Global Carrageenan Gum Market Size, Share, And Enhanced Productivity By Product Type (Kappa Carrageenan, Lota Carrageenan, Lambda Carrageenan, Others), By Processing Technology (Alkali Treatment Process, Alcohol Precipitation, Gel-Press Filtration Process, Others), By Functionality (Thickening Agent, Gelling Agent, Stabilizer/Emulsifier, Texturizing Agent, Others), By Application (Food and Beverages, Personal Care and Toiletries, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172564

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

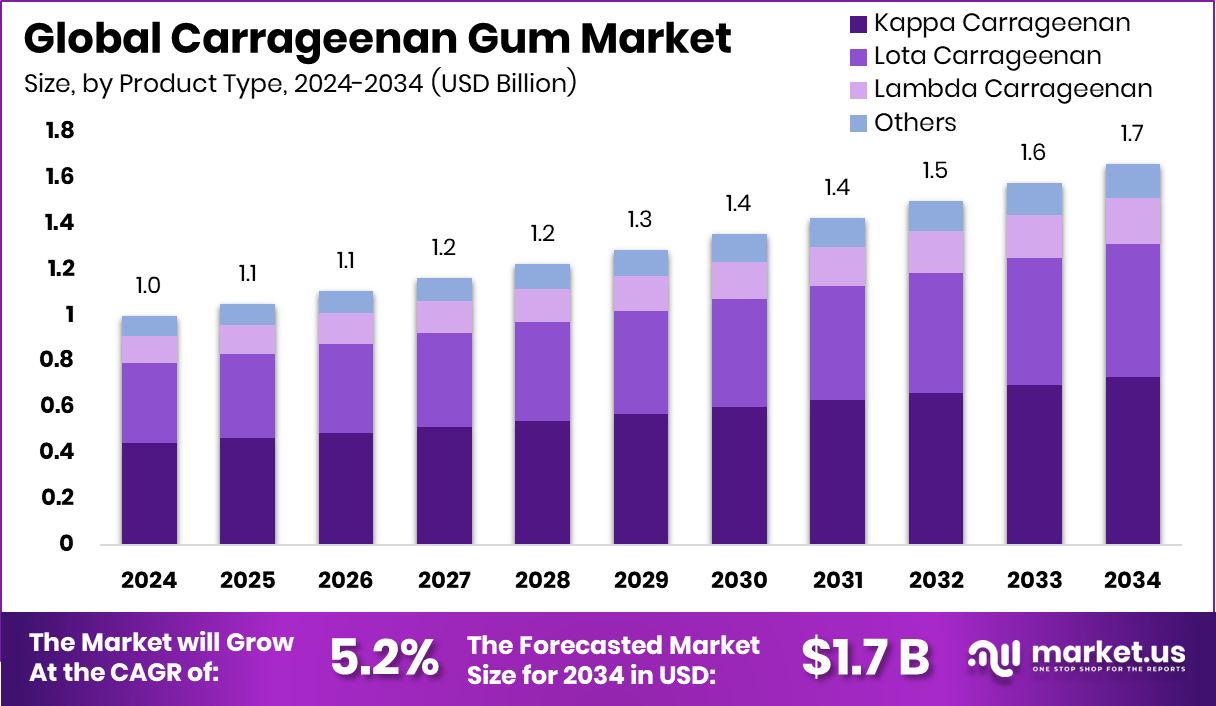

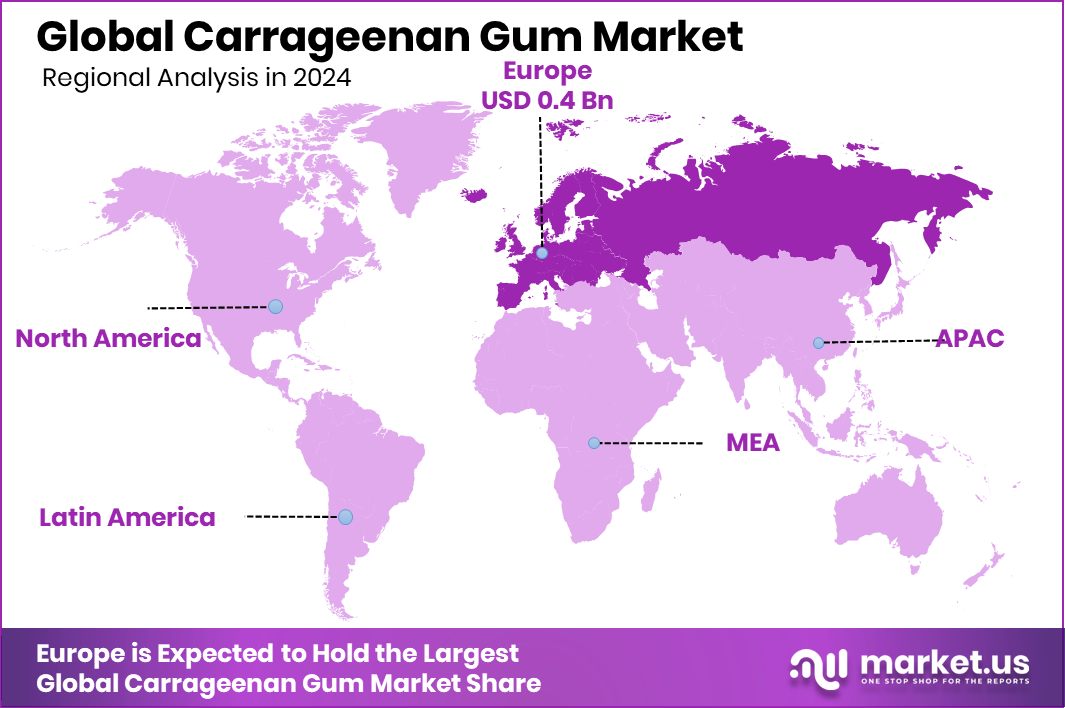

The Global Carrageenan Gum Market is expected to be worth around USD 1.7 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. Europe’s Carrageenan Gum Market accounted for 48.20%, generating revenues of USD 0.4 Bn.

Carrageenan gum is a natural ingredient taken from red seaweed and used to thicken, stabilize, and improve texture in many everyday products. It is commonly added to foods to keep ingredients evenly mixed and to create a smooth, consistent feel. Because it comes from plants, carrageenan fits well with clean-label and plant-based product preferences, making it easy for consumers to understand and accept.

The carrageenan gum market covers the production, processing, and sale of this ingredient for use across food, beverages, personal care, and other daily-use items. Growth in this market is linked to rising demand for natural alternatives to synthetic additives. A clear signal of this shift is Bioweg’s USD 19 million Series A funding, which supports replacing microplastics with bio-based alternatives, reinforcing interest in seaweed-based and biodegradable materials like carrageenan.

One key growth factor is changing regulations and public policies around alcohol and consumer products. Lawmakers proposing a 6% tax on alcohol sales and policy changes that could cost more than USD 225 million are pushing producers to reformulate products, manage costs, and improve shelf stability, indirectly supporting functional ingredients that enhance efficiency.

From a demand perspective, government actions highlight wider social awareness around alcohol consumption. The Menlo Park Police Department receiving USD 54,000 in alcohol control grants, Anchorage raising nearly USD 14 million from alcohol sales tax, and Nunavut allocating USD 3.3 million for substance abuse prevention reflect stricter oversight. These shifts encourage producers to innovate responsibly, creating opportunities for carrageenan gum in reformulated, stable, and compliant product lines.

Key Takeaways

- The Global Carrageenan Gum Market is expected to be worth around USD 1.7 billion by 2034, up from USD 1.0 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In Carrageenan Gum Market, Kappa carrageenan dominates product types, holding 44.2% share globally today.

- Alkali treatment process leads processing technologies in Carrageenan Gum Market with 39.8% adoption worldwide.

- Thickening agent functionality accounts for 39.1% usage within the expanding Carrageenan Gum Market segment.

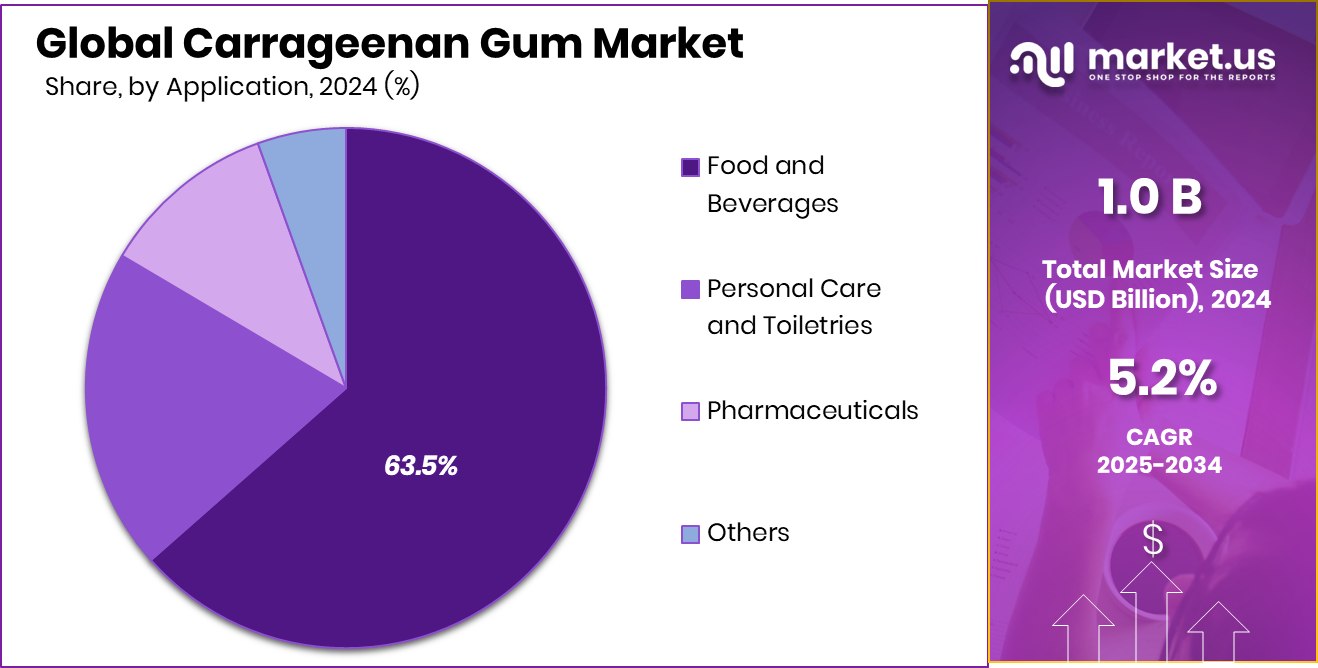

- Food and beverages remain the primary application, representing 63.5% of demand in the Carrageenan Gum Market globally.

- The European carrageenan gum industry reached USD 0.4 Bn, holding a strong 48.20% market share.

By Product Type Analysis

In the carrageenan gum market, kappa carrageenan dominates product type with 44.2% share.

In 2024, Kappa carrageenan held a dominant 44.2% share in the Carrageenan Gum Market by product type, mainly due to its strong gelling ability and wide use in processed foods. This product type is especially valued in dairy items such as cheese, chocolate milk, and desserts, where it helps improve texture and stability. Food manufacturers prefer kappa carrageenan because it forms firm gels with potassium salts, supporting consistent product quality during storage and transport.

Its cost-effectiveness compared to alternative hydrocolloids further supports adoption. In addition, rising consumption of convenience foods and clean-label formulations has increased demand for plant-based texturizers, positioning kappa carrageenan as a reliable ingredient across both developed and emerging food markets.

By Processing Technology Analysis

Within the Carrageenan Gum Market, the alkali treatment process leads the processing technology at 39.8%.

In 2024, the alkali treatment process accounted for 39.8% of the Carrageenan Gum Market by processing technology, reflecting its importance in improving product strength and purity. This method enhances gel strength by converting precursor molecules into high-quality carrageenan, making it suitable for food-grade applications. Manufacturers favor alkali processing because it delivers consistent viscosity and better functional performance in end products.

Moreover, this technology supports large-scale production while maintaining compliance with food safety standards. Growing investments in modern processing facilities and quality control systems have further strengthened the role of alkali-treated carrageenan, particularly for suppliers serving multinational food and beverage companies demanding uniform specifications and reliable supply chains.

By Functionality Analysis

In the Carrageenan Gum Market, thickening agent functionality holds a significant 39.1% market share.

In 2024, thickening agent functionality captured 39.1% of the Carrageenan Gum Market, highlighting its critical role in improving texture, mouthfeel, and stability. Carrageenan is widely used to thicken sauces, soups, dairy beverages, and plant-based drinks without altering flavor. Its ability to work effectively at low concentrations makes it attractive for manufacturers seeking cost efficiency and clean ingredient labels.

As consumers increasingly prefer smooth and consistent food textures, demand for natural thickeners has risen steadily. Carrageenan also supports reduced-fat and reduced-sugar formulations by compensating for texture loss, making it a key functional ingredient in reformulated products aimed at health-conscious consumers.

By Application Analysis

Food and beverage applications dominate the carrageenan gum market, accounting for 63.5% demand.

In 2024, food and beverages applications dominated the Carrageenan Gum Market with a strong 63.5% share, driven by extensive use across dairy, meat, confectionery, and beverage products. Carrageenan helps improve shelf life, prevent ingredient separation, and maintain uniform texture in processed foods. Its plant-based origin aligns well with the rising demand for vegan and vegetarian products, especially in dairy alternatives.

Rapid growth in packaged food consumption, urban lifestyles, and expanding food service sectors has further increased usage. Additionally, regulatory acceptance of carrageenan in many countries supports its continued use, making food and beverages the most stable and revenue-generating application segment.

Key Market Segments

By Product Type

- Kappa Carrageenan

- Lota Carrageenan

- Lambda Carrageenan

- Others

By Processing Technology

- Alkali Treatment Process

- Alcohol Precipitation

- Gel-Press Filtration Process

- Others

By Functionality

- Thickening Agent

- Gelling Agent

- Stabilizer/Emulsifier

- Texturizing Agent

- Others

By Application

- Food and Beverages

- Personal Care and Toiletries

- Pharmaceuticals

- Others

Driving Factors

Natural Ingredients Demand Driving Carrageenan Gum Adoption

In 2024, the Carrageenan Gum Market is strongly driven by rising demand for natural and plant-based ingredients across everyday products. Food and beverage makers are actively replacing synthetic stabilizers with seaweed-based options that are easier to explain to consumers and align with clean-label trends. Carrageenan gum helps improve texture, consistency, and shelf stability without changing taste, making it a practical solution for manufacturers managing cost and quality together. This shift toward sustainable materials is also visible beyond food.

For example, VinFast’s non-binding USD 1 billion funding deal with UAE investors highlights growing global capital support for cleaner, future-ready materials and supply chains. Such large investments reflect broader confidence in sustainable inputs, indirectly strengthening demand for bio-based ingredients like carrageenan. As industries aim to lower environmental impact while meeting regulatory and consumer expectations, carrageenan gum continues to benefit from its natural origin, versatility, and wide acceptance.

Restraining Factors

Policy Budget Uncertainty Restrains Carrageenan Gum Market Growth

In 2024, budget and policy uncertainty remain a key restraining factor for the Carrageenan Gum Market. When governments announce USD 242 million in non-binding budget disregards along with USD 13.1 million in line-item vetoes, it creates hesitation across supply chains that depend on stable regulations and public spending. Such decisions often delay approvals, slow infrastructure support, and reduce clarity for industries tied to food processing and agricultural inputs.

For carrageenan producers, uncertainty can affect seaweed sourcing programs, quality monitoring, and expansion planning. Food manufacturers may also delay product launches or reformulation plans when policy signals are unclear. As a result, demand growth can soften temporarily, even when consumer interest remains steady. Clear and predictable policy support is important for maintaining confidence, and without it, market participants tend to move cautiously, limiting short-term investment and slowing overall market momentum.

Growth Opportunity

Microalgae-Based Ingredients Open New Carrageenan Growth

In 2024, a major growth opportunity for the Carrageenan Gum Market comes from rising interest in algae-based and plant-derived ingredients. This direction is reinforced by Paris-based Edonia raising €2 million to produce plant-based ingredients from microalgae, showing strong confidence in marine and algae-driven solutions. Such funding highlights how food and ingredient producers are exploring new, sustainable sources that complement seaweed-derived carrageenan.

Carrageenan gum fits naturally into this shift, as it already supports clean-label, vegan, and environmentally responsible product development. As microalgae and seaweed innovation expand together, manufacturers can create more efficient texture systems and reduce dependence on synthetic additives. This opens doors for carrageenan in modern food, beverage, and wellness products, especially where sustainability stories and natural sourcing play a key role in purchasing decisions.

Latest Trends

Clean Label Formulations Boost Carrageenan Gum Usage

In 2024, one of the latest trends in the Carrageenan Gum Market is the strong move toward clean-label formulations. Food and beverage companies are simplifying ingredient lists and choosing familiar, plant-based components that consumers recognize and trust. Carrageenan gum fits this trend well because it comes from seaweed and works effectively as a natural thickener and stabilizer.

Manufacturers are using it to improve texture in dairy alternatives, sauces, desserts, and ready-to-drink products without relying on synthetic additives. This trend is also supported by growing interest in vegan and vegetarian diets, where carrageenan helps replace animal-based ingredients. As clean labels become a key buying factor, carrageenan gum continues to gain attention for balancing functionality, transparency, and consumer-friendly positioning across multiple product categories.

Regional Analysis

Europe dominated the Carrageenan Gum Market with 48.20%, valued at USD 0.4 Bn in 2024.

The Carrageenan Gum Market shows clear regional variation, with Europe emerging as the dominating region, holding 48.20% of the market and valued at USD 0.4 Bn. Europe’s leadership is supported by strong demand from processed food, dairy, and plant-based product manufacturers, where carrageenan is widely used for texture stability and shelf-life improvement. Strict quality standards and consistent use of approved food additives further strengthen market maturity across the region.

North America represents a stable market, driven by steady consumption of convenience foods, flavored dairy products, and meat processing applications, although growth remains moderate due to mature consumption patterns.

Asia Pacific shows expanding usage as urbanization and packaged food consumption increase, especially in developing economies, where carrageenan supports cost-efficient food formulation.

The Middle East & Africa remain an emerging market, supported by gradual growth in food processing and imports of stabilizing agents for beverages and dairy substitutes. Latin America contributes steadily, backed by processed meat, dessert, and beverage production, though overall penetration remains lower compared to Europe’s dominant position of 48.20% and market value of USD 0.4 Bn.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Ingredion Incorporated continues to play a strategic role in the global Carrageenan Gum Market through its strong focus on texture solutions for food and beverage manufacturers. The company’s strength lies in formulation expertise, helping customers achieve consistent viscosity, stability, and mouthfeel across dairy, beverages, and processed foods. Ingredion’s close collaboration with food producers allows it to tailor carrageenan-based systems to evolving consumer preferences, including clean-label and plant-based products. Its global production footprint and application labs support reliable supply and technical support, reinforcing long-term customer relationships.

FMC Corporation remains a key player due to its long-standing experience in marine-sourced hydrocolloids. In 2024, FMC’s carrageenan operations benefit from vertically integrated sourcing and strong process control, ensuring consistent quality for food-grade applications. The company’s emphasis on performance-driven ingredients supports demanding applications such as dairy desserts, meat processing, and beverages. FMC’s technical knowledge and scale allow it to meet stringent regulatory and quality requirements, making it a preferred supplier for large food manufacturers seeking dependable functional ingredients.

Ashland Global Holdings Inc. brings value to the Carrageenan Gum Market through its broader specialty ingredient portfolio and formulation science capabilities. Ashland focuses on delivering functional performance, particularly in texture modification and stability enhancement. Its strength lies in combining carrageenan with complementary ingredients to improve product consistency and processing efficiency. In 2024, Ashland’s customer-centric approach and application support help food manufacturers optimize formulations, reinforcing its position as a solution-oriented supplier rather than a commodity-focused player.

Top Key Players in the Market

- Ingredion Incorporated

- FMC Corporation

- Ashland Global Holdings Inc.

- Meron Group

- Macel Carrageenan Corporation

- Cargill, Incorporated

- W Hydrocolloids, Inc

- Others

Recent Developments

- In July 2025, W Hydrocolloids launched RICOVIS 86360B, formulated to improve creaminess in breakfast cream products, especially for dairy-free and plant-based formulations. The product helps manufacturers achieve smooth texture and stability, reinforcing WHI’s role as an innovation partner for clean-label ingredient solutions.

- In May 2025, Cargill Beauty, a division of Cargill, Incorporated, launched a new Satiagel™ VPC 614 Kappa Carrageenan aimed specifically at the personal care market. This product completes their carrageenan portfolio by offering a kappa type that works well in high gelling applications and solid formulations, helping cosmetic makers achieve better texture and structure in natural products.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Billion Forecast Revenue (2034) USD 1.7 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kappa Carrageenan, Lota Carrageenan, Lambda Carrageenan, Others), By Processing Technology (Alkali Treatment Process, Alcohol Precipitation, Gel-Press Filtration Process, Others), By Functionality (Thickening Agent, Gelling Agent, Stabilizer/Emulsifier, Texturizing Agent, Others), By Application (Food and Beverages, Personal Care and Toiletries, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ingredion Incorporated, FMC Corporation, Ashland Global Holdings Inc., Meron Group, Macel Carrageenan Corporation, Cargill, Incorporated, W Hydrocolloids, Inc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Carrageenan Gum MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Carrageenan Gum MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ingredion Incorporated

- FMC Corporation

- Ashland Global Holdings Inc.

- Meron Group

- Macel Carrageenan Corporation

- Cargill, Incorporated

- W Hydrocolloids, Inc

- Others