Global Automotive Heat Exchanger Market Size, Share, Growth Analysis By Design Type (Plate-Bar, Tube Fin, Micro-channel Flat Tube, Shell-and-Tube, Others), By Material (Aluminum, Copper/Brass, Stainless Steel, Composites and Polymers), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial and Off-Highway Vehicles), By Powertrain Type (Internal Combustion Engine (ICE), Hybrid Electric Vehicles (HEV/PHEV), Battery Electric Vehicles (BEV), Fuel-Cell Electric Vehicles (FCEV)), By Application (Radiators, Charge-Air Coolers/Intercoolers, Oil Coolers, EGR and Exhaust Gas Heat Recovery, Cabin HVAC (Evaporator and Condenser), Battery/Power-electronics Coolers, Fuel-cell Humidifiers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176962

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

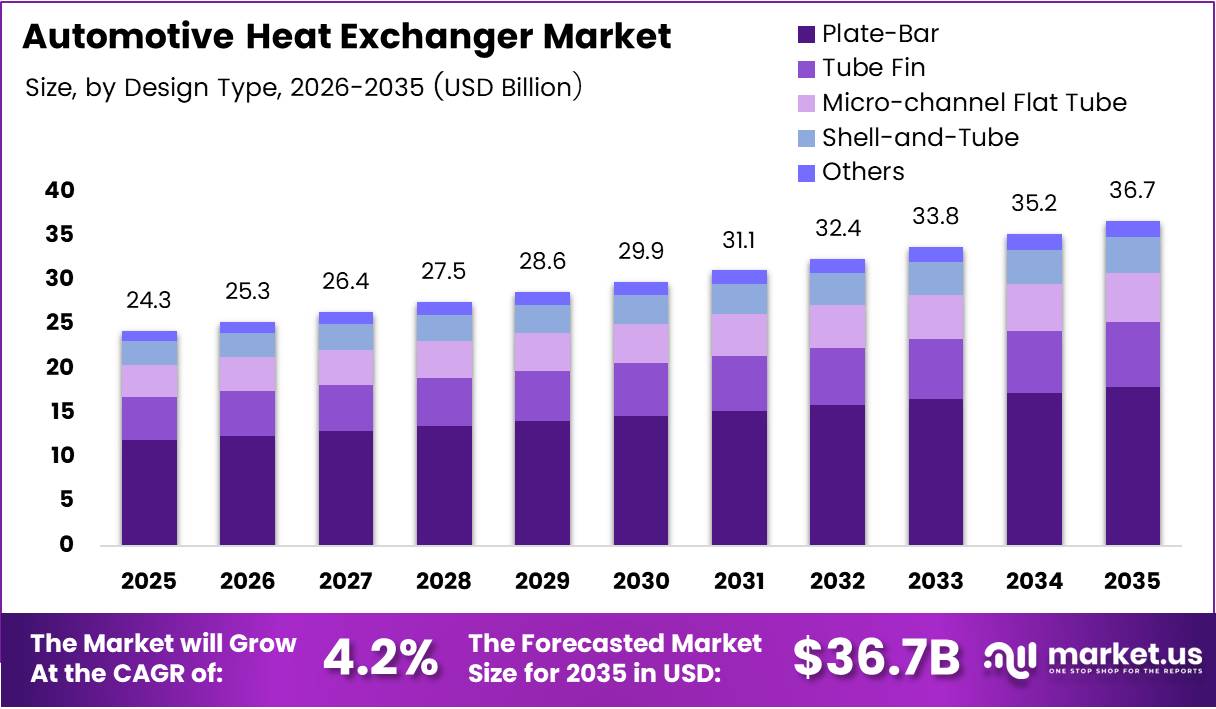

Global Automotive Heat Exchanger Market size is expected to be worth around USD 36.7 Billion by 2035 from USD 24.3 Billion in 2025, growing at a CAGR of 4.20% during the forecast period 2026 to 2035.

Automotive heat exchangers serve as critical thermal management components that regulate temperature across powertrain, battery, and cabin systems. These devices transfer heat between fluids to maintain optimal operating conditions. Manufacturers integrate heat exchangers into radiators, intercoolers, oil coolers, and HVAC systems to ensure vehicle performance and safety.

The market experiences robust expansion driven by vehicle electrification and stricter emission standards. Electric vehicle adoption accelerates demand for specialized battery cooling and power electronics thermal management solutions. Additionally, advanced thermal technologies enhance fuel efficiency while meeting regulatory requirements across global automotive markets.

Government investments in electric mobility infrastructure boost heat exchanger innovation and production capacity. Regulatory frameworks mandate improved fuel economy and reduced emissions, compelling automakers to deploy sophisticated thermal systems. Consequently, manufacturers develop lightweight, high-efficiency heat exchangers that optimize energy consumption across diverse vehicle platforms.

Strategic consolidation reshapes the competitive landscape as industry leaders expand thermal management capabilities. In March 2025, Eaton announced the acquisition of Boyd Corporation to strengthen electrification and thermal management solutions. This move reflects growing recognition of thermal systems as essential enablers of next-generation automotive technologies.

According to SAE International, vehicle thermal management systems in FCEVs can consume up to ~15% of total fuel-cell power during high-power operation. This substantial energy demand underscores the critical importance of efficient heat exchanger designs in maintaining fuel-cell vehicle performance and range. Moreover, optimized thermal architectures directly impact overall vehicle efficiency and operating costs.

According to Royal Society of Chemistry, multi-reactor hydrogen generation systems showed conversion improvement from ~15.8% (initial reactor) to ~99.99% (final reactor) through staged thermal reaction management. This remarkable efficiency gain demonstrates how advanced heat exchanger integration enables breakthrough performance in hydrogen-based automotive applications. Therefore, thermal system optimization represents a key technological frontier for future mobility solutions.

Key Takeaways

- Global Automotive Heat Exchanger Market valued at USD 24.3 Billion in 2025, projected to reach USD 36.7 Billion by 2035 at 4.20% CAGR

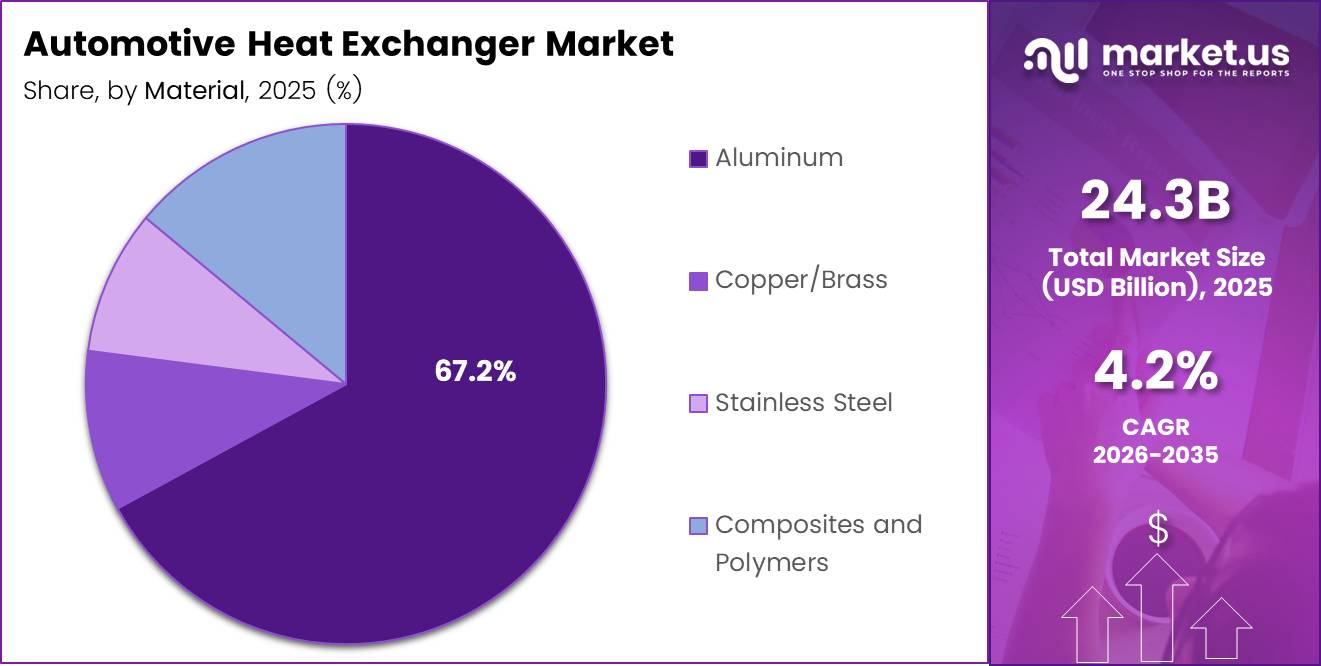

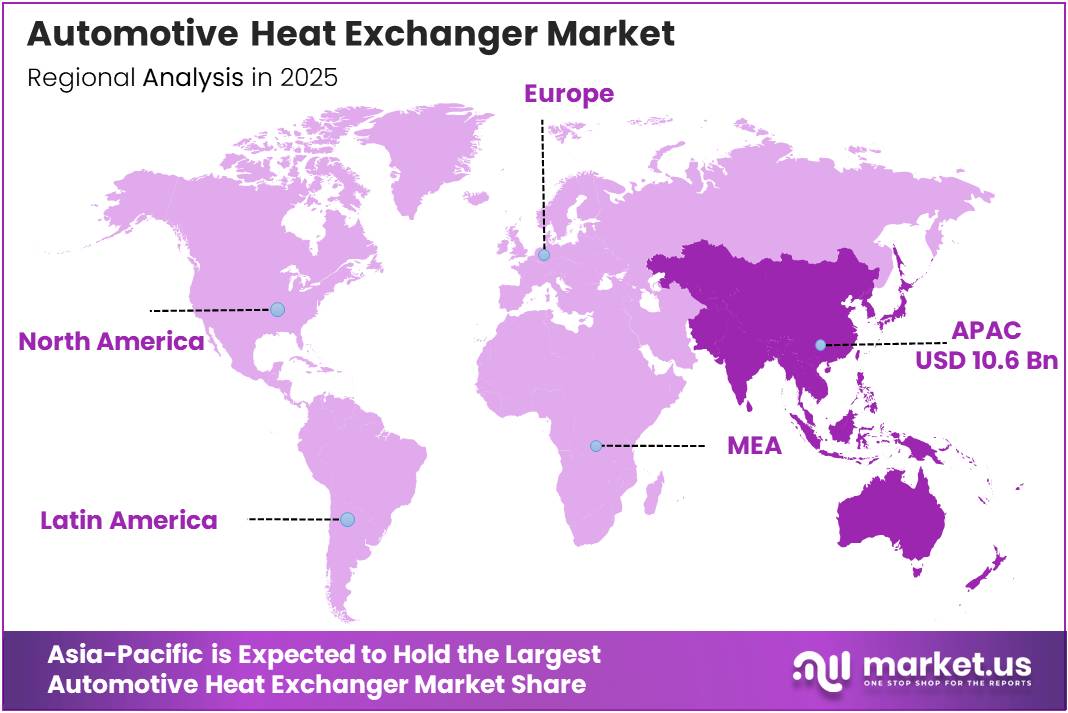

- Asia-Pacific dominates with 43.80% market share, valued at USD 10.6 Billion

- Aluminum material segment leads with 67.20% market share due to lightweight properties

- Passenger Cars segment holds 69.50% share driven by high production volumes

- Internal Combustion Engine (ICE) powertrain commands 59.70% share despite electrification trends

- Radiators application segment captures 27.30% share as primary thermal management component

- Plate-Bar design type accounts for 32.60% share due to superior thermal efficiency

Design Type Analysis

Plate-Bar dominates with 32.60% due to superior thermal transfer efficiency and compact design advantages.

In 2025, Plate-Bar held a dominant market position in the By Design Type segment of Automotive Heat Exchanger Market, with a 32.60% share. This design excels in high-pressure applications and offers excellent heat transfer rates per unit volume. Moreover, manufacturers favor plate-bar configurations for radiators and charge-air coolers across passenger and commercial vehicle platforms.

Tube Fin designs maintain significant presence in traditional ICE cooling applications and HVAC systems. These heat exchangers provide reliable performance at competitive costs, making them suitable for mass-market vehicles. Additionally, tube fin architecture supports easy maintenance and repair, extending service life in demanding operating environments.

Micro-channel Flat Tube technology gains traction in electric vehicle battery cooling and advanced thermal management systems. These lightweight designs deliver superior heat dissipation while reducing refrigerant charge requirements. Furthermore, micro-channel configurations enable compact integration in space-constrained electric powertrain layouts, supporting next-generation vehicle architectures.

Shell-and-Tube configurations serve specialized heavy-duty and industrial automotive applications requiring robust construction. Others category encompasses emerging designs including brazed plate and hybrid architectures for niche applications. Consequently, design diversity enables manufacturers to optimize thermal performance across varied vehicle segments and operating conditions.

Material Analysis

Aluminum dominates with 67.20% due to lightweight properties, excellent thermal conductivity, and cost-effectiveness.

In 2025, Aluminum held a dominant market position in the By Material segment of Automotive Heat Exchanger Market, with a 67.20% share. This material offers optimal strength-to-weight ratio essential for modern fuel efficiency standards and vehicle electrification. Additionally, aluminum’s corrosion resistance and recyclability align with automotive industry sustainability goals, making it the preferred choice across multiple applications.

Copper/Brass materials deliver superior thermal conductivity for high-performance cooling applications in premium vehicle segments. These traditional materials excel in compact heat exchanger designs where maximum heat transfer efficiency is critical. However, higher material costs and weight considerations limit widespread adoption compared to aluminum alternatives in mass-market applications.

Stainless Steel serves specialized applications requiring exceptional durability and resistance to extreme operating conditions. This material finds use in exhaust gas heat recovery systems and fuel-cell components operating at elevated temperatures. Moreover, stainless steel heat exchangers provide extended service life in corrosive environments encountered in heavy-duty commercial vehicles.

Composites and Polymers represent emerging material solutions for low-temperature applications and weight-sensitive electric vehicle platforms. These advanced materials enable design flexibility and potential cost reduction in specific thermal management applications. Consequently, material innovation continues expanding heat exchanger performance boundaries while addressing evolving automotive industry requirements.

Vehicle Type Analysis

Passenger Cars dominates with 69.50% due to high global production volumes and diverse thermal management requirements.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type segment of Automotive Heat Exchanger Market, with a 69.50% share. This segment encompasses sedans, SUVs, hatchbacks, and crossovers requiring multiple heat exchangers across powertrain, HVAC, and battery systems. Therefore, sheer production scale and component variety drive substantial heat exchanger demand in passenger vehicle manufacturing.

Light Commercial Vehicles represent a growing segment requiring robust thermal management solutions for urban delivery and commercial operations. These vehicles integrate heat exchangers for engine cooling, transmission oil cooling, and cabin comfort systems. Additionally, electrification of last-mile delivery fleets accelerates demand for battery thermal management components in this segment.

Heavy Commercial and Off-Highway Vehicles demand high-capacity heat exchangers engineered for extreme duty cycles and harsh operating environments. Construction equipment, agricultural machinery, and long-haul trucks require oversized cooling systems maintaining performance under sustained heavy loads. Furthermore, emission control systems in these vehicles incorporate specialized EGR coolers and exhaust gas heat recovery units, expanding heat exchanger content per vehicle.

Powertrain Type Analysis

Internal Combustion Engine (ICE) dominates with 59.70% due to continued global production despite gradual electrification transition.

In 2025, Internal Combustion Engine (ICE) held a dominant market position in the By Powertrain Type segment of Automotive Heat Exchanger Market, with a 59.70% share. Conventional gasoline and diesel vehicles require comprehensive thermal management across engine, transmission, oil, and exhaust systems. Moreover, emission regulations drive integration of additional heat exchangers for EGR cooling and exhaust gas heat recovery applications.

Hybrid Electric Vehicles (HEV/PHEV) incorporate dual thermal management systems serving both combustion engines and electric powertrains. These vehicles demand integrated cooling solutions managing engine heat, battery thermal conditioning, and power electronics cooling simultaneously. Additionally, hybrid architectures require sophisticated thermal routing optimizing energy efficiency across operating modes and driving conditions.

Battery Electric Vehicles (BEV) prioritize specialized heat exchangers for battery pack thermal management and power electronics cooling. These applications require precise temperature control maintaining lithium-ion batteries within optimal operating ranges for performance and longevity. Furthermore, BEV thermal systems increasingly integrate heat pump technologies for cabin heating, enhancing vehicle range in cold climates.

Fuel-Cell Electric Vehicles (FCEV) represent emerging applications requiring advanced heat exchangers managing fuel-cell stack cooling and hydrogen system thermal control. These vehicles incorporate specialized components operating across wide temperature ranges while maintaining system efficiency. Consequently, FCEV thermal architecture complexity drives innovation in heat exchanger design and integration methodologies.

Application Analysis

Radiators dominates with 27.30% due to universal requirement across all vehicle types and powertrain configurations.

In 2025, Radiators held a dominant market position in the By Application segment of Automotive Heat Exchanger Market, with a 27.30% share. These components serve as primary cooling systems dissipating engine heat or battery thermal loads to ambient air. Therefore, radiators represent essential thermal management infrastructure installed in virtually every vehicle platform globally.

Charge-Air Coolers/Intercoolers enhance engine performance and efficiency by reducing intake air temperature in turbocharged and supercharged applications. These heat exchangers improve combustion efficiency while supporting higher power density and reduced emissions. Additionally, intercooler adoption increases across both passenger and commercial vehicle segments as downsized turbocharged engines become industry standard.

Oil Coolers maintain optimal lubricant temperatures across engine, transmission, and differential systems extending component life and performance. Battery/Power-electronics Coolers represent rapidly growing applications driven by vehicle electrification requiring precise thermal management for lithium-ion batteries and inverters. Moreover, these specialized heat exchangers enable fast-charging capabilities and sustained high-power operation in electric vehicles.

EGR and Exhaust Gas Heat Recovery systems capture waste heat improving overall vehicle efficiency and reducing emissions. Cabin HVAC components including evaporators and condensers ensure passenger comfort across diverse climate conditions. Fuel-cell Humidifiers and Others category encompasses emerging applications supporting hydrogen fuel-cell vehicles and advanced thermal management technologies, expanding application diversity across evolving automotive platforms.

Drivers

Vehicle Electrification Driving Demand For Battery And Power Electronics Cooling Systems

Electric vehicle production accelerates globally, creating substantial demand for specialized thermal management components. Battery packs require precise temperature control maintaining optimal performance, safety, and longevity across varied operating conditions. Additionally, power electronics including inverters and onboard chargers generate significant heat loads demanding efficient cooling solutions for sustained high-power operation.

Automakers invest heavily in battery thermal management technologies supporting fast-charging infrastructure and extended vehicle range. According to SAE International, intelligent thermal routing using radiators plus plate heat exchangers improves low-temperature vehicle energy efficiency by maximizing waste-heat utilization. This integrated approach optimizes energy consumption while reducing auxiliary power requirements, directly enhancing electric vehicle competitiveness and consumer appeal.

According to Transportation Research Board, waste-heat recovery integration in heavy-duty fuel-cell vehicle thermal systems can generate significant fuel-saving benefits depending on load cycle and ambient conditions. Heavy commercial vehicles particularly benefit from capturing exhaust energy and fuel-cell waste heat to support cabin heating and battery preconditioning. Consequently, thermal system optimization delivers measurable efficiency gains across diverse vehicle platforms and operating environments.

Restraints

Fluctuating Aluminum And Raw Material Prices Increasing Production Costs

Aluminum constitutes the primary material for automotive heat exchangers, representing significant production cost components. Global commodity markets experience price volatility driven by supply chain disruptions, energy costs, and geopolitical factors affecting material availability. Therefore, manufacturers face margin pressure when raw material prices spike unexpectedly, challenging profitability across competitive automotive supply chains.

Copper, brass, and specialty alloys used in high-performance heat exchangers similarly experience price fluctuations impacting component costs. Material cost increases often cannot be immediately passed to automakers due to long-term supply contracts and competitive pricing pressures. Additionally, manufacturers must balance material selection between performance requirements and cost optimization, sometimes compromising thermal efficiency for economic viability.

According to SAE International, in EV thermal systems, secondary coolant circuits can remain unused >95% of vehicle lifetime, showing strong optimization opportunity for integrated heat-exchange designs. This inefficiency highlights how over-engineered thermal systems add unnecessary cost and weight without proportional performance benefits. Moreover, design complexity increases when integrating multiple thermal circuits for worst-case operating scenarios that rarely occur during typical vehicle operation cycles.

Growth Factors

Expanding EV Ecosystem Creating Demand For Advanced Cooling Technologies

Global electric vehicle sales continue accelerating as governments implement supportive policies and charging infrastructure expands rapidly. This growth drives substantial demand for battery thermal management systems, power electronics coolers, and integrated thermal architectures optimizing energy efficiency. Moreover, electric vehicle platforms require heat exchangers managing thermal loads absent in conventional vehicles, expanding total addressable market significantly.

According to SAE International, advanced EV thermal management coolant redistribution strategies can reduce component cooling time by ~30%. This efficiency improvement enables faster battery preconditioning, optimized cabin heating, and enhanced overall vehicle performance across varied climate conditions. Therefore, intelligent thermal management systems represent critical enabling technologies differentiating premium electric vehicle offerings in competitive markets.

According to research from multiple institutions, coupling fuel-cell high-temperature and battery low-temperature circuits using a water-to-water heat exchanger can eliminate the need for additional electric heating elements (PTC heaters). This integrated approach reduces system complexity, weight, and cost while improving overall thermal efficiency in hybrid and fuel-cell vehicles. Additionally, manufacturers develop lightweight and smart sensor-enabled heat exchangers incorporating real-time thermal monitoring and adaptive control capabilities.

Emerging Trends

Growing Adoption Of Microchannel And Compact Heat Exchanger Designs

Microchannel heat exchanger technology gains widespread adoption across electric vehicle battery cooling and HVAC applications. These compact designs deliver superior heat transfer efficiency while reducing refrigerant charge and overall system weight significantly. Additionally, microchannel configurations enable tight integration within space-constrained electric powertrain layouts, supporting aerodynamic vehicle designs and improved packaging efficiency.

AI-based thermal monitoring systems emerge as critical technologies optimizing heat exchanger performance through predictive analytics and adaptive control. These intelligent platforms analyze real-time operating data, adjusting coolant flow rates and thermal routing to maximize efficiency across dynamic driving conditions. Moreover, machine learning algorithms predict component degradation, enabling proactive maintenance strategies reducing unexpected failures and extending heat exchanger service life.

According to Royal Society of Chemistry, automotive onboard ammonia cracking modules using integrated heat exchange achieved ~93.5% thermal efficiency at ~475 °C operating temperature. This breakthrough enables efficient hydrogen generation for fuel-cell vehicles using ammonia as a liquid carrier fuel. Furthermore, lightweight and high-conductivity materials including advanced aluminum alloys and composite structures support integrated vehicle thermal management platforms consolidating multiple cooling functions into unified architectures.

Regional Analysis

Asia-Pacific Dominates the Automotive Heat Exchanger Market with a Market Share of 43.80%, Valued at USD 10.6 Billion

Asia-Pacific leads global automotive heat exchanger production driven by massive vehicle manufacturing capacity across China, Japan, South Korea, and India. The region accounts for 43.80% market share, valued at USD 10.6 Billion, benefiting from established automotive supply chains and rapidly growing electric vehicle adoption. Moreover, government incentives supporting electrification and emission reduction accelerate heat exchanger demand across diverse vehicle segments.

North America Automotive Heat Exchanger Market Trends

North America maintains strong demand driven by light truck, SUV, and electric vehicle production across United States and Canada. Strict CAFE standards and emission regulations compel automakers to deploy advanced thermal management technologies improving fuel efficiency. Additionally, domestic electric vehicle manufacturing expansion creates opportunities for battery cooling and power electronics thermal management component suppliers.

Europe Automotive Heat Exchanger Market Trends

Europe demonstrates robust growth supported by stringent CO2 emission targets and aggressive electric vehicle adoption timelines across major markets. Premium automakers integrate sophisticated thermal management systems supporting performance and efficiency objectives in luxury and performance vehicle segments. Furthermore, European manufacturers lead innovation in lightweight materials and integrated thermal architectures optimizing overall vehicle energy consumption.

Middle East and Africa Automotive Heat Exchanger Market Trends

Middle East and Africa markets grow steadily driven by commercial vehicle demand and expanding automotive assembly operations across GCC nations and South Africa. Extreme ambient temperatures in the region necessitate robust cooling systems with oversized heat exchangers maintaining vehicle performance and reliability.

Latin America Automotive Heat Exchanger Market Trends

Latin America experiences moderate growth supported by vehicle production recovery and gradual electrification trends across Brazil and Mexico. Regional automotive manufacturing serves both domestic markets and export-oriented production, driving consistent heat exchanger component demand across passenger and commercial vehicle platforms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Valeo maintains a leading position in automotive thermal systems through comprehensive product portfolios spanning engine cooling, HVAC, and battery thermal management solutions. The company invests heavily in electric vehicle thermal technologies, developing integrated systems optimizing energy efficiency across electrified powertrains. Moreover, Valeo’s global manufacturing footprint enables efficient supply chain management serving major automakers across all regional markets with advanced heat exchanger components.

Mahle delivers specialized thermal management solutions for internal combustion engines, hybrid, and electric vehicle applications through continuous innovation and engineering excellence. The company focuses on lightweight designs and advanced materials improving heat transfer efficiency while reducing overall system weight and cost. Additionally, Mahle’s strong relationships with premium automakers support development of next-generation cooling technologies addressing increasingly stringent performance and efficiency requirements.

Hanon Systems specializes in automotive climate control and powertrain thermal management, providing integrated solutions across HVAC, battery cooling, and engine thermal systems. The company expands its electric vehicle thermal management capabilities through strategic investments in heat pump technologies and battery cooling solutions. Furthermore, Hanon Systems’ expertise in compact, high-efficiency heat exchangers positions the company advantageously within rapidly growing electrification segments.

Denso leverages extensive automotive component experience delivering comprehensive thermal management systems supporting vehicle electrification and emission reduction objectives globally. In November 2025, Daikin Applied acquired Chilldyne to strengthen liquid cooling solutions for high-density thermal management applications, reflecting industry consolidation trends. The company’s advanced manufacturing capabilities and continuous innovation in heat exchanger design maintain its competitive position across diverse automotive applications and vehicle platforms.

Key players

- Valeo

- Mahle

- Hanon Systems

- Denso

- TRAD

- Sanden

- Spectra Premium

- Nissens

- AKG Group

- Ahaus Tool & Engineering

Recent Developments

- April 2025 – Heat and Control acquired Tek-Dry Systems Ltd. and Hunt Heat Exchangers to expand its thermal processing and heat transfer equipment portfolio, strengthening its position in industrial thermal management solutions and automotive heat exchanger manufacturing capabilities.

- May 2025 – Apollo Global Management (through funds) agreed to acquire a majority stake in Kelvion, a global heat exchanger manufacturer, demonstrating strong private equity interest in thermal management technologies driven by growing automotive electrification and industrial cooling demand worldwide.

Report Scope

Report Features Description Market Value (2025) USD 24.3 Billion Forecast Revenue (2035) USD 36.7 Billion CAGR (2026-2035) 4.20% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Design Type (Plate-Bar, Tube Fin, Micro-channel Flat Tube, Shell-and-Tube, Others), By Material (Aluminum, Copper/Brass, Stainless Steel, Composites and Polymers), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial and Off-Highway Vehicles), By Powertrain Type (Internal Combustion Engine (ICE), Hybrid Electric Vehicles (HEV/PHEV), Battery Electric Vehicles (BEV), Fuel-Cell Electric Vehicles (FCEV)), By Application (Radiators, Charge-Air Coolers/Intercoolers, Oil Coolers, EGR and Exhaust Gas Heat Recovery, Cabin HVAC (Evaporator and Condenser), Battery/Power-electronics Coolers, Fuel-cell Humidifiers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Valeo, Mahle, Hanon Systems, Denso, TRAD, Sanden, Spectra Premium, Nissens, AKG Group, Ahaus Tool & Engineering Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Heat Exchanger MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Heat Exchanger MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Valeo

- Mahle

- Hanon Systems

- Denso

- TRAD

- Sanden

- Spectra Premium

- Nissens

- AKG Group

- Ahaus Tool & Engineering