Global Automatic Gearbox Valves Market Size, Share, Growth Analysis By Transmission Type (Automatic, Dual Clutch Transmission, Continuously Variable Transmission), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Product Type (Solenoid Valves, Shift Control Valves, Pressure Regulator Valves, Accumulator Valves, Clutch Control Valves, Pulley Control Valves), By Sales Channel (First Fit, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169060

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Transmission Type Analysis

- By Vehicle Type Analysis

- By Product Type Analysis

- By Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Automatic Gearbox Valves Company Insights

- Key Companies

- Recent Developments

- Report Scope

Report Overview

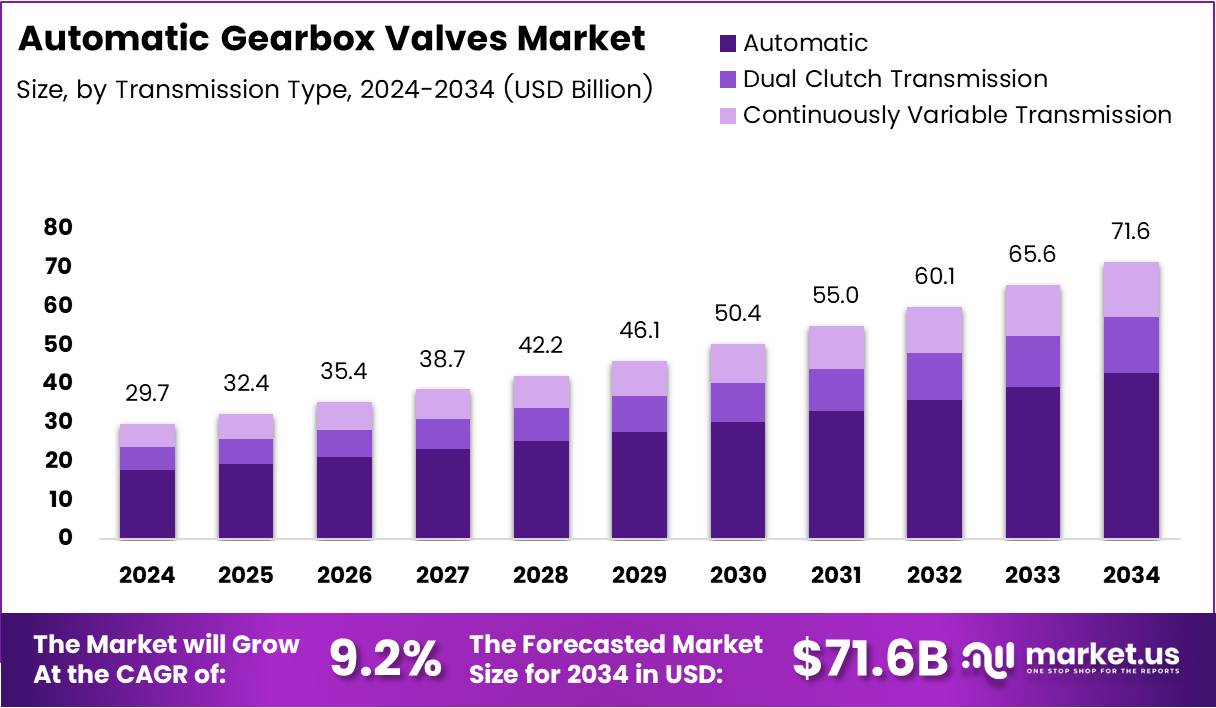

The Global Automatic Gearbox Valves Market is projected to reach approximately USD 71.6 Billion by 2034, rising from USD 29.7 Billion in 2024. This represents a compound annual growth rate of 9.2% during the forecast period from 2025 to 2034. The market demonstrates robust expansion driven by evolving automotive transmission technologies.

Automatic gearbox valves serve as critical hydraulic control components within transmission systems. These precision-engineered devices regulate fluid flow and pressure distribution throughout the gearbox assembly. Furthermore, they enable seamless gear transitions and optimize vehicle performance across diverse driving conditions.

The automotive industry continues embracing advanced transmission architectures that demand sophisticated valve solutions. Meanwhile, regulatory frameworks worldwide push manufacturers toward enhanced efficiency standards and emission controls. Consequently, automakers invest heavily in next-generation mechatronic valve assemblies that integrate electronic controls with hydraulic functionality.

Electric vehicle proliferation creates both challenges and opportunities for traditional gearbox valve suppliers. Nevertheless, hybrid powertrains and multi-speed EV transmissions maintain strong demand for specialized valve components. Additionally, the aftermarket segment expands as existing vehicle fleets require maintenance and component replacements.

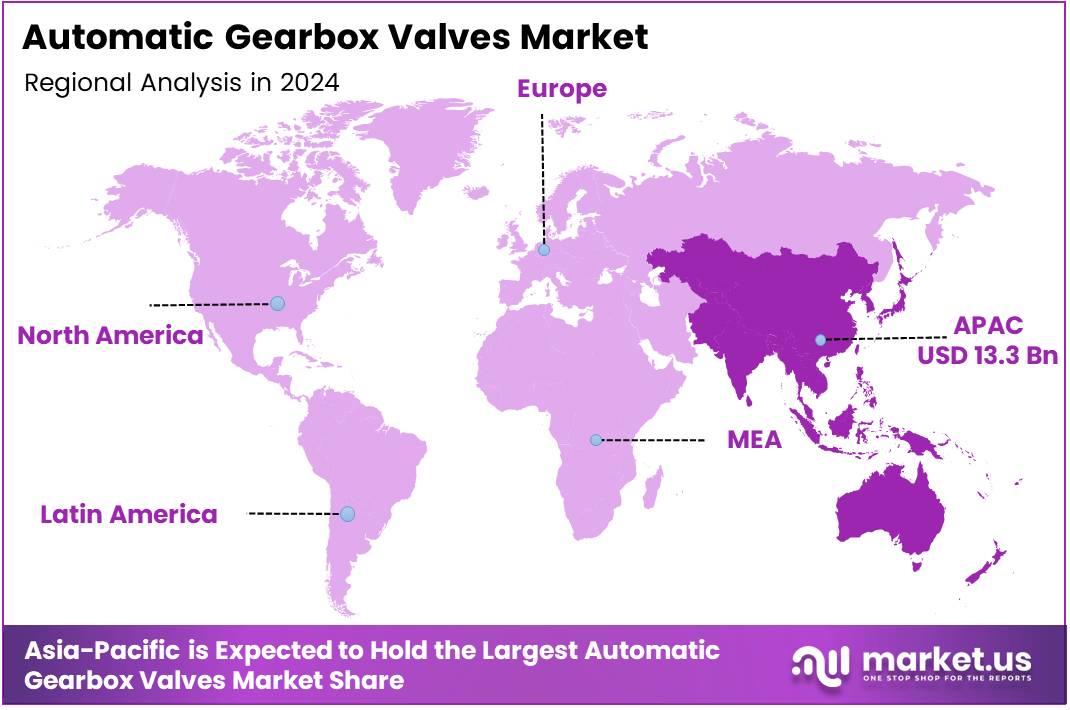

Asia Pacific emerges as the dominant regional market, capturing 44.8% share valued at USD 13.3 Billion. This leadership stems from concentrated automotive manufacturing hubs and rising vehicle production volumes. Similarly, China’s stringent transmission standards and NEV policies accelerate technology adoption among domestic suppliers.

According to a 2024 SAE technical paper, innovative composite materials for spool valves achieved 15% weight reduction alongside improved thermal resistance. Moreover, industry statistics reveal that valve body malfunctions account for approximately 35% of all automatic transmission failures in luxury vehicles. These findings underscore the critical importance of quality valve engineering.

Government incentives supporting localized manufacturing reshape supply chain dynamics significantly. Subsequently, tier-one suppliers establish regional production facilities to comply with content requirements. The market landscape therefore reflects a strategic balance between technological innovation and cost-effective manufacturing scalability.

Key Takeaways

- Global Automatic Gearbox Valves Market projected to reach USD 71.6 Billion by 2034, up from USD 29.7 Billion in 2024.

- Market grows at a CAGR of 9.2% during 2025–2034.

- Asia Pacific leads with 44.8% share valued at USD 13.3 Billion in 2024.

- Automatic transmission segment dominates with 56.3% share in 2024.

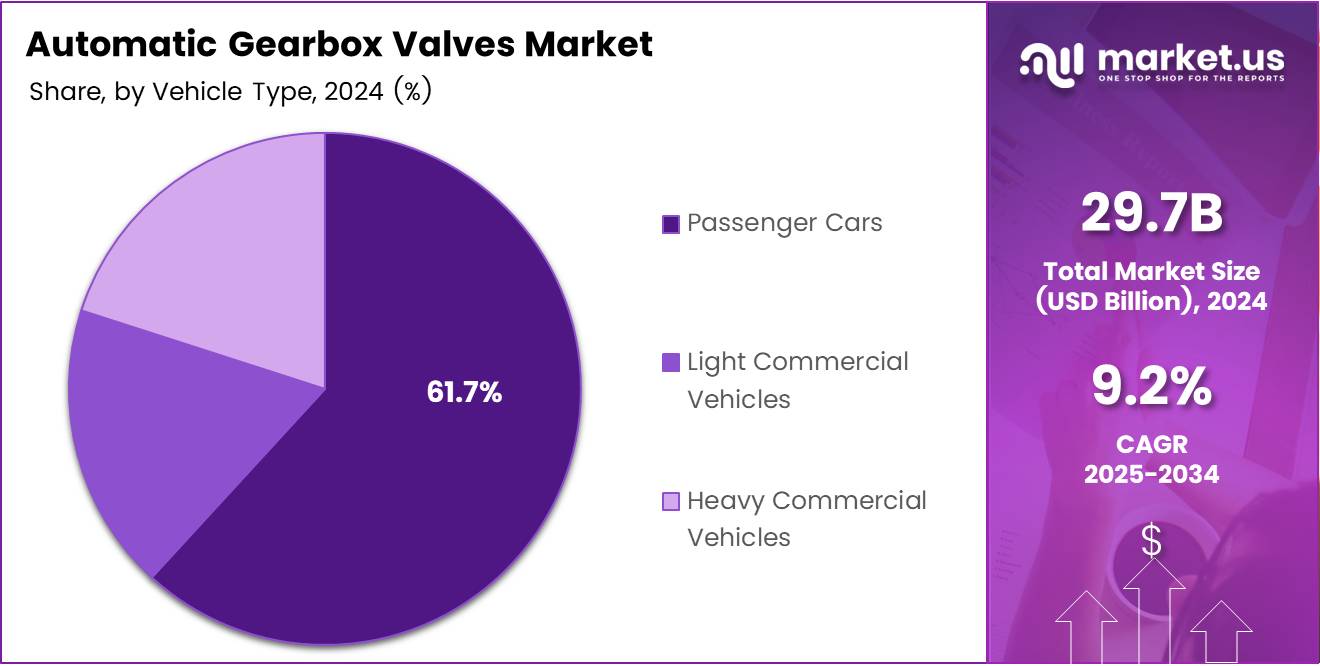

- Passenger Cars lead the vehicle type segment with 61.7% share in 2024.

- Solenoid Valves dominate product type with 34.9% share in 2024.

- First Fit (OEM) channel holds 73.2% share in 2024.

By Transmission Type Analysis

Automatic transmission dominates with 56.3% share due to widespread adoption in global passenger vehicle fleets.

In 2024, Automatic held a dominant market position in the By Transmission Type Analysis segment, capturing 56.3% share. Traditional automatic transmissions remain prevalent across established automotive markets owing to consumer preference for convenience. Additionally, continuous refinements in hydraulic valve technology enhance shift quality and fuel efficiency. Manufacturers prioritize valve integration that supports eight-speed and ten-speed configurations, thereby expanding application scope significantly.

Dual Clutch Transmission systems gain traction among performance-oriented and premium vehicle segments worldwide. These architectures require specialized clutch control valves that manage precise engagement timing between dual input shafts. Consequently, DCT applications demand higher valve response rates and durability specifications. European manufacturers particularly favor this technology for sporty driving dynamics.

Continuously Variable Transmission technology employs unique pulley control valves that modulate belt tension continuously throughout operation. CVT systems deliver smooth acceleration without discrete gear steps, appealing to fuel-conscious consumers. However, specific valve requirements limit interchangeability with conventional automatic components. Japanese automakers lead CVT adoption globally.

By Vehicle Type Analysis

Passenger Cars dominate with 61.7% share driven by high production volumes and diverse transmission configurations.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment, accounting for 61.7% share. Global passenger vehicle production sustains consistent demand for automatic gearbox valves across multiple transmission types. Moreover, evolving consumer expectations regarding driving comfort and convenience accelerate automatic transmission penetration rates. Compact and mid-size sedan segments particularly drive volume growth.

Light Commercial Vehicles incorporate automatic transmissions increasingly to improve driver comfort during urban delivery operations. These applications require robust valve assemblies that withstand frequent stop-and-go cycling patterns. Furthermore, fleet operators recognize fuel efficiency benefits from optimized transmission control. Consequently, LCV adoption rates climb steadily across developed markets.

Heavy Commercial Vehicles utilize specialized automated manual transmissions and automatic systems for long-haul trucking applications. These demanding environments necessitate valves engineered for extended durability under high torque loads. Additionally, driver shortage concerns push fleet managers toward automated shifting solutions. North American and European markets lead heavy-duty automatic transmission adoption.

By Product Type Analysis

Solenoid Valves dominate with 34.9% share owing to electronic control integration and fast response characteristics.

In 2024, Solenoid Valves held a dominant market position in the By Product Type Analysis segment, commanding 34.9% share. Electronic solenoid actuation enables precise hydraulic pressure modulation synchronized with transmission control unit commands. Consequently, modern transmissions rely heavily on multiple solenoid valves for shift quality optimization. Automotive OEMs increasingly specify proportional solenoid designs for smoother operation.

Shift Control Valves direct hydraulic fluid pathways to engage specific gear combinations within the transmission assembly. These mechanical components must maintain sealing integrity across wide temperature ranges and pressure differentials. Traditional automatic transmissions typically employ multiple shift valves coordinated through complex valve body castings. Reliability remains paramount for these fundamental components.

Pressure Regulator Valves maintain optimal line pressure throughout the transmission hydraulic circuit regardless of operating conditions. These valves prevent system over-pressurization while ensuring adequate clamping force for clutch packs. Additionally, advanced regulator designs adapt pressure levels based on driving demands. Fuel efficiency gains emerge from minimized parasitic pump losses.

Accumulator Valves manage hydraulic shock absorption during clutch engagement and gear transition events within the transmission. These components smooth shift quality by controlling pressure application rates precisely. Furthermore, accumulator integration reduces mechanical wear on friction materials. Premium vehicle segments particularly benefit from refined calibration.

Clutch Control Valves regulate hydraulic pressure applied to individual clutch packs enabling specific gear ratio engagement. Precise control characteristics determine shift feel and transmission responsiveness directly. Modern multi-clutch transmissions employ numerous control valves coordinated electronically. Consequently, valve quality significantly impacts overall transmission performance perception.

Pulley Control Valves specifically serve CVT applications by modulating hydraulic pressure acting on variable-diameter pulley assemblies. These specialized components enable continuous ratio adjustment throughout the operating range. CVT manufacturers require valves with exceptionally stable control characteristics. Japanese suppliers dominate this niche product category.

By Sales Channel Analysis

First Fit dominates with 73.2% share driven by OEM production volumes and integrated supply relationships.

In 2024, First Fit held a dominant market position in the By Sales Channel Analysis segment, capturing 73.2% share. Original equipment manufacturer installations constitute the primary demand driver for automatic gearbox valves globally. Subsequently, tier-one transmission suppliers maintain long-term partnerships with valve manufacturers for consistent quality. New vehicle production volumes directly correlate with first-fit valve consumption rates across all regions.

Aftermarket channels serve replacement and repair needs for existing vehicle populations requiring transmission service or overhaul. Independent repair facilities and dealership service departments source valve components through distribution networks. Additionally, aging vehicle fleets in mature markets sustain steady aftermarket demand. Quality concerns drive consumers toward OEM-specification replacement parts increasingly.

Key Market Segments

By Transmission Type

- Automatic

- Dual Clutch Transmission

- Continuously Variable Transmission

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Product Type

- Solenoid Valves

- Shift Control Valves

- Pressure Regulator Valves

- Accumulator Valves

- Clutch Control Valves

- Pulley Control Valves (CVT)

By Sales Channel

- First Fit

- Aftermarket

Drivers

Stringent Emission Standards and Localization Incentives Accelerate Valve Technology Adoption

The 2025 EU Euro 7 calibration mandates trigger comprehensive OEM redesigns of hydraulic control modules and mechatronic valve units. These regulatory requirements push manufacturers toward advanced valve architectures that optimize emission performance. Consequently, suppliers invest heavily in engineering capabilities to meet evolving compliance standards across multiple jurisdictions.

U.S. IRA 2024-2025 localization credits push tier-one suppliers to expand North American solenoid valve manufacturing capacity significantly. Government incentives reshape supply chain strategies as companies establish domestic production facilities. Furthermore, regional manufacturing reduces logistics costs and improves delivery responsiveness. This geographic expansion creates substantial capital investment opportunities throughout the supply base.

Post-2024 semiconductor oversupply enables 2025 repricing of TCU microcontrollers, thereby accelerating advanced valve integration across product lines. Lower component costs make sophisticated electronic control systems economically viable for mainstream vehicle segments. Additionally, improved chip availability alleviates supply chain constraints that previously limited production. Transmission manufacturers capitalize on favorable pricing dynamics.

China’s 2025 NEV transmission standard GB draft rollout forces upgrades to high-precision proportional and on-demand pressure valves. Domestic manufacturers must comply with stringent performance specifications to access the world’s largest automotive market. Subsequently, technology transfer accelerates as international suppliers collaborate with Chinese partners. Market access requirements drive continuous product innovation.

Restraints

Raw Material Cost Volatility and Regulatory Compliance Challenges Constrain Market Growth

The 2025 nickel and copper price volatility pressures cost structures for valve bodies and coil windings substantially. Commodity market fluctuations create pricing uncertainty that complicates long-term supply agreements between manufacturers and automakers. Consequently, suppliers implement hedging strategies and explore alternative materials to mitigate exposure. However, material substitution often requires extensive validation testing.

Additionally, profit margins compress when raw material costs surge faster than contractual price adjustment mechanisms allow. Smaller valve manufacturers particularly struggle to absorb cost increases without passing them to customers. This dynamic intensifies competitive pressures as larger players leverage economies of scale. Supply chain resilience becomes increasingly critical for sustained operations.

Tightening 2025 EU PFAS restrictions disrupt fluoropolymer seal supply chains in high-temperature valve assemblies dramatically. Environmental regulations targeting per- and polyfluoroalkyl substances force component redesigns across numerous applications. Furthermore, alternative seal materials may not match fluoropolymer performance characteristics under extreme operating conditions. Compliance timelines create urgency for engineering solutions.

Regulatory uncertainty complicates product development roadmaps as manufacturers anticipate future restriction expansions globally. Investment decisions require careful assessment of long-term material viability beyond current compliance requirements. Meanwhile, customers demand assurance regarding product availability and performance consistency. This regulatory landscape adds complexity to strategic planning processes.

Growth Factors

Digital Integration and Regional Manufacturing Expansion Create New Market Opportunities

AI-enabled predictive lubrication algorithms rolling into 2025 OTA platforms drive demand for smart valve feedback sensors significantly. Connected vehicle technologies enable real-time transmission monitoring and adaptive maintenance scheduling. Consequently, valve manufacturers integrate sensor capabilities that provide diagnostic data to vehicle control systems. This digital transformation opens premium market segments.

Furthermore, predictive analytics optimize transmission fluid life and component longevity through intelligent valve control strategies. Automakers differentiate their offerings through enhanced reliability and reduced ownership costs. Subsequently, technology partnerships form between valve suppliers and software developers. The convergence of mechanical and digital systems reshapes product specifications fundamentally.

The 2025 MEA transmission industrialization through Saudi and UAE EV-component clusters opens sourcing for cost-optimized valve casting. Middle Eastern governments invest heavily in automotive manufacturing infrastructure to diversify economic bases. Subsequently, new production capacity emerges in regions previously dependent on imports. This geographic diversification creates competitive dynamics and pricing opportunities.

OEM shift to 48-volt hybrid transmissions in 2025 spurs adoption of low-leakage electrohydraulic modulator valves across vehicle platforms. Mild hybrid architectures require specialized components that integrate seamlessly with electric motor assist systems. Additionally, efficiency gains from reduced hydraulic losses justify premium valve technologies. Global electrification trends sustain this growth trajectory.

End-of-life patents on key Gen-3 mechatronic valve blocks expiring 2024-2025 unlock aftermarket manufacturing entrants into previously restricted markets. Intellectual property freedom enables broader competition and alternative sourcing options for repair operations. Consequently, aftermarket pricing becomes more competitive while maintaining quality standards. Independent suppliers capitalize on expanded market access opportunities significantly.

Emerging Trends

Modular Integration and Cybersecurity Requirements Transform Valve System Architecture

The 2025 procurement shifts toward single-module mechatronic valve packs to reduce calibration complexity across transmission variants substantially. Integrated assemblies simplify manufacturing processes and improve system reliability through reduced interconnection points. Moreover, modular designs enable platform sharing across vehicle segments, thereby achieving economies of scale. Automakers increasingly specify complete mechatronic solutions rather than discrete components.

Tier-one and tier-two 2025 partnerships focused on AI-ready valve diagnostics for next-generation TCUs accelerate collaborative development programs. Traditional supplier relationships evolve into technology alliances that share intellectual property and development costs. Subsequently, innovation cycles compress as companies combine complementary capabilities. These strategic partnerships reshape competitive dynamics throughout the supply chain.

Expansion of real-time pressure-mapping in 2025 bench testing accelerates spec adoption for fast-response servo valves industry-wide. Advanced testing methodologies identify performance characteristics previously undetectable through conventional validation procedures. Furthermore, simulation accuracy improves through detailed component behavior modeling. Engineering standards evolve to incorporate these enhanced measurement capabilities systematically.

OEMs integrating cyber-hardened CAN-FD architecture in 2025 transmissions elevate demand for secure smart valve interfaces significantly. Cybersecurity concerns drive hardware and software requirements as vehicles become increasingly connected. Consequently, valve control modules incorporate authentication protocols and encrypted communication channels. This security layer adds complexity but proves essential for preventing unauthorized transmission manipulation.

Regional Analysis

Asia Pacific Dominates the Automatic Gearbox Valves Market with 44.8% Market Share, Valued at USD 13.3 Billion

Asia Pacific commands the global automatic gearbox valves market, holding 44.8% share valued at USD 13.3 Billion in 2024. This regional dominance stems from concentrated automotive manufacturing infrastructure across China, Japan, South Korea, and India. Moreover, rising middle-class populations drive passenger vehicle demand, thereby sustaining production growth. Additionally, local suppliers benefit from proximity to major OEM assembly plants, ensuring competitive logistics advantages. Government policies supporting domestic manufacturing further strengthen the regional supply base.

North America Automatic Gearbox Valves Market Trends

North America maintains substantial market presence driven by domestic automotive production and strong aftermarket demand. U.S. manufacturers prioritize advanced transmission technologies in pickup trucks and SUV segments particularly. Furthermore, localization incentives under recent legislation encourage regional valve production capacity expansion. The mature vehicle fleet sustains consistent replacement component demand through established distribution networks.

Europe Automatic Gearbox Valves Market Trends

Europe demonstrates sophisticated demand for premium valve technologies aligned with stringent emission regulations and performance expectations. German and French automakers specify advanced mechatronic systems extensively across their product portfolios. Additionally, the transition toward hybrid powertrains creates specialized valve requirements. European suppliers maintain technological leadership in high-precision hydraulic control components.

Middle East and Africa Automatic Gearbox Valves Market Trends

Middle East and Africa represent emerging opportunities as regional governments invest in automotive manufacturing infrastructure. Saudi Arabia and UAE establish EV component production clusters that include transmission system suppliers. However, current market size remains limited compared to established regions. Import dependency characterizes most markets throughout this diverse geographic area.

Latin America Automatic Gearbox Valves Market Trends

Latin America experiences moderate growth driven primarily by Brazilian and Mexican automotive production volumes. Economic volatility creates cyclical demand patterns that challenge long-term planning. Nevertheless, international OEMs maintain regional manufacturing operations that source valves locally. Aftermarket channels remain important due to extended vehicle lifecycles.

Key Automatic Gearbox Valves Company Insights

The global automatic gearbox valves market in 2024 features established tier-one suppliers alongside specialized component manufacturers competing across technology and cost dimensions. BorgWarner maintains leadership through comprehensive mechatronic valve systems integrated with advanced transmission controls, leveraging decades of powertrain expertise. The company invests heavily in electrification-compatible hydraulic solutions that address evolving market requirements. Additionally, their global manufacturing footprint enables responsive regional supply.

Bosch GmbH leverages extensive automotive electronics capabilities to develop intelligent valve systems with integrated diagnostic functionality. Their solenoid valve technologies incorporate precision control characteristics demanded by premium transmission applications. Furthermore, Bosch’s research infrastructure supports continuous innovation in materials and actuation mechanisms. Strategic partnerships with major automakers ensure market access globally.

Continental AG combines hydraulic expertise with electronic control system integration, offering complete mechatronic valve assemblies. The company emphasizes cybersecurity features as transmission systems become increasingly connected. Moreover, Continental’s diversified automotive portfolio creates synergies across product development. Their engineering resources address complex validation requirements efficiently.

Aisin Seiki capitalizes on deep transmission manufacturing experience to supply comprehensive valve solutions across multiple product lines. Japanese quality standards and production efficiency characterize their operations. Additionally, Aisin maintains strong relationships with Asian OEMs through long-term supply agreements. Their CVT valve technologies particularly demonstrate specialized engineering capabilities.

Industry consolidation trends continue as larger players acquire specialized capabilities and regional manufacturing assets. Meanwhile, emerging suppliers from Asia challenge established competitors through cost-competitive offerings. Technology differentiation increasingly determines market positioning as automatic transmissions evolve. Subsequently, research investment and OEM collaboration intensity correlate strongly with sustained market success. The competitive landscape remains dynamic with ongoing strategic partnerships.

Key Companies

- BorgWarner

- Atsumitec

- Avex

- Hikari Seiko

- Bosch GmbH

- Eaton

- Aisin Seiki

- Continental AG

- Mahle GmbH

Recent Developments

- In June 2025, Allison Transmission acquired Dana Inc.’s off-highway unit for USD 2.7 Billion, significantly expanding its heavy-duty transmission portfolio. This strategic acquisition enhances Allison’s capabilities in specialized valve systems for construction and mining equipment applications globally.

- In June 2025, Latham & Watkins advised Allison Transmission on the acquisition of Dana’s off-highway business, facilitating comprehensive due diligence and regulatory approval processes. The transaction strengthens Allison’s competitive position within commercial vehicle transmission markets substantially.

- In March 2024, Take-Two acquired Gearbox from Embracer for USD 460 Million, though this transaction falls outside the automatic gearbox valves industry. The gaming industry consolidation reflects broader M&A activity across technology-intensive sectors during this period.

Report Scope

Report Features Description Market Value (2024) USD 29.7 Billion Forecast Revenue (2034) USD 71.6 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Transmission Type (Automatic, Dual Clutch Transmission, Continuously Variable Transmission), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Product Type (Solenoid Valves, Shift Control Valves, Pressure Regulator Valves, Accumulator Valves, Clutch Control Valves, Pulley Control Valves), By Sales Channel (First Fit, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BorgWarner, Atsumitec, Avex, Hikari Seiko, Bosch GmbH, Eaton, Aisin Seiki, Continental AG, Mahle GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automatic Gearbox Valves MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automatic Gearbox Valves MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BorgWarner

- Atsumitec

- Avex

- Hikari Seiko

- Bosch GmbH

- Eaton

- Aisin Seiki

- Continental AG

- Mahle GmbH