Global Clinical Alarm Management Market By Product Type (Nurse Call Systems, Ventilators, Physiological Monitors, EMR Integration Systems, and Others), By Component (Solutions and Services), By End-user (Hospitals & Clinics, Specialty Centers, Long-Term Care Facilities, Home Care Settings, and Ambulatory Care Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144293

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

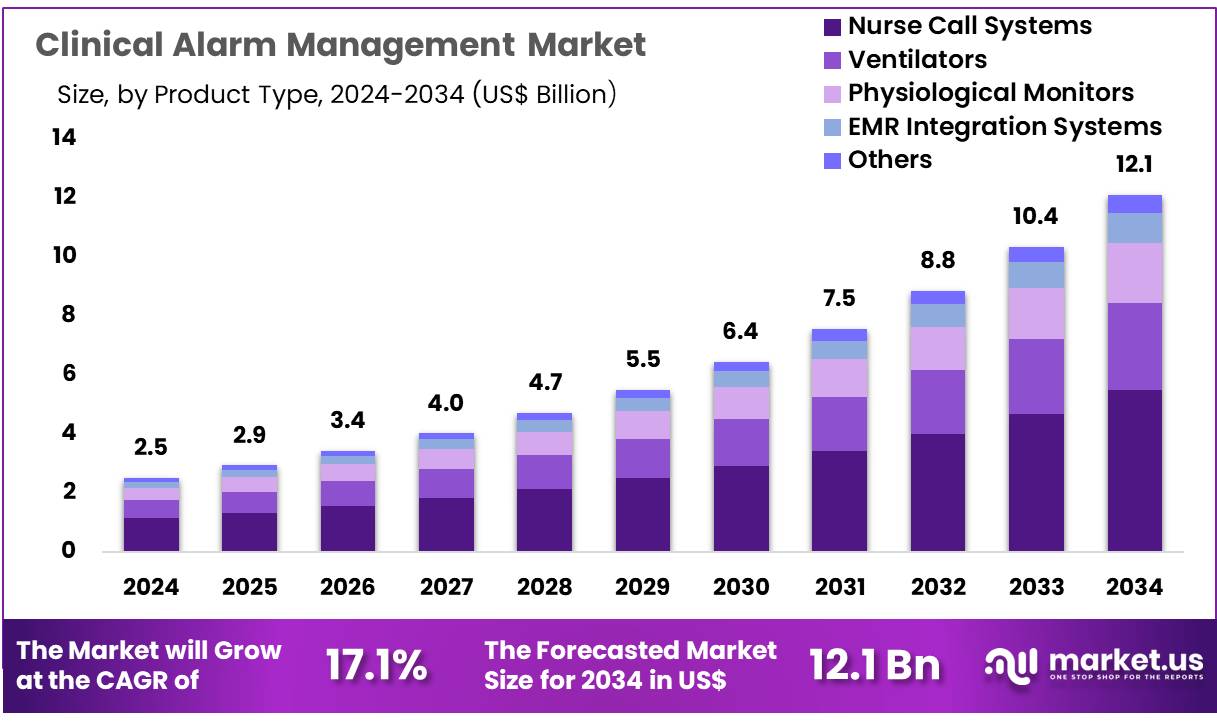

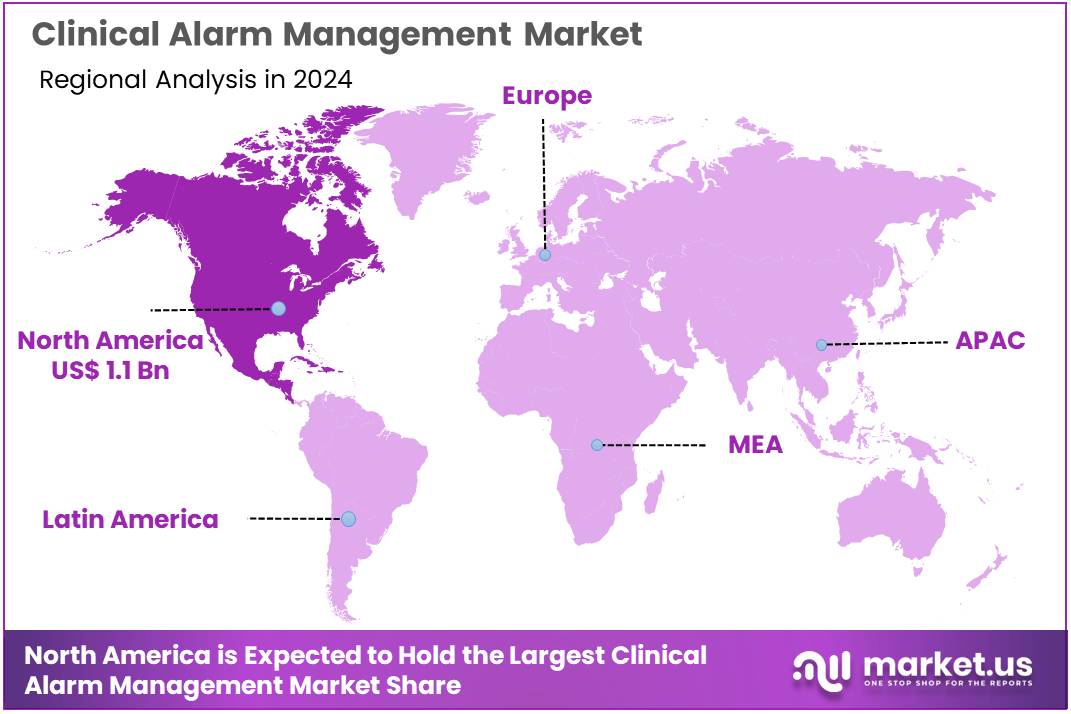

Global Clinical Alarm Management Market size is expected to be worth around US$ 12.1 billion by 2034 from US$ 2.5 billion in 2024, growing at a CAGR of 17.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 13.8% share with a revenue of US$ 1.1 billion.

Increasing patient safety concerns and the growing complexity of healthcare environments are driving the expansion of the clinical alarm management market. Hospitals and healthcare facilities face significant challenges with alarm fatigue, which leads to delayed or missed responses to critical alerts. The need for efficient alarm systems that prioritize alerts based on severity and improve communication across healthcare teams has never been more critical.

In June 2023, Niels-Stensen-Kliniken GmbH awarded a contract to Ascom, worth CHF 1 million, to deploy a state-of-the-art alarm system and IP-DECT infrastructure to improve communication and response efficiency within their healthcare facilities.

The increasing adoption of advanced technologies, such as real-time data analytics and predictive algorithms, has made it possible to further enhance alarm management by minimizing false alarms and improving response times. Opportunities in this market arise from the growing demand for integrated solutions that enhance workflow, reduce alarm fatigue, and ensure timely intervention in critical care settings.

Key Takeaways

- In 2024, the market for clinical alarm management generated a revenue of US$ 2.5 billion, with a CAGR of 17.1%, and is expected to reach US$ 12.1 billion by the year 2033.

- The product type segment is divided into nurse call systems, ventilators, physiological monitors, EMR integration systems, and others, with nurse call systems taking the lead in 2024 with a market share of 45.3%.

- Considering component, the market is divided into solutions and services. Among these, solutions held a significant share of 58.3%.

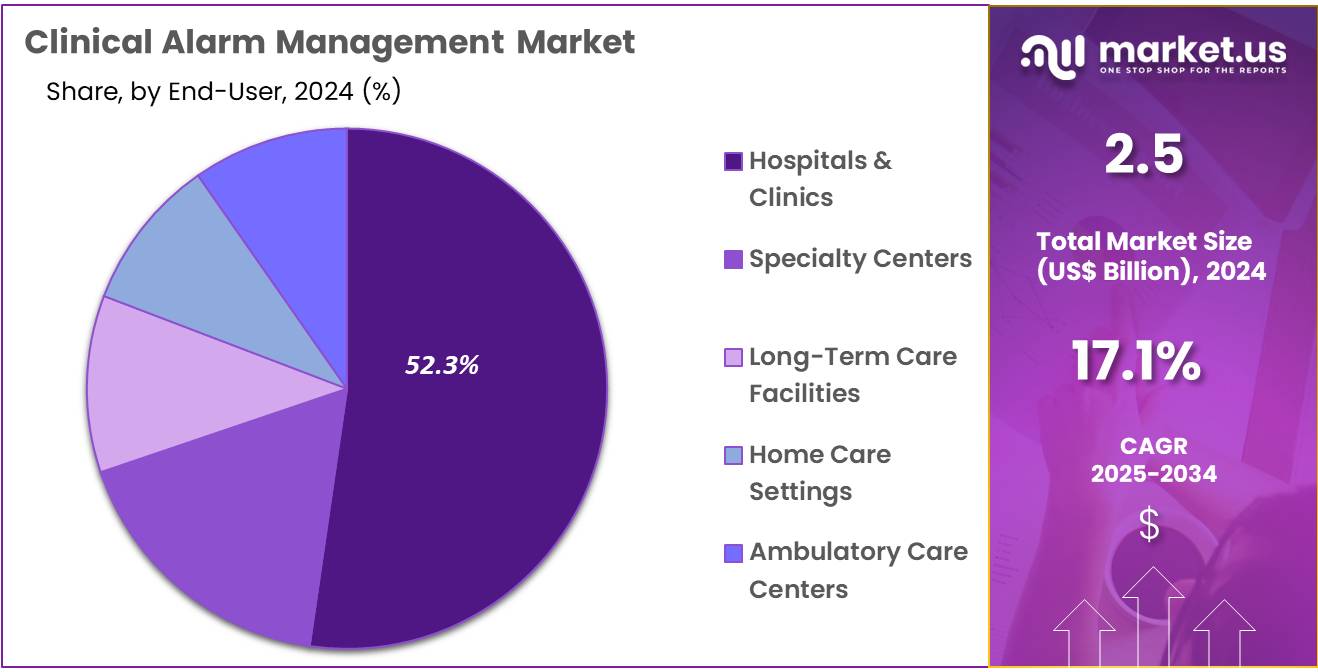

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, specialty centers, long-term care facilities, home care settings, and ambulatory care centers. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 52.3% in the clinical alarm management market.

- North America led the market by securing a market share of 43.8% in 2024.

Product Type Analysis

The nurse call systems segment led in 2024, claiming a market share of 45.3% as healthcare facilities increasingly adopt advanced communication systems to improve patient care and staff response times. Nurse call systems are anticipated to become more integrated with other hospital technologies, such as physiological monitors and EMR integration systems, to provide real-time alerts and ensure swift response to patient needs.

The rising demand for better patient safety and care coordination is likely to drive the growth of this segment. Additionally, innovations in nurse call systems, including voice-activated and wireless systems, are projected to enhance the efficiency of healthcare operations, leading to increased adoption across hospitals and clinics, further fueling the segment’s growth.

Component Analysis

The solutions held a significant share of 58.3% as healthcare providers continue to seek integrated, effective solutions to manage and respond to alarm fatigue and improve patient outcomes. Solutions that incorporate advanced alarm management features, such as real-time monitoring, data analytics, and seamless integration with other hospital systems, are expected to gain widespread adoption.

The growing awareness of the impact of alarm fatigue on healthcare staff and patient safety is likely to drive the demand for comprehensive alarm management solutions. Additionally, healthcare facilities are increasingly looking for technologies that improve clinical workflow, reduce false alarms, and enhance communication between staff, all of which are expected to drive growth in the solutions segment.

End-User Analysis

The hospitals & clinics segment had a tremendous growth rate, with a revenue share of 52.3% owing to the increasing demand for advanced alarm systems to ensure patient safety and optimize care delivery. Hospitals and clinics are expected to remain the largest consumers of clinical alarm management solutions, as these facilities are responsible for managing a high volume of patients who require constant monitoring. The rising focus on reducing alarm fatigue among healthcare professionals and enhancing response times to critical patient conditions is likely to contribute to the growth of this segment.

Additionally, the adoption of integrated alarm management systems that connect with patient monitoring devices, nurse call systems, and electronic medical records (EMR) is anticipated to drive further demand. As hospitals and clinics continue to prioritize patient safety and operational efficiency, the clinical alarm management solutions in these settings are expected to expand.

Key Market Segments

Product Type

- Nurse Call Systems

- Ventilators

- Physiological Monitors

- EMR Integration Systems

- Others

Component

- Solutions

- Services

End-user

- Hospitals & Clinics

- Specialty Centers

- Long-Term Care Facilities

- Home Care Settings

- Ambulatory Care Centers

Drivers

Rising Patient Safety Concerns are Driving the Market

The increasing focus on patient safety is a major driver for the clinical alarm management market. Alarm fatigue, a critical issue in healthcare settings, has led to adverse patient outcomes, prompting regulatory bodies to enforce stricter guidelines. In 2022, The Joint Commission reported that 85% of sentinel events in hospitals were linked to alarm-related issues. This has spurred healthcare providers to adopt advanced alarm management solutions to reduce false alarms and improve response times.

According to the US Food and Drug Administration, over 500 alarm-related incidents were reported in 2023, emphasizing the need for better systems. Companies like Philips and GE Healthcare have introduced AI-driven alarm management tools, with Philips reporting a 30% reduction in false alarms in pilot studies conducted in 2023. These developments highlight the growing demand for effective solutions to enhance patient safety.

Restraints

High Implementation Costs are Restraining the Market

The high costs associated with implementing advanced clinical alarm management systems are a significant restraint. Hospitals and healthcare facilities, especially in developing regions, often face budget constraints that limit their ability to invest in these technologies.

In 2023, the American Hospital Association estimated that the average cost of deploying a comprehensive alarm management system ranges from US$ 500,000 to US$ 2 million, depending on the size of the facility. Smaller hospitals, which account for nearly 60% of healthcare facilities in the US, struggle to allocate such funds. Additionally, training staff to use these systems adds to the overall expense. These financial barriers slow down the adoption rate, particularly in resource-limited settings, hindering market growth.

Opportunities

Integration with IoT and AI is Creating Growth Opportunities

The integration of Internet of Things (IoT) and artificial intelligence (AI) technologies is creating significant growth opportunities in the clinical alarm management market. IoT-enabled devices can seamlessly communicate with alarm systems, providing real-time data and reducing response times. In 2023, a study by the Healthcare Information and Management Systems Society found that hospitals using IoT-integrated alarm systems reported a 40% improvement in alarm accuracy.

AI algorithms, which analyze patterns to prioritize critical alerts, are also gaining traction. For instance, GE Healthcare’s AI-powered alarm management system reduced non-actionable alarms by 50% in a 2022 pilot program. These technological advancements are enabling healthcare providers to optimize workflows and improve patient outcomes, driving market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the clinical alarm management market. Economic growth in emerging markets, such as India and Brazil, is increasing healthcare investments, creating opportunities for market expansion. For example, India’s healthcare budget rose by 12% in 2023, enabling hospitals to adopt advanced technologies.

However, inflation and supply chain disruptions, exacerbated by geopolitical tensions like the Russia-Ukraine conflict, have increased the cost of medical devices and software. In 2023, the World Health Organization noted a 15% rise in medical equipment prices due to these factors.

Despite these challenges, government initiatives and public-private partnerships are fostering innovation. For instance, the US government allocated US$1 billion in 2023 to modernize hospital infrastructure, including alarm systems. These efforts ensure sustained growth, even in a complex global environment.

Latest Trends

Adoption of Cloud-Based Solutions is a Recent Trend

The adoption of cloud-based clinical alarm management solutions is a prominent trend in the market. Cloud platforms offer scalability, remote access, and cost-efficiency, making them attractive to healthcare providers. In 2023, a report by the European Hospital and Healthcare Federation revealed that 65% of hospitals in Europe are either using or planning to implement cloud-based alarm management systems.

Similarly, in the US, 70% of large hospitals have adopted cloud solutions, according to a 2022 survey by the American Medical Association. Companies like Siemens Healthineers and Ascom are leading this shift, with Siemens reporting a 25% increase in cloud-based system sales in 2023. This trend is transforming how healthcare facilities manage alarms, ensuring greater flexibility and efficiency.

Regional Analysis

North America is leading the Clinical alarm management Market

North America dominated the market with the highest revenue share of 43.8% owing to the increasing adoption of advanced healthcare technologies, rising concerns over alarm fatigue, and stringent regulatory requirements. The US Food and Drug Administration (FDA) reported a 30% increase in adverse events related to alarm fatigue between 2022 and 2023, prompting hospitals to invest in smarter alarm systems.

The Joint Commission’s National Patient Safety Goals have mandated hospitals to improve alarm system safety, leading to a 25% rise in compliance-related investments in 2023. According to the American Hospital Association (AHA), over 85% of US hospitals upgraded their alarm management systems in 2023 to reduce false alarms and improve patient outcomes.

Major healthcare providers, such as Mayo Clinic and Cleveland Clinic, have implemented AI-driven alarm management solutions, resulting in a 40% reduction in non-actionable alarms. The Canadian Institute for Health Information (CIHI) reported a 15% increase in hospital spending on alarm management technologies in 2023, reflecting growing awareness of their importance.

Additionally, the US Centers for Medicare & Medicaid Services (CMS) introduced new reimbursement policies in 2023, incentivizing hospitals to adopt advanced alarm management systems. These factors, combined with the rising prevalence of chronic diseases and the need for efficient patient monitoring, have fueled the growth of the clinical alarm management market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare digitization, rising hospital infrastructure investments, and growing awareness of patient safety. The World Health Organization (WHO) reported a 22% increase in healthcare technology adoption across the region between 2022 and 2023, with alarm management systems playing a critical role.

India’s National Health Authority (NHA) allocated US$500 million in 2023 to modernize hospital infrastructure, including the integration of advanced alarm systems. China’s National Health Commission announced a 30% increase in spending on healthcare technology in 2023, with a focus on reducing alarm fatigue in large hospitals.

Japan’s Ministry of Health, Labour, and Welfare reported a 20% rise in the adoption of AI-based alarm management solutions in 2023, aiming to enhance patient monitoring efficiency. Australia’s Australian Commission on Safety and Quality in Health Care (ACSQHC) highlighted a 15% reduction in adverse events related to alarm fatigue in 2023, attributed to improved alarm management practices.

Southeast Asian countries, such as Thailand and Malaysia, are anticipated to witness increased demand for these systems due to government initiatives to improve healthcare quality. The region’s expanding healthcare sector, coupled with rising investments in digital health technologies, is projected to drive sustained growth in the clinical alarm management market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the clinical alarm management market focus on innovation, data integration, and strategic partnerships to foster growth. They invest in developing advanced alarm systems that leverage artificial intelligence (AI) and machine learning to reduce alarm fatigue and enhance patient safety.

Companies also expand their product offerings by integrating alarm management solutions with existing healthcare systems to streamline workflows and improve response times. Collaborations with hospitals and healthcare organizations help promote the adoption of these technologies. Additionally, players target emerging markets, where rising healthcare demands create new opportunities for alarm management solutions.

Philips Healthcare, headquartered in Amsterdam, Netherlands, is a global leader in medical technologies and healthcare solutions. The company offers advanced clinical alarm management systems that use real-time monitoring and data analytics to improve patient safety and reduce alarm overload.

Philips emphasizes innovation, focusing on integrating AI and predictive analytics into its alarm management solutions. The company has a strong global presence and continues to expand its market footprint through strategic partnerships with healthcare providers and institutions. Philips remains committed to advancing healthcare through the development of cutting-edge solutions and technologies.

Top Key Players

- West-Com

- Vocera Communications

- Medtronic

- Masimo

- Hill-Rom Services, Inc

- GE Healthcare

- Capsule Technologies, Inc

- Ascom

Recent Developments

- In April 2023, Philips and Northwell Health announced a strategic seven-year partnership to enhance patient monitoring processes. This collaboration is designed to integrate advanced technologies into their healthcare framework, offering flexibility and scalability to improve patient outcomes.

- In March 2023, Ascom secured a EUR 3 million agreement with UniHA, the French network for public hospital procurement. The partnership aims to upgrade patient monitoring systems and workflows, streamlining hospital operations while enhancing overall care quality.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 billion Forecast Revenue (2034) US$ 12.1 billion CAGR (2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Nurse Call Systems, Ventilators, Physiological Monitors, EMR Integration Systems, and Others), By Component (Solutions and Services), By End-user (Hospitals & Clinics, Specialty Centers, Long-Term Care Facilities, Home Care Settings, and Ambulatory Care Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape West-Com, Vocera Communications, Medtronic, Masimo, Hill-Rom Services, Inc, GE Healthcare, Capsule Technologies, Inc, Ascom. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Alarm Management MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Alarm Management MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- West-Com

- Vocera Communications

- Medtronic

- Masimo

- Hill-Rom Services, Inc

- GE Healthcare

- Capsule Technologies, Inc

- Ascom