Global Anhydrous Hydrofluoric Acid Market Size, Share, And Business Benefit By Purity (Greater Than 99.90%, Less Than 99.90%), By Type (Fluorite-Based, Fluorosilicic Acid), By End-use (Chemical, Mining, Metallurgical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161781

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

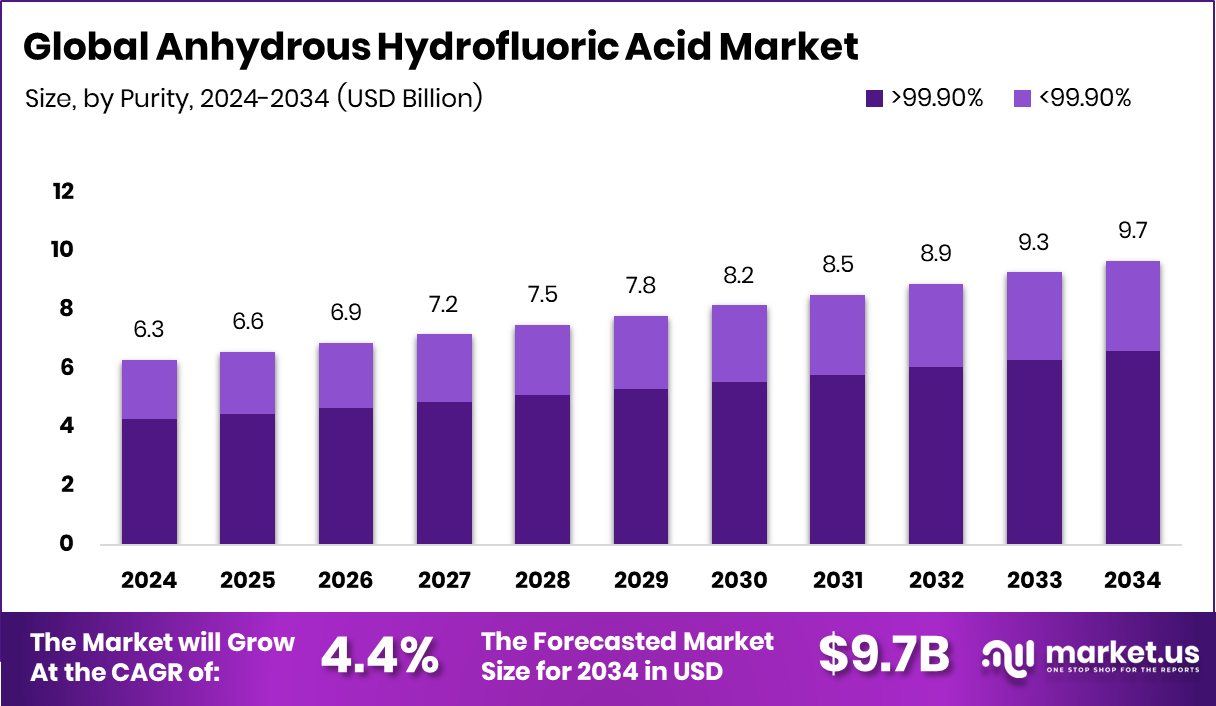

The Global Anhydrous Hydrofluoric Acid Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.3 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Strong industrial expansion and chemical manufacturing capacity reinforced Asia-Pacific’s 46.80% market dominance.

Anhydrous hydrofluoric acid (AHF) is the essentially water-free form of hydrogen fluoride. Unlike common aqueous hydrofluoric acid, it exists as a highly reactive, corrosive liquid (or vapor under certain conditions) with minimal moisture content. It is prized in industry for its strength in breaking silicate bonds, its role as a fluorination agent, and its utility in high-purity chemical syntheses.

In terms of market context, the Anhydrous Hydrofluoric Acid Market refers to the global trade, production, and consumption of this pure, water-free HF in sectors such as chemical intermediates, fluorochemical manufacture, electronics, metallurgy, and refining. Recently, INNOVX secured $110 million for Fluoralpha’s industrial project in Jorf Lasfar, and Vitol, with Breakwall, committed $150 million to back a metallurgical coal mine, reflecting strong capital flows into supporting infrastructure and upstream feedstocks that can influence supply chains.

Key demand arises from the electronics and semiconductor industry, where AHF is used for etching of silicon and glass and in the production of high-purity materials. As chip manufacturing becomes more sophisticated, purity demands rise, benefitting anhydrous grades over aqueous forms. Also, in the chemical sector, demand for fluorinated intermediates—for refrigerants, agrochemicals, or pharmaceuticals—requires AHF as a core reagent.

One major opportunity lies in expanding into regions with nascent fluorochemical and electronics industries, especially in Asia and parts of Latin America, where supply remains limited. Developing safer and more efficient methods for handling and storage of AHF (to reduce hazards) opens paths for new entrants. There is also scope for producing ultra-high purity grades tailored for advanced electronics or specialty chemicals.

Key Takeaways

- The Global Anhydrous Hydrofluoric Acid Market is expected to be worth around USD 9.7 billion by 2034, up from USD 6.3 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, the Anhydrous Hydrofluoric Acid Market with >99.90% purity held 69.3% share, ensuring superior fluorination efficiency.

- The Fluorite-Based segment dominated the Anhydrous Hydrofluoric Acid Market in 2024, accounting for a 76.5% share globally.

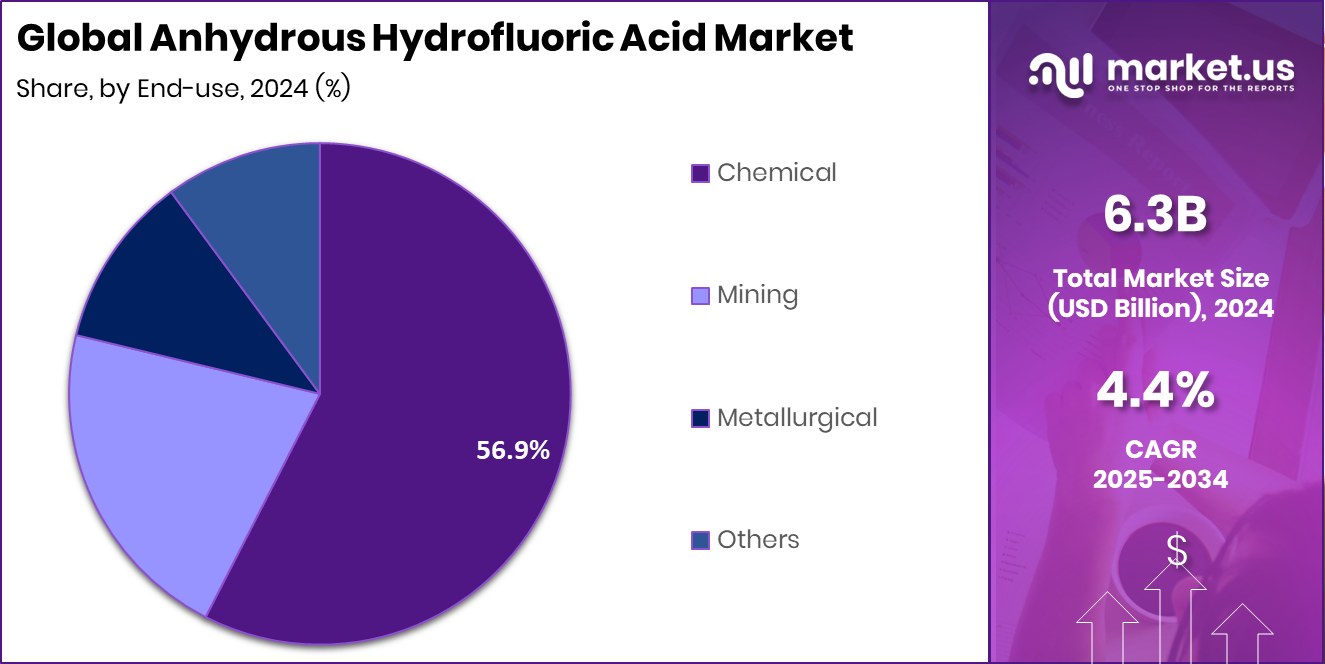

- The Chemical sector led the Anhydrous Hydrofluoric Acid Market in 2024, capturing a 56.9% share of total consumption.

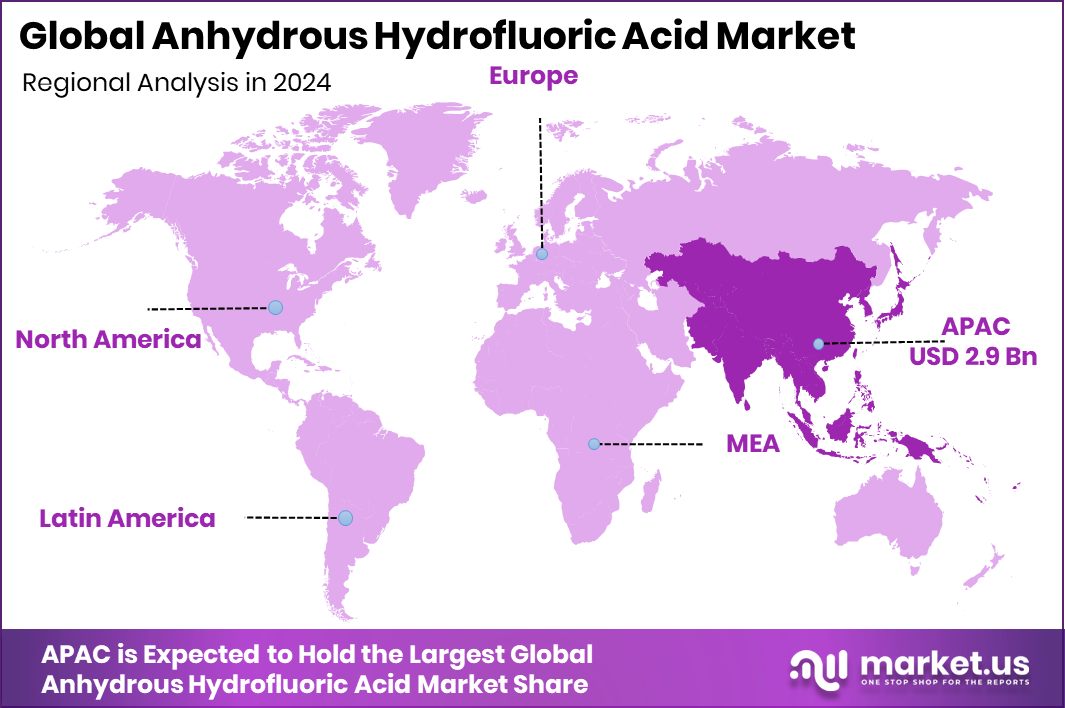

- The Asia-Pacific recorded a market valuation of around USD 2.9 billion overall.

By Purity Analysis

In 2024, the Anhydrous Hydrofluoric Acid Market saw >99.90% purity dominate with 69.3% share.

In 2024, >99.90% held a dominant market position in the By Purity segment of the Anhydrous Hydrofluoric Acid Market, with a 69.3% share. This high-purity grade is preferred for its superior performance in applications demanding stringent quality, particularly in electronics, semiconductors, and fluorochemical synthesis.

Its minimal impurity levels ensure precision and reliability during etching, cleaning, and refining operations. Industries requiring controlled reactions and high-end material processing continue to rely on >99.90% purity to maintain consistent output standards.

The segment’s dominance also reflects growing emphasis on ultra-refined chemical processes, where trace impurities can compromise product quality, making this purity level the benchmark choice across critical industrial and manufacturing applications globally.

By Type Analysis

Fluorite-based Anhydrous Hydrofluoric Acid Market captured a notable 76.5% share in 2024.

In 2024, Fluorite-Based held a dominant market position in the By Type segment of the Anhydrous Hydrofluoric Acid Market, with a 76.5% share. This dominance reflects the extensive use of fluorspar (fluorite) as the primary raw material for producing anhydrous hydrofluoric acid through established industrial processes.

The abundance and cost-effectiveness of fluorite make it the preferred source for large-scale manufacturing, ensuring a consistent supply to downstream industries such as fluorochemical production, refining, and electronics.

Its reliable purity levels and efficient conversion rates contribute to its strong market presence. The Fluorite-Based segment continues to define the market’s structure by supporting both traditional and high-end applications requiring dependable, high-purity hydrofluoric acid.

By End-use Analysis

The chemical sector dominated the Anhydrous Hydrofluoric Acid Market with a 56.9% share.

In 2024, Chemical held a dominant market position in the by-end-use segment of the Anhydrous Hydrofluoric Acid Market, with a 56.9% share. This dominance is attributed to the widespread use of anhydrous hydrofluoric acid as a key raw material in producing various fluorochemicals, catalysts, and specialty compounds.

The chemical sector relies heavily on its strong reactivity and purity for manufacturing refrigerants, fluoropolymers, and inorganic fluorides. Its role in synthesis and transformation processes makes it indispensable for numerous downstream applications.

The segment’s large share also reflects the expanding scale of fluorochemical and industrial chemical production, where anhydrous hydrofluoric acid remains a critical reagent for achieving high yields and consistent product quality.

Key Market Segments

By Purity

- >99.90%

- <99.90%

By Type

- Fluorite-Based

- Fluorosilicic Acid

By End-use

- Chemical

- Mining

- Metallurgical

- Others

Driving Factors

Rising Fluorochemical Production Fuels Market Expansion

One major driving factor for the Anhydrous Hydrofluoric Acid Market is the growing production of fluorochemicals used across industries like electronics, refrigerants, and specialty materials. Anhydrous hydrofluoric acid serves as a core raw material in making these compounds, which are essential for semiconductors, batteries, and polymer manufacturing.

As global industries shift toward high-performance materials and low-emission refrigerants, the demand for pure hydrofluoric acid continues to rise. Additionally, industrial investments supporting chemical and metallurgical supply chains are strengthening market growth.

For instance, a Singaporean consortium recently secured $850 million to support South32’s Australian coking coal operations, ensuring a stable feedstock and energy base vital for producing fluorine-related chemicals and maintaining global industrial continuity.

Restraining Factors

Severe Health And Safety Risks Limit Adoption

One major restraining factor for the Anhydrous Hydrofluoric Acid Market is its extreme toxicity and corrosiveness, which pose serious health and safety concerns. Even small exposures can cause severe burns, respiratory issues, and long-term tissue damage, demanding strict handling protocols.

Industries using this chemical must invest heavily in protective systems, storage equipment, and emergency response infrastructure, which increases operational costs. Moreover, stringent government regulations surrounding its production, transportation, and disposal make its use complex and expensive for many manufacturers.

These safety challenges often discourage small and mid-scale facilities from adopting anhydrous hydrofluoric acid, limiting its wider industrial utilization despite its essential role in high-purity chemical and metallurgical processes worldwide.

Growth Opportunity

Expanding Chemical Infrastructure Creates New Growth Potential

A key growth opportunity for the Anhydrous Hydrofluoric Acid Market lies in the rapid expansion of chemical manufacturing infrastructure across emerging regions. The increasing establishment of fluorochemical and semiconductor production facilities is boosting the need for high-purity anhydrous hydrofluoric acid.

Many developing economies are now investing in chemical value chains to strengthen local production capacity and reduce import dependence. This growing industrial base directly drives new opportunities for AHF producers to supply essential feedstock.

Additionally, international financial collaborations are improving access to capital for infrastructure projects. Recently, UKEF entered the Uzbekistan market with a €12.6 million deal, supporting industrial development that could indirectly enhance regional demand for high-purity hydrofluoric acid in chemical applications.

Latest Trends

Shift Toward High-Purity Grades For Advanced Industries

A key trend in the Anhydrous Hydrofluoric Acid Market is the rising shift toward high-purity grades to meet the growing needs of advanced industries such as electronics, semiconductors, and precision chemicals.

Manufacturers are focusing on producing ultra-refined anhydrous hydrofluoric acid with minimal contaminants to support applications that demand strict process control and product consistency. This shift is driven by the rapid miniaturization of electronic components and the expansion of cleanroom-based manufacturing facilities.

As global quality standards tighten, producers are upgrading purification technologies and refining processes to ensure purity levels above 99.9%. This trend highlights a broader industry move toward safer, cleaner, and more efficient formulations that enhance reliability in high-end industrial and technological applications.

Regional Analysis

In 2024, the Asia-Pacific dominated the Anhydrous Hydrofluoric Acid Market with 46.80%.

In 2024, the Asia-Pacific held a dominant position in the global Anhydrous Hydrofluoric Acid Market, accounting for 53.8% of the total share. The region’s leadership is driven by the rapid expansion of the chemical and electronics sectors in countries such as China, Japan, South Korea, and India. Increasing demand for high-purity fluorochemicals, semiconductor etching materials, and metal processing agents has strengthened regional consumption levels.

North America followed with stable growth supported by advancements in refining and industrial manufacturing, particularly in the U.S. and Canada. Europe showcased steady demand due to the region’s focus on sustainable chemical processes and fluorinated material applications.

Meanwhile, the Middle East & Africa and Latin America are emerging markets, gradually expanding due to industrial diversification and rising investments in chemical infrastructure development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF continued to strengthen its chemical portfolio through the development of high-performance intermediates and efficient processing systems that optimize the use of anhydrous hydrofluoric acid in fluorochemical synthesis. The company’s focus on circular chemistry and emissions reduction aligns with the industry’s shift toward cleaner fluorine production.

Solvay maintained a strategic focus on fluorine-based materials and derivatives, emphasizing innovation in environmentally compatible processes. The company’s strong presence in Europe and Asia supports the production of advanced fluorochemical solutions for semiconductors, specialty materials, and energy storage. Solvay’s long-standing expertise in handling hydrofluoric compounds reinforces its position as a leading supplier in high-purity applications.

Arkema continued to expand its fluorochemicals business through modernization of its production facilities and efficiency-driven initiatives. Its investment in high-purity HF and downstream fluoropolymers has strengthened its role in electronics, automotive, and industrial manufacturing. Collectively, these companies play a vital role in advancing safe handling practices, improving process yields, and ensuring a steady supply across global industries dependent on anhydrous hydrofluoric acid for high-value chemical synthesis.

Top Key Players in the Market

- BASF

- Solvay

- Arkem

- LANXESS

- Gulf Flour

- SRF Limited

- Donguye Group Ltd.

- Stella Chemifa Corporation

- Honeywell International Inc.

- Orbia Flour & Energy Materials

- Zhejiang Yonghe Refrigerant Co., Ltd.

Recent Developments

- In June 2025, Solvay and Veolia inaugurated a new recycling unit at Rosières-aux-Salines to process industrial flue gas treatment residues, recovering salts for reuse in chemical production. This reflects a move toward circular chemistry.

- In April 2025, BASF announced it would invest in a semiconductor-grade sulfuric acid plant at its Ludwigshafen site, aiming to produce ultra-pure acid for chip manufacturing. The move strengthens its capabilities in high-purity chemicals used in the semiconductor supply chain.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Billion Forecast Revenue (2034) USD 9.7 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (>99.90%, <99.90%), By Type (Fluorite-Based, Fluorosilicic Acid), By End-use (Chemical, Mining, Metallurgical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Solvay, Arkem, LANXESS, Gulf Flour, SRF Limited, Donguye Group Ltd., Stella Chemifa Corporation, Honeywell International Inc., Orbia Flour & Energy Materials, Zhejiang Yonghe Refrigerant Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anhydrous Hydrofluoric Acid MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Anhydrous Hydrofluoric Acid MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Solvay

- Arkem

- LANXESS

- Gulf Flour

- SRF Limited

- Donguye Group Ltd.

- Stella Chemifa Corporation

- Honeywell International Inc.

- Orbia Flour & Energy Materials

- Zhejiang Yonghe Refrigerant Co., Ltd.