Global Automotive Navigation System Market Size, Share, Growth Analysis By Device Type (In-Dash Navigation Systems, Portable Navigation Devices (PNDs), Smartphone-Based Navigation), By Technology (2D Maps, 3D Maps, Voice-Guided Navigation, Augmented Reality Navigation), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Component (Hardware, Software, Services), By Connectivity (Embedded Systems, Connected Systems), By Distribution Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174902

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Overview

- Key Takeaways

- Device Type Analysis

- Technology Analysis

- Vehicle Type Analysis

- Component Analysis

- Connectivity Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Market Overview

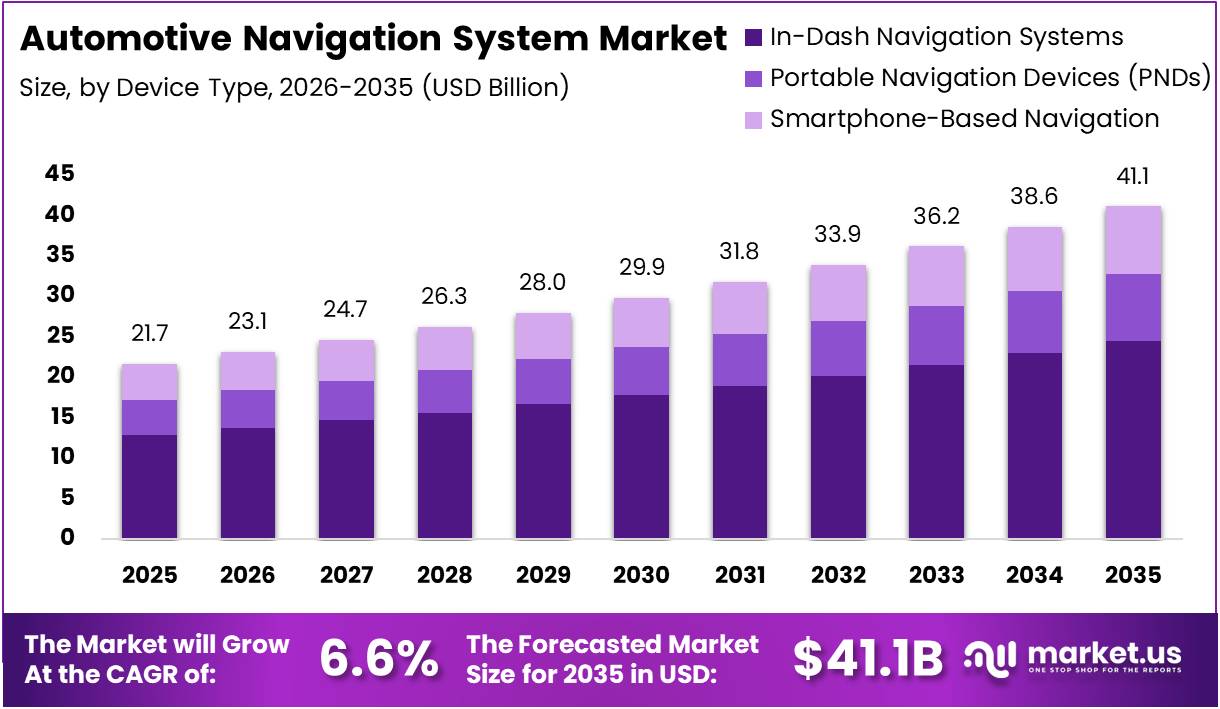

The Global Automotive Navigation System Market size is expected to be worth around USD 41.1 Billion by 2035 from USD 21.7 Billion in 2025, growing at a CAGR of 6.6% during the forecast period 2026 to 2035.

The automotive navigation system market encompasses technologies that provide real-time positioning, routing, and location-based services to vehicle occupants. These systems integrate GPS satellites, digital mapping, and telematics to deliver accurate turn-by-turn directions. Moreover, they enhance driver convenience, safety, and overall travel efficiency across passenger and commercial vehicle segments.

Modern navigation solutions have evolved beyond basic routing capabilities. They now incorporate advanced driver assistance features, voice-guided interfaces, and dynamic traffic updates. Additionally, integration with smartphone ecosystems and cloud-based platforms has transformed how drivers interact with navigation technology in their vehicles.

The market is experiencing robust growth driven by increasing consumer demand for connected vehicle experiences. However, manufacturers are focusing on embedding navigation systems directly into vehicle infotainment platforms. Consequently, this shift has reduced reliance on standalone portable devices and smartphone-based alternatives.

Government regulations promoting vehicle safety and telematics adoption have accelerated market expansion. Furthermore, rising investments in autonomous driving technology require sophisticated navigation infrastructure. Therefore, automakers are prioritizing embedded navigation systems with high-definition mapping capabilities to support future mobility requirements.

Technological advancements in artificial intelligence and cloud computing are reshaping navigation capabilities. According to research, over 60% of American drivers use a GPS service at least once per week. Additionally, the growing electric vehicle segment demands specialized navigation features including charging station location and range optimization algorithms.

Consumer acceptance of navigation technology continues strengthening based on performance improvements. According to research, most respondents at 80% either agreed or strongly agreed that navigation systems effectively re-route them after missing turns. Moreover, 76% of respondents indicated that listening to voice directions reduces screen viewing time.

The integration of augmented reality and lane-level guidance represents emerging innovation areas. Additionally, partnerships between automotive manufacturers and mapping technology providers are accelerating development cycles. Therefore, the automotive navigation system market is positioned for sustained growth through technological evolution and increasing vehicle connectivity standards.

Key Takeaways

- The global Automotive Navigation System Market is projected to reach USD 41.1 Billion by 2035, growing at a CAGR of 6.6% from 2025 to 2035.

- In-Dash Navigation Systems dominate the By Device Type segment with 59.6% market share in 2025.

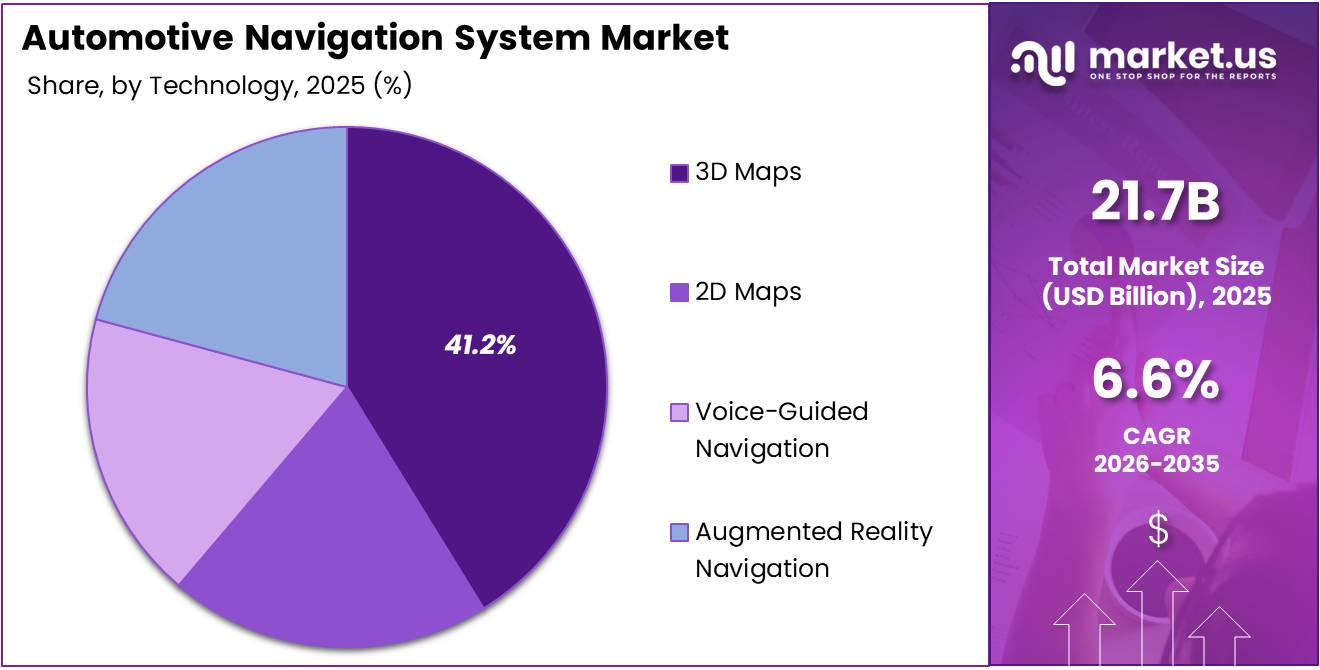

- 3D Maps lead the By Technology segment, capturing 41.2% of the market.

- Passenger Cars hold the largest share in the By Vehicle Type segment with 78.3% market dominance.

- Hardware component accounts for 52.7% share in the By Component segment.

- Embedded Systems dominate the By Connectivity segment with 65.4% market share.

- OEM distribution channel leads with 71.8% market share in 2025.

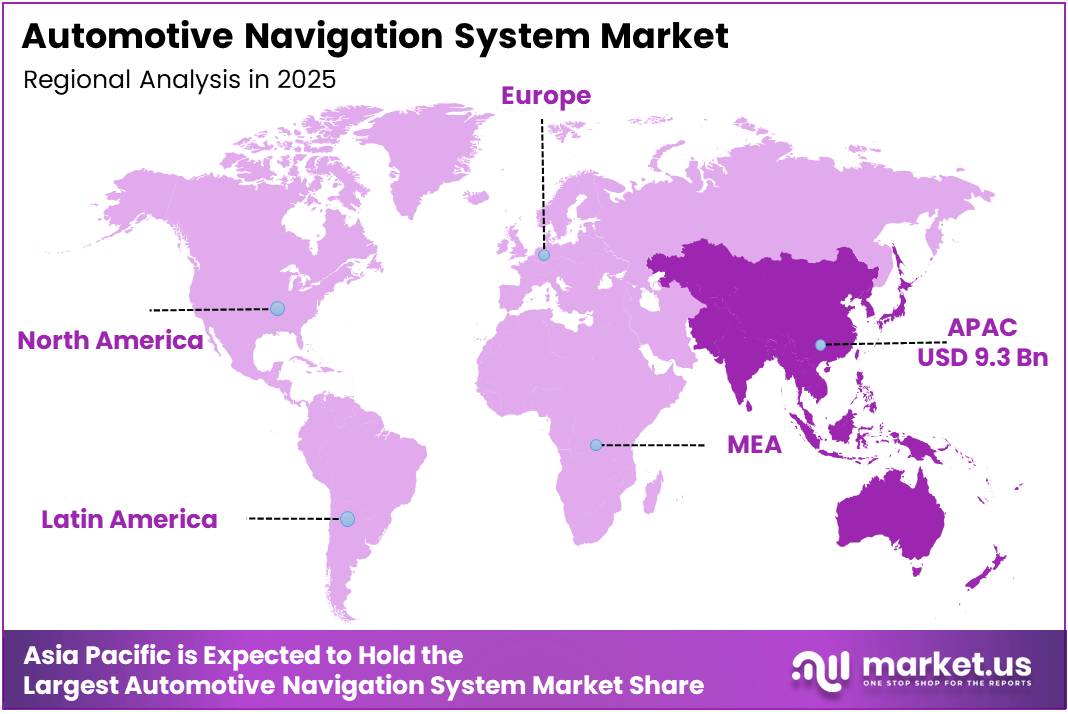

- Asia Pacific region dominates with 43.20% market share, valued at USD 9.3 Billion.

Device Type Analysis

In-Dash Navigation Systems dominate with 59.6% due to seamless integration with vehicle infotainment platforms and superior user experience.

In 2025, In-Dash Navigation Systems held a dominant market position in the By Device Type segment of Automotive Navigation System Market, with a 59.6% share. These factory-integrated systems offer seamless connectivity with vehicle controls and ADAS features. Moreover, automakers increasingly bundle navigation as standard equipment, driving adoption across premium and mid-range vehicle segments.

Portable Navigation Devices represent a declining segment as smartphone navigation gains prominence. However, they maintain niche appeal among fleet operators and budget-conscious consumers. Additionally, PNDs offer standalone functionality without requiring cellular data connectivity or smartphone integration for basic routing needs.

Smartphone-Based Navigation continues expanding through free applications and integrated mapping services. These solutions leverage existing consumer hardware and provide frequent software updates. Consequently, they appeal to cost-sensitive users and those preferring flexible, multi-device navigation options over embedded automotive systems.

Technology Analysis

3D Maps dominate with 41.2% due to enhanced visualization, realistic terrain rendering, and improved navigation accuracy in complex urban environments.

In 2025, 3D Maps held a dominant market position in the By Technology segment of Automotive Navigation System Market, with a 41.2% share. These advanced mapping solutions provide depth perception and landmark recognition that simplify navigation. Furthermore, 3D visualization reduces driver confusion at complex intersections and highway interchanges through realistic environmental representation.

2D Maps maintain relevance for basic routing applications and resource-constrained systems. They require less processing power and display simplicity that some users prefer. Additionally, 2D mapping enables faster rendering on older hardware platforms while consuming minimal data bandwidth for map updates.

Voice-Guided Navigation enhances safety by reducing visual distraction and enabling hands-free operation. This technology integrates natural language processing for intuitive command recognition. Moreover, voice guidance complements visual mapping by providing turn-by-turn audio instructions that keep drivers focused on road conditions.

Augmented Reality Navigation represents emerging innovation that overlays directional information onto real-world camera feeds. This technology provides lane-level guidance and highlights upcoming turns through windshield displays. Consequently, AR navigation improves situational awareness and reduces navigation errors in unfamiliar environments.

Vehicle Type Analysis

Passenger Cars dominate with 78.3% due to higher production volumes, consumer preference for integrated navigation, and standard equipment trends.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Navigation System Market, with a 78.3% share. These vehicles represent the largest automotive segment globally with diverse navigation requirements. Moreover, consumers increasingly expect embedded navigation as standard equipment across sedan, SUV, and hatchback categories.

Commercial Vehicles utilize navigation systems optimized for fleet management and logistics efficiency. These solutions integrate route optimization algorithms that reduce fuel consumption and delivery times. Additionally, commercial navigation platforms provide specialized features including weight restrictions, height clearances, and designated truck routing for professional drivers.

Component Analysis

Hardware dominates with 52.7% due to essential physical components including GPS receivers, displays, processors, and antenna systems.

In 2025, Hardware held a dominant market position in the By Component segment of Automotive Navigation System Market, with a 52.7% share. Physical components form the foundation of navigation system functionality and performance. Furthermore, advances in processor technology and display quality drive continuous hardware improvements that enhance user experience and system responsiveness.

Software encompasses mapping databases, routing algorithms, and user interface applications that enable navigation functionality. This component requires regular updates to maintain map accuracy and feature enhancements. Additionally, software development focuses on artificial intelligence integration and cloud connectivity for dynamic traffic information.

Services include map updates, traffic data subscriptions, and technical support that maintain system relevance. These recurring revenue streams provide ongoing value to consumers through current information. Moreover, service offerings increasingly incorporate predictive analytics and personalized routing based on driver behavior patterns.

Connectivity Analysis

Embedded Systems dominate with 65.4% due to factory integration, dedicated hardware, and seamless vehicle electrical system connectivity.

In 2025, Embedded Systems held a dominant market position in the By Connectivity segment of Automotive Navigation System Market, with a 65.4% share. These permanently installed solutions offer superior integration with vehicle controls and displays. Moreover, embedded navigation systems provide reliable performance without dependence on external devices or cellular connectivity for core functionality.

Connected Systems leverage cloud-based services and real-time data connectivity for enhanced navigation features. These platforms enable live traffic updates, weather information, and dynamic route optimization. Additionally, connected navigation integrates with smartphone ecosystems and over-the-air updates that maintain system currency throughout vehicle ownership.

Distribution Channel Analysis

OEM dominates with 71.8% due to factory installation, vehicle integration requirements, and automaker bundling strategies.

In 2025, OEM held a dominant market position in the By Distribution Channel segment of Automotive Navigation System Market, with a 71.8% share. Original equipment manufacturers integrate navigation systems during vehicle production for optimal compatibility. Furthermore, automakers increasingly include navigation as standard equipment across trim levels, reducing consumer need for aftermarket solutions.

Aftermarket distribution serves vehicle owners seeking navigation upgrades or replacement systems. This channel provides retrofit solutions for older vehicles lacking factory navigation. Additionally, aftermarket offerings include specialized navigation units with features unavailable in OEM systems, appealing to enthusiasts and professional drivers.

Key Market Segments

By Device Type

- In-Dash Navigation Systems

- Portable Navigation Devices (PNDs)

- Smartphone-Based Navigation

By Technology

- 2D Maps

- 3D Maps

- Voice-Guided Navigation

- Augmented Reality Navigation

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Component

- Hardware

- Software

- Services

By Connectivity

- Embedded Systems

- Connected Systems

By Distribution Channel

- OEM

- Aftermarket

Drivers

Rising Integration of Navigation Systems with ADAS and Vehicle Safety Functions Drives Market Growth

Advanced driver assistance systems increasingly rely on navigation data for predictive safety features. Integration enables collision avoidance systems to anticipate road geometry and traffic conditions ahead. Moreover, navigation platforms provide essential positioning information that enhances adaptive cruise control and lane-keeping assistance functionality across modern vehicles.

Consumer demand for real-time traffic information and dynamic routing capabilities continues accelerating market adoption. Drivers expect predictive arrival times that account for current congestion patterns and incidents. Additionally, navigation systems leverage cloud connectivity to optimize routes automatically, reducing travel time and fuel consumption through intelligent path selection.

Connected car technologies and embedded telematics platforms are expanding rapidly across global automotive markets. These systems integrate navigation with vehicle diagnostics, remote services, and entertainment features. Consequently, automakers prioritize navigation as core infrastructure supporting comprehensive connected vehicle ecosystems that enhance ownership experience and enable new service offerings.

Restraints

High Development, Licensing, and Continuous Map Update Costs Limit Market Adoption

Navigation system development requires substantial investment in software engineering, mapping databases, and licensing agreements. Automakers and technology providers face ongoing expenses for map data acquisition and updates. Moreover, maintaining accurate global coverage demands continuous investment in surveying, satellite imagery, and ground-truth verification across diverse geographical regions.

Licensing fees for mapping content, traffic data, and location-based services represent significant recurring costs. These expenses particularly burden smaller automotive manufacturers and aftermarket suppliers with limited scale. Additionally, intellectual property complexities surrounding navigation algorithms and mapping technologies create barriers that increase development timelines and market entry costs.

Dependence on stable connectivity and GPS signal accuracy introduces performance limitations in certain environments. Urban canyons, tunnels, and dense foliage can degrade positioning precision and system reliability. Furthermore, navigation accuracy relies on satellite constellation availability and atmospheric conditions that vary globally, affecting consistent user experience across different geographical markets.

Growth Factors

Increasing Adoption of AI- and Cloud-Based Navigation Platforms Accelerates Market Expansion

Artificial intelligence enables personalized navigation experiences through learning driver preferences and behavior patterns. Cloud-based platforms deliver real-time updates without requiring hardware upgrades or manual software installation. Moreover, AI-powered systems optimize routing by analyzing historical traffic data, predicting congestion patterns, and suggesting alternative paths proactively.

Electric vehicle proliferation creates demand for specialized navigation features addressing range anxiety and charging infrastructure. EV-optimized navigation calculates energy consumption based on route topography, weather conditions, and driving style. Additionally, these systems integrate charging station databases with availability status and reservation capabilities that streamline long-distance electric vehicle travel.

Autonomous vehicle development requires highly accurate navigation with centimeter-level positioning and lane-specific routing capabilities. Growing penetration of embedded navigation in mid-range vehicles expands market accessibility beyond premium segments. Consequently, automakers standardize navigation equipment across broader product portfolios, democratizing access to advanced location-based services and connected features.

Emerging Trends

Shift from Standalone Navigation Devices to Fully Embedded Systems Reshapes Market Landscape

Automotive manufacturers increasingly integrate navigation directly into vehicle infotainment architectures rather than offering standalone units. This transition improves system cohesion with vehicle controls and reduces component redundancy. Moreover, embedded solutions enable tighter integration with powertrain management, climate control, and advanced driver assistance systems for comprehensive vehicle intelligence.

Voice assistants and AI interfaces are transforming navigation interaction by enabling natural language commands and conversational queries. Drivers access navigation functions without manual input through voice recognition technology. Additionally, AI assistants provide contextual recommendations for destinations, route preferences, and points of interest based on historical behavior and real-time conditions.

High-definition mapping and lane-level digital technologies deliver unprecedented positioning accuracy for autonomous and semi-autonomous driving applications. These advanced maps include road geometry, lane markings, traffic signs, and infrastructure details at centimeter precision. Consequently, HD mapping enables automated lane changes, precise merging, and complex intersection navigation that traditional navigation systems cannot support effectively.

Regional Analysis

Asia Pacific Dominates the Automotive Navigation System Market with a Market Share of 43.20%, Valued at USD 9.3 Billion

Asia Pacific leads the automotive navigation system market driven by massive vehicle production volumes and rapid connected car adoption. China, Japan, and South Korea represent major manufacturing hubs with strong consumer demand for advanced navigation features. Moreover, the region benefits from 43.20% market share valued at USD 9.3 Billion, supported by government initiatives promoting intelligent transportation systems and vehicle connectivity standards.

North America Automotive Navigation System Market Trends

North America maintains strong navigation system adoption through premium vehicle penetration and consumer technology expectations. The United States and Canada demonstrate high smartphone integration rates and demand for real-time traffic services. Additionally, regulatory emphasis on vehicle safety and autonomous driving development supports continued navigation technology investment across the region.

Europe Automotive Navigation System Market Trends

Europe exhibits robust navigation system deployment driven by stringent environmental regulations and urban congestion management initiatives. Germany, France, and the United Kingdom lead in embedded navigation adoption across passenger vehicle segments. Furthermore, European automakers prioritize integrated navigation supporting emissions reduction through optimized routing and electric vehicle infrastructure integration.

Latin America Automotive Navigation System Market Trends

Latin America represents an emerging market with growing navigation system adoption as vehicle ownership expands. Brazil and Mexico drive regional demand through increasing middle-class purchasing power and urbanization trends. However, infrastructure limitations and economic volatility moderate growth compared to more developed automotive markets globally.

Middle East & Africa Automotive Navigation System Market Trends

Middle East and Africa show increasing navigation system penetration supported by infrastructure development and smart city initiatives. GCC countries demonstrate strong premium vehicle sales with high navigation equipment rates. Additionally, South Africa represents the largest automotive market in Africa with growing consumer interest in connected vehicle technologies and location-based services.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

TomTom International BV operates as a leading mapping and location technology provider serving automotive manufacturers globally. The company specializes in high-definition maps, traffic information, and navigation software integrated into millions of vehicles. Moreover, TomTom continuously invests in autonomous driving map development and AI-powered routing algorithms that enhance navigation accuracy and user experience across diverse applications.

HERE Technologies delivers comprehensive mapping platforms and location intelligence services to automotive and technology industries worldwide. The company provides real-time traffic data, HD maps, and positioning solutions supporting both conventional and autonomous vehicles. Additionally, HERE Technologies maintains extensive partnerships with major automakers enabling broad market penetration and continuous innovation in navigation technology development.

Garmin Ltd. manufactures consumer and automotive navigation devices combining GPS technology with robust hardware design and user-friendly interfaces. The company offers both aftermarket portable units and embedded OEM solutions across passenger and commercial vehicle segments. Furthermore, Garmin leverages its outdoor recreation and aviation expertise to deliver specialized navigation features appealing to diverse customer requirements.

Continental AG provides integrated automotive navigation systems as part of comprehensive infotainment and telematics solutions for global vehicle manufacturers. The company combines hardware components, software platforms, and connectivity services into complete navigation ecosystems. Moreover, Continental emphasizes integration with advanced driver assistance systems and autonomous driving technologies that position navigation as critical infrastructure for future mobility applications.

Top Key Players in the Market

- TomTom International BV

- HERE Technologies

- Garmin Ltd.

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Alpine Electronics

- Pioneer Corporation

- Mitsubishi Electric Corp.

- Aisin AW Co.

Recent Developments

- January 2026 – Visteon Corporation, a global leader in automotive technology, announced a strategic collaboration with TomTom to deliver the world’s first in-car local AI conversational navigation assistant. This partnership combines Visteon’s cockpit electronics expertise with TomTom’s mapping technology to enable natural language interaction for enhanced driver experience and simplified navigation control.

- April 2025 – Micware Co., Ltd. has acquired the NaviCon/NaviBridge application from DENSO CORPORATION, which allows users to set destinations for car navigation systems. This acquisition expands Micware’s navigation software portfolio and strengthens its position in smartphone-to-vehicle connectivity solutions that enhance user convenience and cross-platform integration capabilities.

- March 2025 – Hexagon completed acquisition of Septentrio, expanding the reach of mission-critical navigation and autonomy applications. This strategic move enhances Hexagon’s positioning technology capabilities with Septentrio’s high-precision GNSS receivers, supporting advanced navigation requirements for autonomous vehicles and intelligent transportation systems across global markets.

Report Scope

Report Features Description Market Value (2025) USD 21.7 Billion Forecast Revenue (2035) USD 41.1 Billion CAGR (2026-2035) 6.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type (In-Dash Navigation Systems, Portable Navigation Devices (PNDs), Smartphone-Based Navigation), By Technology (2D Maps, 3D Maps, Voice-Guided Navigation, Augmented Reality Navigation), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Component (Hardware, Software, Services), By Connectivity (Embedded Systems, Connected Systems), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TomTom International BV, HERE Technologies, Garmin Ltd., Continental AG, Denso Corporation, Robert Bosch GmbH, Alpine Electronics, Pioneer Corporation, Mitsubishi Electric Corp., Aisin AW Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Navigation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Navigation System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- TomTom International BV

- HERE Technologies

- Garmin Ltd.

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Alpine Electronics

- Pioneer Corporation

- Mitsubishi Electric Corp.

- Aisin AW Co.