Global Automotive Connectors Market Size, Share, Growth Analysis By Product (PCB, IC, RF, Fiber Optic, Other), By Connectivity (Wire to Board, Wire to Wire, Other), By Vehicle (Passenger Car, Commercial Vehicle), By Application (Safety & Security, CCE, Powertrain, Body Wiring & Power Distribution, Navigation & Instrumentation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169429

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

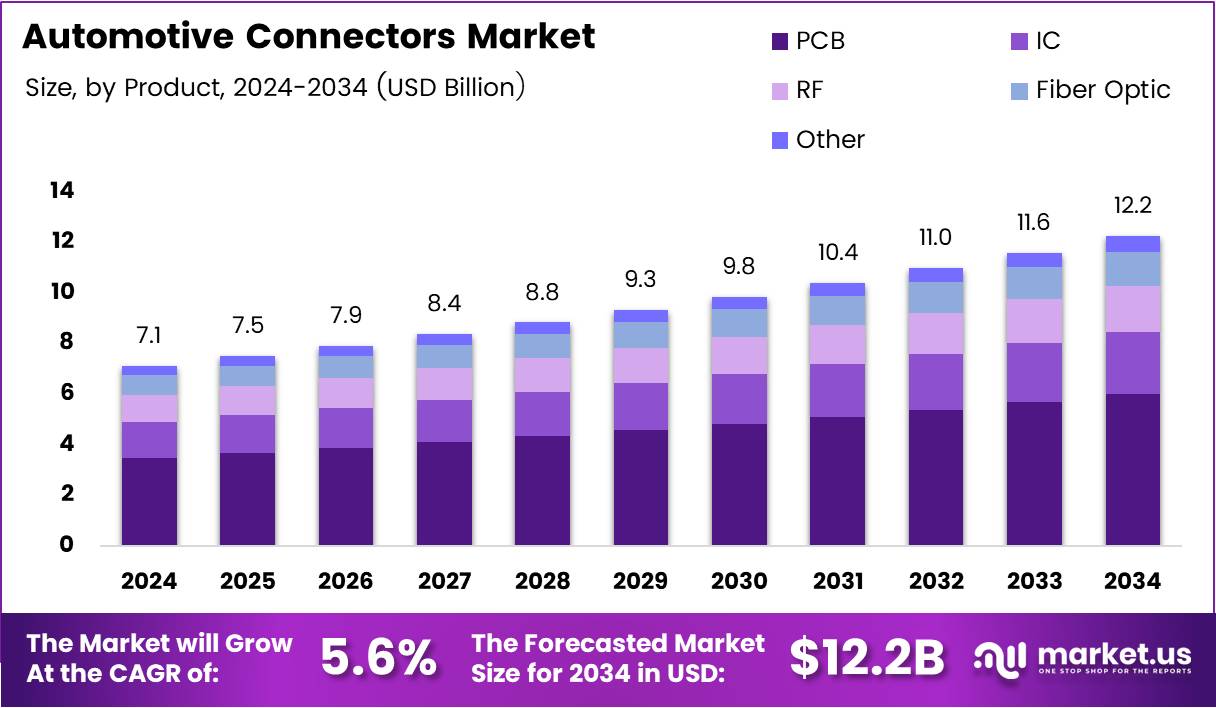

The Global Automotive Connectors Market size is expected to reach approximately USD 12.2 Billion by 2034, up from USD 7.1 Billion in 2024, expanding at a CAGR of 5.6% during the forecast period. This growth trajectory reflects the automotive industry’s rapid technological transformation and electrification momentum.

Automotive connectors serve as critical interface components that enable electrical signal transmission and power distribution across vehicle systems. These precision-engineered devices facilitate communication between electronic control units, sensors, infotainment systems, and powertrains. Modern vehicles require increasingly sophisticated connector solutions to support advanced functionalities.

The market benefits from accelerating vehicle electrification trends and rising adoption of autonomous driving technologies. Electric vehicles demand high-voltage connector architectures capable of handling substantial power loads safely. Meanwhile, advanced driver-assistance systems require ultra-reliable data transmission interfaces to ensure passenger safety and system performance.

Connected-car ecosystems are driving demand for robust, high-speed connectors that support real-time data exchange. Manufacturers increasingly prioritize lightweight, miniaturized designs that enhance fuel efficiency without compromising durability. These compact solutions enable flexible vehicle platform architectures while reducing overall system weight and manufacturing complexity.

However, developing durable connectors that withstand extreme temperatures, vibrations, and environmental stresses requires substantial investment. Complex global compliance requirements create additional challenges for manufacturers navigating diverse regulatory frameworks. Standardization efforts continue evolving to address interoperability concerns across international automotive supply chains.

Significant opportunities emerge from autonomous driving platforms requiring high-bandwidth connectivity solutions. The expanding EV charging infrastructure necessitates specialized high-power connectors designed for rapid energy transfer. According to Global Automotive Consumer Study, approximately 25% of U.S. consumers demonstrate willingness to invest in connected-vehicle technologies, indicating growing market acceptance.

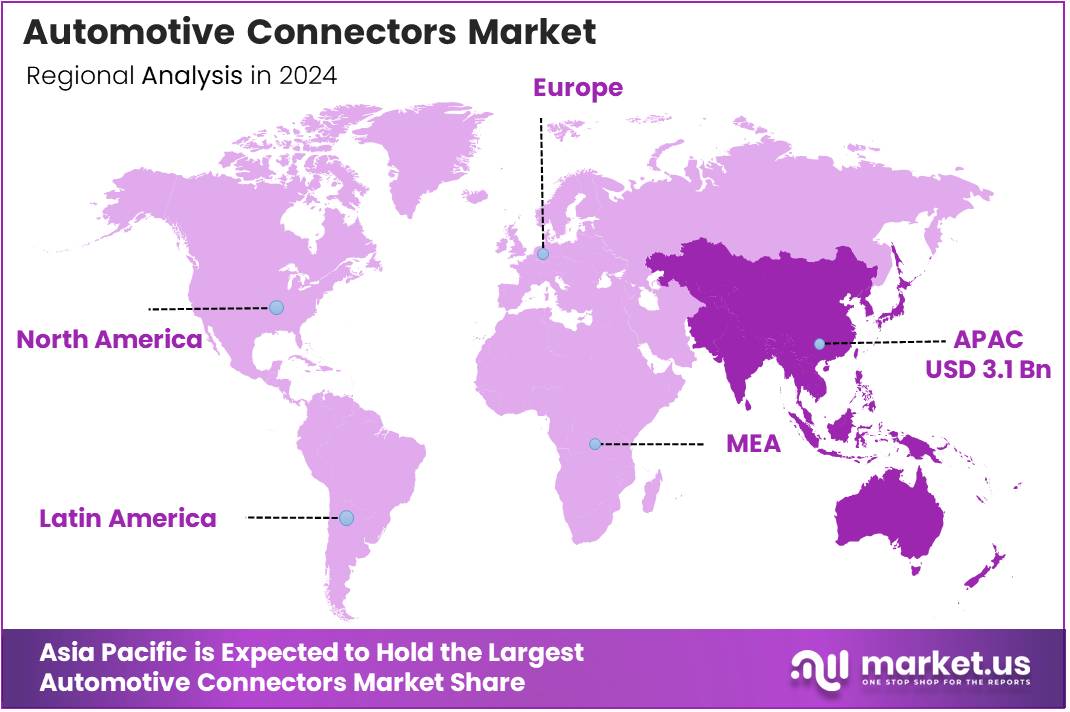

Asia-Pacific dominates the global landscape, commanding a 44.9% market share valued at USD 3.1 Billion, driven by robust automotive manufacturing capabilities. Regional government initiatives promoting electric mobility and smart transportation infrastructure further accelerate connector demand. Industry players focus on developing sustainable, recyclable materials aligned with environmental regulations and green manufacturing mandates.

Key Takeaways

- Global Automotive Connectors Market projected to reach USD 12.2 Billion by 2034 from USD 7.1 Billion in 2024

- Market expanding at a CAGR of 5.6% during the forecast period 2025-2034

- Asia-Pacific region leads with 44.9% market share, valued at USD 3.1 Billion

- PCB connectors dominate product segment with 54.2% market share

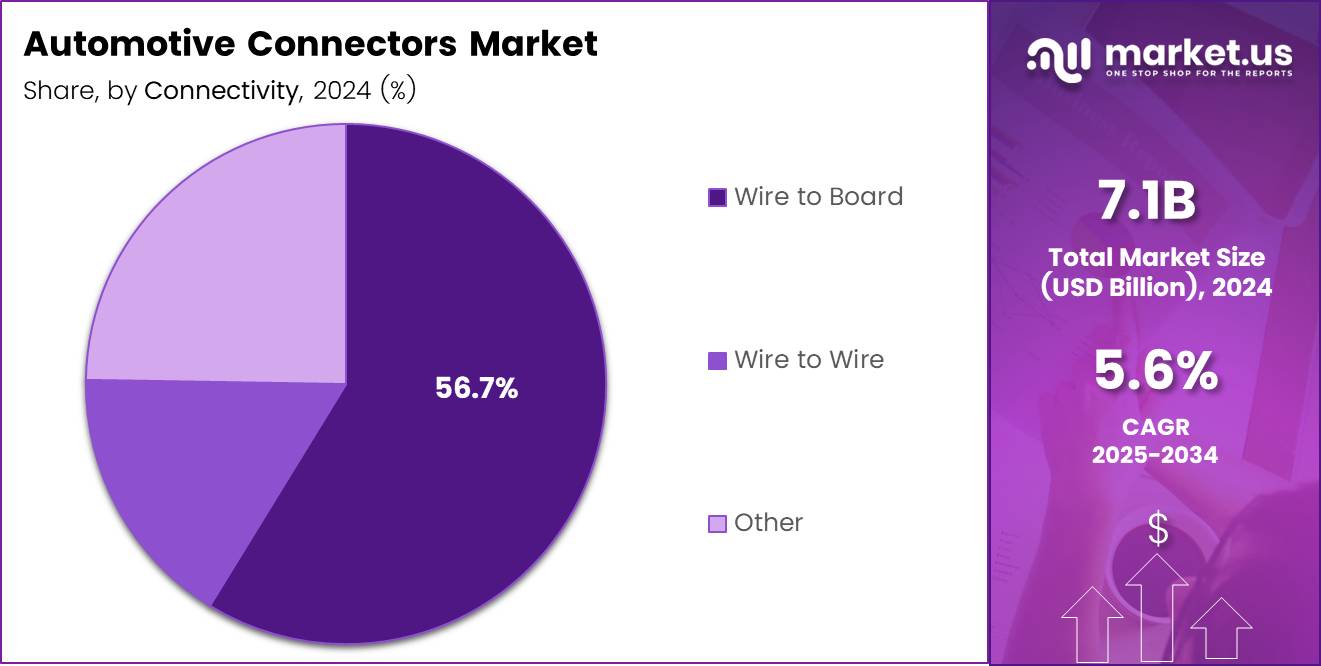

- Wire to Board connectivity holds 56.7% market share in connectivity segment

- Passenger cars account for 78.8% of vehicle segment demand

- Safety & Security applications command 36.3% of application segment

Segments Overview

By Product Analysis

PCB connectors dominate with 54.2% market share due to widespread application across automotive electronic systems.

In 2024, PCB connectors held a dominant market position in the By Product segment, capturing 54.2% share. These connectors facilitate essential connections between printed circuit boards and various automotive electronic modules. Their prevalence stems from cost-effectiveness, reliable performance, and compatibility with automated manufacturing processes. PCB connectors support critical functions including engine control, transmission management, and infotainment systems.

IC connectors serve specialized applications requiring high-density interconnections for integrated circuit components. These precision devices enable sophisticated electronic control units to manage complex vehicle functions. Consequently, IC connectors play vital roles in advanced powertrain systems and sophisticated driver-assistance technologies requiring precise signal integrity.

RF connectors address growing demand for wireless communication capabilities within modern vehicles. These specialized components support GPS navigation, cellular connectivity, and vehicle-to-everything communication protocols. Furthermore, RF connectors enable emerging telematics applications that enhance vehicle safety and driver convenience through real-time data exchange.

By Connectivity Analysis

Wire to Board connectivity dominates with 56.7% share due to versatile application across diverse automotive systems.

In 2024, Wire to Board connectors held a dominant market position in the By Connectivity segment, accounting for 56.7% share. These connectors provide essential interfaces between wiring harnesses and electronic control modules throughout vehicles. Their widespread adoption reflects reliability, ease of installation, and ability to accommodate various wire gauges. Wire to Board solutions support both power distribution and signal transmission requirements.

Wire to Wire connectors facilitate direct connections between cable assemblies without intermediate circuit boards. These components prove particularly valuable in body wiring applications where flexible routing paths are necessary. Additionally, Wire to Wire connectors simplify maintenance procedures by enabling quick disconnection and reconnection during service operations.

Other connectivity solutions encompass specialized connector types including board-to-board and hybrid designs. These alternative architectures address unique packaging constraints and performance requirements in modern vehicle architectures. Therefore, manufacturers continuously develop innovative connectivity solutions to meet evolving automotive design challenges and space limitations.

By Vehicle Analysis

Passenger cars dominate with 78.8% market share driven by high production volumes and advanced feature content.

In 2024, Passenger Cars held a dominant market position in the By Vehicle segment, representing 78.8% share. Personal vehicles incorporate extensive electronic systems requiring numerous connector interfaces for functionality. Modern passenger cars feature advanced infotainment, comprehensive safety systems, and sophisticated climate control requiring reliable electrical connections. Consequently, each vehicle platform demands hundreds of specialized connectors throughout its architecture.

Commercial vehicles represent a significant market segment with distinct connector requirements for heavy-duty applications. Trucks and buses require robust connectors capable of withstanding severe operating conditions including extreme temperatures and constant vibration. Furthermore, commercial vehicle connectors must deliver extended service life to minimize maintenance costs and maximize vehicle uptime across demanding operational environments.

By Application Analysis

Safety & Security applications dominate with 36.3% share reflecting critical importance of reliable connectivity in protective systems.

In 2024, Safety & Security held a dominant market position in the By Application segment, capturing 36.3% share. These applications encompass airbag systems, anti-lock braking, electronic stability control, and advanced driver-assistance features. Safety-critical connectors require rigorous testing and qualification processes to ensure flawless performance during emergency situations. Consequently, manufacturers invest heavily in developing ultra-reliable connector solutions for these demanding applications.

CCE (Climate Control and Comfort Electronics) applications require connectors supporting HVAC systems and cabin comfort features. These components enable precise temperature regulation and air distribution throughout vehicle interiors. Moreover, CCE connectors facilitate integration of heated seats, ambient lighting, and other convenience features enhancing passenger experience.

Powertrain applications demand high-temperature resistant connectors for engine management and transmission control systems. These robust components withstand harsh underhood environments while maintaining signal integrity for critical performance parameters. Additionally, electrified powertrain architectures require specialized high-voltage connectors capable of safely managing substantial electrical power.

Body Wiring & Power Distribution applications utilize extensive connector networks distributing electrical power throughout vehicle structures. These systems support lighting, door modules, window controls, and numerous other electrical loads. Furthermore, modern vehicles implement intelligent power distribution architectures requiring sophisticated connector solutions with diagnostic capabilities.

Navigation & Instrumentation applications incorporate connectors supporting display systems, instrument clusters, and positioning technologies. These interfaces enable driver information systems to present critical vehicle data and navigation guidance. Therefore, connectors serving these applications must deliver excellent signal quality for high-resolution displays and precise sensor data transmission.

Key Market Segments

By Product

- PCB

- IC

- RF

- Fiber Optic

- Other

By Connectivity

- Wire to Board

- Wire to Wire

- Other

By Vehicle

- Passenger Car

- Commercial Vehicle

By Application

- Safety & Security

- CCE

- Powertrain

- Body Wiring & Power Distribution

- Navigation & Instrumentation

- Others

Drivers

Rising Integration of Advanced Driver-Assistance Systems Accelerates Demand for High-Reliability Automotive Connectors

Modern vehicles increasingly incorporate sophisticated ADAS features requiring extensive sensor networks and electronic control units. These safety-critical systems depend on ultra-reliable connector solutions ensuring flawless data transmission between radar sensors, cameras, and processing units. Consequently, automotive manufacturers prioritize connector designs with enhanced signal integrity and vibration resistance to support autonomous driving capabilities.

The accelerating shift toward vehicle electrification fundamentally transforms connector requirements across automotive architectures. Electric vehicles demand specialized high-voltage connector systems capable of safely managing substantial power loads during charging and operation. Moreover, battery management systems require precise monitoring connections ensuring optimal performance and longevity. These electrification trends drive substantial investment in advanced connector technologies supporting next-generation powertrains.

Connected-car ecosystems necessitate robust data-transmission interfaces supporting real-time communication between vehicles and external infrastructure. Telematics systems require reliable connectors enabling continuous connectivity for navigation, entertainment, and vehicle diagnostics. Furthermore, increasing adoption of lightweight, miniaturized components helps manufacturers improve fuel efficiency while maintaining system reliability and performance standards across diverse operating conditions.

Restraints

High Development Costs and Complex Compliance Requirements Challenge Automotive Connector Manufacturers

Developing durable connector designs capable of withstanding extreme temperatures, constant vibration, and harsh environmental conditions requires substantial engineering investment. Manufacturers must conduct extensive testing protocols ensuring connector reliability across vehicle lifecycles spanning years of demanding operation. These rigorous development processes significantly increase time-to-market and overall production costs for new connector solutions.

Complex standardization requirements across global automotive supply chains create additional challenges for connector manufacturers serving international markets. Different regions maintain distinct regulatory frameworks governing electrical safety, electromagnetic compatibility, and environmental compliance. Consequently, manufacturers must navigate diverse certification processes while ensuring connector designs meet varying technical specifications across multiple jurisdictions.

Furthermore, automotive OEMs frequently implement proprietary connector specifications requiring custom development efforts from suppliers. These unique requirements limit economies of scale and increase inventory complexity throughout supply chains. Additionally, rapid technological evolution in vehicle architectures necessitates continuous connector redesigns, straining manufacturer resources and potentially delaying product launches for next-generation vehicle platforms.

Growth Factors

Autonomous Driving Platforms and EV Infrastructure Expansion Create Significant Market Opportunities

The surge in autonomous driving development creates substantial demand for high-speed connectors supporting data-intensive computing platforms. Self-driving vehicles require massive bandwidth to process sensor data from multiple sources simultaneously while maintaining ultra-low latency. Consequently, connector manufacturers develop specialized solutions delivering gigabit-per-second transmission rates with exceptional electromagnetic interference resistance for reliable autonomous operation.

Growing utilization of smart, sensor-integrated connectors enables predictive maintenance capabilities across vehicle fleets. These intelligent components monitor connection integrity and environmental conditions, providing early warnings of potential failures. Moreover, expanding EV charging infrastructure necessitates specialized high-power connector solutions designed for rapid energy transfer and extended service life under frequent cycling conditions.

Rising adoption of modular connector systems enables flexible vehicle platform design supporting multiple model variants from common architectures. These standardized solutions reduce manufacturing complexity while accommodating diverse feature configurations across product lineups. Additionally, modular approaches facilitate easier service procedures and component replacement, enhancing overall vehicle maintainability throughout operational lifecycles and reducing total ownership costs.

Emerging Trends

High-Density Connectors and Sustainable Materials Shape Future Automotive Connectivity Solutions

The proliferation of high-density connectors addresses increasing electronic content in advanced infotainment and telematics systems. Modern vehicles feature large touchscreen displays, multiple wireless interfaces, and sophisticated audio systems requiring numerous electrical connections. Consequently, manufacturers develop compact connector designs maximizing circuit density while minimizing package dimensions to accommodate space-constrained vehicle architectures and complex wiring harnesses.

Increasing use of sealed, waterproof connectors supports harsh-environment vehicle applications including underbody systems and exterior lighting. These ruggedized components feature advanced sealing technologies preventing moisture ingress and maintaining electrical integrity throughout vehicle lifecycles. Furthermore, rapid development of optical and high-frequency connectors enables data-intensive automotive networks supporting emerging bandwidth requirements for autonomous driving and vehicle-to-everything communication protocols.

Adoption of sustainable, recyclable connector materials reflects growing environmental consciousness driven by green manufacturing policies. Automotive manufacturers increasingly prioritize suppliers offering eco-friendly solutions reducing environmental impact across product lifecycles. Therefore, connector developers explore alternative materials and manufacturing processes minimizing carbon footprints while maintaining performance standards required for demanding automotive applications.

Regional Analysis

Asia-Pacific Dominates the Automotive Connectors Market with 44.9% Market Share, Valued at USD 3.1 Billion

Asia-Pacific commands the global automotive connectors landscape, holding a 44.9% market share valued at USD 3.1 Billion. This regional dominance stems from massive automotive manufacturing capabilities concentrated in China, Japan, South Korea, and India. Furthermore, aggressive government initiatives promoting electric vehicle adoption and smart mobility infrastructure accelerate connector demand. The region benefits from established electronics supply chains and cost-competitive production capabilities supporting both domestic consumption and global exports.

North America Automotive Connectors Market Trends

North America represents a significant market driven by advanced vehicle technologies and stringent safety regulations. The region demonstrates strong adoption of premium vehicles featuring extensive electronic content and sophisticated driver-assistance systems. Additionally, substantial investments in electric vehicle manufacturing and charging infrastructure create growing demand for specialized high-voltage connector solutions throughout the automotive value chain.

Europe Automotive Connectors Market Trends

Europe maintains a prominent market position supported by leading automotive manufacturers and strict environmental regulations. The region pioneers advanced emission reduction technologies and electric mobility adoption, driving sophisticated connector requirements. Moreover, European automakers emphasize premium features and innovative vehicle architectures requiring cutting-edge connectivity solutions for next-generation platforms and autonomous driving development programs.

Latin America Automotive Connectors Market Trends

Latin America shows steady growth potential driven by expanding automotive production in Brazil and Mexico. The region attracts global manufacturers establishing production facilities to serve local markets and export opportunities. However, economic volatility and fluctuating currency values create challenges for sustained market expansion and technology adoption across the regional automotive industry.

Middle East and Africa Automotive Connectors Market Trends

Middle East and Africa represent emerging markets with gradual automotive industry development and increasing vehicle ownership rates. The region experiences growing demand for reliable connector solutions supporting vehicles operating in extreme temperature conditions. Furthermore, infrastructure investments and economic diversification initiatives create opportunities for automotive sector growth and associated component demand.

Key Automotive Connectors Company Insights

The global automotive connectors market in 2024 features established industry leaders leveraging extensive engineering expertise and global manufacturing networks.

TE Connectivity maintains a prominent position through comprehensive product portfolios addressing diverse vehicle architectures and advanced connectivity requirements. The company delivers innovative solutions supporting electrification trends and autonomous driving development.

Aptiv PLC excels in developing intelligent connectivity solutions integrating advanced sensing capabilities with robust mechanical designs. Their focus on software-defined vehicle architectures positions them strategically for emerging automotive technology trends. Meanwhile, Amphenol Corporation demonstrates strength in harsh-environment connector applications serving commercial vehicles and heavy-duty applications requiring exceptional durability.

Yazaki Corporation leverages deep automotive industry relationships and vertically integrated manufacturing capabilities to serve global OEMs efficiently. Their extensive wiring harness expertise enables optimized connector integration throughout vehicle electrical systems. These leading manufacturers continuously invest in research and development to address evolving market demands for miniaturization, higher data rates, and enhanced environmental resistance across diverse automotive applications.

Key Companies

- TE Connectivity

- Aptiv PLC

- Amphenol Corporation

- Yazaki Corporation

- Molex Incorporated

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Kyocera Corporation

- Rosenberger Group

Recent Developments

- In February 2024, FIT Voltaira Group completed the acquisition of Auto-Kabel Group, expanding its automotive connectivity portfolio and strengthening European market presence. This strategic transaction enhances the combined entity’s capabilities in developing specialized connector solutions for electric vehicle applications and advanced automotive electrical architectures.

- In November 2025, Molex extended its eHV High-Voltage Connector Portfolio to ensure safe, reliable, and efficient electrical connections in electric and hybrid vehicles. The expanded product line addresses growing demand for robust high-voltage connectivity solutions supporting next-generation electrified powertrains and rapid charging infrastructure requirements.

- In October 2025, KYOCERA formed a capital and business alliance with Japan Aviation Electronics Industry, strengthening collaborative development of advanced connector technologies. This partnership leverages complementary expertise to accelerate innovation in high-density connectors supporting autonomous driving platforms and data-intensive automotive applications.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Billion Forecast Revenue (2034) USD 12.2 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (PCB, IC, RF, Fiber Optic, Other), By Connectivity (Wire to Board, Wire to Wire, Other), By Vehicle (Passenger Car, Commercial Vehicle), By Application (Safety & Security, CCE, Powertrain, Body Wiring & Power Distribution, Navigation & Instrumentation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TE Connectivity, Aptiv PLC, Amphenol Corporation, Yazaki Corporation, Molex Incorporated, Sumitomo Electric Industries, Ltd., Hirose Electric Co., Ltd., JST Manufacturing Co., Ltd., Kyocera Corporation, Rosenberger Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Connectors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Connectors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TE Connectivity

- Aptiv PLC

- Amphenol Corporation

- Yazaki Corporation

- Molex Incorporated

- Sumitomo Electric Industries, Ltd.

- Hirose Electric Co., Ltd.

- JST Manufacturing Co., Ltd.

- Kyocera Corporation

- Rosenberger Group