Global Geosynthetics Market By Product (Geotextiles, Geomembranes, Geogrids, Geonets, and Other Products), By Application (Separation, Reinforcement, Filtration, Drainage, and Barrier), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 20761

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

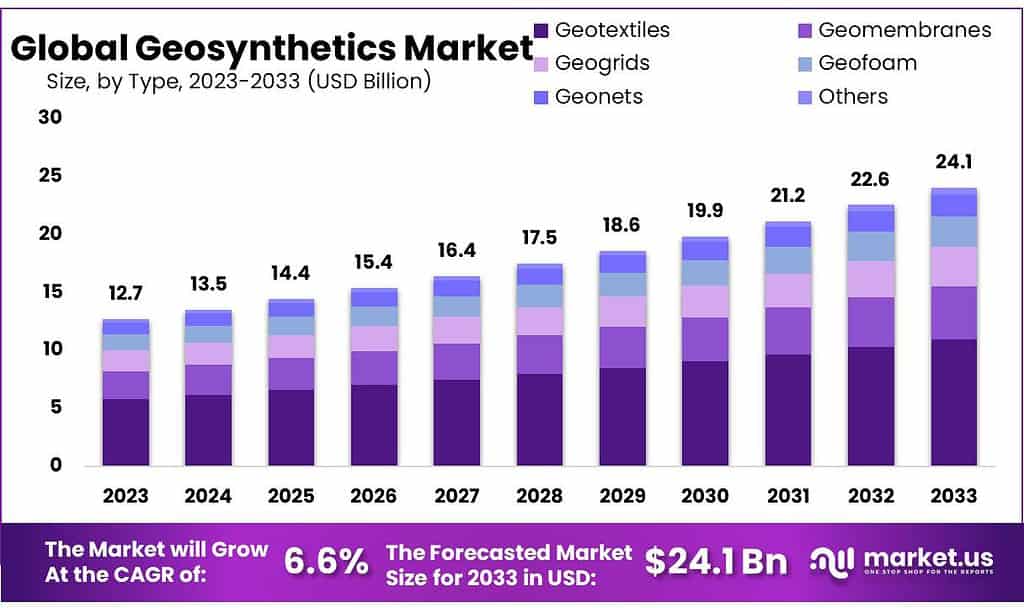

The global Geosynthetics market size is expected to be worth around USD 24.1 billion by 2033, from USD 12.7 billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2023 to 2033.

Geosynthetics is a term that refers to products that stabilize terrain. They are often polymeric products that solve civil engineering issues. These products include geonets.

These products are made from polystyrene, polypropylene, polyvinyl chloride, and polyester. Geosynthetics systems are used in various civil engineering and geotechnical applications.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Geotextiles Dominate: Geosynthetics Market hold a significant 45.7% of the market share in 2023 due to their superior performance, made from materials like PP and polyethylene polyester.

- Geomembranes Steady Growth: Expected to grow steadily due to increased awareness of their use in reservoirs and demand for drainage, addressing concerns about evaporation and emissions.

- Geogrids in Infrastructure: Known for their remarkable bearing capacity, frequently used in railway and road infrastructure, as well as supporting structures like retaining walls for bridges.

- Geonets for Various Applications: Used widely in different applications like landfill leachate collection, road drainage, and erosion control due to their ability to slow down surface runoff.

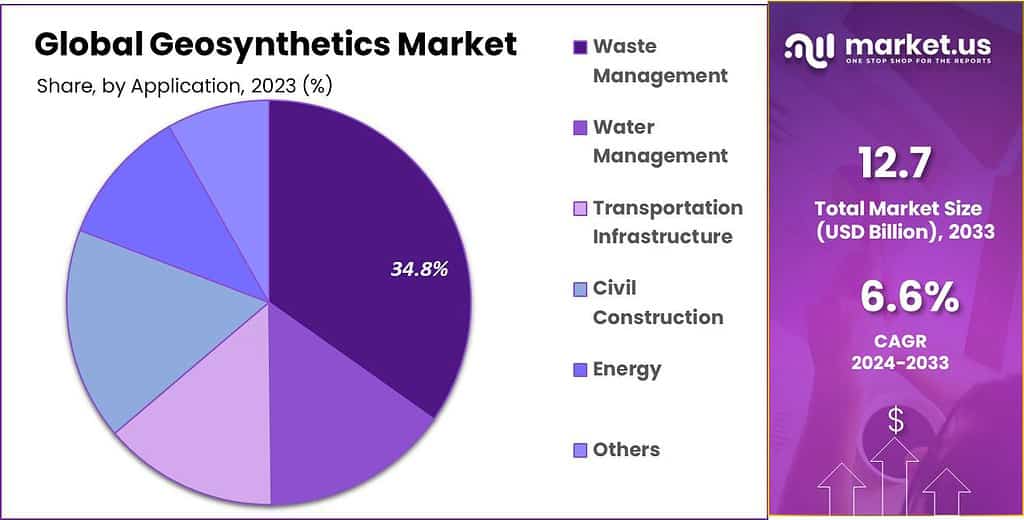

- Applications in Waste Management Lead: Waste management holds a hefty 34.8% share in 2023, reflecting the crucial role of geosynthetics in handling waste efficiently.

- Diverse Application Scenarios: From reinforcement in roads to filtration, separation, and barrier applications, geosynthetics play a vital role in maintaining infrastructure integrity and stability.

- Market Drivers: Increased investments in waste management, rising global population, urbanization, and heightened environmental consciousness fuel the demand for effective waste and water management solutions.

- Challenges with Raw Materials: Fluctuating crude oil prices affect the costs of essential raw materials used in geosynthetics, impacting product pricing.

- Opportunities in Mining and Oil & Gas: The mining sector, particularly in Asia and South America, presents significant opportunities due to increased demand for metals and minerals.

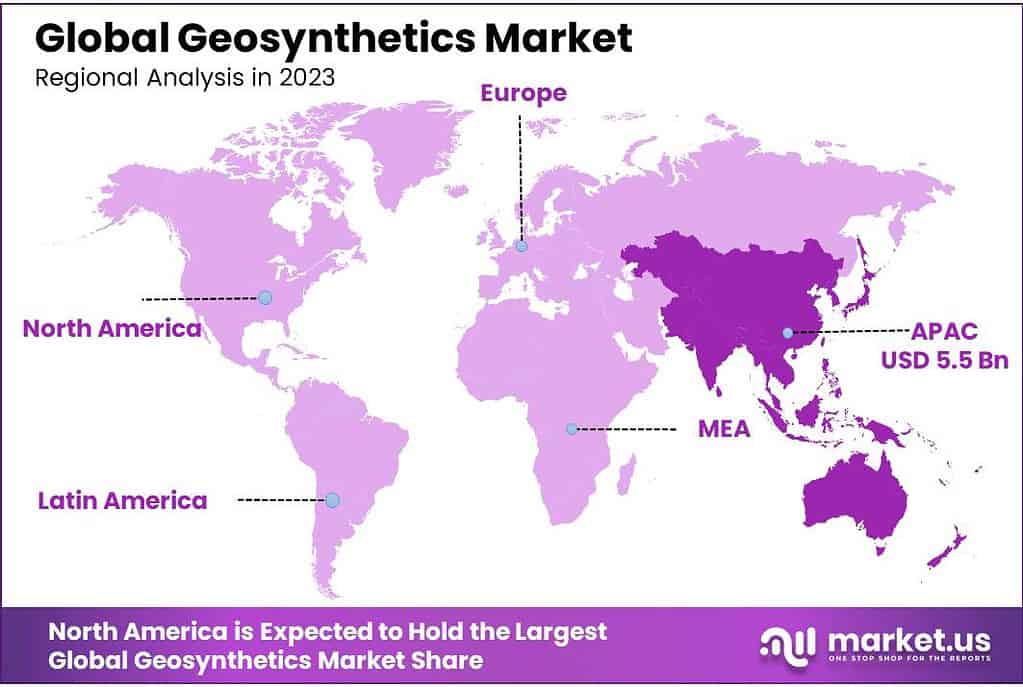

- Regional Analysis: Asia Pacific dominates the market (43.8% of total global revenue in 2023) with anticipated growth in oil reinforcement in foundation work for residential buildings.

- Europe and Other Regions: Europe sees significant market presence due to construction directives, waste management policies, while South America, Africa, and the Middle East witness growth in infrastructure and commercial activities.

- Key Market Players: Industry leaders like Propex Operating Company LLC, TenCate Geosynthetics, Tensar International Corporation, and others drive innovation and market expansion through strategic agreements and acquisitions.

Product Analysis

Geosynthetics Market accounted for 45.7% of the global market share in 2023. Because of its superior performance and functional advantages over other materials, the segment dominated the market share. The synthetic fabrics used for manufacturing geotextiles consist of PP and polyethylene polyester.

In terms of revenue, Geomembranes should grow at a steady rate from 2023 to 2032. This is due to increasing awareness of their use as floating covers in reservoirs to control evaporation and reduce Volatile Organic Compounds, emissions,s and the demand for drainage.

Geogrids have a remarkable bearing capacity and are used more frequently in railway and road infrastructure construction. Geogrids are also used to build retaining walls that support bridge abutments or railway bridges.

The Geosynthetics Market is expected to grow due to the above factors. Geonets are used in separation media to collect landfill leachates, foundation wall systems in drainage, road drainage systems, and methane gas. Because of its ability to slow down surface runoff, the product is expected to be more widely used in erosion control.

By Application

In 2023, Waste Management led the market, holding a hefty 34.8% share. They were the top dogs in handling things.

The application segment is divided into reinforcement, drainage, separation, filtration, and barrier. Geosynthetics, such as geotextile and geomembrane, are used to separate layers of different materials. This is necessary to ensure the infrastructure remains intact.

The forecast period will see the segment grow because of increased investments in developing countries’ construction and repair of roads. The geosynthetics in the soil are used to increase the soil’s shear and tensile strengths.

Geosynthetics Market and geogrids are used to reinforce sub-soil in road construction. Filtration is moving liquid through geosynthetics while keeping the soil particles. Drainage is an essential application in almost every geotechnical structure.

It transmits liquid inside the plane and reduces lateral pressure on a retention wall. Geosynthetics prevent liquid and vapor contamination. They are commonly used in waste containment systems to provide a moisture barrier.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

By Product

- Geotextiles

- Geomembranes

- Geogrids

- Geonets

- Other Products

By Application

- Waste Management

- Water Management

- Transportation Infrastructure

- Civil Construction

- Energy

- Others

Drivers

Growth of the geosynthetics market can be attributed to increasing investments in waste management in emerging economies

The global rise in population and urbanization is causing a surge in solid and liquid waste levels. As environmental consciousness grows, there’s a heightened demand for effective waste and water management solutions.

Geosynthetics play a crucial role by serving as landfill caps, preventing the movement of fluids into landfills. This helps reduce or eliminate post-closure generation of leachate, cutting down treatment costs significantly.

Moreover, geosynthetics are extensively utilized in various water management endeavors, addressing widespread concerns about water pollution. Specifically, geosynthetic liner systems are employed in waste treatment lagoons within wastewater treatment plants.

Their purpose is to safeguard vital water resources such as lakes, rivers, ponds, aquifers, and reservoirs. This anticipated rise in demand for geosynthetics is expected to persist throughout the forecast period.

Restraints

Fluctuating raw material prices due to the volatility in the prices of crude oil

The costs and availability of raw materials play a significant role in determining the prices of final geosynthetic products. Many essential raw materials like polyethylene, polypropylene, polyvinyl chloride, and ethylene propylene diene monomer are sensitive to fluctuations in crude oil prices. Changes in crude oil directly impact the costs of these materials used in geosynthetics manufacturing.

However, the ongoing pandemic has caused widespread travel bans both domestically and internationally. This has notably decreased the demand for transportation fuel, consequently affecting crude oil prices.

Opportunity

Rising demand from the mining and oil & gas industries

The mining sector stands as a significant user of geosynthetics. The growing demand for metals and minerals in Asia is set to propel this industry forward. Notably, China leads in the production of rare earth metals, gold, copper, coal, limestone, and iron & steel. India, too, has seen substantial investments in its iron & steel sector.

Additionally, South America has emerged as an attractive hub for mining investments by major global players. Countries like Brazil, Peru, and Chile boast significant mining capabilities and have seen increased foreign investments over the last five years.

Regional Analysis

The Asia Pacific was the dominant market and accounted for 43.8% of the total global revenue in 2023. Over the forecast period, there will be a significant increase in demand for oil reinforcement in foundation work for residential buildings in emerging countries like China and India.

Europe was the second largest market, thanks to numerous construction directives like 89/106/EEC or M/107 European Union that have required geosynthetics on infrastructure projects. The German government also enforced a stringent waste management policy in both the municipal and industrial sectors.

Geosynthetics is expected to increase due to increased infrastructure activity in South America’s developing economies, including Brazil. Rising water management practices will boost the regional market growth.

The growing offshore oil and gas sector in Brazil, Argentina, and Venezuela has also influenced the growth of this market. Geosynthetics is booming in Africa and the Middle East. Over the forecast period, the region will increase civil and commercial building activities, including stadiums or hotels.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Industry leaders have made strategic agreements with suppliers to ensure an uninterrupted supply of raw materials and equipment. The geosynthetics industry has a competitive edge because of factors such as the expansion in manufacturing capacity in the Asia Pacific and the Middle East.

Market leaders are forming agreements with emerging players to increase their market reach and expand their distribution capacity. Companies will also likely form partnerships with eCommerce portals to provide buyers with timely access to geosynthetic product information.

Маrkеt Кеу Рlауеrѕ

- Propex Operating Company LLC

- AGTU America

- Tensar International Corporation

- Officine Maccaferri S.p.A.

- PRS Geo-Technologies

- Koninklijke Ten Cate N.V.

- HUESKER Group

- Fibertex Nonwovens A/S

- TENAX Group

- Low and Bonar PLC

- GSE Holdings, Inc.

- Solmax

- NAUE GmbH & Co. KG

- Global Synthetics

- TYPAR

Recent Development

In June 2021: SOLMAX acquired TenCate Geosynthetics, the Netherlands-based provider of geosynthetics and industrial fabrics. The acquisition is expected to increase the innovation capabilities and global reach of the company. The acquisition is expected to bring additional business opportunities for the company in containment and infrastructure applications in mining, transportation, energy, waste management, and civil engineering.

Report Scope

Report Features Description Market Value (2023) USD 12.7 Billion Forecast Revenue (2033) USD 24.1 Billion CAGR (2023-2032) 6.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Geotextiles, Geomembranes, Geogrids, Geonets, and Other Products), By Application (Separation, Reinforcement, Filtration, Drainage, and Barrier) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Propex Operating Company LLC, AGTU America, Tensar International Corporation, Officine Maccaferri S.p.A., PRS Geo-Technologies, Koninklijke Ten Cate N.V., HUESKER Group, Fibertex Nonwovens A/S, TENAX Group, Low and Bonar PLC, GSE Holdings, Inc., Solmax, NAUE GmbH & Co. KG, Global Synthetics, TYPAR Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are geosynthetics?Geosynthetics are synthetic materials used in civil engineering and construction projects to improve soil stability, prevent erosion, manage drainage, and provide reinforcement. They're made from polymers and include materials like geotextiles, geomembranes, geogrids, and geocells.

What’s the future outlook for the geosynthetics market?The market is expected to grow due to increased infrastructure development, environmental concerns, and urbanization. Advancements in material technology and increasing awareness of geosynthetic benefits may further drive market expansion.

What factors drive the growth of the geosynthetics market?Infrastructure Development: Growing demand for roads, railways, and ports. Environmental Concerns: Need for waste management solutions and erosion control. Urbanization: Expansion of cities leading to increased construction activities. Government Regulations: Emphasis on environmental protection and infrastructure development.

-

-

- GSE Holdings Inc.

- Officine Maccaferri S.p.A.

- Koninklijke Ten Cate N.V.

- Fibertex Nonwovens A/S

- Propex Operating Company LLC

- NAUE GmbH & Co. KG

- TENAX Group

- Low and Bonar PLC

- Other Key Players