Global Brewers Yeast Market Size, Share, And Enhanced Productivity By Product (Dry, Liquid), By Functional Strain (High Gravity Strains, Lager Strains, Ale Strains, Specialty Strains), By Application (Food Supplements, Feed Supplements), By Distribution Channel (Direct Sales to Breweries and Wineries, Wholesale Distribution, Online Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172515

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

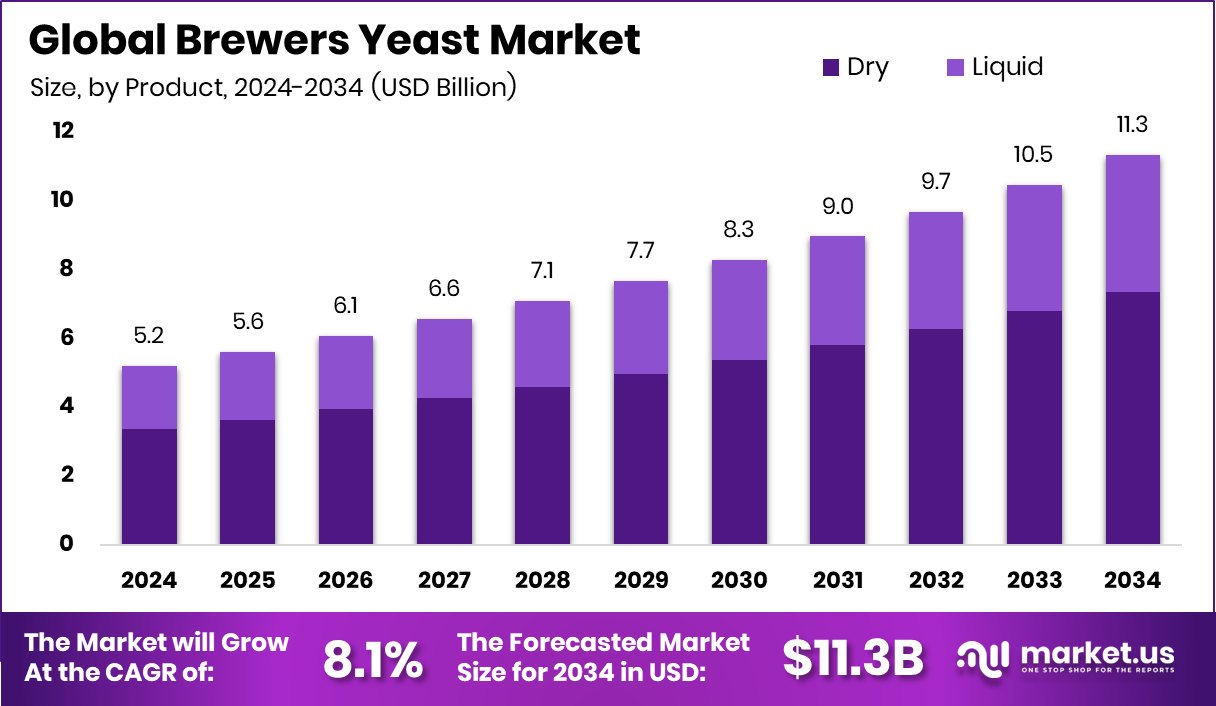

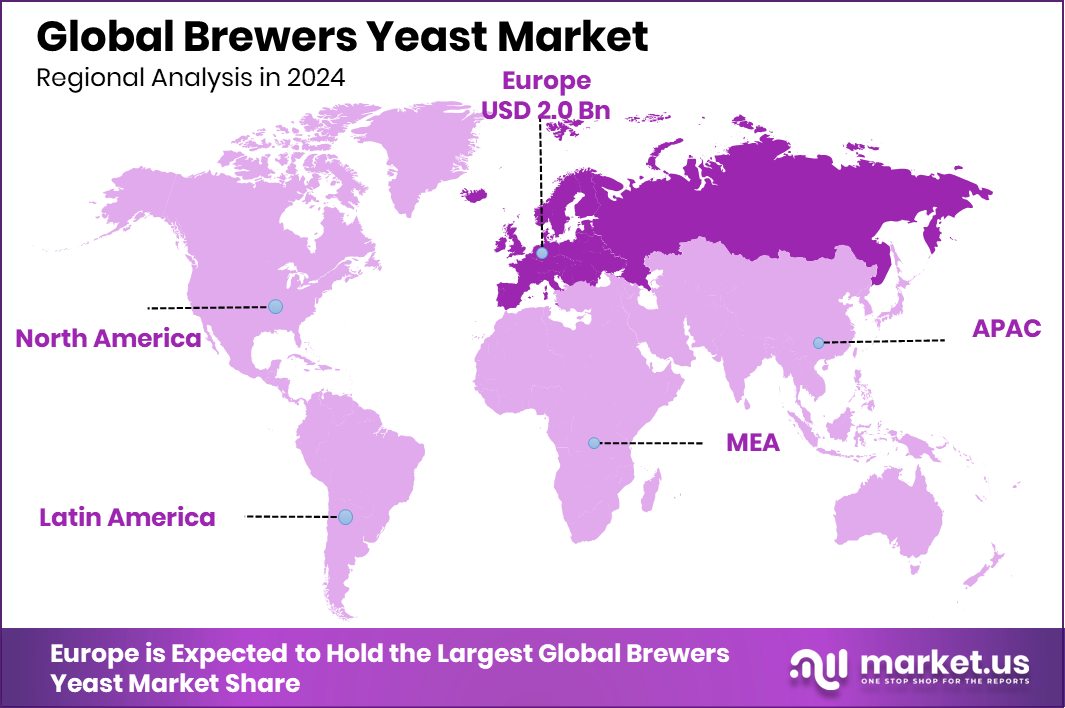

The Global Brewers Yeast Market is expected to be worth around USD 11.3 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034. Europe’s brewers’ yeast market dominance stands at 38.80%, valued at nearly USD 2.0 Bn.

Brewers yeast is a natural microorganism created during the beer-making process. It is rich in protein, B-vitamins, fiber, and minerals, making it useful beyond brewing. Brewers yeast is commonly dried and reused in food products, supplements, and functional ingredients. Its clean-label profile and nutritional density make it attractive for health-focused and sustainable food applications.

The Brewers Yeast Market covers the production, processing, and reuse of yeast sourced from brewing and fermentation activities. The market has expanded as brewers’ yeast is increasingly upcycled into food ingredients rather than discarded. A clear example is Yeastup opening a £9m industrial-scale facility to convert spent brewers’ yeast into functional food ingredients, highlighting growing industrial confidence in circular food systems.

Growth factors are strongly linked to sustainability and protein demand. Startups are transforming waste yeast into high-value ingredients. Yeastup raised €9.47M to convert a former dairy site into a yeast upcycling facility, while a Swiss startup secured $10M to repurpose a dairy factory for beer waste protein, supporting scalable production.

Demand is rising for yeast-based egg and protein alternatives. Revyve raised $28m Series B, alongside an earlier €24M raise, to scale yeast proteins for egg replacement and food additives. This reflects strong demand from plant-based and bakery sectors seeking stable, affordable inputs.

Opportunities continue to expand as innovation funding accelerates. Paris-based Yeasty raised €1.4 million for alternative proteins, while FUMI Ingredients received €500,000 to develop egg whites from upcycled beer yeast. These investments show growing opportunities in food innovation, waste reduction, and functional nutrition.

Key Takeaways

- The Global Brewers Yeast Market is expected to be worth around USD 11.3 billion by 2034, up from USD 5.2 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034.

- In the Brewers Yeast Market, dry products dominate with 64.8% share due to stability advantages.

- Within the brewers’ yeast market, ale strains lead with 39.9%, reflecting widespread brewing versatility globally.

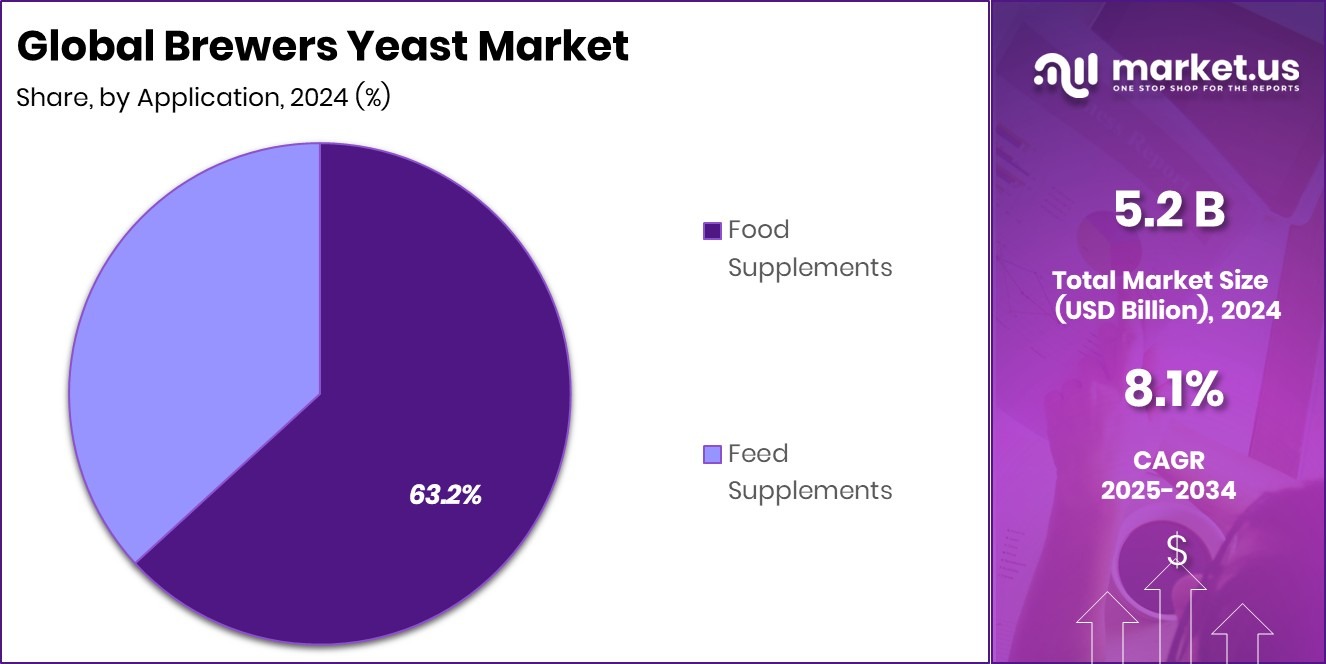

- In the Brewers Yeast Market, food supplement application holds 63.2%, driven by nutrition demand worldwide.

- Across the brewers’ yeast market, direct sales to breweries and wineries account for 56.3% channels.

- The brewer’s yeast market in Europe accounts for 38.80%, generating USD 2.0 Bn revenues.

By Product Analysis

Dry products dominate the Brewers Yeast Market, holding 64.8% share globally.

In 2024, the Brewers Yeast Market by product saw the dry form commanding a 64.8% share, underlining its dominant position in global demand. Dry brewers’ yeast continues to be preferred due to its longer shelf life, easier storage, and cost-effective logistics compared with liquid alternatives. Manufacturers benefit from reduced cold-chain requirements and greater stability, which supports expanded export markets across Asia-Pacific and Latin America.

Brewers also report more consistent fermentation performance with dry strains, driving deeper adoption even among craft and microbreweries. This strong preference supports production scale-ups and supply chain investments, while innovations around drying technologies aim to further improve viability and strain robustness, sustaining dry product’s leadership through evolving industry needs.

By Functional Strain Analysis

Ale strains lead the Brewers Yeast Market by functional strain at 39.9%.

In 2024, by functional strain, Ale Strains held a 39.9% share in the Brewers Yeast Market, reflecting robust demand from craft and traditional ale producers worldwide. Ale yeast strains are widely appreciated for their ability to deliver complex flavor profiles, higher fermentation temperatures, and diverse aromatic characteristics, making them a staple for premium and specialty beer segments.

Growth in craft beer consumption, particularly in North America and Europe, has fueled this segment, as brewers seek unique sensory differentiation. The popularity of seasonal ales and experimental brews further amplifies ale strain adoption. With ongoing R&D in strain development, producers are introducing tailored ale yeasts that enhance mouthfeel and consistency, catering to consumer preferences for artisanal quality.

By Application Analysis

Food supplements drive the Brewers Yeast Market application segment with 63.2%.

In 2024, by application, Food Supplements accounted for a 63.2% share of the Brewers Yeast Market, highlighting the ingredient’s expanding use beyond traditional brewing. Brewer’s yeast is increasingly valued in the nutraceutical and functional foods sectors for its rich profile of B-vitamins, protein, minerals, and beta-glucans, positioning it as a preferred additive in dietary supplements, fortified foods, and wellness products.

Rising health awareness and demand for natural, nutrient-dense ingredients drive formulators to incorporate brewers’ yeast into tablets, powders, and fortified beverages. The trend toward immune support and digestive health has also boosted its relevance. Nutraceutical companies are innovating with encapsulation and flavor-masking technologies to improve consumer acceptance, widening brewers’ yeast applications across mainstream health-oriented product lines.

By Distribution Channel Analysis

Direct sales to breweries and wineries dominate the Brewers Yeast Market at 56.3%.

In 2024, by distribution channel, Direct Sales to Breweries and Wineries held a 56.3% share in the Brewers Yeast Market, underscoring the importance of close supplier–producer relationships. Direct sales enable yeast manufacturers to offer customized strain solutions, technical support, and reliable supply continuity directly to end-users, enhancing process integration and fermentation performance. This channel’s strength is particularly evident among larger commercial breweries and wineries that require bulk quantities, traceability, and tailored fermentation profiles.

Direct engagement also facilitates rapid response to demand fluctuations and quality assurance protocols, which are critical for consistent product outcomes. Strategic partnerships and long-term contracts further entrench direct sales as the preferred pathway. In addition, digital ordering platforms and predictive supply analytics are enhancing direct channel efficiency and customer experience across regions.

Key Market Segments

By Product

- Dry

- Liquid

By Functional Strain

- High Gravity Strains

- Lager Strains

- Ale Strains

- Specialty Strains

By Application

- Food Supplements

- Feed Supplements

By Distribution Channel

- Direct Sales to Breweries and Wineries

- Wholesale Distribution

- Online Platforms

- Others

Driving Factors

Rising Demand for Natural Yeast-Based Nutrition

One major driving factor of the Brewers Yeast Market is the growing demand for natural, science-backed nutrition across human and pet health. Consumers increasingly prefer ingredients that are clean-label, protein-rich, and naturally sourced, which makes brewers’ yeast highly attractive. This shift is supported by recent funding activity in the nutrition ecosystem. Kradle secured $4M to expand pet supplement offerings, reflectingthe rising use of yeast-based nutrients in animal wellness.

At the same time, Nuritas raised $42 million in Series C funding to accelerate the discovery of functional food ingredients, reinforcing interest in bioactive compounds derived from fermentation. In addition, Warsaw-based Evidose raised €455k to validate dietary supplement effectiveness, highlighting demand for clinically supported ingredients. Together, these developments show how trust, validation, and natural nutrition trends are directly pushing brewers’ yeast adoption across supplements, functional foods, and pet nutrition markets.

Restraining Factors

Trust and Effectiveness Concerns Limit Yeast Adoption

One key restraining factor in the Brewers Yeast Market is consumer trust around supplement effectiveness and delivery formats. While brewers’ yeast is widely used in nutrition products, buyers increasingly question whether supplements truly deliver promised benefits. This concern is visible in funding-linked developments. A brand making stick-on supplements received 50 lakhs on Shark Tank India, but public discussions quickly shifted toward validating real absorption and effectiveness, creating caution among consumers.

Similarly, GetSupp raised Rs 9.5 crore to scale its nutrition platform, yet its growth highlights how buyers now compare products, seek evidence, and delay purchases without clear proof. These trust gaps slowthe wider adoption of yeast-based supplements, as brands must invest more time and resources into education, trials, and transparency before consumers commit to regular use.

Growth Opportunity

Public Funding Expands Functional Yeast Applications

A major growth opportunity in the Brewers Yeast Market comes from rising public investment in food safety, nutrition, and sustainable agriculture. The FDA seeking $7.2 billion to enhance food safety, improve nutrition standards, and strengthen public health signals a stronger regulatory focus on ingredient quality and transparency. This creates room for brewers’ yeast as a natural, traceable, and nutritionally rich input in food and supplement formulations.

At the same time, a researcher receiving a $2M grant to test feed additives that reduce methane emissions highlights new opportunities for yeast-based solutions in animal nutrition and environmental impact reduction. Brewer’s yeast, already known for functional benefits, can play a larger role in approved feed and food systems. Together, these funding actions open pathways for wider adoption, validation, and innovation across human nutrition, animal feed, and sustainability-driven markets.

Latest Trends

Yeast Solutions Gain Momentum in Sustainable Farming

One of the latest trends in the Brewers Yeast Market is the growing use of yeast-based solutions to support climate-friendly livestock and sustainable dairy production. This trend is reinforced by targeted funding. A Swedish biotech secured €6M in a seed round to develop a methane-reducing cattle feed supplement, highlighting strong interest in natural feed additives that lower emissions. Brewer’s yeast fits well into this direction due to its functional properties and compatibility with animal nutrition systems.

At the same time, the USDA granted $10 million toward research focused on sustainable milk production, signaling government support for feed innovations that improve efficiency while reducing environmental impact. Together, these developments show how brewers’ yeast is moving beyond traditional uses and becoming part of broader sustainability strategies in agriculture, animal health, and low-emission food systems.

Regional Analysis

Europe leads the brewer’s yeast market with a 38.80% share, reaching a USD 2.0 Bn value.

Europe leads the Brewers Yeast Market, holding 38.80% share and reaching USD 2.0 Bn, supported by its well-established brewing culture, dense network of commercial breweries, and steady demand for consistent fermentation inputs across large and craft producers.

North America remains a strong regional contributor, driven by active craft brewing and a mature supplements channel that also uses brewer’s yeast as a recognized functional ingredient. Asia Pacific shows expanding adoption as modern retail, evolving consumer tastes, and growing local brewing capacity improve the availability of standardized yeast formats.

In the Middle East & Africa, demand is more selectively concentrated, shaped by localized production needs and import-led supply, with purchasing often tied to quality assurance requirements and reliable technical support.

Latin America continues to build momentum as breweries broaden product portfolios and seek stable inputs that help maintain taste uniformity across batches. Overall, regional performance reflects differences in brewing scale, product standardization needs, and supply reliability expectations, with Europe clearly setting the pace in both market share and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AB Mauri India Pvt. Ltd. plays a strategically important role in the brewers’ yeast market through its strong technical expertise and localized manufacturing presence. The company benefits from deep relationships with breweries and food producers, allowing it to support consistent fermentation performance and application-specific yeast solutions. Its focus on process reliability, strain stability, and customer-level technical service strengthens its position in a market where quality assurance and repeatability are critical purchasing factors.

Alltech Inc. brings a diversified biological sciences perspective to the brewers’ yeast market. In 2024, its strength lies in leveraging yeast-based innovation across multiple end uses, including brewing and nutrition. The company’s emphasis on research-driven yeast functionality and performance optimization supports demand from customers seeking value beyond basic fermentation, particularly where yeast quality impacts final product consistency.

Angel Yeast Company stands out globally for its large-scale production capabilities and broad yeast portfolio. In 2024, the company’s competitiveness is reinforced by vertical integration and strong process control, enabling it to supply brewers’ yeast with consistent quality at scale. Its expanding global footprint supports stable supply and responsiveness, positioning Angel Yeast as a reliable partner for breweries operating across diverse regional markets.

Top Key Players in the Market

- AB Mauri India Pvt. Ltd.

- Alltech Inc.

- Angel Yeast Company

- Archer Daniels Midland Company

- Associated British Food Plc.

- Cargill Incorporated

- Koninklijke DSM N.V.

- Kothari Fermentation and Biochem Ltd.

- Lallemand Inc.

- Leiber GmbH

Recent Developments

- In April 2025, Alltech shared innovative sustainable solutions for agriculture and food production at the VIV Asia event. The company highlighted its advanced nutrition, feed ingredients, and biological products that support animal performance and food chain quality. Events like this demonstrate Alltech’s ongoing commitment to research and industry collaboration.

- In January 2024, AB Mauri India announced a major project to build a greenfield yeast manufacturing plant in Pilibhit, Uttar Pradesh. This initiative involves a sizeable investment to expand yeast production capacity, support local industrial growth, and create thousands of jobs in the region. The new facility is expected to enhance supply reliability for brewers and other yeast users.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 11.3 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Dry, Liquid), By Functional Strain (High Gravity Strains, Lager Strains, Ale Strains, Specialty Strains), By Application (Food Supplements, Feed Supplements), By Distribution Channel (Direct Sales to Breweries and Wineries, Wholesale Distribution, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AB Mauri India Pvt. Ltd., Alltech Inc., Angel Yeast Company, Archer Daniels Midland Company, Associated British Food Plc., Cargill Incorporated, Koninklijke DSM N.V., Kothari Fermentation and Biochem Ltd., Lallemand Inc., Leiber GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Mauri India Pvt. Ltd.

- Alltech Inc.

- Angel Yeast Company

- Archer Daniels Midland Company

- Associated British Food Plc.

- Cargill Incorporated

- Koninklijke DSM N.V.

- Kothari Fermentation and Biochem Ltd.

- Lallemand Inc.

- Leiber GmbH