Global Generative AI in FMCG Market By Component(Generative AI Software, Generative AI Services), By Application(Demand Forecasting, Product Design and Innovation, Personalized Marketing, Price Optimization, Supply Chain Optimization, Consumer Insights, Content Generation, Quality Control, Packaging Design, Promotion Planning, Others), By FMCG sub-industries(Food & Beverages, Household Products, Personal Care and Hygiene, Electronics and Appliances, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 120926

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

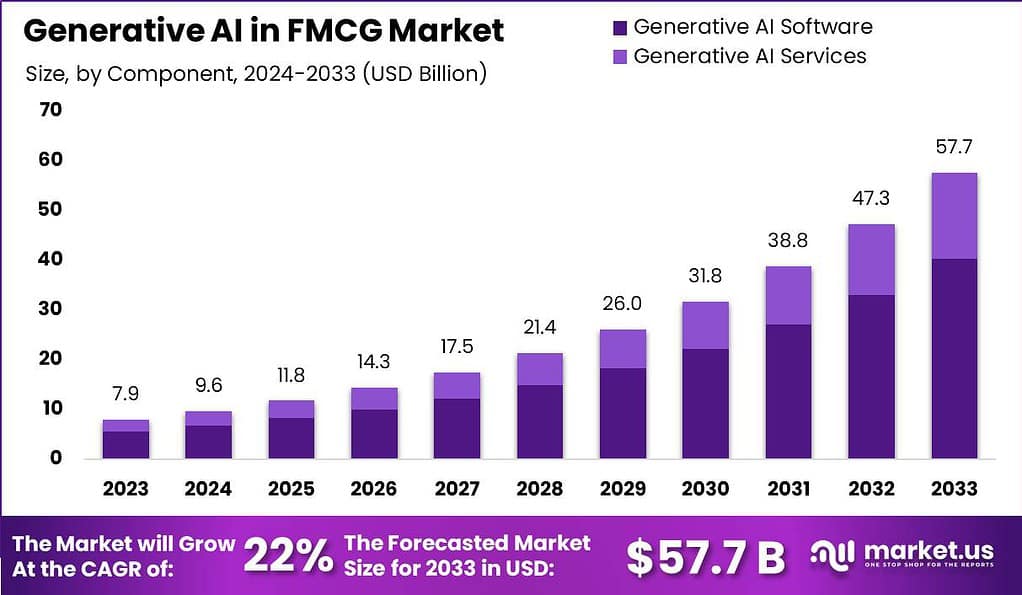

The Global Generative AI in FMCG Market size is expected to be worth around USD 57.7 Billion By 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 22% during the forecast period from 2024 to 2033.

Generative AI is increasingly influential in the Fast-Moving Consumer Goods (FMCG) industry, offering companies new ways to enhance efficiency and innovate. This technology, which includes tools that can generate text, images, and even predictions, helps FMCG companies in several key areas. For instance, generative AI can design new product packaging or create personalized marketing content that appeals directly to individual consumer preferences, all at a remarkable speed

The generative AI in FMCG market is experiencing significant growth as companies recognize its potential to drive competitiveness and meet evolving consumer demands. Key players in the industry are investing in AI research and development to develop advanced generative AI models that can create compelling and unique product designs, packaging concepts, and marketing campaigns.

The market for generative AI in FMCG is driven by factors such as the need for differentiation in a competitive market, the rising demand for personalized products, and the desire to optimize the product development process. As the technology evolves, it is expected to enable even more sophisticated applications, such as real-time product customization and virtual try-on experiences for consumers

However, challenges exist in the adoption of generative AI in the FMCG industry. These include ensuring data privacy and security, ethical considerations in algorithmic decision-making, and the need for skilled AI talent. Overcoming these challenges will be crucial to fully harness the potential of generative AI in FMCG.

The generative AI market is poised for remarkable growth in the coming years. According to the latest market research, the Global Generative AI Market is expected to be worth around USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023, representing a robust CAGR of 34.2% during the forecast period from 2024 to 2033.

The widespread adoption of generative AI is evident across various consumer segments and geographies. 70% of consumers seek recommendations for new products and services, indicating a strong demand for the technology’s capabilities. In terms of regional adoption, 73% of the Indian population surveyed is using generative AI, followed by 49% in Australia, 45% in the US, and 29% in the UK.

Generative AI is particularly popular among younger demographics, with 65% of users being Millennials or Gen Z, and 72% being employed. The technology has gained significant traction, with nearly 6 in 10 users believing they are on their way to mastering it. Furthermore, 70% of Gen Z report using the technology, and 52% of them trust it to help them make informed decisions. Overall, 52% of generative AI users say they use the technology more now than when they first started.

The adoption of generative AI is also gaining momentum in the retail sector. Retail executives surveyed estimate that 36% of their employees are already using generative AI today, and this figure is expected to grow to 45% by the end of 2025, highlighting the increasing integration of the technology within retail operations

Key Takeaways

- The Generative AI in FMCG Market size is expected to be worth around USD 57.7 Billion By 2033, growing at a CAGR of 22% during the forecast period from 2024 to 2033.

- Generative AI Software segment held a dominant market position within the FMCG sector, Demand Forecasting segment held a dominant market position within the Generative AI in FMCG market, capturing more than a 15% share in 2023.

- In 2023, the Food & Beverages segment held a dominant market position within the Generative AI in FMCG market, capturing more than a 30% share.

- In 2023, APAC held a dominant market position in the generative AI sector within the FMCG industry, capturing more than a 38% share.

By Component

In 2023, the Generative AI Software segment held a dominant market position within the FMCG sector, capturing more than a 70% share. This significant market share is primarily attributed to the software’s critical role in automating and enhancing various facets of the FMCG operations, from product development to customer engagement and supply chain management.

Generative AI software enables companies to rapidly analyze consumer data and generate insights, which can be used to tailor products and marketing strategies to specific consumer preferences and emerging trends. This level of customization and speed in generating actionable data is essential in the fast-paced FMCG industry, where staying ahead of consumer demands and market shifts is crucial for maintaining competitiveness.

Moreover, the preference for generative AI software is driven by its ability to significantly reduce operational costs and increase efficiency. By automating routine tasks and optimizing logistical operations, companies can achieve a much higher output with lower resource expenditure. For example, generative AI applications can predict optimal inventory levels, thus reducing overstocking and understocking scenarios, which are costly issues in the FMCG sector.

Additionally, AI-driven analytics for customer behavior can lead to more effective marketing campaigns, targeted promotions, and personalized product recommendations, all of which enhance consumer satisfaction and loyalty. Given these advantages, the Generative AI Software segment is leading the charge in transforming the FMCG market.

The continued investment in AI development and the increasing integration of AI tools across business processes signal further growth and innovations in this area. Businesses leveraging this technology are not only streamlining their operations but are also setting new standards for innovation and consumer engagement in the industry. As generative AI continues to evolve, its impact is expected to expand, further solidifying its leading position in the market.

By Application

In 2023, the Demand Forecasting segment held a dominant market position within the Generative AI in FMCG market, capturing more than a 15% share. This prominence is largely due to the crucial role demand forecasting plays in optimizing the supply chain and minimizing inventory costs. Generative AI significantly enhances the accuracy and speed of demand predictions by analyzing vast arrays of historical sales data, market trends, consumer behavior, and external factors such as economic shifts and seasonal variations.

For instance In 2023, Nestlé and Procter & Gamble (P&G) are notable examples of FMCG companies leveraging generative AI. Nestlé uses AI to optimize its supply chain and improve sustainability by making all its product packaging recyclable or reusable by 2025.

This allows FMCG companies to make informed decisions on production and inventory levels, avoiding both shortages and excess stock, which can be costly. The importance of the Demand Forecasting segment is underscored by its impact on other critical areas of FMCG operations, such as procurement, production planning, and distribution. Effective demand forecasting helps companies reduce waste, maximize resource utilization, and improve overall operational efficiency.

Moreover, the ability to anticipate market demands more accurately supports strategic product launches and promotional activities, ensuring that new products are introduced at the optimal time and with appropriate marketing support to maximize consumer engagement and sales. As businesses continue to navigate the complexities of the global market, the reliance on advanced generative AI tools for demand forecasting is expected to grow.

This technology not only provides a competitive edge by enabling more agile responses to market changes but also drives sustainability by reducing overproduction and waste. Thus, the Demand Forecasting segment is likely to maintain its leading position in the market, as more FMCG companies adopt generative AI to refine their forecasting capabilities and enhance overall business resilience.

By FMCG sub-industries

In 2023, the Food & Beverages segment held a dominant market position within the Generative AI in FMCG market, capturing more than a 30% share. This significant market share is attributed to the essential role of AI in transforming numerous aspects of the food and beverage industry, from optimizing supply chain operations to personalizing consumer experiences.

Generative AI technologies are particularly adept at analyzing consumer preferences and market trends, enabling companies to innovate and tailor their product offerings rapidly. This includes everything from developing new flavors based on emerging consumer preferences to designing marketing campaigns that resonate with specific demographics.

Moreover, the Food & Beverages segment benefits substantially from AI’s capability in managing complex supply chains that are typical in this industry. With perishable goods and stringent regulatory requirements, generative AI aids in predicting demand more accurately, optimizing delivery routes, and managing inventory efficiently, all of which are critical for maintaining product freshness and reducing waste.

Additionally, AI-driven analytics helps in maintaining quality control standards and compliance with health regulations, which are paramount in the food industry. The continued investment in generative AI tools in the Food & Beverages industry is driven by the need to stay competitive in a rapidly changing market environment.

As consumers become more health-conscious and environmentally aware, companies are using AI to develop more sustainable and healthier food options, enhancing brand loyalty and consumer satisfaction. Thus, the Food & Beverages segment’s leading position in the Generative AI FMCG market is likely to expand as technological advancements continue to enable deeper insights and more innovative approaches to meeting consumer demands.

Key Market Segments

By Component

- Generative AI Software

- Generative AI Services

By Application

- Price Optimization

- Supply Chain Optimization

- Consumer Insights

- Demand Forecasting

- Product Design and Innovation

- Personalized Marketing

- Content Generation

- Quality Control

- Packaging Design

- Promotion Planning

- Others

By FMCG sub-industries

- Food & Beverages

- Household Products

- Personal Care and Hygiene

- Electronics and Appliances

- Others

Driver

Predictive Analytics Transforming the FMCG Sector

In the rapidly evolving Fast-Moving Consumer Goods (FMCG) sector, predictive analytics powered by generative AI stands out as a key driver of growth and efficiency. In 2023, the integration of AI in processes such as demand forecasting and inventory management has proven instrumental. FMCG companies leverage generative AI to process and analyze large datasets, enabling precise predictions of consumer demand and efficient supply chain management.

The technology’s ability to anticipate market trends and optimize stock levels minimizes waste and enhances product availability, crucial for maintaining competitive advantage in a sector characterized by thin profit margins and high consumer expectations. Such advancements not only boost operational efficiency but also improve financial outcomes by aligning product availability with market demand, thereby reducing operational costs and enhancing customer satisfaction.

Restraint

Data Constraints and Cost Implications

Despite the advantages, the adoption of generative AI in the FMCG sector faces significant restraints, primarily due to data constraints and the high costs associated with AI implementation. Generative AI requires extensive, well-structured datasets to train effectively. Many FMCG companies, especially smaller ones, do not possess robust data repositories, which limits the potential outputs and benefits of AI technologies.

Furthermore, developing bespoke AI solutions entails substantial financial investments in specialized talent and advanced computational infrastructure. For many smaller FMCG companies, the high upfront costs and uncertain return on investment pose substantial barriers, hindering the widespread adoption and scalability of generative AI solutions in the sector.

Opportunity

Sustainable Manufacturing via Generative AI

Sustainable manufacturing represents a significant growth opportunity within the FMCG sector, driven by generative AI. This technology enhances manufacturing processes, enabling companies to reduce waste and lower energy consumption-key factors in minimizing environmental impact. For instance, generative AI’s capability to optimize production processes and supply chain logistics not only streamlines operations but also supports the industry’s shift towards sustainability.

This shift is increasingly important as consumers and regulators demand more environmentally friendly practices. By integrating AI, FMCG companies can improve their operational efficiency while also advancing their commitment to environmental stewardship, presenting a substantial opportunity for growth and differentiation in a competitive market.

Challenge

Balancing Innovation with Regulatory Compliance

One of the principal challenges in implementing generative AI within the FMCG sector is balancing technological innovation with stringent regulatory compliance. FMCG products, particularly in the food and beverages category, are heavily regulated to ensure consumer safety. The introduction of AI-driven innovations, from new product formulations to AI-enhanced quality control processes, must be navigated carefully to comply with existing regulations.

Moreover, as generative AI continues to evolve, regulatory frameworks may struggle to keep pace, creating a complex landscape for FMCG companies. Ensuring that new AI applications are both effective and compliant requires ongoing monitoring and adaptation, presenting a continuous challenge for the industry.

Growth Factors

- Advanced Predictive Analytics: Generative AI significantly boosts predictive analytics in FMCG, improving demand forecasting, supply chain optimization, and inventory management. This leads to reduced waste, better stock management, and minimized overproduction, aligning closely with sustainability goals and efficiency.

- Enhanced Product Development: The technology enables rapid prototyping and testing of new products, allowing for quicker adaptation to consumer preferences and market changes. This accelerates innovation cycles within FMCG companies, enabling them to stay ahead in competitive markets.

- Operational Efficiency: Generative AI streamlines operations across multiple departments, from manufacturing to customer service, by automating routine tasks and optimizing logistical operations. This not only boosts productivity but also reduces operational costs.

- Marketing and Consumer Engagement: By analyzing extensive consumer data, generative AI can create highly targeted and personalized marketing campaigns, enhancing consumer engagement and improving the effectiveness of marketing spends.

- Sustainability Initiatives: FMCG companies are leveraging generative AI to enhance their sustainability practices, such as by optimizing resource use and reducing waste. This is increasingly important as consumers and regulatory bodies demand more environmentally friendly practices.

Emerging Trends

- Hyper-Personalization: Generative AI is facilitating the trend of hyper-personalization in the FMCG sector. By utilizing consumer data, companies can now create personalized products, tailored marketing messages, and unique consumer experiences on a scale previously unattainable.

- Sustainable Manufacturing: There is a growing trend towards using generative AI to drive sustainable manufacturing processes. This technology helps in reducing resource wastage and improving energy efficiency, aligning with global sustainability goals.

- AI-Driven Supply Chain Innovations: Generative AI is revolutionizing supply chain management by predicting demand more accurately, optimizing delivery routes, and automating inventory management, which significantly enhances operational efficiencies.

- Expansion of AI-Enhanced Customer Services: FMCG companies are increasingly adopting AI tools for customer service to provide instant, 24/7 support to customers. AI-driven chatbots and virtual assistants are becoming standard features on FM Consumer platforms.

- Adoption of AI in Regulatory Compliance: As regulatory requirements become more stringent, FMCG companies are using AI to ensure compliance more efficiently. This includes monitoring quality control, ensuring product safety standards, and adhering to environmental regulations.

Regional Analysis

In 2023, APAC held a dominant market position in the generative AI sector within the FMCG industry, capturing more than a 38% share. This substantial market share can be attributed to several pivotal factors. Primarily, the region’s rapid digital transformation and the adoption of advanced technologies in countries like China, Japan, and South Korea have significantly driven AI integration in various sectors, including fast-moving consumer goods (FMCG). These countries have not only invested heavily in AI infrastructure but also in research and development, fostering innovation across their industries.

Moreover, the high population density in APAC contributes to an extensive consumer base for FMCG products, which in turn increases demand for generative AI applications aimed at optimizing product design, consumer interaction, and supply chain logistics. Additionally, government initiatives across the region to promote AI technology have lowered barriers for FMCG companies to adopt these solutions, further bolstering the market growth.

Europe and North America follow APAC in terms of market influence but have distinct characteristics driving their AI adoption. In Europe, stringent data protection regulations such as GDPR are shaping the ways in which AI is implemented, focusing on privacy and consumer rights. Meanwhile, North America is leveraging its strong technological infrastructure and innovative ecosystem to push boundaries in AI capabilities, particularly in personalization and customer service enhancements within the FMCG sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the fast-evolving market of Generative AI within the FMCG sector, a constellation of key players is shaping the landscape, each bringing unique innovations and strategic strengths to the forefront. IBM, Microsoft, Google Cloud, and Amazon Web Services (AWS) are at the helm, providing robust cloud infrastructure, cutting-edge AI tools, and extensive machine learning capabilities that enable FMCG companies to enhance operational efficiency and consumer engagement. These players have established a significant presence in the market by continuously advancing AI technologies and offering scalable solutions that cater to diverse FMCG needs.

SAP and Oracle are pivotal in integrating AI into business processes, specializing in creating data-driven solutions that improve decision-making and streamline supply chains. Their expertise in enterprise resource planning (ERP) systems allows FMCG companies to leverage generative AI for everything from demand forecasting to personalized marketing strategies. Accenture and Capgemini stand out for their consultancy roles, guiding FMCG giants through digital transformation initiatives and implementing AI technologies that optimize product innovation and customer experiences.

Top Key Players in the Market

- IBM

- Microsoft

- Google Cloud

- Amazon Web Services (AWS)

- SAP

- Oracle

- Accenture

- Capgemini

- SAS

- Alibaba Cloud

- Other key players

Recent Developments

- In February 2023, The Coca-Cola Company shared some big news that got people excited in the consumer goods industry. They said that they’re going to use a special kind of technology called generative AI from a company called OpenAI for their marketing and how they interact with consumers. This is a significant step forward because it shows that Coca-Cola wants to use the latest technology to make their advertisements and consumer experiences even better.

- In January 2024, Google unveiled a suite of new AI-powered tools for retailers. This included a generative AI chatbot that retailers can integrate into their websites and mobile apps. The virtual agents are able to converse with consumers and provide personalized product recommendations based on shoppers’ preferences and browsing behavior. These new capabilities aim to enhance the online shopping experience and streamline other retail operations through the use of advanced AI technology.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Bn Forecast Revenue (2033) USD 57.7 Bn CAGR (2024-2033) 22% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Generative AI Software, Generative AI Services), By Application(Demand Forecasting, Product Design and Innovation, Personalized Marketing, Price Optimization, Supply Chain Optimization, Consumer Insights, Content Generation, Quality Control, Packaging Design, Promotion Planning, Others), By FMCG sub-industries(Food & Beverages, Household Products, Personal Care and Hygiene, Electronics and Appliances, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM, Microsoft, Google Cloud, Amazon Web Services (AWS), SAP, Oracle, Accenture, Capgemini, SAS, Alibaba Cloud, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is generative AI in the FMCG market?Generative AI in the FMCG market refers to the use of advanced algorithms and neural networks to create new product ideas, improve existing offerings, optimize supply chain management, and enhance marketing strategies. It involves analyzing vast amounts of data to generate innovative concepts, simulate product variations, optimize inventory levels, and personalize customer experiences.

How big is Generative AI in FMCG Market?The Global Generative AI in FMCG Market size is expected to be worth around USD 57.7 Billion By 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 22% during the forecast period from 2024 to 2033.

Which region accounted for the largest Generative AI in FMCG Market?In 2023, APAC held a dominant market position in the generative AI sector within the FMCG industry, capturing more than a 38% share.

Who are the key players in the Global Generative AI in FMCG Market?Some of the major key players are IBM, Microsoft, Google Cloud, Amazon Web Services (AWS), SAP, Oracle, Accenture, Capgemini, SAS, Alibaba Cloud, Other key players

What are the key drivers of growth in the generative AI in the FMCG market?The key drivers of growth in the generative AI market in the FMCG industry include accelerated innovation and product development, enhanced customer experiences through personalization, improved supply chain management and logistics optimization, and the ability to gain a competitive edge by staying ahead of market trends and consumer demands.

Generative AI in FMCG MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in FMCG MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Microsoft

- Google Cloud

- Amazon Web Services (AWS)

- SAP

- Oracle

- Accenture

- Capgemini

- SAS

- Alibaba Cloud

- Other key players