Global Cheese Snacks Market By Type (Mozzarella, Parmesan, Cheddar, Feta, Others), By Product Type (Baked, Fried, Frozen Snacks), By End-User (Franchise Outlets, Bakery, HoReCa, Household), By Sales Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151539

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

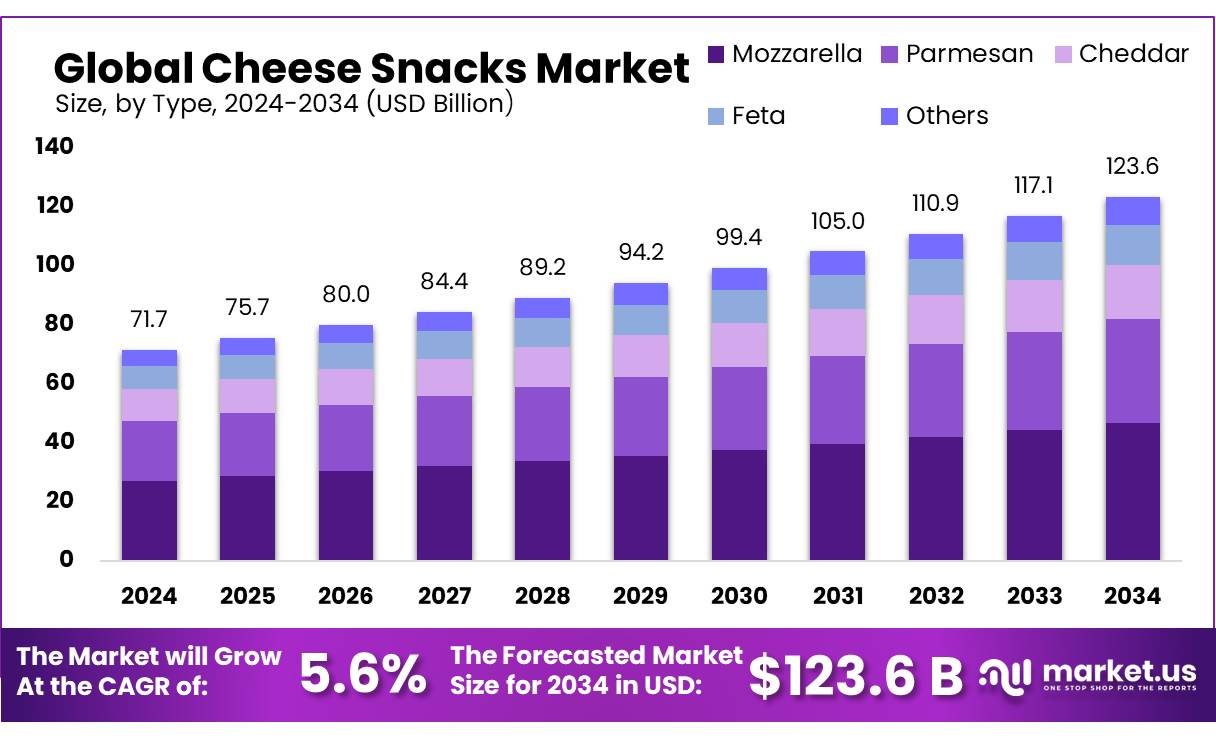

The Global Cheese Snacks Market size is expected to be worth around USD 123.6 Billion by 2034, from USD 71.7 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The global cheese snacks concentrates industry—encompassing cheese powders, pastes, and liquids—has developed robust momentum, propelled by evolving consumer preferences, technological innovation, and government support. The industry can be outlined across four key segments: introduction, current scenario, driving factors, and future growth opportunities.

Supporting industrial expansion, government programs and agricultural output are critical. In Mexico, cheese production is forecast to increase by 2% in 2025 to 485,000 MT, and consumption by 2% to 675,000 MT, driven by rising incomes and HRI demand. Milk production in the same region is expected to reach 13.9 MMT in 2025, supporting upstream raw material availability. Although data for India are less specified by concentrate, India’s dairy production is being bolstered via government schemes, which aim to elevate milk yields and processing, indirectly benefiting cheese concentrate supply chains.

Opportunities exist in expanding application domains—ready-to-eat meals, snacks, sauces, and dressings—alongside ongoing interest in clean-label, nutritional variants . Emerging technologies may improve yield and flavor retention. Additionally, expansion in developing markets—particularly India, China, Mexico, and Brazil—presents high potential, supported by rising urbanization, shifting dietary habits, and supportive dairy-sector infrastructure development.

Key Takeaways

- Cheese Snacks Market size is expected to be worth around USD 123.6 Billion by 2034, from USD 71.7 Billion in 2024, growing at a CAGR of 5.6%.

- Mozzarella held a dominant market position, capturing more than a 37.9% share in the global cheese snacks market.

- Baked held a dominant market position, capturing more than a 47.1% share in the global cheese snacks market.

- HoReCa held a dominant market position, capturing more than a 36.2% share in the global cheese snacks market.

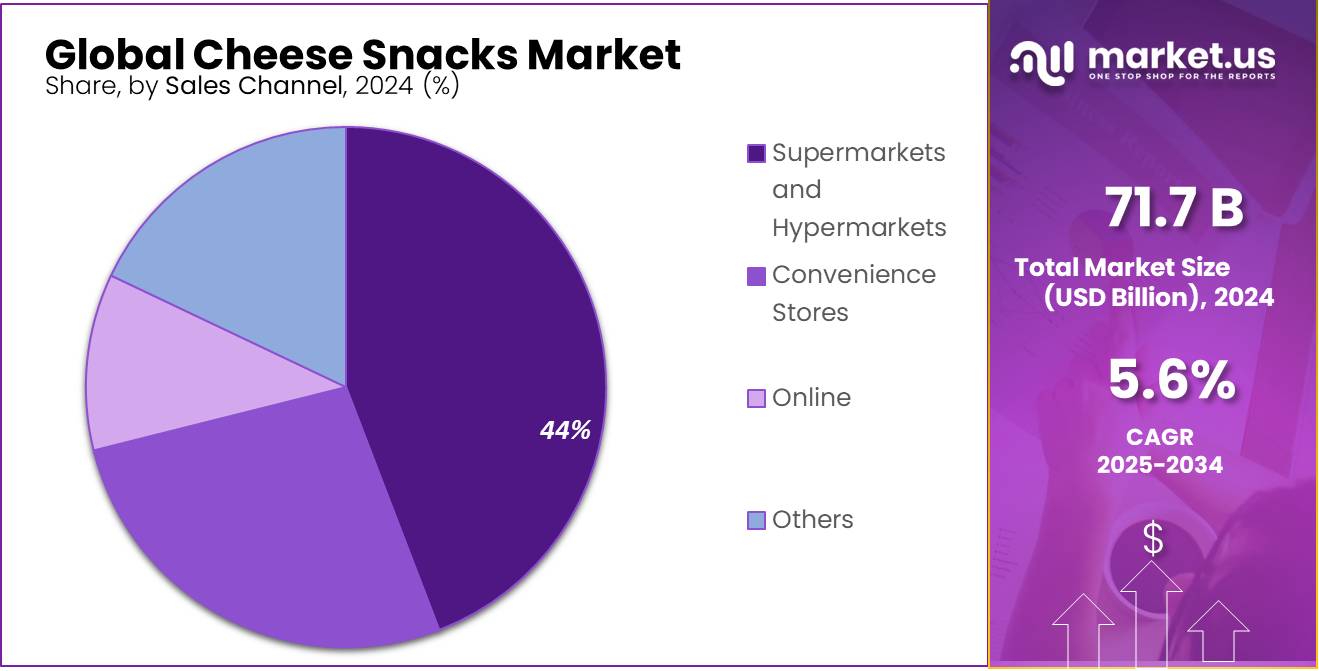

- Supermarkets and Hypermarkets held a dominant market position, capturing more than a 44.3% share in the global cheese snacks market.

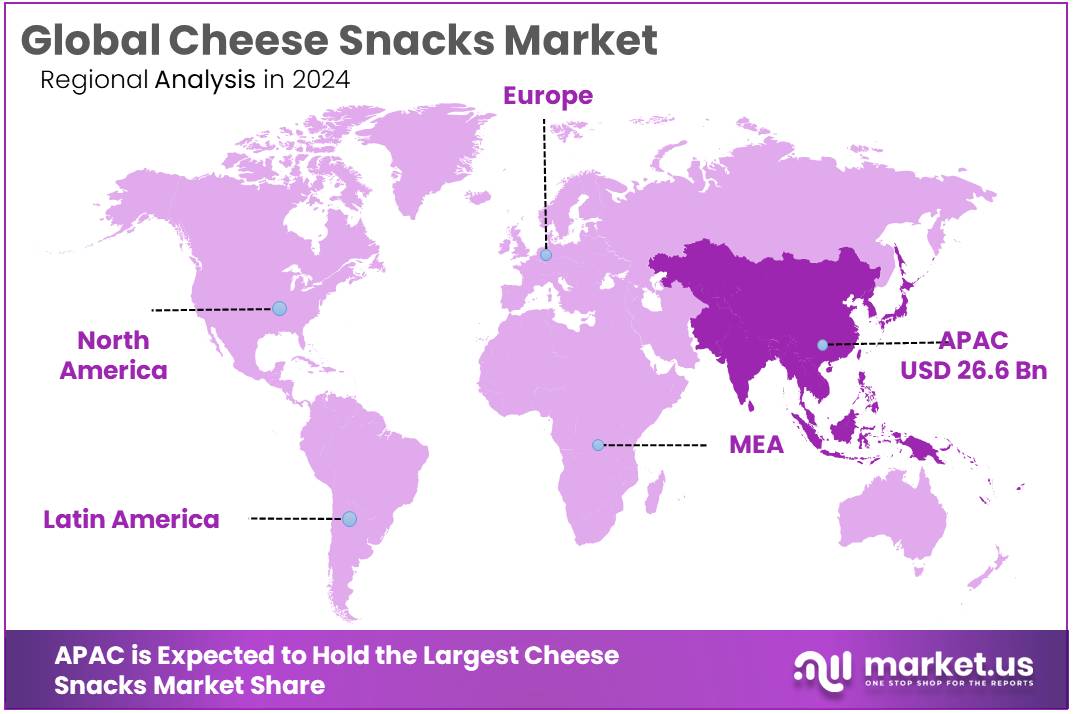

- APAC region held a dominant position in the global cheese snacks market, capturing a significant share of 37.2%, valued at US$ 26.6 billion.

By Type

Mozzarella Leads with 37.9% Market Share in 2024 Due to Its Versatile Use in Snacks

In 2024, Mozzarella held a dominant market position, capturing more than a 37.9% share in the global cheese snacks market. Its popularity stems from its soft texture, mild flavor, and excellent melting properties, making it a preferred ingredient in various snack formats like cheese sticks, stuffed crusts, and baked cheese bites. The convenience of ready-to-eat mozzarella snacks, along with its wide appeal across all age groups, has helped drive consistent demand throughout the year.

Mozzarella’s compatibility with both Western and fusion snack recipes also adds to its versatility, keeping it ahead of other cheese types in the snacking segment. Looking ahead to 2025, mozzarella-based snacks are expected to maintain steady traction as manufacturers continue to innovate with formats like oven-baked bites, single-serve packs, and protein-rich snack bars, further supporting its strong market position.

By Product Type

Baked Cheese Snacks Dominate with 47.1% Share in 2024 Owing to Health Appeal and Crunchy Texture

In 2024, Baked held a dominant market position, capturing more than a 47.1% share in the global cheese snacks market. This strong performance is driven by growing consumer demand for healthier snacking options with lower fat content compared to fried alternatives. Baked cheese snacks are widely preferred for their crunchy texture, clean-label appeal, and portability, especially among working adults and school-going children.

Their extended shelf life and minimal oil usage make them a top choice for both individual consumption and multipack retail formats. As awareness around healthy eating habits continues to rise in 2025, the baked segment is expected to maintain its lead. Food manufacturers are introducing a variety of new baked snack formats, such as cheese thins, crisps, and protein-packed bites, catering to consumers who seek both flavor and nutrition. This momentum is likely to further strengthen the baked segment’s position in the market over the coming years.

By End-User

HoReCa Sector Leads with 36.2% Share in 2024 Due to Rising Demand in Restaurants and Catering Services

In 2024, HoReCa held a dominant market position, capturing more than a 36.2% share in the global cheese snacks market. This dominance is largely driven by the increasing use of cheese-based snacks across hotels, restaurants, and catering services, where these products are featured in appetizers, side dishes, and gourmet platters. The HoReCa segment benefits from the consistent demand for high-quality, ready-to-serve cheese snacks that enhance menu variety and reduce kitchen prep time.

Mozzarella sticks, cheese-filled pastries, and baked cheese cubes are particularly popular in casual dining and event catering setups. In 2025, this segment is expected to grow steadily as more hospitality chains focus on innovative cheese-based offerings to attract customers seeking comfort food and indulgent flavors. Seasonal promotions and customizable cheese snack platters are also boosting volume sales in this channel, further supporting the HoReCa segment’s strong position in the market.

By Sales Channel

Supermarkets and Hypermarkets Dominate with 44.3% Share in 2024 Thanks to Strong Shelf Visibility and Bulk Buying

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 44.3% share in the global cheese snacks market. This leadership is mainly due to their wide product variety, strategic in-store displays, and the ability to offer discounts on bulk purchases. These retail formats serve as a key destination for consumers seeking convenient access to both branded and private-label cheese snack options.

Shoppers often prefer supermarkets for the opportunity to compare multiple flavors, formats, and package sizes in one place, while also benefiting from promotional offers and loyalty rewards. In 2025, supermarkets and hypermarkets are expected to remain the top sales channel, especially in urban areas, as more consumers resume in-store grocery shopping for freshness and immediate availability. The rising trend of health-conscious snacking is also pushing retailers to expand shelf space for baked and low-fat cheese snack options, further strengthening their market hold.

Key Market Segments

By Type

- Mozzarella

- Parmesan

- Cheddar

- Feta

- Others

By Product Type

- Baked

- Fried

- Frozen Snacks

By End-User

- Franchise Outlets

- Bakery

- HoReCa

- Household

By Sales Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Government Support and Infrastructure Development

A significant driving force behind the growth of the cheese snacks concentrates market in India is the robust support from government initiatives aimed at enhancing dairy infrastructure and promoting organized milk procurement. The National Programme for Dairy Development (NPDD) plays a pivotal role in this regard. Launched in 2014, the NPDD focuses on creating and strengthening infrastructure for quality milk testing equipment, primary chilling facilities, and milk processing units. In the financial year 2023-24, the government allocated ₹345.93 crore to the NPDD, underscoring its commitment to the dairy sector.

Additionally, the Rashtriya Gokul Mission (RGM), another government initiative, aims to conserve and develop indigenous bovine breeds. In March 2025, the Union Cabinet approved the continuation of the RGM with an additional outlay of ₹1,000 crore, bringing the total budget to ₹3,400 crore for the period 2021-22 to 2025-26 . This initiative not only supports the dairy sector’s growth but also ensures the sustainability of milk production, which is crucial for the cheese snacks concentrates industry.

These government-backed programs have led to the establishment of over 16,000 dairy cooperative societies and the enrollment of more than 15 lakh farmers under the NPDD scheme between 2019 and 2024 . Such developments have enhanced milk procurement and processing capabilities, thereby increasing the availability of quality milk for cheese production. Consequently, the cheese snacks concentrates market benefits from a steady supply of raw materials, facilitating consistent production and meeting the growing consumer demand.

Restraints

Infrastructure Gaps and Cold Chain Limitations

A significant challenge facing the cheese snacks concentrates market in India is the inadequate infrastructure, particularly the lack of efficient cold chain systems. This shortfall hampers the effective transportation and storage of perishable dairy products, leading to increased spoilage and reduced shelf life. Consequently, dairy producers often struggle to meet the growing demand for cheese snacks, impacting market growth.

The government’s initiatives, such as the Dairy Processing and Infrastructure Development Fund (DIDF), aim to address these issues by providing financial assistance for establishing and upgrading dairy processing units. However, the implementation of these schemes has been uneven across regions, with rural areas facing more significant challenges due to limited access to resources and technology.

Additionally, the fragmented nature of India’s dairy sector, characterized by numerous small-scale producers, complicates the establishment of standardized processing and storage facilities. This fragmentation leads to inefficiencies and quality inconsistencies, further hindering the growth potential of the cheese snacks concentrates market.

Opportunity

Export Growth and Global Market Expansion

India’s dairy industry is witnessing a significant transformation, driven by increased milk production and strategic government initiatives aimed at boosting exports. In the 2024–25 fiscal year, India’s exports of meat, dairy, and poultry products reached $5.1 billion, marking a 12.57% increase from the previous year. This growth reflects the country’s expanding presence in the global dairy market.

The government’s support plays a pivotal role in this expansion. The Revised National Program for Dairy Development (NPDD), with an outlay of ₹2,790 crore, focuses on enhancing milk procurement, processing capacity, and quality control. Additionally, the Revised Rashtriya Gokul Mission (RGM), with a budget of ₹3,400 crore, aims to promote indigenous cattle breeding and strengthen the dairy supply chain.

These initiatives are complemented by the establishment of Agri Export Zones (AEZs), which are designated areas aimed at boosting agricultural exports. The government has identified 20 agricultural products with high export potential, including dairy items, to diversify and expand its export portfolio.

Furthermore, India’s milk production continues to rise, with an estimated 216.5 million metric tons in 2025, up from 211.7 million metric tons in 2024. This increase is attributed to factors such as improved herd size, better fodder availability, and favorable climatic conditions.

Trends

Government Support and Infrastructure Development

A significant driving force behind the growth of the cheese snacks concentrates market in India is the robust support from government initiatives aimed at enhancing dairy infrastructure and promoting organized milk procurement. The National Programme for Dairy Development (NPDD) plays a pivotal role in this regard. Launched in 2014, the NPDD focuses on creating and strengthening infrastructure for quality milk testing equipment, primary chilling facilities, and milk processing units. In the financial year 2023–24, the government allocated ₹345.93 crore to the NPDD, underscoring its commitment to the dairy sector.

Additionally, the Rashtriya Gokul Mission (RGM), another government initiative, aims to conserve and develop indigenous bovine breeds. In March 2025, the Union Cabinet approved the continuation of the RGM with an additional outlay of ₹1,000 crore, bringing the total budget to ₹3,400 crore for the period 2021–22 to 2025–26 . This initiative not only supports the dairy sector’s growth but also ensures the sustainability of milk production, which is crucial for the cheese snacks concentrates industry.

These government-backed programs have led to the establishment of over 16,000 dairy cooperative societies and the enrollment of more than 15 lakh farmers under the NPDD scheme between 2019 and 2024 . Such developments have enhanced milk procurement and processing capabilities, thereby increasing the availability of quality milk for cheese production. Consequently, the cheese snacks concentrates market benefits from a steady supply of raw materials, facilitating consistent production and meeting the growing consumer demand.

Regional Analysis

In 2024, the APAC region held a dominant position in the global cheese snacks market, capturing a significant share of 37.2%, valued at US$ 26.6 billion. This dominance is driven by the growing urban population, increasing disposable incomes, and a shift towards convenient snack options, particularly in countries like China, India, and Japan. The demand for cheese snacks in these regions is further fueled by changing consumer preferences, with a noticeable shift towards more indulgent snack options, driven by Western influences and greater availability of cheese-based products in the market.

In countries like China, the rapid urbanization and modernization of food retail sectors have played a key role in expanding the cheese snacks market. According to the National Bureau of Statistics of China, the urban population in the country surpassed 60% in 2024, increasing access to processed and packaged foods, including cheese snacks. India, with its large and youthful population, is also experiencing a boom in snack consumption, with cheese snacks becoming a trendy option among the urban youth. Additionally, the rise in health-conscious eating habits is supporting the demand for more nutritious alternatives, such as cheese snacks made from natural ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

General Mills is a leading American multinational food company headquartered in Minneapolis, Minnesota. Founded in 1856, it owns a diverse portfolio of brands, including Cheerios, Pillsbury, Häagen-Dazs, and Betty Crocker. The company operates globally, providing a wide range of food products across various categories. General Mills focuses on innovation and consumer satisfaction, aiming to deliver high-quality products that meet the evolving tastes and preferences of its customers.

Godrej Industries Limited is an Indian conglomerate with interests in various sectors, including consumer goods, real estate, and agriculture. The company is known for its commitment to sustainability and innovation, offering a range of products that cater to the diverse needs of its customers. Through its various business segments, Godrej Industries aims to contribute positively to society and the environment, aligning with its vision of creating a more inclusive and sustainable future.

EnWave Corporation is a Canadian technology company that has developed Radiant Energy Vacuum (REV™) technology, a method of dehydration that preserves the natural properties of food. The company licenses this technology to food producers, enabling them to create shelf-stable snacks with enhanced flavor and nutritional value. EnWave’s REV™ technology has been adopted by various food companies globally, contributing to the innovation in snack production processes.

Top Key Players in the Market

- Amy’s Kitchen, Inc.

- EnWave Corporation

- General Mills, Inc.

- Godrej Industries Limited

- ITC Limited

- Kellogg Company

- Mars

- McCain Foods Limited

- Parle Products Pvt. Ltd.

- PepsiCo, Inc.

- Rich Products Corporation

- Sargento Foods Incorporated

- The Kraft Heinz Company

- TINE SA

- U&S Unismack S.A.

- UTZ Quality Foods, LLC.

Recent Developments

In 2024 Godrej Industries Limited, the Indian frozen food market was valued at approximately ₹3,500 crore, with the snacking industry projected to grow at a CAGR of 11.5%, reaching over ₹15 billion by 2024.

EnWave reported revenues of $8.18 million for the fiscal year ending September 30, 2024, a decrease from $11.36 million in 2023. However, the company achieved a net loss reduction to $2.4 million in 2024, compared to a net loss of $6.5 million in 2023, indicating improved operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 71.7 Bn Forecast Revenue (2034) USD 123.6 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mozzarella, Parmesan, Cheddar, Feta, Others), By Product Type (Baked, Fried, Frozen Snacks), By End-User (Franchise Outlets, Bakery, HoReCa, Household), By Sales Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amy’s Kitchen, Inc., EnWave Corporation, General Mills, Inc., Godrej Industries Limited, ITC Limited, Kellogg Company, Mars, McCain Foods Limited, Parle Products Pvt. Ltd., PepsiCo, Inc., Rich Products Corporation, Sargento Foods Incorporated, The Kraft Heinz Company, TINE SA, U&S Unismack S.A., UTZ Quality Foods, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amy's Kitchen, Inc.

- EnWave Corporation

- General Mills, Inc.

- Godrej Industries Limited

- ITC Limited

- Kellogg Company

- Mars

- McCain Foods Limited

- Parle Products Pvt. Ltd.

- PepsiCo, Inc.

- Rich Products Corporation

- Sargento Foods Incorporated

- The Kraft Heinz Company

- TINE SA

- U&S Unismack S.A.

- UTZ Quality Foods, LLC.