Global Acerola Extract Market Size, Share, And Business Benefits By Source (Conventional, Organic), By Product (Liquid, Powder), By Application (Food and Beverages, Pharmaceuticals and Healthcare, Animal Feed, Beauty and Personal Care, Others), By Distribution Channel (Supermarket and Hypermarkets, Pharmacies, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154173

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

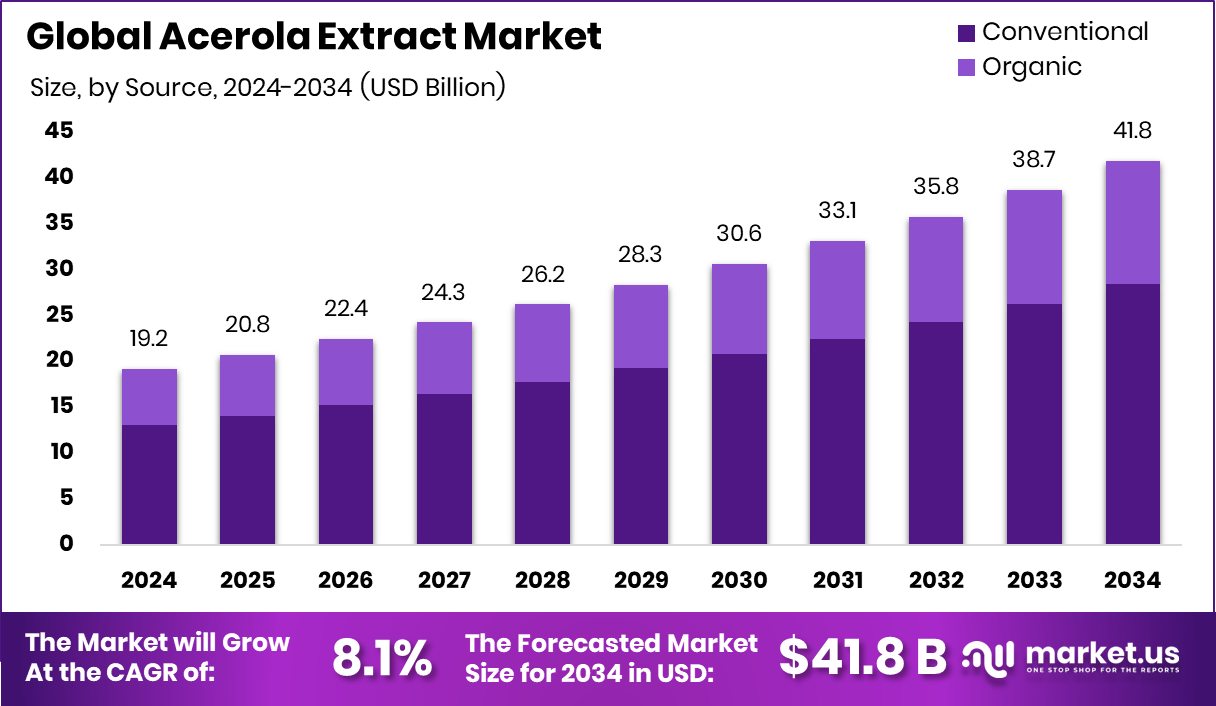

The Global Acerola Extract Market is expected to be worth around USD 41.8 billion by 2034, up from USD 19.2 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034. Strong demand for natural supplements drove growth in North America’s 41.8% market share.

Acerola extract is a natural substance derived from the acerola cherry, a tropical fruit native to Central and South America. Known for its exceptionally high vitamin C content, acerola is often used as a natural antioxidant and immune-boosting ingredient in dietary supplements, skincare products, and functional foods. The extract is typically available in powder or liquid form and contains a concentrated blend of nutrients including vitamin C, polyphenols, carotenoids, and bioflavonoids.

The acerola extract market refers to the global trade, production, and consumption of acerola-based ingredients across various industries, including food and beverages, nutraceuticals, cosmetics, and pharmaceuticals. The market has seen increasing traction due to the growing consumer preference for clean-label products and natural alternatives to synthetic additives. The demand is supported by applications ranging from natural vitamin C enrichment in juices and snacks to its use in anti-aging skincare formulations.

The primary growth factor for the acerola extract market is the rising awareness of natural health supplements and immune support products. With consumers becoming more health-conscious, especially after global health events, the preference for plant-based sources of vitamin C has grown significantly. Additionally, acerola’s antioxidant properties are being recognized for their role in reducing oxidative stress, further boosting demand across dietary and skincare applications. According to an industry report, Molson Coors Agrees to Settle Vizzy Class Action Lawsuit for $9.5 Million.

Demand for acerola extract is rising due to its multipurpose benefits and alignment with clean-label trends. Consumers are actively seeking natural ingredients that serve both functional and preventive health roles. Food and beverage manufacturers are incorporating acerola extract to enhance nutritional value while maintaining product purity.

Key Takeaways

- The Global Acerola Extract Market is expected to be worth around USD 41.8 billion by 2034, up from USD 19.2 billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034.

- In the Acerola Extract Market, conventional sources dominated in 2024, accounting for a 67.9% share.

- Powder form led the Acerola Extract Market in 2024, capturing a significant 78.2% of the segment.

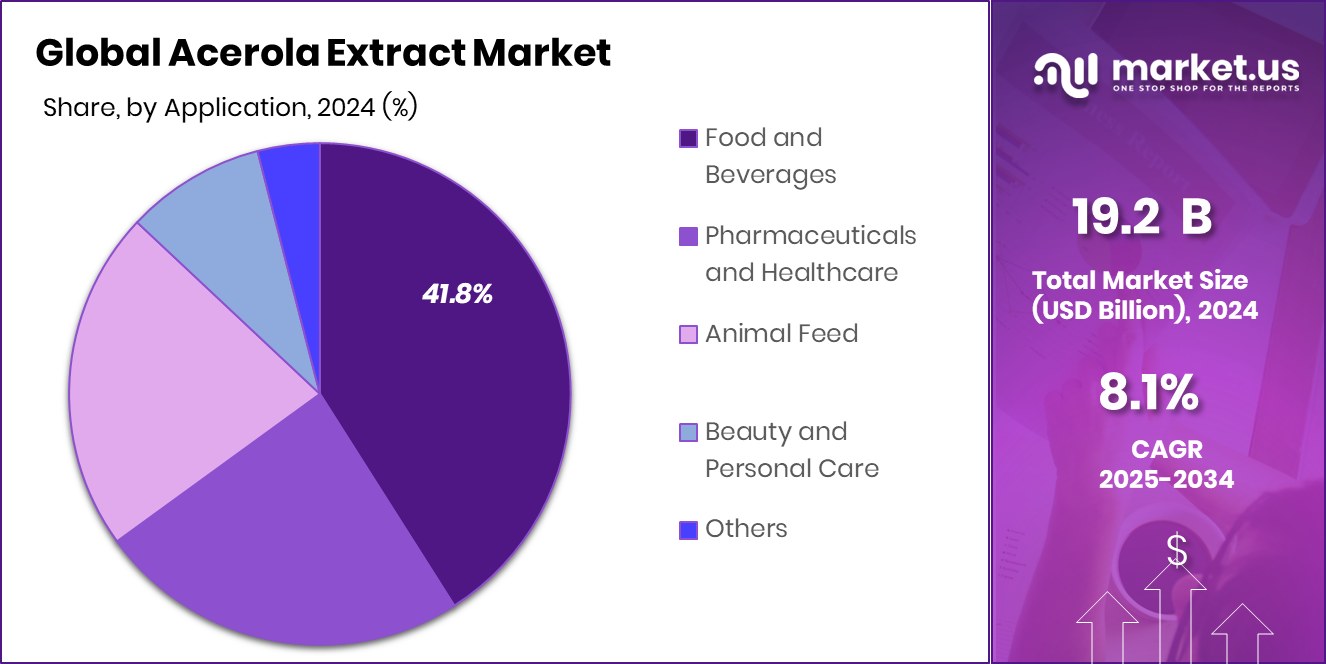

- Food and Beverages held a strong position in the Acerola Extract Market with 41.8% market share.

- Supermarkets and Hypermarkets contributed 38.3% to the Acerola Extract Market distribution in 2024.

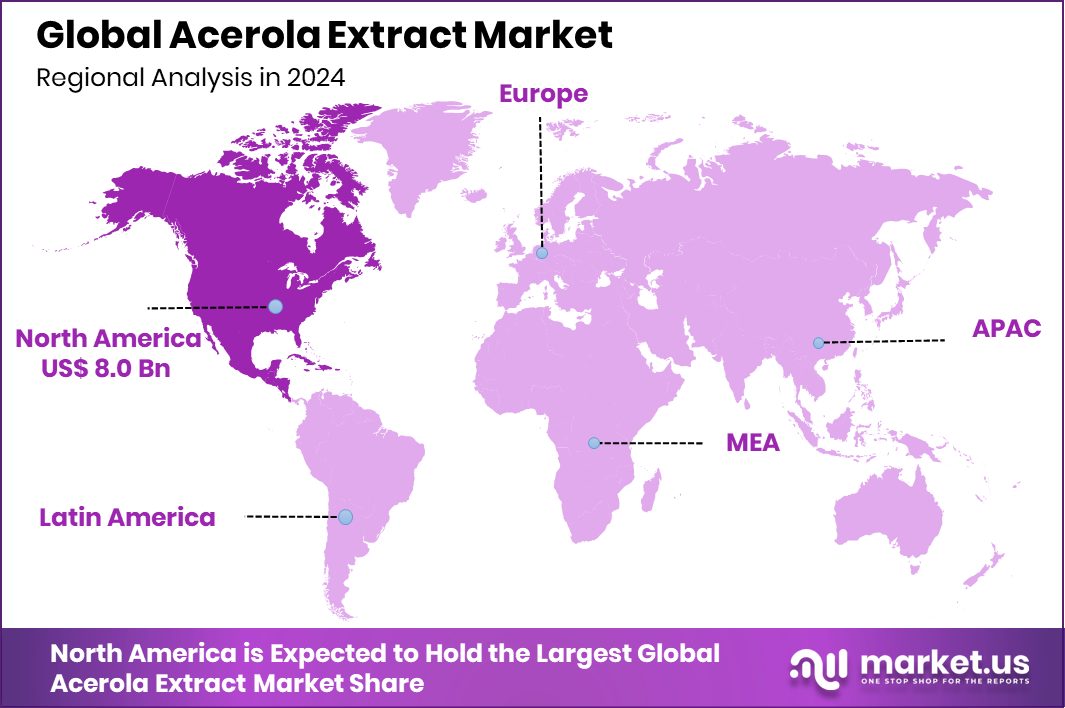

- The market size in North America reached a value of USD 8.0 billion.

By Source Analysis

Conventional source dominates the Acerola Extract Market with a 67.9% share.

In 2024, Conventional held a dominant market position in the By Source segment of the Acerola Extract Market, with a 67.9% share. This dominance can be attributed to the widespread availability and cost-efficiency of conventionally grown acerola cherries, which continue to meet the volume demands of food, beverage, and nutraceutical manufacturers. Conventional acerola extract is commonly used due to its affordability and consistent supply, making it a practical choice for large-scale commercial applications.

The processing infrastructure for conventional sourcing is also well-established, which ensures standardized extraction and easier integration into various formulations. Manufacturers favor conventional sources as they provide stable yields and a streamlined supply chain, which helps keep the product price competitive in global markets. The segment’s strong market hold also reflects current consumer acceptance of conventionally grown ingredients in supplements and food items, especially where organic certification is not a primary concern.

By Product Analysis

Powder form leads the Acerola Extract Market at 78.2% share.

In 2024, Powder held a dominant market position in the By Product segment of the Acerola Extract Market, with a 78.2% share. This significant share reflects the strong preference for powdered acerola extract across various application industries, particularly in dietary supplements, functional foods, and beverages. The powder form offers high stability, longer shelf life, and easier handling during processing and storage, making it the preferred format for bulk manufacturing and formulation.

Its solubility in different media and consistent concentration of active compounds—especially vitamin C—allow formulators to maintain uniformity in end products. Additionally, powder is favored in dry blends, capsules, tablets, and powdered drink mixes, all of which benefit from its convenience and scalability. The dominance of powder is further supported by its lightweight nature and reduced transportation costs, which are crucial advantages for global distribution.

The 78.2% market share also reflects how powder aligns well with clean-label demands, allowing product developers to use minimal carriers and additives. This has reinforced its role in health-conscious product lines and positioned it as the go-to choice for acerola extract in the mainstream and premium product categories alike. The format’s functional versatility continues to drive its strong market preference.

By Application Analysis

Food and Beverages drive the Acerola Extract Market with 41.8% demand.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Acerola Extract Market, with a 41.8% share. This strong market share is primarily driven by the growing consumer demand for natural and functional ingredients in everyday food products. Acerola extract, known for its high vitamin C content and antioxidant properties, is increasingly being used in juices, smoothies, nutritional bars, and fortified snacks to enhance both nutritional value and shelf stability.

Manufacturers in the food and beverage sector are incorporating acerola extract not only as a health-boosting component but also as a natural preservative and color stabilizer, particularly in clean-label formulations. The extract’s natural origin aligns with current industry trends favoring non-synthetic additives, which further supports its adoption in mainstream and premium product lines. Its compatibility with various food matrices and its mild, fruity flavor make it an ideal ingredient for diverse product development.

The 41.8% share in 2024 highlights the strong positioning of acerola extract within food and beverage applications, reflecting its role as a versatile and functional ingredient. As consumer preference continues to shift toward plant-based and nutrient-rich food options, the use of acerola extract in this segment remains robust and highly favored.

By Distribution Channel Analysis

Supermarkets and Hypermarkets hold 38.3% of the Acerola Extract Market.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Acerola Extract Market, with a 38.3% share. This leadership reflects the strong consumer reliance on large retail outlets for purchasing health and wellness products, including acerola extract. These stores offer high product visibility, wide brand availability, and the convenience of one-stop shopping, which significantly boosts sales volume for functional food ingredients and supplements.

The organized retail environment of supermarkets and hypermarkets enables consumers to compare products, read labels, and make informed purchasing decisions. In addition, the placement of acerola extract products in dedicated health and wellness aisles enhances product exposure and encourages impulse buying. Promotional campaigns and seasonal discounts offered at these stores also contribute to their popularity as a key sales channel.

The 38.3% share in 2024 underlines the influence of modern retail infrastructure in driving acerola extract consumption. With their broad reach in urban and semi-urban areas, supermarkets and hypermarkets continue to be the preferred retail platforms for both established and emerging health-conscious consumers. This segment’s dominance is expected to remain strong as retailers expand shelf space for natural and functional food ingredients.

Key Market Segments

By Source

- Conventional

- Organic

By Product

- Liquid

- Powder

By Application

- Food and Beverages

- Pharmaceuticals and Healthcare

- Animal Feed

- Beauty and Personal Care

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies

- Online Retail

- Others

Driving Factors

Rising Demand for Natural Vitamin C Sources

One of the main driving factors behind the growth of the acerola extract market is the increasing demand for natural sources of vitamin C. Consumers are becoming more aware of the health benefits of vitamin C, especially for immunity, skin health, and overall wellness. Acerola extract contains a very high amount of natural vitamin C, making it a preferred alternative to synthetic ascorbic acid.

As people move toward clean-label and plant-based products, acerola is gaining popularity in both the food and supplement industries. Its natural origin and antioxidant properties are attracting manufacturers looking to meet consumer expectations. This rising preference for plant-derived nutrients is significantly pushing the demand for acerola extract in global markets.

Restraining Factors

High Production Cost Limits Market Accessibility Globally

One major factor restraining the growth of the acerola extract market is the high cost of production. Acerola cherries are perishable and require careful handling, rapid processing, and advanced extraction techniques to retain their nutritional value—especially vitamin C, which is highly sensitive to heat and oxidation. These processing requirements increase operational costs.

Additionally, acerola cultivation is limited to specific tropical regions, which adds to sourcing and transportation expenses. As a result, the final product often becomes expensive for end-users, particularly in price-sensitive markets. This cost barrier limits widespread adoption in mainstream products, especially when synthetic alternatives are available at a lower price.

Growth Opportunity

Expanding Use in Natural Food Preservation Products

A major growth opportunity for the acerola extract market lies in its expanding use as a natural preservative in food products. Acerola extract is rich in natural antioxidants and ascorbic acid (vitamin C), which help slow down oxidation and extend shelf life in various foods, especially meat, beverages, and bakery items. As food manufacturers move away from synthetic additives due to health and regulatory concerns, acerola extract offers a clean-label solution.

Its ability to maintain color, freshness, and nutritional quality naturally makes it an ideal choice for food preservation. With rising consumer demand for preservative-free yet long-lasting products, the application of acerola extract in this area is expected to grow significantly across multiple industries.

Latest Trends

Popularity of Clean-Label and Plant-Based Nutrition

A key trend shaping the acerola extract market is the growing popularity of clean-label and plant-based nutrition. Consumers are increasingly seeking products made with recognizable, natural ingredients, and acerola extract fits well within this demand narrative. Its plant origin and minimal processing align with clean-label goals, appealing to health-conscious buyers who prioritize transparency in product sourcing.

Plant-based lifestyles are also gaining traction, and acerola extract serves as a natural, plant-derived source of vitamin C and antioxidants. As more food, beverage, and supplement brands emphasize sustainability and natural formulation, acerola extract is being featured prominently in product lines that emphasize clean, plant-based wellness. This trend is expected to strengthen its market presence in the coming years.

Regional Analysis

North America dominated the Acerola Extract Market in 2024 with a 41.8% share.

In 2024, North America held a dominant position in the global Acerola Extract Market, accounting for 41.8% of the total share, valued at USD 8.0 billion. The strong market presence in this region is driven by the rising consumer inclination toward clean-label, plant-based, and functional health products. The region’s well-established food and nutraceutical sectors have integrated acerola extract into a wide range of applications, especially in dietary supplements and natural food preservation.

In Europe, demand for acerola extract is supported by increasing awareness of natural antioxidants and sustainable sourcing in personal care and wellness products. Regulatory backing for natural ingredients in foods and cosmetics further supports their usage across the region.

Asia Pacific is emerging as a promising region due to growing interest in plant-based ingredients, especially in functional beverages and immunity-boosting supplements. The rising health consciousness in countries such as India, China, and Japan is expanding the potential consumer base.

The Middle East & Africa and Latin America regions are witnessing gradual growth, driven by expanding urban populations and increasing acceptance of natural health products. Although still developing markets, these regions show long-term potential for acerola extract adoption across food, beverage, and pharmaceutical sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Florida Food Inc. continued to strengthen its position through its specialization in natural fruit ingredients, with acerola extract being one of its key offerings. The company’s emphasis on clean-label and non-GMO formulations has positioned it well to meet the rising demand from functional beverages and dietary supplements. Its proximity to acerola sourcing regions in Florida and Brazil has enabled efficient supply chain control and ensured consistent product quality.

Niagro, based in Brazil, remained a critical player in 2024, leveraging its strong local sourcing of acerola and advanced extraction facilities. The company has focused on offering organic and standardized acerola extracts rich in vitamin C. Its direct access to fresh acerola and adherence to sustainability in processing have made it a preferred supplier for international nutraceutical and food manufacturers.

Naturex, a part of the Givaudan group, maintained its leadership by offering a diverse portfolio of acerola-based ingredients, including powders and concentrates. In 2024, the company expanded its application focus beyond beverages into baked goods and meat preservation, using acerola’s natural antioxidant properties. Its global distribution network and stringent quality controls have continued to support its competitive edge.

Nichirei Corporation Inc. of Japan remained influential in the Asia-Pacific market. In 2024, the company emphasized acerola’s use in functional foods and wellness drinks targeted at aging populations. Its in-house R&D and cold chain capabilities enabled it to ensure product stability and freshness, reinforcing consumer trust in high-quality acerola-based formulations across Japanese and Southeast Asian markets.

Top Key Players in the Market

- Dohler GmbH

- The Green Labs LLC

- Blue Macaw Flora

- NutriBotanica

- Diana Food S.A.S

- Florida Food Inc.

- Niagro

- Naturex

- Nichirei Corporation Inc.

- Kemin Industries, Inc

- Advanced Biotech

- Bösch Boden Spies

- KINGHERBS

- Foodchem International Corporation

- Vita Forte Inc.

Recent Developments

- In April 2025, Diana Food released Acerowell™, its first acerola solution fully standardized in vitamin C and polyphenols. The product was officially launched at Vitafoods Europe in May 2025, where it was presented alongside other health-active solutions. These developments underscore the company’s focus on clean-label innovation and healthy‑aging positioning.

- In March 2025, Döhler North America acquired Premier Juices to strengthen its position in the natural fruit ingredient sector. This strategic move expanded its blending, supply chain, and technical support capabilities across North America, indirectly benefiting its acerola extract offerings through improved sourcing, processing, and regional distribution efficiencies.

Report Scope

Report Features Description Market Value (2024) USD 19.2 Billion Forecast Revenue (2034) USD 41.8 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Conventional, Organic), By Product (Liquid, Powder), By Application (Food and Beverages, Pharmaceuticals and Healthcare, Animal Feed, Beauty and Personal Care, Others), By Distribution Channel (Supermarket and Hypermarkets, Pharmacies, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dohler GmbH, The Green Labs LLC, Blue Macaw Flora, NutriBotanica, Diana Food S.A.S, Florida Food Inc., Niagro, Naturex, Nichirei Corporation Inc., Kemin Industries, Inc, Advanced Biotech, Bösch Boden Spies, KINGHERBS, Foodchem International Corporation, Vita Forte Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dohler GmbH

- The Green Labs LLC

- Blue Macaw Flora

- NutriBotanica

- Diana Food S.A.S

- Florida Food Inc.

- Niagro

- Naturex

- Nichirei Corporation Inc.

- Kemin Industries, Inc

- Advanced Biotech

- Bösch Boden Spies

- KINGHERBS

- Foodchem International Corporation

- Vita Forte Inc.