Global Chondroitin Sulfate Market Size, Share, And Business Benefits By Source (Bovine Cartilage, Porcine Cartilage, Shark Cartilage, Avian Cartilage, Synthetic, Others), By Grade (Pharmaceutical Grade, Food Grade, Cosmetics Grade), By Form (Powder, Granules, Tablets and Capsules, Injectable / Solution), By Application (Pharmaceuticals and OTC Drugs, Dietary Supplements, Cosmetics and Personal Care, Veterinary Medicine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158545

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

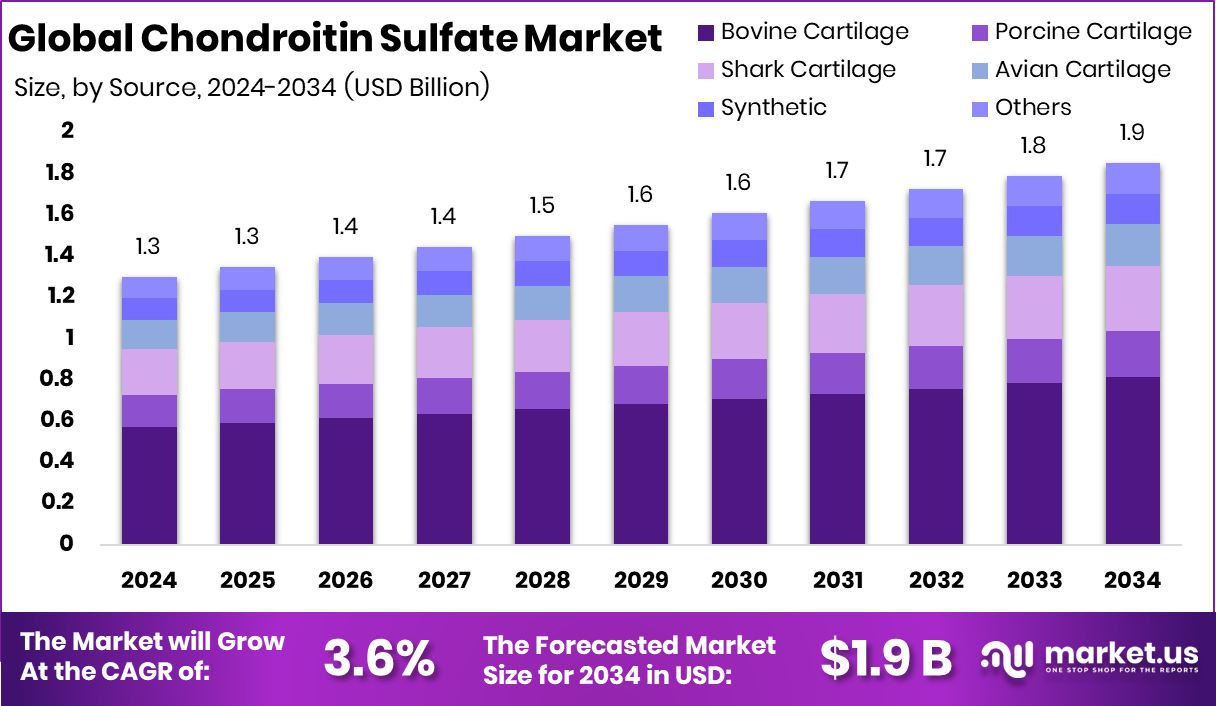

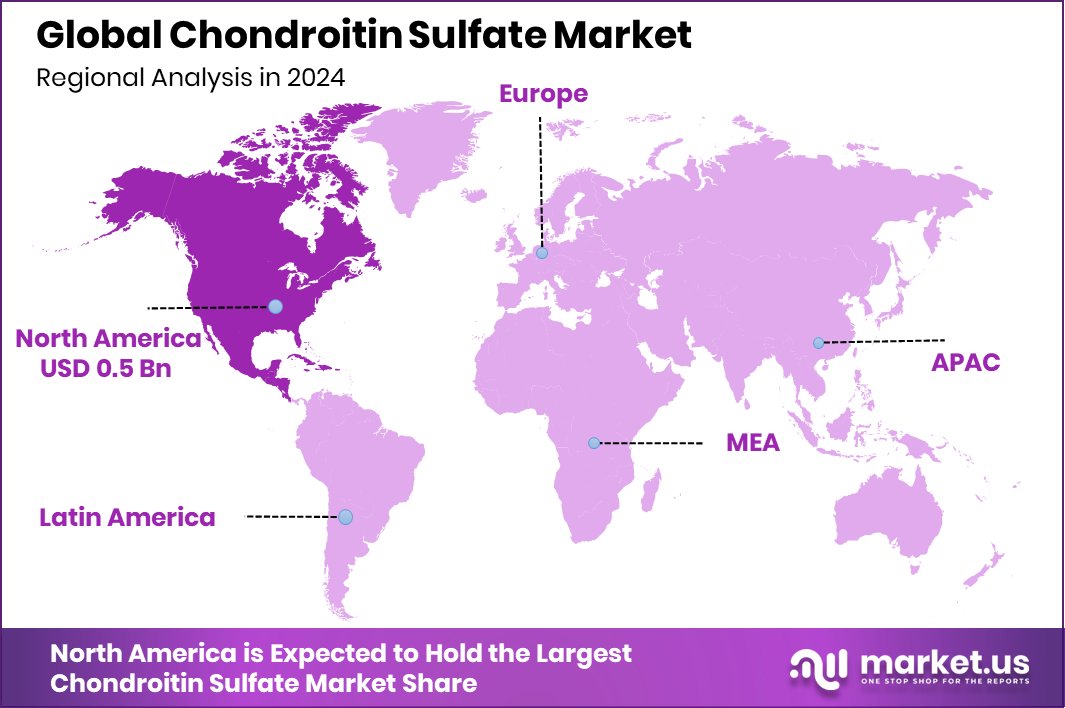

The Global Chondroitin Sulfate Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034. With a 43.80% share, North America’s Chondroitin Sulfate Market achieved USD 0.5 Bn in 2024.

Chondroitin sulfate is a naturally occurring substance found in the cartilage around joints. It is widely used as a dietary supplement because of its role in supporting joint health, reducing pain from osteoarthritis, and improving mobility. This compound helps retain water in cartilage, ensuring elasticity and cushioning of the joints, which makes it a key ingredient in many nutraceutical and pharmaceutical products aimed at bone and joint care.

The chondroitin sulfate market refers to the global trade, production, and demand for this compound across various industries, including healthcare, nutraceuticals, pharmaceuticals, and cosmetics. Its popularity is growing as more people are turning to preventive healthcare and natural supplements, especially with the rise in aging populations worldwide. The market is expanding as chondroitin sulfate finds broader applications, not only in joint care products but also in skincare and other health-focused formulations.

Rising cases of arthritis, osteoporosis, and other joint-related issues are driving steady growth. Increasing awareness of preventive healthcare and the benefits of natural supplements has further boosted the demand. According to an industry report, Oregon State University secures a historic $250 million investment to establish a world-class veterinary teaching hospital.

The demand is strongly supported by an aging global population seeking joint support solutions. Additionally, younger consumers focused on fitness and sports recovery are contributing to steady usage. The market has vast opportunities in nutraceutical innovation, particularly in combining chondroitin sulfate with other bioactive compounds for enhanced results. Expansion into skincare and pharmaceutical formulations also opens new avenues for long-term growth.

Key Takeaways

- The Global Chondroitin Sulfate Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In the Chondroitin Sulfate Market, bovine cartilage leads with a 43.9% share due to wide availability.

- Pharmaceutical grade dominates the market at 56.4%, highlighting its trusted role in healthcare and supplements.

- Powder form holds a 39.3% share, reflecting a strong preference for easy formulation in diverse health applications.

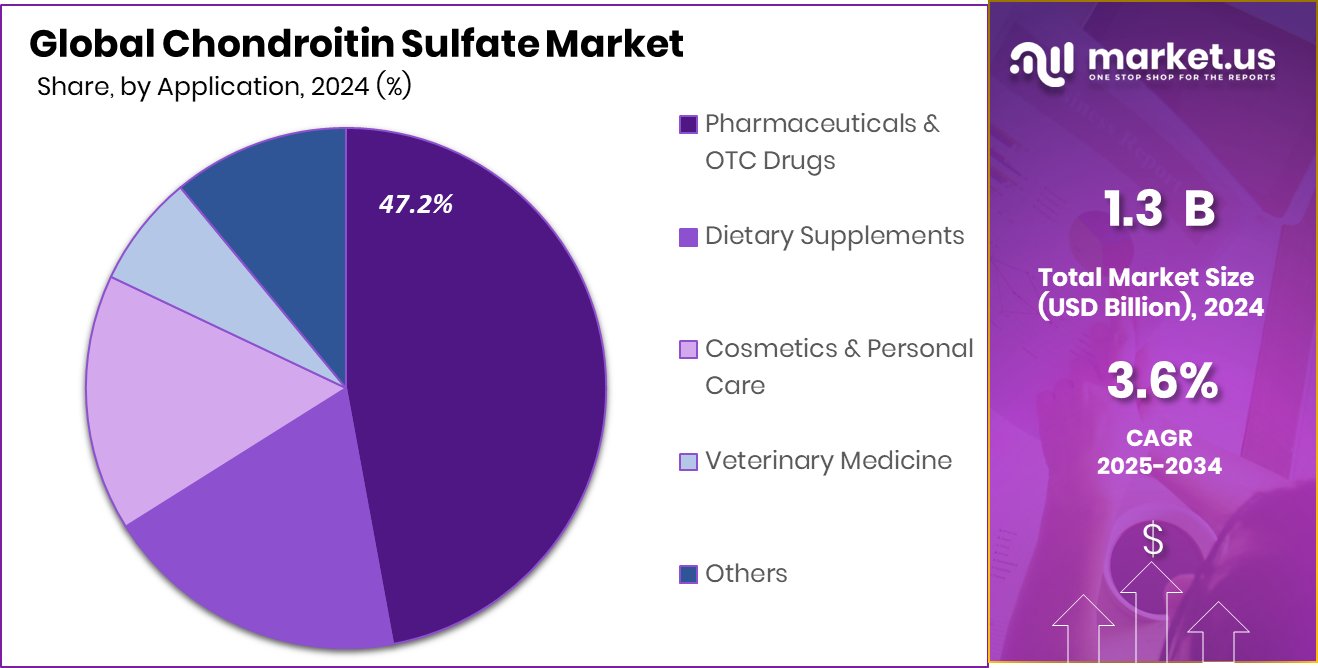

- Pharmaceuticals and OTC drugs account for 47.2%, making them the largest application segment in this market.

- The Chondroitin Sulfate Market in North America, valued at USD 0.5 Bn, held a 43.80% share.

By Source Analysis

Bovine cartilage holds a 43.9% share in the chondroitin sulfate market.

In 2024, Bovine Cartilage held a dominant market position in the By Source segment of the Chondroitin Sulfate Market, accounting for a 43.9% share. This dominance is primarily attributed to the abundant availability of bovine raw material and its cost-effectiveness in large-scale extraction processes. Bovine cartilage is widely recognized for delivering high-quality chondroitin sulfate with consistent yield, making it a preferred choice for nutraceutical and pharmaceutical applications.

Its extensive use in dietary supplements, particularly those targeting joint health and osteoarthritis management, further supports its leading share. Additionally, strong consumer trust in bovine-derived health ingredients and their proven efficacy continues to reinforce the market’s reliance on this source, ensuring steady demand growth.

By Grade Analysis

Pharmaceutical grade leads with 56.4% dominance in the chondroitin sulfate market.

In 2024, Pharmaceutical Grade held a dominant market position in the By Grade segment of the Chondroitin Sulfate Market, with a 56.4% share. This strong presence is driven by its widespread application in prescription drugs and advanced nutraceuticals aimed at managing osteoarthritis, joint pain, and cartilage repair.

Pharmaceutical-grade chondroitin sulfate is valued for its purity, safety, and compliance with stringent regulatory standards, making it the preferred option for medical use. The growing demand for clinically validated ingredients in healthcare products further supports its leadership. Rising awareness of preventive healthcare and the increasing adoption of high-quality supplements among aging populations reinforce the reliance on pharmaceutical-grade chondroitin sulfate, securing its dominant share in the market.

By Form Analysis

Powder form represents 39.3% usage within the chondroitin sulfate market.

In 2024, Powder held a dominant market position in the By Form segment of the Chondroitin Sulfate Market, with a 39.3% share. The preference for powder form is largely due to its versatility and ease of incorporation into a wide range of applications, including dietary supplements, functional foods, and pharmaceuticals. Its stability, longer shelf life, and convenience in packaging and transport further enhance its adoption.

Powder form also allows precise dosage formulation, making it suitable for capsules, tablets, and blended nutraceutical products. With rising consumer interest in joint health and preventive care, the demand for powdered chondroitin sulfate continues to expand, solidifying its leadership in the market’s form-based segment.

By Application Analysis

Pharmaceuticals and OTC drugs capture 47.2% of the chondroitin sulfate market.

In 2024, Pharmaceuticals and OTC Drugs held a dominant market position in the By Application segment of the Chondroitin Sulfate Market, with a 47.2% share. This leadership stems from the extensive use of chondroitin sulfate in the treatment of osteoarthritis, joint pain, and cartilage-related disorders, where it is widely included in both prescription and over-the-counter medications.

Its clinically supported benefits in improving mobility and reducing inflammation have made it a trusted ingredient in pharmaceutical formulations. The aging population and growing demand for effective joint health solutions continue to drive this segment forward. Moreover, the preference for safe, natural-origin compounds in healthcare enhances the reliance on chondroitin sulfate in pharmaceutical and OTC drug applications.

Key Market Segments

By Source

- Bovine Cartilage

- Porcine Cartilage

- Shark Cartilage

- Avian Cartilage

- Synthetic

- Others

By Grade

- Pharmaceutical Grade

- Food Grade

- Cosmetics Grade

By Form

- Powder

- Granules

- Tablets and Capsules

- Injectable / Solution

By Application

- Pharmaceuticals and OTC Drugs

- Dietary Supplements

- Cosmetics and Personal Care

- Veterinary Medicine

- Others

Driving Factors

Rising Joint Disorders Drive Strong Market Growth

One of the main driving factors of the Chondroitin Sulfate Market is the rising number of people suffering from joint disorders such as osteoarthritis and osteoporosis. With the global population aging rapidly, cases of joint pain, cartilage damage, and reduced mobility are becoming more common. According to an industry report, Veterinary stem cell therapy moves closer to FDA approval with $18 million in funding.

Chondroitin sulfate plays a key role in supporting joint health by improving flexibility, reducing inflammation, and slowing down cartilage breakdown. This has created a strong demand for supplements, pharmaceutical products, and over-the-counter medicines that include this compound. Additionally, more people are turning toward preventive healthcare and natural solutions, further boosting demand. As joint-related issues continue to rise worldwide, the market for chondroitin sulfate is set to expand steadily.

Restraining Factors

High Production Costs Limit Wider Market Expansion

A key restraining factor in the Chondroitin Sulfate Market is the high cost of production and processing. Extracting chondroitin sulfate from natural sources such as bovine or marine cartilage requires advanced techniques, strict quality controls, and compliance with regulatory standards, all of which increase overall costs.

These expenses are often passed on to the end consumer, making products more expensive compared to other joint health supplements. In some regions, the high price limits accessibility for middle- and low-income groups, slowing down mass adoption. Additionally, fluctuations in raw material supply can further impact cost stability. As a result, the high production and pricing challenges act as barriers to the wider market growth.

Growth Opportunity

Expanding Use in Skincare Creates New Opportunities

A major growth opportunity for the Chondroitin Sulfate Market lies in its expanding use in the skincare and cosmetic industry. Known for its ability to retain moisture and support collagen production, chondroitin sulfate is increasingly being added to creams, serums, and anti-aging products. Consumers today are seeking natural and effective ingredients that improve skin hydration, elasticity, and overall appearance, which makes this compound highly attractive for cosmetic formulations.

With rising awareness about preventive skincare and the growing preference for bioactive, science-backed ingredients, manufacturers have significant room to innovate. As beauty and wellness trends continue to merge, the use of chondroitin sulfate in skincare offers a promising path for long-term market expansion. According to an industry report, WisCARES is awarded a $2 million grant from Maddie’s Fund to grow its community pet resource center and veterinary clinic.

Latest Trends

Growing Popularity of Combination Joint Health Supplements

One of the latest trends in the Chondroitin Sulfate Market is the increasing popularity of combination supplements that blend chondroitin sulfate with other joint-supporting ingredients like glucosamine, collagen, or hyaluronic acid. Consumers are showing greater interest in products that deliver multi-functional benefits, addressing not only joint pain but also cartilage strength, flexibility, and overall mobility.

These formulations are especially appealing to aging populations, athletes, and fitness enthusiasts who prefer comprehensive solutions for long-term joint care. The trend is also supported by rising awareness of preventive healthcare and a preference for natural, science-backed formulations. This shift toward combined products is shaping innovation, encouraging companies to create more effective and convenient supplement options. According to an industry report, UC Davis School of Veterinary Medicine is beginning a $110 million expansion project.

Regional Analysis

In 2024, North America dominated the Chondroitin Sulfate Market with a 43.80% share, reaching USD 0.5 Bn.

The Chondroitin Sulfate Market shows varied growth patterns across regions, shaped by healthcare awareness, demographic trends, and demand for joint health products. North America emerged as the dominating region in 2024, holding a 43.80% share valued at USD 0.5 billion. This leadership is supported by the region’s aging population, high prevalence of osteoarthritis, and widespread adoption of dietary supplements and pharmaceutical-grade formulations.

Strong healthcare infrastructure and consumer awareness further reinforce its dominant position. Europe follows with steady growth, supported by increasing preventive healthcare practices and demand for nutraceuticals in countries like Germany and France. Asia Pacific is expected to see rapid expansion, driven by a growing elderly population, rising disposable incomes, and awareness of joint health in countries such as China, Japan, and India.

Meanwhile, the Middle East & Africa region is gradually adopting chondroitin sulfate in pharmaceutical and nutraceutical products as healthcare access improves. Latin America is also witnessing rising interest, largely due to increased awareness of natural health supplements and supportive government initiatives in healthcare. Together, these regional dynamics highlight North America’s continued leadership, while Europe and the Asia Pacific are poised as key contributors to future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bioiberica S.A.U. stands out as a leading name in the space, well-recognized for its focus on high-purity pharmaceutical-grade chondroitin sulfate. The company benefits from its strong European footprint and regulatory compliance, which enhance trust among the pharmaceutical and nutraceutical industries. Its emphasis on research-driven production ensures consistent demand from healthcare applications, particularly in joint health solutions.

Changzhou Qianhong Bio-pharma Co., Ltd. has solidified its position as one of the prominent suppliers from Asia, leveraging large-scale manufacturing capacity and efficient sourcing. The company plays a crucial role in ensuring steady global availability, especially in regions with growing healthcare needs. Its production strength allows it to compete in cost-sensitive markets, making it a vital contributor to industry expansion.

Focus Chem Biotech has gained recognition for offering reliable chondroitin sulfate solutions with a balance of quality and affordability. The company’s adaptability and ability to meet the requirements of both nutraceutical and pharmaceutical customers have helped strengthen its market relevance. Collectively, these players ensure supply stability, drive innovation, and enhance global access, positioning the chondroitin sulfate market for long-term, sustainable growth.

Top Key Players in the Market

- Bioiberica S.A.U.

- Changzhou Qianhong Bio-pharma Co., Ltd.

- Focus Chem Biotech

- Gnosis by Lesaffre

- IBSA Institut Biochimique SA

- Jiaxing Hengtai Pharma Co., Ltd.

- Kraeber & Co. GmbH

- Pacific Rainbow International Inc.

- Qingdao WanTuMing Biological Co., Ltd.

- Seikagaku Corporation

Recent Developments

- In April 2025, Gnosis by Lesaffre announced that its fermentation-derived chondroitin sulfate (previously called Mythocondro®) would be officially rebranded as MyCondro™. The change came with a new logo and a simpler name to make it more recognizable. MyCondro is animal-free, made via fermentation, aims to be more sustainable, and claims higher purity and better bioavailability than traditional, animal-derived versions.

- In February 2025, Qingdao WanTuMing Biological Co., Ltd. announced that it had successfully obtained the USP GMP Audit Certificate and the USP Dietary Ingredient Certification from the U.S. Pharmacopeia (USP).

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 1.9 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Bovine Cartilage, Porcine Cartilage, Shark Cartilage, Avian Cartilage, Synthetic, Others), By Grade (Pharmaceutical Grade, Food Grade, Cosmetics Grade), By Form (Powder, Granules, Tablets and Capsules, Injectable / Solution), By Application (Pharmaceuticals and OTC Drugs, Dietary Supplements, Cosmetics and Personal Care, Veterinary Medicine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bioiberica S.A.U., Changzhou Qianhong Bio-pharma Co., Ltd., Focus Chem Biotech, Gnosis by Lesaffre, IBSA Institut Biochimique SA, Jiaxing Hengtai Pharma Co., Ltd., Kraeber & Co. GmbH, Pacific Rainbow International Inc., Qingdao WanTuMing Biological Co., Ltd., Seikagaku Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chondroitin Sulfate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Chondroitin Sulfate MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bioiberica S.A.U.

- Changzhou Qianhong Bio-pharma Co., Ltd.

- Focus Chem Biotech

- Gnosis by Lesaffre

- IBSA Institut Biochimique SA

- Jiaxing Hengtai Pharma Co., Ltd.

- Kraeber & Co. GmbH

- Pacific Rainbow International Inc.

- Qingdao WanTuMing Biological Co., Ltd.

- Seikagaku Corporation