Global Compressed Air Treatment Equipment Market Size, Share, And Enhanced Productivity By Equipment Type (Filters (Particulate Filter/Pre-Filter, Coalescing Filter/Oil Removal, Adsorber Filter/Oil Vapor Removal, Filtered Centrifugal Separator, High Temperature After Filters, Others), Dryers (Refrigerated Dryers, Desiccant Air Dryers, Membrane Dryers, Others),Aftercoolers, Others), By Application (Plant Air/Shop Air, Instrument Air, Process Air, Others), By End Use (Aerospace, Automotive, Construction, Chemical, Food and Beverage, Healthcare, Others), By Distribution Channel (Direct Sales, Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175540

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

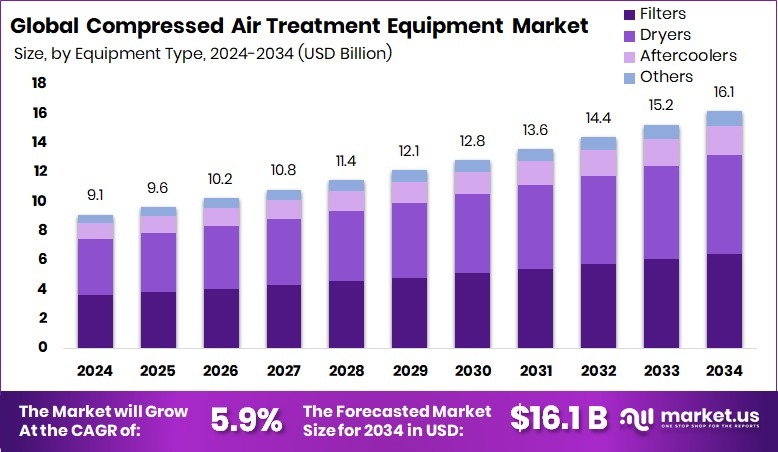

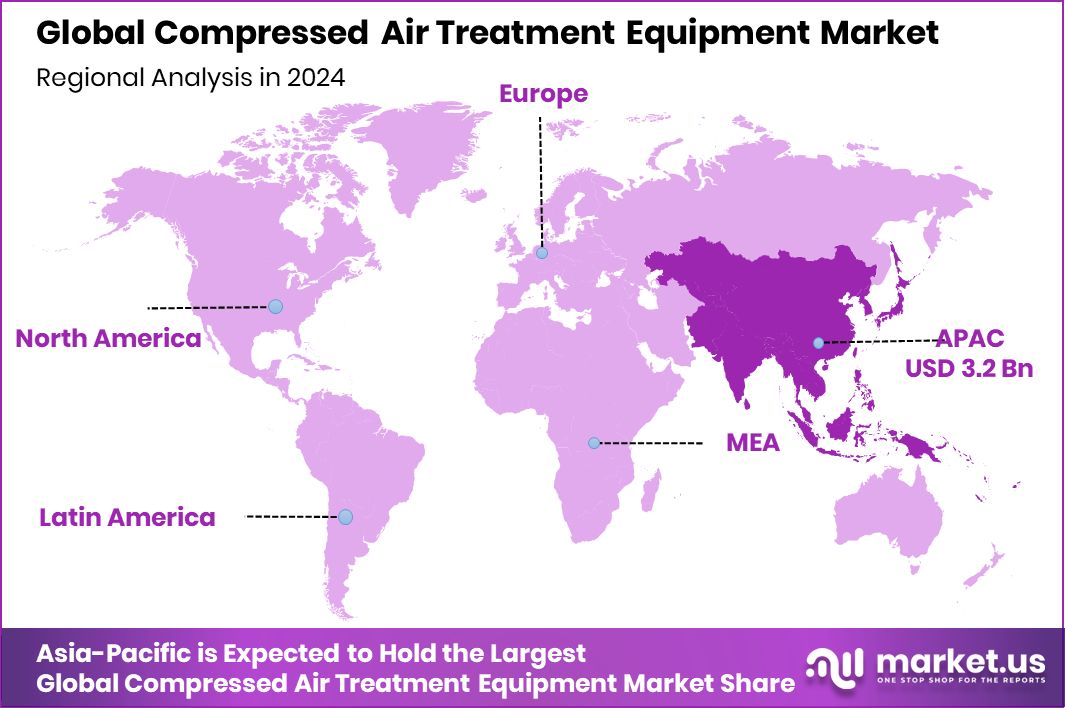

The Global Compressed Air Treatment Equipment Market is expected to be worth around USD 16.1 billion by 2034, up from USD 9.1 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. In the Asia Pacific, rising industrial activity drove 35.20% share and a USD 3.2 Bn value.

The Compressed Air Treatment Equipment refers to the systems used to clean, dry, and condition compressed air before it reaches tools, machinery, or production lines. These systems remove moisture, oil, and particles to ensure safe, efficient, and reliable operation across industries where air purity is essential. The Compressed Air Treatment Equipment Market represents the demand for filters, dryers, aftercoolers, and related systems across applications such as plant air, instrument air, and process air. Growth today is shaped by rising industrial automation, tighter quality standards, and the need to protect equipment from contaminants.

A key growth factor comes from expanding industrial activity and the rising need for uninterrupted, clean air in manufacturing environments. As factories automate more processes, demand increases for dependable air quality systems that prevent downtime and protect sensitive tools. This creates a continuous need across aerospace, automotive, chemical, and food sectors.

Demand is further strengthened by the global shift toward energy storage and large-scale infrastructure upgrades. Recent funding—such as Hydrostor securing AUD 82.6 million, Highview Power raising £300 million, and the $1.76B DOE award for underground air-battery projects—shows how clean air and storage technologies are gaining momentum, indirectly supporting the adoption of precision air systems.

There is also a strong opportunity emerging from new investments in long-duration storage and industrial air solutions. Projects aiming to store thousands of megawatt-hours of energy, such as Hydrostor’s California plan, highlight how compressed air will remain essential. As innovation continues to push toward cost targets like $0.05/kWh, the need for advanced air treatment equipment grows across global industries.

Key Takeaways

- The Global Compressed Air Treatment Equipment Market is expected to be worth around USD 16.1 billion by 2034, up from USD 9.1 billion in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- The Compressed Air Treatment Equipment Market grows steadily as filters gain a strong 39.7% share.

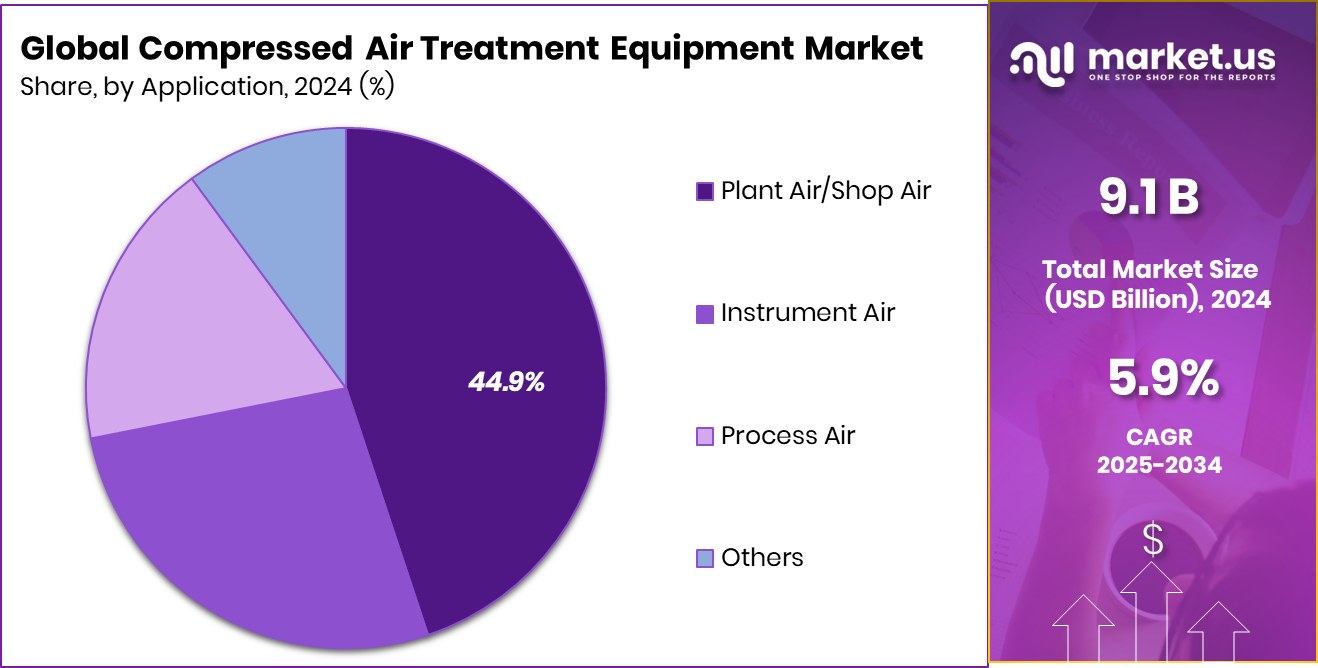

- In the Compressed Air Treatment Equipment Market, plant air and shop air applications dominate with 44.9%.

- Automotive end-use holds 29.6%, strengthening demand in the expanding Compressed Air Treatment Equipment Market globally.

- Direct sales channels capture 67.2%, shaping distribution patterns in the Compressed Air Treatment Equipment Market today.

- The region Asia Pacific maintained 35.20%, supported by its strong USD 3.2 Bn demand.

By Distribution Channel Analysis

Compressed Air Treatment Equipment Market was dominated by filters with a 39.7% share.

In 2024, the Compressed Air Treatment Equipment Market saw filters hold a dominant share of 39.7%, reflecting their critical role in ensuring clean, dry, and contaminant-free air across industrial operations. As manufacturers increasingly adopt automation and pneumatic tools, demand for high-efficiency filtration systems continues to rise.

Filters remain essential for removing particulates, oil aerosols, and moisture—helping protect equipment, improve product quality, and meet stringent regulatory standards. Industries such as food processing, pharmaceuticals, and electronics heavily rely on these filtration units to maintain precision and hygiene. The growing emphasis on energy-efficient filtration and extended service life further pushed adoption in 2024, making filters the preferred equipment type in compressed air treatment systems.

By Equipment Type Analysis

Compressed Air Treatment Equipment Market applications were dominated by plant air/shop air, holding 44.9% share.

In 2024, Plant Air/Shop Air applications accounted for a leading 44.9% share of the Compressed Air Treatment Equipment Market, supported by the widespread need for reliable compressed air in day-to-day industrial operations. Manufacturing units depend heavily on clean air for powering tools, operating machinery, and supporting automated production lines, making air treatment indispensable.

Rising industrial expansion in automotive, metal fabrication, packaging, and general engineering has amplified the requirement for moisture removal, filtration, and stable airflow. As factories aim to reduce downtime and safeguard equipment, investments in advanced dryers, filters, and aftercoolers increased. The steady shift toward IIoT-enabled monitoring systems also strengthened this segment’s dominance in 2024.

By Application Analysis

Compressed Air Treatment Equipment Market end use was dominated by automotive, capturing a 29.6% share.

In 2024, the automotive sector held a strong 29.6% share of the Compressed Air Treatment Equipment Market, driven by extensive use of compressed air in painting, assembly, component manufacturing, and quality inspection. Clean and controlled air is essential for preventing defects in coating lines and ensuring precision in pneumatic tools.

As electric vehicle (EV) production expanded globally, OEMs and Tier-1 suppliers invested heavily in air treatment upgrades to maintain high production standards. The focus on energy efficiency, reduced maintenance costs, and compliance with environmental norms also encouraged adoption. Growing automation across automotive plants further boosted demand, positioning automotive as a crucial end-use industry in 2024.

By End Use Analysis

Compressed Air Treatment Equipment Market distribution was dominated by direct sales with 67.2% share.

In 2024, the Direct Sales channel dominated the Compressed Air Treatment Equipment Market with an impressive 67.2% share, reflecting customers’ preference for customized solutions, technical support, and direct engagement with manufacturers. Industrial buyers often require tailored systems for specific applications, making direct sales the preferred route for high-value installations.

Manufacturers benefit from closer client relationships, faster feedback cycles, and stronger after-sales service opportunities. Large industries—such as chemicals, food processing, and heavy engineering—typically rely on direct procurement to ensure system reliability and long-term performance. The rise of turnkey projects, system integration needs, and on-site consultation services further strengthened the dominance of direct sales in 2024.

Key Market Segments

By Equipment Type

- Filters

- Particulate Filter/Pre-Filter

- Coalescing Filter/Oil Removal

- Adsorber Filter/Oil Vapor Removal

- Filtered Centrifugal Separator

- High Temperature After Filters

- Others

- Dryers

- Refrigerated Dryers

- Desiccant Air Dryers

- Membrane Dryers

- Others

- Aftercoolers

- Others

By Application

- Plant Air/Shop Air

- Instrument Air

- Process Air

- Others

By End Use

- Aerospace

- Automotive

- Construction

- Chemical

- Food and Beverage

- Healthcare

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Driving Factors

Compressed Air Treatment Equipment Market

The Compressed Air Treatment Equipment Market continues to gain momentum as industries move toward deeper automation and rely more heavily on clean, consistent air quality. Rising industrial automation increases clean air demand because modern machinery, robotics, and precision-driven tools require contaminant-free compressed air to function without failures or downtime. This shift is supported by ongoing investment and innovation in related clean-air technologies.

A notable example is Synnefa receiving a $300K grant to deploy IoT-enabled solar dryers across Kenya, highlighting how digital monitoring and controlled air environments are becoming more essential in energy and industrial ecosystems. Such advancements indirectly push industries to prioritize reliable air treatment systems to maintain efficiency and meet production standards.

Restraining Factors

Compressed Air Treatment Equipment Market

Despite healthy progress, high installation costs slow market growth for compressed air treatment systems. Many industries, particularly smaller facilities, hesitate to invest in advanced filters, dryers, and monitoring systems due to upfront costs and ongoing maintenance expenses. Infrastructure upgrades often require significant capital, which can delay adoption. The financial challenges are reflected in broader industrial funding trends, such as Synnefa securing USD 300K to deploy IoT-based solar drying technology in Kenya—a reminder that many organizations depend on external support to adopt modern equipment. Without similar funding streams, businesses may defer upgrading compressed air systems, limiting wider implementation and slowing market expansion even when cleaner air quality is urgently needed.

Growth Opportunity

Compressed Air Treatment Equipment Market

Growth opportunities are expanding as industries explore advancements in energy-efficient air systems. Companies are increasingly investing in solutions that reduce power consumption and deliver cleaner, drier air with lower operating costs. Innovation in adjacent fields supports this momentum, such as Purdue researchers receiving $118,000 for projects in freeze-drying and thermal imaging, and Henan allocating 200 million yuan for emergency wheat-drying efforts. These initiatives signal a rising global commitment to efficiency, sustainability, and improved processing environments. As industries upgrade to energy-saving equipment and look for ways to stabilize operations in fluctuating climates, demand for efficient compressed air treatment systems grows, creating strong market opportunities.

Latest Trends

Compressed Air Treatment Equipment Market

One of the latest trends shaping the Compressed Air Treatment Equipment Market is the integration of smart monitoring technologies to improve air reliability and system uptime. Digital sensors, connected platforms, and automated alerts are transforming how companies manage moisture, contaminants, and pressure fluctuations. This trend aligns with funding momentum in smart agricultural drying technologies, such as a startup receiving $150,000 to develop solar-powered crop-drying devices equipped with enhanced monitoring features. As industries increasingly adopt digital oversight to enhance operational transparency and prevent air system failures, compressed air treatment solutions with intelligent monitoring capabilities are becoming a preferred choice.

Regional Analysis

Asia Pacific led the market with 35.20%, reaching a valuation of USD 3.2 Bn.

In the Compressed Air Treatment Equipment Market, the Asia Pacific region dominated the global landscape in 2024, holding a significant 35.20% share valued at USD 3.2 Bn. This leadership reflects the region’s rapidly expanding industrial base, with strong activity across manufacturing, automotive, electronics, and general engineering.

North America followed with steady adoption driven by upgraded industrial infrastructure and stringent air quality requirements across production facilities. Europe maintained consistent growth supported by advanced automation and increasing emphasis on energy-efficient compressed air systems across Germany, France, and the U.K. The Middle East & Africa region showed gradual expansion as industrial diversification programs accelerated demand for treated compressed air in petrochemicals and construction-linked applications.

Latin America continued to develop at a moderate pace, supported by manufacturing clusters and the rising need for reliable air systems in food processing and automotive operations. Across all regions, the demand for cleaner, safer, and more efficient compressed air solutions shaped market performance, but Asia Pacific remained the clear leader due to its strong industrial momentum and large-scale manufacturing activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alpha-Pure continued strengthening its presence through specialized filtration and purification solutions designed to support industries requiring high-quality compressed air. The company’s emphasis on dependable system performance and efficient contaminant removal positioned it as a preferred choice for users seeking long-term operational stability. Its portfolio remained aligned with industries prioritizing clean air standards, giving it a solid role in the overall market dynamics.

Atlas Copco maintained a prominent influence as its equipment offerings remained widely adopted across diverse industrial environments. With a reputation for engineering precision, the company’s dryers, filters, and air treatment modules supported improved energy efficiency and system reliability. Its continued investment in performance-driven compressed air solutions helped industries lower maintenance downtime and enhance equipment protection, reinforcing Atlas Copco’s significance in global operations throughout 2024.

Beko Technologies contributed strong value through its focus on delivering high-quality condensate management and air treatment technology. The company’s solutions helped users maintain cleaner and safer air networks, especially in facilities with sensitive applications. Its expertise in moisture control and air quality optimization made it an important contributor to the market’s technical progression during the year.

Top Key Players in the Market

- Alpha-Pure

- Atlas Copco

- Beko Technologies

- Chicago Pneumatic

- Elgi Compressors

- Emerson Climate

- Gardner Denver

- Mann+Hummel

- Mikropor

- Omega Air

Recent Developments

- In December 2025, Mikropor announced a collaboration with Danfoss to develop new-generation refrigerated air dryers with AXV Series expansion valves. These valves help the dryers deliver better energy efficiency, more stable evaporation pressure, and a lower dew point, making them more effective at removing moisture from compressed air. The updated design aims to improve performance and energy savings compared to standard systems, supporting industrial users who need clean, dry air.

- In August 2024, Omega Air introduced a new, improved series of refrigeration dryers with a smaller footprint and better components. These dryers help remove moisture from compressed air more efficiently, making them easier for factories to install and use. The change also focused on being more environmentally friendly by changing the cooling gas type, improving performance,e and sustainability.

Report Scope

Report Features Description Market Value (2024) USD 9.1 Billion Forecast Revenue (2034) USD 16.1 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Filters (Particulate Filter/Pre-Filter, Coalescing Filter/Oil Removal, Adsorber Filter/Oil Vapor Removal, Filtered Centrifugal Separator, High Temperature After Filters, Others), Dryers (Refrigerated Dryers, Desiccant Air Dryers, Membrane Dryers, Others), Aftercoolers, Others), By Application (Plant Air/Shop Air, Instrument Air, Process Air, Others), By End Use (Aerospace, Automotive, Construction, Chemical, Food and Beverage, Healthcare, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpha-Pure, Atlas Copco, Beko Technologies, Chicago Pneumatic, Elgi Compressors, Emerson Climate, Gardner Denver, Mann+Hummel, Mikropor, Omega Air Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Compressed Air Treatment Equipment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Compressed Air Treatment Equipment MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpha-Pure

- Atlas Copco

- Beko Technologies

- Chicago Pneumatic

- Elgi Compressors

- Emerson Climate

- Gardner Denver

- Mann+Hummel

- Mikropor

- Omega Air