Global Automated Nucleic Acid Extraction Systems Market By Product Type (Kits & Consumables and Instruments), By End-user (Pharmaceutical & Biotechnology Companies, Hospitals, Forensic Laboratories, Diagnostic Centres, and Academic Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170415

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

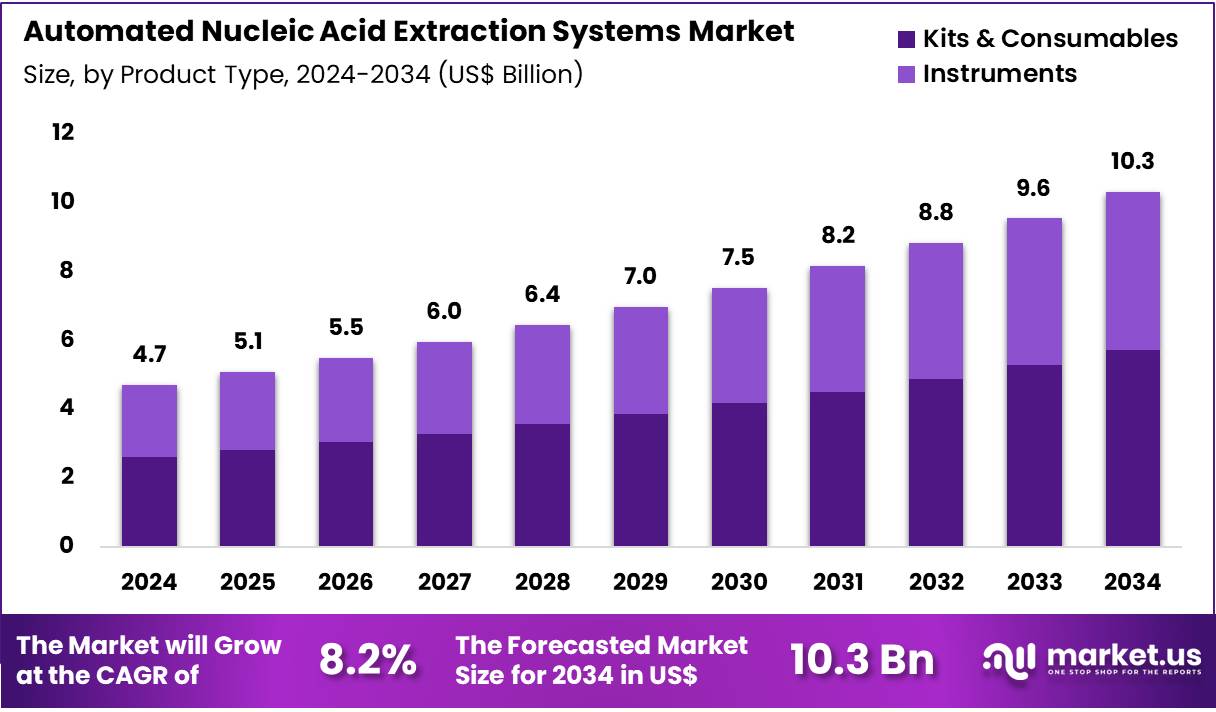

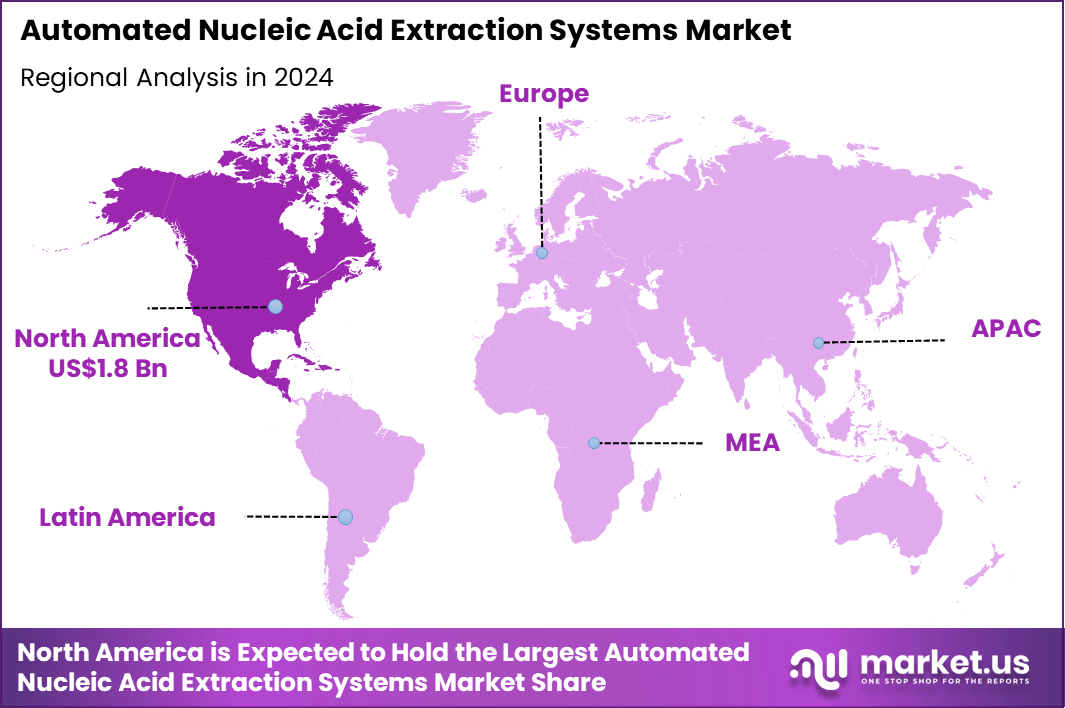

Global Automated Nucleic Acid Extraction Systems Market size is expected to be worth around US$ 10.3 billion by 2034 from US$ 4.7 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 1.8 Billion.

Increasing demand for high-throughput molecular diagnostics propels the Automated Nucleic Acid Extraction Systems market, as laboratories scale operations to meet escalating testing volumes in oncology and infectious disease workflows. Manufacturers engineer magnetic bead and silica membrane platforms that process hundreds of samples simultaneously while minimizing cross-contamination risks.

These systems enable rapid DNA/RNA isolation from tumor biopsies for next-generation sequencing panels, viral load quantification in plasma for hepatitis and HIV monitoring, pathogen detection in respiratory swabs for multiplex respiratory panels, and microbiome profiling from stool specimens in gut health studies. Strategic partnerships create opportunities for seamless integration with downstream companion diagnostic pipelines.

In August 2024, QIAGEN expanded its Master Collaboration Agreement with AstraZeneca to co-develop companion diagnostics for chronic disease therapies, directly leveraging automated extraction to ensure consistent, high-quality nucleic acids for precision medicine applications. This alliance accelerates CDx commercialization and reinforces the critical role of automation in therapeutic development.

Growing adoption of liquid biopsy applications accelerates the Automated Nucleic Acid Extraction Systems market, as clinicians favor non-invasive sampling to enable serial monitoring of circulating tumor DNA and cell-free fetal DNA. Biotechnology firms optimize low-input protocols that recover ultra-short fragments from plasma with exceptional purity and yield. These platforms support early cancer detection through mutation profiling in asymptomatic screening, treatment response tracking in metastatic disease via allele frequency changes, non-invasive prenatal testing for aneuploidy and microdeletion syndromes, and transplant rejection surveillance using donor-derived cell-free DNA ratios.

High-sensitivity extraction opens avenues for population-scale liquid biopsy programs and real-time therapeutic adjustment. Diagnostic developers increasingly incorporate these systems into regulatory submissions for novel liquid biopsy assays. This minimally invasive trend drives sustained innovation in automated workflows tailored for challenging sample types.

Rising integration of artificial intelligence in process optimization invigorates the Automated Nucleic Acid Extraction Systems market, as laboratories deploy smart robotics that adapt protocols dynamically to sample quality and downstream assay requirements. Technology providers embed machine learning algorithms into instruments that predict optimal bead binding times and elution volumes for maximum recovery.

These intelligent systems find applications in forensic human identification from degraded evidence, ancient DNA analysis in archaeological specimens, single-cell genomics from dissociated tissues, and metagenomic sequencing of environmental samples for biodiversity monitoring. AI-enhanced automation creates opportunities for error-proof traceability and predictive maintenance that minimize downtime. Collaborative networks actively standardize data outputs to facilitate global genomic databases. This convergence of robotics and intelligence positions automated extraction as the backbone of next-generation molecular laboratories.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.7 Billion, with a CAGR of 8.2%, and is expected to reach US$ 10.3 Billion by the year 2034.

- The product type segment is divided into kits & consumables and instruments, with kits & consumables taking the lead in 2024 with a market share of 55.3%.

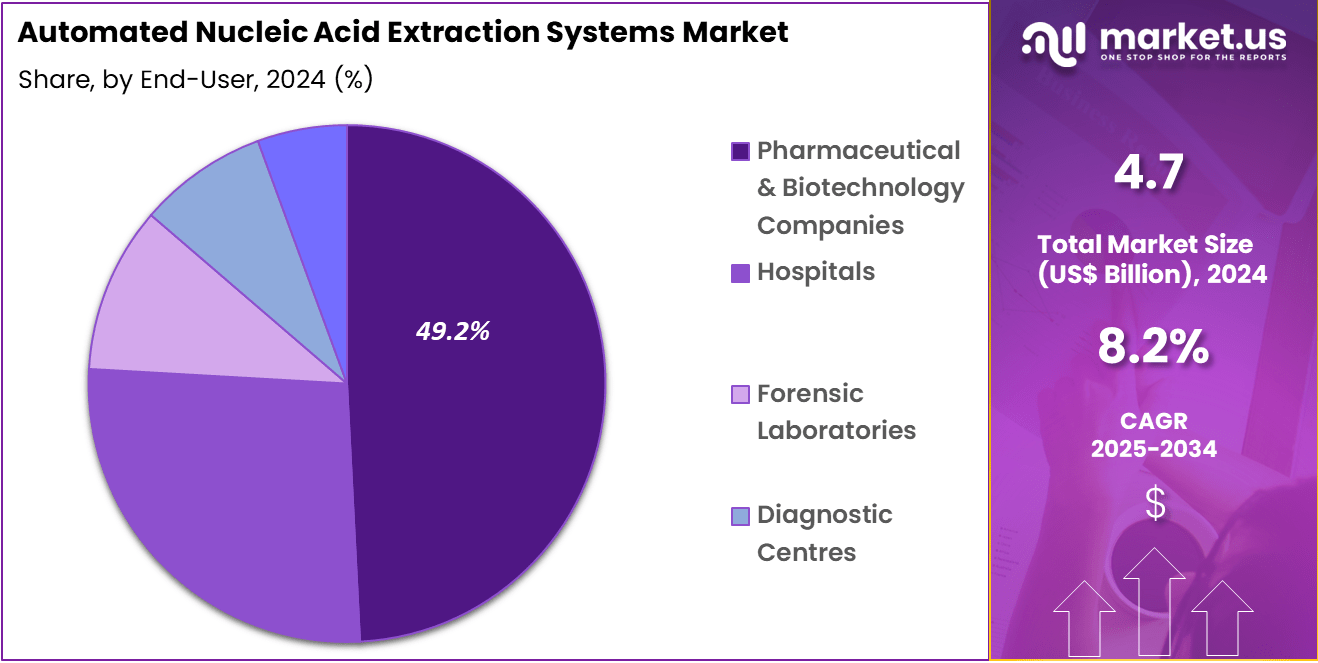

- Considering end-user, the market is divided into pharmaceutical & biotechnology companies, hospitals, forensic laboratories, diagnostic centres, and academic research institutes. Among these, pharmaceutical & biotechnology companies held a significant share of 49.2%.

- North America led the market by securing a market share of 37.9% in 2024.

Product Type Analysis

Kits & consumables, holding 55.3%, are expected to dominate due to their essential role in supporting the high-throughput processes of automated nucleic acid extraction systems. The demand for reagents and consumables such as extraction kits, purification columns, and buffers is driven by the increasing number of molecular diagnostics applications in clinical, research, and forensic settings. As the biotechnology and pharmaceutical industries continue to prioritize precision medicine, the need for reliable and scalable nucleic acid extraction systems grows.

Technological improvements in reagent quality and efficiency drive further adoption, as customers seek to reduce operational costs while maintaining accuracy. With ongoing research in genomics and biotechnology, the adoption of kits and consumables is expected to increase in both routine diagnostics and R&D laboratories. These factors keep kits & consumables anticipated to remain the leading product type in the automated nucleic acid extraction systems market.

End-User Analysis

Pharmaceutical & biotechnology companies, holding 49.2%, are expected to remain the dominant end-user segment due to their extensive use of automated nucleic acid extraction systems in drug development, genomics research, and clinical testing. As pharmaceutical companies increasingly focus on personalized medicine and gene therapies, they require efficient and scalable nucleic acid extraction platforms to support their research and manufacturing processes.

The growing need for high-quality genetic material extraction from a variety of sample types drives demand for these systems. Biotechnology companies also require advanced extraction technologies to meet the growing demand for biomarker discovery and validation in clinical trials. The expanding applications of nucleic acid-based testing in diagnostics, drug discovery, and therapy development further strengthen this segment’s growth. These factors ensure that pharmaceutical and biotechnology companies will remain the leading end-users in the automated nucleic acid extraction systems market.

Key Market Segments

By Product Type

- Kits & Consumables

- Instruments

By End-user

- Pharmaceutical & Biotechnology Companies

- Hospitals

- Forensic Laboratories

- Diagnostic Centres

- Academic Research Institutes

Drivers

The Escalating Demand for High-Throughput Nucleic Acid Processing in Molecular Diagnostics Is Driving the Market

The escalating demand for high-throughput nucleic acid processing in molecular diagnostics has positioned itself as a central driver for the automated nucleic acid extraction systems market, propelled by the imperative for efficient sample preparation in pathogen identification and genetic analysis. As diagnostic laboratories confront mounting caseloads from infectious diseases and cancer screenings, automated systems deliver consistent yields and purity, minimizing manual variability that could compromise downstream assays. These platforms integrate seamlessly with PCR and sequencing workflows, enabling labs to scale operations without proportional increases in personnel.

The shift toward precision medicine further amplifies this need, where reliable extraction underpins variant detection and therapeutic matching. According to the National Institutes of Health, genetics research funding rose from USD 11,615 million in fiscal year 2022 to USD 12,445 million projected for 2024, bolstering infrastructure for automated tools. Such investments facilitate procurement of systems like QIAGEN’s QIAcube Connect, which processes up to 12 samples per run. Hospitals and diagnostic centers, handling diverse specimen types from blood to tissue, benefit from reduced turnaround times, enhancing patient outcomes in urgent scenarios.

Regulatory alignments, including IVDR compliance, assure interoperability with global standards, fostering adoption across borders. Economically, automation curtails labor costs while elevating throughput, justifying capital expenditures in resource-optimized environments. This driver ultimately elevates the market by embedding extraction efficiency into the core of modern diagnostics.

Restraints

The Substantial Upfront Investment Required for Automated Systems Is Restraining the Market

The substantial upfront investment required for automated nucleic acid extraction systems persists as a key restraint on the market, deterring adoption in budget-constrained laboratories and emerging economies. High-end instruments, often exceeding USD 100,000 in cost, coupled with ancillary expenses for reagents and maintenance, strain operational budgets in smaller facilities. This financial barrier favors large academic and commercial entities, perpetuating disparities in technological access and slowing global penetration.

Maintenance contracts and validation protocols add ongoing overheads, complicating return-on-investment calculations for underfunded public health labs. The global nucleic acid extraction equipment market, valued at USD 747.4 million in 2024, reflects moderated growth amid these fiscal hurdles, with projections to USD 1,084.5 million by 2030 at a 6.4% CAGR. Smaller clinics revert to manual kits, risking inconsistencies that undermine assay reliability and regulatory compliance.

Training demands for operators further inflate indirect costs, particularly in regions with limited skilled personnel. Reimbursement frameworks lag in covering automated workflows, exacerbating hesitancy among payers. Supply chain volatilities for proprietary consumables compound affordability issues during demand fluctuations. Mitigating this restraint calls for modular, scalable designs and financing incentives to broaden equitable deployment.

Opportunities

Integration with Next-Generation Sequencing Workflows Is Creating Growth Opportunities

Integration with next-generation sequencing workflows is unveiling considerable growth opportunities in the automated nucleic acid extraction systems market by streamlining library preparation and enhancing data quality for genomic research. Automated extraction ensures unbiased input nucleic acids, critical for uniform coverage in NGS panels used for oncology and rare disease studies. This synergy reduces preparation artifacts, enabling labs to process larger cohorts with minimal intervention.

Opportunities proliferate through partnerships with sequencing providers, customizing protocols for high-molecular-weight DNA preservation. The U.S. nucleic acid isolation and purification market dominated North America with an 86.02% revenue share in 2024, driven by NGS-compatible automation in biotechnology hubs. Point-of-care adaptations extend reach to clinical settings, where rapid extraction supports real-time sequencing for infectious outbreaks.

Cost savings from batch processing, up to 50% in reagent use, attract biopharma firms scaling pharmacogenomics trials. Emerging applications in metagenomics open avenues for environmental and microbiome analysis, diversifying user bases. Regulatory endorsements for IVD-marked systems accelerate validations, easing market entry. These integrations collectively propel innovation toward comprehensive, end-to-end genomic pipelines.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the automated nucleic acid extraction systems market forward as rising healthcare budgets and explosive growth in molecular diagnostics push laboratories worldwide to embrace fully automated platforms that deliver speed, accuracy, and scalability for genomics, oncology, and infectious disease workflows. Leading manufacturers aggressively launch next-generation magnetic bead and column-based systems, capturing strong demand from research institutes and high-volume clinical labs eager to replace labor-intensive manual processes.

At the same time, stubborn inflation and softening economic growth tighten capital expenditure across hospitals and smaller facilities, forcing many buyers to postpone upgrades and extend the life of older equipment longer than planned. Geopolitical friction, particularly U.S.-China trade disputes and broader supply-chain conflicts, repeatedly disrupts the flow of essential reagents, semiconductors, and precision components, creating production bottlenecks and unpredictable pricing for global suppliers.

Current U.S. tariffs significantly raise landed costs on imported extraction instruments and consumables, compressing margins for distributors and making advanced automation less accessible to budget-conscious American customers. These duties also trigger retaliatory barriers in overseas markets that complicate exports and slow collaborative R&D for U.S. innovators. Yet this very pressure accelerates investment in domestic production capacity, nearshoring partnerships, and home-grown technology breakthroughs, building a far more secure and responsive supply ecosystem that will drive sustained leadership and healthier growth for the entire industry.

Latest Trends

The FDA Clearance of the KingFisher Apex Purification System in 2021 Is a Recent Trend

The FDA clearance of Thermo Fisher Scientific’s KingFisher Apex Purification System, announced in late 2021 with full U.S. rollout in 2022, exemplifies a recent trend toward versatile, high-capacity automated extraction for diverse nucleic acid applications. This benchtop instrument processes up to 384 samples per run using magnetic bead technology, supporting DNA, RNA, protein, and cell isolations in under 30 minutes. Its modular design accommodates variable throughput, from research to clinical diagnostics, minimizing footprint in lab spaces.

The clearance validates performance equivalence to predicate devices, with yields exceeding 90% for viral RNA from challenging matrices. This development aligns with post-pandemic emphases on scalable preparedness, as evidenced by integrations with Thermo Fisher’s NGS reagents. Early adoptions in U.S. reference labs report 40% workflow accelerations, optimizing for variant surveillance.

The system’s software enables remote monitoring, enhancing compliance in regulated environments. This trend influences competitors to prioritize user-configurable platforms, fostering ecosystem interoperability. As expansions continue into 2024, it underscores a shift to flexible automation amid evolving molecular needs. In summary, the KingFisher Apex solidifies 2022’s focus on adaptable, efficient extraction paradigms.

Regional Analysis

North America is leading the Automated Nucleic Acid Extraction Systems Market

North America accounted for 37.9% of the overall market in 2024, and the region saw significant growth in the Automated Nucleic Acid Extraction Systems market due to increasing demand for high-throughput and accurate genomic diagnostics. The adoption of these systems surged in clinical and research laboratories as they enabled faster and more reliable RNA and DNA extraction, which is critical for applications in oncology, infectious diseases, and genetic research. The rise in precision medicine and personalized therapies also contributed to the market’s growth, as these systems are integral in generating high-quality samples for biomarker analysis.

The Centers for Disease Control and Prevention (CDC) reported that more than 100 million Americans are living with diabetes, which drives the need for genetic testing and personalized treatment plans (CDC – “Diabetes Statistics 2022”). Additionally, the integration of automation into laboratories increased operational efficiency, reducing manual labor and errors, thus enhancing overall productivity. These factors collectively supported strong market performance in North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness substantial growth in the Automated Nucleic Acid Extraction Systems market during the forecast period as healthcare infrastructure continues to improve and the demand for high-quality diagnostics rises. The increasing prevalence of chronic diseases such as cancer, diabetes, and genetic disorders, along with advancements in biotechnology, will drive the need for precise nucleic acid extraction systems. Hospitals and research facilities across emerging markets are investing in automated platforms to streamline genomic analysis and improve turnaround times.

The World Health Organization (WHO) reported that 60% of all cancer cases worldwide are expected to be in Asia by 2025 (WHO – “Cancer Statistics in Asia 2023”), underscoring the urgent need for reliable diagnostic tools in the region. The growing emphasis on precision medicine, alongside rising government investments in biotechnology, will contribute significantly to the market’s growth in Asia Pacific. These developments position the region for continued expansion of automated nucleic acid extraction solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major vendors in the automated nucleic‑acid extraction segment drive growth by developing high‑throughput platforms that streamline workflows and enable simultaneous processing of hundreds of samples, appealing to large diagnostic labs and research centres. They expand their reach by establishing global supply chains and distribution partnerships across emerging and mature markets, ensuring local availability of reagents and instruments. They enhance their value proposition by integrating extraction systems with sample‑tracking software and laboratory information systems, offering labs an end‑to‑end solution that reduces manual handling and error rates.

They broaden their portfolio by offering flexible reagent kits compatible with multiple sample types blood, tissue, swabs and environmental samples to serve diverse applications such as infectious‑disease diagnostics, genomics, and environmental monitoring. They pursue strategic acquisitions or collaborations with niche biotech firms to incorporate novel extraction chemistries or improve automation modules, accelerating innovation cycles.

One leading company, QIAGEN NV, combines broad global infrastructure, a wide catalog of extraction reagents and instruments, and strong service and support networks to supply automated extraction solutions to diagnostic and research labs worldwide, reinforcing its position as a trusted supplier in molecular workflows.

Top Key Players

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics / Roche Molecular Systems

- Promega Corporation

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Bio‑Rad Laboratories, Inc.

- Takara Bio Inc.

Recent Developments

- On January 10, 2025, QIAGEN announced an enhancement to its QIAcuity Digital PCR system, boosting its multiplexing capabilities. While serving as a downstream analyzer, this upgrade increases the demand for highly purified and concentrated nucleic acid samples, which are essential for optimizing the efficiency of multiplex PCR processes.

- In June 2024, Thermo Fisher Scientific introduced the Thermo Scientific™ KingFisher™ PlasmidPro Maxi Processor, a cutting-edge automated system designed for large-scale plasmid DNA purification. This innovation accelerates cell and gene therapy production by ensuring the delivery of high-purity DNA, streamlining the manufacturing process.

Report Scope

Report Features Description Market Value (2024) US$ 4.7 Billion Forecast Revenue (2034) US$ 10.3 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits & Consumables and Instruments), By End-user (Pharmaceutical & Biotechnology Companies, Hospitals, Forensic Laboratories, Diagnostic Centres, and Academic Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape QIAGEN N.V., Thermo Fisher Scientific, Inc., Roche Diagnostics, Promega Corporation, Agilent Technologies, Inc., PerkinElmer, Inc., Bio‑Rad Laboratories, Inc., Takara Bio Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Nucleic Acid Extraction Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automated Nucleic Acid Extraction Systems MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- QIAGEN N.V.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics / Roche Molecular Systems

- Promega Corporation

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Bio‑Rad Laboratories, Inc.

- Takara Bio Inc.