Global Automotive Infotainment Systems Market Size, Share, Growth Analysis By Product Type (Communication Unit, Audio Unit, Display Unit, Heads-Up Display, Navigation Unit), By Fit Type (OEM, Aftermarket), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035.

- Published date: Jan 2026

- Report ID: 174939

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

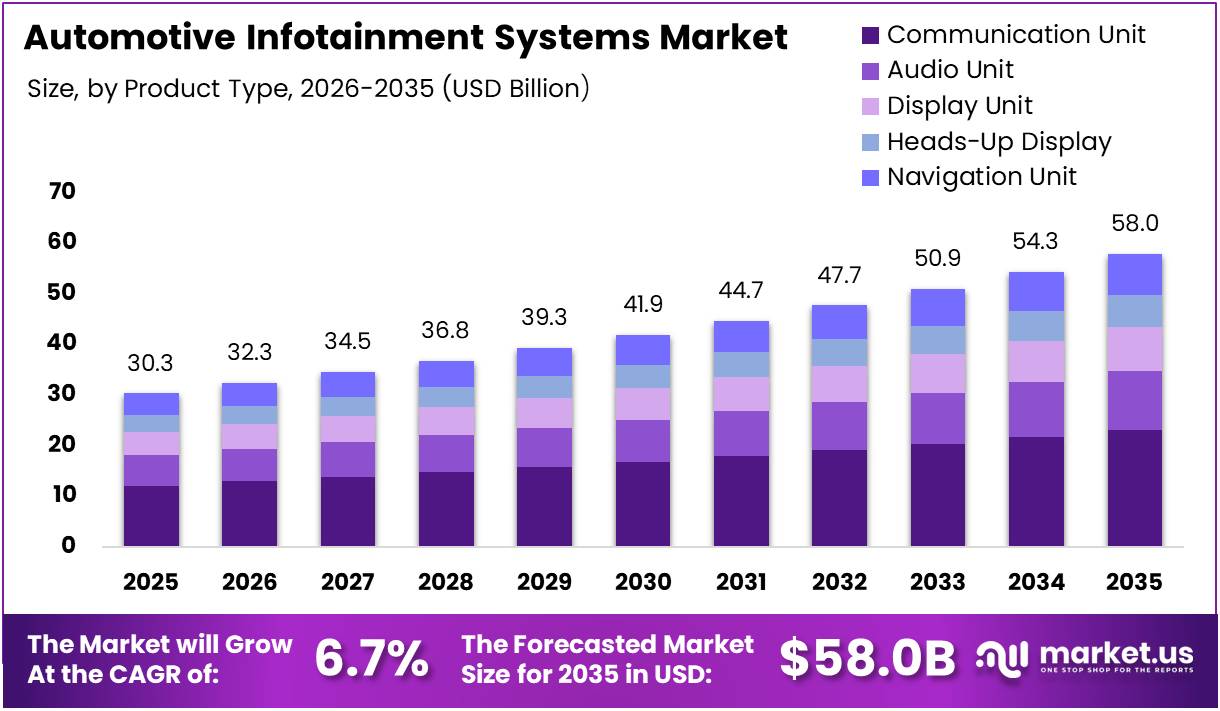

The Global Automotive Infotainment Systems Market size is expected to be worth around USD 58.0 Billion by 2035 from USD 30.3 Billion in 2025, growing at a CAGR of 6.7% during the forecast period 2026 to 2035.

Automotive infotainment systems represent integrated hardware and software platforms that deliver entertainment, navigation, communication, and vehicle information to drivers and passengers. These systems combine touchscreen displays, audio units, connectivity modules, and user interfaces into unified digital cockpits. They serve as the primary interface between vehicle occupants and various in-car functions.

The market experiences robust growth driven by consumer expectations for smartphone-like experiences within vehicles. Automakers increasingly prioritize infotainment capabilities as key differentiators in competitive segments. Advanced connectivity features, voice control, and seamless integration with mobile devices have become standard expectations rather than premium features.

Government regulations promoting road safety through hands-free communication and driver assistance integration further accelerate adoption. Investment in connected car infrastructure and 5G networks enables more sophisticated infotainment functionalities. Electric vehicle proliferation creates additional opportunities as manufacturers redesign interior experiences around digital interfaces.

Growing penetration into mid-range vehicle segments expands the total addressable market significantly. Integration of artificial intelligence, cloud connectivity, and over-the-air update capabilities represents the next evolution. Personalization features and multi-user profiles enhance the value proposition for consumers seeking customized experiences.

According to research, 60% of global vehicle owners say infotainment systems are a critical factor in deciding which car to buy or lease. Moreover, 67% of vehicle owners want their in-car infotainment systems to organize all available content regardless of source.

The automotive infotainment landscape continues evolving with technological advancements in display technologies, processing power, and connectivity standards. Manufacturers focus on creating intuitive user experiences while addressing cybersecurity concerns. The convergence of entertainment, navigation, and vehicle control functions positions infotainment systems as central to modern automotive design philosophy.

Key Takeaways

- Global Automotive Infotainment Systems Market is projected to reach USD 58.0 Billion by 2035 from USD 30.3 Billion in 2025, growing at a CAGR of 6.7%

- Communication Unit segment dominates by product type with 39.9% market share in 2025

- OEM fit type holds 79.4% market share, leading the aftermarket segment significantly

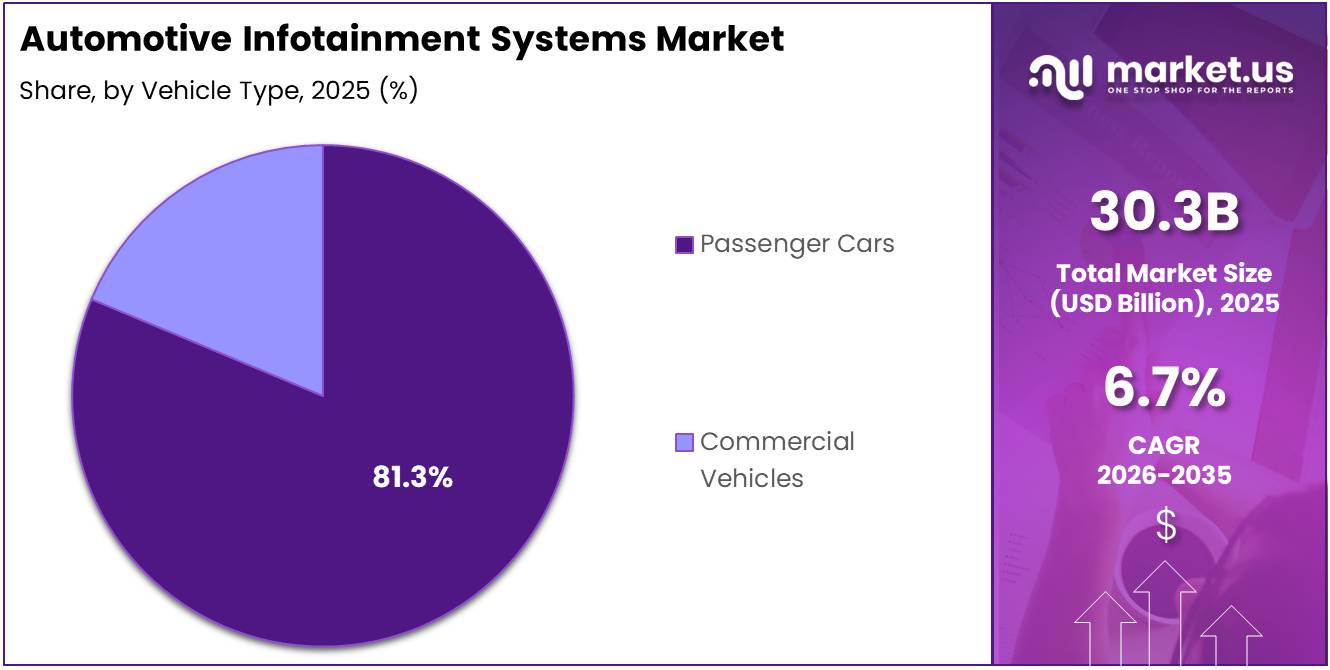

- Passenger Cars segment accounts for 81.3% share in the vehicle type category

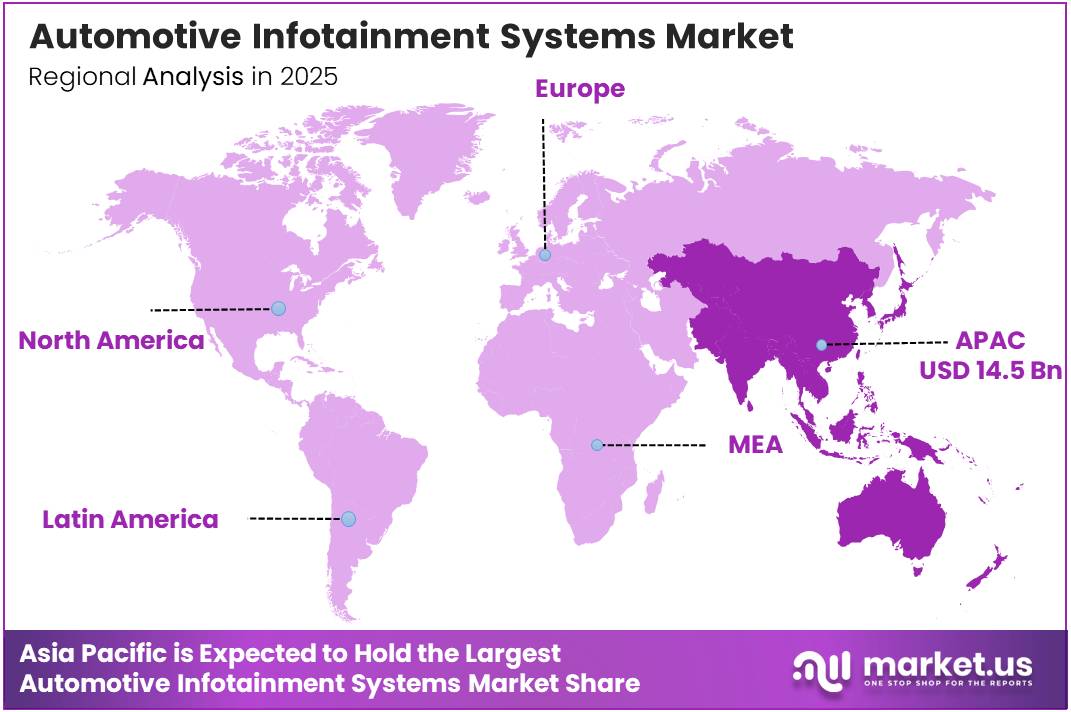

- Asia Pacific dominates the regional market with 47.90% share, valued at USD 14.5 Billion

Product Type Analysis

Communication Unit dominates with 39.9% due to rising demand for seamless connectivity and smartphone integration.

In 2025, Communication Unit held a dominant market position in the By Product Type segment of Automotive Infotainment Systems Market, with a 39.9% share. This segment includes connectivity modules enabling smartphone integration, Bluetooth pairing, wireless protocols, and cellular network access. Consumer demand for seamless Apple CarPlay and Android Auto functionality drives adoption across all vehicle segments.

Audio Unit remains essential as the foundation of in-car entertainment experiences. These components deliver high-quality sound reproduction through advanced digital signal processing and amplification technologies. Integration with streaming services and digital radio formats maintains relevance despite shifting consumer preferences toward connected features.

Display Unit growth accelerates with the transition toward larger touchscreen interfaces and digital instrument clusters. Manufacturers adopt high-resolution screens with improved brightness, response times, and multi-touch capabilities. The shift from physical buttons to touch-based controls increases display unit importance in overall system architecture.

Heads-Up Display technology gains traction in premium and mid-range vehicles as safety features become democratized. Projecting critical information onto windshields reduces driver distraction while maintaining awareness. Augmented reality integration represents the next evolution, overlaying navigation guidance directly onto the road view ahead.

Navigation Unit integration expands beyond basic GPS to include real-time traffic, predictive routing, and cloud-connected mapping services. Over-the-air map updates eliminate the need for manual software installations. Integration with vehicle sensors enables more accurate positioning and enhanced driver assistance system coordination.

Fit Type Analysis

OEM dominates with 79.4% due to factory integration advantages and comprehensive warranty coverage.

In 2025, OEM held a dominant market position in the By Fit Type segment of Automotive Infotainment Systems Market, with a 79.4% share. Original equipment manufacturers integrate infotainment systems during vehicle production, ensuring optimal compatibility with electrical architectures and interior design. Factory installation provides seamless integration with steering controls, voice commands, and vehicle diagnostics systems.

Aftermarket solutions serve vehicle owners seeking to upgrade older cars or replace outdated systems with modern connectivity features. This segment offers flexibility and customization options not available through factory configurations. Cost-conscious consumers find value in aftermarket systems that deliver similar functionality at lower price points than manufacturer upgrades.

Vehicle Type Analysis

Passenger Cars dominates with 81.3% due to higher production volumes and consumer demand for connected features.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Infotainment Systems Market, with an 81.3% share. This category encompasses sedans, hatchbacks, SUVs, and crossovers where infotainment serves as a primary differentiator. Consumers prioritize entertainment, navigation, and connectivity features when selecting personal vehicles, driving comprehensive system adoption across price segments.

Commercial Vehicles increasingly adopt infotainment systems as fleet management and driver productivity tools gain importance. These installations focus on navigation efficiency, communication capabilities, and integration with telematics platforms. Safety features and regulatory compliance drive adoption in trucks, vans, and delivery vehicles operating in commercial contexts.

Key Market Segments

By Product Type

- Communication Unit

- Audio Unit

- Display Unit

- Heads-Up Display

- Navigation Unit

By Fit Type

- OEM

- Aftermarket

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Drivers

Seamless Connectivity and Enhanced User Experience Drive Market Growth

Rising consumer demand for seamless smartphone integration and app-based vehicle connectivity fundamentally reshapes automotive infotainment expectations. Drivers expect their vehicles to mirror mobile device functionality with intuitive interfaces and instant access to digital services. Manufacturers respond by prioritizing CarPlay, Android Auto, and proprietary connectivity platforms across all vehicle segments.

Automaker focus on enhanced in-car user experience as a key vehicle differentiation strategy intensifies competitive pressures. Premium features once limited to luxury segments now appear in mid-range and entry-level vehicles. This democratization expands the total addressable market while increasing average system sophistication and revenue per unit.

Growing penetration of connected cars supported by expanding 4G/5G automotive networks enables advanced infotainment capabilities. Real-time traffic updates, cloud-connected services, and over-the-air software updates require robust cellular connectivity. Network infrastructure improvements in emerging markets unlock new opportunities for connected vehicle features and subscription-based services.

Restraints

High Integration Costs and Cybersecurity Concerns Limit Market Adoption

High system integration costs and complex software-hardware compatibility requirements create barriers for manufacturers and consumers. Developing infotainment platforms that seamlessly integrate with diverse vehicle architectures demands significant engineering resources. Legacy vehicle electrical systems often require expensive modifications to support modern connectivity features and user interfaces.

Data privacy and cybersecurity risks associated with connected infotainment platforms raise consumer and regulatory concerns. Increasing connectivity expands potential attack surfaces for malicious actors seeking vehicle control or personal information. Manufacturers must invest heavily in security infrastructure while balancing user convenience with protective measures.

Rapid technology obsolescence increasing lifecycle management challenges affects both manufacturers and consumers. Infotainment systems risk becoming outdated within months of vehicle production due to fast-evolving smartphone standards and connectivity protocols. This creates pressure for over-the-air update capabilities while raising concerns about long-term system viability and resale value.

Growth Factors

Market Expansion Through Segment Penetration and Technological Integration

Expansion of infotainment systems into mid-range and entry-level vehicle segments significantly broadens the addressable market. Previously limited to premium vehicles, advanced connectivity features now appear as standard equipment across price points. This democratization increases unit volumes while creating opportunities for tiered feature offerings and subscription services.

Integration of AI-based voice assistants and intelligent personalization features transforms infotainment from passive systems to proactive companions. Natural language processing enables conversational interactions while machine learning adapts to individual preferences. Multi-user profile support allows personalized experiences for different drivers without manual configuration.

Rising adoption of infotainment platforms in electric and software-defined vehicles creates new design opportunities unconstrained by traditional automotive conventions. Electric vehicle manufacturers leverage digital interfaces as primary control mechanisms, elevating infotainment importance. Software-defined architectures enable continuous feature improvements and new revenue streams through over-the-air updates.

Emerging Trends

Digital Transformation Reshapes Automotive Cockpit Design

Shift toward next generation digital cockpits with unified infotainment and driver information displays eliminates traditional analog instrumentation. Manufacturers integrate multiple screens into seamless interfaces spanning entire dashboards. This convergence simplifies manufacturing while enabling flexible configurations tailored to different market segments and consumer preferences.

Increasing use of AI-driven personalization for content, navigation, and settings enhances user satisfaction and engagement. Systems learn individual preferences for climate control, seating positions, entertainment choices, and route preferences. Predictive features anticipate driver needs based on historical patterns, time of day, and calendar integration.

Growing adoption of cloud-connected infotainment with over-the-air updates transforms vehicles into continuously improving platforms. Manufacturers deploy new features, security patches, and performance optimizations without requiring service center visits. This capability extends vehicle lifespan while creating opportunities for subscription-based services and ongoing customer relationships.

Regional Analysis

Asia Pacific Dominates the Automotive Infotainment Systems Market with a Market Share of 47.90%, Valued at USD 14.5 Billion

Asia Pacific leads the global market with 47.90% share, valued at USD 14.5 Billion, driven by massive vehicle production volumes in China, Japan, and South Korea. Rapid urbanization and growing middle-class populations fuel demand for connected vehicle features. Regional manufacturers aggressively adopt advanced infotainment technologies to compete in domestic and export markets.

North America Automotive Infotainment Systems Market Trends

North America demonstrates strong adoption driven by consumer preferences for advanced technology and connectivity features. Major automakers headquartered in the region prioritize infotainment innovation as competitive differentiators. High smartphone penetration and robust cellular networks support sophisticated connected car services and over-the-air update deployment.

Europe Automotive Infotainment Systems Market Trends

Europe shows steady growth supported by stringent safety regulations promoting driver assistance integration with infotainment platforms. Premium automotive manufacturers in Germany lead innovation in digital cockpit design and user experience. Environmental regulations favoring electric vehicles create opportunities for next-generation infotainment architectures.

Latin America Automotive Infotainment Systems Market Trends

Latin America experiences gradual adoption as economic conditions improve and vehicle production increases. Manufacturers focus on cost-effective solutions balancing functionality with affordability for price-sensitive markets. Smartphone integration features drive consumer interest despite lower overall technology penetration compared to developed regions.

Middle East & Africa Automotive Infotainment Systems Market Trends

Middle East and Africa demonstrate growing interest in premium vehicle features and connectivity solutions. Luxury vehicle sales in Gulf Cooperation Council countries support adoption of advanced infotainment technologies. Infrastructure development and improving cellular networks enable connected car services in major urban centers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Alpine Electronics maintains a strong position through expertise in premium audio systems and aftermarket infotainment solutions. The company leverages decades of automotive electronics experience to deliver high-quality products across passenger and commercial vehicle segments. Strategic partnerships with major automakers ensure steady OEM integration opportunities while aftermarket presence provides diversified revenue streams.

Clarion Co., Ltd. focuses on delivering comprehensive infotainment platforms combining navigation, connectivity, and entertainment features. The company emphasizes user-friendly interfaces and seamless smartphone integration to meet evolving consumer expectations. Investment in cloud-connected services and over-the-air update capabilities positions Clarion for software-driven revenue models.

Continental AG leverages its position as a leading automotive supplier to integrate infotainment systems with broader vehicle architectures. The company develops unified digital cockpit solutions combining instrument clusters, center displays, and head-up displays. Strong research and development capabilities enable Continental to lead in emerging technologies like augmented reality navigation and AI-driven personalization.

Delphi Automotive PLC brings extensive automotive electronics expertise to infotainment system development and manufacturing. The company focuses on scalable platforms that serve multiple vehicle segments with different feature configurations. Integration capabilities with vehicle networks and sensor systems enable advanced driver assistance features alongside traditional entertainment and navigation functions.

Top Key Players in the Market

- Alpine Electronics

- Clarion Co., Ltd.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International

- JVC KENWOOD Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation

Recent Developments

- January 2026 – P3 and VNC Automotive join forces to enable seamless integration of consumers’ favorite phone standards, bringing Apple CarPlay to SPARQ OS infotainment platform. This partnership enhances smartphone connectivity options and expands platform compatibility across multiple vehicle manufacturers.

- October 2025 – Applied Intuition and Stellantis partner to redefine intelligent in-vehicle infotainment systems through advanced software development tools and simulation capabilities. The collaboration accelerates development cycles and improves system validation processes for next-generation digital cockpit solutions.

Report Scope

Report Features Description Market Value (2025) USD 30.3 Billion Forecast Revenue (2035) USD 58.0 Billion CAGR (2026-2035) 6.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Communication Unit, Audio Unit, Display Unit, Heads-Up Display, Navigation Unit), By Fit Type (OEM, Aftermarket), By Vehicle Type (Passenger Cars, Commercial Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alpine Electronics, Clarion Co., Ltd., Continental AG, Delphi Automotive PLC, Denso Corporation, Harman International, JVC KENWOOD Corporation, Panasonic Corporation, Pioneer Corporation, Visteon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Infotainment Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Infotainment Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpine Electronics

- Clarion Co., Ltd.

- Continental AG

- Delphi Automotive PLC

- Denso Corporation

- Harman International

- JVC KENWOOD Corporation

- Panasonic Corporation

- Pioneer Corporation

- Visteon Corporation