Genetic Testing Market By Product (Consumables, Software & Services and Equipment), By Technology (Next Generation Sequencing, Array Technology, PCR-based Testing, FISH, Microarray and Others), By Test Type (Diagnostic Testing, Predictive & Pre-symptomatic Testing, Carrier Testing, Prenatal & Newborn Testing and Pharmacogenomic Testing), By Application (Oncology, Neurology, Cardiology, Rare Diseases, Reproductive Healthn and Others), By End User (Hospitals & Clinics, Diagnostic Laboratories, Academic & Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 102212

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

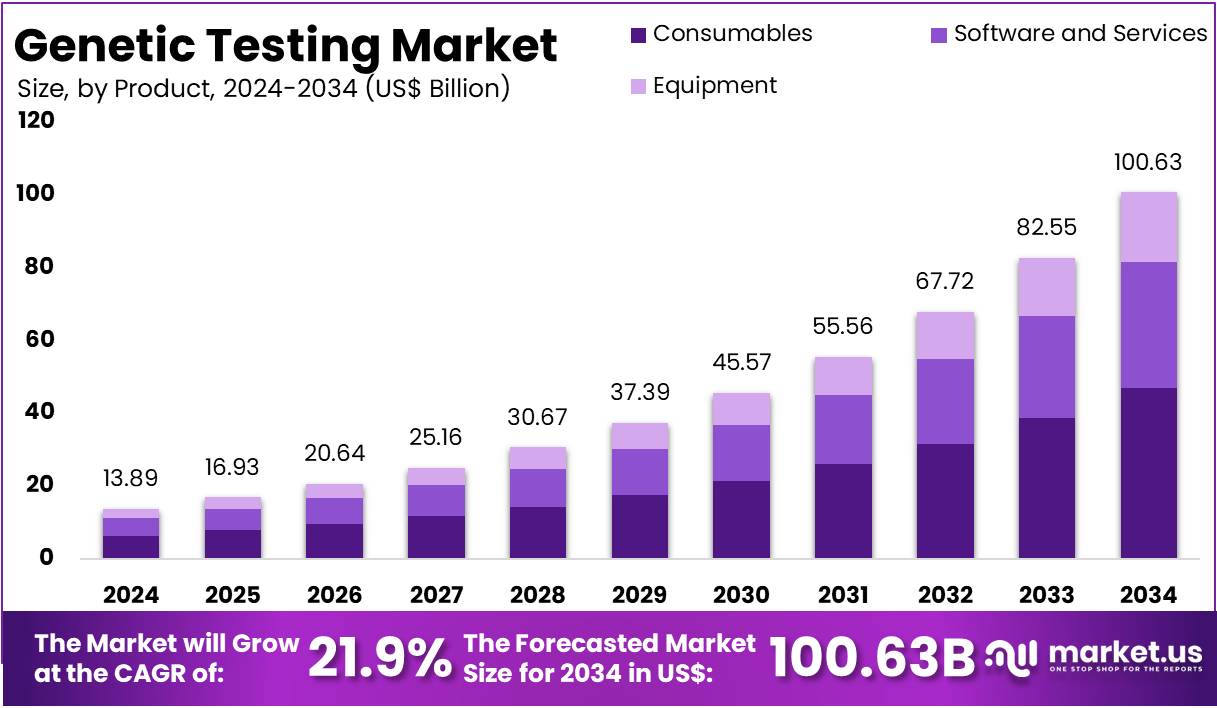

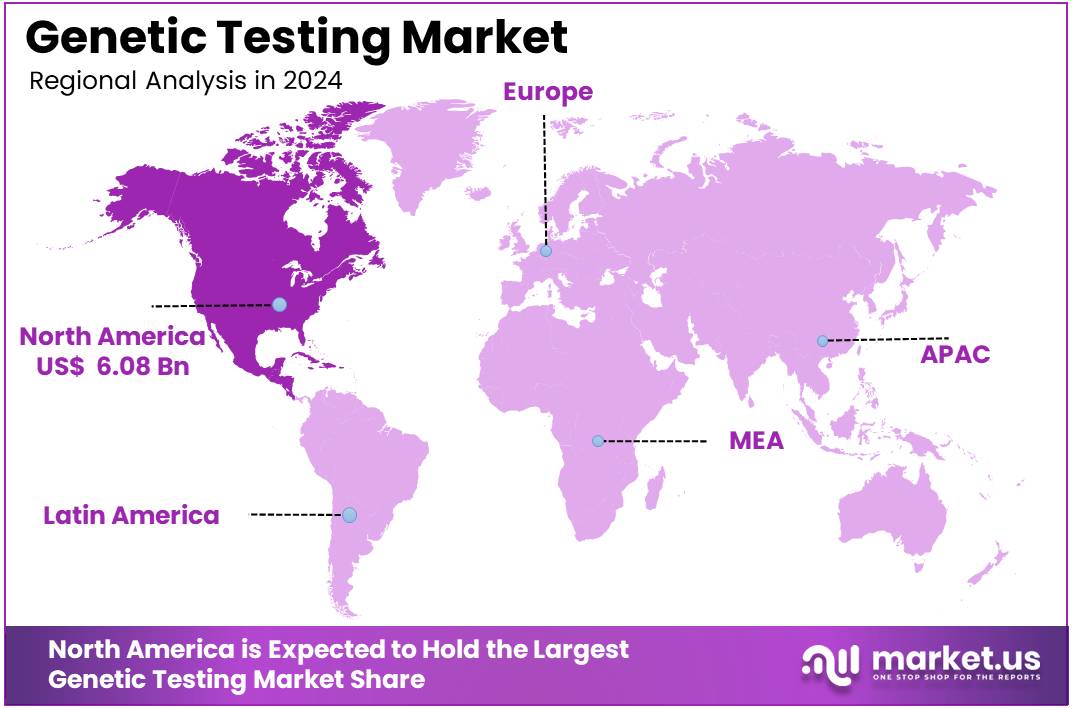

The Genetic Testing Market size is expected to be worth around US$ 100.63 billion by 2034 from US$ 13.89 billion in 2024, growing at a CAGR of 21.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.8% share and holds US$ 6.08 Billion market value for the year.

Genetic testing involves analyzing a person’s blood or other tissues to detect any alterations in their genetic material. This type of testing can help determine whether an individual has a genetic condition or is at risk of developing one in the future. The results from genetic testing can be valuable in various ways, including diagnosing genetic disorders, starting appropriate treatments, implementing preventive measures, and even influencing personal life choices such as career decisions and family planning.

The genetic testing market has experienced significant growth due to advancements in genomics and biotechnology, providing a deeper understanding of genetic makeup and its impact on health. Genetic tests are widely used in clinical diagnostics, personalized medicine, and ancestry research. With technologies like Next-Generation Sequencing (NGS), the cost of genetic testing has decreased, making it more accessible to both healthcare providers and consumers.

In March 2023, Illumina Inc., recognized as a global leader in DNA sequencing and array-based technologies, expanded its strategic partnership with Myriad Genetics Inc., a leading company in genetic testing and precision medicine. The collaboration aims to enhance access to oncology homologous recombination deficiency (HRD) testing across the United States. Under this agreement, the Illumina TruSight™ Oncology 500 HRD (TSO 500 HRD) — a research-use-only test — became available in the U.S.

Key applications include early disease detection, cancer genomics, genetic screening, and pharmacogenomics for personalized drug treatments. Direct-to-consumer genetic testing, led by companies like 23andMe and AncestryDNA, has further expanded the market by offering accessible health and ancestry insights.

In May 2025, Gene Solutions, a prominent provider of prenatal and oncology genetic testing, entered into a strategic partnership with NEWCL Biomedical Laboratory, Taiwan’s first clinical laboratory to hold Laboratory Developed Tests (LDTs) certification. This collaboration aims to establish a state-of-the-art Next-Generation Sequencing (NGS) laboratory in Taiwan. The agreement was formalized through the signing of a Memorandum of Understanding (MoU) at NEWCL’s advanced facility in New Taipei City.

However, ethical concerns around privacy, data security, and genetic discrimination remain challenges. Despite this, the increasing adoption of genetic testing across healthcare, research, and wellness sectors presents strong growth opportunities, with the market expected to continue expanding in the coming years.

Key Takeaways

- In 2024, the market for Genetic Testing generated a revenue of US$ 13.89 billion, with a CAGR of 21.9%, and is expected to reach US$ 100.63 billion by the year 2034.

- The Product segment is divided into Consumables, Software and Services, and Equipment with Consumables taking the lead in 2024 with a market share of 46.8%.

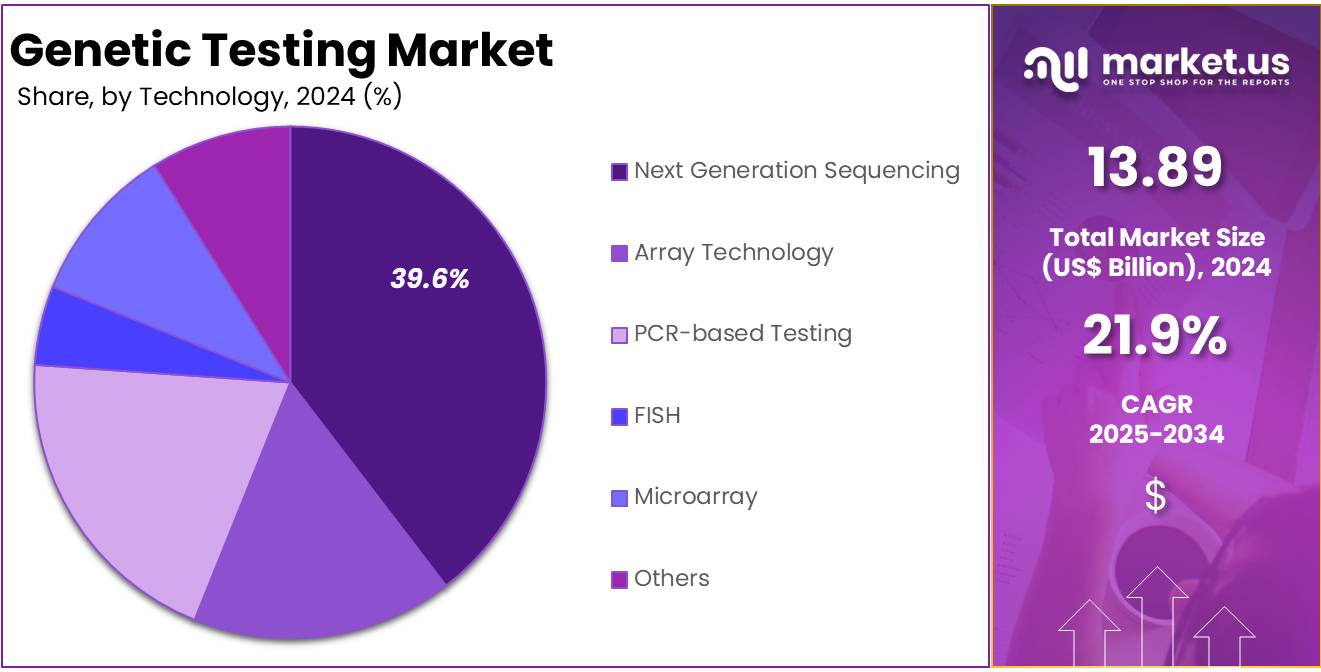

- By Technology, the market is bifurcated into Next Generation Sequencing, Array Technology, PCR-based Testing, FISH, Microarray, and Others, with Next Generation Sequencing leading the market with 39.6% of market share in 2024.

- Considering the Test Type segment, the market is bifurcated into Diagnostic Testing, Predictive & Pre-symptomatic Testing, Carrier Testing, Prenatal & Newborn Testing, and Pharmacogenomic Testing, with Diagnostic Testing taking the lead in 2024 with 59.7% market share.

- By Application, the market is classified into Oncology, Neurology, Cardiology, Rare Diseases, Reproductive Health, and Others with Oncology taking the lead in 2024 with 36.8% market share.

- With respect to End User segment, the market is bifurcated into Hospitals & Clinics Diagnostic Laboratories, Academic & Research Institutes, and Others with Hospitals & Clinics dominating the market with 43.9% market share.

- North America led the market by securing a market share of 43.8% in 2024.

Product Analysis

Consumables dominated the product segment with 46.8% market share. Consumables, including reagents, test kits, and other single-use items, are integral to the entire genetic testing process. They are essential for laboratory operations, from sample collection to analysis, and are required for each individual test, making them a consistent revenue driver. With the growth of genetic testing technologies such as Next-Generation Sequencing (NGS), the demand for consumables has surged, as these technologies require a wide range of reagents and kits for various applications.

Companies like Illumina, Thermo Fisher, and Roche offer consumables that facilitate genetic testing for clinical diagnostics, research, and personalized medicine. Consumables are a high-margin segment, as they often need to be replenished after every test, ensuring a recurring revenue stream for manufacturers. Furthermore, as genetic testing expands to include at-home kits for direct-to-consumer testing, the demand for consumable products is set to rise, contributing significantly to the segment’s market dominance.

In August 2020, Illumina, Inc. introduced the NovaSeq™ 6000 v1.5 Reagent Kit, designed to empower researchers with the ability to make groundbreaking discoveries. These new reagent kits aim to make whole genome sequencing more accessible and cost-effective for labs of all sizes, offering the US$600 genome. By addressing key customer demands and providing a more affordable price per sample across various applications, the kits bring data-rich solutions—such as single-cell genomics, whole genome sequencing, and liquid biopsy—within reach, enabling researchers to explore genetic variation and tackle their most pressing biological questions.

Technology Analysis

Next Generation Sequencing (NGS) is the dominant technology in the genetic testing market which accounted for 39.6% market share due to its high throughput, accuracy, and cost-effectiveness. NGS allows for rapid sequencing of DNA and RNA, enabling the detection of genetic mutations, variations, and disease-associated genes. Unlike traditional methods, NGS can sequence entire genomes or targeted regions, providing comprehensive insights into genetic disorders and conditions. It has transformed areas like oncology, rare diseases, and prenatal testing by offering faster and more detailed results.

Companies like Illumina and Thermo Fisher lead in NGS technologies, making it the preferred choice for researchers, clinicians, and diagnostic labs. The reduction in sequencing costs and improvement in accuracy have made NGS widely accessible, further driving its adoption.

In June 2025, bioMérieux, a global leader in in vitro diagnostics, announced an agreement to acquire the assets of Day Zero Diagnostics, a US-based company specializing in infectious disease diagnostics using genome sequencing and machine learning to address the growing threat of antibiotic-resistant infections. This strategic acquisition is set to strengthen bioMérieux’s expertise in next-generation sequencing (NGS) and rapid diagnostics, reinforcing its commitment to advancing healthcare and promoting Antimicrobial Stewardship through innovative solutions.

Test Type Analysis

Diagnostic testing holds the largest share of 59.7% within the genetic testing market due to its critical role in detecting genetic disorders and diseases. It involves identifying genetic mutations associated with specific conditions, such as cancer, cardiovascular diseases, and neurological disorders. Diagnostic genetic tests are essential for confirming the presence of genetic conditions and guiding treatment decisions. The growing prevalence of genetic disorders and the increasing focus on early disease detection have driven the demand for diagnostic testing.

Technologies like NGS and PCR-based testing are widely used for diagnostic purposes, enabling healthcare providers to detect mutations in genes that may cause diseases like cystic fibrosis, Huntington’s disease, and various forms of cancer. As awareness about genetic disorders grows, along with the increasing availability of affordable and accurate testing, the diagnostic testing segment continues to expand.

In June 2025, Myriad Genetics, Inc., a leader in molecular diagnostic testing and precision medicine, announced early access to the FirstGene™ Multiple Prenatal Screen. The company will initiate a large-scale study that will provide simultaneous reports to patients while gathering clinical validity and utility evidence for this groundbreaking new offering.

Application Analysis

Oncology is the leading application in the genetic testing market with 36.8% market share, driven by the increasing use of genetic testing in cancer detection, treatment, and prevention. Genetic tests are used to identify mutations in cancer-related genes, enabling personalized treatment plans tailored to the genetic profile of both the patient and the tumor.

Techniques like NGS and PCR are widely used in oncology for cancer genomics, helping identify mutations that influence prognosis and treatment responses. The growing emphasis on personalized cancer therapies, such as targeted therapies and immunotherapies, further propels the adoption of genetic testing in oncology.

For example, genetic tests can help oncologists identify mutations in the BRCA1/BRCA2 genes in breast cancer patients, determining their eligibility for specific treatments or preventive measures. As cancer continues to be a leading cause of death globally, the demand for genetic testing in oncology is expected to increase, making it a dominant application.

In May 2025, Guardant Health, Inc., a leading precision oncology company, has announced the launch of the Guardant Hereditary Cancer test, a germline test designed to identify genetic variants linked to cancer risk. This test aims to assist cancer care teams in providing optimal patient care. Germline genetic testing is recommended by medical guidelines for patients diagnosed with cancer, as it enables genetically targeted treatments and helps identify relatives who could benefit from personalized cancer screening and prevention strategies.

End User Analysis

Hospitals and clinics are the dominant end-user segment in the genetic testing market with 43.9% market share, primarily due to their direct involvement in diagnosing and treating patients. Hospitals and clinics utilize genetic testing for a wide range of clinical applications, from prenatal screening to cancer diagnosis and personalized medicine. As genetic testing becomes integral to routine healthcare, hospitals and clinics are the primary providers of these services, offering genetic tests as part of diagnostic procedures.

Additionally, the increasing prevalence of genetic disorders and the demand for personalized treatments have prompted hospitals to invest in genetic testing services. Hospitals benefit from genetic testing by enabling more accurate diagnoses, identifying patients’ genetic predispositions to diseases, and tailoring treatments accordingly.

For instance, hospitals use genetic tests to assess cancer risks, determine drug responses, and screen for genetic diseases in newborns. In June 2020, Apollo Clinic partnered with MapmyGenome® to introduce genomics-based healthcare at its centers in India. The collaboration launched Genomepatri™, a comprehensive health test offering over 100 reports on lifestyle diseases, physiological traits, drug responses, and carrier status, designed to provide individuals with a detailed understanding of their genetic makeup and health risks.

Key Market Segments

By Product

- Consumables

- Software and Services

- Equipment

By Technology

- Next Generation Sequencing

- Array Technology

- PCR-based Testing

- FISH

- Microarray

- Others

By Test Type

- Diagnostic Testing

- Predictive & Pre-symptomatic Testing

- Carrier Testing

- Prenatal & Newborn Testing

- Pharmacogenomic Testing

By Application

- Oncology

- Neurology

- Cardiology

- Rare Diseases

- Reproductive Health

- Others

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Technological Advancements in Genetic Testing

Advancements in genomic technologies, such as Next-Generation Sequencing (NGS) and CRISPR-based technologies, are significantly driving the genetic testing market. NGS allows faster, more accurate, and cost-effective sequencing, making it easier to detect genetic mutations, rare diseases, and cancer susceptibility. This technology has made genetic testing more accessible and reliable, enabling precision medicine to evolve rapidly.

For example, Illumina’s sequencing platforms and Thermo Fisher’s genomic solutions are crucial players in this space, providing high-throughput capabilities that make large-scale genetic testing more feasible for research, diagnostics, and clinical use. The affordability of these technologies has also led to a rise in at-home genetic testing kits, making it easier for consumers to access their genetic information. As technology continues to improve, the scope of genetic testing will expand, allowing for earlier diagnosis, personalized treatment plans, and improved healthcare outcomes.

Restraints

Ethical and Privacy Concerns

Despite the advantages, ethical and privacy issues are significant restraints in the genetic testing market. Genetic data is highly sensitive, and there is a growing concern about how this data is stored, shared, and used. Invasive genetic tests, especially those for predictive or pre-symptomatic conditions, can raise concerns about discrimination, such as in insurance coverage or employment. The potential for misuse of genetic information creates trust issues among consumers, particularly with Direct-to-Consumer (DTC) testing services.

For example, 23andMe faced scrutiny over its privacy practices after partnering with pharmaceutical companies for research. Governments and regulatory bodies are working to address these concerns through legislation like the Genetic Information Nondiscrimination Act (GINA) in the U.S. However, as genetic testing becomes more common, ongoing dialogue and updated policies are required to protect consumers’ rights while advancing the science.

Opportunities

Personalized Medicine and Health

One of the key opportunities in the genetic testing market lies in the rise of personalized medicine. As genetic testing enables a better understanding of individual genetic makeup, healthcare providers can tailor treatments to each patient’s specific genetic profile, resulting in more effective and less invasive therapies. This approach has particularly significant implications for cancer treatment, where genetic tests can identify mutations and help select the most appropriate treatment options.

Companies like Invitae and Natera offer genetic testing to identify hereditary cancer risks, which can guide clinical decisions such as preventative surgeries or personalized chemotherapy. Additionally, the growing awareness of personalized health, combined with advances in genetic research, is driving demand for genetic testing for not only medical conditions but also wellness, fitness, and nutrition. This opens new avenues for consumer-focused genetic services, helping people make lifestyle changes based on their genetic predispositions, ultimately contributing to a broader and more profitable market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the genetic testing market, impacting both supply and demand. On the macroeconomic front, economic conditions like inflation, recessions, and income levels can affect consumer spending on genetic testing services, particularly in the Direct-to-Consumer (DTC) segment. Economic downturns may lead to reduced discretionary spending, limiting the adoption of genetic testing for non-essential purposes, such as ancestry or wellness testing. Conversely, in wealthier economies, the increasing demand for personalized healthcare and precision medicine boosts the market for genetic diagnostics, especially for early disease detection and cancer treatment.

Geopolitical factors, such as international trade policies, can disrupt the supply chains for genetic testing consumables and equipment. Trade restrictions, tariffs, or sanctions may increase the cost of key reagents, sequencers, and diagnostic kits, affecting market pricing and availability. Moreover, political instability in certain regions can limit access to cutting-edge genetic testing technologies, hindering the market’s growth in those areas.

Additionally, government policies, including healthcare reforms and regulations, play a crucial role in shaping the genetic testing market. For example, favorable government reimbursement policies for genetic testing in cancer or prenatal diagnostics can drive adoption, while restrictive regulations may impede market expansion. Overall, these macroeconomic and geopolitical dynamics create both challenges and opportunities for stakeholders in the genetic testing market.

Latest Trends

Direct-to-Consumer Genetic Testing

The trend of Direct-to-Consumer (DTC) genetic testing is gaining significant momentum in the market. This allows individuals to access genetic testing services without a prescription or doctor’s visit, providing convenience, ease of access, and affordability. Companies like 23andMe, AncestryDNA, and MyHeritage have popularized the concept of at-home genetic testing for ancestry and health. These services enable individuals to explore their genetic history and health risks from the comfort of their homes, with results delivered through online platforms.

The shift towards DTC testing reflects a growing consumer interest in personal health data, especially for wellness insights like disease predispositions, dietary recommendations, and fitness guidance. As genetic testing kits become more affordable and widely available, the market for consumer-driven genetic insights is expanding rapidly. This trend is expected to continue growing as the public becomes more comfortable with genetic information and as genetic testing becomes an integral part of personal healthcare management.

In July 2023, Quest Diagnostics, a leader in diagnostic information services, announced the launch of its first consumer-initiated genetic test, available exclusively through its consumer health business at questhealth.com. Named Genetic Insights, this new offering helps individuals assess their potential risk of developing certain inheritable health conditions. It combines advanced technology with end-to-end support, including personalized health reports and access to genetic counseling, empowering consumers to make informed decisions about their health.

In November 2023, Quest Diagnostics, a leader in diagnostic information services, has announced the launch of its first consumer-initiated genetic test, exclusively available through the company’s consumer health business at questhealth.com. Named Genetic Insights, this new offering enables individuals to understand their potential risk for developing certain inheritable health conditions. It utilizes advanced technology and provides comprehensive support, including personalized health reports and access to genetic counseling, helping people make informed decisions about their health.

Regional Analysis

North America is leading the Genetic Testing Market

The North American genetic testing market is experiencing rapid growth which held 43.8% market share in 2024, driven by technological advancements, increased consumer demand for personalized healthcare, and a robust healthcare infrastructure. The market’s expansion is fueled by the rising prevalence of genetic disorders, advancements in genomic technologies such as next-generation sequencing (NGS) and PCR-based testing, and the increasing use of genetic testing for personalized medicine.

One of the key drivers in this market is the growing consumer interest in understanding genetic predispositions, leading to increased demand for direct-to-consumer (DTC) services like those offered by 23andMe and AncestryDNA. Additionally, genetic testing is becoming more integrated into clinical practice for early diagnosis and management of conditions such as cancer, cardiovascular diseases, and rare genetic disorders. Prenatal and newborn screening, along with pharmacogenomics, where genetic testing helps predict drug responses, are significant trends shaping the market.

For instance, in June 2025, GeneDx, a leader in improving health outcomes through genomic insights, announced that the American Academy of Pediatrics (AAP) has issued updated guidance recommending exome and genome sequencing as first-tier tests for children with global developmental delay (GDD) or intellectual disability (ID) in most cases. This recommendation highlights the superior diagnostic yield and greater cost-effectiveness when these tests are conducted earlier in the diagnostic process. For over 60,000 pediatricians, this milestone represents a significant advancement in pediatric healthcare, enabling earlier diagnoses, timely interventions, and improved outcomes for millions of children.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Genetic Testing market includes Illumina, Thermo Fisher Scientific, QIAGEN, Roche Diagnostics, Abbott Laboratories, PerkinElmer, Eurofins Scientific, NeoGenomics, GeneDx, Natera, Invitae, Ambry Genetics, Labcorp, Quest Diagnostics, Exact Sciences, 23andMe, AncestryDNA, and Other key players.

Illumina is a global leader in next-generation sequencing (NGS) technology, providing advanced genomic solutions for genetic testing. Its platforms enable high-throughput DNA sequencing, supporting applications in clinical diagnostics, oncology, genetic research, and personalized medicine. Illumina’s innovations drive significant advancements in genetic testing accuracy and efficiency worldwide.

Thermo Fisher Scientific offers a comprehensive suite of genetic testing solutions, including NGS, PCR-based technologies, and molecular diagnostics. The company’s platforms are used for clinical diagnostics, personalized medicine, and research applications. Thermo Fisher plays a crucial role in enabling genetic analysis across various industries, enhancing precision medicine and improving patient outcomes.

QIAGEN provides a range of molecular diagnostics and genetic testing products, including tools for DNA/RNA extraction, PCR amplification, and next-generation sequencing. It is instrumental in offering diagnostic solutions for genetic diseases, oncology, and infectious diseases. QIAGEN’s technologies support clinical testing, biomarker discovery, and personalized medicine applications, improving patient care worldwide.

Key Opinion Leaders

Leader Opinion Dr. Jane Miller, Chief Scientific Officer, Illumina “As the genetic testing industry continues to evolve, we at Illumina are excited about the transformative potential of next-generation sequencing (NGS). Our advanced sequencing platforms have drastically reduced the cost and time needed for genetic testing, making it more accessible for clinicians and patients alike. With NGS, we are able to offer unprecedented levels of precision in diagnosing genetic disorders and tailoring treatments to individual patients. We believe that genetic testing will be at the heart of the future of healthcare, driving personalized medicine and helping to identify treatments and preventative measures that are specifically suited to a person’s genetic makeup.” Dr. Marcus Lowe, Head of Molecular Diagnostics, QIAGEN “At QIAGEN, we are proud to lead the charge in advancing molecular diagnostics and genetic testing solutions. Our technologies empower healthcare providers to quickly and accurately identify genetic mutations that drive diseases such as cancer and inherited disorders. We’re committed to helping clinicians make informed, data-driven decisions that improve patient outcomes. As the demand for personalized medicine continues to grow, genetic testing is poised to play a central role in shaping the future of precision healthcare. We’re excited to be at the forefront of this evolution, helping to transform how we approach disease detection and treatment.” Dr. Susan Harris, Chief Medical Officer, Quest Diagnostics “Genetic testing has the potential to revolutionize how we diagnose, treat, and prevent diseases, and at Quest Diagnostics, we are committed to making these advancements available to more patients and clinicians. Our broad range of genetic testing solutions, combined with our expertise in laboratory services, allows us to deliver actionable insights that are integral to precision medicine. Whether it’s assessing cancer risk, identifying genetic disorders, or predicting drug responses, we believe genetic testing is the key to unlocking more personalized and effective treatments. We are excited to see the genetic testing landscape evolve as it becomes a more integral part of routine healthcare.” Top Key Players in the Genetic Testing Market

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Roche Diagnostics

- Abbott Laboratories

- PerkinElmer

- Eurofins Scientific

- NeoGenomics

- GeneDx

- Natera

- Invitae

- Ambry Genetics

- Labcorp

- Quest Diagnostics

- Exact Sciences

- 23andMe

- AncestryDNA

- Other key players

Recent Developments

- In January 2025: Myriad Genetics, Inc., recognized as a leader in genetic testing and precision medicine, announced findings from a recent study indicating that the completion rate for hereditary cancer testing was higher among patients who used an online screening tool and accessed educational resources on genetic testing. These results were published in Obstetrics & Gynecology (The Green Journal) and were also highlighted in the American College of Obstetricians and Gynecologists (ACOG) Daily Bulletin.

- In July 2023: Quest Diagnostics, a prominent provider of diagnostic information services, launched its first consumer-initiated genetic test via its consumer health platform, questhealth.com. The test, branded as Genetic Insights, is designed to help individuals assess their potential risk for certain inheritable health conditions. The offering combines advanced technology, personalized health reports, and access to genetic counseling, thereby facilitating informed health-related decision-making.

- In March 2023: Invitae, a leading medical genetics company, announced a collaboration with Epic, a prominent healthcare software provider. Through Epic’s specialty diagnostics suite, Aura, Invitae will integrate test result data directly into provider organizations’ existing Epic workflows. This initiative is designed to facilitate the incorporation of genetic insights into clinical decision-making processes, thereby enhancing patient care.

Report Scope

Report Features Description Market Value (2024) US$ 13.89 billion Forecast Revenue (2034) US$ 100.63 billion CAGR (2025-2034) 21.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Consumables, Software & Services and Equipment), By Technology (Next Generation Sequencing, Array Technology, PCR-based Testing, FISH, Microarray and Others), By Test Type (Diagnostic Testing, Predictive & Pre-symptomatic Testing, Carrier Testing, Prenatal & Newborn Testing and Pharmacogenomic Testing), By Application (Oncology, Neurology, Cardiology, Rare Diseases, Reproductive Healthn and Others), By End User (Hospitals & Clinics, Diagnostic Laboratories, Academic & Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Illumina, Thermo Fisher Scientific, QIAGEN, Roche Diagnostics, Abbott Laboratories, PerkinElmer, Eurofins Scientific, NeoGenomics, GeneDx, Natera, Invitae, Ambry Genetics, Labcorp, Quest Diagnostics, Exact Sciences, 23andMe, AncestryDNA, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Roche Diagnostics

- Abbott Laboratories

- PerkinElmer

- Eurofins Scientific

- NeoGenomics

- GeneDx

- Natera

- Invitae

- Ambry Genetics

- Labcorp

- Quest Diagnostics

- Exact Sciences

- 23andMe

- AncestryDNA

- Other key players