Global Ghost Kitchen Insurance Market Size, Share and Analysis Report By Coverage Type (General Liability, Property Insurance, Workers’ Compensation, Cyber Liability, Business Interruption, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By Distribution Channel (Direct, Brokers/Agents, Online Platforms, Others), By End-User (Independent Ghost Kitchens, Restaurant Chains, Food Delivery Platforms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176358

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- By Coverage Type

- By Enterprise Size

- By Distribution Channel

- By End User

- Regional Perspective

- United States Market Overview

- Technology Enablement Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Emerging Trends Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

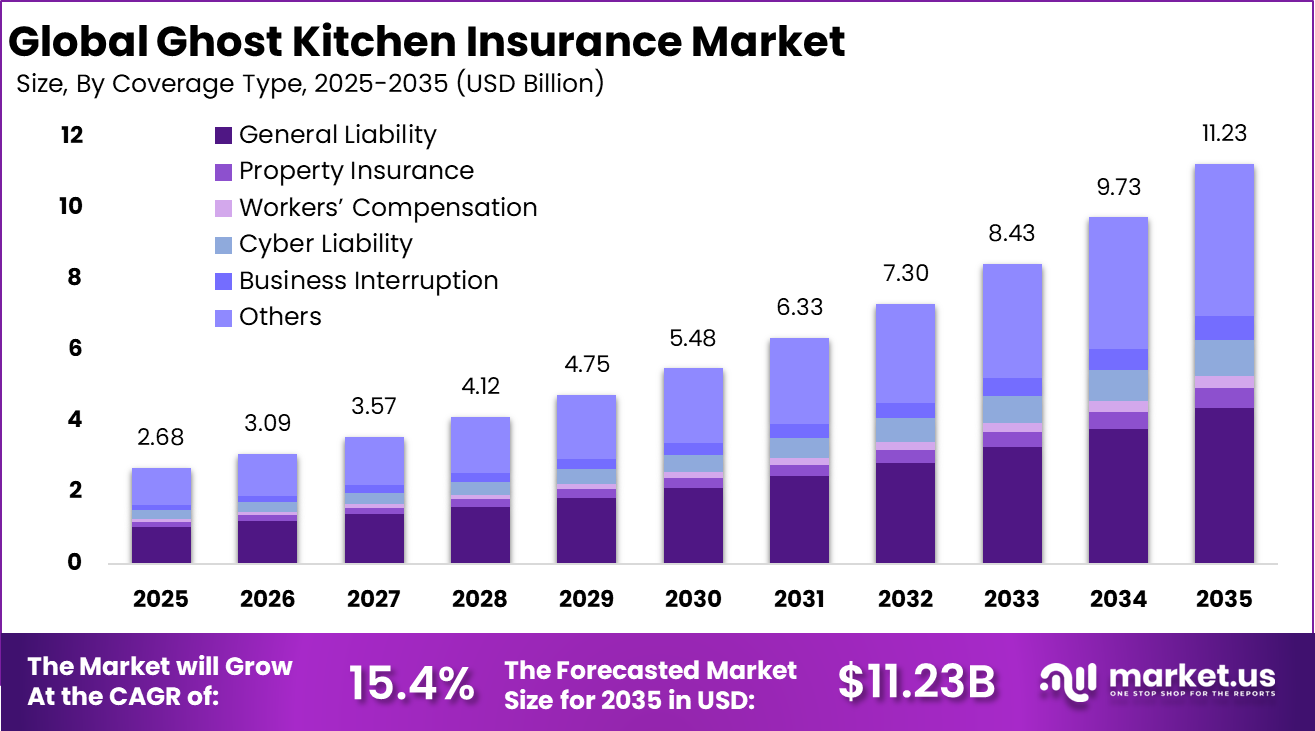

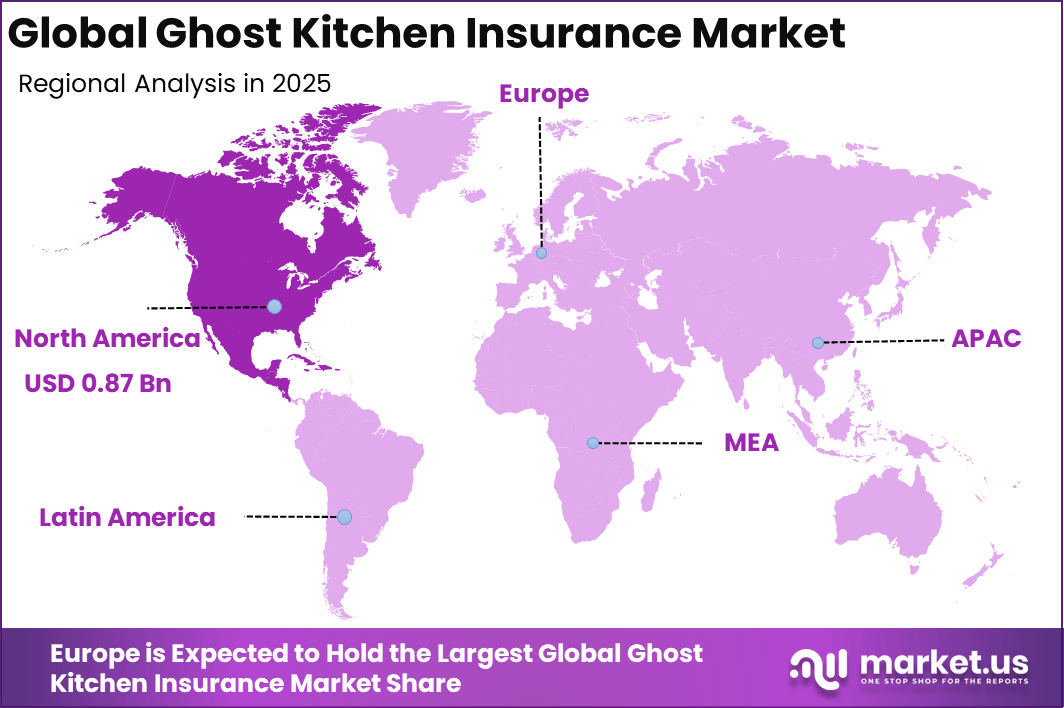

The Global Ghost Kitchen Insurance Market is expanding rapidly alongside the rise of delivery-only food services, projected to grow from USD 2.68 billion in 2025 to approximately USD 11.23 billion by 2035, registering a strong CAGR of 15.4% over the forecast period. North America led the market, capturing more than 32.7% share and generating USD 0.87 billion in revenue, driven by high penetration of cloud kitchens, food-tech platforms, and demand for specialized insurance coverage.

The Ghost Kitchen Insurance Market covers insurance solutions designed for delivery only food service operations that operate without customer facing dining areas. These kitchens rely heavily on digital ordering platforms, third party delivery services, and centralized cooking facilities. Their operating model creates a unique risk profile compared with traditional restaurants. Insurance coverage is therefore structured to address property risk, food safety liability, business interruption, and technology related exposure.

Ghost kitchens often operate multiple brands from a single location, which increases operational density and shared risk. Equipment usage is intensive, and production volumes can fluctuate sharply based on online demand patterns. Insurance plays a critical role in protecting revenue continuity and maintaining compliance with food safety regulations. As the model expands globally, tailored insurance solutions are becoming essential for sustainable operations.

One key driver of the Ghost Kitchen Insurance Market is the rapid growth of online food delivery and app based ordering behavior. Operators depend on continuous kitchen operations to meet delivery commitments, making downtime financially damaging. This dependency increases the need for insurance that covers equipment failure and operational disruptions. The absence of on site dining does not reduce risk exposure but reshapes it.

For instance, in November 2025, Nationwide Mutual Insurance Company introduced modular food business insurance, adapting to ghost kitchen models, emphasizing EPLI and cyber for gig worker-heavy operations. Adoption reflects 11% margin pressures in low seasons.

Demand for ghost kitchen insurance is rising as more entrepreneurs and restaurant chains adopt asset light and delivery focused models. Many operators enter the market quickly with limited physical infrastructure, which increases exposure to uninsured losses. Insurance becomes a requirement to protect limited capital and ensure operational survival. This demand is especially strong among multi brand operators and franchise style kitchens.

Key Takeaway

- General liability insurance led coverage types with a 38.9% share, reflecting the need to manage third party injury, property damage, and food related liability risks.

- Large enterprises dominated demand with a 74.5% share, supported by multi location operations and higher insurance requirements.

- Direct distribution channels captured 42.7%, indicating preference for faster policy placement, customized coverage, and reduced intermediary costs.

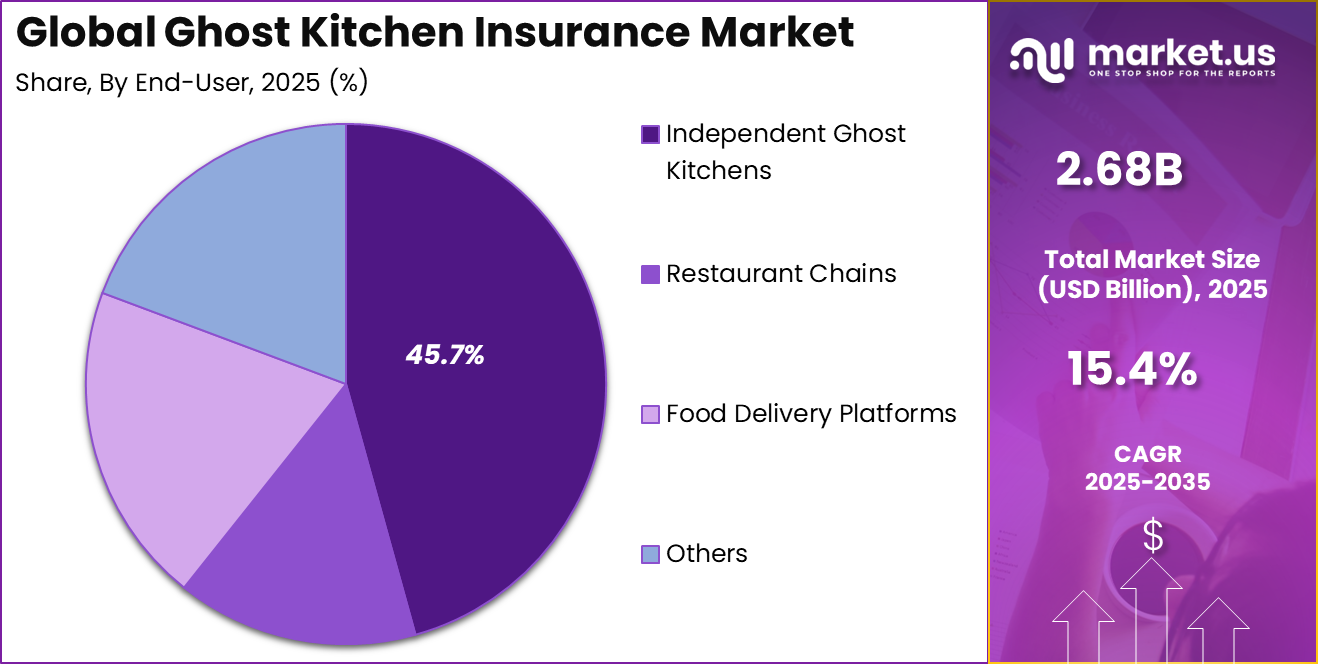

- Independent ghost kitchens held 45.7% share, as standalone operators continue to expand within the delivery focused food service model.

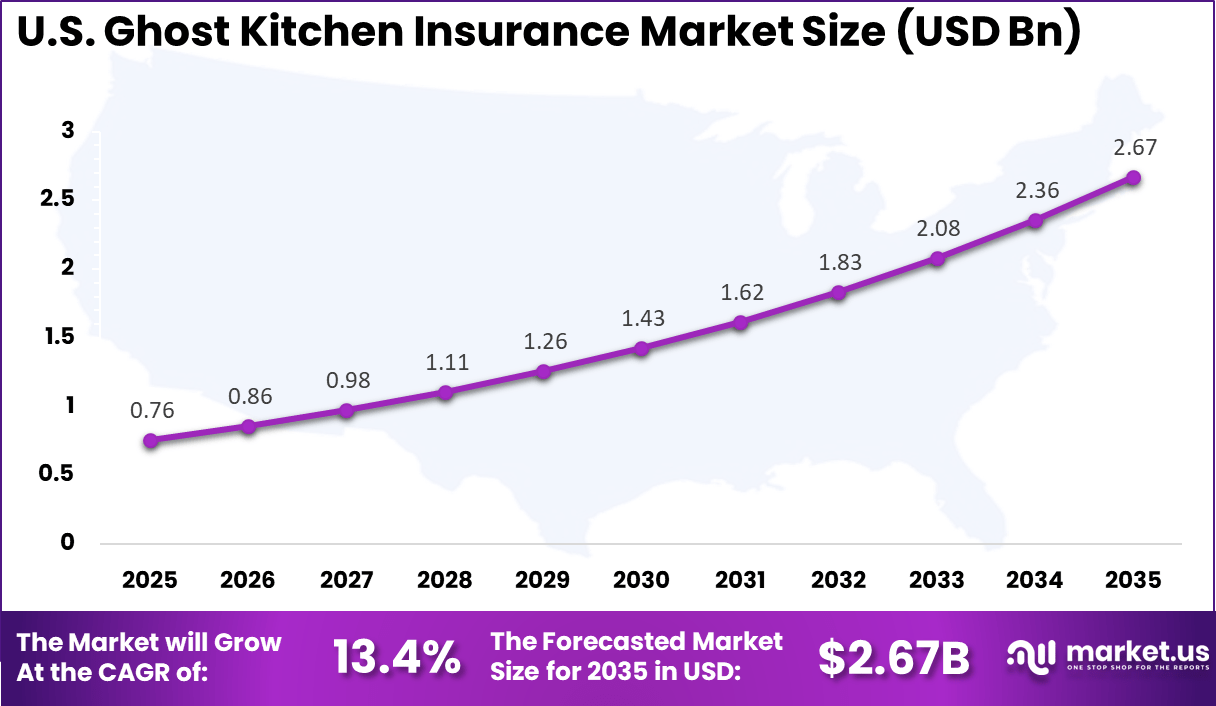

- The US ghost kitchen insurance market was valued at USD 0.76 billion in 2025 and is growing at a 13.4% CAGR, driven by rapid growth in delivery only food services.

- North America led globally with more than 45.7% share, supported by high penetration of ghost kitchens and established commercial insurance frameworks.

Key Insights Summary

Cost of Ghost Kitchen Insurance

- Insurance costs for ghost kitchens are generally lower than traditional restaurants, as there is no front of house exposure such as customer slip and fall incidents.

- Average annual premiums for comprehensive coverage, including general liability and property insurance, typically range from USD 500 to USD 9,000.

- Insurance expenses form part of a broader monthly operating budget of USD 11,000 to USD 42,000, depending on scale and location.

- Due to the absence of dining areas, operators often carry lower employment liability and property coverage limits compared with full service restaurants.

Risk and Liability Statistics

- Foodborne illness risk remains significant, as a single outbreak affecting around 250 customers can result in costs of up to USD 1.9 million from lawsuits, legal fees, and lost revenue.

- Cyber risk exposure is high, as ghost kitchens operate primarily through digital platforms, with nearly 100% of revenue processed via third party delivery apps such as food ordering marketplaces.

- Cyber liability insurance is increasingly viewed as essential due to dependence on online ordering, payment systems, and customer data.

- Adoption rate continues to rise, with roughly 20% of US restaurants now operating ghost kitchen facilities or virtual brands to meet delivery driven demand.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rapid expansion of delivery-only and cloud kitchen models +4.6% North America, Asia Pacific Short to medium term Growth in online food delivery platforms and aggregators +3.8% Global Medium term Rising liability exposure related to food safety and operations +2.9% Global Short term Increasing insurance requirements by landlords and platforms +2.4% North America, Europe Medium term Higher participation of small and independent food entrepreneurs +1.7% Asia Pacific, Latin America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Price sensitivity among small ghost kitchen operators -2.8% Global Short to medium term Limited insurance awareness among first-time food entrepreneurs -2.3% Asia Pacific, Latin America Medium term Complexity of multi-coverage insurance requirements -1.9% Global Medium term Informal operations with weak regulatory enforcement -1.6% Emerging Markets Medium to long term High business churn rate among ghost kitchens -1.4% Global Short term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialized food service insurers High Medium North America, Europe Stable premium growth from niche coverage Large commercial insurers Medium Low to Medium Global Portfolio diversification opportunity Digital insurance platforms Very High Medium North America Strong growth via online onboarding Private equity firms Medium Medium North America, Europe Consolidation of fragmented insurance books Venture capital investors Medium High North America Selective interest in embedded insurance models By Coverage Type

General liability insurance represents the leading coverage type in the Ghost Kitchen Insurance Market, accounting for 38.9% of overall adoption. This dominance is driven by the high exposure to third party injury, food safety incidents, and property damage within shared kitchen environments. Frequent interaction with delivery personnel and reliance on third party platforms increase liability risk for operators.

The importance of general liability coverage is further strengthened by contractual obligations with property owners and food delivery platforms. Many agreements require proof of active liability insurance before operations can begin. As compliance standards tighten, this coverage remains a foundational element of risk protection.

For Instance, in January 2026, Chubb Limited launched enhanced general liability endorsements for food services, including ghost kitchens. The update covers food contamination costs, customer slips during pickups, and equipment failures in delivery-only setups. This helps operators handle rising claims from high-volume orders without huge out-of-pocket expenses. Chubb aimed the product at small businesses to fill gaps in standard policies.

By Enterprise Size

Large enterprises dominate the enterprise size segment with a share of 74.5%. These operators typically manage multiple kitchen locations, centralized production models, and high order volumes. The scale of operations increases financial exposure, driving higher insurance adoption.

The dominance of large enterprises is also linked to structured risk management practices. Larger operators often maintain standardized insurance policies across facilities to ensure consistency and operational continuity. This approach reinforces their leading position within the segment.

For instance, in September 2025, Nationwide Mutual Insurance expanded coverage for large-scale ghost kitchen operators managing multiple brands. New options include higher limits for property damage across sites and cyber protection for online orders. This supports big enterprises scaling in shared hubs with complex risks. Nationwide focused on non-traditional food businesses to meet growing multi-location needs.

By Distribution Channel

Direct distribution accounts for 42.7% of policy placement in the Ghost Kitchen Insurance Market. This channel is preferred due to the need for customized coverage that reflects varied kitchen layouts, equipment use, and operational intensity. Direct engagement allows for clearer communication of risk profiles and coverage requirements.

The expansion of digital insurance platforms has further supported direct distribution. Online policy management and faster underwriting processes appeal to operators seeking efficiency. As a result, direct channels continue to gain relevance in insurance procurement.

For Instance, in November 2025, Hiscox Ltd rolled out direct online quoting for ghost kitchen liability and property bundles. Owners can buy policies instantly via app, skipping brokers for quick startup coverage on delivery risks. The move cuts setup time for independent testing of new menus. Hiscox highlighted easy claims access to build trust in self-service channels.

By End User

Independent ghost kitchens represent 45.7% of total insurance demand. These operators typically function as standalone businesses without the backing of large hospitality groups. Their exposure to operational disruption, food liability, and regulatory penalties makes insurance coverage critical.

Insurance adoption among independent ghost kitchens is influenced by licensing requirements and brand credibility. Customers and delivery partners often prefer insured operators to reduce risk exposure. This sustains steady demand from independent end users.

For Instance, in January 2026, The Hartford introduced tailored insurance for independent ghost kitchens, covering delivery drivers and food spoilage in single-site operations. Policies address unique needs like rider accidents and platform outages without chain-level extras. This fits solo chefs launching virtual brands amid booming app deliveries. The Hartford stressed flexible terms for small-scale growth.

Regional Perspective

North America holds a significant position in the Ghost Kitchen Insurance Market, accounting for 32.7% of total activity. The region benefits from a mature food delivery ecosystem, high adoption of cloud kitchen models, and strong regulatory oversight related to food safety and workplace standards. Insurance penetration remains high across commercial food operations.

The region’s legal environment also encourages comprehensive risk coverage. Operators prioritize insurance to manage litigation and compliance exposure. These factors collectively support North America’s leading role in the market.

For instance, in September 2025, Tokio Marine HCC updated its Restaurant Recovery Insurance application to specifically address ghost kitchen operations, covering food contamination and revenue losses for delivery-only models. This innovation reinforces North American dominance in tailored ghost kitchen risk solutions.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 0.76 Bn and a growth rate of 13.4% CAGR. Rapid expansion of online food ordering and virtual restaurant brands continues to increase operational activity. This growth directly supports rising demand for specialized insurance coverage.

Insurance adoption in the U.S. is driven by strict local health regulations and liability exposure. Independent operators and large enterprises alike seek coverage to protect assets and maintain business continuity. These dynamics underpin sustained growth in the U.S. segment.

For instance, in January 2025, Liberty Mutual enhanced its property catastrophe reinsurance program with $500M aggregate coverage, protecting against frequency risks relevant to ghost kitchen operations vulnerable to supply chain disruptions and events. This bolsters U.S. market resilience in the expanding delivery-focused food insurance space.

Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~)% Primary Function Geographic Relevance Adoption Timeline Digital policy issuance and instant online underwriting +3.9% Faster onboarding of kitchens North America, Europe Short term Usage-based and flexible insurance pricing models +3.1% Cost alignment with operations Global Medium term Integrated compliance and documentation platforms +2.4% Regulatory readiness North America, Europe Medium term Automated claims processing and settlement tools +2.0% Improved trust and retention Global Medium to long term API integration with food delivery platforms +1.6% Embedded insurance distribution North America Long term Increasing Adoption Technologies

Digital kitchen management systems are being widely adopted to track orders, inventory, and production timing. These systems improve efficiency but also introduce technology related risks such as system outages and data loss. Insurers are adapting policies to reflect the operational dependence on digital infrastructure. Technology exposure is now a recognized component of ghost kitchen risk assessment.

Automated cooking equipment and smart appliances are also becoming more common in high volume ghost kitchens. While automation improves consistency and throughput, it raises equipment failure and maintenance risks. Insurance coverage increasingly accounts for these technologies through equipment breakdown protection. This trend supports more specialized policy design.

The primary reason for adopting digital and automated systems is operational efficiency. Ghost kitchens compete on speed, order accuracy, and delivery reliability. Technology enables high throughput with limited staff, which is essential for profitability. Insurance providers recognize that technology is central to risk management and service continuity.

Another reason is compliance and traceability. Digital systems help document food handling, temperature control, and sanitation practices. This documentation is valuable during inspections and liability claims. Insurance adoption is strengthened when technology supports defensible operational records.

Investment and Business Benefits

Investment opportunities exist in insurance products designed specifically for delivery only food operations. Bundled policies that combine property, liability, cyber, and business interruption coverage are increasingly attractive. These solutions reduce complexity for operators managing multiple brands. Insurers offering modular coverage options can capture growing demand.

There is also opportunity in risk advisory and loss prevention services tailored to ghost kitchens. Services such as fire risk assessment, food safety audits, and equipment maintenance guidance add value beyond policy issuance. These services help reduce claim frequency while strengthening client retention. This approach supports long term portfolio growth.

For ghost kitchen operators, insurance provides financial protection against sudden shutdowns and liability claims. Coverage supports recovery from equipment failure, kitchen fires, or food safety incidents. This stability is critical for businesses operating on thin margins. Insurance also enhances credibility with partners and investors.

For insurers, ghost kitchens represent a scalable and repeatable client segment. Standardized kitchen layouts and operating models allow for structured underwriting frameworks. As operators expand across multiple locations, insurance relationships can scale accordingly. This creates predictable revenue streams when risks are properly managed.

Emerging Trends Analysis

The ghost kitchen insurance market is witnessing a clear shift toward coverage models that address digital and platform driven risks. As ghost kitchens rely heavily on online ordering systems and third party delivery applications, insurers are increasingly incorporating cyber liability and technology related protections into standard policies.

Coverage linked to data breaches, payment fraud, and system downtime is becoming more relevant as digital transactions account for nearly 100% of customer interactions in this operating model. Another emerging trend is the customization of insurance products based on shared kitchen environments, where multiple brands operate from a single facility, increasing the need for clearly defined liability and property risk boundaries.

In addition, there is growing attention toward business interruption coverage tailored for delivery only operations. Disruptions caused by equipment failure, power outages, or suspension from delivery platforms can immediately halt revenue generation. Insurers are adapting policy structures to reflect these operational realities, where even short downtime can lead to material financial losses.

Key Market Segments

By Coverage Type

- General Liability

- Property Insurance

- Workers’ Compensation

- Cyber Liability

- Business Interruption

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Distribution Channel

- Direct

- Brokers/Agents

- Online Platforms

- Others

By End-User

- Independent Ghost Kitchens

- Restaurant Chains

- Food Delivery Platforms

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Large commercial insurers such as Zurich Insurance Group, Allianz SE, and AXA XL hold strong positions in the ghost kitchen insurance market. Their coverage typically includes property damage, general liability, product liability, and business interruption. These insurers apply risk models aligned with high kitchen density and delivery-driven operations. Chubb Limited and AIG add capacity for multi-location operators. Demand is driven by rapid growth of delivery-only food businesses.

Mid-market and small business focused insurers such as The Hartford, Nationwide Mutual Insurance Company, and Hiscox Ltd support independent and franchise ghost kitchens. Travelers Companies, Inc. and Markel Corporation emphasize tailored policies for fire risk, equipment breakdown, and food safety liability. These players benefit from flexible underwriting and strong claims handling. Adoption is supported by regulatory requirements and landlord insurance mandates.

Specialty insurers and reinsurers such as Berkshire Hathaway Specialty Insurance, Tokio Marine HCC, and Sompo International address higher-risk and scaled kitchen models. Munich Re and Beazley Group support risk transfer and innovative coverage structures. QBE Insurance Group, Arch Insurance Group, and Assicurazioni Generali S.p.A. expand regional coverage. Other insurers enhance competition and customization across the ghost kitchen ecosystem.

Top Key Players in the Market

- Zurich Insurance Group

- AXA XL

- Chubb Limited

- Allianz SE

- AIG (American International Group)

- Liberty Mutual Insurance

- The Hartford

- Nationwide Mutual Insurance Company

- Hiscox Ltd

- Travelers Companies, Inc.

- Berkshire Hathaway Specialty Insurance

- Sompo International

- Tokio Marine HCC

- Markel Corporation

- Munich Re

- Beazley Group

- CNA Financial Corporation

- QBE Insurance Group

- Arch Insurance Group

- Assicurazioni Generali S.p.A.

- Others

Recent Developments

- In November 2025, Chubb launched AI-powered embedded insurance through Chubb Studio, enabling instant cyber and liability add-ons for ghost kitchen partners at point-of-sale. This innovation drives adoption among delivery-focused businesses.

- In October 2025, AXA XL rolled out enhanced restaurant contamination insurance, targeting ghost kitchen vulnerabilities like supply chain disruptions and foodborne outbreaks with global coverage up to $50M.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Bn Forecast Revenue (2035) USD 11.2 Bn CAGR(2026-2035) 15.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability, Property Insurance, Workers’ Compensation, Cyber Liability, Business Interruption, Others), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By Distribution Channel (Direct, Brokers/Agents, Online Platforms, Others), By End-User (Independent Ghost Kitchens, Restaurant Chains, Food Delivery Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zurich Insurance Group, AXA XL, Chubb Limited, Allianz SE, AIG (American International Group), Liberty Mutual Insurance, The Hartford, Nationwide Mutual Insurance Company, Hiscox Ltd, Travelers Companies, Inc., Berkshire Hathaway Specialty Insurance, Sompo International, Tokio Marine HCC, Markel Corporation, Munich Re, Beazley Group, CNA Financial Corporation, QBE Insurance Group, Arch Insurance Group, Assicurazioni Generali S.p.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ghost Kitchen Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Ghost Kitchen Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Zurich Insurance Group

- AXA XL

- Chubb Limited

- Allianz SE

- AIG (American International Group)

- Liberty Mutual Insurance

- The Hartford

- Nationwide Mutual Insurance Company

- Hiscox Ltd

- Travelers Companies, Inc.

- Berkshire Hathaway Specialty Insurance

- Sompo International

- Tokio Marine HCC

- Markel Corporation

- Munich Re

- Beazley Group

- CNA Financial Corporation

- QBE Insurance Group

- Arch Insurance Group

- Assicurazioni Generali S.p.A.

- Others