Global 2-Methoxy-2-Methylheptane (CAS 76589-16-7) Market Size, Share Analysis Report By Grade (Pharmaceutical Grade, Chemical Grade), By Application (Analytical Reagents, Pharmaceutical Intermediates) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169982

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

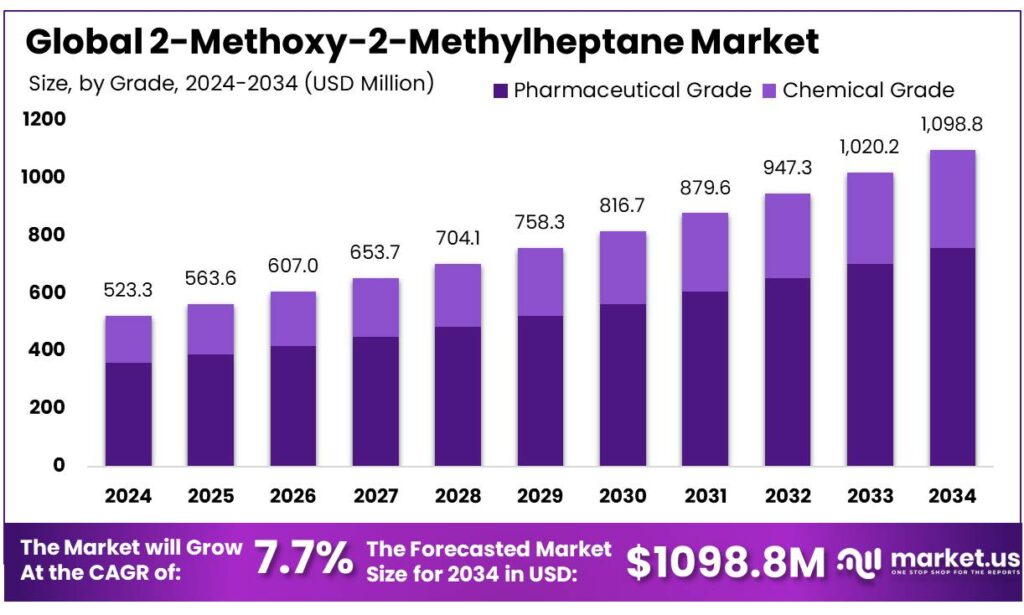

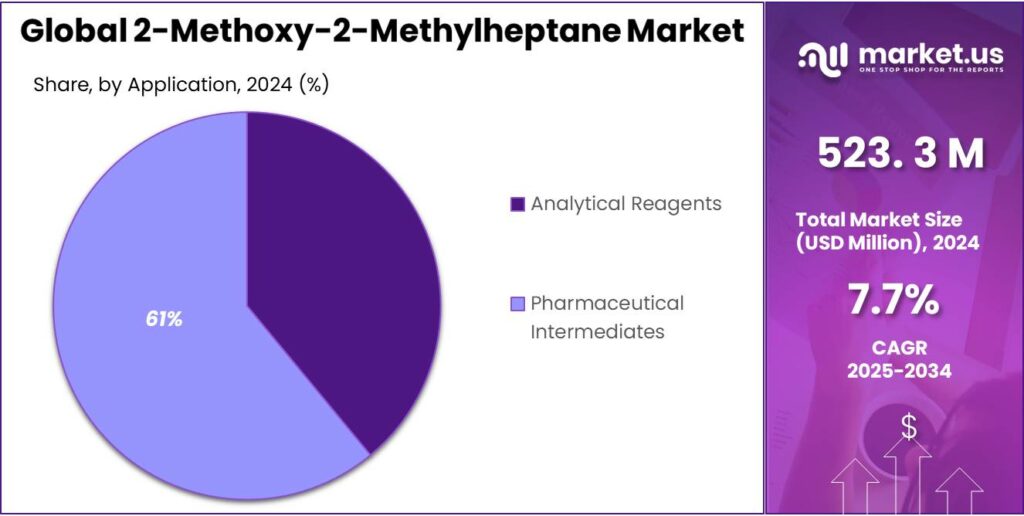

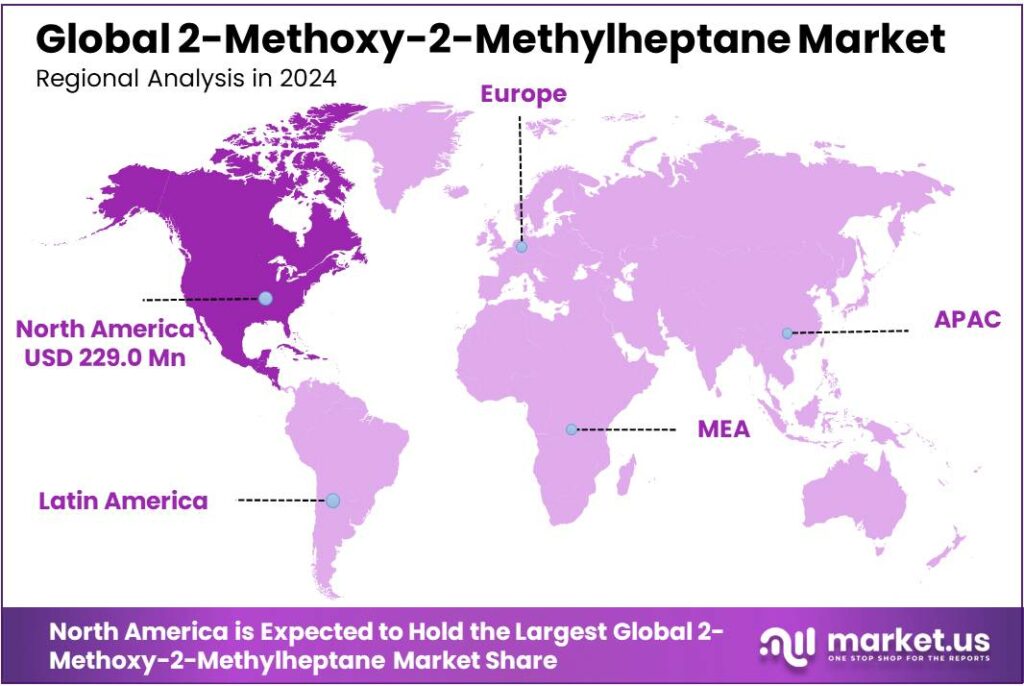

The Global 2-Methoxy-2-Methylheptane (CAS 76589-16-7) Market size is expected to be worth around USD 523.3 Million by 2034, from USD 1098.8 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 43.80% share, holding USD 229.0 Million revenue.

2-Methoxy-2-methylheptane (CAS 76589-16-7) is a tertiary ether with the molecular formula C₉H₂₀O and a molecular weight of 144.25 g/mol, classified as a colourless to pale-yellow liquid with a characteristic radish-like, herbaceous odour. Regulatory testing in Australia (NICNAS, now AICIS) reports a boiling point of 160.5 °C, density of 793 kg/m³ at 20 °C, water solubility of 0.119 g/L at 20 °C and a closed-cup flash point of 45 °C, leading to its classification as a Flammable Liquid Category 3, Skin Sensitiser Category 1B and Chronic Aquatic Toxicant Category 3 under GHS.

Industrial use is still niche but clearly defined. The NICNAS public report indicates introduction volumes in Australia of <1 tonne per year for use as a fragrance ingredient, typically up to 0.5% in fine fragrances and 0.05% in personal-care and household products, marketed under the trade name “Daikon Ether.” In the wider market, suppliers describe 2-methoxy-2-methylheptane as a high-performance fuel ether and non-polar solvent, valued for higher molecular weight and lower water solubility compared with conventional ethers, as well as a building block in organic and pharmaceutical synthesis.

Macro-drivers for this niche ether sit within the broader chemicals and consumer-products ecosystem. The global chemicals industry generated about USD 4.7 trillion in sales in 2022, underscoring the scale of opportunity for differentiated specialty solvents and additives. UNEP/OECD analysis notes that chemicals already reached USD 5.7 trillion in sales in 2017 and that global chemical sales are projected to double by 2030, with the fastest growth in middle-income economies – a positive structural backdrop for high-value fragrance and fuel ethers.

On the demand side, 2-methoxy-2-methylheptane is indirectly linked to the expansion of processed foods, beverages and personal-care categories through its role in fragrances and flavours. FAO reports that global agriculture value added rose from USD 3.9 trillion in 2022 to USD 4.0 trillion in 2023, a 2.6% increase that supports long-term growth in food and beverage value chains. The FAO Food Price Index averaged 125.1 points in November 2025, 2.1% below its November 2024 level, underscoring continued margin pressure and the need for high-impact, cost-efficient flavour and fragrance systems.

- A KPMG/industry review estimates global food processing value addition at about USD 1.7 trillion in 2019, with the Indian food-processing market alone expected to rise from USD 263 billion in 2019-20 to USD 535 billion by 2025. Complementing this, India’s food-processing gross value added grew from ₹2.97 lakh crore in 2019-20 to ₹3.22 lakh crore in 2020-21, indicating robust downstream demand for flavours, fragrances and related solvent systems. These expanding consumer value chains underpin medium-term demand for specialty odourants such as 2-methoxy-2-methylheptane.

Key Takeaways

- 2-Methoxy-2-Methylheptane (CAS 76589-16-7) Market size is expected to be worth around USD 523.3 Million by 2034, from USD 1098.8 Million in 2024, growing at a CAGR of 7.7%.

- Monocrystalline Wafer held a dominant market position, capturing more than a 76.3% share.

- PV Modules held a dominant market position, capturing more than a 58.7% share.

- North America emerged as the leading regional market for solar silicon wafers, accounting for 43.80% of regional share and an estimated USD 229.0 Million.

By Grade Analysis

Monocrystalline Wafer dominates with 76.3% due to high efficiency and growing adoption in solar installations.

In 2024, Monocrystalline Wafer held a dominant market position, capturing more than a 76.3% share as demand increased for high-efficiency solar modules in residential, commercial, and utility-scale projects. The preference for monocrystalline wafers was driven by their superior energy conversion rates, durability, and space efficiency compared to other wafer types. In 2025, the segment continued to expand as manufacturers focused on upgrading production lines to meet rising global demand and governments promoted renewable energy adoption through incentives and policy support.

Technological advancements in wafer fabrication, such as improved crystal growth techniques and reduced material wastage, contributed to cost optimization and enhanced performance, strengthening the segment’s market position. The strong adoption of monocrystalline wafers was particularly notable in regions with limited installation space, where high-efficiency solutions were critical for maximizing energy output. Overall, the segment’s growth reflects a combination of technological superiority, cost-effectiveness over the product lifecycle, and increasing global emphasis on sustainable energy solutions.

By Application Analysis

PV Modules dominate with 58.7% as demand for efficient solar power generation continues to rise.

In 2024, PV Modules held a dominant market position, capturing more than a 58.7% share as global solar installations expanded across residential, commercial, and utility-scale sectors. The segment’s growth was supported by rising adoption of high-performance silicon wafers that improved module efficiency and long-term reliability. In 2025, demand remained steady due to continued government incentives, declining module costs, and wider integration of solar power in grid and off-grid systems.

Increasing investments in large solar farms and rooftop installations further strengthened the segment, as PV modules remained the primary application for silicon wafers owing to their proven durability, scalability, and compatibility with advanced manufacturing technologies. The segment’s sustained leadership reflected strong project pipelines, improving energy yields, and the shift toward clean energy across major global markets.

Key Market Segments

By Grade

- Pharmaceutical Grade

- Chemical Grade

By Application

- Analytical Reagents

- Pharmaceutical Intermediates

Emerging Trends

Trend toward tightly governed, data-rich fragrance ethers

One of the clearest trends around 2-Methoxy-2-Methylheptane (Daikon Ether, CAS 76589-16-7) is how it sits inside a new wave of “data-rich” fragrance ethers that regulators actively manage rather than leave in the background. In 2024, the US EPA moved this substance into a Significant New Use Rule (SNUR) bracket, highlighting specific concerns such as skin sensitization and aquatic toxicity and requiring review before certain new uses can start.

At the same time, countries that looked at 2-Methoxy-2-Methylheptane early have laid down very detailed dossiers. The Australian regulator AICIS (then NICNAS) assessed “Heptane, 2-methoxy-2-methyl-” as a fragrance ingredient introduced at < 1 tonne per year, classifying it as Flammable Liquid Category 3, Skin Sensitisation Category 1B and Chronic Aquatic Toxicity Category 3. The same report allows use at up to 0.5% in fine fragrances and 0.05% in personal-care and household products, and still concludes there is no “unreasonable risk” when normal controls are followed.

These case-by-case decisions are happening against a huge industry backdrop. UNEP’s Global Chemicals Outlook II notes that the global chemical industry exceeded US$5 trillion in 2017 and is projected to almost double by 2030, with Asia expected to account for close to 50% of global sales by then.

On the downstream side, personal-care and home-care brands are still expanding, but with sharper expectations on safety. Cosmetics Europe reports that retail sales of cosmetics and personal-care products in Europe reached about €104 billion in 2024, keeping the region a flagship beauty market. Every new shower gel, detergent or fine fragrance launched into that market must comply with both regional legislation and global fragrance codes, which nudges perfumers toward ingredients that already carry full regulatory clearance, as this ether does under TSCA and AICIS.

Drivers

Growing demand for advanced fragrance ingredients

A major force behind demand for 2-Methoxy-2-Methylheptane (Daikon Ether, CAS 76589-16-7) is the steady expansion of the global chemical industry, which creates space for high-value niche ingredients. UN Environment notes that chemical industry sales exceeded US$5 trillion in 2017 and are projected to roughly double by 2030, with the fastest growth in emerging economies. This rising base of production and consumption encourages formulators to look for differentiated solvents and fragrance molecules that offer distinctive odour profiles and robust regulatory data, exactly the type of positioning 2-Methoxy-2-Methylheptane occupies.

The broader chemical sector’s economic weight also supports long-term innovation budgets. The International Council of Chemical Associations estimates that chemicals contribute about US$5.7 trillion to world GDP and support roughly 120 million jobs worldwide through direct and indirect effects. This scale means that even small shifts toward new fragrance and solvent systems can translate into meaningful volumes for specialty molecules such as 2-Methoxy-2-Methylheptane.

- On the demand side, Cosmetics Europe reports that the European cosmetics and personal-care market reached €104 billion in retail sales in 2024, with more than 9,600 SMEs active in manufacturing across the region. Such a large and fragmented customer base continuously needs new scent profiles that can differentiate products while meeting strict safety rules, which favours well-characterised ingredients like Daikon Ether.

Government and industry roadmaps for chemicals also play a role. An OECD-linked analysis for the EU chemical sector estimates that global chemical output could rise from about €3.47 trillion in 2017 to around €6.6 trillion by 2030, and potentially quadruple by 2050 (Climate Bonds Initiative / EU chemical sector transition. These projections are embedded in policy discussions on sustainable chemistry, encouraging companies to replace older, poorly documented fragrance chemicals with ingredients that have modern toxicology, environmental data and clear regulatory registrations—an area where 2-Methoxy-2-Methylheptane already has detailed dossiers with regulators such as Australia’s AICIS and US EPA.

Restraints

Regulatory pressure and safety profile limit wider use

A major restraint for 2-Methoxy-2-Methylheptane (Daikon Ether, CAS 76589-16-7) is its regulatory and hazard profile. The Australian industrial chemicals regulator (AICIS, formerly NICNAS) classifies the substance as Flammable Liquid Category 3, Skin Sensitiser Category 1B and Chronic Aquatic Toxicant Category 3, based on tests showing a flash point of 45 °C, a log Pow of 3.7 and ecotoxicity values of 24 mg/L (48-h Daphnia EC₅₀) and 23 mg/L (72-h algae EC₅₀). These data led to a formal “harmful to aquatic life with long-lasting effects” label and a conservative aquatic PNEC of 46 µg/L.

- The AICIS assessment notes introduction volumes starting at 0.15 tonnes per year and rising to 0.6 tonnes per year by year five, all under a “limited-small volume” category capped at ≤1 tonne per year. That is tiny compared with other aroma chemicals and underlines how tightly controlled, niche ingredients can be. Formulators have to justify every kilogram against alternative materials that may not carry the same sensitisation or aquatic-toxicity flags.

This sits inside a much tougher global chemicals landscape. The UN Environment Programme estimates that the chemical industry was already worth US$5 trillion in 2017 and is on track to double by 2030, but it also warns that the global goal to minimise chemical harm “will not be achieved” without much stronger controls, with potential benefits from better management running into the “high tens of billions” of dollars each year. In practice, this means more scrutiny on fragrance ethers that are not readily biodegradable and show chronic aquatic risk, like 2-Methoxy-2-Methylheptane, making buyers cautious about long-term dependence.

Regional rules add extra headwinds. In Europe, the chemicals agency ECHA reports that an EU-wide enforcement project found one in three imported substances in mixtures lacked a required REACH registration, prompting calls for tighter checks and more documentation. At the same time, the European Chemical Industry Council (CEFIC) estimates that the EU’s “green push” is already costing chemical firms more than US$20 billion per year, with regulatory compliance alone accounting for up to 10% of capital spending and €1.32 billion in carbon-credit costs for just 73 companies in 2023.

Finally, the rising cost of specialised reporting rules makes downstream users nervous about adding any chemical with a complex hazard profile. In the United States, for example, a single PFAS reporting rule was estimated to impose nearly US$1 billion in compliance costs on businesses, leading to political pushback and revisions.

Opportunity

Growing space for well-documented specialty fragrance ethers

A clear growth opportunity for 2-Methoxy-2-Methylheptane (Daikon Ether, CAS 76589-16-7) sits in its role as a modern, well-studied fragrance ether at a time when regulators and brands are pushing hard for safer, better-documented ingredients. The Australian regulator AICIS (formerly NICNAS) allows its use at up to 0.5% in fine fragrances and 0.05% in personal-care and household products, and concludes that, at these levels, it does not pose an unreasonable risk to public health or the environment when handled with standard controls.

- Behind this sits a very large and still-growing chemicals backbone. UNEP’s Global Chemicals Outlook notes that the global chemical industry was worth about US$5 trillion in 2017 and is projected to double by 2030 as consumption rises across downstream sectors. The European Environment Agency adds that world chemical sales could reach €6.2 trillion by 2030, with the EU-27 still ranking among the largest producers.

The industry is also investing heavily in innovation, which favours ingredients that open new design space for perfumers and formulators. ICCA estimates that the global chemical industry invested around US$51 billion in R&D in 2017, supporting 1.7 million jobs and generating US$92 billion in additional economic activity. At the same time, a transition study for the EU chemicals sector estimates that roughly 53% of primary production capacity will need reinvestment by 2030, requiring over €1 trillion of cumulative transition investment and about a 50% increase in annual capex versus business-as-usual levels.

At the same time, a transition study for the EU chemicals sector estimates that roughly 53% of primary production capacity will need reinvestment by 2030, requiring over €1 trillion of cumulative transition investment and about a 50% increase in annual capex versus business-as-usual levels. At the same time, a transition study for the EU chemicals sector estimates that roughly 53% of primary production capacity will need reinvestment by 2030, requiring over €1 trillion of cumulative transition investment and about a 50% increase in annual capex versus business-as-usual levels.

Regional Insights

North America leads with 43.80% and a market value of 229.0 Million.

In 2024, North America emerged as the leading regional market for solar silicon wafers, accounting for 43.80% of regional share and an estimated USD 229.0 Million in market value; this leadership was underpinned by rapid expansion of module manufacturing, supportive policy incentives, and sizeable utility-scale project pipelines. Strong downstream demand from large PV module and cell manufacturers accelerated procurement of high-quality monocrystalline wafers, while rising domestic capacity additions reduced dependence on imports and shortened supply chains.

The commercial and industrial rooftop segments also supported demand growth, driven by corporate renewable procurement and community solar programs that increased installations across multiple states. Regulatory clarity and incentive mechanisms — including manufacturing tax credits and production support — were noted as key enablers that attracted capital to both wafer and downstream module plants. Logistics and trade dynamics influenced pricing volatility during the year, but near-term offtake agreements and long-term supply contracts moderated exposure for large buyers.

Research and development activity focused on yield improvement and material-use efficiency, further strengthening the region’s competitive position. While Asia Pacific retains major global capacity, North America’s combination of policy support, growing local manufacturing, and a sizeable project pipeline consolidated its role as the dominant regional market for solar silicon wafers in 2024, with continued momentum expected into 2025 as manufacturers and developers execute planned capacity expansions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LONGi reported full-year 2024 revenue of CNY 82.58 billion and disclosed silicon wafer shipments of 82.8 GW for the reporting period; wafer external sales were 35.03 GW in the prior reporting window. The company’s scale and wafer output underpin its leading role in the monocrystalline wafer supply chain.

GCL Technology recorded CNY 15.1 billion in revenue for 2024, while increasing polysilicon production and scaling capacity (annual capacity reported ~480,000 MT across the group). The firm’s upstream polysilicon strength supports wafer feedstock availability despite near-term margin pressures in 2024.

Trina Solar reported H1 2024 revenue of approximately USD 6.05 billion and module shipments of 34 GW in the first half; cumulative 210mm module shipments exceeded 140 GW, underpinning strong downstream demand for high-quality wafers and integrated supply chain advantage.

JinkoSolar reported total revenues of RMB 92.26 billion for 2024 and industry-leading module shipments (annual shipments reported around 92.9 GW), reflecting very large wafer and cell throughput to support its module output and market share. Financial stress from ASP declines affected profitability in 2024.

JA Solar’s 2024 disclosures reported full-year revenue near CNY 69–70 billion and highlighted continued module and wafer production investments; annual results signalled pressure on margins but sustained production capacity for wafers and cells. The company remains a significant wafer-to-module integrator.

Top Key Players Outlook

- Alfa Aesar

- TCI America

- BenchChem

- Santa Cruz Biotechnology, Inc.

- European Chemicals Agency

- Others

Recent Industry Developments

GCL-Poly Energy reported a challenging but active 2024 as a major polysilicon and wafer-feedstock supplier: the group recorded revenue of CNY 15.1 billion and a net loss of CNY 4.75 billion for the year, reflecting severe price pressure across the polysilicon chain.

In 2024 Trina Solar reported revenue of USD 6.047 billion and module shipments of 34 GW, reflecting strong operational throughput as demand for high-efficiency, large-format modules grew.

Report Scope

Report Features Description Market Value (2024) USD 523.3 Mn Forecast Revenue (2034) USD 1098.8 Mn CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Pharmaceutical Grade, Chemical Grade), By Application (Analytical Reagents, Pharmaceutical Intermediates) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alfa Aesar, TCI America, BenchChem, Santa Cruz Biotechnology, Inc., European Chemicals Agency, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Methoxy-2-Methylheptane (CAS 76589-16-7) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

2-Methoxy-2-Methylheptane (CAS 76589-16-7) MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Aesar

- TCI America

- BenchChem

- Santa Cruz Biotechnology, Inc.

- European Chemicals Agency

- Others