Global Automotive Steel Wheels Market By Vehicle Type (Passenger Vehicle, Heavy Commercial Vehicle, Light Commercial Vehicle), By Application (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141184

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

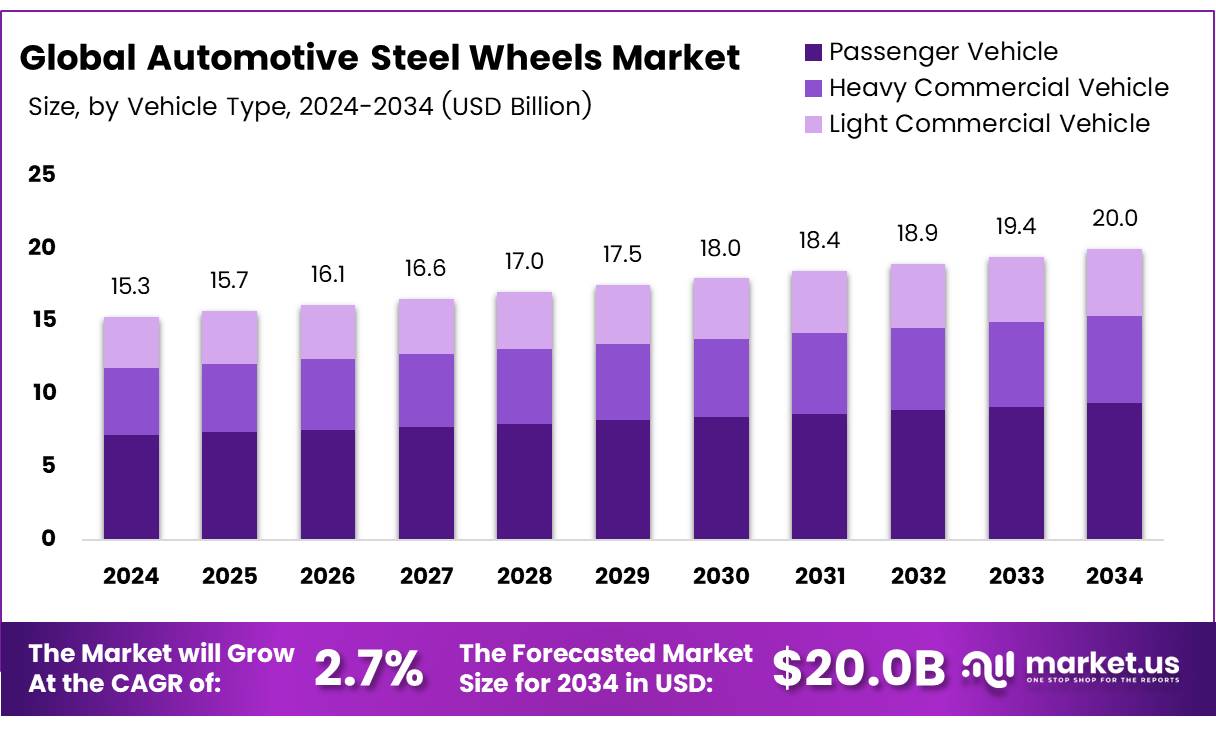

The Global Automotive Steel Wheels Market size is expected to be worth around USD 20.0 Billion by 2034, from USD 15.3 Billion in 2024, growing at a CAGR of 2.7% during the forecast period from 2025 to 2034.

The automotive steel wheels market encompasses the production, distribution, and consumption of steel wheels used in vehicles. Steel wheels are a critical component in the automotive industry, providing strength, durability, and cost-effectiveness, especially in entry-level and mid-range vehicles. They are preferred for their robustness and ability to withstand heavy usage in various driving conditions.

The market is driven by the growing demand for affordable, high-performance wheels across a wide range of vehicle types, from passenger cars to commercial vehicles. According to IMIProducts, the average weight of a steel wheel is approximately 78 lbs. This provides superior strength, although it is heavier than aluminum wheels. As noted by RealTruck, a steel wheel can weigh around 2.5 to 3 times more than an aluminum wheel of the same size, which makes it a more economical option, especially in mass-market vehicles.

The automotive steel wheels market has witnessed steady growth due to the ongoing demand for cost-effective, reliable, and durable wheel solutions. This growth can be attributed to the expanding automotive industry, particularly in developing countries, where the demand for affordable vehicles is rising.

Additionally, the increasing adoption of electric vehicles (EVs) presents a new opportunity for steel wheels, given the need for lightweight, durable components that can support the unique requirements of EVs.

Government investments in infrastructure development, especially in emerging markets, have further accelerated the demand for commercial and passenger vehicles, positively impacting the steel wheels market.

Moreover, various regulatory frameworks have been established to ensure the quality and environmental sustainability of automotive parts. The shift towards reducing the carbon footprint in the automotive industry has resulted in an increase in government funding and incentives aimed at promoting sustainable manufacturing practices.

Regulations also govern the recyclability of materials used in the production of steel wheels, making it an attractive choice in line with global sustainability goals.

As per IndexBox, while the price range for aluminum rims typically starts at $50 to $100 per rim for basic models, steel wheels remain a more economical choice for manufacturers targeting cost-conscious consumers. This pricing dynamic reflects the competitive advantage of steel wheels, contributing to their dominant position in the market, especially in the mass-market automotive segment.

Key Takeaways

- The global automotive steel wheels market size is projected to reach USD 20.0 billion by 2034, growing at a CAGR of 2.7%.

- The Passenger Vehicle segment dominated the market in 2024 with a 46.2% share, driven by high production volumes and global demand.

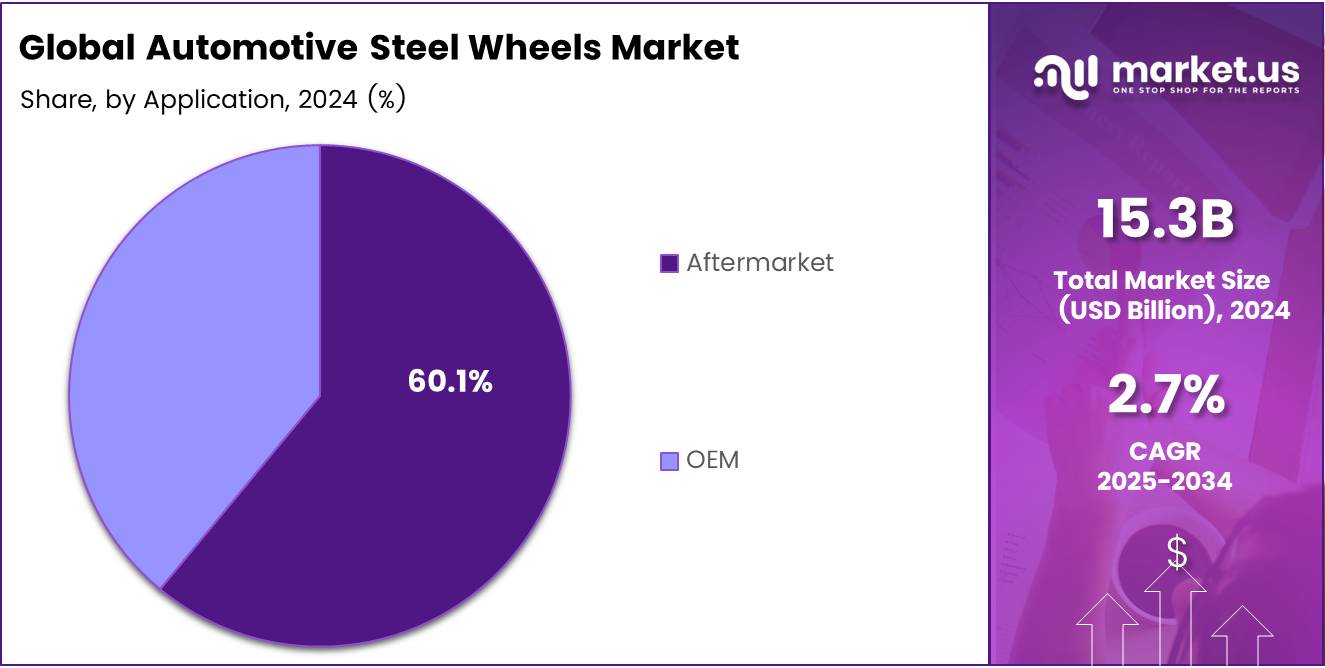

- The aftermarket segment held a significant 60.1% market share in 2024, due to increasing demand for cost-effective and durable replacement wheels.

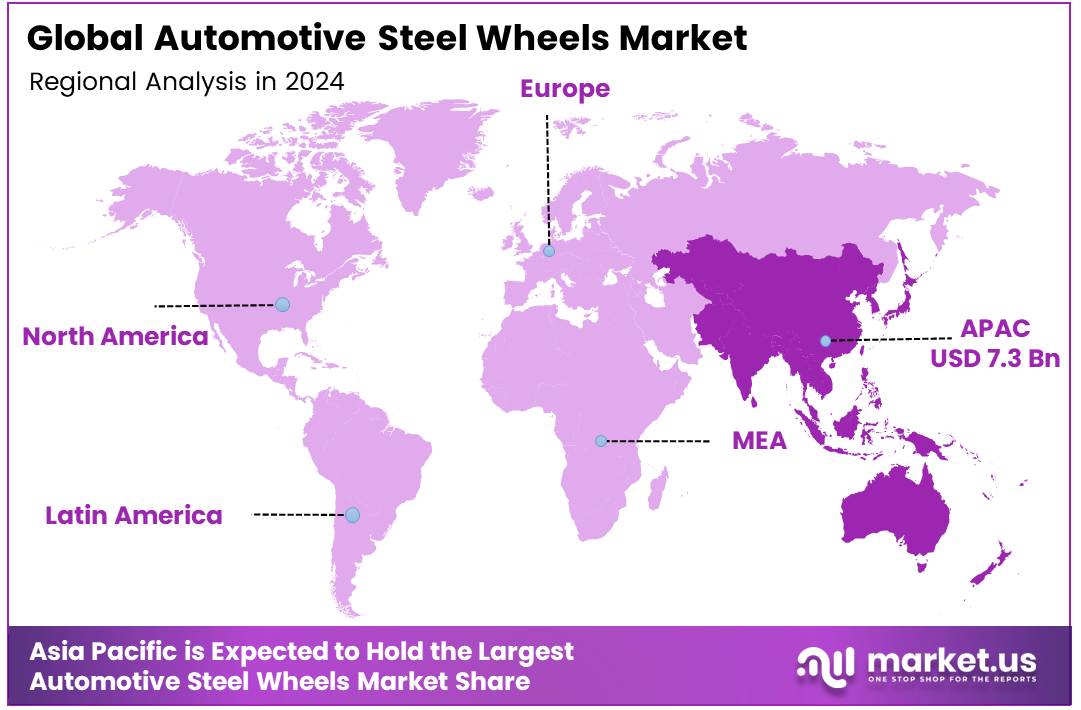

- Asia Pacific is the leading region in the market, accounting for 48.2% of the market share, valued at approximately USD 7.3 billion.

Vehicle Type Analysis

Passenger Vehicles dominate with a 46.2% market share in the Automotive Steel Wheels segment in 2024

In 2024, the Passenger Vehicle segment held a dominant position in the By Vehicle Type analysis of the Automotive Steel Wheels Market, commanding a 46.2% share. This significant share can be attributed to the high volume of passenger vehicles produced globally, coupled with their ongoing demand in emerging and developed markets.

The increased production of fuel-efficient and compact vehicles further contributes to this segment’s growth, alongside the automotive industry’s focus on cost-effective and durable steel wheel solutions.

The Heavy Commercial Vehicle (HCV) segment, while a critical part of the automotive sector, accounted for a smaller share compared to passenger vehicles. However, it is expected to grow steadily, driven by the expansion of logistics, construction, and industrial applications. Heavy-duty vehicles typically require robust, high-performance steel wheels, contributing to a stable demand for specialized solutions within this category.

Light Commercial Vehicles (LCVs) also hold a notable market share, supported by their versatility in business and urban transportation. Although smaller than passenger vehicles, LCVs are essential for e-commerce, last-mile delivery, and urban freight, indicating a sustained, albeit modest, growth trajectory in the coming years.

Application Analysis

Aftermarket Dominates Automotive Steel Wheels Market with 60.1% Share in 2024, Driven by Cost-Effectiveness and Durability

In 2024, the aftermarket segment held a dominant position in the global automotive steel wheels market, capturing a substantial 60.1% share. This dominance can be attributed to the increasing preference for cost-effective and durable replacement wheels, as well as the rising trend of vehicle customization.

Aftermarket wheels are often perceived as more affordable alternatives to Original Equipment Manufacturer (OEM) products, providing consumers with a wide range of styles and finishes to match specific vehicle needs. Additionally, the growing vehicle fleet and longer vehicle lifespans contribute significantly to the continued demand for aftermarket steel wheels.

OEM steel wheels are typically designed and manufactured by the vehicle manufacturer, ensuring high-quality standards and compatibility. However, the relatively higher cost and limited design flexibility compared to aftermarket options have constrained its share in the market.

Overall, the aftermarket segment is projected to continue its growth trajectory due to the increasing demand for replacement parts, vehicle customization, and the overall shift towards more budget-conscious consumer preferences.

Key Market Segments

By Vehicle Type

- Passenger Vehicle

- Heavy Commercial Vehicle

- Light Commercial Vehicle

By Application

- Aftermarket

- OEM

Drivers

Cost-Effectiveness Drives Widespread Adoption of Steel Wheels

The automotive steel wheels market is primarily driven by their cost-effectiveness. Steel wheels are significantly cheaper than alloy wheels, making them a preferred option for cost-conscious consumers and automakers. Their affordability, combined with their durability and strength, makes steel wheels an appealing choice for a wide range of vehicles.

These wheels are especially popular in entry-level and mid-range vehicles, which prioritize cost savings while maintaining functional performance. Furthermore, steel wheels are known for their robustness, withstanding harsh road conditions and heavy-duty usage, which boosts their appeal in both standard and utility vehicles. This resilience ensures a strong presence in the replacement market, where damaged wheels are often replaced with steel alternatives.

As a result, the consistent demand from vehicle owners seeking affordable replacement options contributes significantly to market growth. Additionally, the ease of production and availability of raw materials enhances the attractiveness of steel wheels as a cost-effective solution, supporting their ongoing adoption across the automotive industry.

Restraints

Shift Toward Alloy Wheels Poses a Challenge to Steel Wheel Market Growth

The automotive steel wheels market faces significant challenges due to the growing preference for alloy wheels, particularly in premium and high-end vehicle segments. Alloy wheels are favored for their lighter weight and aesthetic appeal, offering better performance and more stylish designs than steel wheels. This shift is limiting the demand for steel wheels, as automakers increasingly equip their vehicles with alloy options to meet consumer preferences for both performance and design.

Additionally, steel wheels are often perceived as less attractive compared to their alloy counterparts, which further restricts their adoption in luxury vehicles. The limitations in design and weight make steel wheels less appealing to customers seeking high-performance or visually appealing solutions.

As consumers continue to prioritize aesthetics and weight efficiency, the automotive steel wheels market may face stagnant or reduced growth in the future, particularly in segments that value these features most. Thus, the market’s expansion is hindered by consumer trends favoring alloy wheels, reducing the overall demand for traditional steel wheels.

Growth Factors

Expansion in Emerging Markets Boosts Steel Wheel Market Potential

The automotive steel wheels market stands to benefit significantly from the expansion of the automotive sector in emerging markets. With economies like China, India, and Southeast Asia experiencing rapid urbanization and industrial growth, the demand for vehicles, especially in the affordable segments, is rising. This trend is creating an increased need for cost-effective automotive components, including steel wheels.

As consumers in these regions lean toward budget-friendly vehicle options, manufacturers have an opportunity to supply durable and cost-efficient steel wheels. Additionally, the ongoing rise of electric vehicles (EVs) provides a further avenue for growth, particularly in entry-level EV models, where cost control is crucial.

Steel wheels can offer a competitive edge in these markets, where affordability is a key driver of purchase decisions. As automotive lightweighting trends continue, manufacturers are also focusing on reducing the weight of steel wheels, which can help meet the evolving demands for fuel efficiency and environmental sustainability.

Furthermore, forming strategic partnerships with automobile manufacturers to become preferred suppliers of steel wheels presents a crucial growth opportunity. These collaborations can enhance supply chain integration and ensure steady demand, making the automotive steel wheel market well-positioned for sustained growth in emerging economies.

Emerging Trends

Shift Towards Lighter Steel Wheels for Enhanced Fuel Efficiency

The automotive steel wheels market is being influenced by several significant trends. Lightweighting has emerged as a key focus, with manufacturers striving to reduce the weight of steel wheels without sacrificing durability or strength. This trend aligns with the broader automotive industry’s goal of improving fuel efficiency and reducing emissions by lowering vehicle weight.

Additionally, the adoption of 3D printing technology is enhancing the design and prototyping processes for steel wheels. This approach not only speeds up production cycles but also enables more cost-effective manufacturing. On the environmental front, steel wheel producers are increasingly focusing on eco-friendly production methods.

Reducing CO2 emissions and implementing sustainable manufacturing practices have become integral to the industry’s strategy. Furthermore, ongoing research into advanced steel alloys is improving the strength-to-weight ratio of steel wheels, making them more competitive with lighter alloy alternatives. As a result, these technological and sustainability trends are driving the continued development and innovation in the steel wheel segment.

Regional Analysis

Asia Pacific leads the automotive steel wheels market with 48.2% share and USD 7.3 billion

The global automotive steel wheels market is witnessing significant growth, driven by various regional dynamics. Asia Pacific dominates the market, accounting for 48.2% of the market share, valued at approximately USD 7.3 billion.

This is attributed to the region’s substantial automotive production and consumption, particularly in countries like China, India, and Japan, where the demand for cost-effective yet durable steel wheels is high. The growing automotive manufacturing activities in the region, coupled with the increasing adoption of steel wheels in emerging markets, significantly contribute to this dominance.

Regional Mentions:

North America holds a substantial market share as well, owing to the presence of established automotive manufacturers and a steady demand for steel wheels in light trucks and passenger vehicles. The market in North America is expected to grow moderately, driven by advancements in vehicle design and material innovations. The United States, being a major automotive hub, is a key contributor to the regional market, with an emphasis on aftermarket sales and replacement wheels.

Europe is also a significant player in the automotive steel wheels market, driven by robust manufacturing capabilities in countries like Germany, France, and Italy. The region’s market growth is propelled by the growing demand for high-performance vehicles and a focus on reducing vehicle weight to enhance fuel efficiency. However, the trend toward lightweight materials, such as aluminum alloys, could pose challenges to steel wheel adoption in the long term.

The Middle East & Africa market is characterized by a growing automotive sector, primarily in countries such as Saudi Arabia and the UAE. The increasing demand for passenger cars, particularly in the Middle East, is expected to boost the region’s market, though it remains relatively small compared to other regions.

In Latin America, the automotive steel wheels market is driven by increasing automotive production in countries like Brazil and Mexico. However, the region faces economic volatility, which could limit market growth prospects in the short to medium term.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global automotive steel wheels market in 2024 remains highly competitive, driven by major players focused on technological innovation, cost efficiency, and expanding production capacity.

U.S. Wheel Corp. stands out for its high-quality steel wheel offerings and extensive distribution network in North America, serving a diverse customer base, including aftermarket sectors. The company’s emphasis on custom design and durable products strengthens its competitive edge.

Steel Strips Group, a key supplier in the automotive industry, leverages its expertise in manufacturing and technological innovation to provide cost-effective steel wheels. Its strategic focus on sustainability, particularly in energy-efficient manufacturing, is expected to boost its market share.

ALCAR Wheels GmbH has solidified its position as a major European player, providing a comprehensive range of steel and aluminum wheels. The company’s focus on lightweight designs and precision manufacturing technologies positions it well for growth in the region’s increasingly fuel-efficient vehicle market.

MAXION Wheels remains one of the world’s largest producers of wheels, with a strong presence across North America, Europe, and Asia. Its innovative approaches to production processes, including automated manufacturing lines, enable the company to offer both high-volume and bespoke solutions to its clients.

Thyssenkrupp AG, with its extensive global footprint, combines steel production expertise with automotive innovation. The company’s investments in R&D for advanced steel wheel technologies, including lightweighting and strength improvements, provide it a sustainable competitive advantage.

Top Key Players in the Market

- U.S. WHEEL CORP.

- Steel Strips Group

- ALCAR WHEELS GMBH

- MAXION Wheels

- Thyssenkrupp AG

- The CARLSTAR GROUP, LLC.

- Klassic Wheels Limited

- Accuride Corporation

- Automotive Wheels Ltd

- Central Motor Wheel of America, Inc.

- TOPY AMERICA, INC.

- CLN Coils Lamiere Nastri SpA

Recent Developments

- In November 2024, Accuride completed the acquisition of Mefro Wheels, a strategic move aimed at expanding its wheel production capabilities and enhancing its global presence in the automotive industry. The acquisition strengthens Accuride’s portfolio by adding advanced wheel manufacturing technologies.

- In July 2023, Groupe Touchette Inc. acquired Fastco Canada, marking a significant expansion of its product and service offerings in the tire and automotive sector. The acquisition enables Groupe Touchette to further solidify its market position and broaden its distribution network across North America.

- In January 2025, Rex-Cut Abrasives acquired Westfield Grinding Wheel Company’s Non-Woven Unitized and Convolute Wheels division, enhancing its capabilities in precision abrasive solutions. This acquisition broadens Rex-Cut’s product range, offering more diverse solutions to its industrial clientele.

Report Scope

Report Features Description Market Value (2024) USD 15.3 Billion Forecast Revenue (2034) USD 20.0 Billion CAGR (2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Vehicle, Heavy Commercial Vehicle, Light Commercial Vehicle), By Application (Aftermarket, OEM) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape U.S. WHEEL CORP., Steel Strips Group, ALCAR WHEELS GMBH, MAXION Wheels, Thyssenkrupp AG, The CARLSTAR GROUP, LLC., Klassic Wheels Limited, Accuride Corporation, Automotive Wheels Ltd, Central Motor Wheel of America, Inc., TOPY AMERICA, INC., CLN Coils Lamiere Nastri SpA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Steel Wheels MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Steel Wheels MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- U.S. WHEEL CORP.

- Steel Strips Group

- ALCAR WHEELS GMBH

- MAXION Wheels

- Thyssenkrupp AG

- The CARLSTAR GROUP, LLC.

- Klassic Wheels Limited

- Accuride Corporation

- Automotive Wheels Ltd

- Central Motor Wheel of America, Inc.

- TOPY AMERICA, INC.

- CLN Coils Lamiere Nastri SpA