Genomic Biomarkers Market By Type (Predictive Biomarkers and Prognostic Biomarkers), By Disease Indication (Oncology, Neurological Diseases, Renal Disorders, Cardiovascular Diseases, and Other Disease Indications) By End-User (Hospitals, Diagnostic, Research Laboratories, and, Other End-Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124487

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Type Analysis

- Disease Indication Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Market Share and Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Genomic Biomarkers Market size is expected to be worth around USD 17 Billion by 2033, from USD 7.1 Billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

The Genomic Biomarkers Market is a dynamic sector within the broader landscape of healthcare and biotechnology, characterized by its profound impact on diagnostics, personalized medicine, and disease management. Genomic biomarkers, comprised of genetic material such as DNA or RNA, serve as crucial indicators of biological processes, disease states, and treatment responses.

This market segment is experiencing robust growth, driven by advancements in genomic technologies, increased understanding of molecular mechanisms underlying diseases, and rising demand for precision medicine solutions. Key factors propelling market expansion include the growing prevalence of chronic diseases, escalating healthcare expenditure, and the shift towards value-based healthcare models emphasizing personalized treatment approaches.

Moreover, collaborative efforts between academia, pharmaceutical companies, and diagnostic firms are fueling innovation and accelerating the development of novel genomic biomarkers for various therapeutic areas, including oncology, cardiovascular diseases, neurology, and infectious diseases.

Key Takeaways:

- In 2023, the market for genomic biomarkers generated a revenue of USD 7.1 billion, with a CAGR of 9.1%, and is expected to reach USD 17.0 billion by the year 2033.

- The type segment is divided into Predictive Biomarkers and Prognostic Biomarkers, with Prognostic Biomarkers taking the lead in 2023 with a market share of 54.2%.

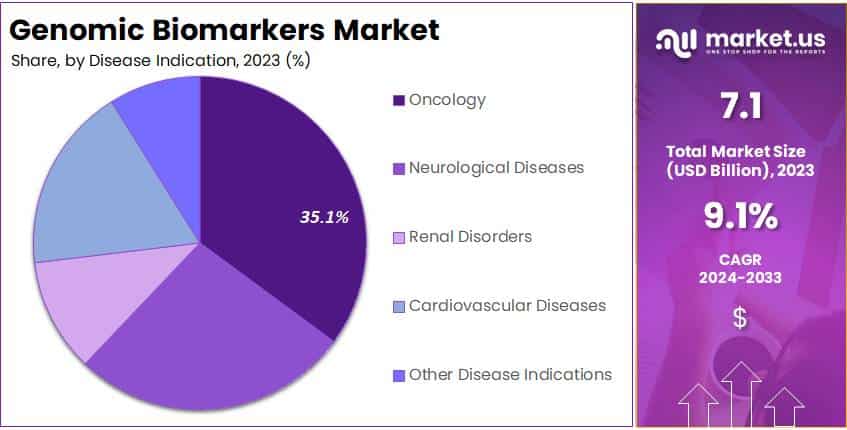

- Considering Disease Indication, the market is divided into Oncology, Neurological Diseases, Renal Disorders, Cardiovascular Diseases, and Other Disease Indications. Among these, Oncology held the significant share of 35.1%

- Furthermore, concerning End-User segmentation, the market is divided into hospitals, diagnostic, research laboratories, and other end-users. Among these, the hospitals sector stands out as the dominant player, holding the largest revenue share of 33.2% in the genomic biomarkers market.

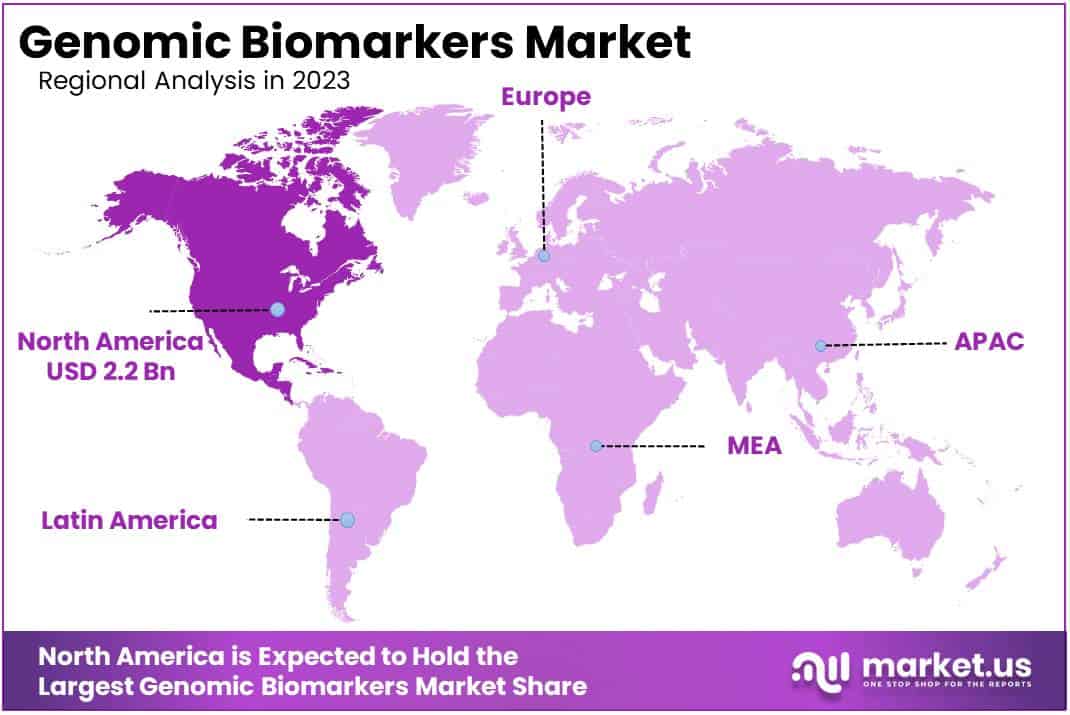

- North America led the market by securing a market share of 42% in 2023.

Type Analysis

In 2023, predictive biomarkers asserted their dominance, capturing the majority market share of 54.2%. As the demand for personalized medicine continues to escalate, fueled by advancements in genomics, bioinformatics, and artificial intelligence, predictive biomarkers are poised to play an increasingly pivotal role in clinical practice. Their ability to pre-emptively identify individuals at heightened risk of disease progression or treatment resistance empowers clinicians to intervene proactively, thereby mitigating disease burden and improving patient outcomes.

Furthermore, the adoption of predictive biomarkers in drug development pipelines facilitates more efficient clinical trials, enabling pharmaceutical companies to select patient populations most likely to benefit from novel therapeutics and expedite the drug approval process.

Disease Indication Analysis

In terms of disease indication, oncology emerged as the dominant segment, holding a significant share of 35.1% of the market. Genomic biomarkers play a pivotal role in oncology by offering insights into tumor biology, prognosis, treatment response, and drug resistance mechanisms. Through the analysis of genetic mutations, gene expression patterns, and molecular signatures, oncologists can stratify patients based on their individual tumor profiles, guiding treatment decisions towards the most effective therapies and clinical trial participation.

Moreover, the advent of targeted therapies and immunotherapies has further fueled the demand for oncology biomarkers, as these innovative treatments rely on identifying specific molecular targets or immune biomarkers for optimal patient selection. As cancer continues to pose a formidable challenge to global healthcare systems, the Oncology segment of the genomic biomarkers market is expected to maintain its dominance, driven by ongoing research efforts, technological advancements, and the imperative to improve outcomes for cancer patients worldwide.

End-User Analysis

The hospitals sector held the largest revenue share, accounting for 33.2% of the market. This prominence is reflective of hospitals’ central role in patient care, diagnosis, and treatment across a wide range of medical specialties, including oncology, cardiology, neurology, and more. Hospitals serve as hubs for comprehensive healthcare services, where patients undergo diagnostic tests, receive treatment, and participate in clinical trials.

In the context of genomic biomarkers, hospitals leverage these advanced diagnostic tools to inform treatment decisions, monitor disease progression, and tailor therapies according to individual patient profiles. Additionally, the integration of genomic testing into routine clinical practice within hospital settings facilitates seamless coordination among multidisciplinary healthcare teams, including oncologists, pathologists, genetic counselors, and primary care physicians.

Key Market Segments

By Type

- Predictive Biomarkers

- Prognostic Biomarkers

By Disease Indication

- Oncology

- Neurological Diseases

- Renal Disorders

- Cardiovascular Diseases

- Other Disease Indications

By End-User

- Hospitals

- Diagnostic

- Research Laboratories

- Other End-Users

Drivers

Growing Prevalence of Chronic Diseases

The use of genomic biomarkers in personalized medicine, particularly in oncology, represents a significant shift toward individualized treatment strategies. In 2023, personalized medicines constituted over 25% of new drug approvals, underscoring the growing reliance on genetic profiles to enhance treatment efficacy and minimize adverse effects. Biomarkers are pivotal in oncology due to the genetic diversity within tumors, enabling tailored therapies that improve clinical outcomes and quality of life for patients.

For instance, the FDA-approved FoundationOne CDx test, which assesses genomic alterations in 324 genes, exemplifies this trend. It supports the selection of targeted therapies and immunotherapies based on specific genetic markers such as microsatellite instability (MSI) and tumor mutational burden. This comprehensive profiling facilitates the matching of approximately one in three cancer patients with effective FDA-approved treatments.

The rapid advancement in biomarker research and technology, including high-throughput sequencing and liquid biopsy, has greatly expanded our ability to identify and utilize these biomarkers. These developments are not only refining our understanding of cancer but also enhancing the precision of treatments offered to patients, thereby optimizing healthcare resources by reducing unnecessary treatments.

Restraints

High Cost of Genomic Testing

The cost of genomic testing, which includes whole genome sequencing (WGS) and whole exome sequencing (WES), varies significantly depending on the complexity and specificity of the test. For instance, targeted gene testing, which is often used for identifying specific hereditary cancer risks, ranges from $100 to $500. More comprehensive tests like WES and WGS can cost between $500 to over $5,000. Despite the potential health benefits, these costs pose a barrier, particularly in settings with limited healthcare budgets.

Coverage for these tests by insurance varies widely. In some cases, such as in the US, over 63% of individuals with insurance have some level of coverage for WES/WGS, but this is not universal and depends heavily on the insurance provider and the specific test being administered. Often, direct-to-consumer genetic tests, which can be purchased without a healthcare provider’s referral, are not covered by insurance. These tests range in price from under a hundred to thousands of dollars, and while they may offer insights into one’s genetic predisposition to various conditions, they lack comprehensive diagnostic capability.

This high cost and variable insurance coverage highlight a significant accessibility challenge in integrating genomic testing into standard healthcare, particularly in resource-constrained settings. Such challenges necessitate the development of more affordable genomic testing options and supportive policies to enhance access to these pivotal healthcare innovations.

Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into genomic data analysis is revolutionizing precision medicine, significantly enhancing the ability to discover and interpret biomarkers and support clinical decisions. AI and ML can process vast genomic datasets, identifying complex patterns and associations that may be invisible to human analysts, with notable speed, accuracy, and scalability.

A major advantage of AI and ML in this field is their capacity to continually learn and improve. For instance, machine learning techniques applied to blood markers in ovarian cancer patients have identified specific subgroups with poorer prognoses, informing targeted treatment development. Additionally, AI algorithms like Logistic Regression and Random Forest are utilized in healthcare for diverse applications ranging from predicting patient outcomes in intensive care units to diagnosing Alzheimer’s disease.

Such AI-driven approaches are also pivotal in areas like drug discovery and the development of personalized treatments. AI helps predict drug efficacy and optimize drug design by analyzing complex data from sources like chemical informatics and spatial transcriptomics, which maps disease pathology at the molecular level.

By leveraging AI and ML, researchers and healthcare professionals are able to unlock new possibilities for personalized patient care, making precision medicine more efficient and comprehensive. These technologies not only facilitate the analysis of genetic data but also integrate clinical, molecular, and lifestyle factors, thereby enhancing the accuracy of medical predictions and interventions.

Impact of Macroeconomic / Geopolitical Factors

The impact of macroeconomic factors on the genomic biomarkers market is significant, affecting demand, supply, investment, and regulatory landscapes. Economic growth, inflation, currency stability, and government spending shape the healthcare sector, influencing this market. During economic booms, increased healthcare spending and research funding boost innovation and market growth.

However, recessions can lead to budget cuts, impacting research investment and slowing market progress. Furthermore, currency volatility affects the cost and competitiveness of imported genomic technologies. Changes in healthcare policies, reimbursement plans, and regulatory frameworks, driven by economic conditions, also alter market access, pricing, and adoption rates of genomic biomarkers.

Latest Trends

Focus on Rare Diseases and Orphan Disease Indications

The pursuit of understanding and treating rare diseases has greatly benefited from advancements in genomic biomarkers, vital for personalized therapies. Globally, over 300 million people are affected by rare diseases, presenting unique challenges due to the limited availability of treatments and the small size of patient populations.

Genomic technologies, such as next-generation sequencing (NGS), have transformed the landscape by enabling precise diagnosis and the identification of specific genetic mutations responsible for these conditions. Recent studies highlight the effectiveness of using genomic biomarkers for patient stratification and identifying therapeutic targets, enhancing the precision of treatments tailored to individual genetic profiles.

Furthermore, the integration of multi-omic approaches, combining various types of data (genomic, transcriptomic, proteomic), has enriched our understanding of the pathophysiology of rare diseases and bolstered drug development, steering towards more informed and effective therapeutic interventions.

Despite these advances, the journey is ongoing, with a significant portion of rare diseases still lacking comprehensive diagnostic and treatment options. Continued collaborative efforts among researchers, healthcare providers, and policymakers are essential to address these gaps and improve outcomes for patients with rare diseases.

Regional Analysis

North America is leading the Genomic Biomarkers Market

North America dominated the market with the highest revenue share of 32%. The region’s leadership in the Genomic Biomarkers Market reflects its advanced healthcare infrastructure, robust research and development activities, and high adoption rates of genomic technologies. The region benefits from significant investments in biotechnology, pharmaceuticals, and academic research, fostering innovation and driving market growth.

Moreover, favorable regulatory policies, strong intellectual property protections, and a well-established reimbursement framework contribute to North America’s market dominance. The presence of key market players, research institutions, and healthcare facilities further accelerates the adoption of genomic biomarkers in clinical practice and drug development, solidifying North America’s position as a key market leader.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific region is poised to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by several factors. Rapid economic growth, expanding healthcare infrastructure, and increasing investments in precision medicine initiatives propel market expansion in the region.

Additionally, growing awareness of personalized medicine, rising healthcare spending, and a shift towards value-based care models drive demand for genomic biomarkers. Furthermore, the Asia Pacific region benefits from a large population base, genetic diversity, and a high prevalence of chronic diseases, offering significant opportunities for biomarker-driven diagnostics and therapies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

The Genomic Biomarkers Market features a varied mix of participants, including biotech companies, pharmaceutical enterprises, diagnostic labs, academic centers, and tech providers. These entities compete in areas such as technology innovation, product uniqueness, market presence, and strategic alliances to secure a competitive advantage and increase market share.

Significant investment in research and development is common among key market players, aiming to create new genomic biomarkers, advanced diagnostic tools, and specialized treatments for distinct patient groups. Furthermore, collaborations between industry players, educational institutions, and healthcare providers are prevalent, enhancing knowledge sharing, resource pooling, and expansion opportunities in the market.

Top Key Players in Genomic Biomarkers Market

- Bio-Rad Laboratories

- Almac Group

- Eurofins Scientific

- Cancer Genetics Inc

- Thermo Fisher Scientific Inc

- Epigenomics AG

- US Biomarkers Inc.

- Myriad Genetics

- Aepodia SA

- Roche Diagnostics

- Other Key Players

Recent Developments

- In August 2023, Bio-Rad Laboratories, Inc., a global leader in life science and clinical diagnostics, acquired a Curiosity Diagnostics, Sp. Z. o. o. from Scope Fluidics, S.A. for a total consideration of up to $170 million, with approximately $100 million in cash and potential future milestone payments of up to $70 million.

- In August 2022, Japan’s Ministry of Health, Labour and Welfare (MHLW) has expanded coverage for Myriad Genetics, Inc.’s BRACAnalysis® Diagnostic System. This approval allows it to serve as a companion diagnostic for identifying patients with germline BRCA mutations and HER2-negative high-risk recurrent breast cancer who may benefit from Lynparza®.

Report Scope

Report Features Description Market Value (2023) USD 7.1 billion Forecast Revenue (2033) USD 17.0 billion CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type- Predictive Biomarkers and Prognostic Biomarkers; By Disease Indication-Oncology, Neurological Diseases, Renal Disorders, Cardiovascular Diseases, and Other Disease Indications; By End-User- Hospitals, Diagnostic, Research Laboratories, and, Other End-Users. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio-Rad Laboratories, Almac Group, Eurofins Scientific, Cancer Genetics Inc., Thermo Fisher Scientific Inc., Epigenomics AG, US Biomarkers Inc., Myriad Genetics, Aepodia SA, Roche Diagnostics, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Genomic Biomarkers market in 2023?The Genomic Biomarkers market size is USD 7.1 Billion in 2023.

What is the projected CAGR at which the Genomic Biomarkers market is expected to grow at?The Genomic Biomarkers market is expected to grow at a CAGR of 9.1% (2024-2033).

List the segments encompassed in this report on the Genomic Biomarkers market?Market.US has segmented the Genomic Biomarkers market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Predictive Biomarkers and Prognostic Biomarkers. By Disease Indication the market has been segmented into Oncology, Neurological Diseases, Renal Disorders, Cardiovascular Diseases, and Other Disease Indications. By End-User the market has been segmented into Hospitals, Diagnostic, Research Laboratories, and, Other End-Users.

List the key industry players of the Genomic Biomarkers market?Bio-Rad Laboratories, Almac Group, Eurofins Scientific, Cancer Genetics Inc, Thermo Fisher Scientific Inc, Epigenomics AG, US Biomarkers Inc., Myriad Genetics, Aepodia SA, Roche Diagnostics, Other Key Players

Which region is more appealing for vendors employed in the Genomic Biomarkers market?North America is expected to account for the highest revenue share with 32%, and boasting an impressive market value of USD 2.2 Billion. Therefore, the Genomic Biomarkers industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Genomic Biomarkers?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Genomic Biomarkers Market.

-

-

- Bio-Rad Laboratories

- Almac Group

- Eurofins Scientific

- Cancer Genetics Inc

- Thermo Fisher Scientific Inc

- Epigenomics AG

- US Biomarkers Inc.

- Myriad Genetics

- Aepodia SA

- Roche Diagnostics

- Other Key Players