Global Automotive Composites Market Size, Share, Growth Analysis By Material Type (Glass Fiber, Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber), By Application (Structural Assembly, Powertrain Component, Interior, Exterior, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 173814

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

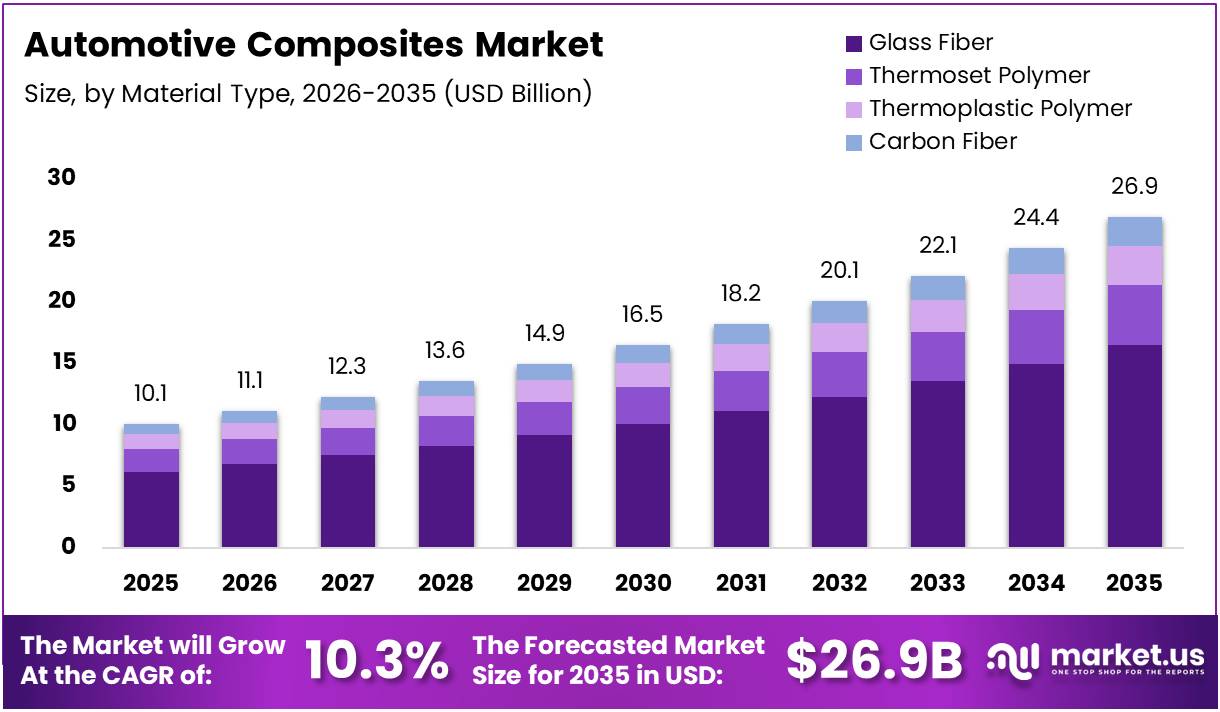

The Global Automotive Composites Market size is expected to be worth around USD 26.9 Billion by 2035, from USD 10.1 Billion in 2025, growing at a CAGR of 10.3% during the forecast period from 2026 to 2035.

The automotive composites market represents a transformative shift in vehicle manufacturing, where advanced polymer-based materials replace traditional metals. These innovative materials combine reinforcing fibers with polymer matrices, creating lightweight yet robust components. Consequently, automakers increasingly adopt composites to enhance fuel efficiency, reduce emissions, and improve overall vehicle performance across passenger cars, commercial vehicles, and electric automobiles.

Market growth accelerates as manufacturers prioritize weight reduction strategies amid stringent environmental regulations. Transitioning toward sustainable mobility solutions, automotive composites enable significant lightweighting without compromising structural integrity. Moreover, expanding electric vehicle production creates substantial opportunities, as battery-powered automobiles particularly benefit from reduced weight, thereby extending driving range and optimizing energy consumption throughout operational lifecycles.

Government initiatives worldwide actively promote composite adoption through investment programs and regulatory frameworks. Subsequently, emission standards compel manufacturers to explore alternative materials that deliver measurable environmental benefits. Additionally, public funding supports research facilities developing next-generation composite technologies, fostering innovation ecosystems that bridge material science and automotive engineering disciplines effectively.

Performance advantages drive market expansion, particularly regarding strength-to-weight ratios compared to conventional materials. Polymer ccomposites demonstrate remarkable capabilities, achieving 20-40% weight savings over traditional metallic alternatives while maintaining superior specific strength properties. Furthermore, these materials offer exceptional design flexibility, enabling complex geometries that optimize aerodynamics and structural performance simultaneously.

Carbon fiber reinforced polymers deliver exceptional lightweighting benefits in premium applications. Notably, carbon fiber wheels achieve 30-40% weight reduction versus forged aluminum counterparts, substantially decreasing unsprung mass for enhanced handling, ride quality, and acceleration characteristics. Moreover, glass-fiber reinforced composites provide 15-25% weight savings, whereas carbon-fiber reinforced composites deliver 25-40% reductions compared to dominant structural metals including steel, iron, and aluminum, thereby transforming automotive design paradigms comprehensively.

Key Takeaways

- Global Automotive Composites Market expected to reach USD 26.9 Billion by 2035, up from USD 10.1 Billion in 2025, growing at a CAGR of 10.3%.

- Glass Fiber leads the market with a 61.3% share in the By Material Type segment.

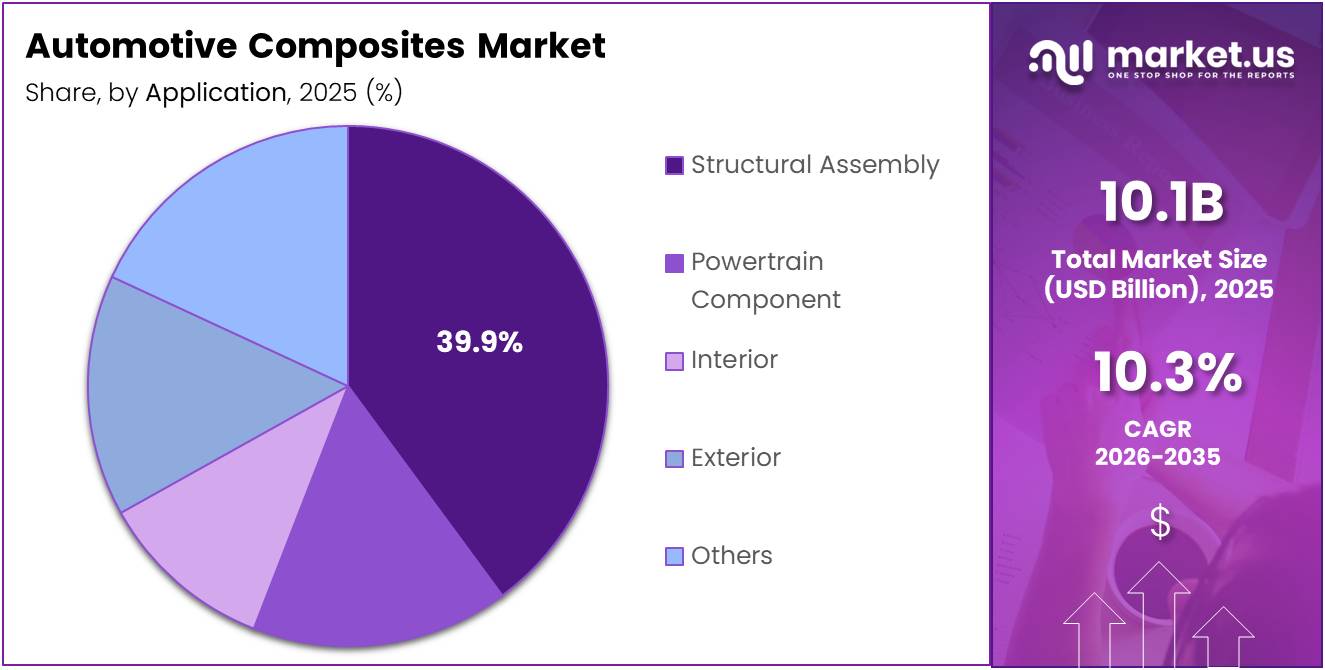

- Structural Assembly dominates applications with a 39.9% market share in 2025.

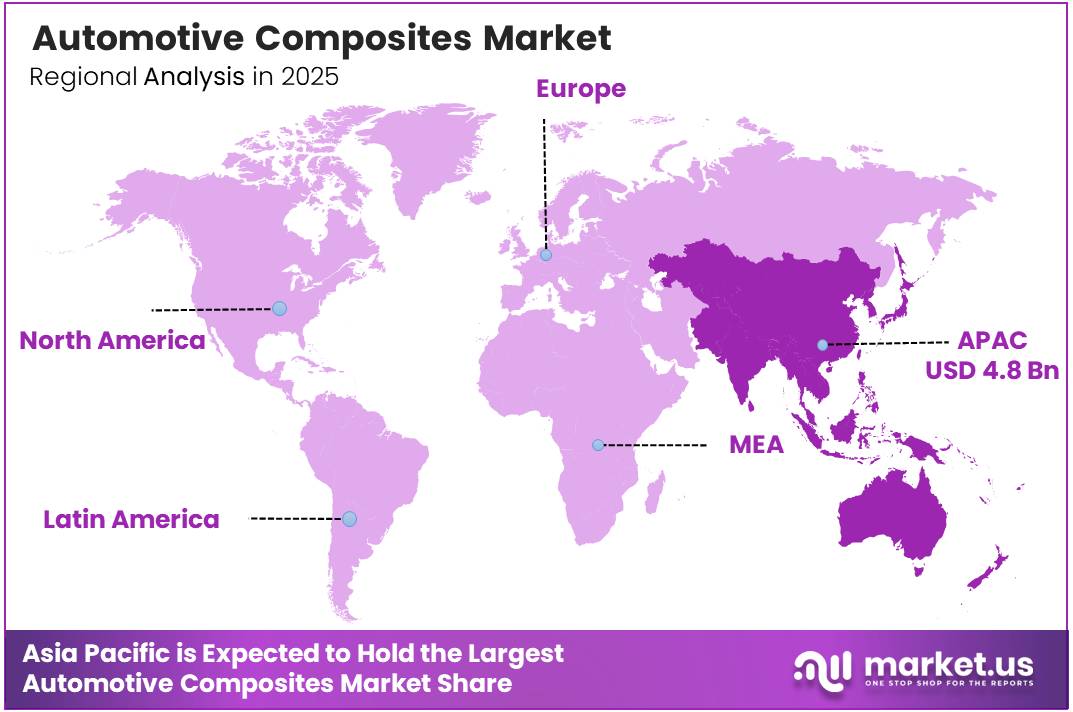

- Asia Pacific holds a 48.2% market share, valued at USD 4.8 Billion, leading global adoption.

By Material Type Analysis

Glass Fiber dominates with 61.3% due to its excellent strength-to-weight ratio and cost-effectiveness.

In 2025, Glass Fiber held a dominant market position in the By Material Type Analysis segment of Automotive Composites Market, with a 61.3% share. This material has become the preferred choice for automotive manufacturers seeking lightweight solutions without compromising structural integrity. Glass fiber composites offer exceptional durability, corrosion resistance, and design flexibility at competitive prices. Their ease of manufacturing and established supply chains make them highly accessible for mass production applications.

Thermoset Polymer represents a significant material category offering irreversible curing properties that enhance dimensional stability. These polymers provide superior heat resistance and chemical stability, making them ideal for under-hood applications. Moreover, thermoset composites deliver excellent mechanical properties and long-term durability, securing their position in critical automotive components where high-temperature resistance is essential.

Thermoplastic Polymer composites are gaining traction due to their recyclability and faster processing times compared to thermosets. These materials offer remarkable impact resistance and can be reshaped when heated, facilitating repair initiatives. Additionally, thermoplastic composites align with sustainability goals as automakers pursue circular economy practices, making them increasingly attractive for high-volume production.

Carbon Fiber represents the premium segment delivering unmatched strength-to-weight ratios for high-performance applications. Despite higher costs, carbon fiber adoption is growing in luxury and electric vehicles where weight reduction directly impacts performance. Consequently, manufacturers are investing in cost-reduction technologies to broaden accessibility across mainstream segments.

By Application Analysis

Structural Assembly dominates with 39.9% due to increasing demand for lightweight vehicle frameworks and enhanced safety performance.

In 2025, Structural Assembly held a dominant market position in the By Application Analysis segment of Automotive Composites Market, with a 39.9% share. This application encompasses critical load-bearing components including chassis elements, pillars, and reinforcement structures forming the vehicle’s foundation. Automotive composites in structural assemblies deliver significant weight reductions while maintaining crash safety performance, with electric vehicles accelerating adoption.

Powertrain Component applications utilize composites for engine and transmission parts benefiting from weight reduction and thermal management. These components include intake manifolds, valve covers, and oil pans requiring heat resistance. Furthermore, composite powertrain parts contribute to noise reduction and vibration damping, while electrification drives development of composite battery enclosures and motor housings.

Interior applications represent a diverse segment where composites enhance aesthetics and functionality within vehicle cabins. Dashboard panels, door trims, and seat structures increasingly incorporate composite materials offering design freedom and weight savings. Moreover, interior composites contribute to improved acoustics and passenger safety through energy-absorbing properties during collisions.

Exterior applications showcase composites in body panels, bumpers, and aerodynamic components shaping vehicle appearance. These parts benefit from corrosion resistance, complex shape formability, and integrated color options eliminating painting requirements. Additionally, exterior composites improve fuel efficiency through weight reduction while enabling distinctive styling that differentiates automotive brands.

Others encompass specialized applications including fuel systems, electrical housings, and ancillary components throughout vehicles. These diverse applications leverage specific composite properties such as chemical resistance and electrical insulation. Consequently, this segment continues expanding as engineers discover innovative uses across evolving automotive technologies.

Key Market Segments

By Material Type

- Glass Fiber

- Thermoset Polymer

- Thermoplastic Polymer

- Carbon Fiber

By Application

- Structural Assembly

- Powertrain Component

- Interior

- Exterior

- Others

Drivers

Stringent Emission Regulations Driving Lightweight Material Adoption

Governments worldwide are implementing strict emission standards to reduce carbon footprints from vehicles. These regulations push automakers to find innovative solutions for reducing vehicle weight. Lighter vehicles consume less fuel and produce fewer emissions, making composites an ideal choice. Automotive composites offer excellent strength-to-weight ratios compared to traditional steel and aluminum.

The electric vehicle sector is experiencing remarkable expansion globally. EV manufacturers require lightweight yet strong materials to offset heavy battery weights and extend driving range. Composites provide the necessary strength while significantly reducing overall vehicle mass. This material choice directly improves battery efficiency and vehicle performance.

Automakers are continuously seeking ways to enhance vehicle quality and longevity. Advanced composite materials offer superior durability against corrosion and environmental damage. They also contribute to improved crash safety through better energy absorption properties. OEMs recognize that composites enable better design flexibility while maintaining structural integrity. This focus on performance enhancement makes composites increasingly attractive for modern vehicle manufacturing.

Restraints

Complex Manufacturing Processes Limiting Market Expansion

The production of automotive composites requires specialized knowledge and sophisticated equipment. Manufacturing facilities must invest heavily in advanced machinery and skilled workforce training. The process involves precise temperature control, curing times, and material handling procedures. Small errors during production can compromise the entire component’s structural integrity.

Composite materials present significant challenges at the end of their lifecycle. Unlike metals, composites cannot be easily melted down and reformed into new products. Current recycling technologies for composite materials remain limited and costly. The separation of different composite layers and matrix materials requires complex chemical processes. This creates environmental concerns as discarded composite parts often end up in landfills.

Growth Factors

Expanding Use of Composites in Electric Vehicle Systems

Electric vehicle manufacturers are discovering new applications for composite materials beyond traditional body panels. Battery enclosures made from composites provide excellent thermal management and lightweight protection. Structural platforms using composites help accommodate large battery packs while maintaining vehicle rigidity. This expanding application scope creates substantial growth opportunities for composite material suppliers.

Environmental consciousness is reshaping material selection in automotive manufacturing. Bio-based composites derived from natural fibers and renewable resins are gaining traction. These sustainable alternatives offer comparable performance while reducing environmental impact. Automakers increasingly prefer materials that align with their sustainability commitments.

Autonomous vehicles require sophisticated sensor integration and specialized structural designs. Composites offer the flexibility needed for embedding sensors and electronic components seamlessly. Next-generation vehicles demand materials that support advanced connectivity and safety features. The unique properties of composites make them ideal for these innovative applications.

Emerging Trends

Growing Use of Hybrid Composite Structures in Vehicle Design

Manufacturers are increasingly combining different materials to optimize vehicle performance and cost. Hybrid structures use composites alongside metals to leverage each material’s strengths. This approach allows engineers to place expensive composites only where maximum benefit occurs. Metal-composite combinations provide cost-effective solutions while maintaining lightweight advantages. The trend toward multi-material designs is reshaping automotive engineering practices.

Composites are moving beyond specialty vehicles into mainstream automotive components. Exterior panels made from composites reduce weight while improving design aesthetics. Interior components benefit from composites’ noise dampening and design flexibility properties. Automakers are replacing traditional materials in doors, hoods, and trunk lids with composite alternatives.

Major automakers are investing heavily in technologies that enable faster composite production. Traditional composite manufacturing was too slow for high-volume vehicle production lines. New automated processes and rapid curing techniques are changing this limitation. These technological advances make composites viable for mass-market vehicles rather than just luxury models.

Regional Analysis

Asia Pacific Dominates the Automotive Composites Market with a Market Share of 48.2%, Valued at USD 4.8 Billion

Asia Pacific leads the global automotive composites market with a commanding share of 48.2%, valued at USD 4.8 billion. The region’s dominance stems from robust automotive manufacturing in China, Japan, South Korea, and India, where stringent emission norms and electric vehicle expansion drive composite adoption. Strong presence of automotive OEMs, favorable government policies, and significant investments in advanced lightweight materials reinforce the region’s market leadership.

North America Automotive Composites Market Trends

North America holds a significant market position, driven by stringent CAFE standards and increasing lightweighting initiatives across the automotive sector. The region’s focus on electric and hybrid vehicles, coupled with substantial R&D investments in advanced composite technologies, supports steady market growth and positions it as a key innovation hub for next-generation automotive materials.

Europe Automotive Composites Market Trends

Europe maintains a strong market presence, propelled by rigorous environmental regulations and carbon neutrality commitments in the transportation sector. The region’s premium automotive segment extensively utilizes advanced composites for weight reduction and performance enhancement, while the accelerating shift toward electric mobility and sustainable composite solutions drives continuous innovation and market expansion.

Middle East and Africa Automotive Composites Market Trends

The Middle East and Africa region exhibits moderate growth in automotive composites adoption, supported by expanding vehicle assembly operations and increasing fuel efficiency awareness. While limited local manufacturing infrastructure poses challenges, government initiatives promoting automotive sector development and gradual industrialization present emerging opportunities for composite material integration in the region.

Latin America Automotive Composites Market Trends

Latin America represents an emerging market for automotive composites, with growth concentrated in Brazil, Mexico, and Argentina. The region’s developing automotive production base and increasing focus on fuel-efficient vehicles create opportunities, though cost sensitivity and limited composite manufacturing capabilities currently moderate the pace of market penetration.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Composites Company Insights

The global automotive composites market in 2025 is characterized by intense competition among established material science leaders and specialized composite manufacturers, each bringing distinct technological capabilities and strategic positioning to address the industry’s evolving lightweighting and sustainability demands.

Hexcel Corporation maintains a commanding presence through its advanced carbon fiber and honeycomb technologies, serving premium automotive segments where weight reduction directly translates to enhanced performance and efficiency. The company’s established aerospace heritage provides cross-industry synergies that strengthen its automotive composites portfolio, particularly in structural applications requiring exceptional strength-to-weight ratios.

Mitsubishi Chemical Carbon Fiber and Composites, Inc. leverages its parent company’s extensive chemical engineering expertise to deliver integrated solutions spanning precursor development through finished composite parts. Their vertical integration capabilities enable rapid material customization and cost optimization, positioning them favorably as automotive manufacturers seek reliable supply chains for carbon fiber reinforced polymers in both electric and conventional vehicle platforms.

mouldCAM Pty Ltd. differentiates itself through specialized engineering software and manufacturing solutions that optimize composite part production efficiency. Their focus on digital tooling and automated layup technologies addresses critical industry bottlenecks in scaling composite component manufacturing to meet automotive volume requirements while maintaining stringent quality standards.

SGL Carbon SE brings comprehensive carbon-based material expertise, offering both carbon fibers and specialized graphite solutions for emerging battery applications in electric vehicles. This dual capability positions the company uniquely to capture value across multiple automotive composite segments, from lightweight structural components to critical energy storage system elements that define next-generation vehicle architectures.

Top Key Players in the Market

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- mouldCAM Pty Ltd.

- SGL Carbon SE

- Teijin Limited

- Toray Industries Inc

- Nippon Sheet Glass Company, Limited

- Solvay S.A.

- Nippon Carbon Co., Ltd.

- Huntsman International LLC.

- BFG International Group

Recent Developments

- In December 2025, In December 2025, Cambium acquired the global advanced composites manufacturer SHD Group to strengthen its materials innovation and enhance its production capabilities across multiple sectors.

- In September 2025, In September 2025, AM Group announced the acquisition of UBC Composites, a top European specialist in high-end carbon fibre components, aiming to expand its portfolio for both aesthetic and structural automotive applications.

- In March 2025, In March 2025, AURELIUS Private Equity completed a mid-market buyout of Teijin Automotive Technologies North America, focusing on boosting its technological capabilities and footprint in the automotive composites sector.

Report Scope

Report Features Description Market Value (2025) USD 10.1 Billion Forecast Revenue (2035) USD 26.9 Billion CAGR (2026-2035) 10.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Glass Fiber, Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber), By Application (Structural Assembly, Powertrain Component, Interior, Exterior, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hexcel Corporation, Mitsubishi Chemical Carbon Fiber and Composites, Inc., mouldCAM Pty Ltd., SGL Carbon SE, Teijin Limited, Toray Industries Inc, Nippon Sheet Glass Company, Limited, Solvay S.A., Nippon Carbon Co., Ltd., Huntsman International LLC., BFG International Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Composites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Composites MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- mouldCAM Pty Ltd.

- SGL Carbon SE

- Teijin Limited

- Toray Industries Inc

- Nippon Sheet Glass Company, Limited

- Solvay S.A.

- Nippon Carbon Co., Ltd.

- Huntsman International LLC.

- BFG International Group