Global Blackstrap Molasses Market By Form (Liquid, Powder), By Grade (High Grade, Low Grade), By Product (Organic, Conventional), By Application (Industrial Fermentation, Food and Beverages, Pharmaceutical, Animal Feed, Others), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150811

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

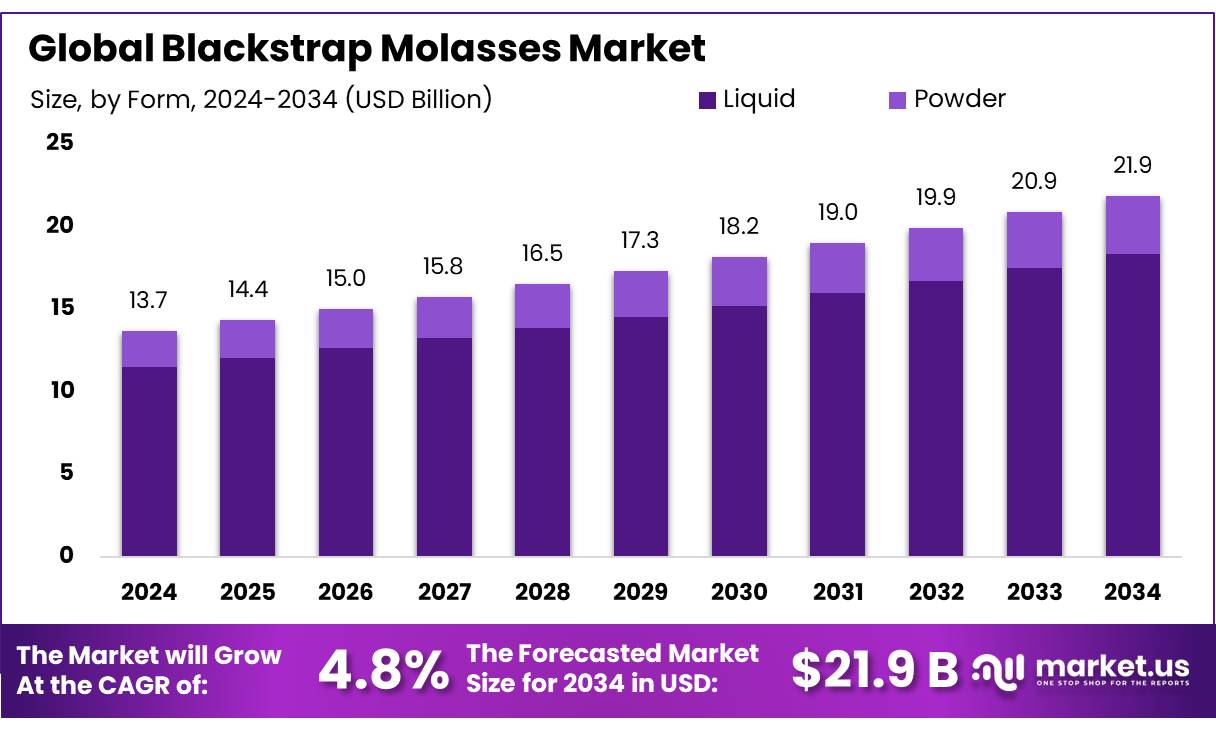

The Global Blackstrap Molasses Market size is expected to be worth around USD 21.9 Billion by 2034, from USD 13.7 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Blackstrap molasses is a sugar refining, recognized for its high mineral content (iron, calcium, magnesium). Its use spans food & beverage, animal feed, fermentation, biofuels, and nutraceutical sectors. The USDA reported that in February 2024, Egyptian government operated molasses mills offered prices ranging from 1,350 to 1,900 EGP per ton (~USD 41–58), indicating involvement of public sector pricing in production.

Government initiatives play a crucial role in supporting the blackstrap molasses industry. For instance, the Indian government has allowed sugar mills to use 6.7 lakh tonnes of B-heavy molasses for ethanol production in the 2023-24 supply year, aiming to improve the finances of sugar mills and promote renewable energy sources. Such policies encourage the utilization of blackstrap molasses in biofuel production, contributing to sustainable energy solutions.

Furthermore, oil marketing companies were authorized in April 2024 to divert an additional 800,000 metric tons of sugar for ethanol production. These interventions generate robust domestic demand for molasses-based ethanol, increasing processing volumes at sugar mills.

Key Takeaways

- Blackstrap Molasses Market size is expected to be worth around USD 21.9 Billion by 2034, from USD 13.7 Billion in 2024, growing at a CAGR of 4.8%.

- Liquid held a dominant market position in the blackstrap molasses market, capturing more than an 83.9% share.

- High Grade held a dominant market position in the blackstrap molasses market, capturing more than a 69.3% share.

- Conventional held a dominant market position in the blackstrap molasses market, capturing more than a 76.4% share.

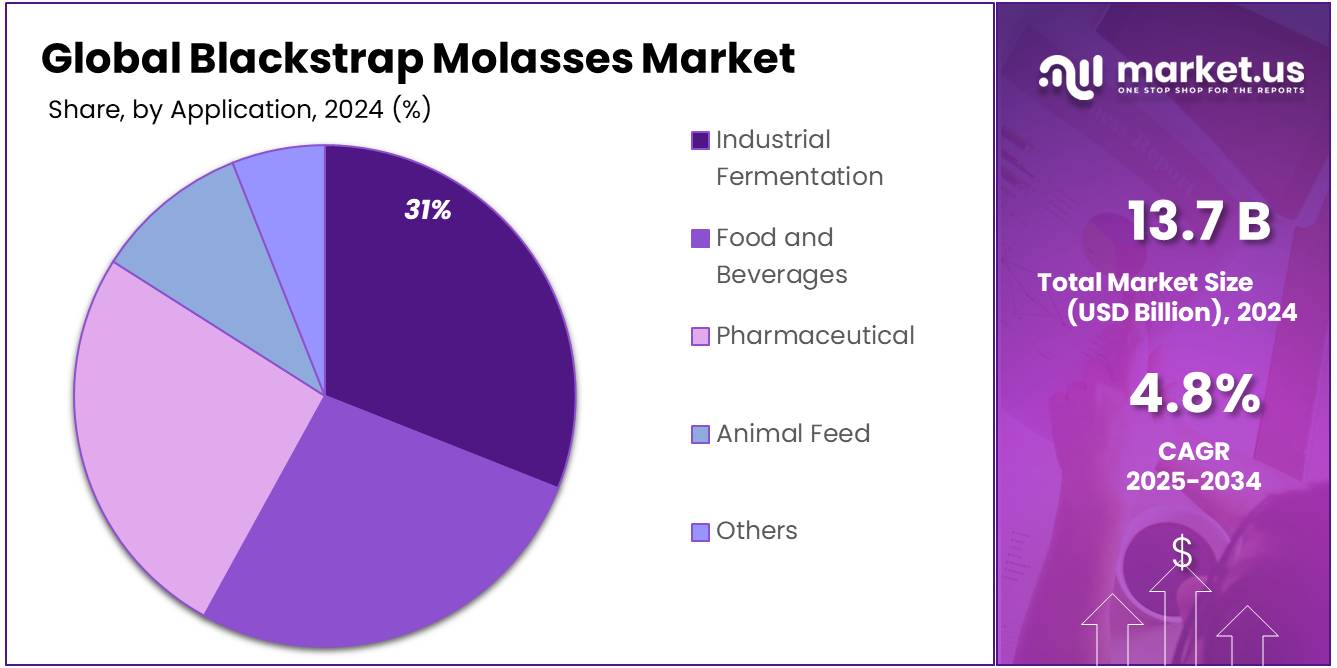

- Industrial Fermentation held a dominant market position in the blackstrap molasses market, capturing more than a 31.8% share.

- Offline held a dominant market position in the blackstrap molasses market, capturing more than a 69.2% share.

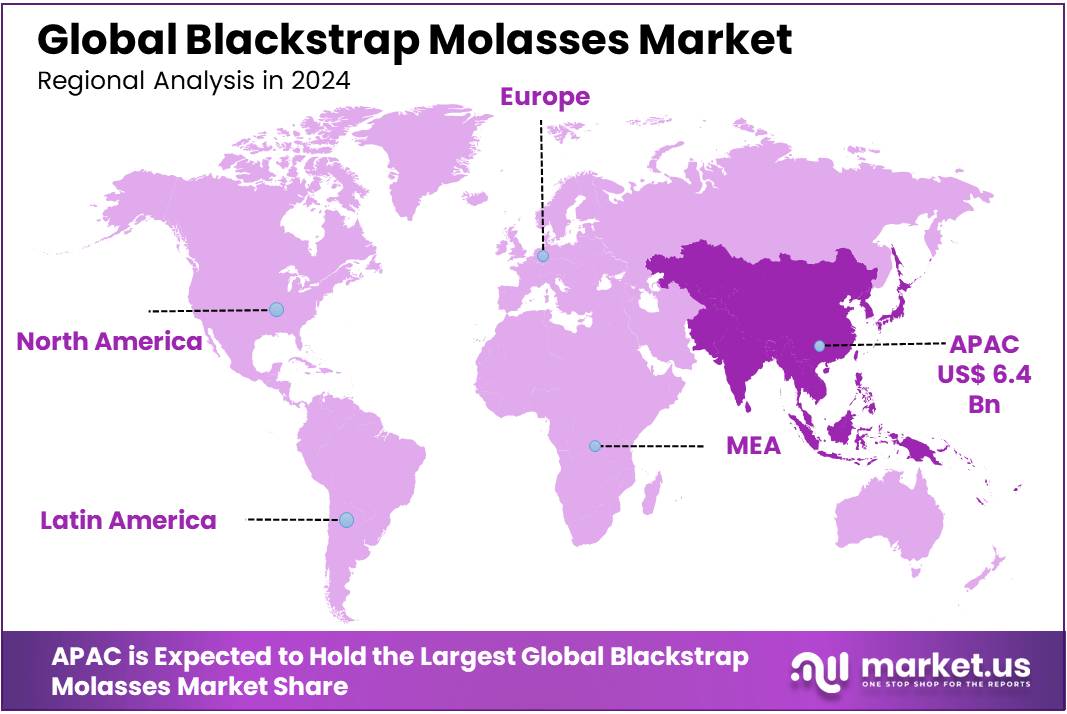

- Asia-Pacific (APAC) region held a dominant position in the global blackstrap molasses market, capturing 47.3% of the total market share, equivalent to a value of approximately USD 6.4 billion.

By Form

Liquid Blackstrap Molasses dominates with 83.9% share in 2024 due to ease of processing and high industrial demand.

In 2024, Liquid held a dominant market position in the blackstrap molasses market, capturing more than an 83.9% share. This form remained the preferred choice across industries due to its easy flow properties, better solubility in food and feed formulations, and compatibility with large-scale fermentation setups. Liquid blackstrap molasses is widely used in distilleries, cattle feed production, and food processing because it eliminates the need for rehydration or additional processing, unlike solid or powdered forms.

Its direct application in ethanol production and as a sweetener in natural health foods further supported its lead in the segment. Additionally, the transport and bulk storage systems for liquid molasses are well-established, particularly in sugar-producing nations like India and Brazil, adding to its commercial advantage. As industrial use continues to expand, the liquid form is expected to maintain its dominant position through 2025, supported by increased demand in biofuels and livestock feed sectors.

By Grade

High Grade Blackstrap Molasses leads with 69.3% share in 2024 due to its rich nutritional value and food-grade applications.

In 2024, High Grade held a dominant market position in the blackstrap molasses market, capturing more than a 69.3% share. This segment maintained its lead primarily because of its superior purity, higher concentration of minerals like iron, calcium, and magnesium, and lower levels of impurities compared to lower-grade molasses.

High grade blackstrap molasses is widely used in the food and beverage sector, especially in the production of health foods, natural sweeteners, and specialty baking products where consistent quality is critical. It is also preferred in nutraceutical applications and organic product lines due to its clean-label appeal. The consistent demand from end users seeking high-quality, naturally sourced ingredients has reinforced its market strength. Moving into 2025, the segment is expected to retain its leadership position, driven by growing interest in functional foods and cleaner industrial inputs.

By Product

Conventional Blackstrap Molasses dominates with 76.4% share in 2024 due to its large-scale availability and lower production costs.

In 2024, Conventional held a dominant market position in the blackstrap molasses market, capturing more than a 76.4% share. This segment’s strong lead is mainly due to its widespread production across major sugar-producing countries, making it more accessible and affordable for industrial users. Conventional blackstrap molasses is commonly used in bulk applications such as animal feed, ethanol manufacturing, and commercial baking, where organic certification is not a critical factor.

Its consistent supply chain, lower input costs, and established processing infrastructure have helped maintain its market edge. While there is growing interest in organic and clean-label options, the demand for conventional molasses remains high in price-sensitive industries. Looking ahead to 2025, this segment is expected to retain its dominance, particularly in developing regions where large-scale agricultural and biofuel activities continue to rely on conventional inputs.

By Application

Industrial Fermentation leads with 31.8% share in 2024 due to its vital role in ethanol and enzyme production.

In 2024, Industrial Fermentation held a dominant market position in the blackstrap molasses market, capturing more than a 31.8% share. The segment’s strong performance is closely linked to the rising demand for bio-based products, particularly ethanol, organic acids, and industrial enzymes. Blackstrap molasses, with its high sugar content and mineral profile, serves as an efficient and cost-effective feedstock in fermentation processes.

It is especially favored in the production of ethanol for fuel blending and in biotechnological applications requiring carbon-rich sources. The availability of molasses at scale and its suitability for microbial growth makes it a key input across fermentation units worldwide. In countries like India and Brazil, where ethanol blending programs are aggressively promoted, molasses-based fermentation is a strategic industrial activity. Moving into 2025, the application of blackstrap molasses in fermentation is expected to expand further, supported by clean energy goals and growing investments in the bioeconomy.

By Distribution Channel

Offline Distribution dominates with 69.2% share in 2024 due to established bulk trade networks and supplier reliability.

In 2024, Offline held a dominant market position in the blackstrap molasses market, capturing more than a 69.2% share. This segment continued to lead as most commercial buyers, including feed manufacturers, distilleries, and food processors, rely on direct procurement from bulk suppliers, traders, and cooperatives. Offline channels offer benefits such as large volume deals, consistent supply relationships, and logistical coordination, which are especially important for industries that consume blackstrap molasses in tonnage quantities.

Traditional supply networks through mills, agricultural boards, and local distributors have remained active in regions like Asia, Latin America, and Africa, where digital infrastructure is still developing. Even in advanced markets, offline contracts are preferred for large-scale procurement due to price negotiations and assured delivery timelines. Going into 2025, the offline channel is expected to remain the preferred mode for industrial-scale transactions, particularly where hands-on quality checks and long-term supplier ties are essential.

Key Market Segments

By Form

- Liquid

- Powder

By Grade

- High Grade

- Low Grade

By Product

- Organic

- Conventional

By Application

- Industrial Fermentation

- Food and Beverages

- Pharmaceutical

- Animal Feed

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Demand for Natural Sweeteners in Food & Beverages

One of the primary driving factors for the Blackstrap Molasses market is the increasing demand for natural sweeteners, as consumers are becoming more health-conscious. This growing awareness of the health risks associated with refined sugars has led many to opt for alternatives like molasses, which not only adds sweetness but also offers nutritional benefits.

According to the U.S. Department of Agriculture (USDA), the global demand for natural sweeteners, including molasses, has been rising steadily. This trend is being driven by the increasing adoption of organic and plant-based food products. As more consumers turn to healthier options, ingredients like Blackstrap Molasses are becoming popular due to their rich content of minerals like iron, calcium, magnesium, and potassium, which refined sugars lack.

Moreover, the U.S. Food and Drug Administration (FDA) has supported this shift with its guidelines promoting the reduction of added sugars in diets. The FDA’s “Nutrition and Labeling” initiative encourages manufacturers to include natural sweeteners like Blackstrap Molasses in their products, which align with the growing preference for clean, nutritious ingredients.

Restraints

High Production Costs Impacting Market Growth

A significant restraint on the Blackstrap Molasses market is the high production cost associated with its extraction and refinement. The cost of producing Blackstrap Molasses remains relatively high compared to other sweeteners, particularly refined sugars and artificial sweeteners, which are more affordable and widely available. This cost disparity has been limiting its adoption among small and medium-sized food producers, who often favor cheaper alternatives to reduce manufacturing costs.

According to the U.S. Department of Agriculture (USDA), the price of molasses in the U.S. has seen fluctuations due to the rising cost of sugar production and the associated costs of processing molasses. In 2020, the average price for molasses was approximately US$0.21 per pound, which is nearly twice the cost of refined sugar, which typically hovers around US$0.10 per pound. The higher price point for Blackstrap Molasses can make it less appealing to businesses looking to cut costs, particularly when refined sugars and corn syrup are more affordable options.

Additionally, weather-related factors such as droughts and floods have impacted the sugarcane and sugar beet crops, from which molasses is derived. The U.S. National Oceanic and Atmospheric Administration (NOAA) reports that weather disruptions in key sugar-producing regions like Florida and Louisiana can affect the raw material supply, further driving up the costs of Blackstrap Molasses production. This unpredictability in raw material availability creates a challenge for producers who rely on consistent pricing and supply chains.

Government initiatives, such as subsidies for traditional sweeteners and sugarcane growers, have not yet been extended to support Blackstrap Molasses production, making it harder for the industry to reduce production costs. Until these factors are addressed, the high cost of Blackstrap Molasses will likely remain a limiting factor for its widespread use in the food industry.

Opportunity

Expansion into Nutraceutical and Functional Foods

A significant growth opportunity for the Blackstrap Molasses market lies in its incorporation into nutraceuticals and functional foods. As consumers become more health-conscious, there is a growing demand for food products that offer additional health benefits beyond basic nutrition. Blackstrap Molasses, rich in essential minerals like iron, calcium, magnesium, and potassium, aligns well with this trend.

The U.S. Department of Agriculture (USDA) has highlighted the increasing interest in functional foods that contribute to health maintenance and disease prevention. For instance, the USDA’s Economic Research Service notes that the functional food market is expanding as consumers seek products that support health and wellness. Blackstrap Molasses, with its nutrient-dense profile, is well-positioned to meet this demand.

Furthermore, the USDA’s Agricultural Research Service is actively researching the conversion of sugar crops and by-products, including molasses, into value-added products with applications in the food, pharmaceutical, and nutraceutical industries. This initiative underscores the potential of Blackstrap Molasses as a raw material for developing functional food ingredients and supplements.

Government support for such initiatives further enhances the growth prospects for Blackstrap Molasses in these sectors. By leveraging its natural nutrient profile and aligning with consumer trends favoring health-promoting foods, Blackstrap Molasses can tap into the expanding market for functional foods and nutraceuticals.

Trends

Increasing Integration of Blackstrap Molasses in Functional Foods

A notable trend in the Blackstrap Molasses market is its growing incorporation into functional foods. As consumers become more health-conscious, there’s a rising demand for food products that offer additional health benefits beyond basic nutrition. Blackstrap Molasses, rich in essential minerals like iron, calcium, magnesium, and potassium, aligns well with this trend.

The U.S. Department of Agriculture (USDA) has highlighted the increasing interest in functional foods that contribute to health maintenance and disease prevention. For instance, the USDA’s Economic Research Service notes that the functional food market is expanding as consumers seek products that support health and wellness. Blackstrap Molasses, with its nutrient-dense profile, is well-positioned to meet this demand.

Furthermore, the USDA’s Agricultural Research Service is actively researching the conversion of sugar crops and by-products, including molasses, into value-added products with applications in the food, pharmaceutical, and nutraceutical industries. This initiative underscores the potential of Blackstrap Molasses as a raw material for developing functional food ingredients and supplements.

Government support for such initiatives further enhances the growth prospects for Blackstrap Molasses in these sectors. By leveraging its natural nutrient profile and aligning with consumer trends favoring health-promoting foods, Blackstrap Molasses can tap into the expanding market for functional foods and nutraceuticals.

Regional Analysis

Asia-Pacific dominates the Blackstrap Molasses market with 47.3% share valued at USD 6.4 billion in 2024, driven by sugarcane production and bioethanol policies.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global blackstrap molasses market, capturing 47.3% of the total market share, equivalent to a value of approximately USD 6.4 billion.

This leadership is strongly supported by the region’s robust sugarcane cultivation and high-volume molasses production, particularly in countries such as India, Thailand, Indonesia, and the Philippines. India alone produced over 400 million metric tons of sugarcane in the 2023–24 season, generating substantial volumes of molasses as a by-product.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is an American agribusiness powerhouse with extensive capabilities in food, feed, ethanol, and bioenergy. Operating over 270 processing plants and 420 crop facilities worldwide, it leverages molasses and related sweetener streams as part of its integrated corn and sugar platform. The company’s vertical integration—including grain origination and fermentation assets—allows it to supply consistent, large-volume molasses to ethanol producers, livestock operations, and industrial food and beverage manufacturers, reinforcing its leadership role in the sector.

B&G Foods is a U.S.-based branded foods holding company that markets the well-known Brer Rabbit Blackstrap Molasses. This product offers a bold, robust flavour and is rich in calcium, magnesium, and potassium, making it popular for home cooking and baking. Leveraging B&G’s distribution network and brand strength, the company positions its molasses as both a pantry staple and a source of functional nutrition, appealing to traditional culinary and healthy-eating consumers alike.

Buffalo Molasses LLC, based in New York, is a familyowned specialist in U.S.–grown sugarcane molasses. Since 2006, it has been producing high-quality certified organic and conventional liquid molasses for dairy, beef, and agricultural use. The firm emphasizes traceability—from farm to final blend—and targets niche markets that value domestic sourcing, sustainable farming practices, and feed-grade quality. Its customized blends for livestock producers have earned it a loyal customer base in the feed industry.

Top Key Players in the Market

- Archer Daniels Midland

- B&G Foods Inc.

- Buffalo Molasses LLC

- Caribbean Molasses Company

- Crosby Molasses Co Ltd.

- Domino Speciality Ingredients

- E D & F Man Holdings Limited

- Malt Products Corporation

- Tate Lyle

- Wilmar International

- Zook Molasses Company

Recent Developments

In 2024, Archer Daniels Midland (ADM) reinforced its position in the blackstrap molasses market via the Carbohydrate Solutions business, which reported a 3% increase in production volumes year-over-year—driven significantly by molasses based streams.

In 2024, B&G Foods Inc. generated net sales of USD 1.93 billion for its packaged foods business, with its Brer Rabbit and Grandma’s Molasses lines making up approximately 1–2% of total revenues—translating to roughly USD 19–39 million in molasses sales.

Report Scope

Report Features Description Market Value (2024) USD 13.7 Billion Forecast Revenue (2034) USD 21.9 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Grade (High Grade, Low Grade), By Product (Organic, Conventional), By Application (Industrial Fermentation, Food and Beverages, Pharmaceutical, Animal Feed, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland, B&G Foods Inc., Buffalo Molasses LLC, Caribbean Molasses Company, Crosby Molasses Co Ltd., Domino Speciality Ingredients, E D & F Man Holdings Limited, Malt Products Corporation, Tate Lyle, Wilmar International, Zook Molasses Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blackstrap Molasses MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Blackstrap Molasses MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland

- B&G Foods Inc.

- Buffalo Molasses LLC

- Caribbean Molasses Company

- Crosby Molasses Co Ltd.

- Domino Speciality Ingredients

- E D & F Man Holdings Limited

- Malt Products Corporation

- Tate Lyle

- Wilmar International

- Zook Molasses Company