Global Garlic Supplements Market Size, Share Analysis Report By Form (Capsules And Tablets, Softgel, Liquids, Powders, Others), By Nature (Organic, Conventional), By Application (Flavouring, Therapeutic, Others), By Sales Channel (Drug Stores, Health And Beauty Stores, Modern Trade Channels, Direct Selling, Third-Party Online Channels, Company Online Channels) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169555

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

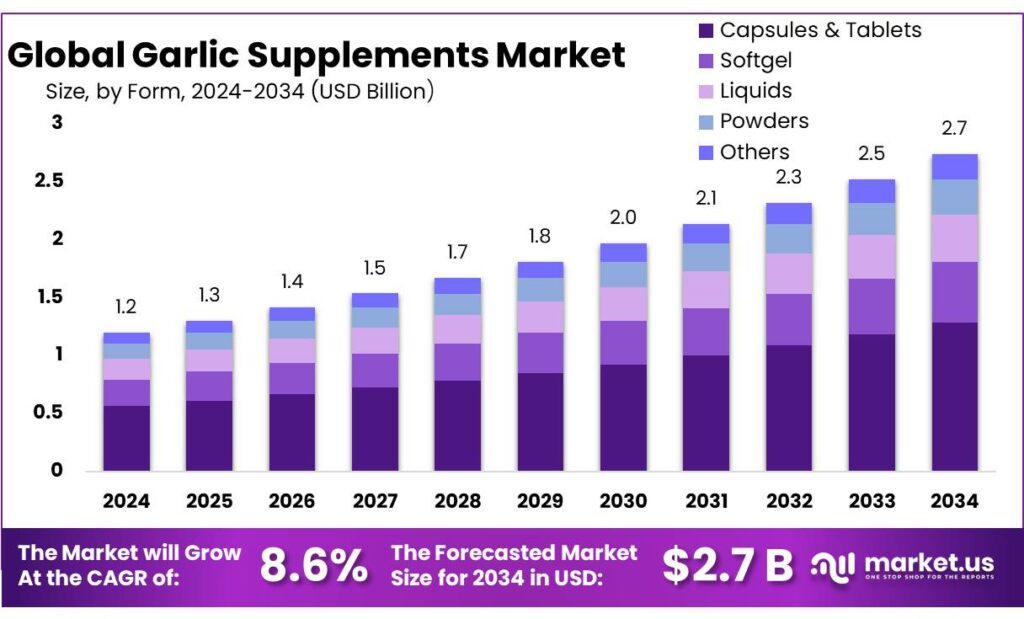

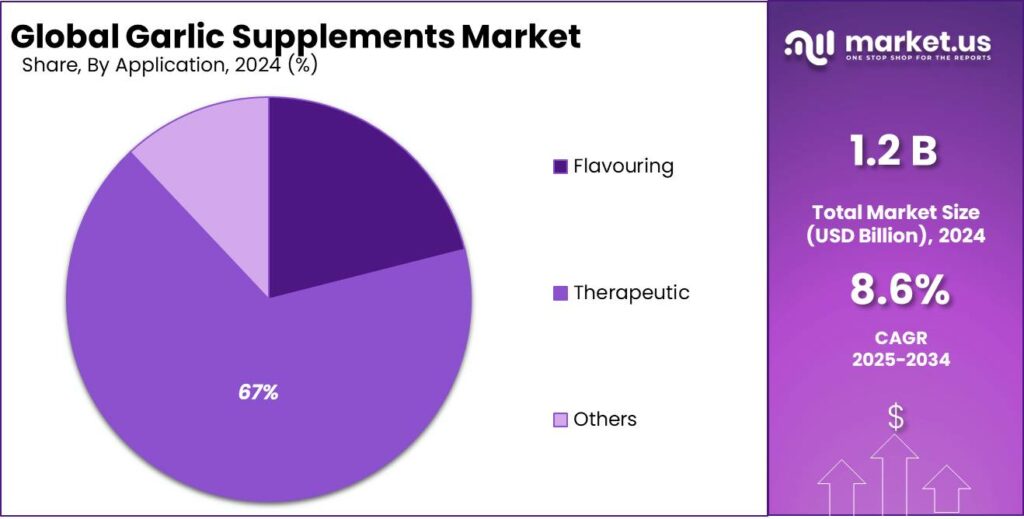

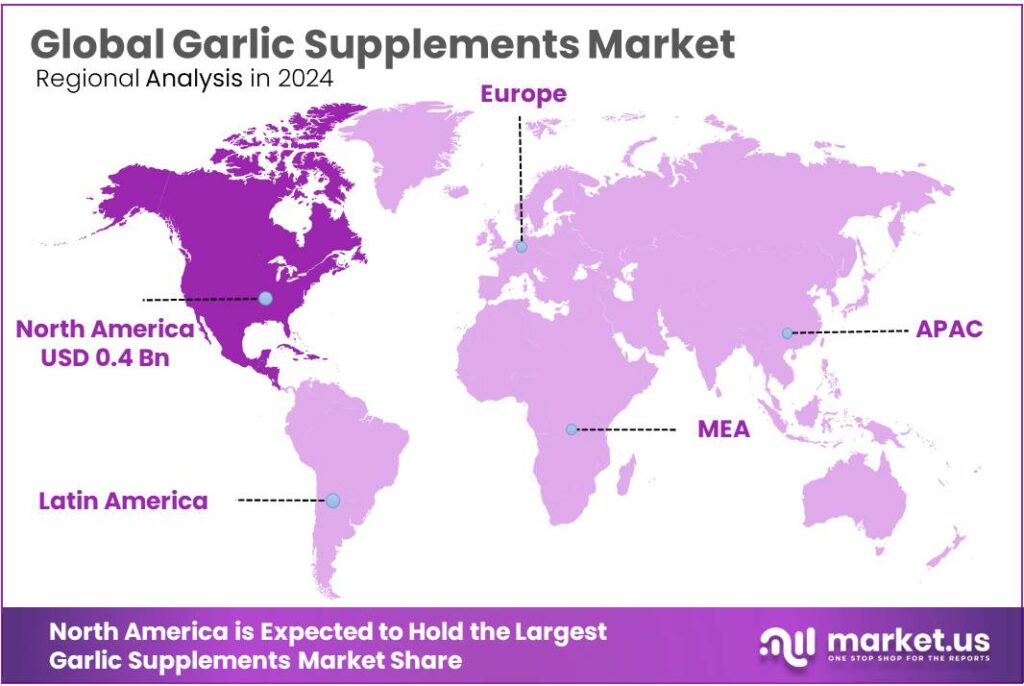

The Global Garlic Supplements Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.60% share, holding USD 0.4 Billion revenue.

Garlic supplements sit at the intersection of traditional herbal medicine and modern cardiovascular prevention. They are typically offered as dehydrated powders, oils, or aged garlic extracts standardized for active sulfur compounds such as allicin. Clinical evidence is now a core industrial growth pillar: a meta-analysis of 12 trials in hypertensive adults found garlic supplements reduced systolic blood pressure by about 8.3 ± 1.9 mmHg and diastolic by 5.5 ± 1.9 mmHg, translating into a 16–40% lower risk of cardiovascular events.

Industrial development is closely tied to the broader dietary supplements ecosystem. In the United States, there are roughly 90,000 dietary supplement products on the market, and between 50–75% of adults use at least one supplement. National survey data show that 52% of American adults take at least one dietary supplement and 31% use multivitamin–multimineral products, while 17.7% report using non-vitamin, non-mineral products such as botanicals, where garlic competes. This broad supplement penetration provides an established retail and online distribution infrastructure that garlic brands can leverage globally.

Demand is structurally underpinned by the global hypertension and cardiovascular disease burden. The World Health Organization estimates that hypertension affects around 1 in 3 adults worldwide and remains a leading cause of stroke and heart disease. A 2024 WHO fact sheet reports about 1.4 billion adults aged 30–79 years living with hypertension, accounting for 33% of that age group, with almost two-thirds residing in low- and middle-income countries. As only a minority of patients achieve blood pressure control, interest in evidence-based adjuncts such as garlic supplements is rising among both consumers and healthcare professionals.

Regulation is another important dimension of the industrial landscape. In the United States, the Dietary Supplement Health and Education Act of 1994 (DSHEA) defines dietary supplements as a food category and requires manufacturers to ensure safety and truthful labelling, while the FDA does not pre-approve products for efficacy before marketing.

In the European Union, Directive 2004/24/EC introduced a simplified registration route for traditional herbal medicinal products, including garlic preparations, provided quality and safety criteria are met. In India, FSSAI’s Nutraceutical Regulations 2016 and updated framework in 2022 formally cover health supplements and nutraceuticals, grouping eight functional food categories and setting composition and labelling rules that apply to garlic-based products.

Key Takeaways

- Garlic Supplements Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 8.6%.

- Cold-chain Storage held a dominant market position, capturing more than a 47.2% share of the garlic supplements market.

- Conventional held a dominant market position, capturing more than a 69.3% share of the garlic supplements market.

- Therapeutic held a dominant market position, capturing more than a 66.8% share of the garlic supplements market.

- Drug Stores held a dominant market position, capturing more than a 31.7% share of the garlic supplements market.

- North America held a dominant position in the garlic supplements market, capturing more than 38.60% of regional share and accounting for approximately USD 0.4 billion.

By Form Analysis

Capsules & Tablets dominate with 47.2% thanks to convenient dosing and wide consumer acceptance.

In 2024, Cold-chain Storage held a dominant market position, capturing more than a 47.2% share of the garlic supplements market by form. This concentration reflected the preference for capsule and tablet formats that provide measured dosing, longer shelf life without specialised handling, and easy incorporation into daily routines; such formats were favoured by retailers and healthcare channels for their labelling clarity and regulatory familiarity.

Manufacturing and packaging practices were aligned to support high-volume capsule and tablet production, and quality controls were emphasised to secure potency and consumer trust. Given consistent consumer demand for convenient, clinically dosed supplements, the capsules and tablets segment was expected to remain the principal form factor into 2025, supported by stable supply chains and continued retailer endorsement.

By Nature Analysis

Conventional leads with 69.3% in 2024 due to wider availability and lower price.

In 2024, Conventional held a dominant market position, capturing more than a 69.3% share of the garlic supplements market by nature. This dominance was supported by well-established cultivation and processing routes, lower raw-material costs versus certified organic alternatives, and broad retail acceptance across pharmacies and mass-market chains. Product sourcing and quality controls were standardised to meet regulatory labelling requirements, which reduced barriers for large manufacturers and private-label suppliers.

Consumer preference for cost-effective supplements and familiar brands further concentrated demand in the conventional segment. Production and distribution practices were therefore aligned to supply high volumes while maintaining shelf stability and potency. The conventional segment is expected to remain the principal revenue driver into 2025 as supply chains and pricing structures continue to favor scale.

By Application Analysis

Therapeutic use leads with 66.8% in 2024 driven by clinical demand and clinician endorsement.

In 2024, Therapeutic held a dominant market position, capturing more than a 66.8% share of the garlic supplements market by application. This concentration was driven by sustained demand from clinical and preventive-health channels where garlic supplements are used for cardiovascular support, immune modulation, and metabolic health; product formulations, standardised dosing and evidence-backed claims were prioritised by manufacturers supplying pharmacies and clinical distributors.

Quality assurance and standardisation of active compounds were emphasised to meet practitioner expectations, while packaging and labelling were aligned to support therapeutic dosing regimens. Manufacturing and distribution practices were therefore optimized for traceability and consistent potency to serve professional channels. Looking into 2025, the therapeutic segment is expected to retain its leading role as healthcare-focused demand and clinical guideline adoption continue to support steady uptake.

By Sales Channel Analysis

Drug Stores lead with 31.7% in 2024 as consumers rely on trusted retail pharmacies.

In 2024, Drug Stores held a dominant market position, capturing more than a 31.7% share of the garlic supplements market by sales channel. This position was supported by strong consumer preference for pharmacy-based purchases where product authenticity, regulated storage conditions, and pharmacist guidance are assured. Steady walk-in traffic and wider availability of standardized garlic formulations further strengthened sales during the year. In 2025, demand through drug stores is expected to remain stable, as the channel continues to benefit from growing interest in preventive health and trusted retail environments.

Key Market Segments

By Form

- Capsules & Tablets

- Softgel

- Liquids

- Powders

- Others

By Nature

- Organic

- Conventional

By Application

- Flavouring

- Therapeutic

- Others

By Sales Channel

- Drug Stores

- Health & Beauty Stores

- Modern Trade Channels

- Direct Selling

- Third-Party Online Channels

- Company Online Channels

Emerging Trends

Shift Toward Odorless, Aged and “Lifestyle-Friendly” Garlic Supplements

One clear new trend in garlic supplements is the move toward products that fit easily into modern life: odorless softgels, aged or fermented garlic, and blends for heart and immune health. Consumers still want the benefits of garlic, but not the strong smell, stomach upset, or social discomfort that can come with high intakes of raw cloves.

Behind this trend is a big health story. The World Health Organization estimates that cardiovascular diseases caused about 19.8 million deaths in 2022, roughly 32% of all global deaths. People hear numbers like this and start looking for simple things they can do every day to support their heart. Garlic already has a long reputation here, so brands are racing to offer friendlier formats: deodorized garlic, aged garlic extract, and black (fermented) garlic capsules.

The agricultural base is strong enough to support this shift. FAO data show that world garlic production reached about 29.1 million tonnes in 2022, with China alone providing around 73% of the total. This steady supply lets manufacturers experiment with more advanced processing—aging, controlled fermentation, standardized extracts—without worrying about raw-material shortages. It also supports regional trends, like India and other Asian producers moving up from bulk bulbs to higher-value health products.

Another important piece of the trend is how common supplement use has become. CDC data show that 57.6% of U.S. adults used at least one dietary supplement in the past 30 days in 2017–2018, and more than 80% of women aged 60 and over took supplements.More recent, industry-backed figures from the Council for Responsible Nutrition suggest this has risen further: its 2024 Consumer Survey reports that 75% of Americans now use supplements, with immune health and energy cited as key reasons for use.

Drivers

Rising Heart Health Concerns Drive Garlic Supplement Demand

One big force behind garlic supplement growth is simple: people are worried about their heart. The World Health Organization estimates that cardiovascular diseases caused about 19.8 million deaths in 2022, roughly 32% of all global deaths. When a condition is that common, consumers naturally look for everyday tools – beyond prescriptions – to feel a bit more in control.

High blood pressure sits at the centre of this story. WHO reports that around 1.4 billion adults aged 30–79 years were living with hypertension in 2024, covering about 33% of people in that age band. Many of them do not know they have it or do not have it under control, which pushes interest in simple lifestyle measures: better diet, exercise, and supportive products like garlic capsules or softgels.

- Governments and global bodies are pushing in the same direction. The World Health Assembly agreed on a target to cut the prevalence of raised blood pressure by 25% by 2025, compared with 2010 levels, as part of the WHO Global Action Plan for noncommunicable diseases. That message – manage salt, weight, and blood pressure early – keeps showing up in national heart-health campaigns and quietly supports demand for “heart friendly” supplements, including garlic.

At the same time, supplement use has become normal for many adults. Data from the U.S. Centers for Disease Control and Prevention show that 57.6% of U.S. adults used at least one dietary supplement in the previous 30 days in 2017–2018, with usage rising sharply in older age groups. More recent work suggests that supplement use among adults has climbed to roughly 58–59%, with about 34–35% of children and adolescents also using some form of supplement. This habit of taking daily pills or softgels makes it very easy for consumers to add garlic to their routine.

Restraints

Safety Concerns and Drug Interactions Limit Garlic Supplement Use

One big restraint for garlic supplements is simple but serious: safety worries, especially around bleeding and drug interactions. The U.S. National Center for Complementary and Integrative Health (NCCIH) clearly warns that garlic supplements may increase the risk of bleeding, particularly when someone is on blood-thinning medicines such as anticoagulants or aspirin, or is about to have surgery. For an older consumer taking several medicines every day, this warning often makes doctors and families cautious about adding garlic capsules on top.

These concerns matter because a large share of heart patients are already on anticoagulants. A major U.S. study of people with atrial fibrillation found that from 2011 to 2020, the proportion of eligible patients receiving oral anticoagulants rose from 56.3% to 64.7%. When more than half of a high-risk group is using blood thinners, any supplement that might raise bleeding risk—even slightly—faces extra scrutiny from cardiologists and surgeons. Many will simply advise their patients to avoid concentrated garlic products and stick to normal food use.

Regulators and clinicians echo this caution. A U.S. Food and Drug Administration (FDA) label for warfarin notes that some botanicals, including garlic, may themselves cause bleeding events and can have anticoagulant or antiplatelet properties, which may be additive to the effect of warfarin. This type of language in official documents filters down into hospital protocols: many surgical teams now ask patients to stop herbal supplements like garlic at least 7–10 days before operations to reduce bleeding risk. Over time, such protocols shape public perception that “garlic pills are not always safe.”

There is also a wider backdrop of concern about supplements in general. A U.S. study funded by the Department of Health and Human Services estimated that around 23,000 emergency department visits every year are linked to adverse events from dietary supplements. These cases involve many product types, not just garlic, but they remind regulators and doctors that “natural” does not mean “risk-free.” When health professionals hear “garlic supplement” they often think first about interactions and bleeding, not benefit.

Opportunity

Natural Preventive Health and Traditional Medicine Create Big Room for Garlic Supplements

One strong growth opportunity for garlic supplements comes from people wanting simple, natural ways to protect their health before they get sick. Chronic illnesses are still huge. The World Health Organization estimates that cardiovascular diseases alone caused about 19.8 million deaths in 2022, roughly 32% of all global deaths. This constant pressure from heart disease keeps demand high for everyday preventive tools, including foods and herbs like garlic.

Garlic already has a long history as both food and medicine. FAO notes that the garlic bulb is widely used in fresh, dried and oil form specifically for medicinal purposes, not just for taste. At the farming level, global garlic production reached about 29.1 million tonnes in 2022, with China alone contributing roughly 73% of output according to FAOSTAT data. This huge and reliable agricultural base makes it easier for industry to develop more value-added garlic supplement formats for global markets.

At the same time, official health bodies acknowledge that garlic supplements do something, even if effects are modest. The U.S. National Center for Complementary and Integrative Health (NCCIH) says garlic supplements can slightly reduce blood pressure in people with hypertension and slightly lower total and LDL cholesterol in those with high cholesterol. This gives companies a scientific hook to design products around heart, metabolic, and immune support, and to talk about benefits in a careful, compliant way.

Another big driver of opportunity is the way people already use supplements. CDC data from NHANES show that 57.6% of U.S. adults used at least one dietary supplement in the past 30 days in 2017–2018, and usage rises to over 80% among women aged 60 and above. An updated analysis covering 2017–March 2020 found that 58.5% of adults reported taking at least one supplement. In simple terms, more than half of adults in a major market already have a “pill habit.” That makes it very easy to add garlic capsules or softgels into daily routines.

Regional Insights

North America leads with 38.60% share, representing USD 0.4 billion in 2024

In 2024, North America held a dominant position in the garlic supplements market, capturing more than 38.60% of regional share and accounting for approximately USD 0.4 billion in revenue. This outcome was supported by well-established nutraceutical supply chains, high consumer awareness of cardiovascular and metabolic health supplements, and concentrated retail penetration through pharmacies and drug stores that provide trusted point-of-sale and professional advice.

Prescription-adjacent distribution channels and sizeable direct-to-consumer e-commerce activity amplified availability, while a favourable regulatory environment for dietary supplements—combined with clear labelling expectations—allowed branded and private-label manufacturers to scale product introductions rapidly. Demand was concentrated in standardized, capsule and tablet formats that facilitate clinical dosing and shelf stability; premium formulations with aged-garlic extracts and standardized allicin content commanded higher average selling prices, supporting value growth despite moderate unit-volume fluctuations.

Supply-side dynamics in 2024 included domestic contract manufacturing capacity and targeted import flows of concentrated extracts, which together helped stabilise lead times and mitigate short-term raw-material tightness. Investment activity during the year focused on quality assurance, stability testing, and marketing to clinician channels, with several firms prioritising evidence generation to support therapeutic claims.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NOW Foods is positioned as a large, vertically integrated supplement manufacturer supplying garlic formulations across retail and professional channels. Production scale and in-house quality control systems support consistent batch testing, standardised potency and competitive pricing for private-label and branded offerings. The company’s broad distribution network and long-standing industry reputation have been used to maintain market access with pharmacies, health stores and e-commerce partners. Operational emphasis has been placed on ingredient traceability and product stability to meet buyer expectations.

Holland & Barrett functions primarily as a retail and own-label platform, offering garlic supplements alongside branded lines; the retailer’s large store network and ecommerce capability support wide market reach. Category management practices—such as curated assortments, staff training and in-store health coaching—have been employed to drive trial and conversion. Supply strategies combine in-house labels and third-party brands to meet diverse price and quality segments, with investments in digital transformation and store experience to sustain sales momentum.

Top Key Players Outlook

- NOW Foods

- Nature’s Bounty Co.

- Wakunaga of America Co. Ltd.

- Solaray Inc.

- Swisse

- Holland & Barrett

- Doppelherz

- GNC

- Blackmores

- Nature’s Bounty

- Healthy Care

Recent Industry Developments

In 2024 Solaray’s profile showed estimated revenue of about USD 29 million and an employee base near 800, reflecting a mid-sized specialist firm with sustained retail reach.

In 2024 NOW Foods revenue in the range of USD 344.4 million (market-data estimate) to USD 800.0 million (industry-report aggregate, including affiliated divisions), while employee count was reported at approximately 900 staff, underscoring a mid-to-large producer profile in the supplement sector.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.7 Bn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Capsules And Tablets, Softgel, Liquids, Powders, Others), By Nature (Organic, Conventional), By Application (Flavouring, Therapeutic, Others), By Sales Channel (Drug Stores, Health And Beauty Stores, Modern Trade Channels, Direct Selling, Third-Party Online Channels, Company Online Channels Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NOW Foods, Nature’s Bounty Co., Wakunaga of America Co. Ltd., Solaray Inc., Swisse, Holland & Barrett, Doppelherz, GNC, Blackmores, Nature’s Bounty, Healthy Care Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NOW Foods

- Nature's Bounty Co.

- Wakunaga of America Co. Ltd.

- Solaray Inc.

- Swisse

- Holland & Barrett

- Doppelherz

- GNC

- Blackmores

- Nature's Bounty

- Healthy Care