Global Combine Harvester Market Size, Share, And Business Benefits By Type (Self-Propelled, Tractor-Pulled Combine, PTO-Powered Combine), By Power Output (HP)(Upto 300 HP, 301 to 450 HP, Above 450 HP),By Mechanism (Hydraulic, Hybrid), By Crop Type (Grains and Cereals, Fruits and Vegetables, Turf and Ornamentals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158344

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

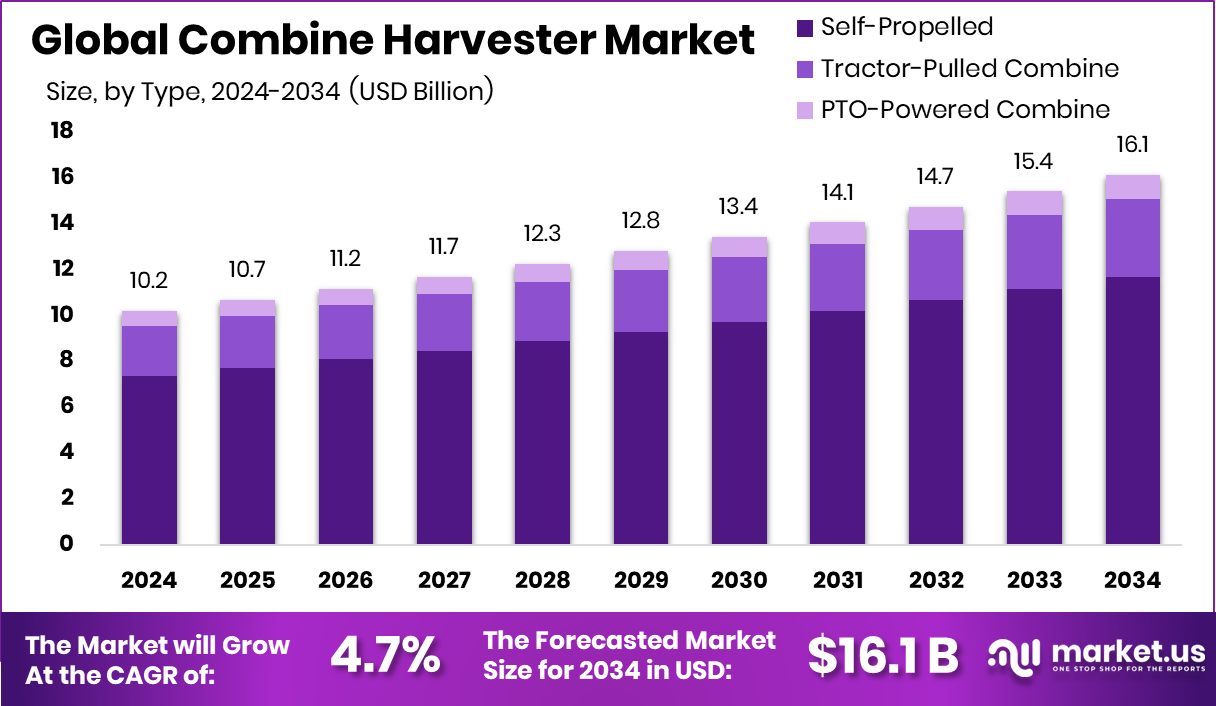

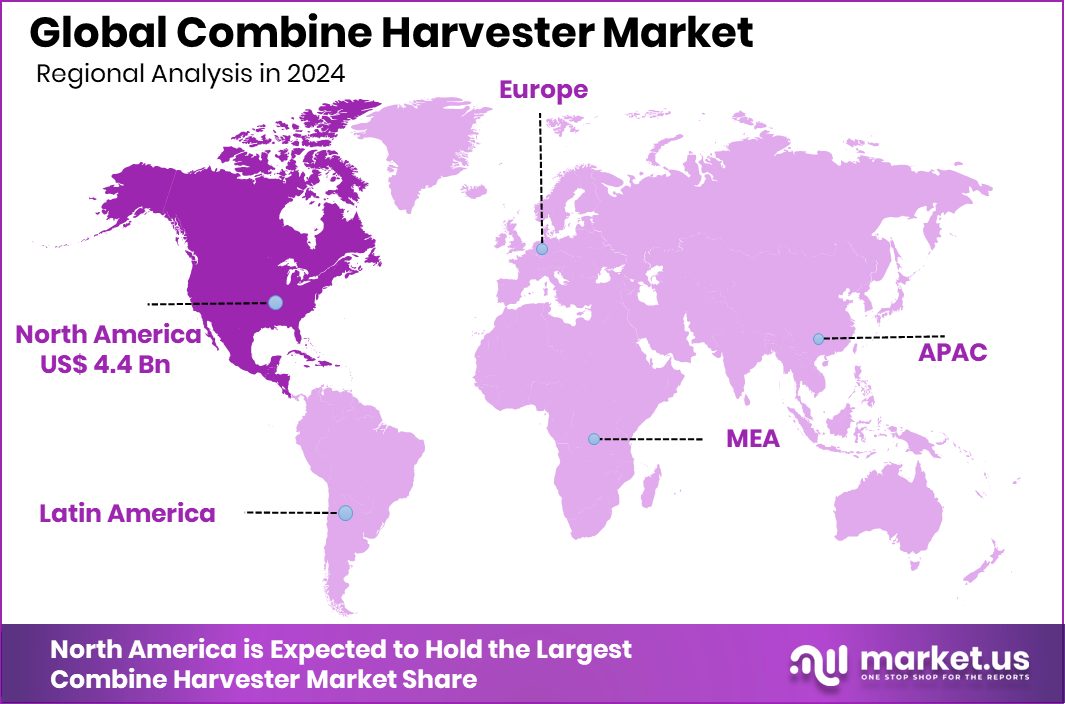

The Global Combine Harvester Market is expected to be worth around USD 16.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. Government subsidies and technology advances boosted the North America Combine Harvester Market, reaching 43.90% share, USD 4.4 Bn.

A combine harvester is a modern machine that combines reaping, threshing, and winnowing into one process, helping farmers harvest crops like wheat, rice, maize, and barley more efficiently. By saving time and reducing manual labor, it minimizes losses caused by delays and ensures higher productivity, especially on large farms where timing is critical.

The combine harvester market covers production, sales, adoption, and government support for these machines. It reflects trends in design, efficiency, automation, and how subsidies encourage farmers to mechanize. A key growth factor is rising government funding. In India, under the Sub-Mission on Agricultural Mechanization (SMAM), ₹656.56 crores have been released to Uttar Pradesh between 2014-15 and 2024-25 to provide machines and set up hi-tech hubs, making adoption easier.

Demand is also increasing due to labor shortages, rising wages, and the pressure to feed a growing population. Efficient harvesting prevents spoilage from bad weather and ensures food security. Subsidies also allow smaller farmers to access these machines.

Future opportunities lie in sustainable and precision farming. The U.S. Department of Agriculture allocated US$1.5 billion in fiscal year 2024 to support climate-smart practices and equipment. This creates scope for advanced harvesters with fuel efficiency, low emissions, and sensor technologies, along with custom hiring services for wider farmer access.

Key Takeaways

- The Global Combine Harvester Market is expected to be worth around USD 16.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Self-propelled machines dominate the Combine Harvester Market with 72.4%.

- Combine Harvester Market favors 301–450 HP power output at 48.2%.

- Hydraulic systems lead the Combine Harvester Market holding 69.8% share.

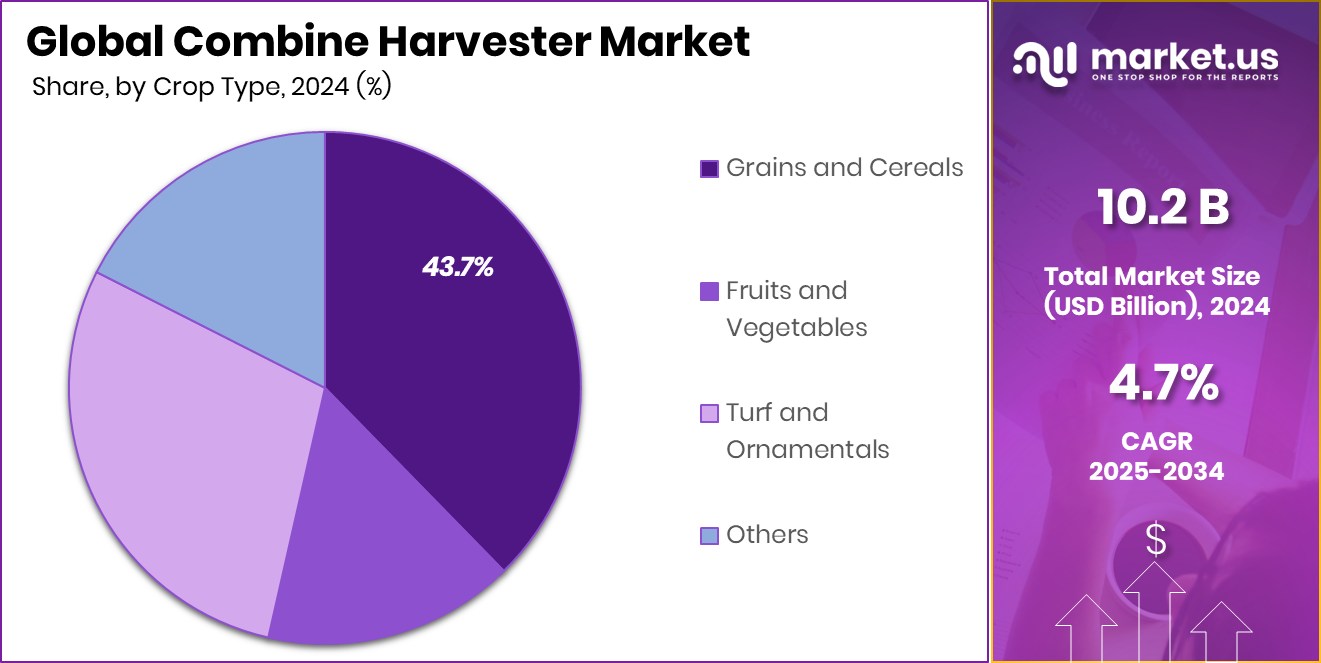

- Grains and cereals drive the Combine Harvester Market with 43.7%.

- Strong mechanization adoption in North America drove the market to 43.90% share, totaling USD 4.4 Bn.

By Type Analysis

In 2024, the Combine Harvester Market saw Self-Propelled models dominate with 72.4% share.

In 2024, Self-Propelled held a dominant market position in By Type segment of the Combine Harvester Market, with a 72.4% share. This leadership is largely driven by their higher efficiency, advanced technology integration, and ability to cover large farming areas in less time compared to traditional methods. Self-propelled harvesters reduce dependence on external tractors, offering farmers a single, compact solution for harvesting operations.

Their strong adoption is supported by government subsidies and funding programs that lower initial costs, making them more accessible even to medium-scale farmers. The rising demand for mechanization, combined with labor shortages and the need to reduce post-harvest losses, ensures that self-propelled machines remain the preferred choice among farmers in 2024.

By Power Output (HP) Analysis

The Combine Harvester Market by power output was led by the 301 to 450 HP range at 48.2%.

In 2024, 301 to 450 HP held a dominant market position in the By Power Output (HP) segment of the Combine Harvester Market, with a 48.2% share. This strong presence is attributed to their ability to handle large-scale farming operations efficiently, offering the power needed for tough field conditions and high-yield crops. These machines provide the right balance between performance and fuel efficiency, making them highly suitable for commercial farming.

Farmers prefer this range as it ensures faster harvesting, reduced operational time, and lower crop wastage during peak seasons. Supported by government subsidies and rising demand for mechanized solutions, the 301 to 450 HP category remains the most reliable and widely adopted choice among modern agricultural producers.

By Mechanism Analysis

By mechanism, the Combine Harvester Market showed a strong preference for Hydraulic systems, capturing 69.8% share.

In 2024, Hydraulic held a dominant market position in By Mechanism segment of the Combine Harvester Market, with a 69.8% share. The dominance of hydraulic-based systems comes from their superior efficiency, reliability, and ease of operation in demanding field conditions. Hydraulic mechanisms provide smoother control, higher precision, and the ability to handle varying crop densities with minimal effort, making them highly effective for large-scale harvesting.

Farmers prefer hydraulic combines because they reduce downtime, improve operational safety, and ensure consistent output across different terrains. With rising adoption of mechanization and strong government funding support to modernize harvesting equipment, hydraulic systems remain the trusted and most widely deployed mechanism type in the global combine harvester market.

By Crop Type Analysis

In crop type, the Combine Harvester Market was highest in Grains and Cereals with 43.7% share.

In 2024, Grains and Cereals held a dominant market position in By Crop Type segment of the Combine Harvester Market, with a 43.7% share. This leadership is mainly due to the extensive global cultivation of crops like wheat, rice, maize, and barley, which are staple foods across most regions. The need for efficient and timely harvesting of these crops, especially in high-production countries, has increased reliance on combine harvesters.

Farmers value the ability of these machines to reduce post-harvest losses and improve yield quality. With rising global food demand and government funding directed toward grain productivity and mechanization, grains and cereals remain the primary driver of combine harvester utilization, securing their dominant position in 2024.

Key Market Segments

By Type

- Self-Propelled

- Tractor-Pulled Combine

- PTO-Powered Combine

By Power Output (HP)

- Upto 300 HP

- 301 to 450 HP

- Above 450 HP

By Mechanism

- Hydraulic

- Hybrid

By Crop Type

- Grains and Cereals

- Fruits and Vegetables

- Turf and Ornamentals

- Others

Driving Factors

Government Subsidies Accelerate Farm Mechanization Adoption Globally

The strongest demand driver is direct public money that lowers the cost of buying harvesters. India’s Sub-Mission on Agricultural Mechanization (SMAM) offers 40–50% subsidies on combine harvesters, making machines far more affordable for small and medium farmers and speeding up upgrades from manual harvesting. In the 2024–25 harvest season, the state of Punjab earmarked ₹500 crore to supply crop-residue management equipment on subsidy funding that supports harvest operations and encourages farmers to pair combines with straw-handling attachments.

Similar state programs also top up support; for example, targeted harvester subsidies have been announced in multiple states to cut acquisition costs and improve access during paddy harvests. Together, these government funds reduce upfront prices, improve productivity per acre, and bring faster adoption of modern combine harvesters.

Restraining Factors

High Equipment Costs Limit Small Farmer Adoption

A major challenge in the combine harvester market is the very high purchase and maintenance cost of these machines. For small and marginal farmers, the upfront investment in a combine harvester is often out of reach, even when government support exists. Beyond the purchase price, expenses for fuel, spare parts, and skilled operators add to the financial burden.

In regions where farm sizes are smaller, it becomes difficult to justify the cost of owning a harvester compared to renting or continuing with traditional methods. This limits overall adoption, particularly in developing economies. As a result, the high cost of equipment remains a key barrier that slows down widespread use of combine harvesters.

Growth Opportunity

Rising Demand for Smart and Precision Harvesting Machines

One big growth opportunity for the combine harvester market comes from the increasing use of smart and precision farming technologies. Farmers today want machines that do more than just harvest—they want equipment that can save fuel, reduce grain losses, and provide real-time data on yield and crop conditions. Modern combine harvesters with GPS, sensors, and automation features are attracting strong interest, especially in regions where labor shortages are rising.

These advanced machines not only improve efficiency but also help farmers make better planting and harvesting decisions for the next season. As governments and private players continue investing in digital agriculture, demand for smart harvesters will grow, opening new opportunities for manufacturers worldwide.

Latest Trends

Growing Adoption of Eco-Friendly and Electric Harvesters

A key trend in the combine harvester market is the move toward eco-friendly and electric-powered machines. Farmers and manufacturers are becoming more conscious about reducing fuel use and lowering emissions. Traditional diesel-based harvesters are being upgraded with cleaner engines, hybrid models, and even fully electric prototypes. This trend is supported by stricter emission norms in Europe, the U.S., and Asia, which push companies to design greener alternatives.

At the same time, government programs promoting sustainable farming are encouraging farmers to adopt machines that protect the environment while boosting productivity. As battery technology improves and costs go down, eco-friendly harvesters are expected to become more common in global agricultural fields.

Regional Analysis

In 2024, North America led the Combine Harvester Market with a 43.90% share, worth USD 4.4 Bn.

The Combine Harvester Market demonstrates varied adoption across regions, shaped by farm sizes, crop diversity, and government support programs. In North America, the market stands out as the dominant region, holding a 43.90% share valued at USD 4.4 billion in 2024. This leadership is driven by large-scale commercial farming, high labor costs, and advanced mechanization practices.

Farmers in the United States and Canada rely heavily on technologically advanced harvesters to maximize efficiency and reduce post-harvest losses, with strong support from federal funding programs aimed at modernizing agriculture. In Europe, adoption is supported by mechanization policies under the Common Agricultural Policy (CAP), where farmers benefit from subsidies for modern equipment.

Asia Pacific is witnessing steady growth due to vast cultivation areas for rice and wheat, alongside rising government funding in countries like India and China to promote mechanized solutions. The Middle East & Africa region shows gradual adoption, with mechanization becoming vital to counter labor shortages and climate challenges. Latin America, particularly Brazil and Argentina, benefits from strong grain exports that push demand for efficient harvesting equipment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deere & Company continued to strengthen its leadership by focusing on advanced precision agriculture solutions, integrating digital tools and automation into its combine harvesters. This emphasis on smart farming technology not only improved harvesting efficiency but also positioned Deere as a frontrunner in sustainability and cost-effective farming practices.

CNH Industrial N.V. made notable contributions by offering a broad portfolio of combine harvesters designed for different farm scales, ensuring accessibility to both large-scale and mid-sized farmers. The company focused on improving machine durability and fuel efficiency, aligning with rising global demand for sustainable equipment. Their strong global distribution network further enhanced their market footprint, particularly in emerging economies where mechanization is accelerating.

AGCO Corporation distinguished itself through innovation in machinery design and enhanced operator comfort, reflecting its strategy of building farmer-friendly solutions. The company invested in upgrading its combine platforms with higher output capacities and better integration of hydraulic systems, which supported their competitive edge in productivity-focused markets.

Top Key Players in the Market

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Claas KGaA mbH

- Kubota Corporation

- SDF Group

- Yanmar Holdings Co., Ltd.

- Mahindra and Mahindra Ltd.

- Iseki and Co., Ltd.

- Rostselmash

Recent Developments

- In September 2024, Case IH (a CNH brand) officially released the Axial-Flow 160 and 260 Series combines, which are available to order for the 2025 harvest. These models include high-power options (e.g., 498 hp, 571 hp, 634 hp) with large grain tank capacities, upgraded displays (dual Pro 1200 terminals), connectivity tools, and automated features like Harvest Command™.

- In February 2024, Deere introduced its S7 Series combines at the Commodity Classic (Houston). These machines feature new JD9 (9 L) and JD14 (13.6 L) engines in Final Tier 4 standard, updated residue management, improved grain-handling, and loss-sensing systems. Deere claimed up to 20% productivity gains and around 10% fuel savings compared to earlier models.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 16.1 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Self-Propelled, Tractor-Pulled Combine, PTO-Powered Combine), By Power Output (HP)(Up to 300 HP, 301 to 450 HP, Above 450 HP), By Mechanism (Hydraulic, Hybrid), By Crop Type (Grains and Cereals, Fruits and Vegetables, Turf and Ornamentals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Deere & Company, CNH Industrial N.V., AGCO Corporation, Claas KGaA mbH, Kubota Corporation, SDF Group, Yanmar Holdings Co., Ltd., Mahindra and Mahindra Ltd., Iseki and Co., Ltd., Rostselmash Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Combine Harvester MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Combine Harvester MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deere & Company

- CNH Industrial N.V.

- AGCO Corporation

- Claas KGaA mbH

- Kubota Corporation

- SDF Group

- Yanmar Holdings Co., Ltd.

- Mahindra and Mahindra Ltd.

- Iseki and Co., Ltd.

- Rostselmash