Global Bacon Market Size, Share, And Business Benefits By Product Type (Standard Bacon, Ready-to-Eat Bacon), By Meat Type (Pork, Beef, Others), By Cut Type (Sliced Bacon, Bacon Bits/Crumbled Bacon, Bacon Rashers/Whole Slabs, Pre-Cooked Bacon), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty and Butcher Shops, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154187

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

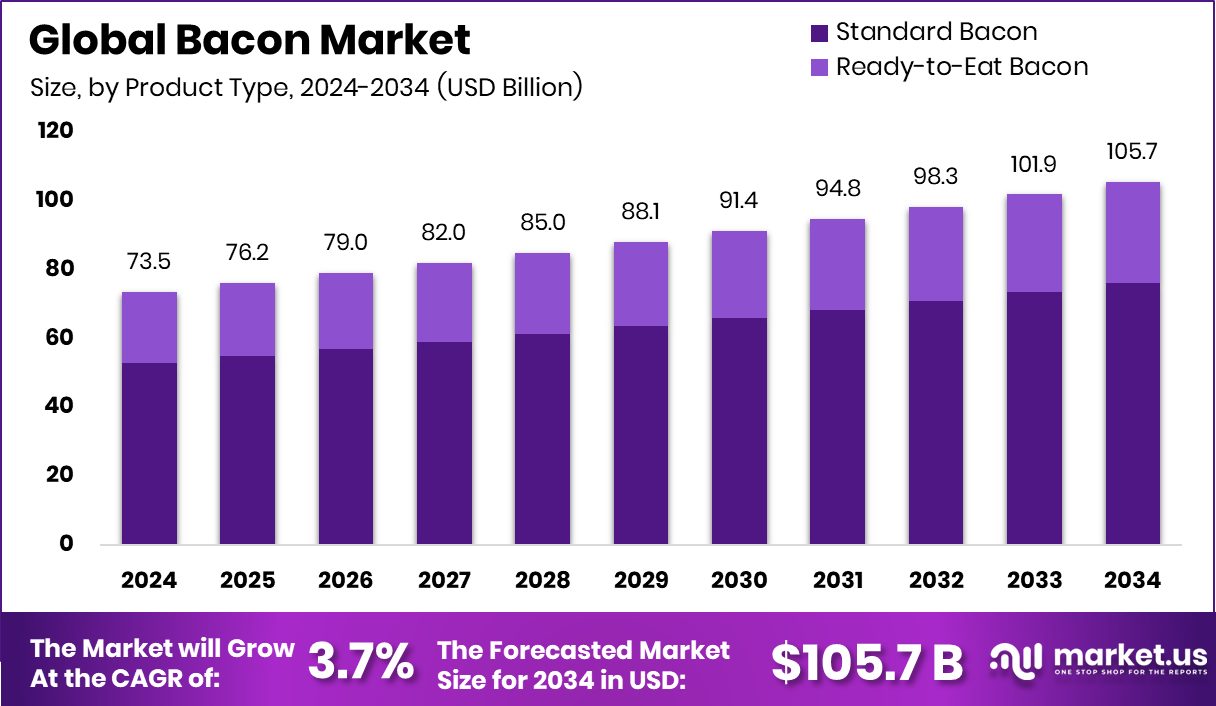

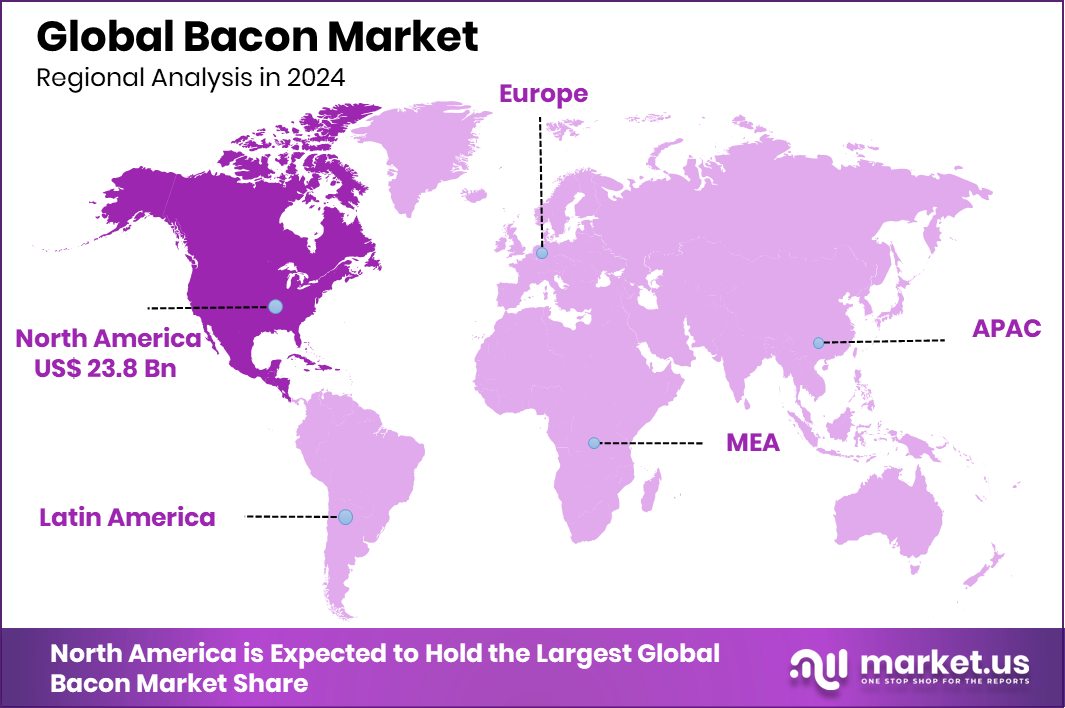

The Global Bacon Market is expected to be worth around USD 105.7 billion by 2034, up from USD 73.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. With 32.4% market share, North America dominates global bacon sales and value.

Bacon is a type of salt-cured meat typically made from pork belly or back cuts. It is known for its rich flavor, crispy texture when cooked, and distinct aroma. Bacon is widely consumed across various cultures, often served as a breakfast item or used as a flavorful addition to burgers, salads, and sandwiches. It is prepared through curing, smoking, or drying processes and comes in different varieties depending on regional preferences and meat cuts. Notably, innovation in plant-based alternatives is gaining traction, as Ecovative introduced mushroom bacon after securing $7 million in seed investment.

The bacon market refers to the global trade and consumption of bacon products across foodservice, retail, and industrial segments. It includes fresh, smoked, and precooked bacon offered in various packaging formats. The market caters to both household and commercial demand, driven by changing dietary preferences, protein consumption, and fast-paced lifestyles. French vegan bacon firm backed by Natalie Portman raised a record-breaking $28.3 million to meet growing plant-based demand, while Seaweed Bacon Startup secured $3 million for growth and development.

The expansion of the bacon market can be attributed to growing consumer preference for high-protein, indulgent food options. Urbanization and the increasing number of quick-service restaurants have also played a key role in boosting bacon consumption. Additionally, technological improvements in meat processing and packaging are extending shelf life and widening distribution. To meet rising demand, MyForest Foods raised $11 million to expand mycelium bacon as demand surged past rivals.

The demand for bacon continues to rise due to its strong cultural presence in Western diets and its versatility in meal preparation. The rising number of dual-income households and time constraints has increased reliance on quick-cook items like bacon, further accelerating retail and foodservice sales. MyForest Foods also secured $15 million in a Series A extension to scale its mycelium pork and jerky production. Additionally, Ecovative received an $11 million investment to accelerate the growth of its mycelium-based bacon, and the Canadian government announced $13 million in pre-election funding to support bacon initiatives.

Key Takeaways

- The Global Bacon Market is expected to be worth around USD 105.7 billion by 2034, up from USD 73.5 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- In 2024, Standard Bacon led the Bacon Market with a 72.1% share due to wide preference.

- Pork remained the primary meat type in the Bacon Market, capturing 86.2% share in 2024.

- Sliced Bacon dominated the Cut Type segment in 2024, accounting for 67.4% of the total market share.

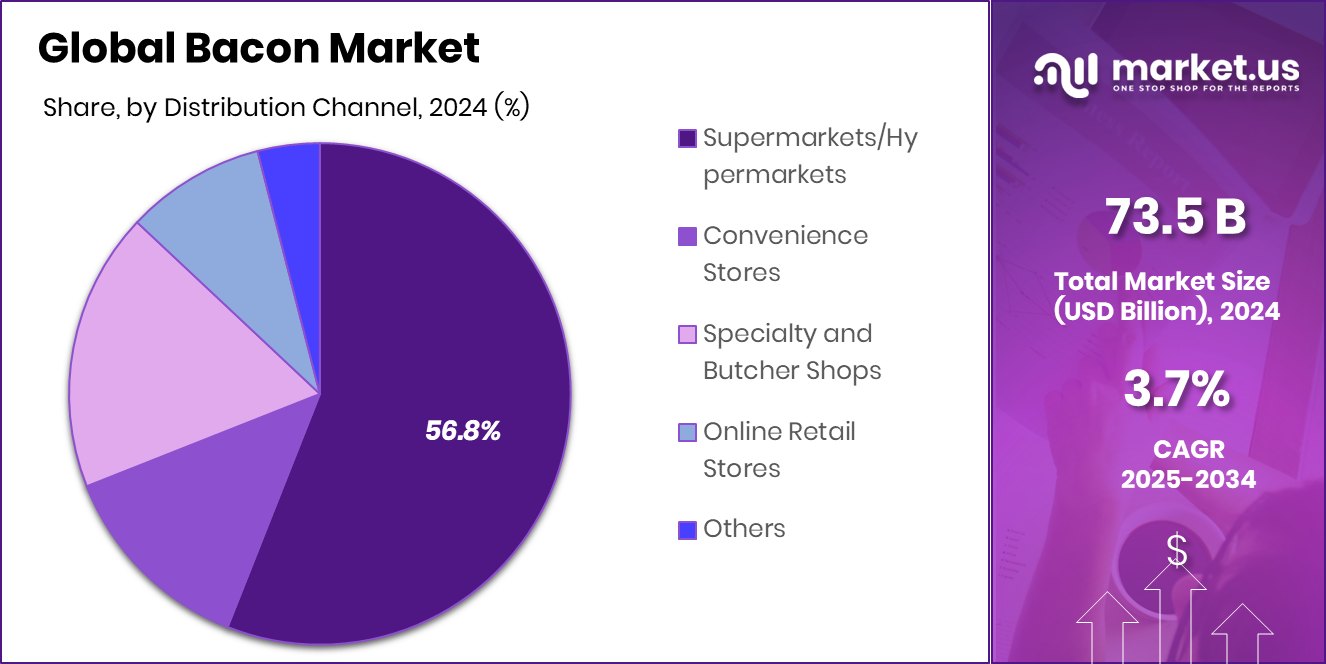

- Supermarkets/Hypermarkets held a leading 56.8% share in the Bacon Market’s distribution channel in 2024.

- Strong pork consumption in North America drives bacon demand to $23.8 billion.

By Product Type Analysis

Standard Bacon dominates the Bacon Market with a 72.1% share.

In 2024, Standard Bacon held a dominant market position in the By Product Type segment of the Bacon Market, with a 72.1% share. This significant share reflects the continued consumer preference for traditional bacon products that offer familiar taste, texture, and preparation methods. Standard bacon remains a staple in both household and foodservice menus due to its wide availability and versatility in culinary use. It is commonly used in breakfast dishes, sandwiches, burgers, and as a flavor enhancer in various recipes.

The strong performance of standard bacon is also supported by established consumption patterns in key markets where pork-based products are widely accepted. Consumers continue to favor the consistency, taste, and affordable pricing of standard bacon, which aligns well with everyday cooking habits. Moreover, retail shelves continue to be dominated by standard cuts, especially in pre-sliced and bulk pack formats that suit both individual and institutional buyers.

The 72.1% market share underscores the stability and resilience of this segment, even as niche variants gain attention. Its dominance is further reinforced by long-standing distribution networks, brand recognition, and habitual consumption behaviors. Moving forward, standard bacon is expected to retain its lead due to its entrenched role in consumer diets and continued high-volume demand.

By Meat Type Analysis

Pork-based bacon leads the market, holding an 86.2% share.

In 2024, Pork held a dominant market position in the By Meat Type segment of the Bacon Market, with an 86.2% share. This overwhelming share highlights pork’s traditional and cultural relevance in bacon production, especially in countries where it remains the primary source for curing and processing bacon. Pork bacon is widely recognized for its balanced fat-to-meat ratio, rich flavor, and crisp texture when cooked, making it the preferred choice among consumers across both retail and foodservice channels.

The 86.2% share reflects strong consumer loyalty to pork-based bacon, supported by its long-standing availability and consistent product quality. Pork bacon continues to lead in various formats, including sliced, pre-cooked, and block options, serving a broad range of culinary applications from breakfast dishes to restaurant-grade entrées. Its dominant position is further reinforced by favorable livestock availability and established supply chains that ensure steady production and distribution across markets.

Furthermore, pork bacon’s widespread acceptance is rooted in traditional cooking practices and flavor profiles that resonate strongly with consumers. This sustained demand has helped the pork segment maintain its leadership in the bacon market. The segment’s continued strength suggests enduring consumer preference and market stability moving forward.

By Cut Type Analysis

Sliced Bacon accounts for 67.4% of total bacon sales.

In 2024, Sliced Bacon held a dominant market position in the By Cut Type segment of the Bacon Market, with a 67.4% share. This strong market presence reflects the high consumer demand for convenience, portion control, and ready-to-cook formats. Sliced bacon is widely preferred in both household and commercial kitchens due to its ease of use, consistent thickness, and faster cooking time compared to other cuts.

The 67.4% share also indicates that sliced bacon continues to be the most accessible format available across supermarkets, delis, and foodservice suppliers. Its uniformity and packaging options appeal to a broad range of consumers, from individuals preparing quick breakfasts to restaurants and cafés seeking efficiency in food prep. Moreover, pre-sliced options offer better visual appeal and portion accuracy, which enhances consumer confidence in product quality.

The dominance of sliced bacon in the cut type segment is further sustained by its strong presence in retail promotions and bulk offerings. Its popularity across global cuisines and recipes reinforces the segment’s consistent performance. The widespread adoption of this cut type underlines its practicality and strong foothold in the bacon market.

By Distribution Channel Analysis

Supermarkets/Hypermarkets capture a 56.8% share in bacon distribution.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Bacon Market, with a 56.8% share. This leadership can be attributed to their widespread accessibility, extensive product variety, and the convenience of one-stop shopping. These large-format retail outlets have become the primary choice for consumers purchasing bacon, offering both branded and private-label options in chilled and packaged forms.

The 56.8% share highlights the effectiveness of supermarkets and hypermarkets in meeting routine consumer demand for fresh and processed meat products. Their ability to maintain cold chain logistics, offer promotional discounts, and provide visibility to a wide range of bacon products significantly influences buyer behavior. Consumers also benefit from in-store sampling, clear labeling, and packaging innovations, making selection easier and more informed.

Furthermore, supermarkets and hypermarkets have established strong supplier relationships that ensure a steady inventory and consistent quality. Their prominence in both urban and semi-urban areas supports frequent purchases and impulse buying behavior, particularly for staple protein products like bacon. The segment’s commanding position is expected to remain strong due to high footfall, trust in product handling standards, and the continued integration of loyalty programs that reinforce repeat purchases.

Key Market Segments

By Product Type

- Standard Bacon

- Ready-to-Eat Bacon

By Meat Type

- Pork

- Beef

- Others

By Cut Type

- Sliced Bacon

- Bacon Bits/Crumbled Bacon

- Bacon Rashers/Whole Slabs

- Pre-Cooked Bacon

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty and Butcher Shops

- Online Retail Stores

- Others

Driving Factors

Rising Protein Consumption Boosting Global Bacon Demand

One of the main driving factors of the bacon market is the rising global consumption of protein-rich foods. Consumers are becoming more health-aware and are looking for convenient ways to include protein in their diets. Bacon, being a rich source of animal protein, fits this demand, especially among non-vegetarian populations. It is widely used not just in breakfasts but also in sandwiches, salads, snacks, and gourmet dishes.

As fitness trends grow and people seek muscle-building foods, bacon has found a regular spot in many households. Additionally, the growing popularity of high-protein diets like keto and paleo has further pushed bacon consumption upward, especially in developed markets where bacon is already part of traditional eating habits.

Restraining Factors

Health Concerns Over Fat And Sodium Content

One key factor holding back the bacon market is the growing concern about its high fat and sodium levels. Many health-conscious consumers are becoming more cautious about eating processed meats due to links with heart disease, high blood pressure, and obesity. Bacon is often seen as unhealthy because it contains saturated fats and preservatives like nitrates, which are also being questioned for their health impact.

As more people shift toward balanced diets with less processed food, the demand for traditional bacon may slow down. Additionally, dietary guidelines in many countries now recommend limiting processed meat intake, further influencing consumer choices. These health-related concerns are likely to restrict the market’s growth, especially in urban areas with higher awareness.

Growth Opportunity

Growing Demand For Low-Fat Bacon Products

A major growth opportunity in the bacon market lies in the rising demand for low-fat and healthier bacon options. As more consumers become health-conscious, they are actively looking for products that offer the same taste with fewer calories, less fat, and reduced sodium. This shift in preference opens doors for manufacturers to develop and promote lean bacon cuts, turkey bacon, or reduced-salt versions.

These options appeal to individuals managing weight, cholesterol, or following special diets. By using cleaner ingredients and highlighting health benefits on packaging, producers can attract a wider audience. The success of low-fat snacks and meat alternatives in recent years suggests strong potential for similar innovation in bacon, especially in health-driven and urban markets.

Latest Trends

Premium and Artisan Bacon Varieties Gaining Consumer Interest

In recent times, a clear trend in the bacon market is the growing popularity of premium and artisan bacon varieties. Consumers are increasingly interested in bacon products that offer unique flavors, high-quality ingredients, and artisanal craftsmanship. Varieties such as hardwood-smoked bacon, applewood-cured bacon, or small-batch specialty bacon are favored by shoppers seeking richer taste and a gourmet experience.

These options often come from heritage breeds or feature specialty curing methods, which elevate them beyond standard products. The premium positioning also attracts food lovers who are willing to pay slightly more for perceived quality and distinctiveness. This trend reflects a consumer shift toward indulgent yet authentic eating experiences and opens opportunities for producers to innovate and differentiate in a crowded market.

Regional Analysis

North America leads the bacon market, accounting for a 32.4% share and a value of USD 23.8 billion.

In 2024, North America held a dominant position in the global bacon market, capturing a 32.4% share and generating USD 23.8 billion in revenue. The region’s leadership is supported by high per capita meat consumption, especially pork-based products, and a deeply rooted bacon-eating culture across households and foodservice sectors.

Bacon remains a staple in traditional American breakfasts and is also widely used in fast-food, ready-to-eat, and restaurant offerings, contributing to sustained demand. Supermarkets and hypermarkets in North America continue to be key distribution channels, offering a wide range of standard and flavored bacon options.

Other regions such as Europe, Asia Pacific, the Middle East & Africa, and Latin America are also witnessing steady growth, driven by rising protein intake and changing dietary preferences. However, their market shares remain lower compared to North America due to regional dietary restrictions, cultural food habits, and lower pork consumption in some areas.

While these regions show potential, North America’s established supply chains, strong retail infrastructure, and consumer familiarity with pork-based products solidify its position as the leading regional market. The high value and volume demand from this region continue to make it a major contributor to the overall growth and profitability of the global bacon industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Hormel Foods Corporation maintained its strong influence in bacon through branded growth and foodservice expansion. While its overall retail volumes declined—driven by specific weakness in turkey and center‑store items—the company’s bacon offerings (notably its Black Label bacon and Bacon 1 cooked lines) posted net sales growth and helped to offset broader retail declines. Foodservice volume and net sales increased by 2% and 7% respectively, across premium proteins, including bacon, though segment profit declined slightly due to higher overhead costs and SG&A expenditures. Fiscal 2024 finished with annual net sales of USD 11.9 billion and an operating income of USD 1.1 billion, achieving improved margins and a record operating cash flow

Tyson Foods Inc., ranked among the world’s largest meat producers, holds a significant position in processing and marketing pork-based proteins, including bacon, serving retail grocers and foodservice channels globally. Tyson’s scale in pork, beef and chicken processing underpins its bacon volume supply and distribution advantage. The company’s extensive processing footprint and brand portfolio allow it to sustain competitive supply chains across key markets.

WH Group Limited, via its Smithfield Foods subsidiary, continues to exercise considerable influence in packaged meat and pork processing. WH Group remains a central market anchor with dominant control over Smithfield. Anton its recent strategy to partially relist Smithfield Foods aimed at increasing capital, expansion, and distribution in the U.S. and Mexico packaged‑meat business. The packaged meats division has doubled its operating margin to around 15% in early 2024, compared to low-margin fresh pork segments. WH Group’s ownership structure ensures export and operational linkages that reinforce global bacon market presence.

Top Key Players in the Market

- Hormel Foods Corporation

- Tyson Foods Inc.

- WH Group Limited

- Fresh Mark Inc.

- Karro Food Group Limited

- The Oscar Mayer Company

- Niman Ranch

- Tonnies Lebensmittel GmbH & Co. KG

- Farmland Foods, Inc.

- Hormel Foods Corporation

Recent Developments

- In March 2024, the company launched Hormel Black Label Ranch Bacon, combining savory bacon with ranch seasoning. Offered for a limited time nationwide, this product was designed to appeal to flavor-seeking consumers, particularly Millennials and Gen Z.

- In January 2024, Tyson Foods opened a new $355 million food production plant in Bowling Green, Kentucky, to support increased output of its iconic Jimmy Dean® and Wright® Brand bacon, both for retail and foodservice markets.

Report Scope

Report Features Description Market Value (2024) USD 73.5 Billion Forecast Revenue (2034) USD 105.7 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standard Bacon, Ready-to-Eat Bacon), By Meat Type (Pork, Beef, Others), By Cut Type (Sliced Bacon, Bacon Bits/Crumbled Bacon, Bacon Rashers/Whole Slabs, Pre-Cooked Bacon), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty and Butcher Shops, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hormel Foods Corporation, Tyson Foods Inc., WH Group Limited, Fresh Mark Inc., Karro Food Group Limited, The Oscar Mayer Company, Niman Ranch, Tonnies Lebensmittel GmbH & Co. KG, Farmland Foods, Inc., Hormel Foods Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hormel Foods Corporation

- Tyson Foods Inc.

- WH Group Limited

- Fresh Mark Inc.

- Karro Food Group Limited

- The Oscar Mayer Company

- Niman Ranch

- Tonnies Lebensmittel GmbH & Co. KG

- Farmland Foods, Inc.

- Hormel Foods Corporation