Global Baobab Ingredient Market Size, Share, And Business Benefits By Product Type (Baobab Pulp, Baobab Powder, Baobab Oil), By Source (Organic, Conventional), By Form (Capsule, Extract, Oil, Powder), By Application (Food (Functional Food, Dairy Products, Bakery and Confectionery, Others), Beverages (Alcoholic, Non-alcoholic), Cosmetics and Personal Care Products, Nutraceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150849

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

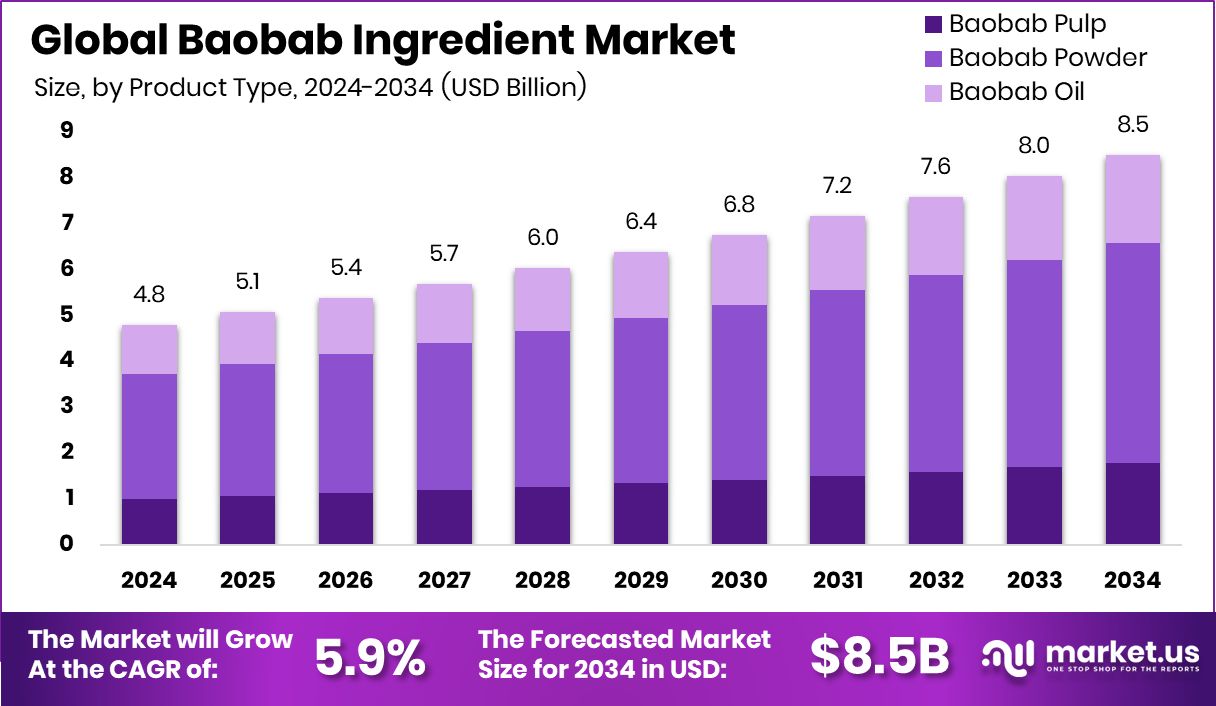

Global Baobab Ingredient Market is expected to be worth around USD 8.5 billion by 2034, up from USD 4.8 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034. Strong consumer demand for natural products drove growth across North America’s USD 2.2 billion market.

Baobab ingredient is derived from the fruit of the baobab tree, native to Africa. This fruit is naturally dry inside the shell and is rich in vitamin C, antioxidants, fiber, calcium, and magnesium. It has a tangy, citrus-like flavor and is commonly used in powdered form for health supplements, food and beverage products, and skincare formulations.

The growing interest in natural and plant-based products is a key factor driving the growth of the baobab ingredient market. As consumers become more health-conscious, they are actively seeking ingredients that offer both nutrition and wellness benefits. Baobab fits well into this trend, especially in functional foods, beverages, and clean-label supplements. Its appeal as a superfood with multiple health benefits makes it a preferred choice in new product formulations.

Demand for baobab is also rising in the personal care sector. The antioxidant and anti-inflammatory properties of baobab make it attractive for skincare and haircare applications. As more consumers turn toward botanical and sustainable beauty solutions, baobab oil and extracts are being incorporated into natural cosmetic lines.

Opportunities in the baobab market are also expanding due to ethical sourcing and sustainability efforts. Harvesting baobab supports rural communities in Africa, offering an economic incentive to preserve baobab trees. This adds social and environmental value, which resonates with ethical consumers. Brands tapping into these values can create deeper customer loyalty.

Key Takeaways

- Global Baobab Ingredient Market is expected to be worth around USD 8.5 billion by 2034, up from USD 4.8 billion in 2024, and grow at a CAGR of 5.9% from 2025 to 2034.

- Baobab powder dominates the market with a 56.4% share due to its high nutritional versatility.

- Conventional sources lead with 68.3%, reflecting broader availability and established farming practices.

- Powder form holds 51.1% market share, favored for easy use in food and health products.

- Food applications account for 27.5%, driven by the growing demand for natural and functional ingredients.

- The North American baobab ingredient market was valued at USD 2.2 billion.

By Product Type Analysis

Baobab powder dominates with 56.4%, favored for its nutritionally rich superfood appeal.

In 2024, Baobab Powder held a dominant market position in the By Product Type segment of the Baobab Ingredient Market, with a 56.4% share. This significant market presence is attributed to the powder’s versatility and wide range of applications across the food, beverage, and dietary supplement industries.

Baobab Powder’s naturally high content of vitamin C, fiber, and antioxidants makes it particularly appealing to health-conscious consumers seeking functional ingredients that support immunity, digestion, and overall wellness. The convenience of using the powder form in various formulations, including smoothies, energy bars, and wellness drinks, has contributed to its widespread adoption.

The dry, shelf-stable nature of Baobab Powder also supports easier transportation, storage, and incorporation into manufacturing processes, making it a preferred choice among producers and formulators.

In addition, its clean-label appeal aligns well with current consumer preferences for natural and minimally processed ingredients. As plant-based and superfood trends continue to influence consumer choices, Baobab Powder’s nutritional profile positions it as a standout product within this space.

By Source Analysis

Conventional sourcing leads at 68.3%, due to wider availability and lower production cost.

In 2024, Conventional held a dominant market position in the By Source segment of the Baobab Ingredient Market, with a 68.3% share. This strong performance is primarily driven by its widespread availability and cost-effectiveness compared to alternative sourcing options.

Conventional baobab ingredients are more readily accessible through established supply chains, allowing manufacturers to scale production efficiently while maintaining competitive pricing. The stability in supply and pricing associated with conventional sourcing has encouraged its use across a broad range of product applications, particularly in the food and beverage industry.

The high market share also reflects the growing demand for baobab in mainstream products, where conventional sourcing remains a practical choice for large-scale production. It supports consistent quality and volume, which are critical for meeting increasing consumer demand. Additionally, many producers favor conventional sources due to the straightforward certification and procurement processes, enabling faster time-to-market for new product launches.

The dominance of conventional sourcing within the baobab ingredient market highlights its integral role in meeting the current commercial and operational needs of manufacturers while maintaining product accessibility for consumers worldwide.

By Form Analysis

Powder form holds 51.1% and is popular for easy blending in foods and beverages.

In 2024, Powder held a dominant market position in the By Form segment of the Baobab Ingredient Market, with a 51.1% share. This leading position is largely attributed to the powder form’s adaptability, stability, and ease of use in a wide range of end products.

Baobab powder is particularly favored for its fine texture, long shelf life, and ability to blend seamlessly into various formulations without altering the product’s consistency or taste profile. These characteristics make it highly suitable for incorporation into functional foods, nutritional supplements, beverages, and health products.

The powdered form also allows for accurate dosing and simplified handling during manufacturing, which enhances production efficiency. Its portability and convenience appeal to both industrial users and end consumers, especially those seeking health-oriented, natural ingredients in everyday consumables.

As demand for superfood ingredients grows, the practicality of the powder form gives it a clear advantage in meeting both commercial needs and consumer expectations. The 51.1% market share reflects the strong preference for this form across industries, solidifying its position as the most widely utilized and commercially viable format in the baobab ingredient sector during the year.

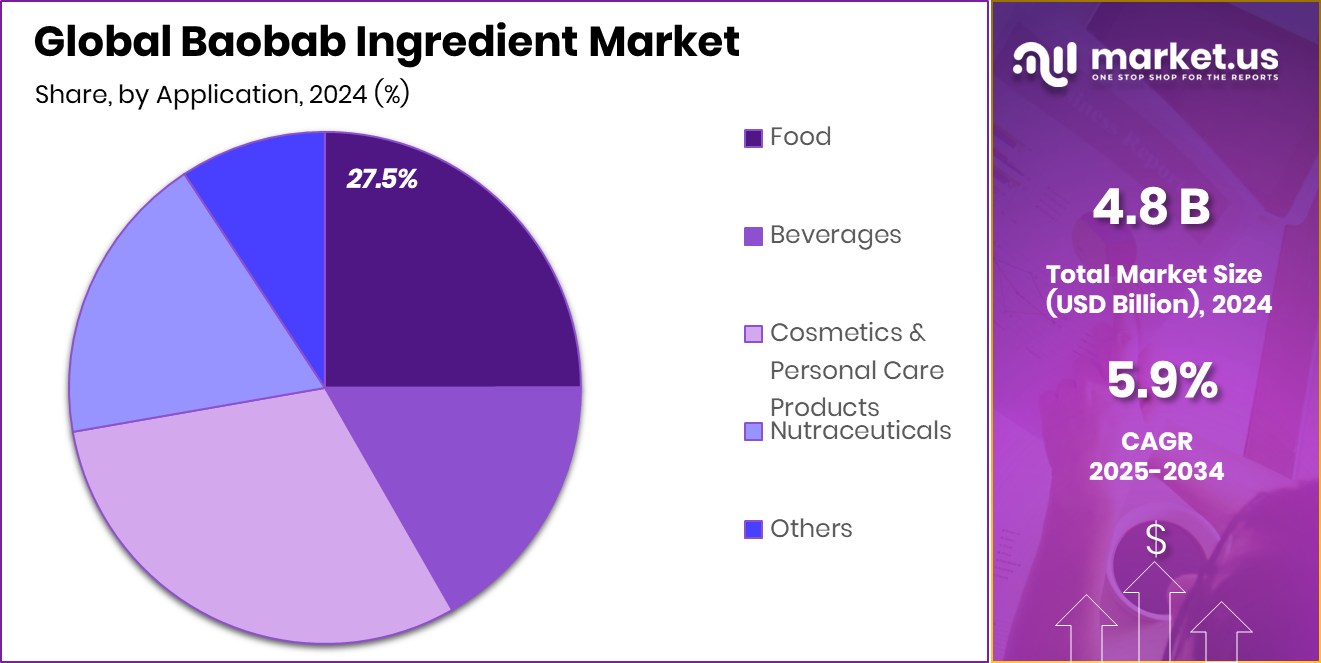

By Application Analysis

Food applications lead with 27.5%, driven by the growing demand for healthy natural ingredients.

In 2024, Food held a dominant market position in the By Application segment of the Baobab Ingredient Market, with a 27.5% share. This leading share is driven by the increasing incorporation of baobab ingredients into a variety of food products, such as snacks, baked goods, cereals, and energy bars.

The growing consumer interest in nutrient-rich, natural food items has positioned baobab as an attractive ingredient due to its high vitamin C content, dietary fiber, and antioxidant properties. These health benefits align well with current food trends focused on wellness and clean-label consumption.

The adaptability of baobab in different culinary formats further supports its strong presence in the food segment. It offers a subtle, tangy flavor that complements both sweet and savory applications, making it a versatile addition to modern food innovations.

Manufacturers are increasingly leveraging their functional properties to enhance nutritional value while also tapping into consumer curiosity about unique, exotic ingredients. The 27.5% market share underscores the growing reliance on baobab in the development of health-oriented food products, reflecting its strong alignment with evolving dietary habits and its established role as a natural, functional food ingredient.

Key Market Segments

By Product Type

- Baobab Pulp

- Baobab Powder

- Baobab Oil

By Source

- Organic

- Conventional

By Form

- Capsule

- Extract

- Oil

- Powder

By Application

- Food

- Functional Food

- Dairy Products

- Bakery and Confectionery

- Others

- Beverages

- Alcoholic

- Non-alcoholic

- Cosmetics and Personal Care Products

- Nutraceuticals

- Others

Driving Factors

Rising Demand for Natural and Healthy Products

One of the top driving factors of the baobab ingredient market is the increasing consumer preference for natural and healthy food and personal care products. People today are more aware of what they eat and apply to their skin. They are actively looking for ingredients that are not only natural but also offer real health benefits.

Baobab is rich in vitamin C, fiber, and antioxidants, which makes it attractive for those wanting to boost immunity, improve digestion, and support overall wellness. Its clean-label appeal and superfood status also make it a popular choice. As more consumers move away from artificial additives and processed products, baobab stands out as a trustworthy, beneficial, and easy-to-use natural ingredient

Restraining Factors

Limited Awareness Among Consumers About Baobab Benefits

One key factor holding back the growth of the baobab ingredient market is that many consumers still don’t know what baobab is or how it can help them. Unlike more common superfoods like chia or turmeric, baobab is still unfamiliar to a large part of the global population. This lack of awareness means that even though the ingredient is healthy and natural, people are not actively looking for it or choosing products that contain it.

Without strong marketing or education, baobab struggles to reach its full market potential. As a result, companies must invest more in spreading knowledge about baobab’s health benefits, uses, and origins to build trust and increase consumer interest in products containing this ingredient.

Growth Opportunity

Expansion into New International Functional Food Markets

As more countries embrace health-focused eating, there’s a big opportunity for baobab to enter new food markets around the world. Its rich nutritional benefits—high vitamin C, fiber, and antioxidants—make it a great fit for functional foods and beverages. By collaborating with local food producers and brands, baobab could be introduced into popular snacks, drinks, and breakfast items tailored to regional tastes.

Educational initiatives, like cooking demos or product sampling at wellness events, can boost consumer confidence and taste familiarity. Exporting responsibly sourced baobab powder could also appeal to consumers who care about environmental and social impact. With the right partnerships and messaging, baobab has the potential to become a well-loved, everyday ingredient in kitchens and grocery stores worldwide.

Latest Trends

Growing Use of Baobab in Skincare Products

A leading trend in the baobab ingredient market is its increasing use in skincare and beauty products. People are now more interested in natural and plant-based cosmetics that are gentle and safe for the skin. Baobab oil, extracted from the seeds, is rich in antioxidants, vitamins A, D, E, and essential fatty acids. These nutrients help moisturize the skin, improve elasticity, and reduce signs of aging.

Because of this, more skincare brands are adding baobab oil to products like creams, serums, and hair treatments. Consumers are also drawn to the ingredient’s African origin and its sustainable, ethical sourcing. This trend is likely to grow as natural beauty continues to be a top choice for health-conscious buyers.

Regional Analysis

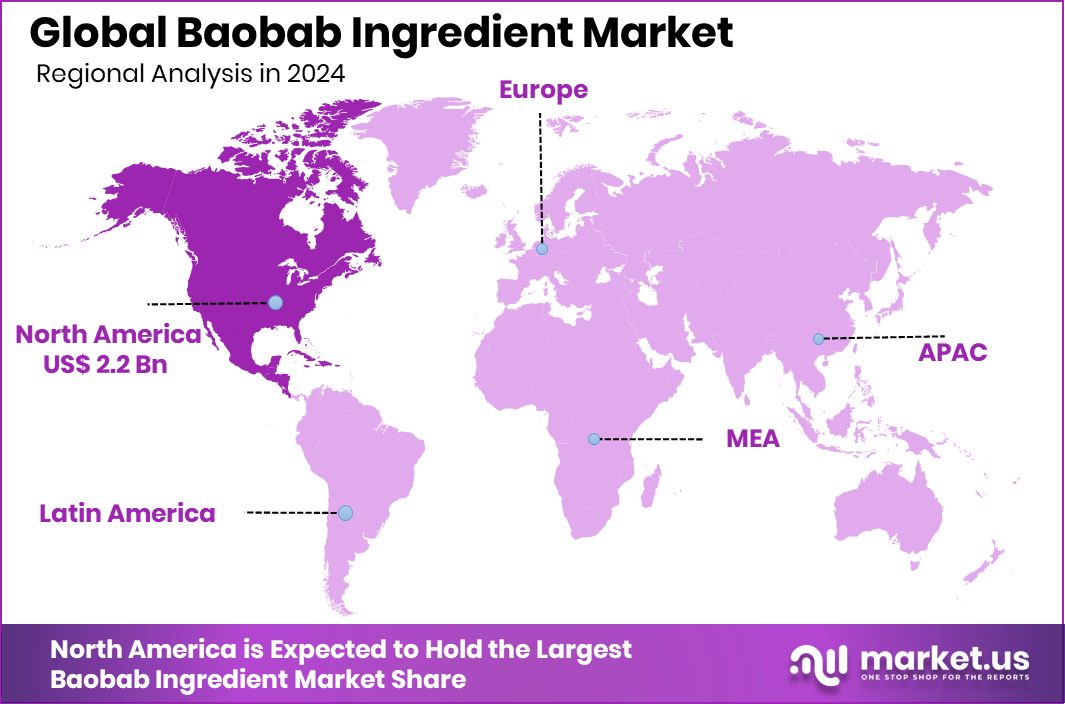

In 2024, North America held a 46% share of the baobab ingredient market.

In 2024, North America dominated the global baobab ingredient market with a commanding 46% share, valued at USD 2.2 billion. This strong position reflects the region’s growing demand for functional, natural, and clean-label ingredients, particularly within the food, beverage, and personal care sectors.

The popularity of superfoods and plant-based nutrition has significantly driven product innovation involving baobab across the U.S. and Canada. Europe followed as a key market, driven by increasing consumer awareness around sustainable and health-oriented products. The Asia Pacific region is witnessing steady growth as interest in natural wellness ingredients continues to rise among health-conscious consumers in countries like Japan, Australia, and parts of Southeast Asia.

The Middle East & Africa region, while still developing in terms of market size, plays a crucial role as the primary source of raw baobab, which supports both local economies and global exports. Latin America is emerging gradually, supported by an increasing shift toward organic and natural dietary preferences.

While all regions present growth potential, North America remains the leading force in terms of market value and adoption, supported by established supply chains, product awareness, and a strong base of health-driven consumers across industries utilizing baobab ingredients.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Aduna Limited, Afriplex, and B’Ayoba played a significant role in shaping the global baobab ingredient market through product innovation, community-focused sourcing, and value-added applications.

Aduna Limited has positioned itself as a purpose-driven brand, widely recognized for bringing African superfoods like baobab into mainstream wellness markets. The company’s approach combines consumer education with ethical sourcing, empowering rural communities in Africa. This socially responsible model not only strengthens its brand image but also appeals to consumers seeking transparency and impact through their purchases.

Afriplex, on the other hand, brings a strong scientific and formulation focus. Known for developing botanical extracts and health-focused ingredients, Afriplex integrates baobab into its wider portfolio for nutraceutical and functional food applications. The company’s strength lies in its technical expertise and ability to meet quality and regulatory standards across international markets. This positions Afriplex well for B2B collaborations and custom formulations.

B’Ayoba has built a solid reputation as a leading supplier of wild-harvested baobab products. Their focus on sustainability, traceability, and fair trade sourcing supports long-term growth and international demand. B’Ayoba’s strong ties with harvesting communities give them a reliable supply chain, which is critical as demand continues to rise.

Top Key Players in the Market

- Aduna Limited

- Afriplex

- B’Ayoba

- EcoProducts

- Halka B. Organics

- Indigo Herbs Ltd.

- Nexira SAS

- Organic Burst UK Ltd.

- Powbab Inc.

Recent Developments

- In May 2024, Nexira presented its baobab‑based solutions, including the inavea™ blend and organic baobab pulp powder, at Vitafoods Europe (Booth H4 F108). They highlighted clean‑label, prebiotic, and certified organic properties to global supplement manufacturers.

- In April 2024, Aduna introduced a lineup of five functional Superfood Blends featuring 29–45% baobab content. Packaged in recyclable, user-friendly tubs, these blends combine baobab with nine other plant-based ingredients, earning certifications like B Corp, FairWild, and People & Planet First. They target wellness-focused consumers and support strong growth in sales and social impact.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Billion Forecast Revenue (2034) USD 8.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Baobab Pulp, Baobab Powder, Baobab Oil), By Source (Organic, Conventional), By Form (Capsule, Extract, Oil, Powder), By Application (Food (Functional Food, Dairy Products, Bakery and Confectionery, Others), Beverages (Alcoholic, Non-alcoholic), Cosmetics and Personal Care Products, Nutraceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aduna Limited, Afriplex, B’Ayoba, EcoProducts, Halka B. Organics, Indigo Herbs Ltd., Nexira SAS, Organic Burst UK Ltd., Powbab Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aduna Limited

- Afriplex

- B’Ayoba

- EcoProducts

- Halka B. Organics

- Indigo Herbs Ltd.

- Nexira SAS

- Organic Burst UK Ltd.

- Powbab Inc.