Global Automotive Instrument Cluster Market Size, Share, Growth Analysis By Cluster Type (Digital, Analog, Hybrid), By Vehicle Type (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle, Electric Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162897

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

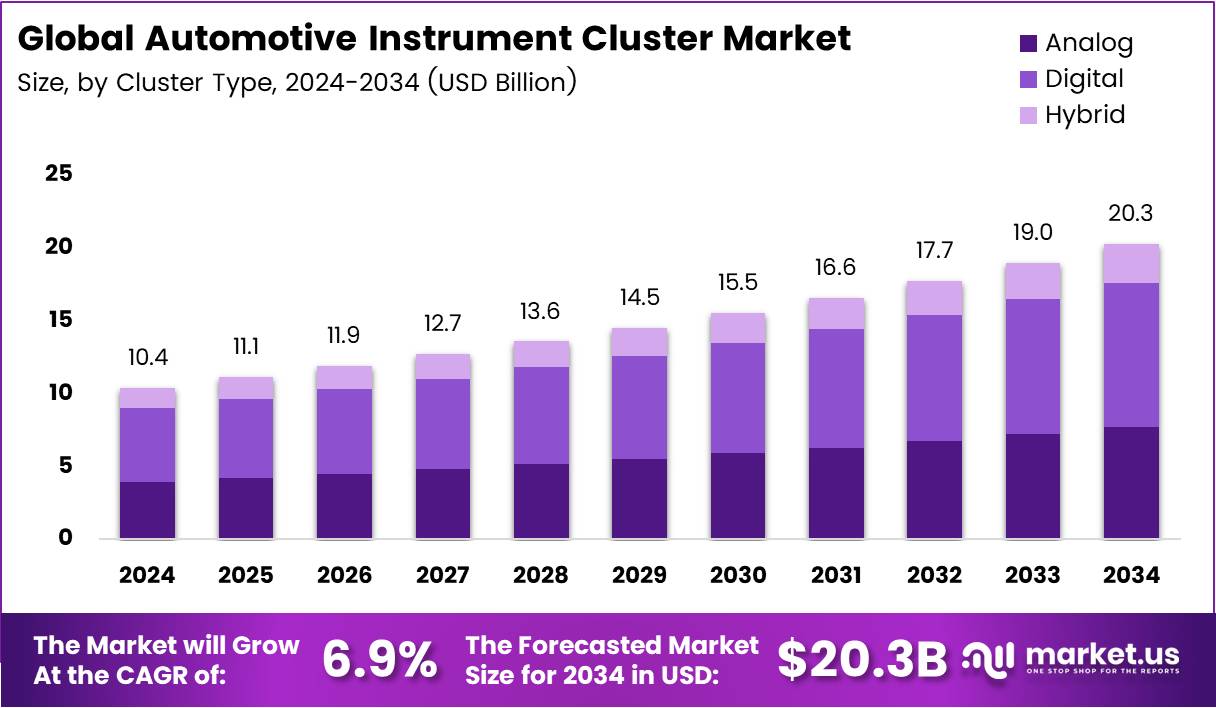

The Global Automotive Instrument Cluster Market size is expected to be worth around USD 20.3 Billion by 2034, from USD 10.4 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Automotive Instrument Cluster serves as the digital and analog interface that displays key vehicle information such as speed, fuel level, temperature, and diagnostics. It enhances driver awareness and safety by integrating with vehicle sensors and infotainment systems. Additionally, the cluster’s evolving design emphasizes functionality, connectivity, and visual ergonomics.

Moreover, the Automotive Instrument Cluster Market is witnessing robust growth, driven by the rising adoption of advanced display technologies and smart cockpit systems. Increasing consumer demand for digital and customizable interfaces accelerates product innovation. The shift toward electric and autonomous vehicles further propels market expansion by requiring more intelligent display and control systems.

Furthermore, global automakers are heavily investing in digital cockpit solutions, creating lucrative opportunities for suppliers. The market benefits from rising integration of LCD and TFT panels, delivering enhanced clarity and aesthetics. As vehicles become more software-defined, the cluster transforms into a central hub for real-time vehicle data visualization and driver assistance.

Additionally, supportive government investments in automotive technology encourage innovation across display electronics and safety standards. Programs promoting electric mobility and connected vehicles stimulate instrument cluster demand. Policymakers are setting regulations that mandate better visibility, driver alerts, and fuel efficiency indicators, ensuring technological compliance across vehicle categories.

Meanwhile, the market experiences consistent revenue growth with strong demand from both passenger and commercial vehicle segments. Manufacturers are optimizing production efficiency and reducing costs through modular platforms. The adoption of advanced HUD (Head-Up Display) and 3D instrument clusters enhances user experience, positioning this market as a key automotive innovation frontier.

In addition, increasing partnerships between automotive OEMs and display technology providers accelerate design evolution and cost optimization. The integration of AI-based diagnostics, augmented reality, and cloud connectivity creates high-value growth avenues. As vehicle architectures modernize, the instrument cluster evolves from a static gauge display to an interactive digital ecosystem.

Looking ahead, the Automotive Instrument Cluster Market is projected to reach significant valuation by 2030, driven by electrification, digitalization, and safety mandates. Continuous R&D investments, along with government support for automotive digitization, will sustain steady growth. Thus, this market stands at the intersection of innovation, regulatory advancement, and mobility transformation.

Key Takeaways

- The Global Automotive Instrument Cluster Market was valued at USD 10.4 Billion in 2024 and is projected to reach USD 20.3 Billion by 2034 at a CAGR of 6.9%.

- Digital clusters dominated the market with a 48.9% share in 2024, driven by advanced display features and integration with smart cockpit systems.

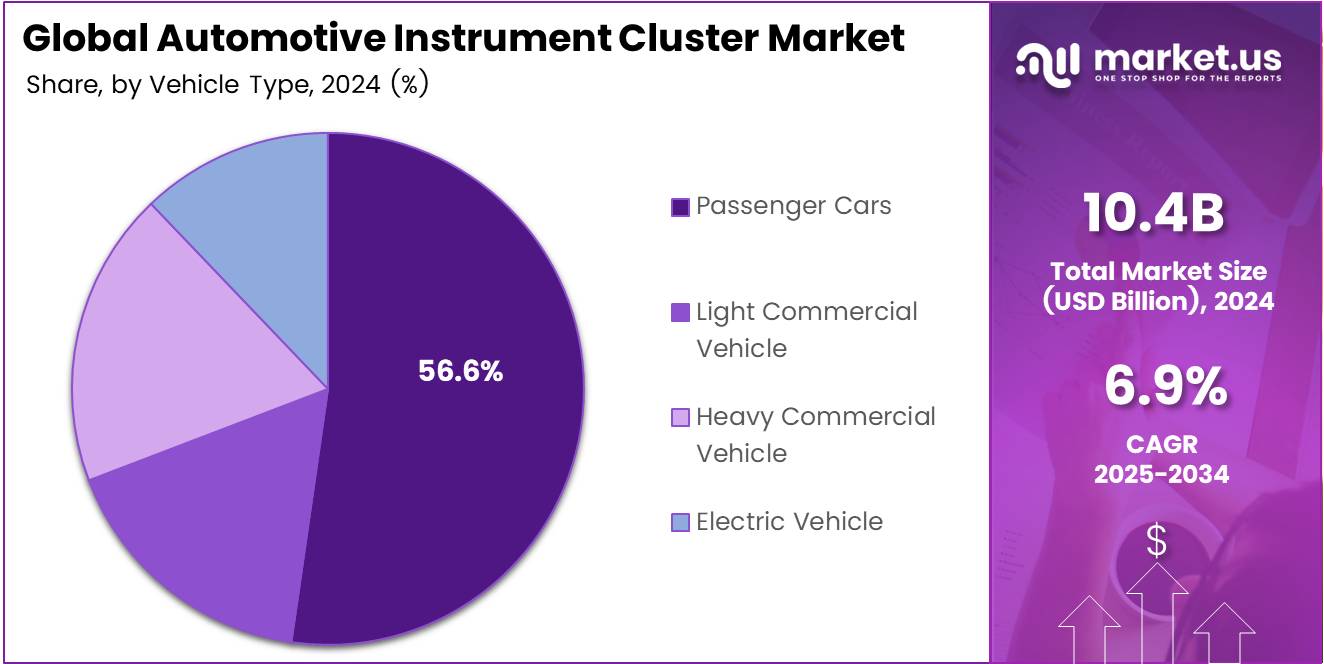

- Passenger Cars held the leading share of 56.6% in 2024, supported by growing adoption of digital dashboards and connected vehicle technologies.

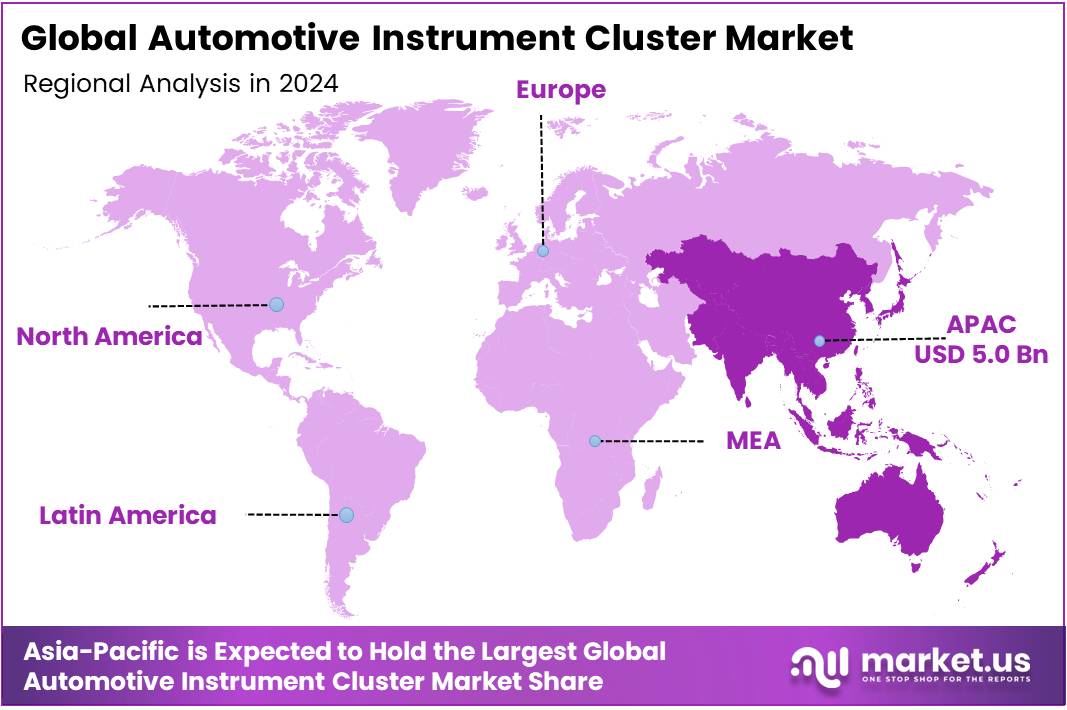

- Asia Pacific dominated regionally with a 48.9% share, valued at approximately USD 5.0 Billion in 2024, due to strong automotive manufacturing in China, Japan, and South Korea.

By Cluster Type Analysis

Digital clusters dominate with 48.9% due to their advanced display capabilities and rising adoption in modern vehicles.

In 2024, Digital held a dominant market position in the By Cluster Type segment of the Automotive Instrument Cluster Market, with a 48.9% share. This dominance is driven by the rapid integration of digital technologies, customizable display options, and enhanced driver assistance features that boost vehicle aesthetics and performance visibility.

Analog clusters continue to maintain relevance, particularly in low-cost and economy vehicles. Their simple design, reliability, and affordability make them suitable for manufacturers targeting price-sensitive consumers. Although the analog segment is gradually declining, it remains a preferred choice for vehicles emphasizing traditional aesthetics and straightforward functionality.

Hybrid clusters are gaining traction as automakers seek to combine the best of both analog and digital displays. This segment appeals to mid-range vehicles, offering a balance between advanced features and affordability. The hybrid cluster’s adaptability, user-friendly interface, and growing inclusion in passenger cars and commercial vehicles drive its steady market growth.

By Vehicle Type Analysis

Passenger Cars dominate with 56.6% due to rising production, consumer demand, and integration of digital dashboards.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Automotive Instrument Cluster Market, with a 56.6% share. Increasing demand for personalized, connected, and premium driving experiences continues to propel the adoption of advanced instrument clusters in passenger vehicles worldwide.

Light Commercial Vehicles (LCVs) are increasingly adopting modern cluster technologies to improve fleet management and driver information systems. These clusters enhance operational efficiency by displaying key vehicle data, supporting navigation, and promoting safer driving, especially as last-mile delivery and e-commerce logistics expand globally.

Heavy Commercial Vehicles (HCVs) are witnessing steady adoption of digital and hybrid clusters. Fleet operators prioritize durability and real-time diagnostic data, making robust and multifunctional clusters essential. The segment benefits from technology upgrades that help reduce maintenance costs and enhance long-haul performance and driver safety.

Electric Vehicles (EVs) rely heavily on advanced digital clusters to communicate real-time energy consumption, range, and battery status. The segment’s rapid growth aligns with the global shift toward sustainability and electrification. As EV production surges, the demand for high-resolution, intelligent instrument clusters continues to rise sharply.

Key Market Segments

By Cluster Type

- Digital

- Analog

- Hybrid

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Electric Vehicle

Drivers

Rising Integration of Digital and Hybrid Instrument Clusters in Passenger Vehicles Drives Market Growth

The automotive instrument cluster market is growing rapidly due to the increasing use of digital and hybrid display systems in passenger vehicles. Automakers are replacing traditional analog gauges with digital interfaces that offer better visibility, customization, and integration with other vehicle functions. This shift is enhancing driver comfort and improving the overall driving experience.

Another major factor driving market demand is the rising need for advanced driver information and safety visualization systems. Modern instrument clusters now display real-time data such as tire pressure, lane assist alerts, and navigation maps. These features help drivers make quicker, safer decisions on the road.

The growing adoption of connected vehicles and telematics is also boosting demand for smart instrument clusters. Integration with infotainment and connectivity systems allows drivers to access mobile apps, calls, and navigation without distraction.

Additionally, the expansion of electric vehicle (EV) production is pushing automakers to adopt customizable digital displays that show battery range, charging status, and energy consumption data. These innovations are transforming the instrument cluster from a simple dashboard component into a central hub for vehicle information and control.

Restraints

Complex Software and Cybersecurity Requirements Limiting Adoption Speed

Despite strong market potential, the automotive instrument cluster industry faces several restraints. One of the biggest challenges is the growing complexity of software development and cybersecurity requirements. As clusters become more connected and software-driven, protecting them from hacking and ensuring secure data communication has become a top concern, which slows down adoption.

Short product life cycles and rapid advancements in display technology also create barriers. Components such as TFT and OLED panels become outdated quickly, forcing automakers to continuously invest in new systems. This increases production costs and limits long-term profitability.

Another restraint is the limited compatibility across different OEM platforms. Each automaker often uses unique hardware and software configurations, making it difficult to standardize instrument cluster designs. This lack of interoperability leads to longer development times and higher integration costs. Overall, these challenges hinder the speed at which digital and hybrid clusters can be deployed across vehicle segments, particularly in cost-sensitive markets.

Growth Factors

Development of AI-Based and AR-Enhanced Instrument Clusters for Driver Assistance Creates New Opportunities

The automotive instrument cluster market is witnessing strong growth opportunities through the adoption of AI-based and augmented reality (AR) technologies. These systems enhance driver assistance by projecting real-time alerts, navigation cues, and safety warnings directly onto the digital display. This not only improves safety but also makes driving more intuitive and engaging.

The mid-range vehicle segment is also becoming a key growth area. Automakers are introducing affordable digital instrument clusters in budget-friendly models, making advanced technology accessible to a broader consumer base. This shift is expected to significantly expand market penetration in emerging economies.

Furthermore, partnerships between OEMs and display manufacturers are enabling the development of modular cluster systems. Such collaborations reduce production costs and allow easier upgrades over time. Finally, the rising demand for personalized and multi-screen cockpit experiences is encouraging manufacturers to design customizable interfaces that reflect user preferences, further driving innovation and market expansion.

Emerging Trends

Shift Toward Full Digital and Curved OLED Display Clusters Drives Market Trends

A major trend shaping the automotive instrument cluster market is the transition toward fully digital and curved OLED displays. These advanced panels provide superior clarity, flexibility, and aesthetic appeal compared to traditional displays, enhancing the interior design of modern vehicles. Automakers are increasingly using them to deliver premium, futuristic cockpit experiences.

Integration of voice and haptic feedback into cluster interfaces is another key trend. This technology allows drivers to control features through voice commands or tactile responses, minimizing distractions and improving safety.

The growing use of over-the-air (OTA) updates is also transforming the market. Automakers can now upgrade cluster software remotely, adding new features or fixing bugs without physical service visits. This supports the shift toward software-defined vehicles.

Finally, minimalist and driver-centric UX designs are becoming more popular. Clusters now feature adaptive user interfaces that adjust themes, brightness, and layout based on driving conditions, providing a more comfortable and personalized experience for users.

Regional Analysis

Asia Pacific Dominates the Automotive Instrument Cluster Market with a Market Share of 48.9%, Valued at USD 5.0 Billion

The Asia Pacific region leads the global automotive instrument cluster market, driven by the rapid expansion of automotive manufacturing hubs across China, Japan, and South Korea. The region’s dominance, accounting for 48.9% of total market share and valued at approximately USD 5.0 Billion in 2024, is attributed to the growing adoption of digital and hybrid clusters in passenger and electric vehicles. Government initiatives supporting EV production and technology localization are further boosting instrument cluster integration in both low-cost and premium vehicles.

North America Automotive Instrument Cluster Market Trends

In North America, the market shows strong growth fueled by high consumer demand for advanced infotainment and driver-assistance features. The integration of fully digital clusters with connected vehicle systems is becoming mainstream, particularly in the U.S. and Canada. Additionally, the rise of electric vehicle adoption and premium SUVs has intensified demand for customizable display panels, creating favorable conditions for steady regional expansion.

Europe Automotive Instrument Cluster Market Trends

Europe’s automotive instrument cluster market is characterized by technological sophistication and high penetration of hybrid and luxury vehicles. The region emphasizes regulatory compliance related to driver information systems and safety visualization. The shift toward sustainable mobility, coupled with premium OEM innovations in digital cockpit architecture, continues to support stable growth across Germany, France, and the U.K.

Middle East & Africa Automotive Instrument Cluster Market Trends

The Middle East & Africa market is emerging gradually, supported by rising imports of technologically advanced vehicles and growing infrastructure for automotive assembly in Gulf countries. Although the adoption rate remains moderate, increasing consumer preference for connected vehicles and government efforts to diversify economies through automotive manufacturing are contributing to long-term opportunities.

Latin America Automotive Instrument Cluster Market Trends

Latin America exhibits moderate but consistent growth in the instrument cluster segment, largely driven by Brazil and Mexico’s automotive production bases. Economic recovery and rising vehicle ownership are encouraging automakers to integrate semi-digital displays even in mid-range models. Continued investment in localized component manufacturing and digital upgrades is expected to enhance regional competitiveness.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Instrument Cluster Company Insights

The global Automotive Instrument Cluster Market in 2024 continues to witness strong competition among major players, each focusing on technological innovation, digital integration, and user-centric design to enhance driving experiences.

Robert Bosch GmbH remains a dominant force in the market, leveraging its extensive expertise in automotive electronics and software integration. The company’s focus on connected and digital cockpit solutions, along with advancements in driver information systems, strengthens its leadership position in both premium and mid-range vehicle segments.

Continental AG continues to expand its portfolio with next-generation instrument clusters that integrate augmented reality and 3D display technologies. Its emphasis on intelligent vehicle architecture and seamless human–machine interfaces supports the growing demand for advanced infotainment and safety displays in modern vehicles.

DENSO Corporation is focusing on innovation-driven growth through the development of high-performance, energy-efficient instrument clusters. By aligning with global electrification trends and connected car ecosystems, DENSO enhances its competitiveness, particularly in the Asian markets where OEM collaborations are increasing.

YAZAKI Corporation maintains its position as a reliable supplier through its commitment to quality and customization. The company’s expertise in wiring harness systems complements its instrument cluster offerings, allowing it to deliver integrated solutions that meet automakers’ evolving requirements for compact, lightweight, and cost-effective designs.

Overall, these key players are accelerating the transition toward digital, connected, and customizable instrument clusters, shaping the future of automotive interiors through innovation, safety integration, and enhanced user experience.

Top Key Players in the Market

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- YAZAKI Corporation

- Pricol Ltd.

- Visteon Corporation

- Delphi Automotive LLP

- Calsonic Kansei Corporation

- Simco Ltd.

- Magneti Marelli S.p.A

- HARMAN International

Recent Developments

- In January 2024, Continental AG introduced its innovative Face Authentication Display” technology, seamlessly integrated behind a driver-display console. This system enhances vehicle security and personalization by recognizing the driver’s face before enabling vehicle functions.

- In January 2024, Ford Motor Company, through its luxury division Lincoln, launched the Digital Experience in the 2024 Nautilus. The system features a massive 48″ panoramic display that merges infotainment and instrument cluster functions for a fully immersive in-cabin experience.

- In January 2024, Robert Bosch GmbH and Qualcomm Incorporated jointly showcased a new Cockpit & ADAS Integration Platform at CES 2024. The collaboration demonstrates next-generation cockpit computing power and driver-assistance capabilities optimized for connected and autonomous vehicles.

Report Scope

Report Features Description Market Value (2024) USD 10.4 Billion Forecast Revenue (2034) USD 20.3 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cluster Type (Digital, Analog, Hybrid), By Vehicle Type (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle, Electric Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Continental AG, DENSO Corporation, YAZAKI Corporation, Pricol Ltd., Visteon Corporation, Delphi Automotive LLP, Calsonic Kansei Corporation, Simco Ltd., Magneti Marelli S.p.A, HARMAN International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Instrument Cluster MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Instrument Cluster MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- YAZAKI Corporation

- Pricol Ltd.

- Visteon Corporation

- Delphi Automotive LLP

- Calsonic Kansei Corporation

- Simco Ltd.

- Magneti Marelli S.p.A

- HARMAN International