Global Aniline Market Size, Share, And Business Benefits By Application (Methylene Diphenyl Diisocyanate (MDI), Rubber-processing Chemicals, Agricultural Chemicals, Dyes and Pigments, Specialty Fibers, Others), By End-use (Building and Construction, Rubber, Consumer Goods, Automotive, Packaging, Agriculture, Others), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Retailers, Specialty Stores, Chemical Supply Chains, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151362

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

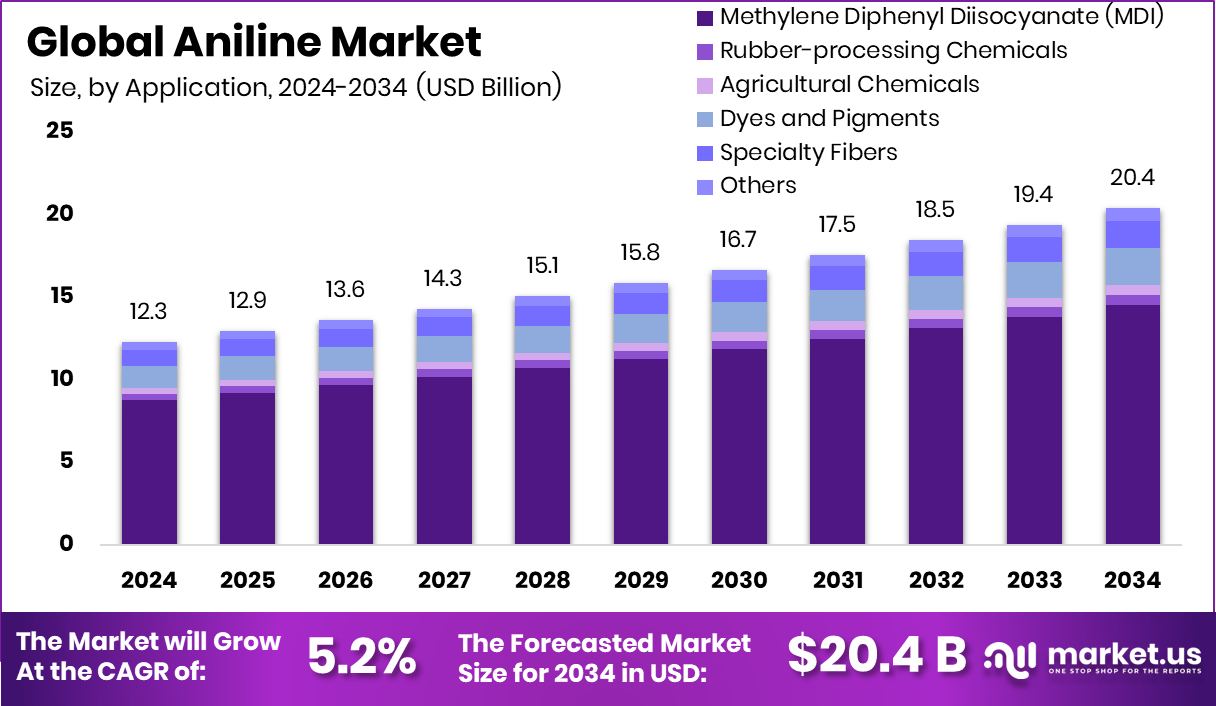

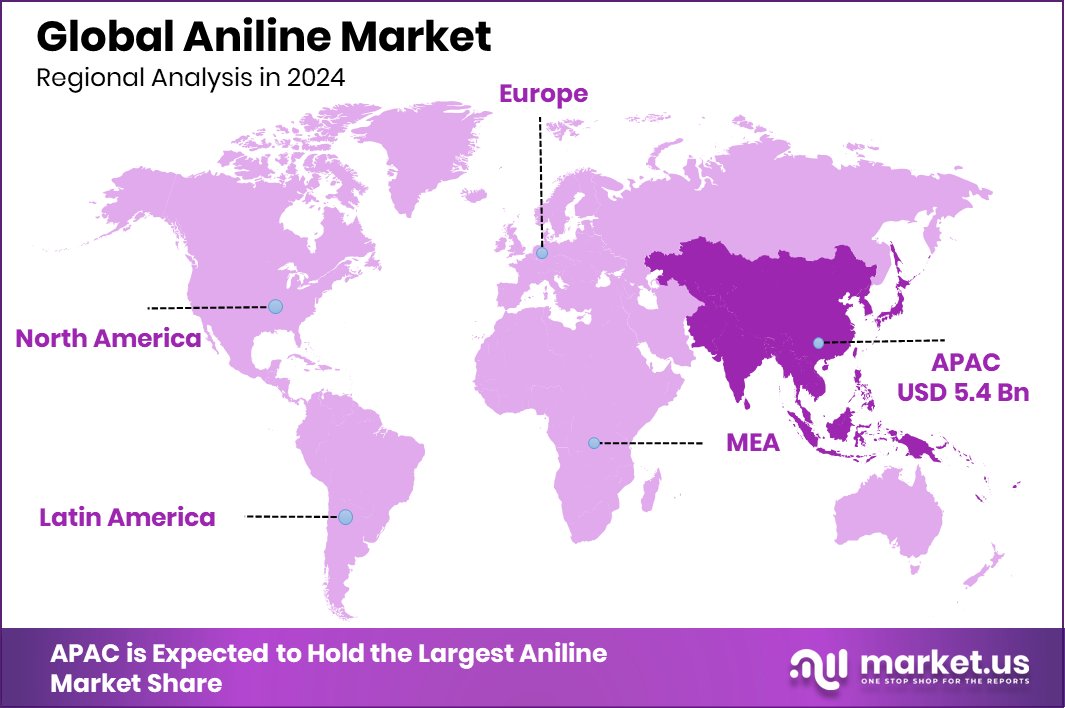

Global Aniline Market is expected to be worth around USD 20.4 billion by 2034, up from USD 12.3 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034. Strong industrial growth in Asia-Pacific drives the Aniline Market to USD 5.4 billion.

Aniline is an organic compound with the formula C₆H₅NH₂. It appears as a clear to slightly yellow liquid with a characteristic odor and is primarily used as a building block in the chemical industry. Aniline is produced through the reduction of nitrobenzene and serves as a key raw material in the manufacture of dyes, rubber processing chemicals, herbicides, and pharmaceuticals.

The aniline market refers to the global demand, supply, and trade of aniline for various industrial applications. It includes the production, distribution, and consumption of aniline across sectors such as automotive, construction, agriculture, textiles, and pharmaceuticals. As industries grow and diversify, the use of aniline-based intermediates and chemicals continues to increase steadily.

Growth in the aniline market is largely driven by the expanding construction and automotive sectors, which heavily rely on polyurethane foams for insulation, seating, and interior components. Urbanization and infrastructure projects in emerging economies further boost the need for these materials, directly increasing aniline consumption.

Demand is also influenced by the agricultural industry’s need for herbicides and by the continued development of synthetic dyes for textiles. These industries benefit from the consistent and efficient performance of aniline-derived products, keeping demand stable.

Key Takeaways

- Global Aniline Market is expected to be worth around USD 20.4 billion by 2034, up from USD 12.3 billion in 2024, and grow at a CAGR of 5.2% from 2025 to 2034.

- The aniline market heavily relies on MDI production, which accounts for 71.2% of total application usage.

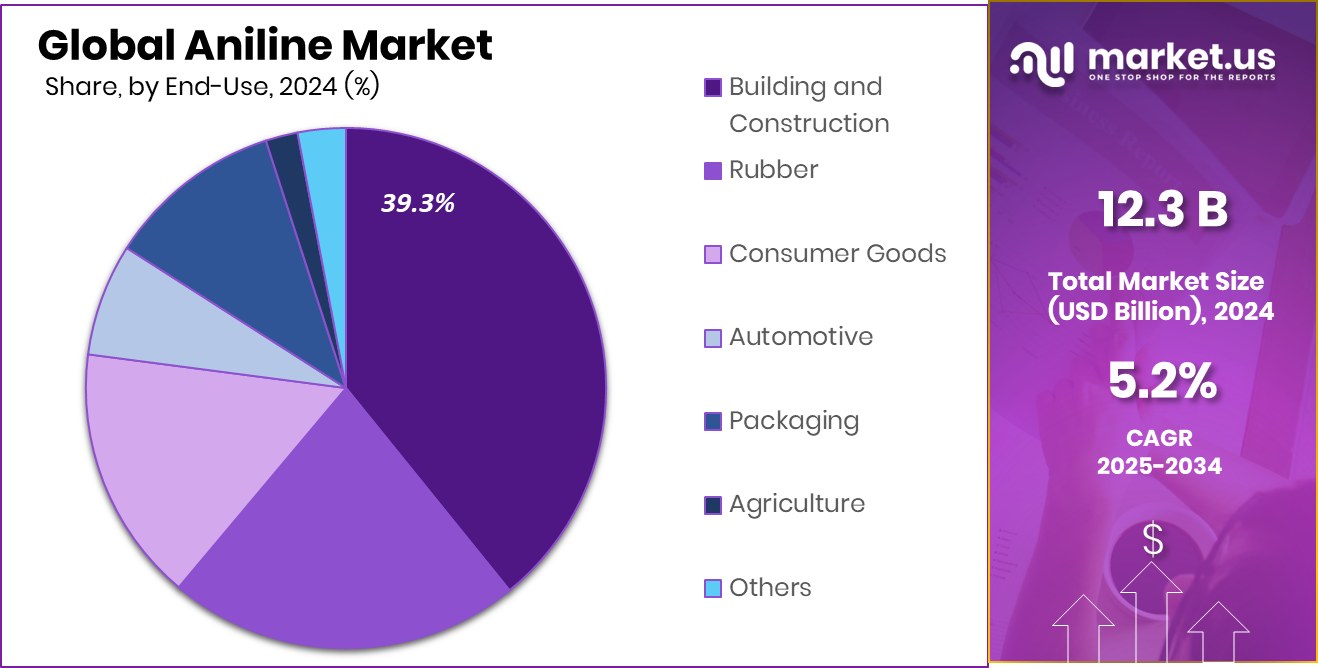

- The building and construction sector drives 39.3% of the aniline market demand through polyurethane-based insulation materials.

- Direct sales dominate the aniline market distribution, contributing 71.8% share due to bulk industrial procurement practices.

- Asia-Pacific accounted for a 44.2% share of the global Aniline Market in 2024.

By Application Analysis

The aniline market thrives as MDI production accounts for 71.2% application share.

In 2024, Methylene Diphenyl Diisocyanate (MDI) held a dominant market position in the By Application segment of the Aniline Market, with a 71.2% share. This strong foothold reflects the material’s essential role in manufacturing polyurethane foams for insulation, automotive seating, and furniture. As construction and automotive industries expand, the reliance on MDI-based polyurethane has only increased, reinforcing the segment’s leading status.

Following MDI, segments such as synthetic dyes, rubber processing chemicals, herbicide intermediates, and pharmaceutical precursors collectively make up the remaining 28.8%. While each application maintains a smaller share individually, their combined activities represent a meaningful portion of aniline demand. Textile and agriculture sectors, in particular, continue to support the dye and herbicide-related uses of aniline, sustaining their respective segments with steady volume and revenue.

The growth trajectory for the MDI segment is particularly notable. Rapid urbanization and infrastructure development are driving demand for energy-efficient building materials, where MDI-based foams serve critical insulation roles. Similarly, consumer preferences for lightweight, more fuel-efficient vehicles are propelling automotive MDI applications.

By End-use Analysis

The building and construction sector drives 39.3% of the total aniline market demand.

In 2024, Building and Construction held a dominant market position in the By End-use segment of the Aniline Market, with a 39.3% share. This leadership is primarily attributed to the widespread use of aniline-based MDI in the production of rigid polyurethane foams, which are critical for thermal insulation in buildings. As construction activities surge globally—driven by urban development, infrastructure expansion, and energy-efficient building standards—the demand for insulation materials has risen sharply, directly boosting the use of aniline in this sector.

The preference for polyurethane foams in modern construction stems from their excellent insulation properties, durability, and versatility in applications ranging from walls and roofs to piping systems. Governments and industries are increasingly emphasizing energy conservation, which has reinforced the demand for high-performance insulation materials, with aniline playing a central role through its link to MDI production.

Furthermore, the growth of green buildings and smart infrastructure projects is expected to sustain and further elevate the importance of aniline in this segment. The construction sector’s push for sustainability and long-term performance makes aniline-derived materials a favorable choice, contributing to its continued dominance in the end-use landscape of the aniline market.

By Distribution Channel Analysis

Direct sales dominate the aniline market distribution, representing a strong 71.8% channel share.

In 2024, Direct Sales held a dominant market position in the By Distribution Channel segment of the Aniline Market, with a 71.8% share. This commanding lead reflects the preference of large-scale industrial buyers—such as chemical manufacturers, automotive suppliers, and construction material producers—for procuring aniline directly from manufacturers. Direct engagement enables buyers to negotiate volume-based pricing, secure long-term supply contracts, and ensure consistent product specifications—a key factor given aniline’s role in critical downstream applications like MDI for polyurethane production.

This distribution strategy also allows manufacturers to foster closer relationships with strategic customers, offering tailored logistics solutions and improved service levels. For industries where product performance and supply reliability are paramount, the direct channel remains the preferred mode of procurement. As a result, intermediaries or third-party distributors capture the remaining 28.2% of the market, catering primarily to smaller end-users or niche segments with lower volume requirements.

The strong position of direct sales underscores the market’s consolidation around industrial-scale usage and long-term partnerships. Companies benefit from streamlined operations and reduced costs when bypassing distributors, while producers gain greater visibility into demand patterns and customer needs.

Key Market Segments

By Application

- Methylene Diphenyl Diisocyanate (MDI)

- Rubber-processing Chemicals

- Agricultural Chemicals

- Dyes and Pigments

- Specialty Fibers

- Others

By End-use

- Building and Construction

- Rubber

- Consumer Goods

- Automotive

- Packaging

- Agriculture

- Others

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retailers

- Specialty Stores

- Chemical Supply Chains

- Others

Driving Factors

Rising Demand for Polyurethane Foam Products

One of the top driving factors for the Aniline Market is the growing demand for polyurethane foam products. Aniline is a key raw material used to make MDI (Methylene Diphenyl Diisocyanate), which is essential for producing polyurethane foams. These foams are widely used in the construction and automotive industries for insulation, seating, and interior parts.

As more buildings aim to be energy efficient and the automotive sector pushes for lightweight materials, the need for high-quality foams increases. This growing usage leads to higher consumption of aniline. Developing countries are also investing in infrastructure and housing, which further boosts demand for insulation materials, making polyurethane foam and, in turn, aniline, a vital part of this global trend.

Restraining Factors

Health and Environmental Concerns Limit Growth

A major restraining factor in the Aniline Market is the growing concern over its health and environmental impacts. Aniline is a toxic chemical that can be harmful if inhaled, ingested, or absorbed through the skin. Long-term exposure may lead to serious health issues for workers and nearby communities. Additionally, improper disposal or accidental leaks can pollute soil and water, raising environmental risks.

As a result, strict government regulations and safety standards have been enforced in many countries. These rules can slow down production, increase compliance costs, and discourage new investments. Companies must invest more in safety systems and waste treatment, which can reduce overall profitability and limit the expansion of aniline manufacturing in sensitive regions.

Growth Opportunity

Innovation in Eco-Friendly Aniline Production Methods

A key growth opportunity in the Aniline Market lies in developing cleaner and greener production methods. Traditional aniline manufacturing relies on reducing nitrobenzene, which can involve harmful chemicals and generate hazardous waste. By investing in newer, eco-friendly techniques—such as hydrogenation with renewable catalysts or bio-based feedstocks—companies can reduce environmental impact, lower energy use, and cut down on toxic byproducts.

These sustainable approaches also help firms meet stricter laws and environmental goals, making them more appealing to eco-conscious customers. As brands and governments push for greener supply chains, producers who adopt these innovations can gain a competitive edge.

Latest Trends

Shift Toward Bio-Based and Renewable Aniline Production

A top trend in the Aniline Market is the move toward bio-based and renewable production methods. Rather than relying solely on traditional fossil-based chemicals, manufacturers are beginning to explore plant-derived or waste-based feedstocks as greener alternatives. These new methods may include using biomass, such as agricultural residues or non-food crops, to produce intermediates that can be further converted into aniline.

This shift helps reduce carbon emissions and supports circular economy goals. It also aligns with growing industry and regulatory demands for sustainable chemicals. As a result, companies that invest in these technologies can improve their environmental credentials and attract investment from eco-conscious clients.

Regional Analysis

In Asia-Pacific, the Aniline Market reached USD 5.4 billion in 2024.

In 2024, Asia-Pacific emerged as the dominant region in the Aniline Market, accounting for 44.2% of the global share and reaching a market value of USD 5.4 billion. This leadership is primarily driven by the rapid expansion of industrial production, growing construction activities, and a strong presence of end-use sectors such as automotive, textiles, and agriculture. The rising demand for polyurethane foam in insulation and seating further strengthens the region’s market position.

North America and Europe follow, supported by established chemical manufacturing infrastructure and technological advancements in eco-friendly aniline processes. While North America maintains steady demand through its automotive and construction sectors, Europe focuses on sustainability and regulatory compliance, encouraging cleaner production practices.

The Middle East & Africa and Latin America represent emerging markets with moderate growth potential, largely driven by infrastructure development and expanding manufacturing bases. However, their overall contribution remains smaller compared to the mature markets. Across all regions, Asia-Pacific continues to lead in both volume and revenue, driven by strong domestic consumption and export-oriented production.

With favorable industrial policies and growing demand for downstream applications, the region is expected to retain its dominant position in the near term, shaping the future trajectory of the global aniline market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Borsodchem Mchz, Covestro AG, Dow, and GNFC played significant roles in shaping the global Aniline Market. These companies demonstrated strong capabilities in scaling up aniline production and meeting the growing global demand, especially from the polyurethane and chemical processing industries.

Borsodchem Mchz maintained a consistent presence in the European market with its specialization in chemicals and advanced manufacturing infrastructure. The company’s strength lies in its integration of aniline with downstream MDI production, ensuring stable supply chains and efficient cost management.

Covestro AG continued to leverage its advanced technology and global network to supply high-purity aniline across various sectors. With a strong focus on innovation and sustainability, Covestro worked toward more environmentally conscious production methods, aligning with shifting regulatory expectations, particularly in Europe.

Dow, as one of the world’s leading chemical companies, remained a significant player with diversified aniline applications. Dow’s global operations enabled it to balance regional demands and supply chain fluctuations while maintaining product quality and consistency across different industries.

GNFC, a key producer based in India, contributed notably to the Asia-Pacific market. The company’s integrated approach and cost-efficient production allowed it to serve both domestic and export markets effectively. Its strategic location and raw material access gave it a competitive edge in a price-sensitive region.

Top Key Players in the Market

- BASF Corporation

- BONDALTI

- Borsodchem Mchz

- Covestro AG

- Dow

- GNFC

- Huntsman International LLC

- Jilin Connell Chemical Industry Co., Ltd.

- Mitsubishi Chemical

- Mitsui Chemical

- Petrochina Co. Ltd.

- Sabic

- SP Chemicals Holdings Ltd.

- Sumika Bayer Urethane Co., Ltd.

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Company

- Wanhua Chemical Group Co. Ltd.

Recent Developments

- In March 2025, Wanhua Chemical—BorsodChem’s parent company—received the “Lifetime Award for Significant Investor” in Hungary. This recognition highlighted substantial investments, including the construction of a new aniline plant, localizing key raw material production, improving supply stability, and cutting carbon emissions.

- In February 2024, BASF Shanghai completed the spin-off of SLIC’s crude MDI plant and its nitrobenzene/aniline unit. The company then extended operational time from 7,500 to 8,000 hours per year, boosting plant capacity from 240 ktpa to nearly 402 ktpa.

Report Scope

Report Features Description Market Value (2024) USD 12.3 Billion Forecast Revenue (2034) USD 20.4 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Methylene Diphenyl Diisocyanate (MDI), Rubber-processing Chemicals, Agricultural Chemicals, Dyes and Pigments, Specialty Fibers, Others), By End-use (Building and Construction, Rubber, Consumer Goods, Automotive, Packaging, Agriculture, Others), By Distribution Channel (Direct Sales, Distributors/Wholesalers, Online Retailers, Specialty Stores, Chemical Supply Chains, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF Corporation, BONDALTI, Borsodchem Mchz, Covestro AG, Dow, GNFC, Huntsman International LLC, Jilin Connell Chemical Industry Co., Ltd., Mitsubishi Chemical, Mitsui Chemical, Petrochina Co. Ltd., Sabic, SP Chemicals Holdings Ltd., Sumika Bayer Urethane Co., Ltd., Sumitomo Chemical Co. Ltd., The Dow Chemical Company, Wanhua Chemical Group Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF Corporation

- BONDALTI

- Borsodchem Mchz

- Covestro AG

- Dow

- GNFC

- Huntsman International LLC

- Jilin Connell Chemical Industry Co., Ltd.

- Mitsubishi Chemical

- Mitsui Chemical

- Petrochina Co. Ltd.

- Sabic

- SP Chemicals Holdings Ltd.

- Sumika Bayer Urethane Co., Ltd.

- Sumitomo Chemical Co. Ltd.

- The Dow Chemical Company

- Wanhua Chemical Group Co. Ltd.