Global Biogas Plants Market Size, Share, And Enhanced Productivity By Type (Fixed-Dome Plants, Balloon Plants, Floating-Drum Plants), By Operation Mode (Continuous Flow Filling, Semi-Batch Filling), By Feedstock (Bio-Municipal Waste, Agriculture Residue, Energy Crops, Others), By Digester Type (Wet Anaerobic Digestion, Dry Anaerobic Digestion), By Application (Power Generation, Heat Generation, Transportation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170445

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

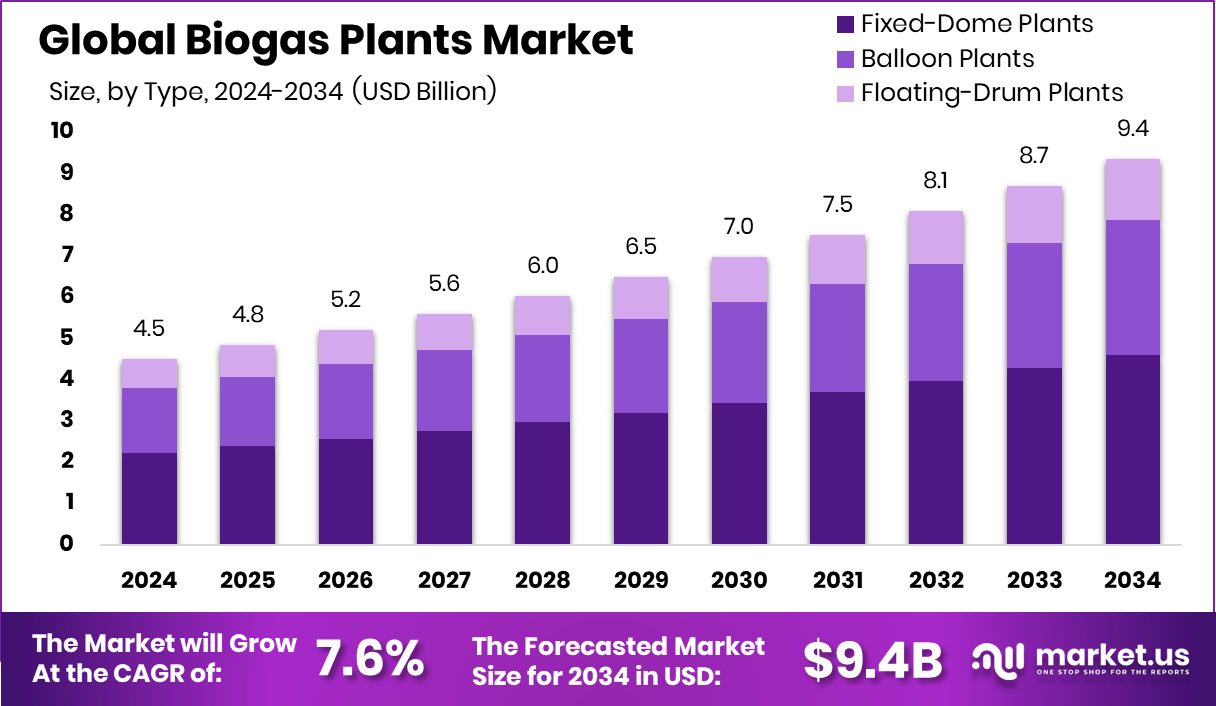

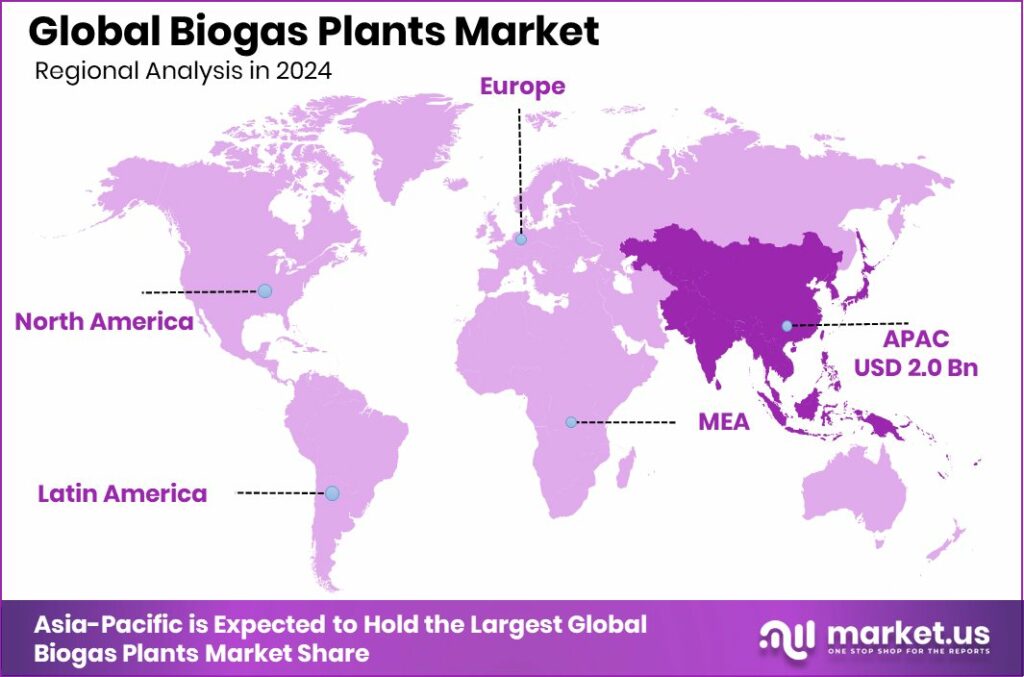

The Global Biogas Plants Market is expected to be worth around USD 9.4 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034. Asia-Pacific accounts for a 45.9% share as the biogas plants market hits USD 2.0 Bn.

Biogas plants are systems that convert organic waste such as agricultural residue, food waste, and organic sludge into biogas through anaerobic digestion. The produced biogas is mainly used for electricity generation, heat, or upgraded into biomethane for grid injection and transport use. These plants also produce digestate, which is used as an organic fertiliser, supporting circular waste management and energy recovery in a single process.

The biogas plants market represents the ecosystem of technologies, infrastructure, and services involved in developing and operating these plants. It includes plant construction, digestion systems, gas handling, and end-use applications. The market exists at the intersection of renewable energy, waste management, and agricultural sustainability, making it relevant for both rural and urban energy planning.

Growth factors are closely linked to government-backed financial support and infrastructure programs. In Poland, the European Investment Bank approved a high-efficiency biomass-to-biogas cogeneration program with a €238 million budget from the EU Modernisation Fund and the Polish National Fund for Environmental Protection and Water Management. Separately, Poland’s NFOSiGW approved over PLN 101 million (€24 million) for a municipal biogas plant developed by Eko Dolina, while another PLN 74 million (€17.4 million) loan was granted to Neo Biofuel Energy for agricultural biogas plant development.

Demand for biogas plants is rising due to energy security needs, waste-to-energy solutions, and regional incentives. India’s momentum is supported by policy-driven support, including a 40% biogas subsidy from the Himachal Pradesh government and Rs 836 crore secured by IOC GPS Renewables to build nine compressed biogas plants. Australia also contributes to demand growth, with Delorean receiving AUD 6.08 million (€3.5 million) from ARENA to advance biogas-linked projects.

Opportunities lie in scaling efficient plants and linking biogas with power, fuel, and grid applications. Large, structured funding continues to unlock new projects and improve operational viability.

- €238 million programme in Poland supports high-efficiency biomass-to-biogas cogeneration, strengthening long-term market stability.

- Rs 836 crore investment in India accelerates compressed biogas infrastructure, opening commercial and transport fuel opportunities.

Key Takeaways

- The Global Biogas Plants Market is expected to be worth around USD 9.4 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 7.6% from 2025 to 2034.

- Fixed-Dome plants dominate the Biogas Plants Market by type, holding 49.2% due to low costs globally.

- By operation mode, Continuous Flow Filling leads the Biogas Plants Market with 68.1% adoption worldwide, steadily growing.

- Agriculture residue is the key feedstock in the Biogas Plants Market, accounting for 39.3% usage across regions.

- Wet anaerobic digestion dominates digester types in the Biogas Plants Market, capturing 69.9% share through efficiency.

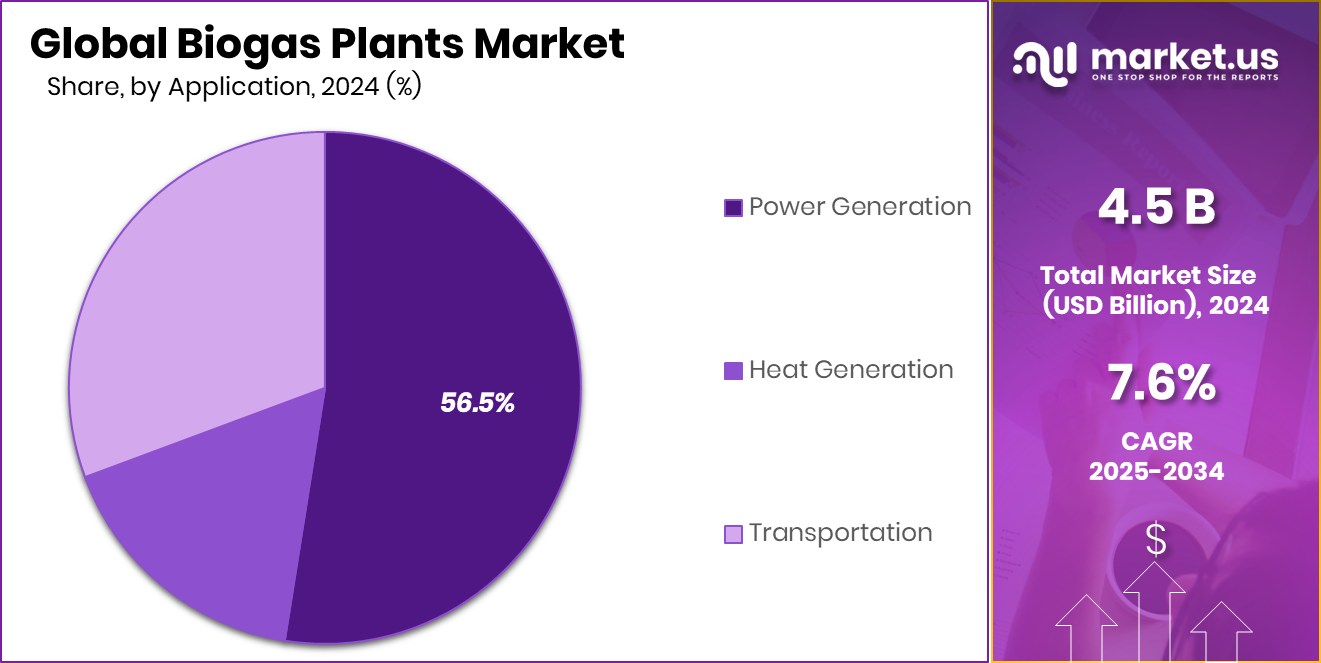

- Power generation leads applications in the Biogas Plants Market, representing 56.5% of installed capacity worldwide today.

- In the Asia-Pacific region, the biogas plants market reached USD 2.0 Bn, capturing 45.9% share regionally.

By Type Analysis

In the Biogas Plants Market, Fixed-Dome Plants dominate the type segment with 49.2% share.

In 2024, Fixed-Dome Plants held a dominant market position in the By Type segment of the Biogas Plants Market, with a 49.2% share. This dominance reflects the strong preference for fixed-dome designs in long-term biogas infrastructure due to their simple construction and underground structure. Their ability to operate without moving parts improves reliability and supports steady gas production over extended periods, making them suitable for both rural and semi-commercial settings.

The 49.2% share also indicates consistent adoption where durability and low operational disruption are valued. Fixed-dome plants align well with regions seeking stable biogas output and long service life. Their dominance highlights how proven design efficiency and structural stability continue to shape purchasing decisions in the biogas plants market.

By Operation Mode Analysis

Across Biogas Plants Market operations, Continuous Flow Filling leads the operation mode, holding 68.1%.

In 2024, Continuous Flow Filling held a dominant market position in the By Operation Mode segment of the Biogas Plants Market, with a 68.1% share. This strong share underlines the market’s preference for uninterrupted feeding systems that support steady digestion and predictable gas output. Continuous flow filling allows regular input of organic material, which helps maintain microbial balance inside the digester.

With a 68.1% share, this operation mode reflects demand for efficiency, process stability, and reduced downtime. Continuous flow systems support consistent energy generation and smoother plant operations. Their dominance shows how operational reliability and controlled digestion processes play a critical role in shaping adoption trends across biogas plant installations.

By Feedstock Analysis

Within the Biogas Plants Market, agricultural feedstock usage leads, contributing 39.3% share.

In 2024, Agriculture Residue held a dominant market position in the By Feedstock segment of the Biogas Plants Market, with a 39.3% share. This leadership highlights the widespread availability of crop residues and farm-based organic waste as reliable inputs for biogas production. Agricultural residue offers a steady and predictable feedstock stream, supporting continuous plant operation.

The 39.3% share reflects how agricultural by-products remain central to biogas systems, especially in regions with strong farming activity. Using residues also supports waste utilisation while ensuring consistent digester performance. This dominance confirms agricultural residue as a practical and widely integrated feedstock within the biogas plants market.

By Digester Type Analysis

Biogas Plants Market digesters prefer wet anaerobic digestion, dominating installations with 69.9%.

In 2024, Wet Anaerobic Digestion held a dominant market position in the By Digester Type segment of the Biogas Plants Market, with a 69.9% share. This significant share demonstrates the preference for digestion processes suited to high-moisture organic inputs. Wet anaerobic digestion supports efficient microbial activity and smooth material handling.

Holding a 69.9% share, this digester type stands out for its adaptability and stable gas yields. Its dominance reflects strong alignment with commonly available feedstocks and established operational practices. Wet anaerobic digestion continues to anchor the market due to its proven performance and compatibility with large-scale biogas plant designs.

By Application Analysis

In the Biogas Plants Market applications, power generation remains the primary use, accounting for 56.5%.

In 2024, Power Generation held a dominant market position in the By Application segment of the Biogas Plants Market, with a 56.5% share. This dominance shows that electricity production remains the primary end-use for biogas systems, driven by the need for a reliable and localised power supply.

With a 56.5% share, power generation applications highlight the role of biogas plants in converting organic waste into usable energy. The segment’s leadership reflects stable demand for electricity-focused biogas solutions. Power generation continues to define application priorities, reinforcing biogas plants as an important contributor to energy output systems.

Key Market Segments

By Type

- Fixed-Dome Plants

- Balloon Plants

- Floating-Drum Plants

By Operation Mode

- Continuous Flow Filling

- Semi-Batch Filling

By Feedstock

- Bio-Municipal Waste

- Agriculture Residue

- Energy Crops

- Others

By Digester Type

- Wet Anaerobic Digestion

- Dry Anaerobic Digestion

By Application

- Power Generation

- Heat Generation

- Transportation

Driving Factors

Rising Investment in Low-Carbon Heat Infrastructure

One major driving factor for the Biogas Plants Market is the growing investment in low-carbon heat and energy infrastructure. Governments are actively supporting systems that can supply clean heat to cities, industries, and communities, where biogas plays a practical role. For example, a £21m heat network scheme awarded to a city highlights how organic-based energy sources are being linked to urban heating needs.

Similarly, the UK Government’s Green Heat Network Fund (GHNF) is providing £34m to four projects across England, supporting heat networks connected to energy-from-waste facilities and low-carbon heat solutions. These initiatives encourage the integration of biogas with district heating, improving energy efficiency and reducing fossil fuel dependence.

At a local level, Solihull securing £9m from the National Wealth Fund for a town centre heat network further strengthens demand for reliable renewable heat inputs, creating steady momentum for biogas plant development.

Restraining Factors

High Capital Intensity Slows Biogas Plant Expansion

A key restraining factor in the Biogas Plants Market is the high upfront capital required for technology development, plant construction, and system integration. While funding is available, it often highlights how cost-heavy clean energy solutions remain. For instance, Conflux Technology’s $11M Series B raise in Australia shows that advanced energy technologies still depend on significant private capital to scale development and global support.

Similarly, the Green Heat Network Fund, awarding over £100m to district heating projects, reflects strong competition for limited public funds, where biogas projects must compete with other clean heat technologies. In addition, HyperHeat securing €3.5M to decarbonise high-temperature industrial heat signals that investment attention is spread across multiple alternatives. This funding landscape, while positive, also underlines financial barriers, longer payback periods, and higher risk perceptions that can slow biogas plant deployment.

Growth Opportunity

Rising Power Demand Drives Biogas Capacity Expansion

A major growth opportunity for the Biogas Plants Market comes from rising electricity demand and large-scale capacity additions in the power sector. India successfully met a 241 GW peak power demand on 9th June 2025 with zero peak shortage, showing the need for reliable and flexible energy sources that can support grid stability. During 2024–25, India added a record 34 GW of generation capacity, of which 29.5 GW came from renewable energy, creating space for biogas to act as a stable, dispatchable complement to intermittent renewables.

Long-term capacity plans also strengthen opportunity, as NLC India seeks ₹50,000 crore investment to reach a 10 GW capacity goalsignallingng sustained infrastructure build-out where biogas can play a balancing role. Globally, capital flows remain supportive, with Nuveen raising $1.3 B for energy and power infrastructure, even as policy shifts like the U.S. plan to cancel $13 B in green energy funds push markets to seek resilient, diversified renewable solutions.

Latest Trends

Large-Scale Funding Accelerates Distributed Biogas Deployment

A key latest trend in the Biogas Plants Market is the rising flow of large, structured capital toward distributed and waste-to-energy systems. Governments and institutions are increasingly backing biogas as part of decentralised renewable energy models. In Nigeria, a new partnership involving NSIA, SEforALL, ISA, and Africa50 launched a US$500 million DRE Nigeria Fund, aimed at financing distributed renewable energy projects, where biogas plants fit well due to local waste availability and flexible deployment.

At the global level, private capital is reinforcing this trend, with Nuveen raising $1.3 billion at the first close of its Energy & Power Infrastructure Credit Fund II, targeting long-term energy assets. Technology-linked support is also visible, as the U.S. DOE allocated $6.9 million for organic waste-to-biofuels projects, strengthening innovation-driven biogas development.

Regional Analysis

Asia-Pacific biogas plant market leads regionally with a 45.9% share, valued at USD 2.0 Bn.

The Asia-Pacific region dominates the Biogas Plants Market, holding a 45.9% share valued at USD 2.0 Bn, reflecting its strong position in regional adoption and operational scale. This dominance is supported by widespread utilisation of biogas plants across diverse economic and geographic settings, where biogas serves as a reliable energy and waste-management solution. Market maturity in Asia-Pacific is reinforced by established deployment across agricultural and semi-urban areas, enabling consistent capacity expansion and long-term operational continuity.

In comparison, North America shows steady market participation, driven by structured infrastructure development and increasing integration of biogas systems within organised energy frameworks, though it remains behind the leading region. Europe continues to maintain a stable presence, supported by its long-standing experience with biogas technologies and systematic market organisation, contributing to gradual expansion.

The Middle East & Africa region reflects emerging market characteristics, with adoption progressing at a measured pace as biogas infrastructure develops across select areas. Latin America represents another developing regional market, where gradual uptake and improving operational awareness support market presence.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Future Biogas Limited stands out as a company strongly aligned with the commercial and industrial biogas landscape. The company is recognised for developing large-scale anaerobic digestion facilities that focus on long-term operational stability and gas output consistency. Its approach emphasises structured project execution, operational reliability, and integration with energy-intensive users. This positioning allows Future Biogas Limited to remain relevant in markets where scale, performance certainty, and dependable feedstock management are critical for sustained biogas plant operations.

PlanET Biogas Global GmbH is viewed as a technology-driven player with a strong emphasis on engineering precision and standardised plant solutions. The company’s strength lies in delivering modular and adaptable biogas systems that support different operational requirements. Analysts note that PlanET Biogas Global GmbH benefits from its process-oriented design philosophy, which helps reduce operational complexity while maintaining stable digestion performance. Its global outlook and technical focus support steady engagement across diverse biogas deployment environments.

WELTEC BIOPOWER GmbH is widely regarded for its experience in customised biogas plant development and long-term service capabilities. The company’s focus on tailored solutions, combined with operational support and system optimisation, strengthens plant efficiency over time. Analysts highlight WELTEC BIOPOWER GmbH’s balanced emphasis on engineering, construction, and lifecycle management as a key factor supporting its sustained presence in the global biogas plants market.

Top Key Players in the Market

- Future Biogas Limited

- PlanET Biogas Global GmbH

- WELTEC BIOPOWER GmbH

- Scandinavian Biogas Fuels International AB

- Envitec Biogas AG

- Ameresco

- AB HOLDING SPA

- RENERGON International AG

- StormFisher

- Strabag

Recent Developments

- In August 2024, WELTEC BIOPOWER modernised a 1-megawatt biogas plant in Australia, increasing its efficiency and ensuring continued energy output from food waste, sewage, and organic inputs at the site. This refurbishment improved plant operations and extended its service life.

- In August 2024, Future Biogas Limited acquired a 51% stake in a portfolio of six gas-to-grid anaerobic digestion facilities from JLEN Environmental Assets Group Limited, significantly expanding its operational capacity with a combined output of 333 GWh of gas. This move broadened the company’s plant portfolio and increased its footprint in the UK biogas market.

- In July 2024, PlanET Biogas USA Inc. completed 12 new anaerobic digestion plant projects across the United States in 12 months, all using PlanET’s proven AD technology. This milestone highlights expanding operational scale and strong project delivery in North America.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 9.4 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fixed-Dome Plants, Balloon Plants, Floating-Drum Plants), By Operation Mode (Continuous Flow Filling, Semi-Batch Filling), By Feedstock (Bio-Municipal Waste, Agriculture Residue, Energy Crops, Others), By Digester Type (Wet Anaerobic Digestion, Dry Anaerobic Digestion), By Application (Power Generation, Heat Generation, Transportation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Future Biogas Limited, PlanET Biogas Global GmbH, WELTEC BIOPOWER GmbH, Scandinavian Biogas Fuels International AB, Envitec Biogas AG, Ameresco, AB HOLDING SPA, RENERGON International AG, StormFisher, Strabag Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Future Biogas Limited

- PlanET Biogas Global GmbH

- WELTEC BIOPOWER GmbH

- Scandinavian Biogas Fuels International AB

- Envitec Biogas AG

- Ameresco

- AB HOLDING SPA

- RENERGON International AG

- StormFisher

- Strabag