Fuel Market Expansion

Growing investments in minerals, materials, and resource development are driving stronger demand for compressors and, in turn, compressor oils. The US DOE planning $1B funding to support critical minerals and materials production is a major push that encourages new industrial projects and equipment installations. Such expansion increases the use of compressors in mining, processing, and manufacturing operations.

Similarly, Saudi Arabia’s earmarking $182 million for minerals exploration boosts regional industrial activity and raises the need for heavy machinery lubrication. These projects expand operations where compressors run continuously, making reliable compressor oils essential. As countries strengthen production capacities, the requirement for high-quality lubricants grows, turning industrial funding into a major driver of market expansion.

Restraining Factors

High Project Costs Slow Market Adoption

Rising costs linked to advanced energy and industrial projects can restrict investment in equipment upgrades, indirectly affecting the use of compressor oils. Funding such as INERATEC securing €70 million from the EIB for Europe’s largest green hydrogen e-fuels plant highlights how capital-intensive projects can strain budgets, limiting additional spending on supportive systems like compressors.

Likewise, First Brands gaining access to the last $600 million of emergency funds shows how companies rely on financial support just to sustain operations. When industries face high capital pressure, they may delay equipment maintenance, reduce lubricant purchases, or extend oil change intervals. These cost-driven decisions slow market growth and act as a significant restraint.

Growth Opportunity

Clean Energy Investments Create New Opportunities

The rapid rise of clean-energy projects is opening strong opportunities for the Compressor Oil Market. Investments like Juniper Green Energy, accelerating with $1 billion in clean-energy funding, show that large-scale renewable installations rely heavily on compressors for cooling, storage, and system pressure management.

Additionally, $85 million allocated for heat pump funding supports technologies that use compressors as a core component. As renewable systems expand, they create long-term demand for high-performance compressor oils that support efficiency and durability. This shift toward clean infrastructure allows lubricant manufacturers to cater to new applications, giving them significant room to grow in emerging low-carbon sectors.

Latest Trends

Shift Toward Employee-Driven Innovation Initiatives

A key trend shaping the Compressor Oil Market is the growing emphasis on employee-led innovation and talent development. A notable example is ELGi Equipment granting 16,100 stock options to a subsidiary employee, which highlights how companies are empowering teams to contribute more deeply to product and operational excellence.

When organizations reward innovation, they accelerate the development of improved compressor technologies and more efficient lubricants. This cultural shift supports advancements in oil formulations, energy efficiency, and sustainable equipment design. As more companies adopt employee-driven growth strategies, the compressor oil industry benefits from faster innovation cycles and stronger product performance trends.

Regional Analysis

Asia Pacific dominates the compressor oil market with 45.5% reaching USD 4.6 Bn.

Asia Pacific remains the dominant region in the Compressor Oil Market, holding a strong 45.5% share valued at USD 4.6 Bn, driven by its expanding industrial base and continuous growth in manufacturing and energy sectors. The region’s rising infrastructure development, steady growth in automotive production, and increasing use of heavy-duty machinery further reinforce its leadership in overall consumption of compressor oils.

North America follows with stable demand supported by its well-established industrial sector, strong oil & gas activities, and consistent adoption of high-performance lubricants across advanced manufacturing facilities.

Europe shows steady growth driven by strict maintenance standards, energy-efficient industrial practices, and a mature mechanical equipment market that sustains compressor oil requirements across various industries.

The Middle East & Africa region reflects moderate expansion as petrochemical operations, construction growth, and ongoing industrial diversification contribute to compressor oil usage in specialized mechanical systems.

Latin America experiences a gradual improvement supported by increasing industrial output, rising mining activity, and equipment modernization across developing economies, contributing to steady demand for compressor oils in key end-use sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Royal Dutch Shell plc continues to influence the market through its broad portfolio of high-performance compressor oils designed for heavy-duty and continuous-operation machinery. The company’s strong refining capabilities and long experience in formulating advanced lubricants allow it to cater to diverse industrial needs, from manufacturing and power generation to automotive and process industries. Its global supply network strengthens product availability, making Shell a consistent player in reliability-driven compressor applications.

Chevron Corporation contributes to market stability with its emphasis on premium base oils and high-purity compressor lubricants engineered for longer service intervals. Chevron’s technical expertise supports equipment efficiency and helps reduce operational downtime, which is essential for industries that rely on continuous compressor performance. Its focus on cleaner formulations and robust industrial partnerships further enhances its presence across regions where energy and manufacturing sectors are expanding.

Exxon Mobil Corporation remains a significant influencer through its advanced lubricant technologies and strong R&D capability. Exxon Mobil offers compressor oils tailored for severe operating conditions, providing oxidative stability, wear protection, and extended drain cycles. Its wide distribution network and deep technical support enable the company to meet the needs of global industries that rely heavily on performance-driven maintenance solutions, reinforcing its position in the 2024 compressor oil landscape.

Top Key Players in the Market

- Royal Dutch Shell pic

- Chevron Corporation

- Exxon Mobil Corporation

- Repsol

- FUCHS

- Indian Oil Corporation Ltd

- Total SA

- CASTROL LIMITED

- HP Lubricants

Recent Developments

- In March 2025, Repsol completed the acquisition of a 40% interest in Unioil Lubricants, Inc., a company that produces and distributes lubricant products in the Philippines. This agreement strengthens Repsol’s footprint in Southeast Asia’s growing lubricants market and supports broader availability of its industrial oils and compressor-related lubricants in the region.

- In July 2024, FUCHS Group successfully finished acquiring the LUBCON Group, a company known for making high-performance specialty lubricants, greases, and oils. This move expands FUCHS’ product range in industrial lubricants that support machinery like compressors and other heavy equipment. The acquisition brings new technology and skilled employees into FUCHS’ global network of lubricant solutions.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Oil (Mineral Oil, Synthetic Oil (PAO, PAG, Esters)Semi-synthetic Oil, Bio-based Oil), By Compressor Type (Dynamic Compressor (Centrifugal Compressor, Axial Compressor), Positive Displacement Compressor (Rotary Screw Compressor, Reciprocating Compressor)), By Application (Gas Compressor, Air Compressor), By End-use (General Manufacturing (Transportation Equipment, Metal Production, Commercial Machinery, Food and Beverage, Rubber and Plastics), Construction, Oil and Gas, Chemical and Petrochemical, Mining, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Royal Dutch Shell pic, Chevron Corporation, Exxon Mobil Corporation, Repsol, FUCHS, Indian Oil Corporation Ltd, Total SA, CASTROL LIMITED, HP Lubricants Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal Dutch Shell pic

- Chevron Corporation

- Exxon Mobil Corporation

- Repsol

- FUCHS

- Indian Oil Corporation Ltd

- Total SA

- CASTROL LIMITED

- HP Lubricants