Global Carbon Fiber Market Size, Share Analysis Report By Raw Material (PAN Based, Pitch Based), By Tow Size (Small Tow, Large Tow), By Application (Automotive, Aerospace and Defense, Wind Turbine, Sports/Leisure, Molding and Compound, Construction, Pressure Vessel, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161555

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

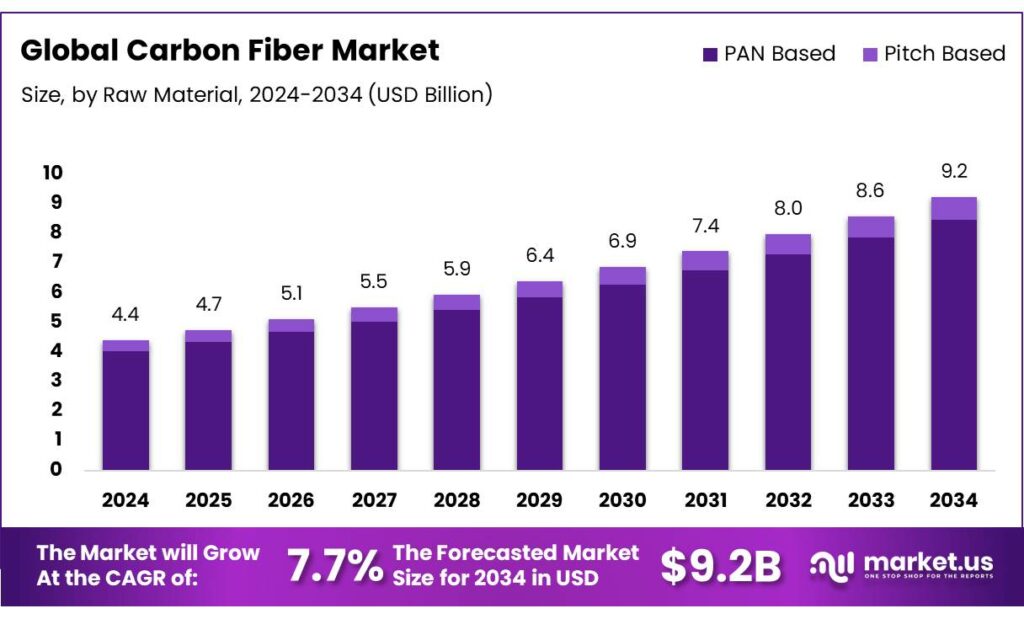

The Global Carbon Fiber Market size is expected to be worth around USD 9.2 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

Carbon fiber (CF) is a high-performance material made from precursor fibers (most commonly polyacrylonitrile, or PAN) which are converted by stabilization, carbonization, and graphitization processes. It offers exceptional strength-to-weight ratio, stiffness, corrosion resistance, and thermal stability. These attributes make carbon fiber a preferred material in demanding applications such as aerospace, wind turbine blades, high-end automotive, pressure vessels, sports equipment, and advanced infrastructure components.

The growth of this industry is underpinned by several strong driving factors. First, the global push toward decarbonization and energy transition stimulates demand in clean-energy infrastructure—especially wind and hydrogen sectors—where carbon fiber’s lightweight, high-strength traits enable longer blades and lighter pressure vessels. For example, in hydrogen storage applications, carbon fiber currently accounts for about 50% of the cost of the storage tank system; research efforts are targeting carbon fiber production costs below USD 15/kg to accelerate adoption.

From a policy and government initiative vantage, several jurisdictions are encouraging carbon fiber deployment or manufacturing. In the United States, agencies such as the DOE have explored policy instruments to support carbon fiber manufacturing via R&D funding, economic development incentives, and clustering strategies.

For instance, the DOE’s Bioenergy Technologies Office announced a USD 12 million funding opportunity to develop renewable carbon fiber from biomass feedstocks. Government incentive frameworks frequently include tax credits, grants, or infrastructure support to promote advanced materials manufacturing, especially when aligned with clean energy goals. In the trade domain, recent U.S. tariff adjustments increased duties on imported carbon fiber tow to 25% effective March 2025, which may encourage domestic production substitution.

Key Takeaways

- Carbon Fiber Market size is expected to be worth around USD 9.2 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 7.7%.

- PAN-based carbon fiber held a dominant market position, capturing more than a 91.5% share of the global carbon fiber market.

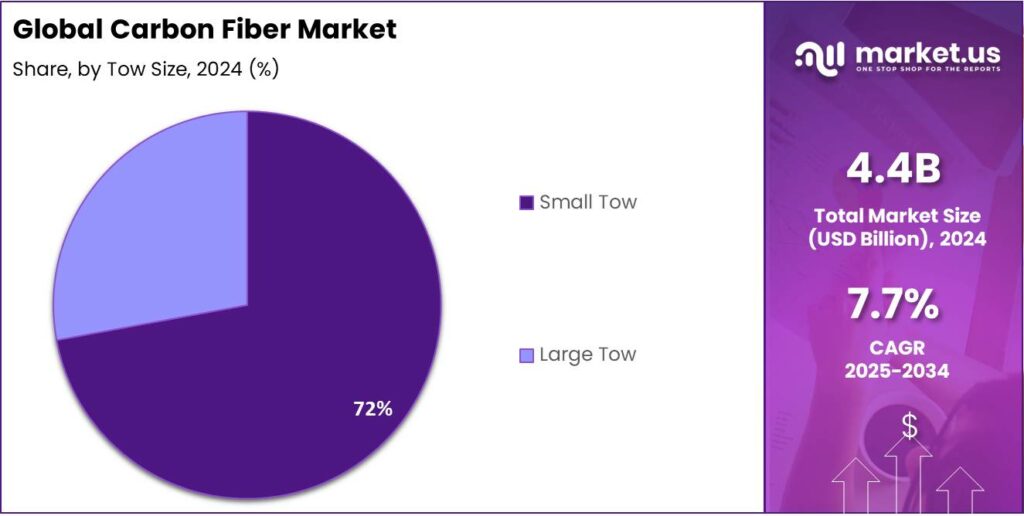

- Small Tow held a dominant market position, capturing more than a 72.1% share of the global carbon fiber market.

- Automotive held a dominant market position, capturing more than a 34.9% share of the global carbon fiber market.

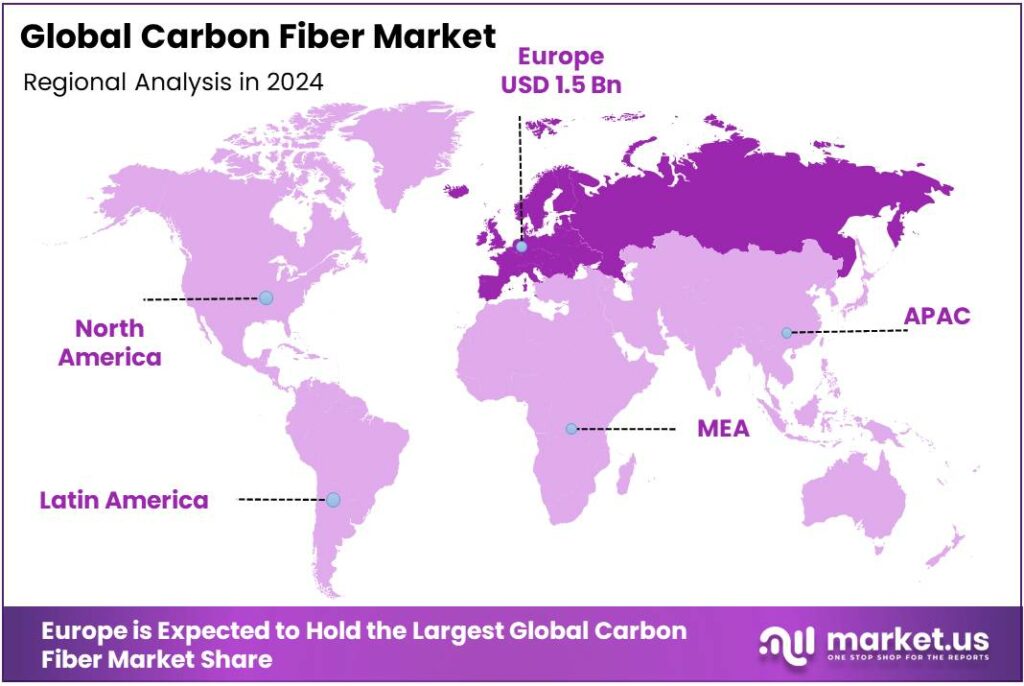

- European carbon fiber market stood at approximately USD 1.5 billion, corresponding to around 34.70%.

By Raw Material Analysis

PAN-Based Carbon Fiber dominates with 91.5% share owing to its superior mechanical properties and cost efficiency

In 2024, PAN-based carbon fiber held a dominant market position, capturing more than a 91.5% share of the global carbon fiber market. This strong dominance is attributed to its exceptional balance of strength, stiffness, and ease of processing, which makes it the preferred raw material across aerospace, automotive, wind energy, and sporting goods sectors. PAN-based fibers are derived from polyacrylonitrile precursors that offer high carbon yield and excellent structural integrity, enabling their wide adoption in high-performance composite materials.

The demand for PAN-based carbon fiber continued to rise as industries focused on lightweight materials to enhance energy efficiency and reduce emissions. The material’s proven performance in applications such as aircraft fuselage structures, electric vehicle components, and large wind turbine blades reinforced its market leadership. Furthermore, the established global production infrastructure for PAN precursor manufacturing ensured stable supply and scalability compared to alternative raw materials such as pitch-based or rayon-based carbon fibers.

By Tow Size Analysis

Small Tow dominates with 72.1% share driven by its precision, high strength, and aerospace-grade performance

In 2024, Small Tow held a dominant market position, capturing more than a 72.1% share of the global carbon fiber market. This leadership is primarily due to its superior tensile strength, uniform filament distribution, and high-quality surface finish, making it ideal for demanding applications such as aerospace, defense, and high-end automotive components. Small tow carbon fibers, typically consisting of fewer than 24,000 filaments per bundle, provide excellent load-bearing capacity and enhanced structural performance compared to large tow fibers.

Manufacturers favored this category for its ability to deliver precision and consistency in advanced composite structures, where safety and performance standards are critical. The high compatibility of small tow fibers with resin systems further enhanced their usage across the wind energy and sporting goods sectors.

By Application Analysis

Automotive dominates with 34.9% share owing to rising demand for lightweight and fuel-efficient vehicles

In 2024, Automotive held a dominant market position, capturing more than a 34.9% share of the global carbon fiber market. This strong presence was driven by the growing shift toward lightweight materials to enhance fuel efficiency and reduce carbon emissions. Automakers increasingly integrated carbon fiber composites into structural components such as body panels, chassis, drive shafts, and interior parts to improve vehicle performance while meeting stringent environmental regulations. The material’s high strength-to-weight ratio and superior durability made it ideal for electric and high-performance vehicles.

The push for vehicle electrification significantly contributed to the demand for carbon fiber, as manufacturers sought to extend the driving range of electric vehicles (EVs) through weight reduction. Leading automotive producers expanded the use of carbon fiber in next-generation EV platforms and sports models to achieve better energy efficiency and aerodynamics. Additionally, the material’s recyclability and compatibility with modern manufacturing processes made it a sustainable choice aligned with global decarbonization goals.

Key Market Segments

By Raw Material

- PAN Based

- Pitch Based

By Tow Size

- Small Tow

- Large Tow

By Application

- Automotive

- Aerospace & Defense

- Wind Turbine

- Sports/Leisure

- Molding & Compound

- Construction

- Pressure Vessel

- Others

Emerging Trends

Rise of Circular & Recyclable Carbon Fiber Composites

Carbon fiber composites today often result in significant scrap or waste during manufacturing: up to 40 % of carbon fiber (or CFRP) material is reportedly sent to landfill during fabrication or trimming steps. That’s not trivial — imagine almost half of the “super material” ending up unused or tossed. To counter this, researchers and manufacturers are pushing for “zero-waste” manufacturing methods or ways to reclaim fibers effectively.

Particularly promising is the work from the U.S. National Renewable Energy Laboratory (NREL). Their team has developed carbon fiber composites made with bio-derivable resin (a greener kind of polymer) that can be recycled at least three times using a mild depolymerization process. This means a part made of carbon fiber composite might live through three life cycles instead of ending in waste after one use. If scaled and commercialized, this would drastically lower the effective cost and environmental burden of carbon fiber parts.

- Another indicator of the trend’s strength is the technological maturity of recycling research. A study tracking research output and development maturity estimated that in 2018, the maturity of carbon fiber composite recycling was around 10%, but projections expect it to hit 50% by 2028, and almost 90% by 2038.

Governments and research bodies are paying attention too. Many countries now include “recyclable materials” or “circular economy” as part of their roadmap or industrial policy. For instance, clean manufacturing and extended producer responsibility (EPR) policies often require producers to think of end-of-life management. Though I didn’t find a carbon-fiber-specific national policy in this latest scan, these broader policies push composite manufacturers to adopt recyclable strategies.

Drivers

Light-weighting to Improve Energy Efficiency in Transportation

One of the most powerful forces steering the growth of carbon fiber is the urgent need to make vehicles lighter so they consume less fuel or electricity. In simple terms: lighter vehicles mean less energy used. According to the U.S. Department of Energy, cutting vehicle weight by just 10% can boost fuel efficiency by 6–8 %. That relationship makes carbon fiber — which offers very high strength for low weight — highly attractive for automakers who must meet tighter emissions and efficiency rules.

In many countries, governments are pushing for stricter standards on fuel economy and carbon emissions. For example, regulatory bodies may require auto manufacturers to reduce fleet average emissions in grams of CO₂ per kilometer. That puts pressure on car companies to look for advanced materials. Replace parts made of steel or aluminum with carbon fiber composites, and you can shave off handfuls of kilos across the body, chassis, or internal components — and those kilos saved translate into real energy and emissions benefits over millions of vehicles.

Governments are also actively supporting research and policies to make lightweight materials more affordable and to encourage their adoption. In the U.S., for instance, Department of Energy (DOE) programs aim to develop lower-cost carbon fiber processes so that this “super material” becomes viable for more regular cars (not just premium models). Public funding, tax incentives, or matching grants for manufacturing modernization are typical levers used in many countries (though the details differ). This kind of support helps offset the high cost of carbon fiber production and encourages industry to scale innovations.

Restraints

High Energy & Environmental Cost of Production

One of the biggest brakes slowing down carbon fiber’s wider adoption is how energy-hungry and carbon-intensive its production can be. That’s more than a technical issue — it touches economics, environment, and public perception.

To start with, producing carbon fiber demands vast amounts of energy. Studies show that making 1 kg of carbon fiber typically consumes between 50 and 80 kWh of energy in conventional routes. In more intensive cases or less optimized processes, the energy use can vary even more widely — from 2.1 to 132.8 kWh per kg in some literature estimates. On the climate side, this high energy use translates into heavy greenhouse gas emissions: many evaluations put the carbon footprint of virgin carbon fiber production in the range of 13 to 34 kg CO₂ per kg of fiber.

This energy and emissions burden is not just a “nice to avoid” — it becomes a competitive liability. In applications that are very sensitive to life-cycle emissions, or where consumers or regulators demand low-carbon materials (for instance, in transportation or green infrastructure), carbon fiber’s footprint can work against it. The higher emissions profile becomes a cost in regulatory compliance, carbon taxes, or environmental disclosures.

Another angle where this restraint bites hard is cost structure. In a detailed cost model for a reasonably large production plant, producing 1 kg of carbon fiber was estimated to cost USD 10.87, where the precursor material alone accounted for ~53.4% of that cost, and energy contributed ~7%. This means that any fluctuation in energy prices or stricter carbon pricing policies can rapidly make carbon fiber less competitive compared to lighter metals or advanced aluminum alloys. Indeed, for new world-scale plants targeting a 10% internal rate of return, industry analysts forecast that costs per kg might need to be around USD 25 under certain energy-intensive assumptions.

Carbon fiber producers often face tension: to lower their carbon footprint or energy demand, they must invest in advanced equipment, cleaner energy sources, or process innovations — all of which require capital and time. For example, the U.S. Department of Energy’s manufacturing programs aim to drive down energy use in carbon fiber production by up to 75% over a decade, relative to baseline processes.

Opportunity

Expansion in Wind Turbine Blades and Renewable Energy

One of the most promising growth opportunities for carbon fiber lies in its application in wind turbine blades, especially as nations push to scale up renewable energy. Wind power is a central part of many countries’ clean energy targets, and carbon fiber offers a way to build longer, lighter, stronger blades — enabling turbines to generate more electricity with each rotation.

In the U.S., the wind energy supply chain report highlights that fiber-reinforced composites — including carbon fiber — compose primary materials used in blades. The report also mentions that demand for carbon fiber for wind turbines could triple by around 2027. This “tripling” is not just hype — it reflects how wind project developers are eyeing carbon fiber to leap past limitations of existing blade technology. As turbines go offshore into harsher environments, the durability, fatigue resistance, and lightweight nature of carbon fiber become more compelling.

Governments increasingly support this shift. Renewable energy mandates, feed-in tariffs, auctions, and subsidies for wind development help drive demand for higher-performance blade materials. Many countries include local content requirements, R&D funding, or tax benefits for innovation in wind tech. For instance, national wind energy agencies often partner with composite material labs or institutes to support novel blade designs that incorporate carbon fiber. These policies de-risk investment in new materials, making carbon fiber more attractive to wind OEMs and blade manufacturers.

Beyond wind, the growth opportunity extends to hybrid energy systems. As more grids integrate solar, storage, and offshore wind, developers demand materials that can handle cyclic loads, corrosion, and material fatigue over decades. Carbon fiber is positioned well in that niche. The global push toward renewable energy is not slowing.

- According to the IEA’s Global Energy Review 2025, global energy demand grew 2.2% in 2024, with electricity demand rising 4.3 % — and renewables contributed 38% of that growth in energy supply. This trend means more investments in wind and solar assets — meaning more demand for advanced materials like carbon fiber.

Regional Insights

Europe dominates with 34.70% share amounting to USD 1.5 Billion as regional carbon fiber leader

In 2024, the European carbon fiber market stood at approximately USD 1.5 billion, corresponding to around 34.70% of the global market. This dominant position is rooted in the strong presence of key industries in Europe—automotive, aerospace, renewable energy (notably wind turbines), and high-performance sports equipment—that demand high-quality carbon fiber for lightweighting and performance.

Year 2024 in Europe saw demand rising particularly in automotive sectors where OEMs increase carbon fiber usage for body structures, frames, and internal parts to reduce vehicle weight and meet stricter emission regulations. Similarly, the wind energy sector placed large orders for carbon fiber used in turbine blades as offshore and onshore wind projects proliferated in Northern Europe. Aerospace further contributed significantly, with European aircraft manufacturers (e.g. Airbus) incorporating carbon fiber in fuselage and wing components.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DowAksa is a vertically integrated carbon fiber company, originally a joint venture between Dow and Aksa, now fully owned by Aksa Akrilik (rebranded as Aksa Carbon). It offers solutions from precursor to finished carbon fiber and resin, targeting industrial markets including energy, aerospace, defense, transport, and infrastructure. Its manufacturing base in Yalova, Turkey, provides geographic proximity to Europe, MENA, and Central Asia. Recent developments include ownership consolidation as Aksa acquired Dow’s 50% stake (worth approximately US$125 million) in mid-2025.

Formosa Plastics (Taiwan) operates a large PAN-based carbon fiber facility (capacity ~8,750 metric tons annually). Its “Tairyfil” line comprises various grades: standard modulus to high modulus, small tow (1.5K-48K), standard to high strength. Products are used in wind energy, sporting goods, pressure vessels, aerospace, automotive, and industrial composites. In 2025, the company announced a Renwu expansion program with NT$2 billion investment to add ~1,600 tons/year to capacity.

Hyosung (South Korea) produces carbon fiber under its TANSOME® brand. It offers a range of grades including standard, intermediate modulus, and ultra-high tensile strength fibers (up to ~6,400 MPa tensile strength in certain grades). The company operates the Jeonju plant, with current capacity significantly lower than future targets; by 2028, it aims to reach 24,000 tons/year. Hyosung is also pursuing sustainable and bio-based feedstocks, and holds certifications for its carbon fiber process (e.g. ISCC PLUS) to strengthen supply chain transparency.

Top Key Players Outlook

- A&P Technology Inc.

- DowAksa USA LLC

- Formosa Plastics Corporation

- Hexcel Corporation

- Hyosung Advanced Materials

- Jiangsu Hengshen Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SGL Carbon

- Solvay

- Teijin Limited

Recent Industry Developments

In 2024, Jiangsu Hengshen Co. Ltd operated with an annual carbon fiber production capacity of 5,000 tons, along with 15 million square meters of fabrics & prepreg, 1,200 tons of high-performance resin, 5,000 tons of composite parts, and 3 million meters of extruded carbon boards.

In 2024, Hexcel utilized between 60% and 65% by value of the carbon fiber it produced, with the remainder sold to external customers.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 9.2 Bn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (PAN Based, Pitch Based), By Tow Size (Small Tow, Large Tow), By Application (Automotive, Aerospace and Defense, Wind Turbine, Sports/Leisure, Molding and Compound, Construction, Pressure Vessel, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A&P Technology Inc., DowAksa USA LLC, Formosa Plastics Corporation, Hexcel Corporation, Hyosung Advanced Materials, Jiangsu Hengshen Co. Ltd, Mitsubishi Chemical Corporation, Nippon Graphite Fiber Co. Ltd, SGL Carbon, Solvay, Teijin Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A&P Technology Inc.

- DowAksa USA LLC

- Formosa Plastics Corporation

- Hexcel Corporation

- Hyosung Advanced Materials

- Jiangsu Hengshen Co. Ltd

- Mitsubishi Chemical Corporation

- Nippon Graphite Fiber Co. Ltd

- SGL Carbon

- Solvay

- Teijin Limited