Global Chloroprene Rubber Market by Product Type (Linear, Pre Cross-linked, Sulfur-Modified, and Others), By Application (Coatings And Adhesives, Wires And Cables, Hoses And Tubes, and Other Applications), By End-Use Industry (Automotive, Textile, Construction, Furniture, Shoes, and Other Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155397

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

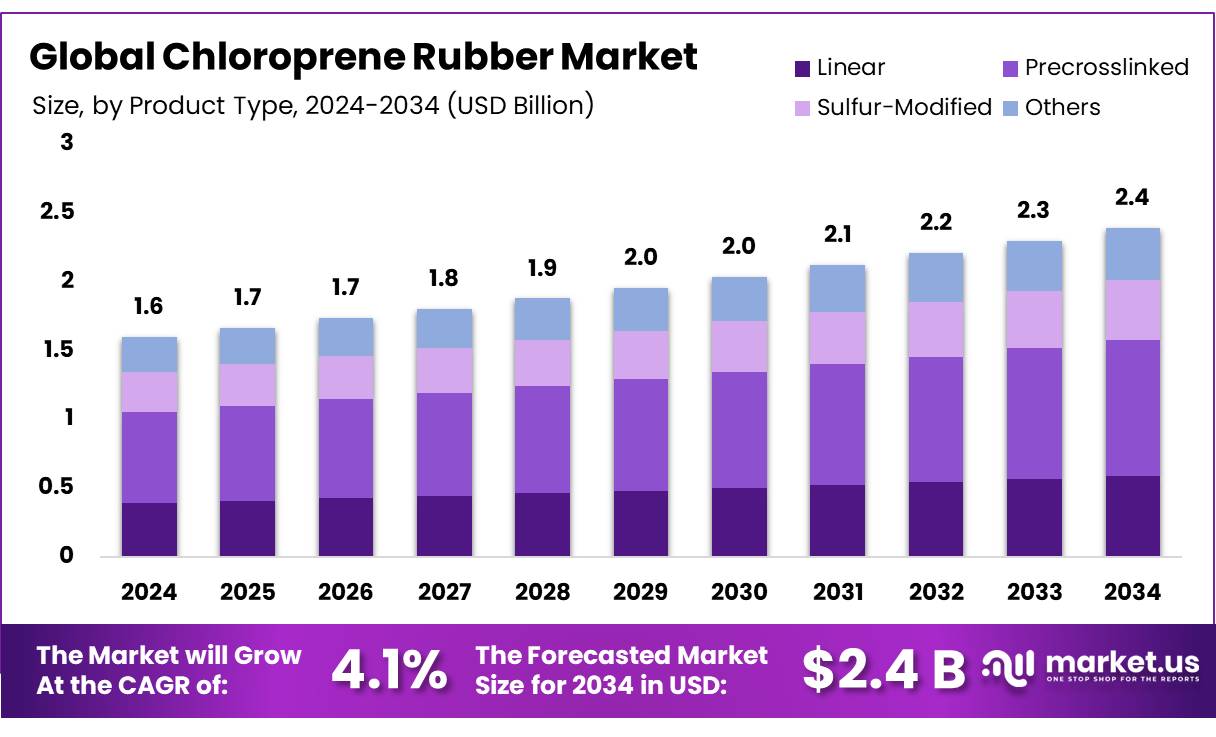

The Global Chloroprene Rubber Market size is expected to be worth around USD 2.4 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

Chloroprene rubber (CR), also known as neoprene, is a synthetic rubber made by polymerizing chloroprene. It is the first commercial synthetic rubber that became available to the rubber industry in 1935 by DuPont. The rubber is known for its good chemical resistance, resistance to aging and ozone, and flame resistance. It is used in various industrial and consumer products, including automotive parts, construction materials, sporting goods, and protective gear.

It’s used in a wide range of applications, including hoses, belts, cables, seals, and various consumer goods. The major demand for the product is in the automotive, construction, and textile industries. While it has good chemical resistance, it’s not recommended for use with strong oxidizing acids, esters, ketones, or chlorinated aromatic and nitro hydrocarbons. And, hence, the product faces challenges from alternative synthetic rubbers, such as silicone rubber.

In recent years, the market has also been characterized by the products’ application in the marine and shoe industry, and the green technologies used in the production of chloroprene rubber, driven by consumer demand for eco-friendly and sustainable practices.

- According to the Environmental Protection Agency, in 2024, the global production of 1,3-butadiene, which is the main raw material when manufacturing chloroprene, reached approximately 26 billion pounds.

Key Takeaways

- The global chloroprene rubber market was valued at USD 1.6 billion in 2024.

- The global chloroprene rubber market is projected to grow at a CAGR of 4.1% and is estimated to reach USD 2.4 billion by 2034.

- In the product segment, precrosslinked chloroprene rubbers dominate the market with around 41.5% of the total market share.

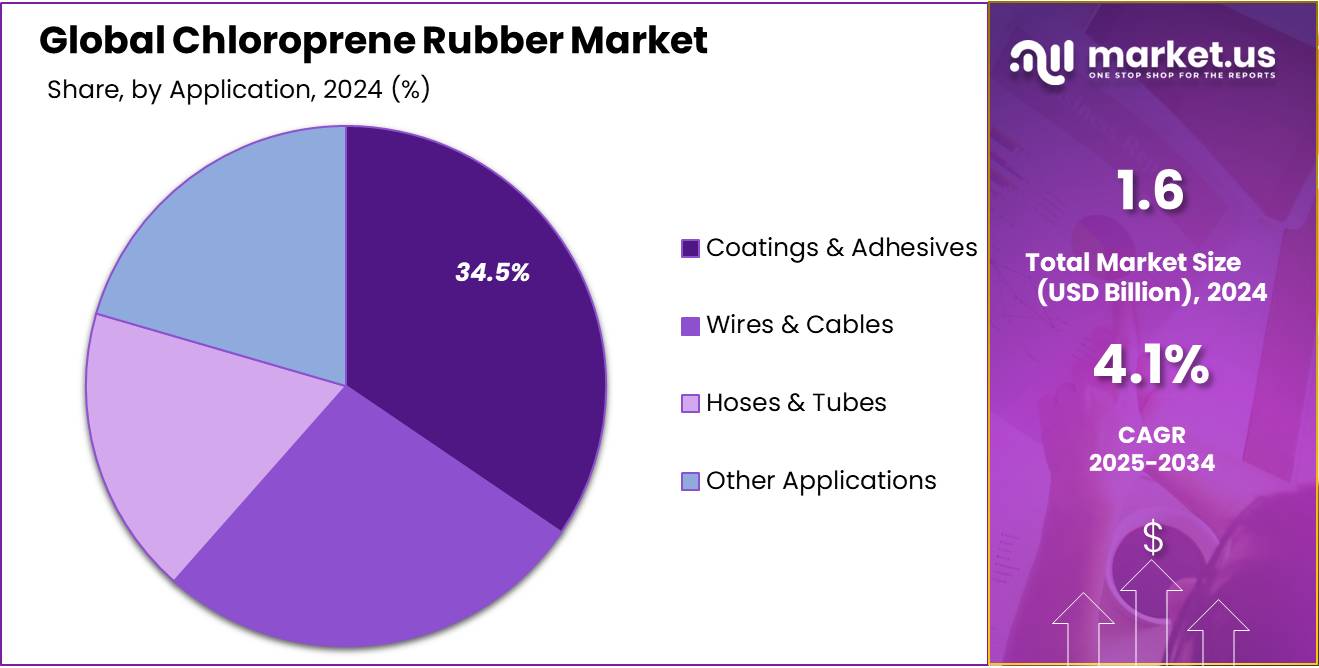

- Among the applications, chloroprene used in coatings and adhesives held the majority of revenue share in 2024 at 34.5%.

- Based on End-Use Industry, the chloroprene rubber market was led by the automotive industry with a substantial market share of 36.8% in 2024.

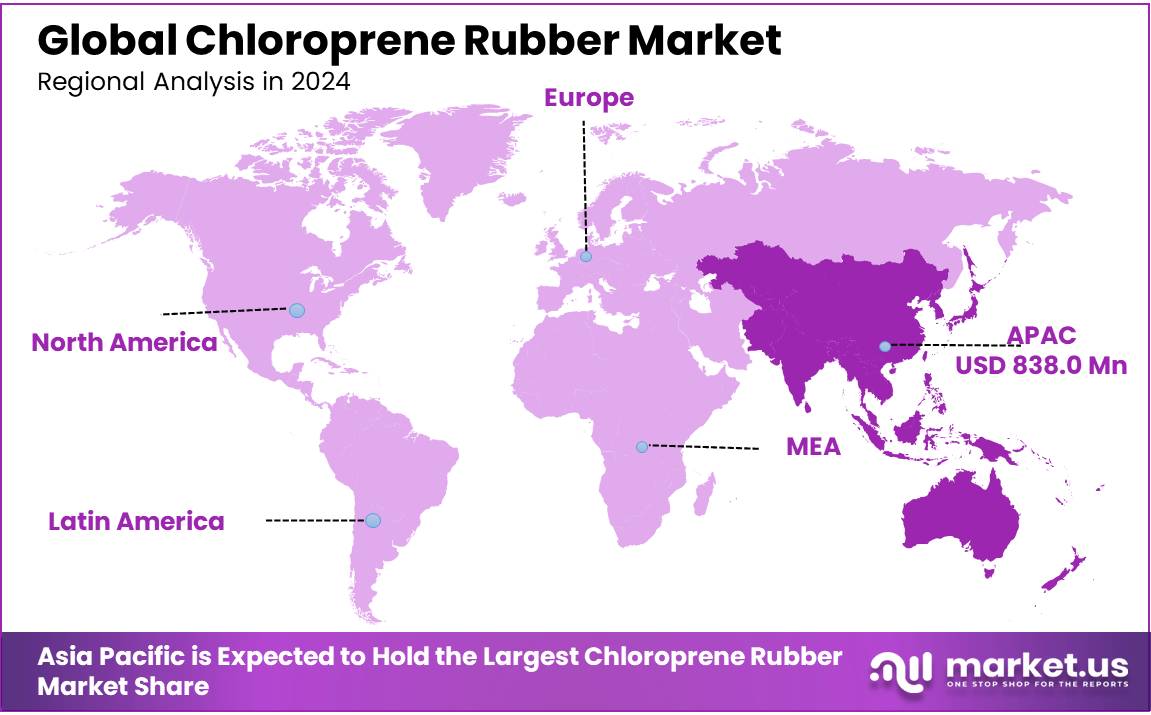

- In 2024, the Asia Pacific was the biggest market for chloroprene rubbers, constituting around 52.4% of the total market share, valued at approximately USD 838 million.

Product Type Analysis

Precrosslinked Chloroprene Rubber Dominates the Market

The chloroprene rubber market is segmented based on product type as linear, pre-crosslinked, sulfur-modified, and crystallized. In 2024, precrosslinked chloroprene rubber held a dominant market position, capturing more than a 41.5% share of the global market. Linear grade chloroprene is mostly produced with n-dodecyl mercaptan as the chain transfer agent and occasionally with xanthogen disulfides. If xanthogen disulfides are used, the elastomers are more readily processible and give vulcanizates with improved mechanical properties.

While many grades of chloroprene rubbers are used across various applications, linear grade chloroprene is used for automotive parts, industrial components, and some adhesive applications, and is among the most widely used. This grade often offers a good balance of properties such as oil, heat, and weather resistance, making it versatile for diverse uses.

Application Analysis

Coatings and Adhesives Application of Chloroprene Rubber Dominated the Market.

Based on application, the chloroprene rubber market is divided into coatings & adhesives, wires & cables, hoses & tubes, and other applications. In 2024, the coatings and adhesives application of chloroprene rubber held a dominant position, capturing a market of about 34.5%. It is widely used in coatings and adhesives due to its excellent properties. It’s a key component in contact adhesives, providing strong, durable bonds for various materials and applications, including high-pressure laminates, automotive trim, and furniture assembly. Additionally, chloroprene latex is used in water-based adhesives and waterproof coatings, particularly for construction and shoes.

End-Use Industry Analysis

The Automotive Industry Dominates the Chloroprene Rubber Market with around 36.8% of the Total Market Share.

Based on end-use industries, the market can be segregated into automotive, textile, construction, furniture, shoes, and other industries. In 2024, the automotive industry in the category dominated the global chloroprene rubber market with a market share of 36.8%. The rubber is widely used in the automotive industry due to its durability, flexibility, and resistance to various environmental factors and chemicals. It is a critical material for manufacturing components like seals, gaskets, hoses, and belts, contributing to the overall efficiency and longevity of vehicles.

Automotive components must withstand harsh conditions, including extreme temperatures, pressure, and exposure to various chemicals, making chloroprene rubber a suitable choice. The industry’s focus on developing more fuel-efficient and durable vehicles has increased the demand for high-performance materials like chloroprene rubber.

Key Market Segments

By Product Type

- Linear

- Precrosslinked

- Sulfur-Modified

- Others

By Application

- Coatings & Adhesives

- Wires & Cables

- Hoses & Tubes

- Other Applications

By End-Use Industry

- Automotive

- Textile

- Construction

- Furniture

- Shoes

- Other Industries

Drivers

High Demand from the Automotive and Construction Industry Drives the Chloroprene Rubber Market.

High demand for chloroprene rubbers from the automotive and construction industries drives the market. Chloroprene rubber is widely used in the automotive and construction industries due to its excellent properties, like resistance to oil, heat, and chemicals. It’s a key component in various automotive parts, including hoses, belts, seals, and gaskets, contributing to the performance, durability, and safety of vehicles. In the construction industry, it is useful in seals, membranes, and expansion joints, enhancing the durability and longevity of structures.

The construction industry also significantly contributes to chloroprene rubber consumption, particularly for applications demanding durability and weather-resistance. This includes its use in roofing membranes, bridge bearings, and construction seals. The notable $2,192.2 billion in U.S. construction spending for December 2024 (4.3% higher year-over-year) underscores a robust sector supporting the chloroprene rubber demand.

Restraints

Alternative Synthetic Rubbers Might Pose a Challenge to the Chloroprene Rubbers Market.

Alternative synthetic rubbers, such as epichlorohydrin (ECO), might hinder the chloroprene rubber market due to their advanced properties. Epichlorohydrin can be used as a replacement for chloroprene rubber in certain applications, particularly where high temperature, oil, and fuel resistance are crucial. ECO, often marketed under the brand name Hydrin, offers a good balance of properties, including excellent resistance to heat, oils, fuels, and ozone, making it suitable for automotive and industrial applications.

Additionally, EPDM (ethylene propylene diene monomer) can be a suitable replacement for chloroprene in certain applications, particularly those prioritizing weather resistance, ozone resistance, and electrical insulation. EPDM offers advantages in outdoor applications due to its excellent resistance to UV rays and ozone.

Opportunity

Marine Applications of Chloroprene Rubber Are Anticipated to Create More Opportunities in the Market.

The emerging applications of chloroprene rubber in the marine industry are expected to create more opportunities in the market. It is widely used in marine applications due to its excellent resistance to saltwater, weathering, and mechanical stress. Its versatility makes it suitable for various components, including seals, gaskets, fenders, and even wetsuits. Chloroprene rubber is the core material for wetsuits and other diving equipment due to its flexibility and insulation properties. There are several major players in the industry, leveraging this trend.

For instance, CR from Denka is used as rubber linings such as container bags, coated cloth for seats, leisure boats, and lifeboats. It is also used as a foam rubber or sponge with a large foam magnification for wetsuits used in marine sports, as well as cushion rubbers and other items that protect human lives from the danger of flames on vehicles such as aircraft and ships. Furthermore, neoprene’s ability to dampen vibrations makes it useful in engine mounts and other areas where noise and vibration reduction are important.

Trends

Shift Towards Blended Chloroprene Elastomers.

The trend in the chloroprene rubber industry is moving towards chloroprene blended elastomers. This is driven by the desire to combine the beneficial properties of CR, such as good mechanical properties, flame resistance, and weather resistance, with the specific advantages of other elastomers like nitrile rubber for oil resistance or butadiene rubber for low-temperature flexibility. Blending allows for the creation of tailor-made materials with optimized properties for various applications.

By adjusting the blend ratios, manufacturers can create elastomeric compounds with specific properties optimized for particular applications. For instance, Ansell Microflex Neopro gloves are made with a unique neoprene blend that offers protection against chemicals and cytotoxic/chemotherapy drugs.

Geopolitical Impact Analysis

Ongoing Geopolitical Tensions Can Affect the Chloroprene Rubber Market by Disrupting the Supply Chain and Increasing the Price Volatility for the Product as well as Raw Materials.

Geopolitical tensions can significantly impact the chloroprene rubber market by disrupting supply chains, increasing price volatility, and affecting investment decisions. In 2023, Russia exported around 11.4% of the world’s total butadiene exports, valued at approximately US$382 million. The Russia-Ukraine war has created instability and led to the disruption of the supply chain of raw materials to the industry. Similarly, amid China-Taiwan tensions, several companies are forced to shift their manufacturing bases to countries such as Vietnam, India, and Thailand.

As a result, many players are facing difficulties. For instance, the business environment of Resonac chloroprene remains severe due to a substantial rise in raw material and electricity costs caused by surging raw material and fuel prices amidst geopolitical tensions. The company made efforts to reduce the production costs through streamlining of the production process; however, it had to raise the prices by US$550.00/t or more for US-dollar-based transactions and Euros 500.00/t or more for euro-based transactions to ensure a stable supply of products and continuity of the business.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Chloroprene Rubber Market

In 2024, the Asia Pacific dominated the global chloroprene rubber market, holding about 52.4%, valued at approximately USD 838 million. The demand for chloroprene rubber is driven by the expanding automotive, construction, and manufacturing sectors in the region. Rapid industrialization in the Asia Pacific, particularly in China, India, Japan, and South Korea, demands a large amount of chloroprene rubber.

- For instance, according to the Industrial Development Organization of the United Nations, 54.3% patents were registered by middle-income industrial economies, with patents increasingly concentrated in the Asia Pacific.

Similarly, in 2023, the United Nations reported that R&D expenditure was relatively higher in Eastern Asia and that there is a positive correlation between R&D and sustainable industrial development. Additionally, the region is home to some well-known major players, such as Denka Company, Shanxi Synthetic Rubber, and Qingdao Nova Rubber in the market. Another prominent region in the market is Europe. Europe is the region where most automotive original equipment manufacturers (OEMs) are situated, increasing the demand from the automotive industry for chloroprene. Additionally, the region has imposed several laws regarding the emphasis on PPE equipment, boosting the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DuPont Performance Elastomers, Showa Denko, Denka Company, Shanxi Synthetic Rubber Group, Tosoh Corporation, Zenith Industrial Rubber Products, ARLANXEO, SEDO Chemicals Neoprene, Qingdao Nova Rubber, and Resonac Holdings Corporation are the giants in the chloroprene rubber market. In a competitive market of chloroprene rubber, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments.

Resonac offers both dry chip and aqueous dispersion latex forms, with over 30 grades available to meet specific application needs. Resonac is actively working to reduce production costs and improve the environmental footprint of its chloroprene production, aligning itself with eco-conscious customers.

Shanxi Synthetic Rubber Group Co., Ltd. is a major producer of chloroprene rubber in China, with a significant market share and a large production capacity. They utilize the calcium carbide-acetylene approach to manufacture CR and are known for their large-scale production of various CR products.

SEDO Chemicals Neoprene GmbH specializes in manufacturing cellular rubber products, including those made from chloroprene. They are known for their ability to produce high-quality, flexible, and durable Neoprene materials, with a focus on custom solutions and short lead times.

Qingdao Nova Rubber Co.’s involvement in the chloroprene rubber market positions it within a sector that is experiencing significant growth, particularly in the automotive and construction industries.

The Major Players in the Industry

- DuPont Performance Elastomers

- Showa Denko K.K.

- Denka Company Limited

- Shanxi Synthetic Rubber Group Co., Ltd.

- Tosoh Corporation

- Zenith Industrial Rubber Products Pvt. Ltd.

- ARLANXEO

- SEDO Chemicals Neoprene GmbH

- Qingdao Nova Rubber Co., Ltd.

- Resonac Holdings Corporation

- Other Key Players

Key Development

- In June 2025, Tosoh Corporation announced that it would invest 75 billion yen to build a second production facility in Nanyang Industrial Park, Shunan City, Yamaguchi Prefecture, Japan, to increase its chloroprene rubber production capacity to meet the growing global demand for chloroprene rubber. After the new plant is put into operation, the Japanese group’s Skyprene brand chloroprene rubber production capacity will increase by 22,000 tons per year.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Linear, Precrosslinked, Sulfur-Modified, Others), By Application (Coatings & Adhesives, Wires & Cables, Hoses & Tubes, Other Applications), By End-Use Industry (Automotive, Textile, Construction, Furniture, Shoes, Other Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape DuPont Performance Elastomers, Showa Denko K.K., Denka Company Limited, Shanxi Synthetic Rubber Group Co., Ltd., Tosoh Corporation, Zenith Industrial Rubber Products Pvt. Ltd., ARLANXEO, SEDO Chemicals Neoprene GmbH, Qingdao Nova Rubber Co., Ltd., Resonac Holdings Corporation, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- DuPont Performance Elastomers

- Showa Denko K.K.

- Denka Company Limited

- Shanxi Synthetic Rubber Group Co., Ltd.

- Tosoh Corporation

- Zenith Industrial Rubber Products Pvt. Ltd.

- ARLANXEO

- SEDO Chemicals Neoprene GmbH

- Qingdao Nova Rubber Co., Ltd.

- Resonac Holdings Corporation

- Other Key Players