Global Biotech Flavor Market Size, Share Analysis Report By Type (Vanilla, Apple, Citrine, Saffron, Chocolate, Others), By Form (Liquid, Powder, Paste), By Application (Food And Beverages, Pharmaceuticals, Nutraceuticals, Personal Care And Cosmetics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159423

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

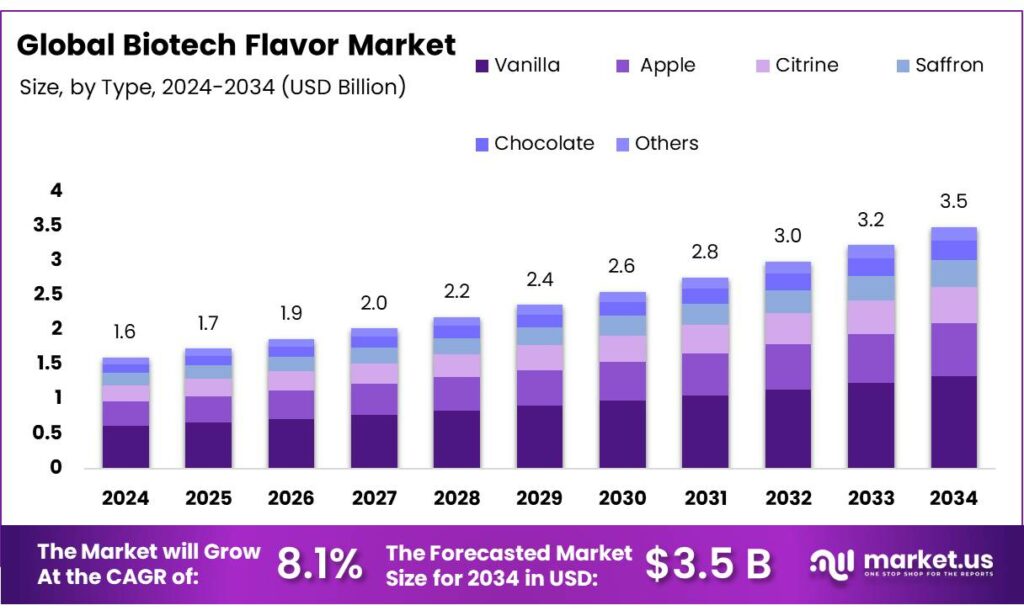

The Global Biotech Flavor Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

The biotech flavors market is a rapidly expanding segment within the food and beverage industry, leveraging advanced biotechnology methods to create natural, sustainable, and cost-effective flavor solutions. These flavors are derived from biotechnological processes such as fermentation, enzyme applications, and synthetic biology, providing alternatives to traditional extraction methods. Biotech flavors can replicate or enhance natural flavors, offering a diverse range of options for food manufacturers aiming to meet growing consumer demand for clean-label and plant-based ingredients.

Government initiatives play a crucial role in supporting the biotech sector. India’s bioeconomy has grown from $10 billion in 2014 to $165.7 billion in 2024, with a target of $300 billion by 2030. The Department of Biotechnology’s BioE3 policy focuses on fostering high-performance biomanufacturing, supporting research and development, and promoting green growth in sectors like bio-based chemicals and smart proteins. Additionally, the Biotechnology Industry Research Assistance Council (BIRAC) has supported over 3,000 startups and the development of more than 750 products, facilitating innovation and entrepreneurship in the biotech sector.

The demand for biotech flavors is further fueled by consumer trends favoring natural and clean-label products. Biotech flavors, derived from microbial fermentation, offer a sustainable alternative to traditional synthetic flavors, aligning with the growing preference for healthier and more transparent food choices among consumers globally. In India, the food and beverage industry remains the largest application segment for biotech flavors, accounting for over 35% of enzyme usage, with a significant shift towards bio-based solutions in food processing.

Key Takeaways

- Biotech Flavor Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 8.1%.

- Vanilla held a dominant market position, capturing more than a 38.3% share of the global biotech flavor market.

- Liquid held a dominant market position, capturing more than a 56.8% share of the global biotech flavor market.

- Food & Beverages held a dominant market position, capturing more than a 54.2% share of the global biotech flavor market.

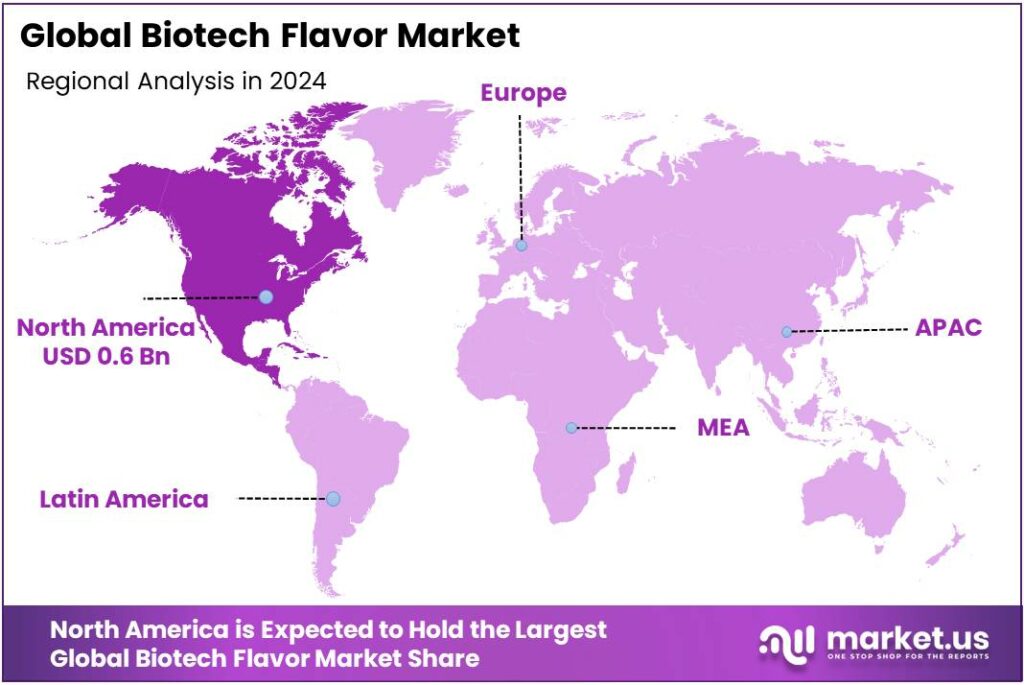

- North America held the largest market share in the global biotech flavor industry, capturing 42.7%, valued at approximately USD 0.6 billion.

By Type Analysis

Vanilla Dominates Biotech Flavor Market with 38.3% Share in 2024

In 2024, Vanilla held a dominant market position, capturing more than a 38.3% share of the global biotech flavor market. This significant share is attributed to the continued high demand for vanilla flavors across various sectors, including food and beverages, perfumes, and cosmetics. Vanilla is one of the most popular and versatile flavors used in a wide range of products, from ice creams and beverages to baked goods and confectioneries.

The increasing consumer preference for natural and clean-label ingredients has driven the demand for biotech vanilla flavors, especially in the wake of concerns about synthetic and artificial additives. Over the years, the popularity of plant-based and dairy-free products, which often require natural vanilla flavors to enhance taste profiles, has further contributed to the growth of this segment.

By Form Analysis

Liquid Biotech Flavors Lead with 56.8% Share in 2024 Due to Versatility and Ease of Use

In 2024, Liquid held a dominant market position, capturing more than a 56.8% share of the global biotech flavor market. This strong share is primarily driven by the versatility and ease of use of liquid flavors, which are ideal for a wide range of applications in the food and beverage industry. Liquid flavors are particularly favored for their ability to blend seamlessly into products such as beverages, sauces, dressings, and ready-to-eat meals, offering flexibility for both manufacturers and consumers.

As the demand for clean-label products continues to rise, liquid biotech flavors are gaining traction due to their natural composition and ability to meet consumer preferences for simpler ingredients. The ease of incorporation into liquid products, coupled with efficient production methods like fermentation, has made liquid biotech flavors a preferred choice in the market.

By Application Analysis

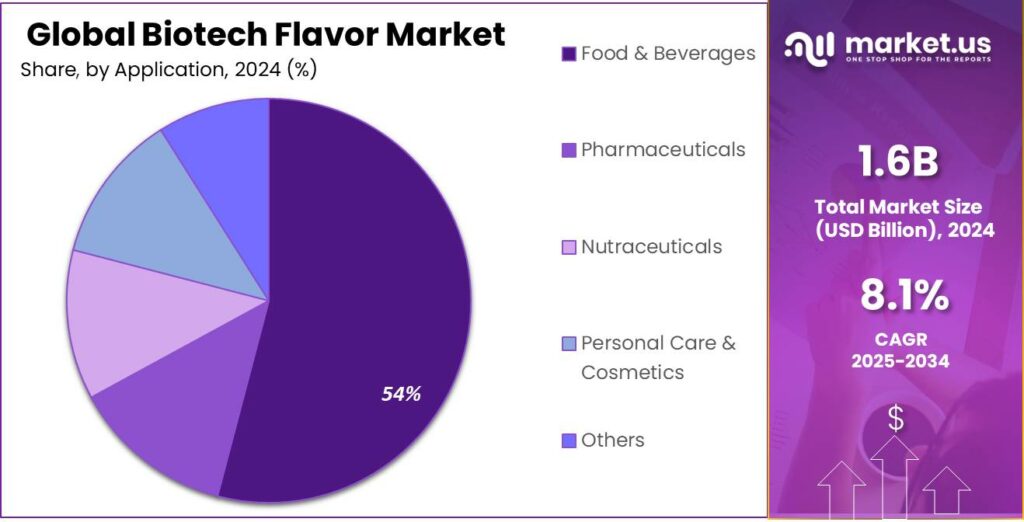

Food & Beverages Lead Biotech Flavor Market with 54.2% Share in 2024 Due to Rising Demand for Natural Flavors

In 2024, Food & Beverages held a dominant market position, capturing more than a 54.2% share of the global biotech flavor market. This significant share can be attributed to the continuous demand for natural, clean-label flavors in food and beverage products. With consumers increasingly prioritizing health-conscious, sustainable, and natural ingredients, biotech flavors have become an essential component in the development of a wide variety of food and drink items, including snacks, dairy, soft drinks, and plant-based products.

The food and beverage industry’s reliance on biotech flavors is further driven by the growing preference for products with simplified ingredient lists, which has led manufacturers to adopt flavors produced through biotechnological processes. These flavors not only meet the clean-label demand but also address challenges related to flavor consistency, quality, and cost-effectiveness, making them highly appealing for food manufacturers globally.

Key Market Segments

By Type

- Vanilla

- Apple

- Citrine

- Saffron

- Chocolate

- Others

By Form

- Liquid

- Powder

- Paste

By Application

- Food & Beverages

- Dairy Products

- Beverages

- Bakery & Confectionery

- Savory & Snacks

- Others

- Pharmaceuticals

- Nutraceuticals

- Personal Care & Cosmetics

- Others

Emerging Trends

A Sustainable Revolution in the Food Industry

The global food industry is undergoing a significant transformation, driven by a surge in consumer demand for natural, clean-label products. This shift is propelling the growth of biotech flavors, which are produced through microbial fermentation and bioconversion processes. These methods utilize genetically modified organisms (GMOs) or enzymes to replicate the taste of natural ingredients, offering a sustainable and innovative approach to flavor production.

The demand for biotech flavors is particularly strong in the North American market, where consumers are increasingly seeking products made with natural ingredients. The rising prevalence of health issues associated with the consumption of high-sugar products has led consumers to switch towards natural alternatives.

- According to the Centers for Disease Control and Prevention (CDC), nearly 10.5% of the U.S. population had diabetes in 2019, highlighting the need for healthier food options.

In addition to technological advancements, regulatory support is playing a crucial role in the growth of the biotech flavor market. In the United States, the Food and Drug Administration (FDA) has recognized certain biotech-derived ingredients as Generally Recognized As Safe (GRAS), facilitating their commercialization. Similarly, the European Food Safety Authority (EFSA) has classified some biotech-derived ingredients as non-novel, streamlining the approval process for these products.

Drivers

Rising Consumer Demand for Natural and Clean-Label Ingredients

One of the major driving factors behind the growth of the biotech flavor market is the rising consumer demand for natural and clean-label ingredients. Consumers are becoming increasingly aware of the ingredients in their food and beverages and are actively seeking products with fewer artificial additives, preservatives, and flavor enhancers. This growing preference for natural, clean-label ingredients has spurred significant demand for biotech flavors, which are derived through biotechnology processes, offering more natural and sustainable alternatives to traditional artificial flavors.

- According to the U.S. Food and Drug Administration (FDA), consumers in the U.S. are increasingly opting for food and beverage products with fewer artificial ingredients. In a 2023 survey, the FDA found that nearly 60% of U.S. consumers stated they check product labels for the absence of artificial colors, preservatives, and flavoring agents. This shift in consumer behavior has driven food manufacturers to seek out more natural, clean-label alternatives that can meet these demands.

The clean-label movement is particularly strong among younger generations, including Millennials and Gen Z. According to a 2023 report by the International Food Information Council (IFIC), 72% of younger consumers actively seek out foods with natural ingredients and are willing to pay a premium for products with transparent labeling and cleaner ingredient lists. As consumers increasingly prioritize health and sustainability, biotech flavors—made from naturally derived raw materials—are seen as a more wholesome, transparent option compared to traditional artificial flavors, which are often associated with health concerns.

The Plant-Based Foods Association reported in 2023 that U.S. sales of plant-based foods grew by 27% over the past two years, signaling a strong trend toward plant-based eating. As the plant-based food sector grows, so does the demand for biotech flavors that can enhance the taste of plant-based products while maintaining a natural, clean-label profile.

Restraints

Regulatory Hurdles in Biotech Flavor Development

The journey of biotech flavors from laboratory innovation to consumer products is significantly influenced by regulatory frameworks. These regulations, while essential for ensuring safety and public health, often present challenges that can impede the timely introduction of new biotech flavors into the market.

In the United States, the approval process for biotech flavors involves multiple agencies, including the Food and Drug Administration (FDA), the Environmental Protection Agency (EPA), and the Department of Agriculture (USDA). Each agency has its own set of guidelines and timelines, which can lead to extended approval periods.

For instance, the FDA’s Food Safety Modernization Act (FSMA) mandates that food facilities implement comprehensive preventive controls and undergo regular inspections. While these measures are crucial for food safety, they can also result in delays for companies seeking to introduce new biotech flavors

The financial burden of meeting regulatory requirements can be substantial. Companies must invest in safety assessments, quality control measures, and documentation to comply with regulatory standards. These costs can be particularly challenging for small and medium-sized enterprises (SMEs) in the biotech sector.

- For example, the Drug Marketing and Manufacturing Association (DMMA) in India highlighted that increasing regulatory burdens could lead to the closure of over 5,000 pharmaceutical units nationwide, particularly in Gujarat, a major pharmaceutical hub. While this pertains to pharmaceuticals, similar challenges are faced by biotech flavor companies.

Consumer acceptance of biotech flavors is closely tied to transparency and labeling practices. Regulatory bodies often require clear labeling of biotech ingredients, which can influence consumer perceptions. The Flavor and Extract Manufacturers Association (FEMA) in the United States evaluates flavor additives, but its process has been criticized for lacking public scientific transparency, prompting calls for stricter regulatory reforms and more rigorous government involvement in the safety evaluations of food flavors

Opportunity

Government Initiatives and Technological Advancements Drive Biotech Flavor Growth

Governments worldwide are recognizing the potential of biotechnology in transforming industries, including food and beverages. In the United States, the Department of Energy (DOE) has invested $220 million in biomanufacturing research and development to support the growth of a domestic biomanufacturing industry. This investment aims to accelerate the development and commercialization of biotech-derived ingredients, such as flavors, by providing funding for research, development, demonstration, and deployment projects.

Advancements in biotechnology are enabling the development of innovative flavor solutions. For instance, the integration of artificial intelligence (AI) in flavor science has led to the creation of platforms like TastePepAI, which utilizes machine learning to design taste peptides with desired flavor profiles. This technology accelerates the discovery of new flavors, enhancing the diversity and appeal of biotech-derived flavor offerings.

Moreover, the use of reinforcement learning frameworks has facilitated the discovery of natural flavor molecules by optimizing the synthesis of compounds with desired taste attributes. These technological advancements not only improve the efficiency of flavor development but also contribute to the creation of sustainable and natural flavor solutions.

Consumer preferences are shifting towards products that are perceived as natural, healthy, and transparent. This trend is driving the adoption of biotech flavors, which are produced through sustainable processes and are free from synthetic additives. The increasing demand for clean-label products is compelling food manufacturers to seek natural alternatives, thereby boosting the demand for biotech-derived flavors.

Regional Insights

North America Dominates Biotech Flavor Market with 42.7% Share in 2024

In 2024, North America held the largest market share in the global biotech flavor industry, capturing 42.7%, valued at approximately USD 0.6 billion. This dominance is driven by the region’s advanced technological infrastructure, high demand for natural and clean-label ingredients, and strong consumer preference for healthier, plant-based, and sustainable food products. The U.S. is the leading market in North America, contributing significantly to this share, supported by the country’s robust food and beverage sector and a rising trend toward innovation in biotech flavor solutions.

The growing demand for plant-based and vegan foods, particularly in North America, has played a pivotal role in increasing the consumption of biotech-derived flavors, which provide authentic taste profiles without relying on animal-based ingredients. According to the Plant-Based Foods Association, the plant-based food market in the U.S. alone grew by 27% from 2020 to 2024, further boosting the adoption of biotech flavors in this sector.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Givaudan SA is a global leader in the flavor and fragrance industry, recognized for its innovation in biotech flavors. The company leverages advanced biotechnology and fermentation processes to create sustainable, natural flavors. Givaudan’s dedication to sustainability and its broad portfolio of biotech flavors make it a key player in the market. In 2023, the company reported a revenue of CHF 7.5 billion, underlining its strong presence in the biotech flavor sector.

Firmenich SA is a Swiss multinational known for its expertise in flavors and fragrances. The company has been at the forefront of biotech flavor innovations, focusing on clean-label, natural, and sustainable ingredients. Firmenich utilizes fermentation and bioconversion to create flavors that mimic traditional tastes. The company reported a strong financial performance in 2023, with a turnover of CHF 4.4 billion, highlighting its influence and growth in the biotech flavor market.

Symrise AG is a German-based global flavor and fragrance producer, specializing in the development of natural and biotech-derived flavors. The company focuses on sustainability, sourcing raw materials responsibly, and using biotechnology to create high-quality flavors. Symrise has been expanding its biotech flavor portfolio, with a revenue of €5.4 billion in 2023, solidifying its position as a key player in the global biotech flavor industry.

Top Key Players Outlook

- Givaudan SA

- Firmenich SA

- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Takasago International Corporation

- Kerry Group plc

- T. Hasegawa Co., Ltd.

- BASF

Recent Industry Developments

In 2024, Givaudan SA, a global leader in flavors and fragrances, demonstrated significant growth in its biotech flavor segment. The company reported a 12.3% increase in revenue on a like-for-like basis, reaching CHF 7.41 billion ($8.19 billion).

In March 31, 2024, Takasago International Corporation reported a revenue of ¥195.9 billion (approximately $1.36 billion USD), marking a 4.9% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 3.5 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vanilla, Apple, Citrine, Saffron, Chocolate, Others), By Form (Liquid, Powder, Paste), By Application (Food And Beverages, Pharmaceuticals, Nutraceuticals, Personal Care And Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Givaudan SA, Firmenich SA, Symrise AG, International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Kerry Group plc, T. Hasegawa Co., Ltd., BASF Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Givaudan SA

- Firmenich SA

- Symrise AG

- International Flavors & Fragrances Inc. (IFF)

- Takasago International Corporation

- Kerry Group plc

- T. Hasegawa Co., Ltd.

- BASF