Global Canned Soup Market Size, Share Report By Type (Condensed, Ready-to-eat), By Category (Vegetarian, Nonvegetarian), By Processing (Regular Soup, Organic Soup), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Food Specialty Stores, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154223

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

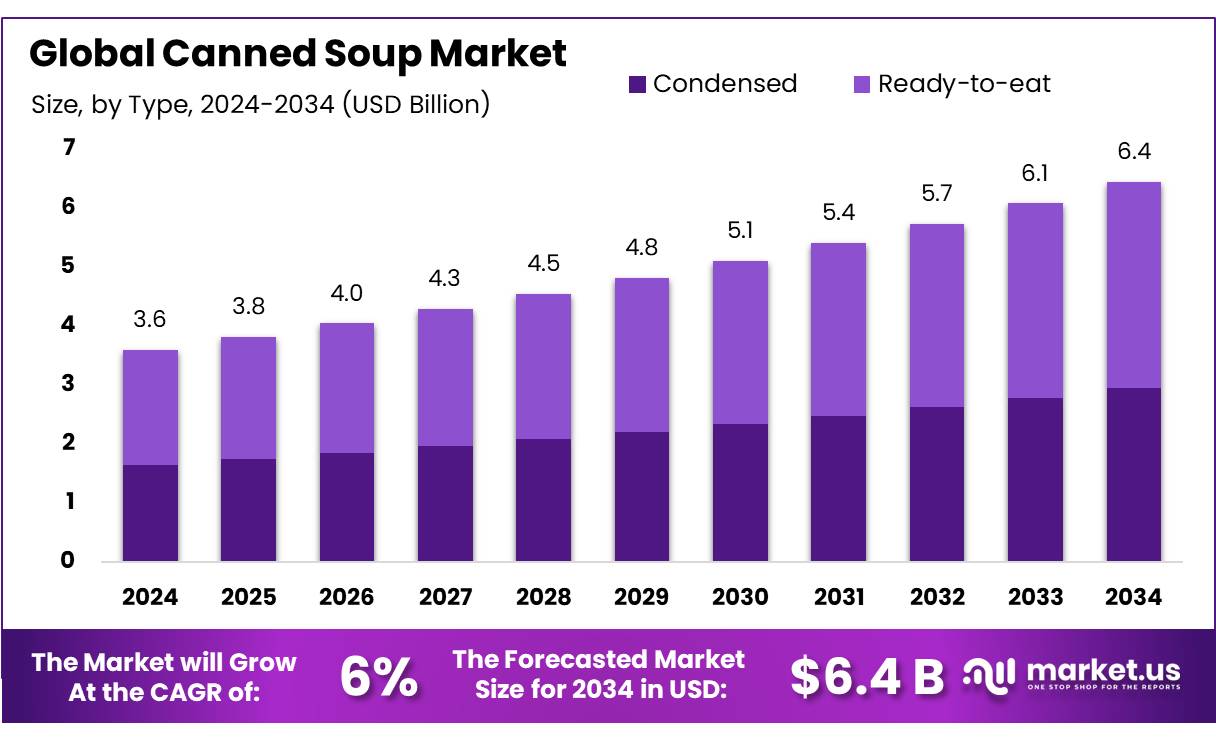

The Global Canned Soup Market size is expected to be worth around USD 6.4 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

The canned soup concentrates industry is defined by the manufacturing and distribution of condensed soups—products requiring addition of water or milk prior to consumption. These items are typically packaged in metal cans, and in some advanced form in aseptically processed containers. The industry is structured around convenience, shelf-stability, and broad flavor appeal, with segments including chicken‐noodle, tomato, vegetable, and cream‑based soups.

Key driving factors include shifting consumer lifestyles—urbanization, time constraints, and rising dual-income households—prompting demand for convenient, ready meals. Health and wellness trends are fueling reformulation toward low‑sodium, organic, clean‑label and plant‑based versions. Regulatory pressure and nutrition guidelines—such as voluntary sodium‑reduction initiatives like Canada’s Healthy Eating Strategy targeting 2300 mg/day average—are prompting manufacturers to reduce salt in processed products including canned soups

Several Indian government initiatives directly support scaling of food processing infrastructure and value‑added products. The Production Linked Incentive Scheme for Food Processing Industry (PLISFPI) running from 2021‑22 to 2026‑27 has a budget outlay of INR 10,900 crore (~USD 1.3 billion) to promote manufacturing of branded processed foods and increase farmer income . The Mega Food Parks Scheme aims to raise processing of perishables from 6 percent to 20 percent, supporting modern processing facilities and cold‑chain linkages, including for processed soups and concentrates

Key Takeaways

- Canned Soup Market size is expected to be worth around USD 6.4 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 6.0%.

- Condensed held a dominant market position, capturing more than a 45.7% share in the canned soup market.

- Nonvegetarian held a dominant market position, capturing more than a 63.8% share in the canned soup market.

- Regular Soup held a dominant market position, capturing more than a 83.2% share in the canned soup market.

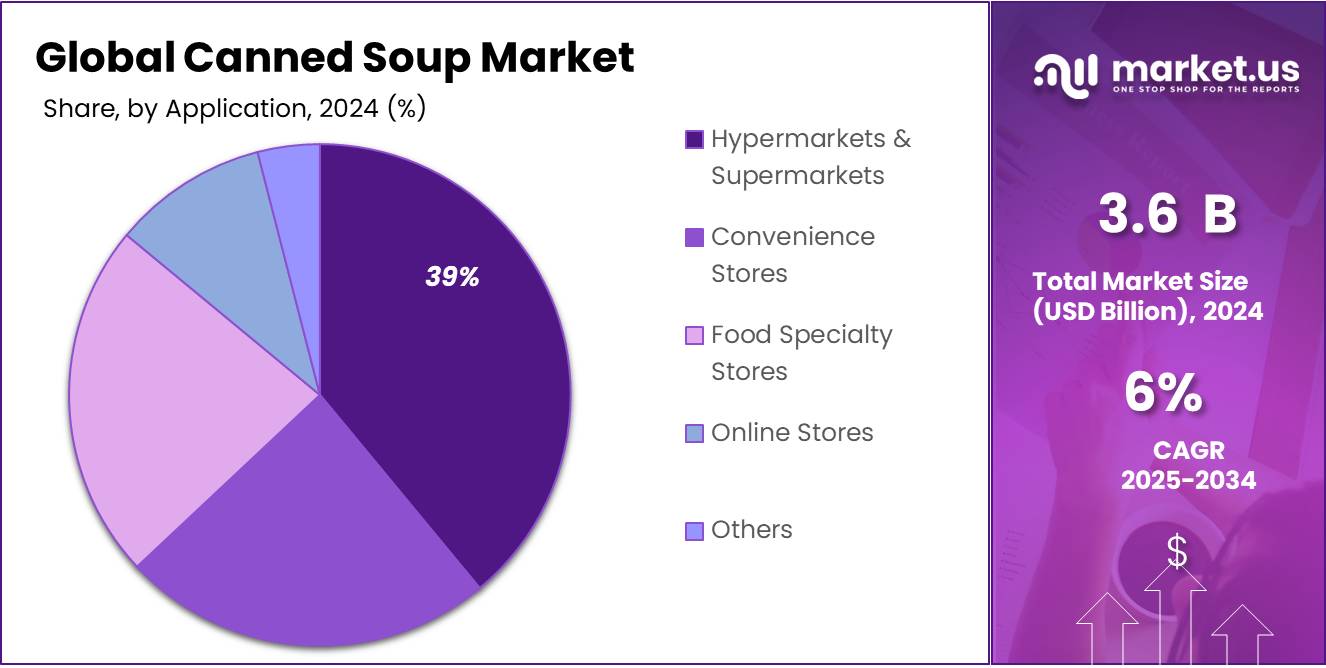

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 39.5% share in the canned soup market.

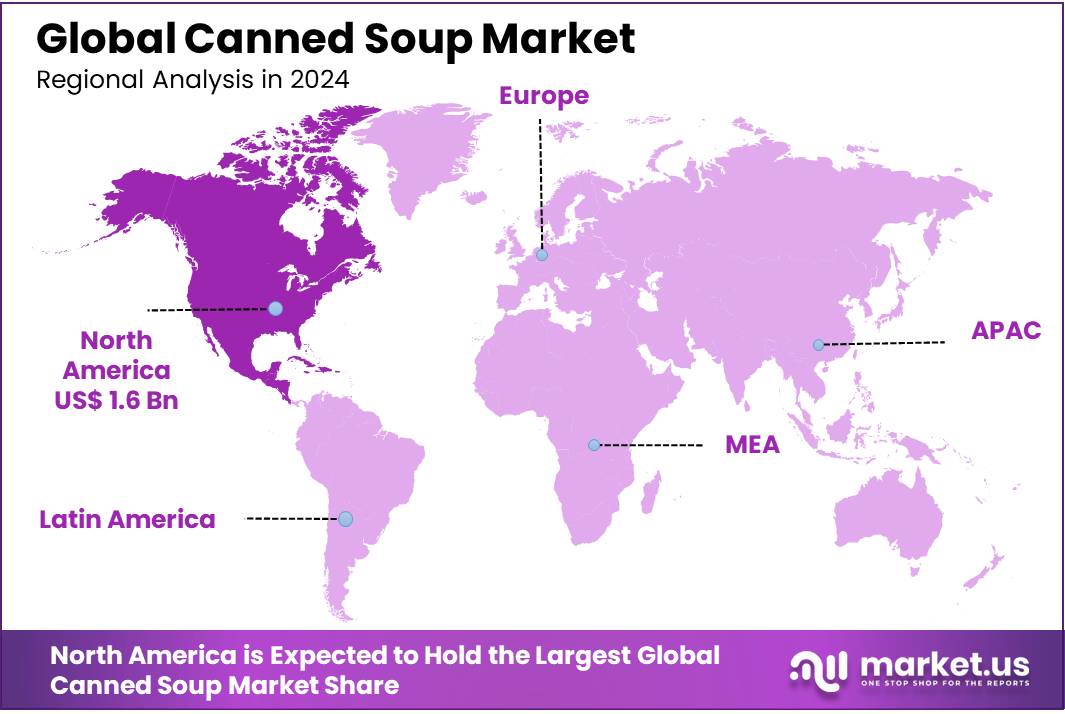

- North America held a dominant position in the global canned soup market, accounting for 44.8% of the total market share, valued at approximately USD 1.6 billion.

By Type Analysis

Condensed Soups dominate with 45.7% due to their convenience and long shelf life.

In 2024, Condensed held a dominant market position, capturing more than a 45.7% share in the canned soup market. This leadership is primarily driven by the convenience these products offer in terms of storage, transportation, and preparation. Condensed soups require minimal packaging space and have a longer shelf life compared to ready-to-serve alternatives, making them highly attractive for both retail and institutional buyers.

Their affordability and ease of reconstitution with water or milk make them suitable for consumers seeking quick meal solutions. By 2025, the segment is expected to maintain its lead, supported by expanding product varieties in low-sodium, organic, and plant-based options that cater to health-conscious consumers. Additionally, demand from the foodservice industry and rising urban consumption continue to strengthen the segment’s overall growth.

By Category Analysis

Nonvegetarian Soups lead with 63.8% due to strong preference for meat-based flavors.

In 2024, Nonvegetarian held a dominant market position, capturing more than a 63.8% share in the canned soup market by category. This strong lead can be attributed to widespread consumer preference for protein-rich and savory options such as chicken noodle, beef stew, and seafood chowders. These products offer a hearty meal solution and are especially popular in colder regions where demand for warm, filling meals is higher.

The convenience of ready-to-eat meat-based soups also appeals to working individuals and families looking for quick meal alternatives. In 2025, the nonvegetarian segment is expected to retain its top spot, supported by continuous innovations in recipes, clean-label offerings, and expansion in global retail and online grocery channels.

By Processing Analysis

Regular Soups dominate with 83.2% due to their wide acceptance and daily use appeal.

In 2024, Regular Soup held a dominant market position, capturing more than a 83.2% share in the canned soup market by processing type. This significant share is largely driven by its wide availability, affordable pricing, and broad consumer familiarity across regions. Regular soups, including classic vegetable, tomato, and chicken varieties, are a staple in households and widely stocked in supermarkets, making them the go-to choice for quick and comforting meals.

The segment also benefits from consistent demand in schools, hospitals, and cafeterias where standardized taste and texture are essential. By 2025, Regular Soup is expected to continue leading the category, supported by brand loyalty, variety in flavor offerings, and its strong presence in both retail and institutional supply chains.

By Distribution Channel Analysis

Hypermarkets & Supermarkets lead with 39.5% due to easy access and wide product variety.

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 39.5% share in the canned soup market by distribution channel. This dominance is mainly due to the high footfall and wide shelf space these stores offer, allowing consumers to browse multiple soup brands and flavors in one place. Bulk promotions, combo deals, and in-store sampling further enhance visibility and drive impulse purchases.

These retail formats are especially popular in urban and semi-urban areas where shoppers prefer the convenience of one-stop grocery buying. In 2025, Hypermarkets & Supermarkets are expected to retain their leadership, supported by continuous retail expansion, better cold-chain facilities, and improved supply chain efficiency across regional and national chains.

Key Market Segments

By Type

- Condensed

- Ready-to-eat

By Category

- Vegetarian

- Nonvegetarian

By Processing

- Regular Soup

- Organic Soup

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Food Specialty Stores

- Online Stores

- Others

Emerging Trends

Reformulation to Lower Sodium Content

A significant trend in the canned soup industry is the reformulation of products to reduce sodium content, driven by growing consumer awareness and regulatory pressures. Excessive sodium intake is linked to health issues like hypertension and cardiovascular diseases. In response, health organizations and governments worldwide are setting guidelines to limit sodium levels in processed foods, including canned soups.

The World Health Organization (WHO) has established global sodium benchmarks for various food categories, including soups. These benchmarks serve as maximum sodium levels that processed foods should contain, aiming to reduce average population sodium intake to below 2 grams per day by 2025. For instance, WHO’s guidelines suggest specific sodium limits for soups to help achieve this goal.

In India, the Food Safety and Standards Authority of India (FSSAI) has been actively involved in promoting healthier food options. While specific sodium reduction targets for canned soups are not detailed, FSSAI’s initiatives encourage the food industry to consider nutritional aspects in product development. This aligns with global trends towards healthier food formulations.

Companies are responding to these trends by reformulating their canned soups to lower sodium content. This not only helps in meeting regulatory standards but also caters to the increasing consumer demand for healthier food options. By focusing on sodium reduction, the canned soup industry can contribute to public health goals and enhance consumer trust.

Drivers

Increasing Demand for Convenient and Ready-to-Eat Meals

One major driving factor for the growth of the canned soup market is the increasing demand for convenient and ready-to-eat meal solutions. As more consumers lead busy lifestyles, especially in urban areas, the preference for products that save time in meal preparation has grown significantly. Canned soups, known for their long shelf life and ease of preparation, meet this demand effectively.

This growth is largely attributed to the increasing adoption of ready-to-eat meals by working professionals and dual-income households, particularly in developed markets like the U.S. and Europe. The growth in disposable incomes, along with busy lifestyles, has made it easier for people to choose quick meal options, such as canned soups, which are also available in a wide variety of flavors and nutritional profiles.

Governments in several countries have also supported the growth of the processed food industry, including canned products, through initiatives like food processing schemes and subsidies. In India, the Ministry of Food Processing Industries (MoFPI) has launched various schemes, including the Production Linked Incentive Scheme for the Food Processing Industry (PLISFPI), to boost the food processing sector and promote value-added products, including canned soups. This initiative is expected to drive further market growth by encouraging both local and international investments in food processing facilities, thereby increasing the availability and affordability of processed food products like canned soups.

Restraints

Concerns Over Health and Nutritional Content

One of the key restraining factors for the canned soup market is the growing consumer concern over the health and nutritional content of processed foods. As more people become health-conscious, there is a rising demand for products that are natural, organic, and free from preservatives, artificial flavors, and high sodium content. Canned soups, while convenient, often contain high levels of sodium and preservatives, which can deter health-conscious consumers from purchasing them.

According to a report by the World Health Organization (WHO), excessive sodium intake is a leading cause of hypertension, which is a major risk factor for cardiovascular diseases. With canned soups typically containing high sodium content, consumers are becoming increasingly cautious about including them in their diets. This has led to a shift in preference towards fresh, homemade, or healthier alternatives, such as soups made with organic ingredients or those offering reduced sodium and preservatives.

To address this concern, several companies are beginning to reformulate their products to offer healthier versions of canned soups. For instance, in the United States, Campbell’s Soup Company introduced a line of “Healthier Request” soups, which are designed with lower sodium and fewer artificial ingredients. However, these healthier alternatives often come at a higher price point, which could limit their appeal among price-sensitive consumers.

Additionally, governments around the world are focusing on the need for healthier food options. For example, in India, the Ministry of Food Processing Industries (MoFPI) has been working on initiatives to promote the production of healthier, fortified food products. This includes programs to reduce salt, sugar, and fat content in processed foods, which could impact the canned soup industry. The Indian government is also promoting food safety standards and fortification, encouraging manufacturers to reformulate their products for better nutritional quality.

Opportunity

Expansion of Food Processing Infrastructure

A significant growth opportunity for the canned soup industry lies in the expansion of food processing infrastructure, particularly through government-backed initiatives aimed at enhancing the sector’s capabilities and reach. In India, the food processing sector is a priority under the “Make in India” initiative, with the Ministry of Food Processing Industries (MoFPI) implementing schemes to attract investment and develop infrastructure. This includes the establishment of Mega Food Parks, which provide essential utilities and common processing facilities to entrepreneurs in agriculturally rich areas. These parks offer a plug-and-play model, facilitating the growth of food processing units, including those producing canned soups.

The government’s support for food processing infrastructure is further evident in the allocation of funds. For the fiscal year 2024-25, the Government of India allocated a budget estimate of ₹3,290 crore to the MoFPI for the development of the food processing sector. This marks an increase of about 30.19% from the revised estimate of ₹2,527.06 crore in 2023-24, underscoring the government’s commitment to enhancing the sector’s infrastructure and capabilities.

Additionally, the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme has been instrumental in promoting the growth of small-scale food processing units. Under this scheme, financial assistance is provided to micro food processing units, including those in the canned soup segment, to modernize their operations and improve product quality. For instance, in the financial year 2024-25, Bihar ranked first in the country for the effective implementation of the PMFME scheme, with loans disbursed to 6,589 units, accounting for 63% of total approved applicants.

Regional Insights

In 2024, North America held a dominant position in the global canned soup market, accounting for 44.8% of the total market share, valued at approximately USD 1.6 billion. This regional dominance is primarily driven by the high penetration of packaged and convenience foods across the United States and Canada. The long-standing cultural familiarity with canned soup products—such as chicken noodle, tomato, and clam chowder—has sustained steady consumption levels among households. In addition, the high working population in North America continues to favor ready-to-eat meal options that offer both nutrition and speed, aligning with the value proposition of canned soups.

Major retail channels such as Walmart, Kroger, and Costco play a critical role in product accessibility and nationwide distribution. These stores offer extensive shelf space to canned soup brands, enabling high visibility and impulse buying. Furthermore, the presence of leading food manufacturers in the region has supported constant innovation in flavor profiles, dietary formulations (low-sodium, organic, and gluten-free), and sustainable packaging, all of which appeal to evolving consumer preferences.

Government regulations concerning food safety, labeling, and packaging, enforced by agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada, ensure high product standards, thereby reinforcing consumer trust. Moreover, rising online grocery sales in the region, especially post-pandemic, have significantly expanded the reach of canned soup products to suburban and rural markets.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agropur Ingredients is a leading global dairy cooperative that supplies various food ingredients, including dairy-based components for canned soups. Their products, such as cheese, milk powders, and whey proteins, are used in soup formulations to enhance flavor, texture, and nutritional content. Agropur is committed to innovation in food technology, working closely with customers to provide tailored solutions for the canned soup industry, focusing on sustainability and quality.

Amy’s Kitchen is a well-known brand in the organic food sector, specializing in natural and organic canned soups. Founded in 1987, the company focuses on delivering nutritious and wholesome products free from artificial ingredients and preservatives. Their canned soups are popular for their clean labels and high-quality ingredients, meeting the growing consumer demand for healthier, plant-based meal options. Amy’s Kitchen continues to innovate in plant-based and organic food offerings to cater to health-conscious consumers.

Arla Foods Ingredients is a global leader in dairy ingredients, providing solutions for the canned soup market. Their products, such as lactose-free milk proteins and whey proteins, are used to enhance the texture, flavor, and nutritional profile of soups. Arla’s commitment to sustainability and innovation in dairy ingredients has positioned them as a key supplier for the food industry, helping manufacturers meet the rising demand for healthy, high-protein canned soups that cater to evolving consumer preferences.

Top Key Players Outlook

- Agropur Ingredients

- Amy’s Kitchen

- Arla Foods Ingredients

- Campbell’s Soup Company

- Glanbia Nutritionals

- Heinz (maker of brands like Heinz Soups)

- Kerry Group

- Pacific Foods

- Progresso

- Conagra Brands

Recent Industry Developments

In April 2024, Glanbia expanded its flavor portfolio by acquiring Flavor Producers for $300 million, enhancing its capabilities in flavor solutions for the food industry.

In 2024 Amy’s Kitchen, reported annual revenues of approximately $750 million, reflecting its strong position in the organic food market.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 6.4 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Condensed, Ready-to-eat), By Category (Vegetarian, Nonvegetarian), By Processing (Regular Soup, Organic Soup), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Stores, Food Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agropur Ingredients, Amy’s Kitchen, Arla Foods Ingredients, Campbell’s Soup Company, Glanbia Nutritionals, Heinz (maker of brands like Heinz Soups), Kerry Group, Pacific Foods, Progresso, Conagra Brands Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agropur Ingredients

- Amy's Kitchen

- Arla Foods Ingredients

- Campbell's Soup Company

- Glanbia Nutritionals

- Heinz (maker of brands like Heinz Soups)

- Kerry Group

- Pacific Foods

- Progresso

- Conagra Brands