Global Cashew Nut Snacks Market Size, Share, And Business Benefits By Source (Organic, Conventional), By Type (Original, Flavored), By Application (Household, Food Service, Industrial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157762

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

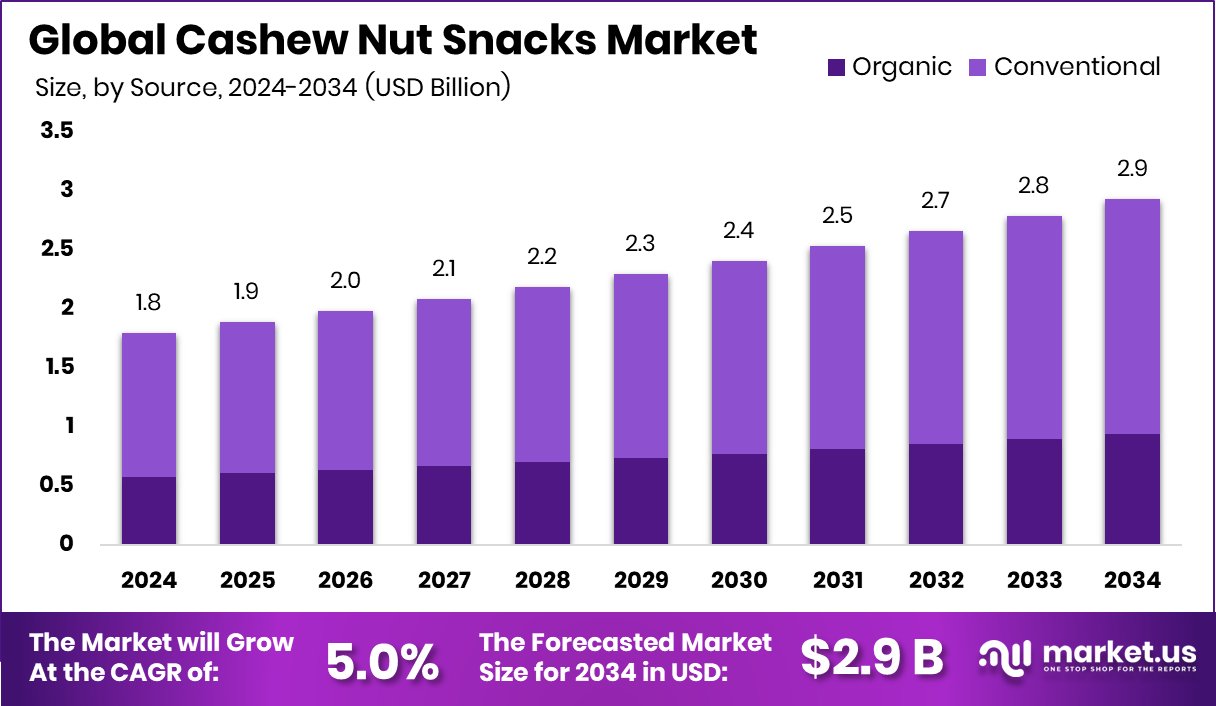

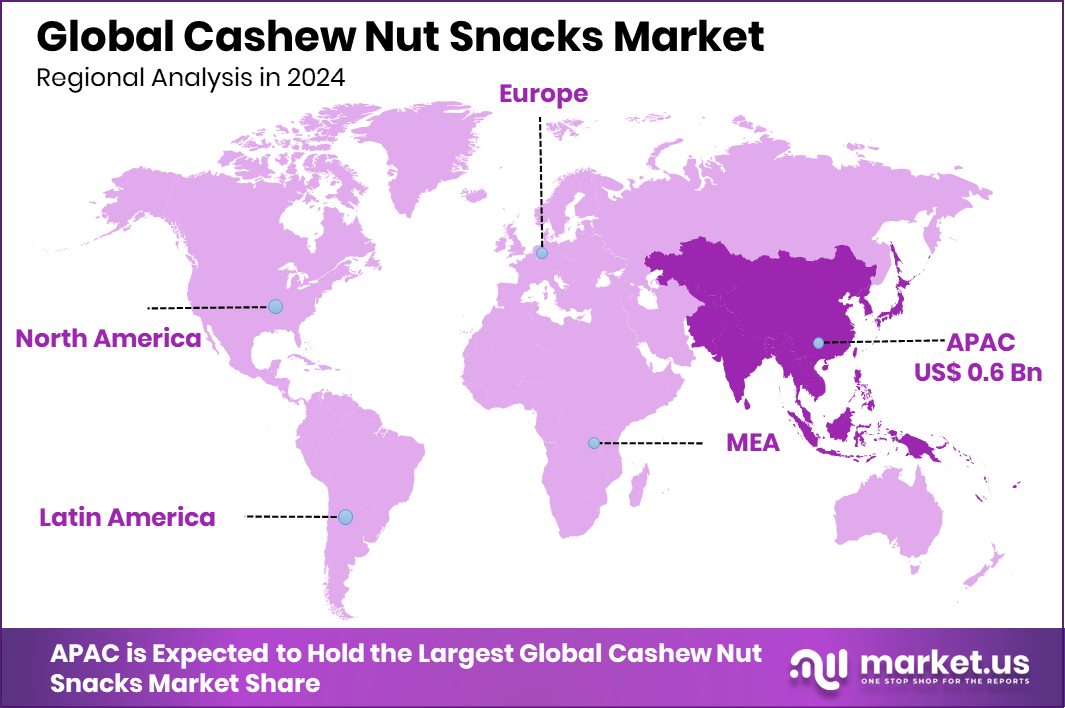

The Global Cashew Nut Snacks Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034. With increasing health-conscious consumers, Asia Pacific’s cashew snack market reached a USD 0.6 Bn value, holding 38.50%.

Cashew nut snacks are ready-to-eat products made from roasted, spiced, or flavored cashew nuts that are processed into convenient snack forms. They are valued not only for their crunchy taste and versatility but also for their nutritional benefits, as cashews are rich in protein, healthy fats, and essential minerals. Available in multiple flavors such as salted, sweet-coated, or spiced, cashew nut snacks cater to both traditional and modern consumer preferences, making them a popular choice in households and on-the-go snacking. According to an industry report, the Ivory Coast is set to unveil a $20 million initiative aimed at supporting its cashew sector.

The cashew nut snacks market refers to the global trade and consumption of these packaged products across retail, online, and foodservice channels. It includes flavored cashews, coated cashews, and mixed nut snack packs where cashews play a leading role. This market is growing steadily as consumers are shifting towards healthier snack alternatives compared to fried or heavily processed options. According to an industry report, Vini Mini secures €500K in seed funding to help prevent food allergies in children.

One of the major growth factors is the increasing health awareness among consumers. People today prefer snacks that are high in nutrition and energy, and cashews naturally fit into this demand with their rich protein, fiber, and micronutrient content. According to an industry report, the International Finance Corporation (IFC) will invest US$25 million in Singapore-based commodity trader Valency International.

In terms of demand, convenience and taste variety are driving consumption. The trend of flavored snacks has gained momentum, and cashews provide a perfect base for seasoning, appealing to both younger and older demographics. This variety ensures repeated purchases and brand loyalty. According to an industry report, ABC Fund has made an investment of EUR€800,000 into Ugandan coffee supplier JKCC.

Key Takeaways

- The Global Cashew Nut Snacks Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.8 billion in 2024, and is projected to grow at a CAGR of 5.0% from 2025 to 2034.

- In 2024, conventional cashew nut snacks held a 67.3% share, reflecting strong consumer trust.

- Original flavor cashew nut snacks captured 57.9% share, showcasing steady demand for natural, unaltered taste.

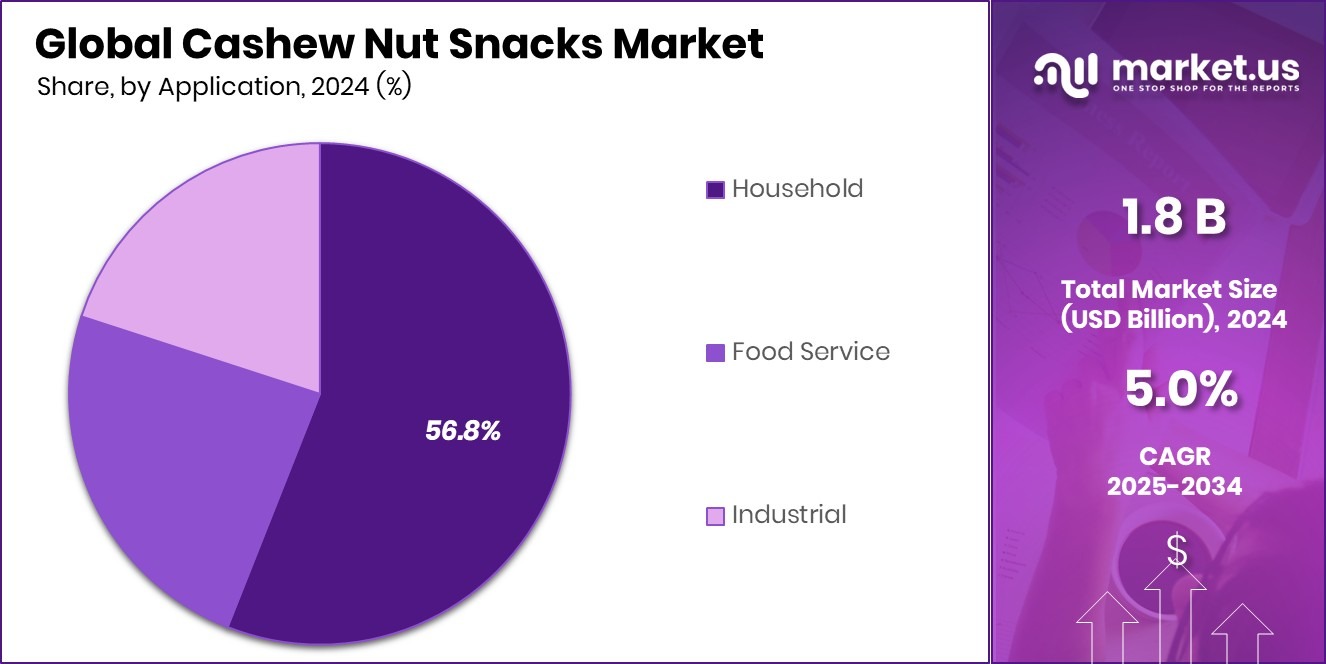

- Household consumption dominated the cashew nut snacks market with a 56.8% share, highlighting everyday snacking preferences.

- Offline channels led distribution with 78.2% share, underlining continued reliance on physical retail shopping options.

- The Asia Pacific’s urbanization contributed to the significant 38.50% share in cashew snack sales, worth USD 0.6 Bn.

By Source Analysis

In 2024, conventional sources dominated the cashew nut snacks market at 67.3%.

In 2024, Conventional held a dominant market position in the By Source segment of the Cashew Nut Snacks Market, with a 67.3% share. This strong share highlights the continued consumer reliance on conventionally sourced cashew nuts, primarily due to their wide availability, affordable pricing, and established supply chains.

Conventional cashew nut snacks remain the preferred choice for mass consumption, especially in regions where cost sensitivity plays a significant role in purchasing decisions. Their easy accessibility through supermarkets, hypermarkets, and online channels further strengthens this dominance.

The conventional segment’s strength also reflects its ability to meet growing demand without significant supply disruptions. Large-scale production and efficient distribution networks ensure consistent quality and competitive prices, making these products appealing to a broad consumer base. While health-conscious buyers may increasingly lean toward premium or alternative sourcing, the conventional cashew snacks segment continues to thrive due to its balance between taste, price, and availability.

Additionally, conventional sourcing supports diverse product offerings, including roasted, salted, and flavored variants that attract consumers seeking both traditional and modern snacking options. With urbanization and busy lifestyles pushing the need for convenient, ready-to-eat snacks, conventional cashew nut snacks remain a cornerstone of the market, maintaining their leading role in 2024.

By Type Analysis

Original type led the Cashew Nut Snacks Market with 57.9%.

In 2024, Original held a dominant market position in By Type segment of the Cashew Nut Snacks Market, with a 57.9% share. This dominance reflects the strong consumer preference for natural-tasting cashew snacks that emphasize authenticity and simplicity. Original cashew nut snacks, often lightly roasted or salted, appeal to health-conscious buyers who value minimal processing and the natural flavor of the nut itself. Their wide acceptance across both traditional households and modern consumers highlights their ability to cater to a broad demographic base.

The segment’s strength also lies in its alignment with rising awareness around clean-label snacking. Consumers are increasingly drawn toward products with fewer additives and ingredients they can trust, making original cashew snacks a go-to option. Their positioning as both a healthy and versatile snack enhances their market share, especially as on-the-go consumption and nutritious snacking trends gain momentum.

Another factor behind the popularity of original cashew snacks is their adaptability across various retail channels. Whether purchased in bulk packs for home use or in smaller pouches for convenience, they maintain a steady demand due to their balance of taste, health, and affordability. In 2024, this clear preference underlined the segment’s ability to retain leadership in the market.

By Application Analysis

Household application captured 56.8% of the global cashew nut snacks market.

In 2024, Household held a dominant market position in By Application segment of the Cashew Nut Snacks Market, with a 56.8% share. This leadership is driven by the strong presence of cashew nut snacks in daily consumption routines, where families and individuals prefer them as a healthy, convenient, and versatile option. Cashew nut snacks are often stocked in homes as a regular item, serving multiple occasions such as quick bites between meals, evening treats, or nutritious additions to family gatherings. Their appeal lies in both their natural taste and the nutritional value they provide, making them a popular choice for households aiming to balance taste with health.

The household segment’s dominance also reflects changing lifestyle patterns, with busy working families and urban consumers increasingly seeking ready-to-eat, nutrient-rich snacks that require no preparation. Affordable pack sizes and bulk packaging options have made these snacks accessible across varied income levels, ensuring wide household penetration. Furthermore, rising awareness around healthy eating habits has encouraged families to replace heavily processed snacks with cashew-based alternatives.

By Distribution Channel Analysis

Offline distribution channels strongly held 78.2% of the cashew nut snacks market.

In 2024, Offline held a dominant market position in the By Distribution Channel segment of the Cashew Nut Snacks Market, with a 78.2% share. This dominance is largely due to the strong consumer reliance on physical retail stores such as supermarkets, hypermarkets, convenience stores, and specialty outlets, where shoppers can directly experience the product before purchasing. The tactile advantage of offline shopping—seeing the packaging, comparing options, and sometimes sampling—plays a key role in driving preference for this channel.

The offline segment also benefits from its ability to cater to both urban and rural consumers. While urban buyers often shop in large retail chains with wide assortments, rural consumers continue to depend on smaller local stores, ensuring that offline channels maintain extensive reach. Attractive in-store promotions, discounts, and product placement strategies further enhance the visibility and sales of cashew nut snacks.

Moreover, impulse buying behavior is stronger in offline retail environments, particularly for snack items that are often positioned at checkout counters or in prominent aisles. This spontaneous purchase pattern contributes significantly to the offline segment’s market share. In 2024, its stronghold was reinforced by trust, accessibility, and consumer preference for in-person shopping experiences, securing its leadership in distribution.

Key Market Segments

By Source

- Organic

- Conventional

By Type

- Original

- Flavored

By Application

- Household

- Food Service

- Industrial

By Distribution Channel

- Offline

- Online

Driving Factors

Rising Health Awareness Fuels Demand for Nutritious Snacks

One of the key driving factors for the cashew nut snacks market is the growing health awareness among consumers. People are shifting from fried or sugar-loaded snacks toward healthier alternatives, and cashews fit perfectly into this trend.

They are naturally rich in protein, healthy fats, fiber, and minerals like magnesium and zinc, which support overall well-being. Consumers today are more informed about the benefits of nutrient-dense diets, and this is influencing their snacking choices.

Cashew nut snacks, especially in their original or lightly seasoned form, are seen as both tasty and beneficial for health. This rising awareness continues to push demand upward, making health-focused consumption a strong force behind market growth in 2024 and beyond.

Restraining Factors

High Price of Cashews Limits Wider Consumption

A major restraining factor for the cashew nut snacks market is the high price of cashews compared to other nuts and common snack options. Cashews require labor-intensive processing, from shelling to grading, which adds to their overall cost.

In addition, fluctuations in raw cashew supply due to climate challenges and dependency on specific producing regions often create price instability. For many consumers, especially in price-sensitive markets, the higher cost makes cashew nut snacks less accessible regularly.

While premium buyers may still prefer them for their taste and health benefits, the broader market faces limitations in scaling. This price barrier slows down wider adoption, particularly in households with limited disposable incomes.

Growth Opportunity

Innovation in Flavors and Packaging Expands Market

A key growth opportunity for the cashew nut snacks market lies in innovation around flavors and packaging. Consumers today are not only looking for healthier snacks but also for exciting taste experiences. Introducing new options such as spicy, honey-coated, or exotic regional flavors can attract younger demographics and adventurous eaters.

At the same time, convenient packaging—like resealable pouches, single-serve packs, or eco-friendly materials—adds value by matching modern lifestyles and sustainability concerns. This combination of taste variety and practical packaging encourages repeat purchases and appeals to a wider consumer base.

As snacking becomes a daily habit worldwide, companies that focus on flavor diversity and smart packaging solutions are well-positioned to capture long-term growth.

Latest Trends

Growing Demand for Plant-Based and Vegan Snacks

One of the latest trends shaping the cashew nut snacks market is the rising demand for plant-based and vegan-friendly options. As more consumers adopt vegetarian, vegan, or flexitarian lifestyles, cashew snacks are gaining popularity as a natural, dairy-free, and protein-rich alternative to processed foods.

Cashews are often highlighted as part of plant-forward diets, not only for their nutrition but also for their versatility in flavoring and recipe inclusion. This trend is particularly strong among younger consumers who actively seek out snacks aligned with health, sustainability, and ethical choices.

By positioning cashew nut snacks as plant-based, companies can tap into a rapidly growing market segment that values both wellness and environmentally conscious consumption. According to an industry report, Oikocredit has invested $3.5 million in Valency Agro Nigeria to expand its cashew processing and export capabilities.

Regional Analysis

In 2024, the Asia Pacific held 38.50% of the Cashew Nut Snacks Market, valued at USD 0.6 Bn.

In 2024, the Cashew Nut Snacks Market was predominantly driven by the Asia Pacific, which held a dominant share of 38.50%, valued at USD 0.6 billion. This region’s strong market position can be attributed to its growing urban population, increasing health awareness, and rising disposable income.

With the expanding middle class and more consumers opting for healthier snacking alternatives, the Asia Pacific has become a hotspot for cashew nut snack consumption. The demand is further fueled by the increasing availability of cashew products through both modern retail and online platforms.

North America and Europe also contribute significantly to the market, driven by consumer preferences for plant-based and nutrient-dense snacks. While these regions continue to show steady growth, their market shares are relatively smaller compared to the Asia Pacific.

The Middle East & Africa and Latin America, though emerging markets, are witnessing gradual growth as awareness around healthy eating and snacking spreads. These regions benefit from increasing health-consciousness and the penetration of modern retail formats, but they remain secondary in terms of overall market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A., with its established presence across food and beverage categories, has been increasingly aligning its snack portfolio with consumer demand for healthier and convenient options. Its focus on nutritious snacking and brand trust has allowed the company to effectively integrate cashew nut snacks into its wider product strategies.

Archer Daniels Midland Company, known for its strength in agricultural processing and ingredients, plays a pivotal role in ensuring consistent cashew sourcing and supply for the global market. ADM’s ability to provide high-quality raw materials and its expertise in scaling production contribute significantly to the growth of cashew-based snacks, especially as demand rises in both developed and emerging regions.

The Kraft Heinz Company has capitalized on its established brand portfolio and global marketing strength to promote cashew nut snacks as part of its broader snacking segment. With a focus on flavor innovation and consumer engagement, Kraft Heinz has positioned cashew snacks as both a healthy and indulgent option.

Top Key Players in the Market

- Nestlé S.A.

- Archer Daniels Midland Company

- The Kraft Heinz Company

- John B. Sanfilippo & Son Inc.

- Haldiram Foods International Private Limited

- Alphonsa Cashew Industries

- Diamond Foods LLC

- Emerald Nuts LLC

- Aryan Food Ingredients Limited

- CBL Natural Foods Private Limited

Recent Developments

- In August 2024, JBSS acquired Lakeville, a snack bar manufacturing facility, for $59 million. This acquisition has bolstered the company’s capabilities in producing private-label snack bars, including cashew-based varieties. In fiscal year 2024, the Lakeville operations contributed approximately $120 million in net sales, with $44.2 million generated in the fourth quarter alone.

- In December 2023, ADM acquired UK-based FDL, a leading developer and producer of premium flavor and functional ingredient systems. This acquisition, completed by the end of January 2024, added over 10,000 proprietary flavor formulations to ADM’s portfolio, enhancing its capabilities in the global flavors market

Report Scope

Report Features Description Market Value (2024) USD 1.8 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional), By Type (Original, Flavored), By Application (Household, Food Service, Industrial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Archer Daniels Midland Company, The Kraft Heinz Company, John B. Sanfilippo & Son Inc., Haldiram Foods International Private Limited, Alphonsa Cashew Industries, Diamond Foods LLC, Emerald Nuts LLC, Aryan Food Ingredients Limited, CBL Natural Foods Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cashew Nut Snacks MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Cashew Nut Snacks MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Archer Daniels Midland Company

- The Kraft Heinz Company

- John B. Sanfilippo & Son Inc.

- Haldiram Foods International Private Limited

- Alphonsa Cashew Industries

- Diamond Foods LLC

- Emerald Nuts LLC

- Aryan Food Ingredients Limited

- CBL Natural Foods Private Limited