Global Battery Felts Market Size, Share, And Enhanced Productivity By Format (Roll, Sheet, Custom), By Material (Polyester, Polypropylene, Acrylic, Glass Fiber), By End-User (Automotive, Industrial, Consumer Electronics, Energy Storage), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177978

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

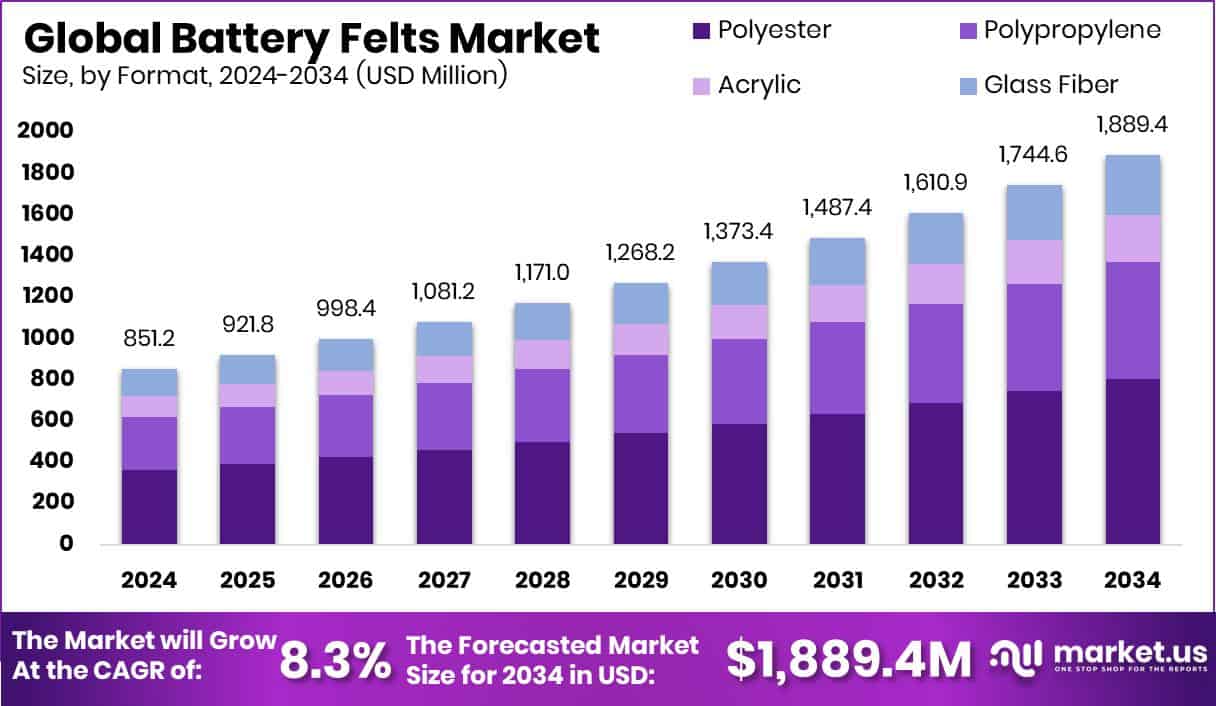

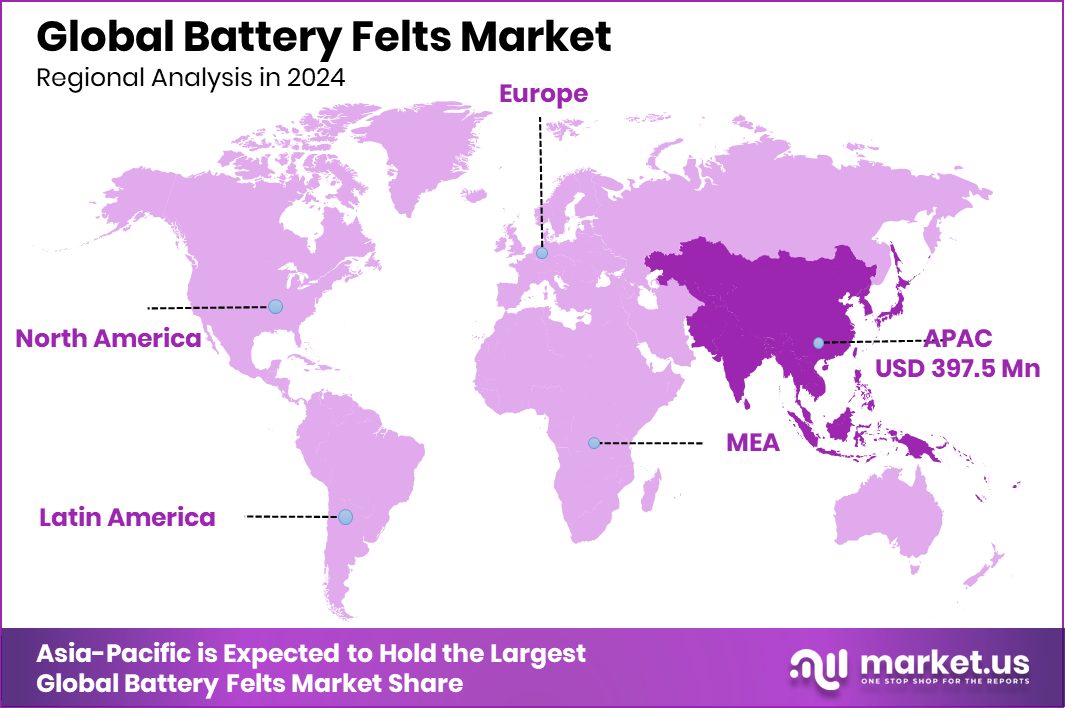

The Global Battery Felts Market is expected to be worth around USD 1,889.4 million by 2034, up from USD 851.2 million in 2024, and is projected to grow at a CAGR of 8.3% from 2025 to 2034. Strong manufacturing growth supported the Asia Pacific’s 46.7% USD 397.5 Mn valuation.

Battery felts are specialized nonwoven fiber materials used inside battery systems to provide insulation, electrolyte absorption, vibration control, and structural stability. They are manufactured in formats such as roll, sheet, and custom designs to suit different battery pack configurations. Made from materials including polyester, polypropylene, acrylic, and glass fiber, battery felts are engineered to withstand chemical exposure, heat, and mechanical stress. These materials play a critical role in improving battery safety, durability, and overall performance across multiple applications.

The Battery Felts Market refers to the global trade and production of these engineered fiber components supplied to automotive, industrial, consumer electronics, and energy storage sectors. Demand is closely tied to battery manufacturing growth, particularly in electric vehicles and grid storage systems. The market structure is shaped by material innovation, production scalability, and evolving battery design standards.

Growth in this market is strongly influenced by large-scale battery investments. Funding such as a16z backing Base Power in a $200M round, Base Power raising $1B for home batteries, the US Department of Energy announcing $45Mn in battery funding, and Ford set to receive a $9.6 billion loan for a battery joint venture, reflects accelerating battery production capacity.

Additional capital, including Form Energy’s US$450 million raise, Ionobell’s $3.9 million financing, Drev’s €2.7m support to reduce battery factory risks, and a £4.1 million funding round to improve EV charge times, further strengthens future demand for battery components like felts. These developments create sustained opportunities for material suppliers aligned with next-generation battery technologies.

Key Takeaways

- The Global Battery Felts Market is expected to be worth around USD 1,889.4 million by 2034, up from USD 851.2 million in 2024, and is projected to grow at a CAGR of 8.3% from 2025 to 2034.

- Roll format dominates the Battery Felts Market, accounting for 58.2% of overall demand.

- Polyester material leads the Battery Felts Market, capturing 42.6% share globally.

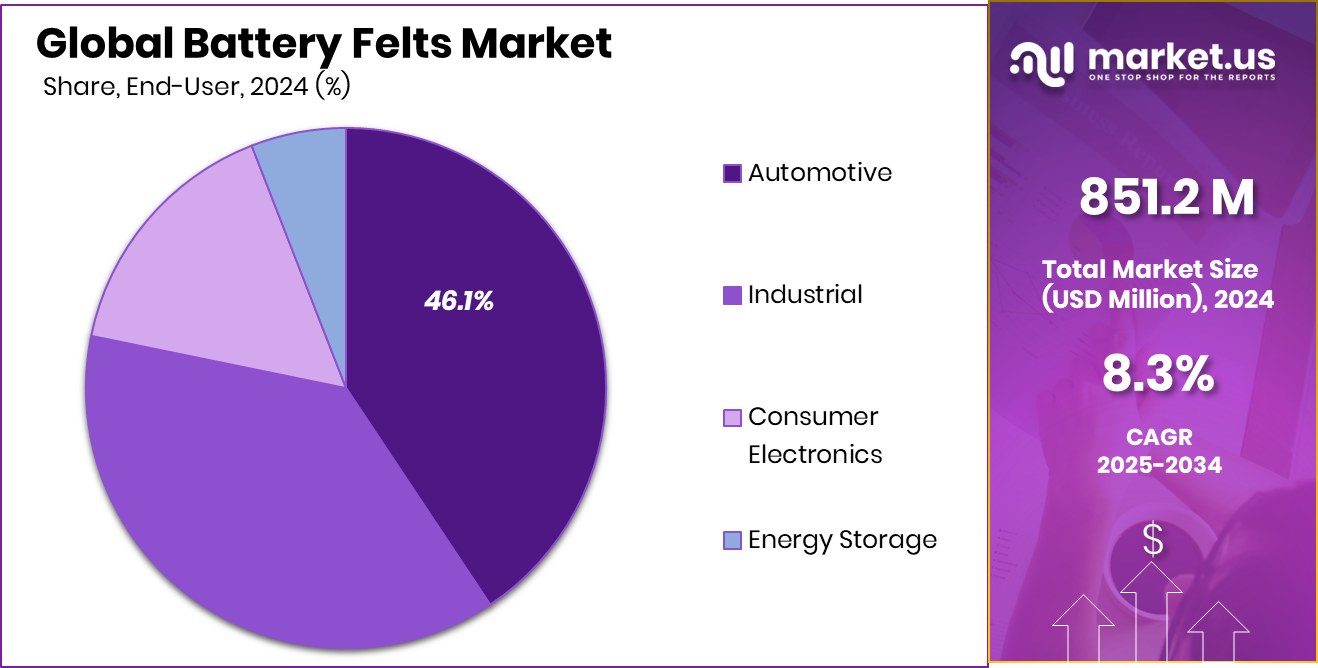

- The automotive sector drives the Battery Felts Market, representing 46.1% total consumption.

- The Asia Pacific generated USD 397.5 Mn revenue in 2024.

By Format Analysis

Roll format dominates the Battery Felts Market with a 58.2% share.

In 2024, the roll format accounted for 58.2% of the Battery Felts Market, reflecting its strong acceptance across large-scale battery manufacturing lines. Roll-based felts are preferred because they support continuous processing, minimize material wastage, and improve production efficiency in automated facilities. Manufacturers favor roll formats for easier storage, uniform thickness control, and compatibility with high-speed cutting and lamination equipment.

As battery production scales up for electric mobility and energy storage systems, roll-based supply ensures consistent quality and faster turnaround times. The format also simplifies transportation and bulk handling, making it cost-effective for global suppliers. With gigafactory expansions accelerating worldwide, roll-format battery felts continue to dominate due to their operational convenience and strong integration with advanced battery assembly processes.

By Material Analysis

Polyester material leads the Battery Felts Market, capturing a 42.6% share.

In 2024, polyester emerged as the leading material segment in the Battery Felts Market, holding 42.6% share due to its balanced performance characteristics and affordability. Polyester-based felts are widely used for insulation, electrolyte absorption, and structural stability within battery systems. The material offers strong chemical resistance, thermal durability, and mechanical strength, which are essential for automotive and industrial battery applications.

Manufacturers prefer polyester because it provides a consistent fiber structure and reliable performance under varying temperature conditions. Additionally, polyester felts can be engineered to meet specific density and porosity requirements, supporting advanced battery designs. As demand rises for durable and lightweight battery components, polyester continues to be the material of choice, supported by its wide availability and cost-efficient production processes.

By End-User Analysis

The automotive end-user segment drives the Battery Felts Market with a 46.1% share.

In 2024, the automotive segment led the Battery Felts Market with a 46.1% share, driven by the rapid growth of electric vehicles and hybrid technologies. Automotive manufacturers increasingly rely on battery felts for thermal management, vibration damping, and insulation within battery packs. As vehicle electrification expands across passenger and commercial segments, the need for reliable and high-performance battery components continues to grow.

Battery felts play a critical role in enhancing safety, improving battery lifespan, and maintaining structural integrity under demanding operating conditions. Automakers are investing heavily in battery innovation, and suppliers are aligning production capacities to meet this surge in demand. The strong push toward sustainable mobility and stricter emission standards further reinforces the automotive sector’s dominant position in the market.

Key Market Segments

By Format

- Roll

- Sheet

- Custom

By Material

- Polyester

- Polypropylene

- Acrylic

- Glass Fiber

By End-User

- Automotive

- Industrial

- Consumer Electronics

- Energy Storage

Driving Factors

Rapid electric vehicle production expansion

The Battery Felts Market is strongly supported by the rapid expansion of electric vehicle production worldwide. As automotive manufacturers increase battery pack output to meet electrification targets, the demand for insulation, cushioning, and thermal management materials such as battery felts continues to rise. Battery felts play a critical role in maintaining structural stability and safety within EV battery modules. At the same time, upstream investments in polymer capacity are strengthening supply security.

For example, Ineos announced that its PE and PP resin site in Scotland will receive a $201M upgrade, reinforcing raw material availability for advanced fiber and felt production. Such infrastructure investments across the polymer value chain create a stable foundation for scaling battery component manufacturing to support expanding EV production volumes.

Restraining Factors

Fluctuating raw material price volatility

Raw material price fluctuations remain a key restraint in the Battery Felts Market. Polyester, polypropylene, acrylic, and glass fiber inputs are directly influenced by petrochemical cost movements and global supply-demand imbalances. When resin and fiber prices shift sharply, felt manufacturers face margin pressure and procurement challenges. Although industrial innovation is progressing, cost stability remains uncertain.

In parallel, capital is flowing toward sustainability-focused projects, such as a Houston company securing $12M in Series A funding for a decarbonization plant. While such initiatives aim to reduce long-term environmental impact, the transition period can contribute to pricing variability in raw materials. These fluctuations affect production planning, long-term contracts, and overall cost competitiveness for battery felt suppliers operating in a rapidly expanding battery ecosystem.

Growth Opportunity

Rising residential home battery adoption

The growing adoption of residential home battery systems presents a significant opportunity for the Battery Felts Market. As homeowners increasingly install backup storage solutions alongside rooftop solar systems, demand for compact, safe, and thermally stable battery packs is increasing. Battery felts are essential in enhancing insulation and structural integrity within these systems. Financial backing toward circular and sustainable materials further strengthens long-term opportunity.

Sumitomo Mitsui Banking Corporation invested $10M in Closed Loop’s Circular Plastics Fund, signaling continued capital support for sustainable polymer development. As recycled and circular plastics gain importance, battery felt manufacturers can explore eco-friendly fiber alternatives while serving expanding home energy storage installations, creating new revenue streams aligned with sustainability and distributed energy trends.

Latest Trends

Development of lightweight thermal solutions

A key trend shaping the Battery Felts Market is the development of lightweight thermal management solutions designed to improve battery efficiency and safety. Manufacturers are engineering felts with optimized density and enhanced heat resistance to meet evolving battery pack designs, particularly in electric mobility and stationary storage systems. Lightweight materials help reduce overall battery weight while maintaining performance standards.

Innovation in polymer feedstocks is also influencing product development. Citroniq raised $12M to advance a bio-based polypropylene plant in the United States, highlighting the movement toward sustainable raw materials. As bio-based and advanced polymers enter commercial production, battery felt manufacturers are positioned to integrate these materials into next-generation thermal solutions that balance performance, safety, and environmental responsibility.

Regional Analysis

Asia Pacific dominated Battery Felts Market with 46.7% share in 2024.

The Battery Felts Market demonstrates varied regional performance across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, reflecting differences in manufacturing concentration and battery production ecosystems. Asia Pacific emerged as the dominating region, accounting for 46.7% of the global market and generating USD 397.5 Mn in revenue. The region’s leadership is supported by its strong presence in automotive battery manufacturing and expanding industrial battery demand.

North America and Europe represent established markets driven by technological advancements and structured supply chains, while maintaining steady adoption across automotive and energy storage applications. Meanwhile, the Middle East & Africa and Latin America are witnessing gradual development, supported by increasing industrialization and emerging battery assembly activities.

Although these regions hold comparatively smaller shares, they contribute to overall market diversification. Overall, Asia Pacific’s 46.7% share and USD 397.5 Mn valuation clearly position it as the leading regional contributor in the global Battery Felts Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ahlstrom brings strong expertise in fiber-based materials and technical nonwovens, positioning itself as a reliable supplier for advanced filtration and insulation solutions used in battery systems. The company’s focus on engineered fiber solutions supports demand for high-performance felts designed for thermal management and structural stability in battery applications.

Mitsubishi Paper Mills leverages its long-standing capabilities in specialty paper and functional materials. Its strength lies in precision-engineered fiber technologies, which can be adapted for battery insulation and separator-related applications. The company’s technical knowledge and quality-driven manufacturing processes enhance its credibility in supplying materials that meet stringent automotive and industrial requirements.

Sappi Lanaken, known for high-quality paper and fiber products, adds value through its advanced material processing expertise. Its capability in developing customized fiber-based solutions aligns well with evolving battery component specifications. Collectively, these companies contribute technical depth, material innovation, and manufacturing reliability, reinforcing their strategic importance within the global Battery Felts Market ecosystem.

Top Key Players in the Market

- Ahlstrom

- Mitsubishi Paper Mills

- Sappi Lanaken

- schweitzer-Mauduit International

- Trelleborg

- Hollingsworth & Vose

Recent Developments

- In March 2025, Ahlstrom, a global specialty fiber materials company that makes advanced materials, including battery separators, launched an advanced Absorbent Glass Mat (AGM) battery separator platform. This new product enhances performance for batteries used in applications like automotive and industrial power systems by offering better electrolyte retention and durability.

- In April 2024, Mitsubishi Paper Mills received a grant for developing a coating solution for lithium-ion battery separators that uses inorganic particles. This innovation aims to improve separator safety and reduce internal resistance in lithium-ion batteries, supporting better battery performance and durability.

Report Scope

Report Features Description Market Value (2024) USD 851.2 Million Forecast Revenue (2034) USD 1,889.4 Million CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Format (Roll, Sheet, Custom), By Material (Polyester, Polypropylene, Acrylic, Glass Fiber), By End-User (Automotive, Industrial, Consumer Electronics, Energy Storage) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ahlstrom, Mitsubishi Paper Mills, Sappi Lanaken, schweitzer-Mauduit International, Trelleborg, Hollingsworth & Vose Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ahlstrom

- Mitsubishi Paper Mills

- Sappi Lanaken

- schweitzer-Mauduit International

- Trelleborg

- Hollingsworth & Vose