Global Genotyping Market Product & Services, Instruments(Sequencers & Amplifiers, Analyzers),Reagents & Kits, Software and Services, Technology-(PCR, Capillary Electrophoresis, Microarrays, Other Technologies) Application-(Pharmacogenomics, Diagnostics and Personalized Medicine, Agricultural Biotechnology, Other Applications) End-User-(Pharmaceutical and Biopharmaceutical Companies, Diagnostics and Research Laboratories, Academic Institutes, Other End-Users) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 41073

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

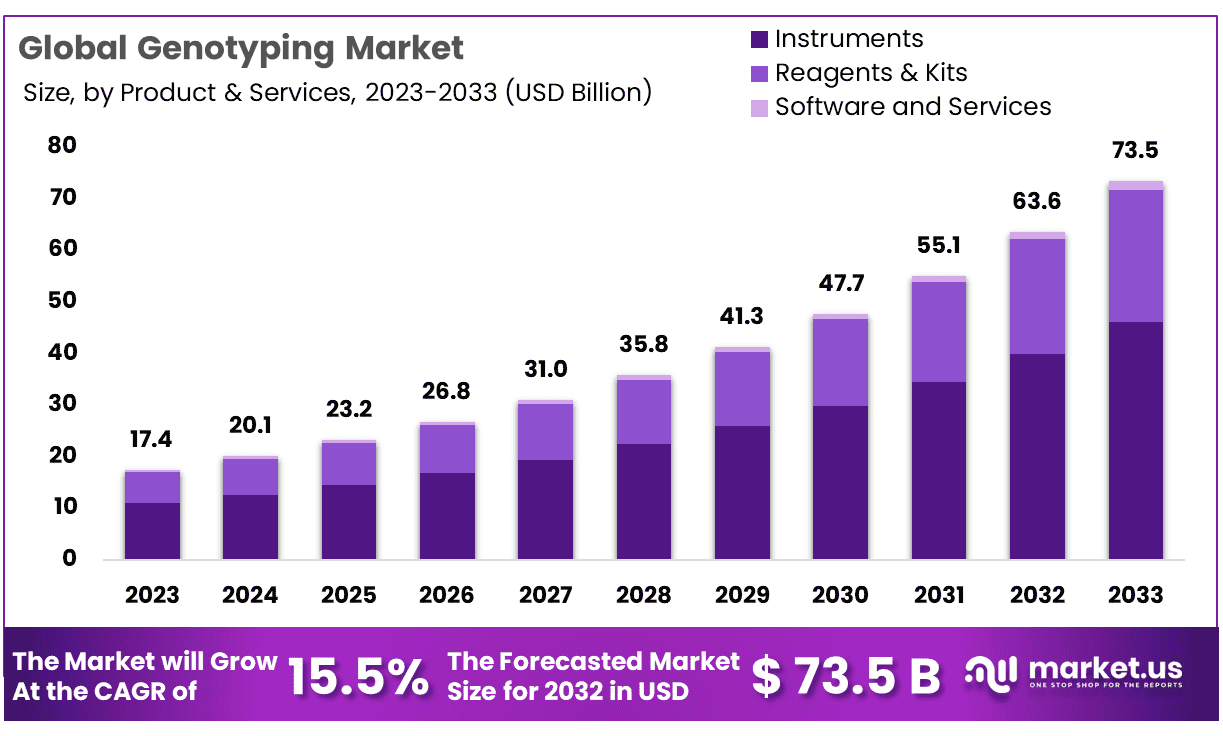

Global Genotyping Market size is expected to be worth around USD 73.5 Billion by 2033 from USD 17.4 Billion in 2023, growing at a CAGR of 15.5% during the forecast period from 2024 to 2033.

Genotyping technology has seen exponential global expansion due to its widespread adoption in drug development, which in turn has been propelled by rising adoption. This growth can be attributed to various factors: firstly, rising prevalence of targeted diseases such as cancer, diabetes and Alzheimer’s has driven significant market expansion; while novel technologies that minimize errors and deliver more efficient results further reinforce market expansion.

Genomics-based techniques like genotyping have become indispensable tools in healthcare settings to facilitate rapid sequencing and early diagnosis of diseases like cancer, diabetes and Alzheimer’s. Healthcare providers increasingly rely on this technique for making informed decisions about potential treatment options which ultimately impacts market dynamics positively.

Market growth for genotyping services has been propelled forward by factors like an increasing elderly population, healthcare expenditure increases and an upsurge in investments, funds and grants; all contributing to an enabling environment for this market segment to flourish.

Key Takeaways

- Market Size & Growth: Genotyping Market size is expected to be worth around USD 73.5 Billion by 2033 from USD 17.4 Billion in 2023, growing at a CAGR of 15.5%.

- Product Analysis: The largest share of 2023 is held by the Reagents & Kits segment is 62.7%.

- Application Analysis: Diagnostics and Personalized Medicine segment accounted for the highest share of 34.8% in 2023.

- Technology Analysis: The segment of sequencing dominated the market in 2023 and had the market dominating with 22%.

- End-Use Analysis: The diagnostics and research laboratories segment had the highest percentage of 37.2% in 2023.

- Regional Analysis: North America accounted for the largest market share of 40.6% in 2023 and holding a USD 7.0 Million value.

Product Analysis

The largest share of 2023 is held by the Reagents & Kits segment is 62.7%. This is due in part to increasing demand for genetic tests, increasing investments in R&D, and increased genotyping test volumes. Due to the increasing adoption of software-based services by academic institutions and research labs, the software & Services segment will also grow. Bioinformatics helps to improve the efficiency of sequencing methods and avoids mistakes that are common in traditional sequencing methods.

Rising R&D expenses, genotyping testing amounts and demand for genetic testing are driving this growth. Furthermore, research labs and universities increasingly utilize software-based solutions as they increase usage; leading to rapid expansion in both services market.

Bioinformatics enhances the efficiency of sequencing methods by reducing errors made through conventional sequencing techniques and increasing their precision. Applications could include applications in areas such as agriculture, animals, human diseases and microorganisms; all factors which are expected to fuel market growth over the forecast timeframe.

Application Analysis

Diagnostics and Personalized Medicine segment accounted for the highest share of 34.8% in 2023. Genotyping is used to identify the most suitable patients for a specific drug by using their genetic makeup.

It helps to identify subsets of people that are responsive and non-responsive. It also helps to reduce trial attrition. In addition, key players are involved in providing solutions for pharmacogenomics.

Thermo Fisher Scientific offers RT-PCR solutions for pharmacogenomic testing. This includes QuantStudio instruments and TaqMan assays. It also includes a PharmacoScan solution, as well as a PharmacoScan Kit.

Due to the increasing adoption of genetic products for research and the growing demand for diagnosis and treatment of genetic diseases, the largest share of the genotyping market is in diagnostics and personalized medicines. The market will grow through strategic collaborations between players.Technology Analysis

The segment of sequencing dominated the market in 2023 and had the market dominating with 22%. It is predicted to expand at a rapid rate over the forecast timeframe due to its increased precision and ability to identify lower expression and differently expressed genes compared with other methods. Genotyping by sequencing is also a way to make comparative analyses across different multiple samples without needing an existing reference genome.

Major factors driving the market growth are the growing demand for advanced diagnostic methods, increasing numbers of CROs and forensic & laboratory laboratories, as well as rising prevalence of chronic diseases and genetic disorders.

The increased specificity of sequencing and its ability to detect the low expression and differentially expressed genes is expected to drive the industry forward. Genotyping through sequencing can also be used to perform comparative analyses across samples without the use of a reference gene.

End Use Analysis

The diagnostics and research laboratories segment had the highest percentage of 37.2% in 2023, due to the growing use of products that genotype for research as well as the growing demand for the diagnosis of genetic diseases and cancer. Additionally, the increasing incidence of cancer also boosts the need for tests to diagnose cancer, for example, cancer genotyping assays and is predicted to propel the market.

Market growth is expected to be driven by the rising prevalence of cancer. Market growth will be driven by the increasing demand for pharmacogenomics in drug development and FDA recommendations to include genotyping and pharmacogenomics studies in drug discovery.

To develop new drugs, pharmacogenomics is actively used by companies. Pfizer has launched a genotyping-based trial to evaluate the effectiveness of Talazoparib for patients with metastatic BRCA mutant-resistant breast cancer. The increasing number of clinical studies based on Pharmacogenomics will drive segment growth.

Key Market Segments

Product & Services

Instruments

- Sequencers & Amplifiers

- Analyzers

Reagents & Kits

Software and Services

Technology

- PCR

- Capillary Electrophoresis

- Microarrays

- Sequencing

- Mass Spectrometry

- Other Technologies

Application

- Pharmacogenomics

- Diagnostics and Personalized Medicine

- Agricultural Biotechnology

- Animal Genetics

- Other Applications

End-User

- Pharmaceutical and Biopharmaceutical Companies

- Diagnostics and Research Laboratories

- Academic Institutes

- Other End-Users

Drivers

Increase in Demand for Customized Medicine And Advances in Genomic Research

One key force driving the genotyping market forward is increasing demand for personalized medicine. Thanks to advancements in genomic research, genetic variations can now be more accurately studied by healthcare practitioners; providing opportunities for tailoring medical therapies according to each person’s genetic makeup and needs.

Genotyping plays an essential role in identifying specific genetic markers linked to diseases, enabling healthcare providers to prescribe targeted and more efficacious medication regimens. As healthcare moves toward precision medicine, genotyping techniques have gained greater acceptance both research and clinical settings.

Growing Incidence of Genetic Disorders

Genotyping market growth is being propelled by an increasing incidence of genetic disorders like cancer, diabetes and rare genetic conditions that require genome testing for diagnosis. Genotyping allows physicians to quickly and accurately identify genetic mutations or variations that contribute to these disorders’ progression.

As our understanding of genetic causes of diseases increases, emphasis has increased on early diagnosis and intervention. Genotyping allows healthcare professionals to assess individual’s genetic risk factors for disease early, leading to proactive measures and customized treatment plans for each person.

Trend

Increased Consumer Interest in Personal Genetics

One notable trend in the genotyping market is the rise of direct-to-consumer (DTC) genetic testing. Consumers are becoming more interested in exploring their genetic makeup to gain insight into ancestry, health conditions, traits and predispositions.

DTC genetic testing companies leverage genotyping technology to provide individuals with easily accessible yet cost effective genetic information – this trend demonstrates increased public understanding and adoption of genomic medicine while shifting toward taking proactive approaches towards personal healthcare.

Integrating Digital Health Platforms

Genotyping data integration into digital health platforms has emerged as a dominant trend within the market. DTC genetic testing companies and healthcare providers alike are offering genotyping tests on digital platforms, so individuals can easily access and manage their genetic information.

This integration not only enhances user experience but also opens doors for data-driven healthcare services; genotyping data can be leveraged for personalized wellness recommendations, lifestyle modifications and disease prevention strategies.

Restraints

Privacy Concerns and Data Security Risks

One significant hindrance of the genotyping market resides in concerns for data privacy and security. Since genotyping involves collecting sensitive genetic information for analysis, individuals and regulatory bodies express concerns over potential misuse or unwarranted access.

Recent instances of data breaches within the healthcare industry have raised awareness regarding the significance of robust security measures, especially as perception of potential risks may discourage individuals from opting for genotyping services and thus restrict market expansion.

Limited Affordability and Accessibility

Gene genotyping services remain limited in accessibility and affordability across a number of geographic and demographic groups, particularly certain regions or demographic groups with high costs associated with advanced genotyping technologies or no reimbursement options available, thus restricting widespread adoption limiting its benefits across society as a whole.

Therefore efforts such as cost reduction strategies, collaborations or advocating for insurance coverage to overcome accessibility and affordability barriers is imperative to increase adoption rates of genotyping technology among wider population.

Opportunity

Agrigenomics and Precision Agriculture

An emerging opportunity in the genotyping market lies with agriculture applications of genotyping technologies known as Agrigenomics. Genotyping technologies are becoming more commonly employed for precision agriculture applications that leverage genetic characterization of crops and livestock for enhanced yield, quality, resistance to diseases and reduced costs using genotyping data – offering significant growth prospects within agriculture’s sector as adoption grows of genotyping data for sustainable and efficient farming practices.

Partnership Between Genomics and Agriculture

Collaborations between genomics companies and agriculture increases market expansion opportunities exponentially. Partnerships and research initiatives to tailor genotyping solutions specifically tailored for agriculture create synergies that benefit both industries. Genotyping helps identify desirable traits faster through breeding programs while contributing to genetically improved crops that increase food production to meet global food shortages.

Regional Analysis

North America accounted for the largest market share of 40.6% in 2023 and holding a USD 7.0 Million value for the Genotyping Market. This is due to the growing adoption of advanced products, major pharmaceutical & biologic companies, proactive government initiatives, and advancements in healthcare infrastructure.

High market share can also be attributed to the presence of large players in this region. Europe is expected to experience a rapid CAGR over the forecast period. Many factors are responsible for the enormous untapped potential of Europe, such as technological advancements in the region and the expanding pharma/biopharma sector.

The Asia Pacific is expected to have the best opportunities. Additionally, there are more clinical trials being performed in this region.

Кеу Regions and Countries

- North America

- The US

- Canada

- Mexico

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Companies

Genotyping market competition requires detailed examination of each player involved. Our investigations include in-depth investigations of every competitor – their company background, financial status, revenue generation, market potential investments in R&D as well as new market initiatives being pursued, global footprint footprint production sites facilities capacities as well as assessments of strengths and weaknesses for every entity in play.

Some of the major players operating in the genotyping market are:

Key Market Players

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Eurofins Scientific Inc.

- Bio-Rad Laboratories Inc.

- Promega Corporation

- CD Genomics

- Synbio Technologies

Recent Development

- January 2023 – Illumina, Inc. has recently introduced their NovaSeq X Plus sequencer which offers a 20% increase in capacity over its predecessor – providing it with the ideal tool to tackle large-scale genotyping projects.

- February 2023 – Thermo Fisher Scientific, Inc. recently unveiled their Ion Torrent Genexus Sequencer, an advanced next-generation sequencer intended for clinical research and diagnostic applications. Designed specifically to increase sequencing speed while decreasing sequencing costs, the new model features many advantages over previous Ion Torrent sequencers such as faster sequencing speed and reduced sequencing costs.

- April 2023 – 10x Genomics, Inc. today unveiled the Chromium X system for single cell RNA sequencing, designed to give researchers a more holistic picture of gene expression. Capable of sequencing up to 100,000 cells at one time, the Chromium X can deliver comprehensive gene expression data analysis.

Report Scope

Report Features Description Market Value (2023) USD 17.4 Billion Forecast Revenue (2033) USD 73.5 Billion CAGR (2024-2033) 15.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product & Services, Instruments(Sequencers & Amplifiers, Analyzers),Reagents & Kits, Software and Services, Technology-(PCR, Capillary Electrophoresis, Microarrays, Other Technologies) Application-(Pharmacogenomics, Diagnostics and Personalized Medicine, Agricultural Biotechnology, Other Applications) End-User-(Pharmaceutical and Biopharmaceutical Companies, Diagnostics and Research Laboratories, Academic Institutes, Other End-Users) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN, F. Hoffmann-La Roche Ltd., Fluidigm Corporation, Eurofins Scientific Inc., Bio-Rad Laboratories Inc., Promega Corporation, CD Genomics, Synbio Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Fluidigm Corporation

- Eurofins Scientific Inc.

- Bio-Rad Laboratories Inc.

- Promega Corporation

- CD Genomics

- Synbio Technologies