Global Butyric Acid Market Size, Share, And Business Benefit By Product (Renewable, Synthetic), By Derivatives (Sodium Butyrate, Calcium Butyrate, Others), By Application (Animal Feed, Chemical Intermediates, Pharmaceuticals, Perfumes, Food and Flavors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164604

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

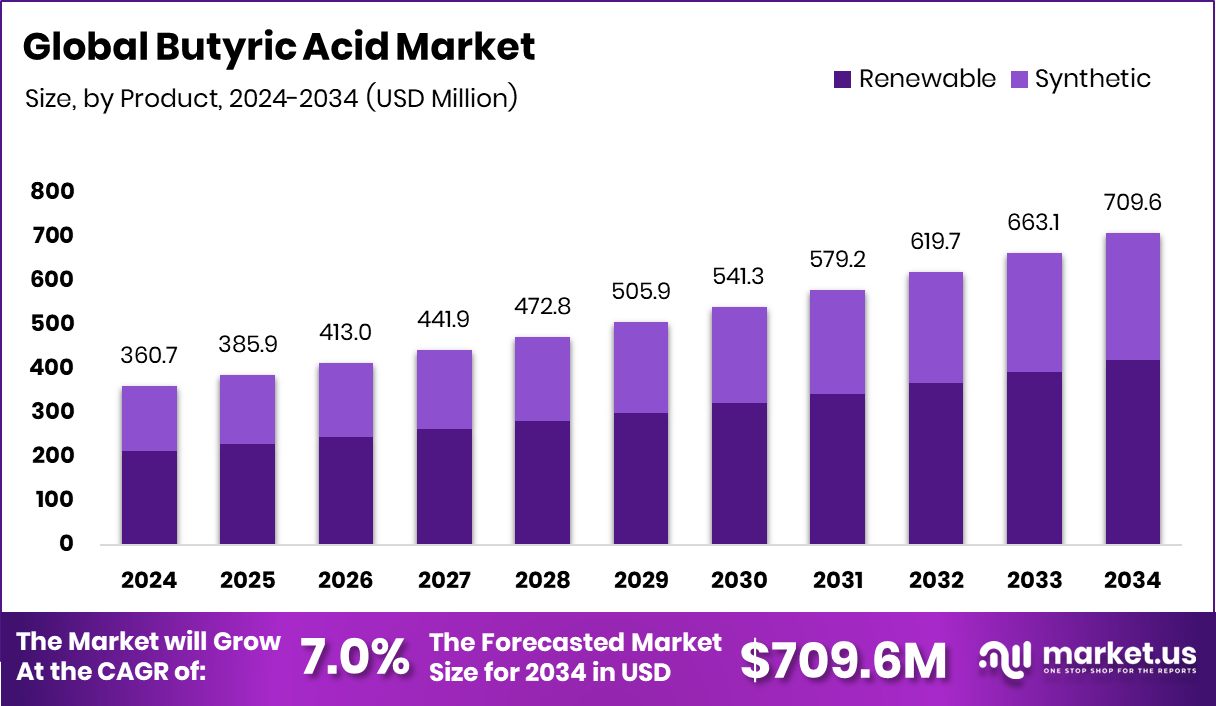

The Global Butyric Acid Market is expected to be worth around USD 709.6 million by 2034, up from USD 360.7 million in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034. Strong livestock production and sustainable feed initiatives boosted Asia-Pacific’s 43.80% market share.

Butyric acid is a short-chain fatty acid with a strong, distinctive odor, naturally found in butter, cheese, and fermented foods. It also occurs in the gut, where it supports digestive health. Industrially, it’s used in making flavorings, fragrances, coatings, and animal feed additives. Its biological importance and wide industrial versatility have made it a valuable ingredient in the food, pharmaceutical, and agricultural sectors.

The butyric acid market covers the production and use of both synthetic and bio-based forms across animal feed, food flavoring, chemical intermediates, and sustainable material development. The market is gaining attention due to the global focus on renewable and low-carbon chemical production, with strong support from agricultural and bio-innovation funding initiatives.

The rising preference for clean-label and antibiotic-free livestock feed is a major growth factor. Butyric acid is being increasingly used as a feed additive to promote gut health and improve nutrient absorption. Funding such as Wastelink raising $3 M to strengthen animal feed supply chains highlights how sustainable nutrition is driving butyric acid adoption.

Growing awareness of climate-friendly and efficient ingredient sourcing supports strong demand. Full Circle Biotechnology’s funding for a 7,000-ton facility to produce low-carbon feed ingredients reflects this shift toward eco-friendly supply chains. Such initiatives increase industrial demand for butyric acid, used as a sustainable component in feed and biochemical processes.

Emerging opportunities lie in integrating circular-economy concepts into chemical and feed manufacturing. Programs like IIM Kashipur’s FIED funding for agri-startups and ADB’s $40 billion support for food security are boosting innovation in agricultural biotechnology. This growing ecosystem opens new avenues for bio-based butyric acid producers in sustainable feed and green chemistry applications.

Key Takeaways

- The Global Butyric Acid Market is expected to be worth around USD 709.6 million by 2034, up from USD 360.7 million in 2024, and is projected to grow at a CAGR of 7.0% from 2025 to 2034.

- Renewable-based butyric acid market dominates with a 59.3% share, driven by bio-manufacturing and sustainable production growth.

- Sodium butyrate holds a 49.5% share in the butyric acid market and is mainly used in animal nutrition.

- Animal feed dominates the butyric acid market with a 45.2% share, supported by livestock health improvement initiatives.

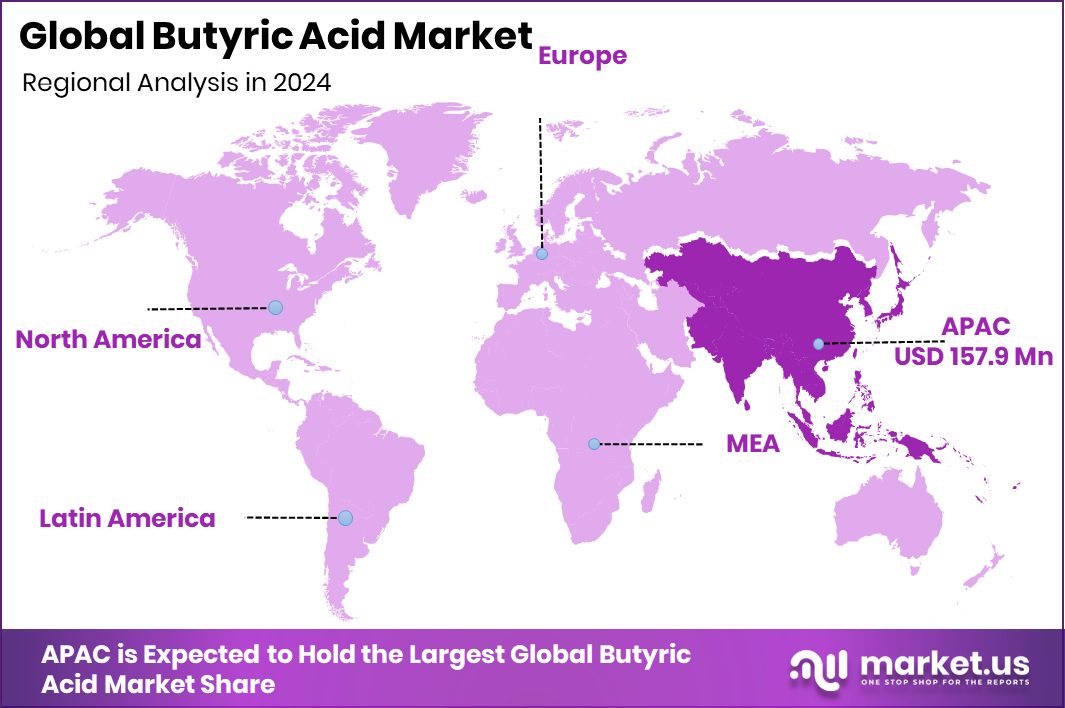

- The Asia-Pacific market value reached around USD 157.9 million, driven by demand.

By Product Analysis

Renewable butyric acid leads market growth with a 59.3% share worldwide.

In 2024, Renewable held a dominant market position in the By Product segment of the Butyric Acid Market, capturing a 59.3% share. This leadership was driven by the growing shift toward bio-based production methods using renewable raw materials such as agricultural waste and fermentation feedstocks. The preference for renewable butyric acid stems from its lower carbon footprint, improved biodegradability, and compliance with sustainable manufacturing goals.

Industries such as animal nutrition, food additives, and bioplastics are increasingly adopting renewable-grade products to meet green certification standards. Supported by expanding sustainable supply chains and government-backed bioeconomy initiatives, the renewable segment is expected to maintain its lead as companies continue transitioning from petrochemical-based to eco-friendly alternatives.

By Derivatives Analysis

Sodium butyrate dominates derivatives, capturing 49.5% share in 2024.

In 2024, Sodium Butyrate held a dominant market position in the By Derivatives segment of the Butyric Acid Market, accounting for a 49.5% share. The segment’s leadership is linked to its extensive use in animal feed formulations aimed at improving gut health, nutrient absorption, and overall growth performance. Sodium Butyrate is widely preferred for its stability, ease of handling, and effectiveness compared to liquid butyric acid. Its strong acceptance in poultry, swine, and aquaculture nutrition has further solidified its market dominance.

Growing awareness about sustainable livestock farming and the shift toward antibiotic-free feed solutions continue to drive demand, ensuring that Sodium Butyrate remains a key value-generating derivative within the global butyric acid industry.

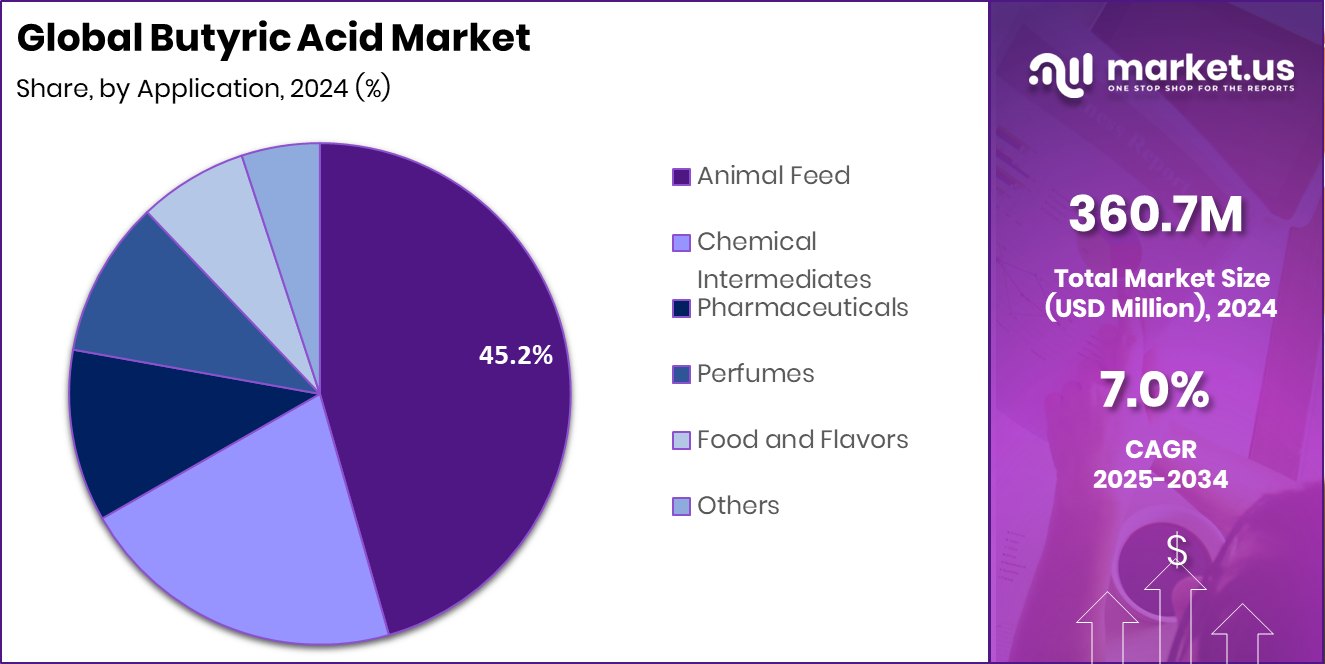

By Application Analysis

Animal feed remains the leading segment with 45.2% market share.

In 2024, Animal Feed held a dominant market position in the By Application segment of the Butyric Acid Market, capturing a 45.2% share. This strong position was driven by the increasing use of butyric acid and its derivatives in enhancing animal gut health and nutrient utilization. The compound supports better intestinal development and feed efficiency, making it a preferred additive in poultry, swine, and dairy feed.

Rising demand for high-quality meat and dairy products, coupled with a shift toward antibiotic-free nutrition, has further boosted its adoption. The segment’s growth is reinforced by the ongoing trend of sustainable livestock production, positioning butyric acid as a vital component in modern animal feed formulations globally.

Key Market Segments

By Product

- Renewable

- Synthetic

By Derivatives

- Sodium Butyrate

- Calcium Butyrate

- Others

By Application

- Animal Feed

- Chemical Intermediates

- Pharmaceuticals

- Perfumes

- Food and Flavors

- Others

Driving Factors

Rising Adoption of Sustainable Feed Additives in Livestock

A major driving factor for the Butyric Acid Market is the growing adoption of sustainable and performance-enhancing feed additives in livestock nutrition. Butyric acid and its derivatives, such as sodium butyrate, are increasingly used to improve gut health, immunity, and nutrient absorption in animals. The global shift toward antibiotic-free and environmentally friendly feed solutions has accelerated this demand.

Funding activities such as Provectus Algae raising US$10.1 million to scale methane-reducing feed supplements for livestock highlight the industry’s focus on low-emission and sustainable farming solutions. Such advancements encourage wider use of butyric acid-based additives in animal diets, supporting both livestock productivity and climate-conscious agriculture across global feed manufacturing chains.

Restraining Factors

High Production Costs and Feed Supply Challenges

A key restraining factor for the Butyric Acid Market is the high production cost associated with raw materials and bio-based processing technologies. These costs often limit large-scale adoption, especially in developing regions where price-sensitive livestock farmers depend on affordable feed solutions. Supply chain disruptions and fluctuating agricultural output further add pressure to the overall production and distribution costs of butyric acid derivatives.

The situation is reflected in initiatives like Milkfed seeking a ₹50 crore NDDB grant to provide free cattle feed in flood-affected districts, showing how natural calamities and resource shortages can strain feed availability. Such challenges affect market stability and slow the broader adoption of butyric acid-based feed additives.

Growth Opportunity

Expanding Digital Integration in the Animal Feed Industry

A major growth opportunity for the Butyric Acid Market lies in the increasing integration of digital technologies within the animal feed industry. As livestock management becomes more data-driven, the use of connected monitoring platforms is improving feed efficiency and demand forecasting. This shift encourages consistent use of butyric acid-based additives to enhance animal performance and gut health.

The development aligns with advancements like BinSentry, raising $68.8 million CAD in Series C funding to expand its remote animal feed monitoring platform in Brazil. Such innovations enable real-time feed management and reduce wastage, creating opportunities for butyric acid suppliers to align their offerings with precision feeding systems and smarter, technology-enabled livestock farming practices globally.

Latest Trends

Growing Shift Toward Plant-Based and Seed Ingredients

A key trend shaping the Butyric Acid Market is the growing shift toward plant-based and seed-derived ingredients for sustainable feed and food production. Consumers and producers are increasingly focusing on natural, eco-friendly, and non-animal sources to lower carbon footprints and enhance product traceability. This movement is reinforced by innovations such as Cano-ela securing €1.6 million to accelerate the development of seed-based ingredients, reflecting the market’s transition toward bio-based feed components.

The trend supports diversification of raw material sources for butyric acid production and encourages integration of renewable agricultural inputs. As sustainability gains importance, plant-derived solutions are expected to influence future production models and feed formulations that use butyric acid derivatives.

Regional Analysis

In 2024, the Asia-Pacific dominated the Butyric Acid Market with a 43.80% share.

In 2024, Asia-Pacific emerged as the dominant region in the Butyric Acid Market, holding a 43.80% share valued at USD 157.9 million. The region’s leadership is supported by its expanding livestock sector, growing demand for antibiotic-free feed, and increasing adoption of sustainable farming practices in major economies such as China, India, and Japan.

Rapid industrialization and rising awareness of gut health in animal nutrition have also strengthened the use of butyric acid derivatives across the feed and food industries. North America follows with steady demand driven by technological advancements in feed formulations and the development of renewable chemical processes.

Europe continues to invest in bio-based production, backed by strong regulatory support for green chemistry. Meanwhile, Latin America is witnessing a gradual adoption in the poultry and swine feed sectors, supported by improving export activities. The Middle East & Africa show emerging potential with growing investments in dairy and livestock nutrition.

Collectively, the regions demonstrate balanced growth; however, Asia-Pacific remains at the forefront due to its large agricultural base, government initiatives for sustainable feed production, and increasing industrial applications of butyric acid across food, chemical, and pharmaceutical segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Eastman Chemical Company continued to strengthen its position in the global Butyric Acid Market through advancements in specialty chemical production and a focus on sustainable feedstock utilization. The company’s expertise in organic acids and intermediates supports consistent supply for food additives, coatings, and animal feed applications. Its emphasis on circular chemistry and renewable material integration aligns with global sustainability goals, enhancing its competitiveness in bio-based butyric acid manufacturing.

Oxea GmbH remained a prominent contributor, leveraging its established platform in oxo derivatives and carboxylic acids. The company’s integrated production network allows efficient output and high product purity, serving diverse applications in feed, flavoring, and specialty chemicals. Oxea’s approach to process optimization and environmental management ensures reliable delivery and compliance with stringent safety standards, reinforcing its long-term presence in the butyric acid value chain.

Tokyo Chemical Industry Co. Ltd. (TCI) plays a critical role in supporting laboratory-scale and industrial research applications for butyric acid and related derivatives. Known for its precision-grade reagents and extensive global distribution, TCI enables innovation in food chemistry, pharmaceuticals, and biotechnological formulations. Its focus on high-quality organic acids positions it as a trusted supplier in research-intensive markets and academic sectors worldwide.

Top Key Players in the Market

- Eastman Chemical Company

- Oxea GmbH

- Tokyo Chemical Industry Co. Ltd.

- Perstorp Holding AB

- Axxence Aromatic GmbH

- BASF

- Celanese Corporation

- Kemin Industries, Inc.

- OXEA GmbH

Recent Developments

- In June 2024, Oxea (then still under the OQ Chemicals name) announced that their Bay City (Texas) carboxylic acids production site achieved the International Sustainability & Carbon Certification (ISCC) Plus certification. This recognises sustainable, traceable feedstocks for their carboxylic acids portfolio.

- In April 2024, Eastman announced a price increase for its acids product line (including glacial acetic acid and dilute acetic acid) in North America and Latin America. This suggests tighter cost dynamics in the acids business, which is related to the company’s broader carboxylic/acid chemicals portfolio.

Report Scope

Report Features Description Market Value (2024) USD 360.7 Million Forecast Revenue (2034) USD 709.6 Million CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Renewable, Synthetic), By Derivatives (Sodium Butyrate, Calcium Butyrate, Others), By Application (Animal Feed, Chemical Intermediates, Pharmaceuticals, Perfumes, Food and Flavors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Eastman Chemical Company, Oxea GmbH, Tokyo Chemical Industry Co. Ltd., Perstorp Holding AB, Axxence Aromatic GmbH, BASF, Celanese Corporation, Kemin Industries, Inc., OXEA GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Eastman Chemical Company

- Oxea GmbH

- Tokyo Chemical Industry Co. Ltd.

- Perstorp Holding AB

- Axxence Aromatic GmbH

- BASF

- Celanese Corporation

- Kemin Industries, Inc.

- OXEA GmbH