Global Cardiac Assist Devices Market By Product Type (Intra-Aortic Balloon Pump and Ventricular Assist Devices (VAD)), By Modality Type (Implantable and Transcutaneous), By End-User (Hospitals & Clinics and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174034

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

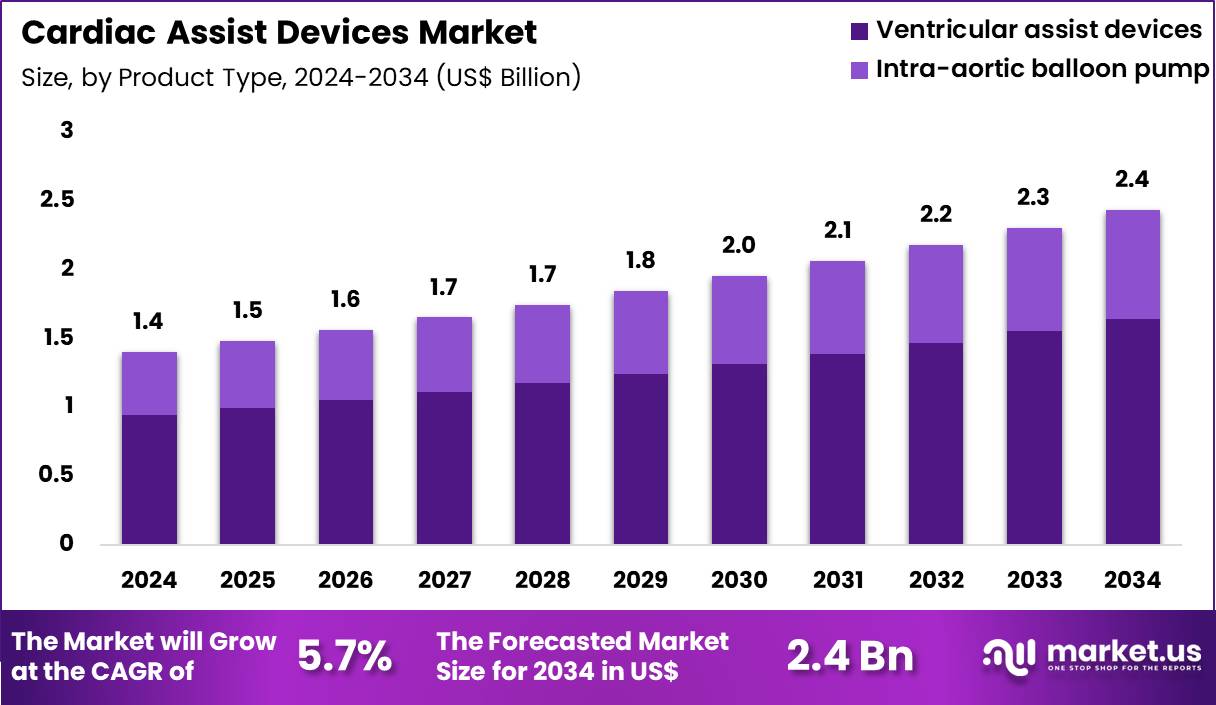

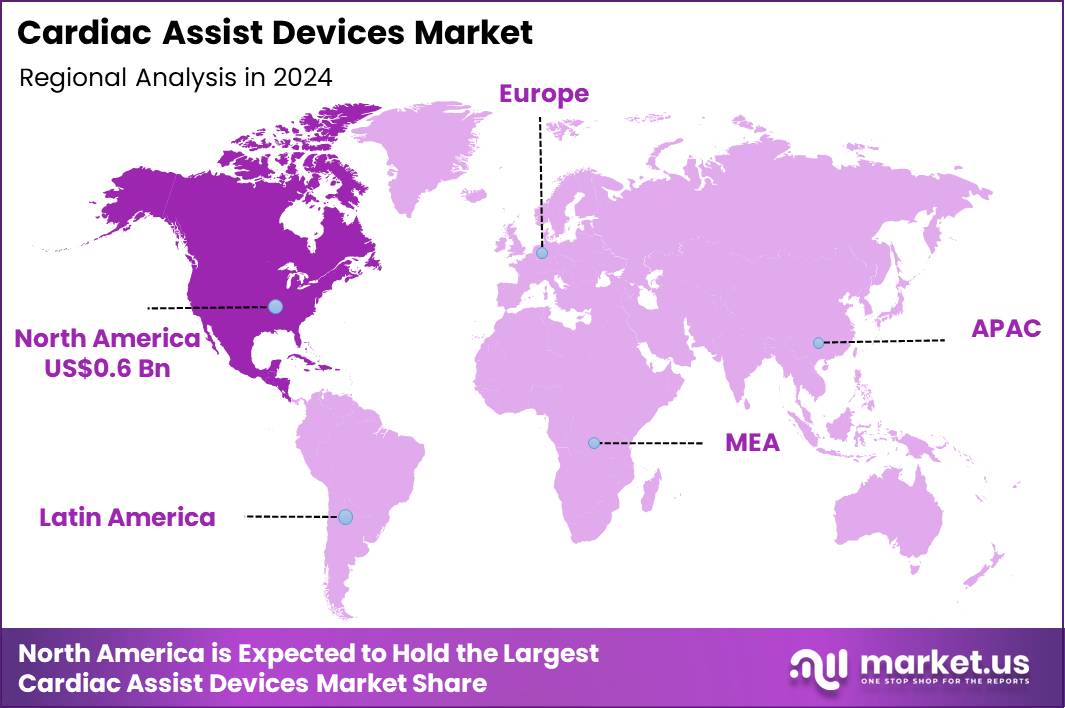

The Global Cardiac Assist Devices Market size is expected to be worth around US$ 2.4 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.6% share with a revenue of US$ 0.6 Billion.

Growing prevalence of advanced heart failure compels cardiologists to increasingly rely on cardiac assist devices that provide mechanical circulatory support for patients with refractory symptoms despite optimal medical therapy. Surgeons implant left ventricular assist devices as destination therapy in individuals ineligible for heart transplantation, restoring adequate cardiac output and improving functional capacity.

These systems serve as a bridge to transplantation, stabilizing hemodynamics in patients awaiting donor organs while preventing end-organ damage. Clinicians utilize right ventricular assist devices to manage isolated right heart failure in postcardiotomy shock or severe pulmonary hypertension. These devices support biventricular configurations that address combined systolic dysfunction, enabling recovery in acute cardiogenic shock following massive myocardial infarction.

In March 2025, Berlin Heart received US FDA approval through a premarket approval supplement for its EXCOR Apex Cannulae. This approval expanded device design specifications within mechanical ventricular assist systems, supporting broader clinical applicability across pediatric and complex heart failure cases. Regulatory clearance of component enhancements such as cannulae sustains incremental innovation and reinforces ongoing growth in the cardiac assist devices market.

Manufacturers pursue opportunities to develop fully implantable continuous-flow systems that eliminate external drivelines, reducing infection risks and enhancing quality of life in long-term destination therapy patients. Developers advance pediatric-specific ventricular assist devices with smaller blood pumps and flexible cannulae, expanding applications in congenital heart disease and cardiomyopathy in younger patients. These innovations facilitate use in high-risk surgical candidates, where short-term support stabilizes patients during high-risk coronary revascularization or valve procedures.

Opportunities emerge in hybrid configurations that combine ventricular assist devices with transcatheter valve therapies, optimizing outcomes in end-stage heart failure with concomitant valvular disease. Companies invest in wireless power transmission technologies that eliminate percutaneous leads, broadening applicability in ambulatory patients requiring prolonged support. Firms explore bridge-to-recovery protocols that leverage temporary assist devices to promote myocardial remodeling in acute fulminant myocarditis.

Industry leaders refine axial and centrifugal pump designs to achieve lower shear stress, minimizing hemolysis and thrombosis risks during extended mechanical support periods. Developers prioritize miniaturized systems that enable less invasive implantation techniques, accelerating recovery in bridge-to-transplant and destination therapy scenarios.

Market participants advance remote monitoring platforms that track device performance and patient hemodynamics, supporting proactive management of complications in outpatient settings. Innovators incorporate biocompatible coatings that enhance antithrombogenicity, improving safety profiles in pediatric and adult populations.

Companies emphasize multidisciplinary care models that integrate cardiac assist devices with advanced heart failure programs, optimizing patient selection and outcomes. Ongoing advancements focus on next-generation pulsatile and continuous-flow hybrids that better mimic native cardiac physiology, elevating therapeutic efficacy across diverse heart failure indications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 5.7%, and is expected to reach US$ 2.4 Billion by the year 2034.

- The product type segment is divided into intra-aortic balloon pump and ventricular assist devices (VAD), with ventricular assist devices (VAD) taking the lead in 2024 with a market share of 67.4%.

- Considering modality type, the market is divided into implantable and transcutaneous. Among these, transcutaneous held a significant share of 59.8%.

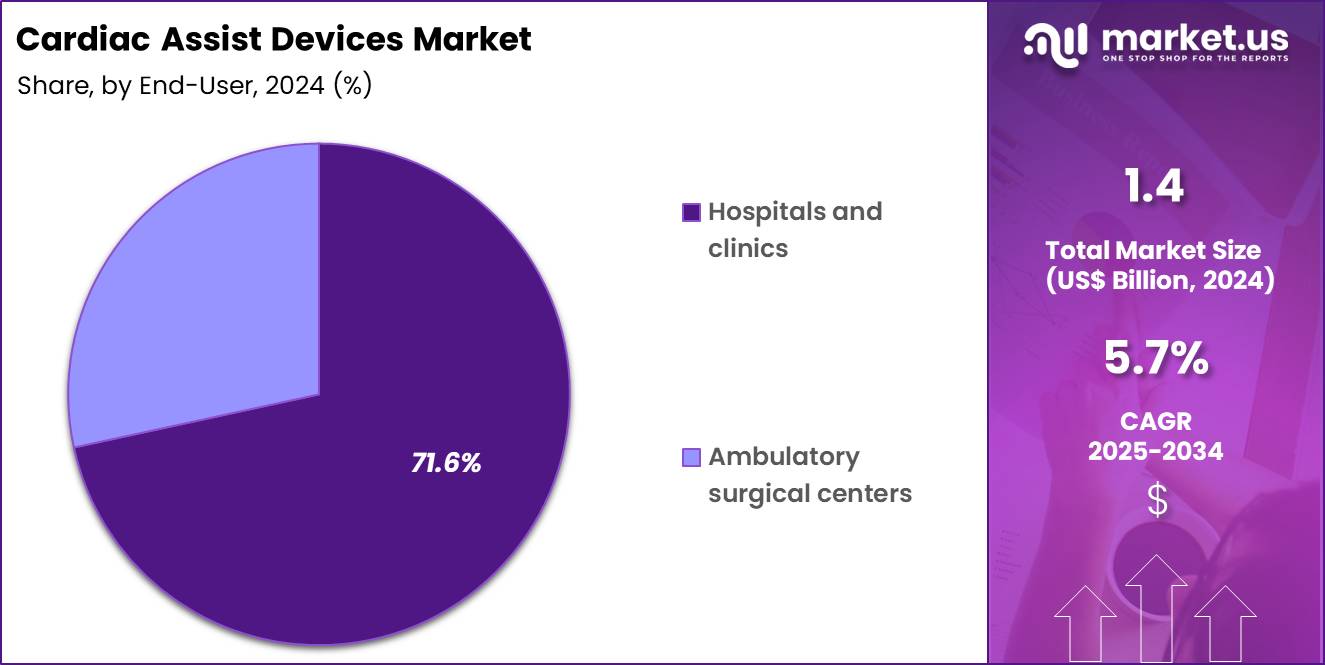

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics and ambulatory surgical centers. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 71.6% in the market.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

Ventricular assist devices accounted for 67.4% of growth within the product type category and represent the core technology in the Cardiac Assist Devices market. Rising prevalence of advanced heart failure increases reliance on long-term mechanical circulatory support. VADs support patients with end-stage heart failure who remain ineligible for immediate transplantation. Improved device durability enhances long-term survival outcomes. Clinicians increasingly adopt VADs as destination therapy rather than bridge-to-transplant alone.

Aging populations expand the pool of heart failure patients requiring advanced support. Advances in pump design reduce thrombosis and hemolysis risks. Smaller device profiles improve patient mobility and quality of life. VADs support both left and biventricular failure management. Survival benefits strengthen physician confidence in broader utilization. Clinical guidelines increasingly reference VAD therapy for refractory heart failure. Improved patient selection criteria optimize outcomes.

Post-implant care pathways improve long-term management. Expanded reimbursement coverage supports adoption in developed markets. Technological innovation drives continuous performance improvements. Heart failure readmission rates decline with VAD support.

Specialized cardiac centers prioritize VAD implantation programs. Increased clinician training improves procedural success. Long-term therapy requirements increase device utilization rates. The segment is projected to maintain dominance due to clinical necessity and technological advancement.

Modality Type Analysis

Transcutaneous modality represented 59.8% of growth within the modality type category and stands as a key driver in the Cardiac Assist Devices market. Transcutaneous systems reduce the need for invasive implantation procedures. Clinicians prefer less invasive approaches for high-risk cardiac patients. Reduced surgical complexity supports broader patient eligibility. Transcutaneous devices enable rapid hemodynamic support in acute settings.

Shorter procedural time improves emergency response efficiency. Hospitals adopt transcutaneous modalities for immediate circulatory stabilization. Lower infection risk compared to fully implanted systems supports preference. Transcutaneous access simplifies device management and troubleshooting. These systems suit temporary and bridge therapies effectively. Acute heart failure and cardiogenic shock cases drive demand.

Flexibility in device removal improves clinical decision-making. Improved catheter-based technologies enhance safety profiles. Training requirements remain lower compared to implantable systems. Transcutaneous devices integrate well into catheterization labs. Cost considerations favor transcutaneous solutions for short-term support.

Improved patient outcomes reinforce clinician adoption. Growing acute cardiac care volumes increase utilization. Technological refinements improve hemodynamic performance. Transcutaneous modality is anticipated to retain leadership due to accessibility and procedural efficiency.

End-User Analysis

Hospitals and clinics accounted for 71.6% of growth within the end-user category and dominate the Cardiac Assist Devices market. Advanced cardiac interventions primarily occur in hospital-based settings. Hospitals manage complex heart failure and cardiogenic shock cases. Availability of cardiac catheterization labs supports device deployment. Multidisciplinary heart teams guide patient selection and management.

Hospitals provide intensive monitoring and postoperative care. Emergency departments initiate rapid circulatory support protocols. Specialized cardiac units increase procedural volumes. Hospitals maintain trained interventional cardiologists and surgeons. Clinics affiliated with hospitals support follow-up and monitoring. High-acuity patient profiles concentrate care within hospitals.

Reimbursement structures favor hospital-based advanced cardiac procedures. Teaching hospitals accelerate adoption through clinical expertise. Referral networks funnel severe cases to tertiary hospitals. Device manufacturers prioritize hospital partnerships for training and support.

Integrated care pathways improve outcomes and utilization. Hospitals manage complications effectively through on-site resources. Expansion of cardiac centers strengthens capacity. Continuous quality improvement programs support best practices. The segment is expected to retain dominance due to infrastructure depth and clinical complexity management.

Key Market Segments

By Product Type

- Intra-Aortic Balloon Pump

- Ventricular Assist Devices (VAD)

By Modality Type

- Implantable

- Transcutaneous

By End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

Drivers

Rising prevalence of heart failure is driving the market

The cardiac assist devices market benefits from the rising prevalence of heart failure, which necessitates mechanical support to improve cardiac output and patient survival in advanced stages. Healthcare providers increasingly rely on devices like ventricular assist devices to bridge patients to transplant or as destination therapy for those ineligible for surgery. Regulatory agencies support device use through approvals that address the growing patient burden, encouraging innovation in durable systems.

Pharmaceutical and device companies invest in R&D to meet the demands of an aging population prone to heart failure. Clinical protocols integrate assist devices into heart failure management to reduce hospitalizations and enhance quality of life. Global health organizations track prevalence trends to inform policy on device accessibility.

Academic research validates the efficacy of assist devices in reducing mortality rates. Patient care improves with devices enabling better hemodynamic stability. Economic factors, including the high cost of untreated heart failure, further justify market expansion. According to the Centers for Disease Control and Prevention, nearly 6.7 million adults aged 20 years or older in the United States have heart failure.

Restraints

High costs of implantation and maintenance are restraining the market

The cardiac assist devices market is restrained by the high costs of implantation and maintenance, which limit accessibility for many patients and strain healthcare budgets. Manufacturers face elevated expenses in device production and post-market surveillance, passing these onto providers. Regulatory requirements for long-term safety data add to financial burdens, deterring widespread adoption. Healthcare systems in low-resource regions struggle with funding for these expensive therapies, reducing market penetration.

Clinical practices must weigh costs against benefits, often opting for medical management over devices in less severe cases. Global disparities in reimbursement exacerbate affordability issues for assist devices. Academic analyses highlight the impact on equity in heart failure care. Patient out-of-pocket expenses remain a barrier, reducing utilization. Economic models project slower growth without cost reduction strategies. The average cost of LVAD implantation exceeds US$200,000, as noted in studies from the National Institutes of Health.

Opportunities

Advancements in minimally invasive implantation techniques is creating growth opportunities

The cardiac assist devices market offers growth opportunities through advancements in minimally invasive implantation techniques, which reduce surgical risks and recovery times for patients. Developers can innovate devices with smaller profiles for percutaneous insertion, expanding eligibility to frailer populations. Regulatory pathways for breakthrough technologies facilitate faster market entry for these innovations.

Healthcare providers gain tools for less invasive procedures, improving outcomes in high-risk heart failure cases. Pharmaceutical partnerships focus on combining devices with drug therapies for comprehensive care. Clinical research explores techniques in bridge-to-recovery scenarios, broadening applications.

Global adoption in emerging markets aligns with infrastructure development for advanced cardiology. Academic collaborations refine implantation methods to minimize complications. Patient therapies benefit from reduced hospital stays with minimally invasive options. The U.S. Food and Drug Administration cleared the Impella RP Flex in 2022, enabling percutaneous insertion for right heart failure support.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions pour resources into advanced cardiac care, spurring the cardiac assist devices market through heightened investments in ventricular pumps and intra-aortic balloon systems for heart failure management. Corporations capitalize on rising healthcare expenditures in aging societies, which amplifies adoption rates and sustains innovation pipelines across North America and Europe. Unfortunately, persistent worldwide inflation elevates raw material and energy costs, pressuring device makers to confront reduced margins in cost-sensitive emerging markets.

Worsening international disputes in manufacturing powerhouses interrupt component shipments, complicating assembly operations for multinational suppliers reliant on Asian hubs. Executives counter these geopolitical risks by redistributing production footprints to diversified locales, which streamlines workflows and uncovers new efficiency gains.

Current US tariffs, establishing a 10% baseline on all imported medical equipment with escalations up to 50% for specific foreign sources, inflate procurement expenses for overseas vendors. Native companies harness this framework to accelerate domestic facility upgrades, which fosters job expansion and bolsters technological sovereignty. Ongoing breakthroughs in durable, minimally invasive implants reliably drive the industry’s upward momentum, securing enhanced patient care and profitable scalability for the future.

Latest Trends

Integration of AI for device monitoring is a recent trend

In 2024, the cardiac assist devices market has demonstrated a prominent trend toward the integration of AI for device monitoring, which enhances real-time data analysis for predictive maintenance and patient management. Manufacturers are incorporating AI algorithms to detect anomalies in pump performance, reducing adverse events.

Healthcare professionals use AI-driven platforms to optimize device settings remotely, improving care efficiency. Regulatory evaluations accommodate AI features with evidence of improved safety for clinical use. Clinical trials are evaluating AI in VADs for heart failure prognostication. Academic studies are exploring AI integration with wearables for comprehensive monitoring.

Global networks are adopting AI to standardize device oversight in diverse settings. Patient therapies gain from AI enabling early intervention for complications. Ethical protocols ensure data privacy in AI applications. According to a 2024 analysis of FDA-approved AI devices in cardiovascular medicine, electrophysiology and imaging lead, with emerging use in assist devices.

Regional Analysis

North America is leading the Cardiac Assist Devices Market

North America accounted for 43.6% of the overall market in 2024, and the Cardiac Assist Devices market expanded as hospitals increased adoption of mechanical circulatory support for advanced heart failure and cardiogenic shock management. Rising prevalence of end-stage heart failure pushed clinicians to deploy ventricular assist devices as both bridge-to-transplant and destination therapy options.

Strong reimbursement frameworks and established transplant infrastructure supported wider clinical use across major cardiac centers. Technological advancements improved device durability, portability, and patient quality of life, encouraging physician confidence. The American Heart Association reported that 6.7 million adults in the United States were living with heart failure in 2022, creating sustained demand for long-term circulatory support solutions.

Growth in minimally invasive implantation techniques further reduced procedural risk. Expanded training programs strengthened clinical capacity. These factors collectively drove solid market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience accelerated expansion during the forecast period as the Cardiac Assist Devices market benefits from rising cardiovascular disease burden and improving access to advanced cardiac care. Rapid population aging increases incidence of heart failure requiring mechanical support beyond pharmacological therapy.

Governments and private healthcare providers invest in specialized cardiac centers to reduce mortality from advanced heart disease. Growing awareness among clinicians improves early referral for device-based intervention. Expansion of transplant programs in countries such as Japan, China, and South Korea supports broader utilization.

The World Health Organization reported that cardiovascular diseases accounted for over 10 million deaths annually in the Asia Pacific region as of 2022, highlighting significant unmet need for advanced therapies. Local manufacturing and strategic partnerships improve device availability. These developments position the region for sustained growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Cardiac Assist Devices market drive growth by advancing compact, durable pump technologies that improve hemodynamic support and quality of life for patients with advanced heart failure. Companies expand adoption through structured clinician training, center-of-excellence partnerships, and post-implant care programs that optimize outcomes and reduce readmissions. Commercial strategies emphasize pathway integration across transplant, destination therapy, and bridge-to-recovery use cases to broaden eligible patient pools.

Innovation priorities include enhanced biocompatibility, remote monitoring, and power management systems that increase reliability and patient mobility. Market expansion targets regions investing in advanced cardiac care infrastructure and reimbursement frameworks for mechanical circulatory support. Abbott anchors leadership with a robust cardiovascular portfolio, global manufacturing scale, and deep clinical relationships that support the widespread use of its ventricular assist solutions.

Recent Developments

- In July 2025, CorWave reported the first ever human implantation of its left ventricular assist system built on wave membrane technology. This event represents a technological breakthrough in cardiac assist devices, as the wave based mechanism is designed to mimic natural cardiac flow dynamics, potentially reducing blood trauma and improving long term patient outcomes. Such innovation strengthens confidence in next generation LVAS platforms and accelerates investment and clinical interest in advanced heart failure support technologies.

- In July 2025, Robert Wood Johnson University Hospital received The Joint Commission’s Gold Seal of Approval for its ventricular assist device program. This recognition reinforces the importance of accredited, high performing clinical centers in driving adoption of complex cardiac assist devices. Program validation by leading regulators increases patient referrals, supports reimbursement confidence, and promotes wider utilization of VAD therapies in advanced heart failure management.

- In April 2025, regulatory authorities in Europe granted approval for a new fully implantable left ventricular assist device, marking a critical step forward in portable and long duration mechanical circulatory support. Fully implantable systems reduce infection risk, enhance patient mobility, and improve quality of life, directly expanding the eligible patient population and strengthening long term demand for cardiac assist devices across European healthcare systems.

Top Key Players

- Abbott Laboratories

- Medtronic plc

- Abiomed, Inc.

- Getinge AB

- Terumo Corporation

- Teleflex Incorporated

- Berlin Heart GmbH

- SynCardia Systems, LLC

- CARMAT

- CorWave SA

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 2.4 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Intra-Aortic Balloon Pump and Ventricular Assist Devices (VAD)), By Modality Type (Implantable and Transcutaneous), By End-User (Hospitals & Clinics and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Medtronic plc, Abiomed, Inc., Getinge AB, Terumo Corporation, Teleflex Incorporated, Berlin Heart GmbH, SynCardia Systems, LLC, CARMAT, CorWave SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cardiac Assist Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Cardiac Assist Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Medtronic plc

- Abiomed, Inc.

- Getinge AB

- Terumo Corporation

- Teleflex Incorporated

- Berlin Heart GmbH

- SynCardia Systems, LLC

- CARMAT

- CorWave SA