Global Generative AI in Telecom Market By Component (Software, Services), By Type (Text-based, Image-based, Voice-base), By Deployment mode (On-premise, Cloud), By Application (Network Optimization, Predictive Maintenance, Improve call center operations & customer support, Personalized Product/Service Recommendations, Security & fraud detection, Marketing and Personalized Product Recommendations, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121023

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

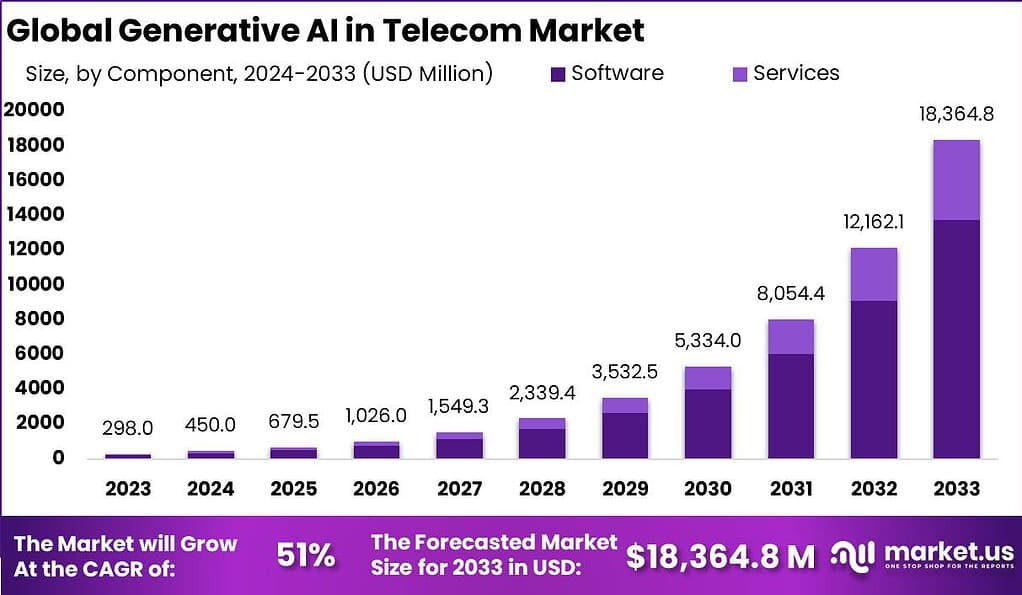

The Global Generative AI in Telecom Market size is expected to be worth around USD 18,364.8 Million By 2033, from USD 298.0 Million in 2023, growing at a CAGR of 51% during the forecast period from 2024 to 2033.

Generative AI refers to artificial intelligence technologies that can create new content, such as text, images, or even designs, based on the data they have been trained on. In the telecom industry, generative AI can be used to improve customer service through chatbots, create personalized marketing messages, and enhance network optimization. This technology can help telecom companies predict network issues before they happen, design new communication services, and even automate complex processes.

The market for generative AI in telecom is experiencing significant growth, driven by the increasing demand for enhanced customer service and more efficient network management. As telecom companies continue to face the dual challenges of maintaining high customer satisfaction and managing extensive, complex network infrastructures, generative AI offers compelling solutions. It enables automated, personalized customer interactions and predictive maintenance capabilities, which can lead to substantial cost savings and improved service reliability.

However, integrating generative AI into existing telecom systems presents several challenges. These include the high initial investment costs, the need for specialized skills to manage AI systems, and concerns related to data privacy and security. Despite these hurdles, the market presents substantial opportunities for new entrants.

Innovators with robust AI solutions can capture significant market share by addressing these challenges and offering scalable and secure AI tools tailored to the telecom industry’s specific needs. New players can differentiate themselves through specialized offerings and by forming strategic partnerships with established telecom providers to gain quicker market penetration and credibility.

A recent survey by NVIDIA revealed that 95% of telecom industry respondents are using AI. However, only 34% have been utilizing AI for more than six months. Additionally, 23% are still researching AI options, and 18% are in the trial or pilot phase of AI projects. This indicates a significant portion of the telecom sector is in the early stages of AI adoption

The telecommunications industry is poised for significant transformation with the anticipated surge in the adoption of Generative AI (GenAI). A recent survey revealed that the use of GenAI in the telco sector is projected to increase from 19% to 48% within the next two years. This substantial growth underscores the sector’s accelerating commitment to integrating advanced AI technologies to enhance operations, customer service, and overall network management.

In the broader context, the Global Generative AI Market is set to experience exponential growth. The market size, valued at USD 13.5 Billion in 2023, is expected to reach an impressive USD 255.8 Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 34.2% during the forecast period from 2024 to 2033. This remarkable expansion highlights the increasing reliance on generative AI across various industries, driven by its potential to innovate and optimize processes.

Specifically, within the telecommunications industry, the Global AI In Telecom Market is projected to grow from USD 1.8 Billion in 2023 to USD 23.9 Billion by 2033. This growth represents a significant CAGR of 29.5% over the forecast period. The adoption of AI in telecom is expected to revolutionize various facets of the industry, including predictive maintenance, network optimization, and personalized customer experiences.

Key Takeaways

- The Generative AI in Telecom Market size is expected to be worth around USD 18,364.8 Million By 2033, growing at a CAGR of 51% during the forecast period from 2024 to 2033.

- Software segment held a dominant position in the generative AI in telecom market, capturing more than a 75% share in 2023.

- In 2023, the text-based segment held a dominant market position in the generative AI in telecom market, capturing more than a 40% share.

- The on-premise segment held a dominant market position in the generative AI in telecom market, capturing more than a 60% share in 2023.

- In 2023, the Network Optimization segment held a dominant market position in the generative AI in telecom market, capturing more than a 25% share.

- In 2023, North America held a dominant market position, capturing more than a 47% share of the global generative AI in the telecom market.

Component Analysis

In 2023, the software segment held a dominant position in the generative AI in telecom market, capturing more than a 75% share. This significant market dominance is primarily attributed to the essential role that software plays in the functionality of generative AI systems.

Software solutions form the core of AI applications, enabling telecom companies to automate operations, enhance customer interactions, and optimize network management. As the backbone of AI implementation, these software solutions include platforms for data analysis, automated response systems, and algorithms for predictive maintenance, all of which are crucial for the daily operations of telecom services.

The leading status of the software segment is further reinforced by the continuous advancements in AI technology, which often manifest through software updates and enhancements. Telecom companies are increasingly investing in AI software to leverage its potential for reducing operational costs and improving service quality. For instance, AI-powered chatbots and virtual assistants, which are software-based, help telecom companies provide 24/7 customer service, handle inquiries more efficiently, and improve customer satisfaction.

Moreover, the scalability of AI software makes it particularly appealing for telecom providers looking to expand their services or enhance their network capabilities without substantial physical infrastructure investments. With the ongoing rollout of 5G and the increasing number of IoT devices, the demand for robust, scalable AI software solutions in the telecom industry is expected to continue growing, thereby maintaining the software segment’s dominance in the market.

Type Analysis

In 2023, the text-based segment held a dominant market position in the generative AI in telecom market, capturing more than a 40% share. This prominence is largely due to the versatility and wide application of text-based AI across various customer service functions.

Text-based AI, including chatbots and automated messaging systems, enables telecom companies to handle large volumes of customer inquiries efficiently. These systems can quickly process and respond to text messages, emails, and online chat queries, significantly reducing wait times and freeing human agents to handle more complex issues. The leading position of the text-based segment is also bolstered by advancements in natural language processing (NLP) technologies.

These advancements have improved the ability of AI systems to understand and generate human-like responses, enhancing the customer experience by providing more accurate and contextually relevant answers. As telecom companies continue to prioritize customer satisfaction, the demand for sophisticated text-based AI solutions that can deliver a seamless, automated, and personalized customer interaction grows.

Furthermore, the scalability of text-based AI applications plays a critical role in their widespread adoption within the telecom industry. These solutions are relatively easier and less costly to implement and maintain compared to their image-based and voice-based counterparts, making them an attractive option for telecom providers looking to enhance operational efficiency and customer service. With ongoing improvements in AI technologies and increasing digital interactions, the text-based segment is expected to maintain its market dominance, driven by its ability to offer effective, scalable, and cost-efficient customer service solutions.

Deployment Mode Analysis

In 2023, the on-premise segment held a dominant market position in the generative AI in telecom market, capturing more than a 60% share. This predominance is attributed to the high level of control and security that on-premise solutions offer to telecom companies.

In an industry where data security and regulatory compliance are paramount, on-premise deployment allows telecom operators to maintain complete control over their AI systems and the sensitive data they process. This is particularly crucial when handling customer data and proprietary network information, which require stringent security measures to protect against breaches and unauthorized access.

The preference for on-premise solutions in the telecom sector is also driven by the need for high-performance computing capabilities. Generative AI applications, particularly in network operations and customer service, demand robust processing power, which can be more effectively managed and scaled in an on-premise environment. This setup ensures that telecom companies can leverage the full potential of AI without being constrained by bandwidth or latency issues, which are often challenges in cloud-based deployments.

Additionally, the on-premise segment’s lead is supported by the significant investments telecom companies have historically made in their IT infrastructure. Many providers prefer to maximize the utilization of these existing assets rather than transitioning to cloud-based solutions, which might involve recurring costs and potential integration challenges with legacy systems. While cloud deployment is gaining traction for its scalability and cost-effectiveness, the on-premise model continues to dominate due to its alignment with the telecom industry’s operational priorities and security requirements.

Application Analysis

In 2023, the Network Optimization segment held a dominant market position in the generative AI in telecom market, capturing more than a 25% share. This leading position is underpinned by the critical need for efficient network management as telecom networks become more complex with the expansion of 5G and IoT (Internet of Things).

Generative AI plays a pivotal role in optimizing network configurations, managing traffic flow, and predicting potential disruptions before they occur. This proactive management helps in maintaining high levels of service quality and network reliability, which are essential for customer satisfaction and operational excellence.

The dominance of the Network Optimization segment is further strengthened by the increasing volume of data traffic and the number of connected devices. As these numbers grow, the complexity of managing these networks increases, making AI-driven solutions not just preferable but necessary. Generative AI algorithms can analyze vast amounts of data in real-time to make immediate adjustments that optimize performance and capacity, thereby ensuring efficient use of resources and minimizing downtime.

Moreover, as telecom operators face pressure to reduce operational costs and improve service delivery, the demand for AI-driven network optimization solutions becomes even more pronounced. These solutions provide a significant return on investment by reducing the need for manual interventions and allowing telecom operators to allocate resources more effectively. With ongoing technological advancements and growing network demands, the Network Optimization segment is expected to maintain its market leadership, driven by its ability to enhance network performance and operational efficiency in the telecom sector.

Key Market Segments

By Component

- Software

- Services

By Type

- Text-based

- Image-based

- Voice-base

By Deployment mode

- On-premise

- Cloud

By Application

- Network Optimization

- Predictive Maintenance

- Improve call center operations & customer support

- Personalized Product/Service Recommendations

- Security & fraud detection

- Marketing and Personalized Product Recommendations

- Others

Driver

Enhanced Customer Experiences through Generative AI

One significant driver in the adoption of generative AI within the telecom industry is the enhancement of customer experiences. Generative AI technologies, such as advanced chatbots and virtual assistants, are revolutionizing customer service by providing instant, accurate responses to inquiries and support requests. This technological advancement significantly reduces customer wait times and improves overall satisfaction by handling routine queries efficiently and allowing human agents to focus on more complex issues.

The implementation of text-based generative AI in customer support systems is particularly impactful. These AI systems are capable of understanding and processing natural language, enabling them to interact with customers in a human-like manner. By learning from vast amounts of data, these AI systems continuously improve their responses, becoming more adept at resolving customer issues over time. As a result, telecom companies can offer 24/7 customer support, which is crucial in maintaining high levels of customer satisfaction and loyalty.

Furthermore, generative AI enables personalized customer interactions. By analyzing customer data, AI can tailor responses and recommendations to individual needs and preferences, enhancing the overall customer experience. This personalization extends to proactive support, where AI can predict potential issues based on customer behavior and usage patterns, addressing them before they escalate into significant problems.

Restraint

High Implementation Costs

Despite the numerous advantages of generative AI, high implementation costs present a significant restraint for its adoption in the telecom industry. The initial investment required for developing and integrating AI technologies can be substantial. This includes the costs associated with acquiring advanced AI hardware, developing custom AI algorithms, and training models on large datasets. These expenses can be particularly burdensome for smaller telecom operators with limited budgets.

Moreover, ongoing costs related to the maintenance and upgrading of AI systems add to the financial burden. Generative AI systems require continuous monitoring and fine-tuning to ensure optimal performance and accuracy. This necessitates hiring skilled AI specialists and data scientists, which further escalates operational costs. Additionally, the rapid pace of technological advancements in AI means that systems can quickly become outdated, requiring frequent updates and replacements to stay competitive.

The high costs also extend to data management. Generative AI systems rely on vast amounts of data to function effectively, and managing this data securely and efficiently involves significant expenditure. Telecom companies must invest in robust data storage solutions and cybersecurity measures to protect sensitive customer information, which adds to the overall cost.

Opportunity

Personalized Marketing Strategies

Generative AI presents a substantial opportunity for telecom companies to enhance their marketing strategies through personalized content and targeted campaigns. By leveraging advanced algorithms and machine learning techniques, telecom operators can analyze customer data to understand individual preferences, behaviors, and needs. This insight allows for the creation of highly customized marketing messages that resonate with each customer on a personal level.

Personalized marketing powered by generative AI can lead to significant improvements in customer engagement and conversion rates. For instance, AI can generate tailored recommendations for services and products based on a customer’s past behavior and predicted future needs. This level of personalization helps in delivering relevant offers and promotions, increasing the likelihood of customer uptake and satisfaction.

Furthermore, generative AI can optimize marketing efforts by identifying the most effective channels and times to reach customers. By analyzing data on customer interactions and responses, AI can determine the optimal timing and medium for marketing messages, ensuring that campaigns are delivered when customers are most likely to engage. This targeted approach reduces marketing waste and enhances return on investment.

Challenge

Data Privacy and Security Concerns

One of the primary challenges in the adoption of generative AI in the telecom industry is ensuring data privacy and security. The use of AI technologies requires the processing and analysis of vast amounts of sensitive customer data, including personal information, communication patterns, and usage behaviors. This data is critical for training AI models and generating accurate, personalized responses, but it also poses significant privacy risks.

Telecom companies must navigate a complex landscape of data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. Compliance with these regulations requires robust data management practices, including secure data storage, encryption, and access controls. Any breach of these regulations can result in severe penalties and damage to the company’s reputation.

Moreover, the increasing sophistication of cyber threats adds to the challenge. AI systems themselves can become targets for cyberattacks, where malicious actors exploit vulnerabilities to gain unauthorized access to sensitive data. Telecom operators must invest in advanced cybersecurity measures to protect their AI infrastructure from such threats. This includes implementing AI-driven security solutions that can detect and respond to anomalies in real time, thereby mitigating the risk of data breaches.

Growth Factors

- Enhanced Customer Support: Generative AI is significantly improving customer support within the telecom sector. Advanced AI chatbots and virtual assistants provide real-time, accurate responses to customer inquiries, thereby enhancing customer satisfaction and reducing wait times. This improvement in customer experience is a key driver of market growth.

- Operational Efficiency: The deployment of generative AI enhances operational efficiency by automating routine tasks and optimizing network management. AI systems can predict and manage network traffic, perform predictive maintenance, and optimize resource allocation, leading to cost savings and improved service quality.

- Personalized Marketing: Generative AI enables telecom companies to deliver highly personalized marketing campaigns. By analyzing customer data, AI can create targeted offers and recommendations, improving engagement and conversion rates. This personalized approach is instrumental in driving customer retention and acquisition.

- Scalability and Flexibility: The shift towards cloud-based AI solutions provides telecom companies with scalable and flexible options to deploy AI capabilities without significant upfront investments. This scalability allows for rapid adaptation to changing market demands and technological advancements.

- Competitive Advantage: Telecom companies leveraging generative AI gain a competitive edge by offering innovative services and enhanced customer experiences. This advantage is crucial in a highly competitive market, where differentiation is key to attracting and retaining customers.

Emerging Trends

- AI-Driven Dynamic Pricing: The adoption of AI-driven dynamic pricing models is transforming the telecom industry. These models analyze customer usage patterns to offer personalized pricing plans, enhancing customer satisfaction and loyalty. This trend is expected to increase telecom revenues by up to 15%.

- Network Optimization: Generative AI is increasingly used for network optimization, which involves analyzing network traffic and predicting demand patterns to ensure optimal performance. This application is critical for maintaining high service quality and customer satisfaction.

- Enhanced Security: AI-driven security measures are becoming essential in the telecom sector to protect against cyber threats. AI technologies can rapidly detect and respond to security breaches, reducing detection times and enhancing overall network security.

- Content Generation: Generative AI is revolutionizing content creation in the telecom industry. AI systems are used to generate personalized marketing content, notifications, and updates, improving customer engagement and reducing marketing costs by up to 30%.

- Integration with IoT: The integration of generative AI with Internet of Things (IoT) devices is creating new opportunities for telecom companies. AI can analyze data from IoT devices to provide insights and optimize services, enhancing the value provided to customers.

Top 5 Use Cases of Generative AI in Telecom

- Network Optimization and Management: Generative AI plays a pivotal role in enhancing network management by predicting network traffic, detecting anomalies, and dynamically allocating resources. AI algorithms can simulate various network conditions and configurations to identify the most efficient solutions, leading to improved bandwidth allocation, reduced latency, and overall enhanced network performance. This is crucial for telecom operators managing vast, complex networks and aiming to deliver consistent, high-quality service.

- Customer Service Automation: Telecom companies are adopting generative AI to automate customer service operations, providing quick and effective responses to customer inquiries and issues. AI-powered chatbots and virtual assistants can handle a wide range of customer service tasks, from troubleshooting problems to managing account inquiries, thereby reducing the workload on human agents and improving customer satisfaction. These AI systems are capable of learning from interactions to improve their responses over time, making them increasingly effective.

- Personalized Services and Recommendations: Generative AI enables telecom operators to tailor services and marketing campaigns to individual preferences. By analyzing customer data, AI models can predict customer needs and preferences, offering personalized product recommendations, tailored service packages, and targeted promotions. This level of customization enhances the customer experience and can significantly increase customer retention and revenue.

- Fraud Detection and Prevention: AI algorithms are adept at detecting patterns indicative of fraudulent activity, such as unusual call patterns or atypical account changes. By continuously learning from transactions, generative AI can identify potential fraud with high accuracy, alerting operators and preempting fraudulent actions. This is especially important in the telecom industry, where large volumes of transactions and data are processed daily.

- Network Security and Threat Detection: Generative AI is instrumental in enhancing network security protocols. It can generate models of potential cybersecurity threats, enabling telecom operators to develop defenses against these threats before they manifest. AI systems monitor network traffic in real time, detect anomalies that could indicate a cybersecurity threat, and initiate automatic countermeasures. This proactive approach to network security is essential in safeguarding critical infrastructure and customer data in an increasingly digital and interconnected world.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 47% share of the global generative AI in the telecom market. This leading position can be attributed to several factors, including the region’s advanced technological infrastructure, significant investments in AI research and development, and the presence of major AI and telecom companies.

The demand for Generative AI in Telecom in North America was valued at USD 140 Million in 2023 and is anticipated to grow significantly in the forecast period. The United States, in particular, is home to numerous tech giants such as Google, IBM, and Microsoft, which are heavily investing in generative AI technologies. Additionally, the high adoption rate of advanced telecom solutions and the increasing demand for enhanced customer service experiences further drive the market in this region.

North America’s regulatory environment also plays a crucial role in fostering AI innovation. Supportive government policies and substantial funding for AI initiatives provide a conducive environment for the growth of generative AI applications in telecom.

Moreover, the high penetration of smartphones and internet connectivity across the region creates a robust foundation for the implementation of AI-driven telecom solutions. This technological readiness, coupled with a strong focus on improving customer experiences through AI, positions North America as a leader in the generative AI in telecom market.

Europe is another significant market for generative AI in telecom, driven by the region’s focus on digital transformation and innovation. Countries like Germany, the UK, and France are leading the adoption of AI technologies in the telecom sector. The European Union’s commitment to AI research and ethical guidelines ensures a balanced approach to AI development, promoting innovation while safeguarding privacy and security. The European telecom market benefits from strong collaboration between industry players and research institutions, fostering advancements in AI applications

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The generative AI in the telecom market is highly competitive, with several key players driving innovation and growth. LeewayHertz stands out as a leader, offering bespoke AI solutions that enhance network optimization and customer experience. Nokia and Ericsson are leveraging their extensive telecommunications expertise to integrate AI into their products, improving network performance and reliability. Cisco Systems utilizes AI to bolster security and streamline operations within telecom networks.

IBM is a major player, providing advanced AI and machine learning solutions that empower telecom operators to analyze vast amounts of data for actionable insights. Amdocs and C3.ai Inc. focus on AI-driven customer management and operational efficiencies, enhancing service delivery. Ciena and ZTE Corporation are at the forefront of incorporating AI to optimize network infrastructures and facilitate the rollout of 5G technology.

Top Key Players in the Market

- LeewayHertz

- Nokia

- Ericsson

- Cisco Systems

- IBM

- Amdocs

- C3.ai Inc.

- Ciena

- ZTE Corporation

- Infosys

- Altran (part of Capgemini)

- Ribbon Communications

- Aria Networks

- Guavus (a Thales company)

- Netcracker Technology (a subsidiary of NEC Corporation)

- Cresta

- Other key players

Recent Developments

- July 2023: Ericsson highlighted the potential of generative AI to transform telecom by enhancing human-readable content generation for various business applications, such as customer service and marketing. They are also focusing on machine-readable content to optimize network configurations and incident detection.

- August 2023: SK Telecom invested $100 million in Anthropic to co-develop a multilingual large language model tailored for telecoms. This partnership aims to accelerate AI-powered transformations and develop new business models within the telecom sector.

- November 2023: Thomson Reuters announced a significant generative AI strategy involving an additional $100 million annual investment. This strategy includes the acquisition of Casetext for $650 million to enhance their AI capabilities across various professional sectors.

Report Scope

Report Features Description Market Value (2023) USD 298 Mn Forecast Revenue (2033) USD 18,364.8 Mn CAGR (2024-2033) 51% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Type (Text-based, Image-based, Voice-base), By Deployment mode (On-premise, Cloud), By Application (Network Optimization, Predictive Maintenance, Improve call center operations & customer support, Personalized Product/Service Recommendations, Security & fraud detection, Marketing and Personalized Product Recommendations, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape LeewayHertz, Nokia, Ericsson, Cisco Systems, IBM, Amdocs, C3.ai Inc., Ciena, ZTE Corporation, Infosys, Altran (part of Capgemini), Ribbon Communications, Aria Networks, Guavus (a Thales company), Netcracker Technology (a subsidiary of NEC Corporation), Cresta, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI and how is it used in the telecom industry?Generative AI refers to artificial intelligence technologies that can generate new content or data, such as text, images, or simulations, based on learned patterns from existing data. In the telecom industry, it is used to enhance customer service through chatbots, automate network operations, optimize network performance, and create personalized marketing content.

How big is Generative AI in Telecom Market?The Global Generative AI in Telecom Market size is expected to be worth around USD 18,364.8 Million By 2033, from USD 298.0 Million in 2023, growing at a CAGR of 51% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Generative AI in Telecom Market?The growth of Generative AI in the telecom market is driven by the need for improved network optimization, enhanced customer experiences, automation of repetitive tasks, and the competitive push to innovate and offer personalized services.

What are the current trends and advancements in Generative AI in Telecom Market?Current trends and advancements include the use of AI for network optimization, enhanced customer service via AI-driven chatbots and virtual assistants, domain-specific AI models, and the adoption of AI for predictive maintenance and automated troubleshooting.

What are the major challenges and opportunities in the Generative AI in Telecom Market?Major challenges include demonstrating AI's ROI, addressing the talent shortage, managing data quality, and building trust in AI systems. Opportunities lie in leveraging AI for operational efficiency, cost reduction, personalized customer experiences, and developing innovative products and services.

Who are the leading players in the Generative AI in Telecom Market?Leading players in the Generative AI in the telecom market include LeewayHertz, Nokia, Ericsson, Cisco Systems, IBM, Amdocs, C3.ai Inc., Ciena, ZTE Corporation, Infosys, Altran (part of Capgemini), Ribbon Communications, Aria Networks, Guavus (a Thales company), Netcracker Technology (a subsidiary of NEC Corporation), Cresta, Other key players

Generative AI in Telecom MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Telecom MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- LeewayHertz

- Nokia

- Ericsson

- Cisco Systems

- IBM

- Amdocs

- C3.ai Inc.

- Ciena

- ZTE Corporation

- Infosys

- Altran (part of Capgemini)

- Ribbon Communications

- Aria Networks

- Guavus (a Thales company)

- Netcracker Technology (a subsidiary of NEC Corporation)

- Cresta

- Other key players