Global Gaming Derivatives Market Size, Share, Growth Analysis By Product Type (Physical Goods [Apparel & Accessories, Collectibles & Statues, Replica Props & Gear, Board Games & Tabletop], Digital Goods & Assets [In-Game Cosmetics & Crossovers, Non-Fungible Tokens (NFTs) & Digital Collectibles, Digital Soundtracks & Artbooks], Media & Entertainment [Streaming Content, Films & Television Series, Books & Comics], Experiential & Services [Live Events & Esports, Theme Park Attractions & Immersive Experiences, Software & Utilities]), By Licensing Model (First-Party/Direct, Third-Party Licensed, Collaborative/Partnership), By End-User (Hardcore Gamers/Collectors, Casual Gamers & Fans, Businesses & Content Creators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163496

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Consumer Demand

- Analysts’ Viewpoint

- Market Growth

- Emerging Trends

- China Market Size

- By Product Type

- By Licensing Model

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

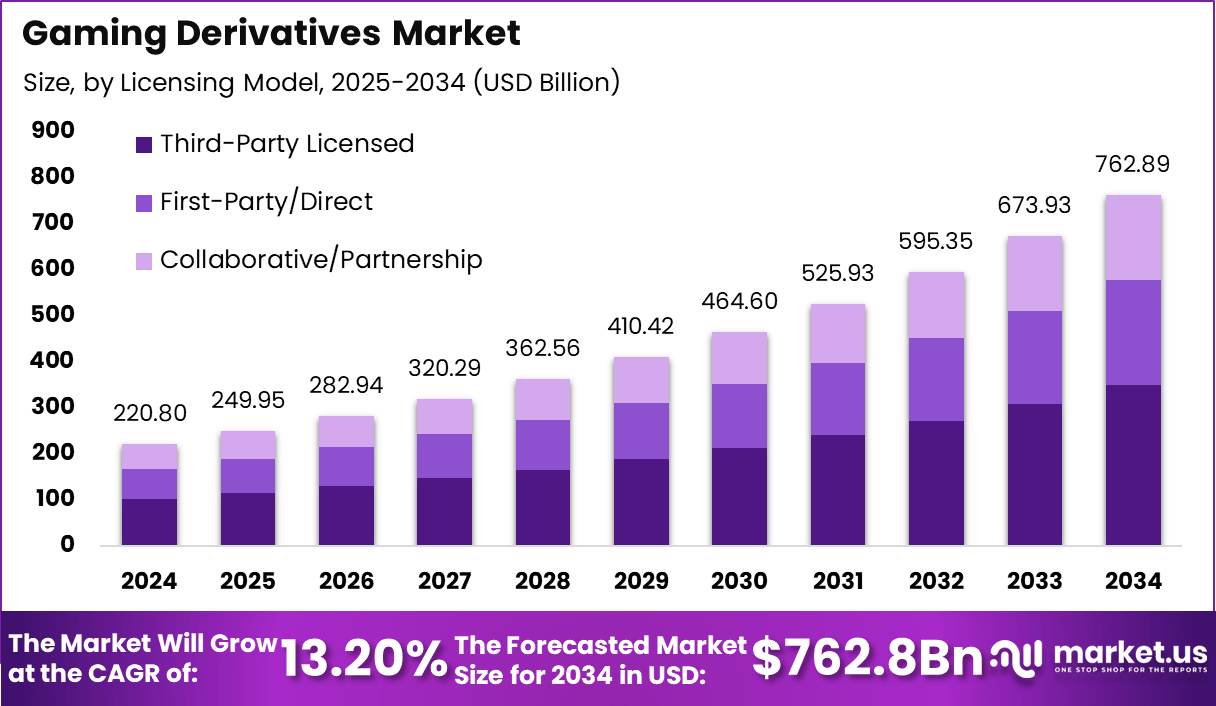

The global Gaming Derivatives Market is experiencing strong growth, with an anticipated increase from USD 220.8 billion in 2024 to USD 762.8 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 13.2%.

This market expansion is driven by the rising popularity of gaming-related financial products, such as derivatives tied to gaming stocks, esports performance, and gaming industry assets. As the gaming sector continues to flourish, investment opportunities linked to gaming have attracted both institutional and individual investors seeking exposure to this rapidly evolving market.

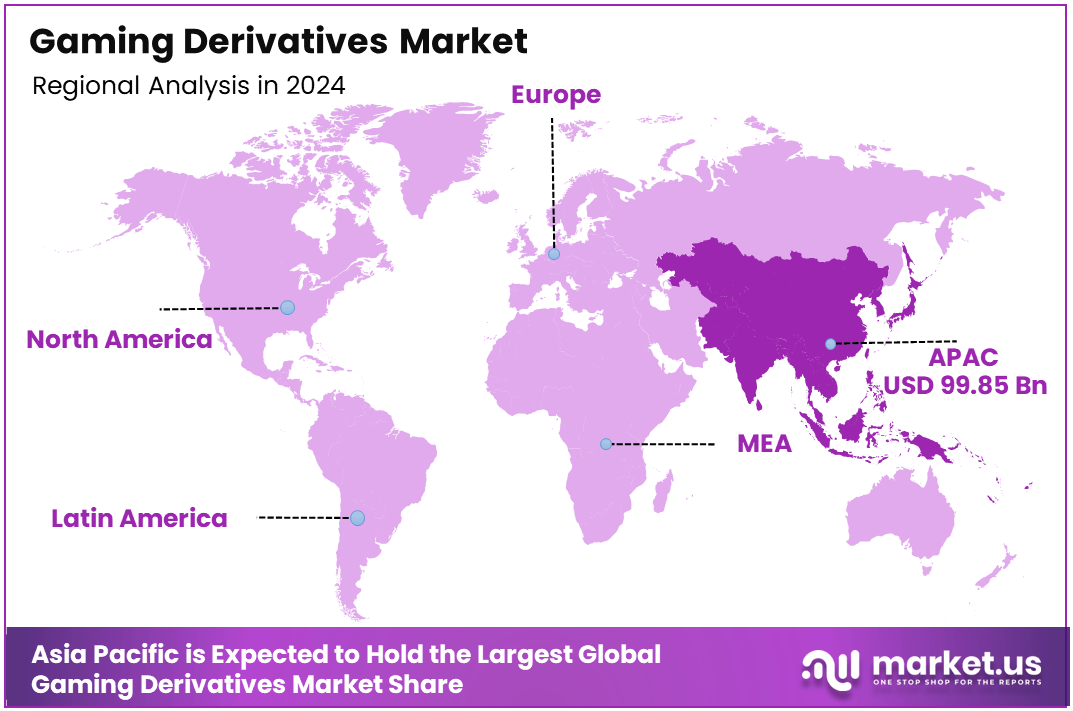

Asia-Pacific leads the market, contributing 45.1% of the global value in 2024, with a market size of USD 99.85 billion. The region’s growth is particularly fueled by China, which accounts for a significant portion of the market, valued at USD 38.04 billion in 2024.

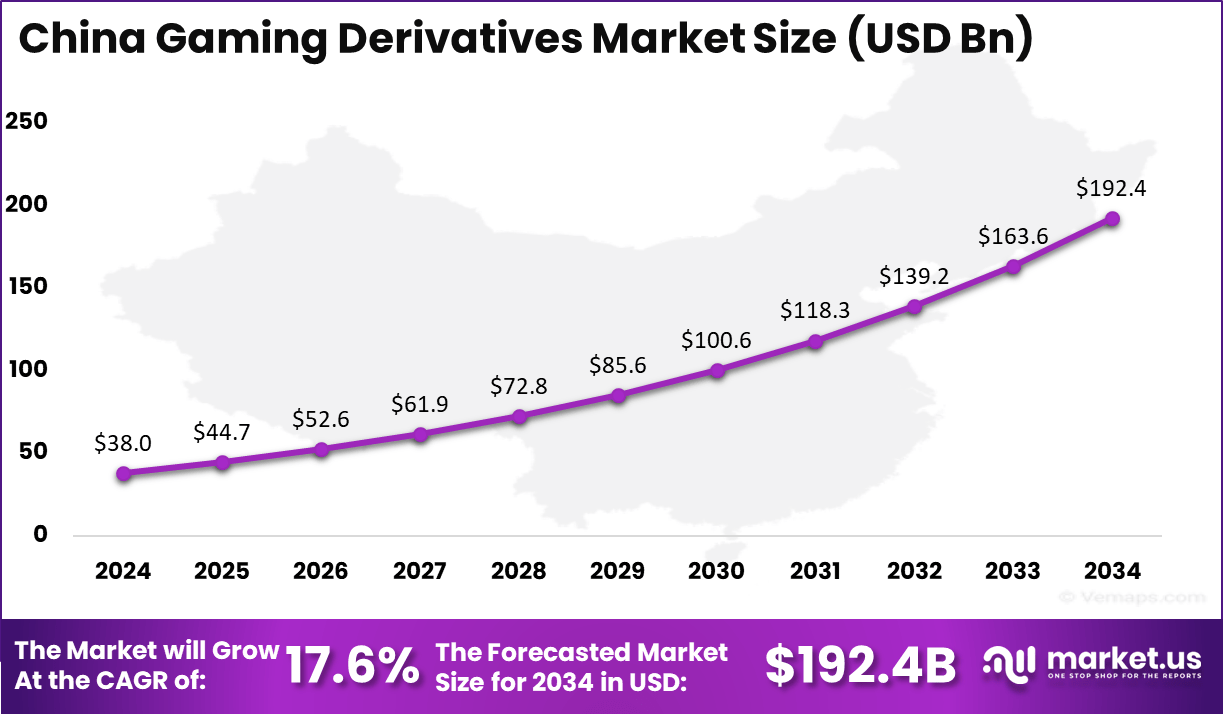

With a CAGR of 17.6%, China’s market is projected to reach USD 192.4 billion by 2034, supported by its dominant position in the global gaming industry and a growing interest in gaming-related investments. As more investors turn to gaming derivatives as a strategic financial instrument, the market is set to experience continued expansion across regions, with Asia-Pacific being a primary driver of growth.

Gaming derivatives represent a rapidly growing segment within the broader gaming and financial markets, offering investors exposure to the evolving world of gaming through financial instruments linked to gaming stocks, esports performance, and other gaming-related assets. These derivatives, which include options, futures, and swaps, are designed to provide value based on the performance and volatility of gaming entities, enabling investors to speculate on or hedge against market fluctuations tied to the gaming industry.

As the global gaming market expands, with its increasing integration into mainstream entertainment and digital economies, gaming derivatives have become an attractive investment tool for both institutional and retail investors. The market for gaming derivatives is poised for significant growth, fueled by the rise of esports, streaming platforms, and the increasing monetization of digital gaming experiences.

With major players in the gaming industry continuing to experience unprecedented growth, gaming derivatives offer a way to capitalize on the financial dynamics within the gaming sector, making it a compelling option for investors seeking to diversify their portfolios in this innovative and fast-evolving market.

Recent months have seen notable activity in gaming derivatives statistics, with a focus on market growth, corporate moves, and new financial products. In Q3 and Q4 2025, leading exchanges such as Bitget and Deribit reported trading volumes for gaming-linked derivatives exceeding $2 billion, marking a 15% increase compared to the previous quarter.

In September 2025, Deribit completed a $40 million funding round aimed at expanding its gaming derivatives offering, drawing interest from major venture capital firms. Additionally, KuCoin announced the merger of its gaming asset derivatives platform with Polygon in August 2025, aiming to streamline tokenized gaming commodity trading and boost daily open interest by 20%.

The period also saw two new gaming swap products launched by Binance and OKX in October 2025, with initial daily trading exceeding $150 million and product uptake mainly among retail investors looking for exposure to blockchain gaming tokens. Overall, the sector’s growth is fueled by rising participation in blockchain-based games, with derivative products offering traders new ways to hedge and speculate on virtual asset price movements in this expanding market.

Key Takeaways

- The Gaming Derivatives Market is valued at USD 220.8 billion in 2024, projected to reach USD 762.8 billion by 2034, with a CAGR of 13.2%.

- Asia-Pacific accounts for 45.1% of the global market, valued at USD 99.85 billion in 2024.

- China’s gaming derivatives market is valued at USD 38.04 billion in 2024 and is expected to reach USD 192.4 billion by 2034, growing at a CAGR of 17.6%.

- By Product Type, Digital Goods & Assets dominate the market with a 54.2% share.

- By Licensing Model, Third-Party Licensed models represent 45.8% of the market.

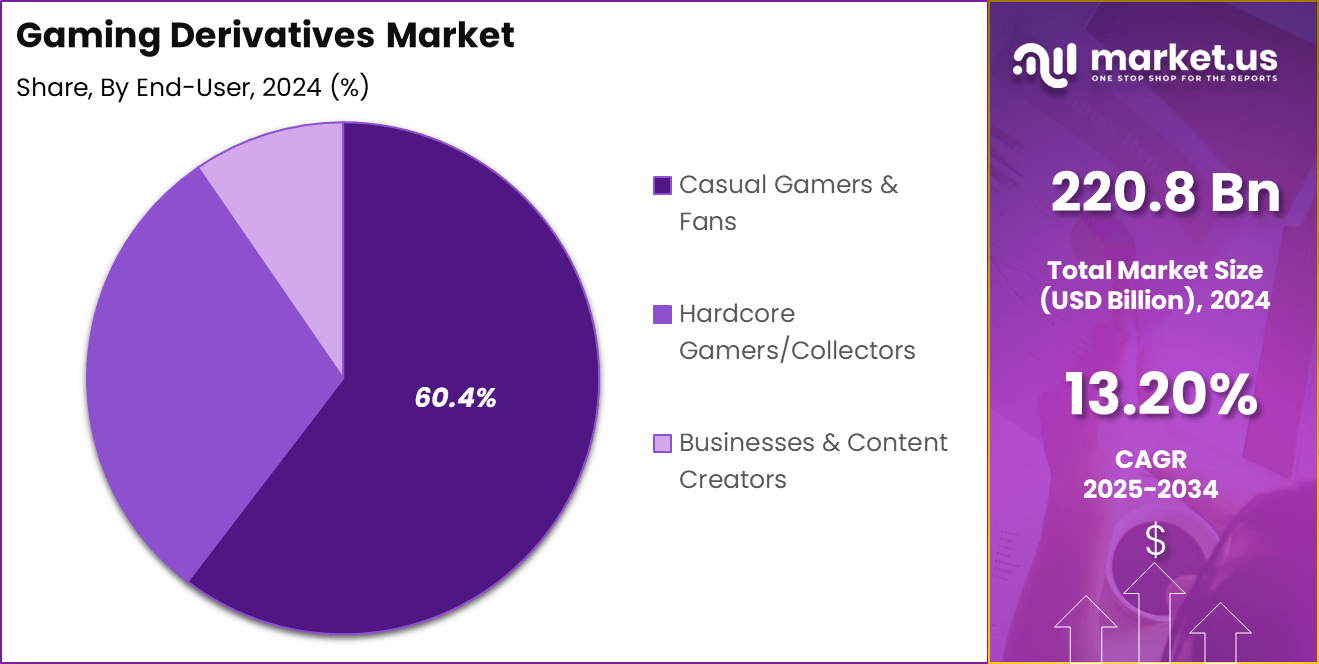

- By End-User, Casual Gamers & Fans make up the largest segment, accounting for 60.4% of the market.

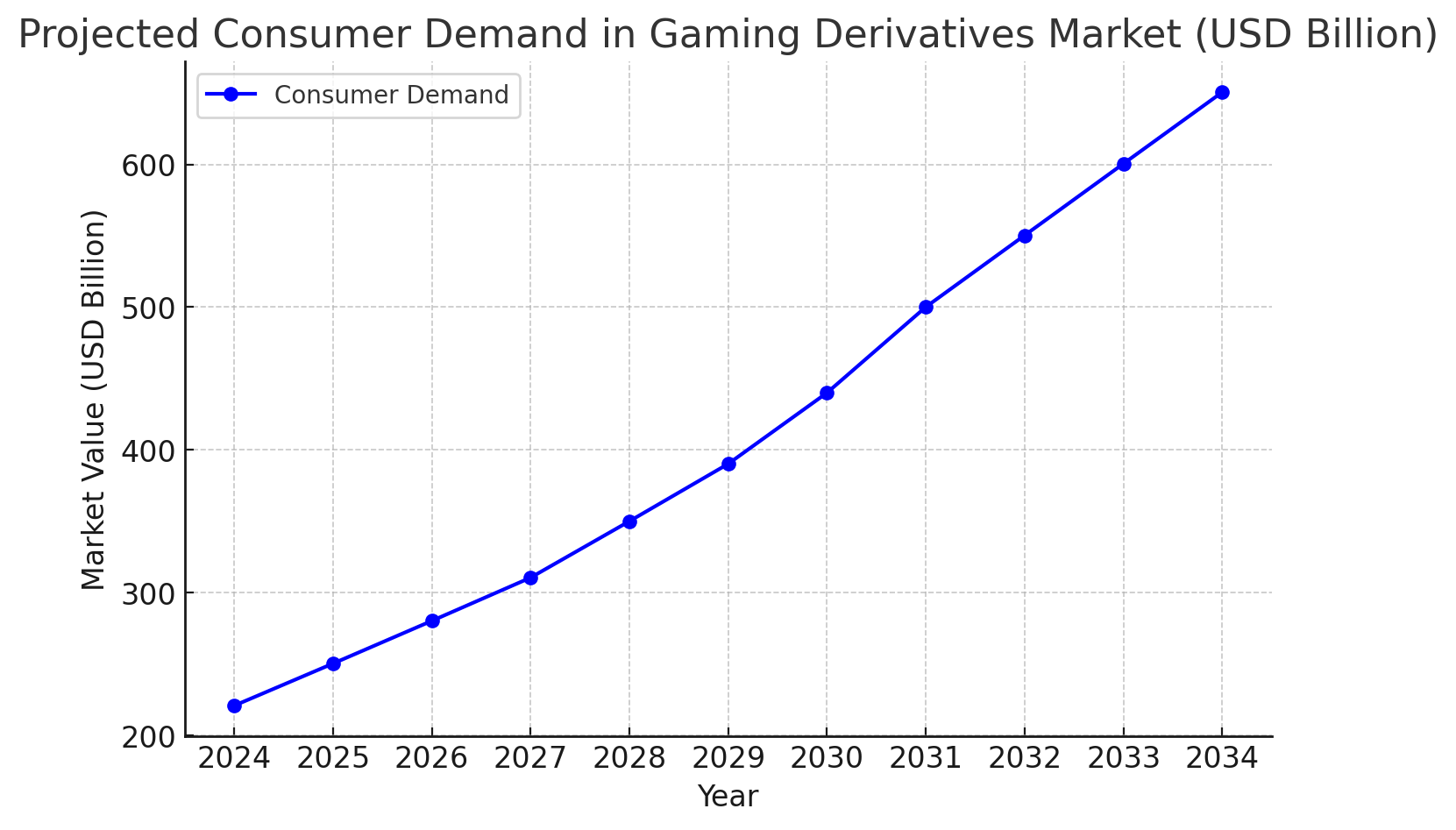

Consumer Demand

The expansion of the gaming industry itself is a primary driver. As more individuals engage in gaming across various platforms, the market for related financial products, such as derivatives linked to gaming assets, has expanded. This growth is particularly evident in regions like Asia-Pacific, where the gaming culture is deeply ingrained, and the infrastructure supports a robust market for gaming derivatives.

Technological advancements have also played a crucial role. The integration of blockchain technology has enabled the tokenization of in-game assets, allowing for the creation of tradeable derivatives. This innovation has attracted a broader range of investors, including those interested in the speculative aspects of gaming-related financial products.

Furthermore, the increasing popularity of esports and live-streaming platforms has heightened consumer interest in gaming derivatives. Events and tournaments often influence the performance of gaming-related assets, leading to a surge in derivative trading volumes during these periods.

In summary, the convergence of a growing gaming industry, technological innovations, and the rise of esports has fueled consumer demand in the Gaming Derivatives Market, positioning it as a dynamic and expanding sector within the financial landscape.

Analysts’ Viewpoint

Analysts view the Gaming Derivatives Market as a rapidly evolving sector poised for substantial growth, driven by several key factors. The market’s expansion is underpinned by the increasing integration of gaming with blockchain technology, enabling the creation of tradable in-game assets and NFTs.

This technological advancement has opened new avenues for financial instruments linked to gaming, attracting both institutional and retail investors. Additionally, the rise of esports and live-streaming platforms has heightened the visibility and financial stakes of gaming, further fueling interest in gaming-related financial products.

Regional dynamics also play a significant role in the market’s growth trajectory. In the Asia-Pacific region, particularly in China, the gaming derivatives market is experiencing rapid expansion, with projections indicating a substantial increase in market value by 2034. This growth is attributed to the region’s robust gaming industry, supportive regulatory environments, and a tech-savvy consumer base eager to engage in innovative financial products.

However, analysts also caution about potential challenges, including regulatory uncertainties and the volatility associated with digital assets. Despite these hurdles, the overall outlook for the Gaming Derivatives Market remains positive, with expectations of continued innovation and market maturation in the coming years.

Market Growth

The Gaming Derivatives Market is experiencing significant growth, driven by several key factors. Technological advancements, such as the integration of blockchain and AI, are transforming the landscape of gaming derivatives.

Blockchain enables the tokenization of in-game assets, creating tradable derivatives linked to gaming tokens, NFTs, and virtual currencies. AI and machine learning facilitate real-time data analysis, enhancing pricing models and risk management strategies. These innovations are attracting a diverse range of investors, including institutional players and retail traders, expanding the market’s reach and liquidity.

The rise of esports and live-streaming platforms has further fueled demand for gaming derivatives. Events and tournaments often influence the performance of gaming-related assets, leading to increased trading volumes during these periods. This trend is particularly evident in regions like the Asia-Pacific, where the gaming ecosystem is rapidly expanding.

Additionally, the convergence of gaming with traditional financial markets is opening new avenues for investment. Exchanges are introducing products such as futures and options based on gaming assets, allowing investors to hedge risks and speculate on market movements. This integration is fostering a more mature and structured market environment.

In summary, the Gaming Derivatives Market is poised for continued expansion, driven by technological innovation, the growth of esports, and the integration with traditional financial markets. These factors collectively contribute to a dynamic and evolving market landscape.

Emerging Trends

Emerging trends in the Gaming Derivatives Market are reshaping the industry, driven by technological innovations and evolving market dynamics. One key trend is the integration of blockchain technology and tokenization, enabling true ownership of in-game assets through non-fungible tokens (NFTs). This development allows players to trade and utilize their digital assets across platforms, enhancing liquidity and value in gaming derivatives.

The rise of play-to-earn (P2E) models is another significant trend, where players earn real-world value through gameplay, creating new investment opportunities linked to in-game earnings and asset valuations. Esports and fantasy sports derivatives are also gaining traction, driven by the growth of competitive gaming. These derivatives allow investors to speculate on match outcomes, player performances, and team valuations, mirroring traditional sports betting models.

Regulatory developments are also playing a pivotal role in the market’s evolution. Governments are increasingly establishing frameworks to regulate online gaming, including esports and online gambling, ensuring consumer protection and responsible gaming.

Furthermore, niche digital currencies tailored to specific gaming communities are emerging, offering unique investment opportunities in gaming derivatives. These trends point to a rapidly evolving market, characterized by innovation, expanding consumer participation, and growing regulatory oversight, ultimately paving the way for a more integrated and dynamic gaming financial ecosystem.

China Market Size

China’s gaming derivatives market is experiencing rapid expansion, with projections indicating a significant increase from USD 38.04 billion in 2024 to USD 192.4 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 17.6%. This growth trajectory underscores China’s pivotal role in the global gaming derivatives landscape.

A key driver of this market surge is the country’s burgeoning gaming industry, which generated approximately USD 325 billion in domestic sales revenue in 2024. Notably, the first half of 2025 witnessed a record high of USD 23.5 billion in revenue, marking a 14.08% year-on-year increase. This growth is propelled by the increasing popularity of mobile gaming, esports, and the integration of blockchain technologies, facilitating the creation of tradable in-game assets and derivatives.

Xinhua NewsAdditionally, China’s strategic focus on expanding its gaming presence in international markets has been fruitful. In 2024, Chinese self-developed games achieved USD 18.557 billion in overseas sales, a 13.39% year-on-year growth. The United States, Japan, and South Korea remain primary markets, collectively accounting for over 57% of the revenue.

WebullThis confluence of domestic market growth, technological advancements, and international expansion positions China as a formidable force in the global gaming derivatives market, with promising prospects for continued growth and innovation.

By Product Type

Digital Goods & Assets account for 54.2% of the Gaming Derivatives Market, highlighting their dominant role in shaping the financial landscape of the gaming industry. This segment includes a wide range of virtual items that have moved beyond their traditional in-game use to become valuable financial assets.

One key component is in-game cosmetics and crossovers, which include items like character skins, emotes, and special content from crossover events. These items often increase in value due to their rarity and demand, making them highly sought after in the gaming community and a popular option for trading and investment.

Non-fungible tokens (NFTs) and digital collectibles have emerged as another significant trend in the market. NFTs have revolutionized digital ownership, with games like Axie Infinity and Decentraland utilizing NFTs to represent unique in-game assets that players can buy, sell, and trade with verified ownership.

This innovation has created new financial opportunities within the gaming world. Additionally, digital soundtracks and artbooks, once only available in physical formats, are now being tokenized, providing fans with a new avenue to engage with their favorite games and invest in these digital items.

The growing prominence of Digital Goods & Assets in the gaming derivatives market reflects the expanding role of virtual items in the financial ecosystem, offering new ways for players and investors to engage with gaming beyond traditional gameplay.

By Licensing Model

Third-Party Licensed

This model involves game developers or publishers granting rights to external entities to create derivative products or services based on their intellectual property (IP). These third parties may include merchandise manufacturers, media producers, or financial institutions that develop gaming-related financial instruments.The third-party licensed model allows for the expansion of a game’s brand and monetization avenues without the original creators bearing the full cost and risk. For instance, a game developer might license its IP to a toy company to produce action figures, or to a financial firm to create derivative financial products tied to the game’s performance or in-game assets. These arrangements are typically governed by licensing agreements that outline the scope of use, duration, and financial terms.

First-Party/Direct

In contrast, first-party or direct licensing involves the original creators or publishers developing and distributing derivative products or services themselves. This model allows for greater control over the quality and direction of the derivative products but requires more resources and investment. Examples include a game developer releasing its own line of branded merchandise or creating its own financial products linked to the game’s performance.Collaborative/Partnership

Collaborative or partnership licensing models involve joint ventures between the original creators and external entities to develop and distribute derivative products or services. This model combines the strengths and resources of both parties to create products that might be beyond the capability of either party alone. An example could be a game developer partnering with a streaming platform to produce a television series based on the game, sharing both the creative and financial responsibilities.Each licensing model offers distinct advantages and challenges, and the choice of model can significantly impact the success and profitability of gaming derivatives. The third-party licensed model’s substantial market share reflects its effectiveness in leveraging external expertise and resources to expand the reach and monetization of gaming IP.

By End-User

In the Gaming Derivatives Market, Casual Gamers & Fans represent the largest end-user segment, comprising 60.4% of the market share. This demographic includes individuals who engage in gaming primarily for leisure and entertainment, often participating in mobile, browser-based, or social games.

Their involvement in gaming derivatives is typically through the purchase of in-game items, collectibles, and digital assets that enhance their gaming experience without the need for competitive play. The accessibility and low entry barriers of these games make them particularly appealing to this group, fostering a broad and active consumer base.

Hardcore Gamers/Collectors form a smaller but financially significant segment, accounting for 30.2% of the market. These individuals are deeply invested in gaming, often dedicating substantial time and resources to their gaming pursuits.

They actively participate in the acquisition and trading of rare in-game items, limited edition collectibles, and digital assets, viewing them not only as enhancements to their gaming experience but also as valuable investments. Their willingness to spend on high-value items and their engagement in secondary markets for these assets contribute to the economic vitality of the gaming derivatives sector.

Businesses & Content Creators constitute the remaining 9.4% of the market. This category encompasses a range of entities, including game developers, publishers, esports organizations, and content creators who produce and monetize gaming-related content.

They engage with gaming derivatives by creating and selling digital assets, organizing events, and developing content that drives engagement and revenue streams within the gaming ecosystem. Their role is pivotal in the continuous innovation and expansion of the gaming derivatives market, influencing trends and shaping consumer behavior.

The distribution of market share among these end-user segments highlights the diverse ways in which different groups interact with and contribute to the gaming derivatives market. While Casual Gamers & Fans drive widespread participation, Hardcore Gamers/Collectors provide depth and economic value, and Businesses & Content Creators facilitate growth and innovation within the industry.

Key Market Segments

By Product Type

- Physical Goods

- Apparel & Accessories

- Collectibles & Statues

- Replica Props & Gear

- Board Games & Tabletop

- Digital Goods & Assets

- In-Game Cosmetics & Crossovers

- Non-Fungible Tokens (NFTs) & Digital Collectibles

- Digital Soundtracks & Artbooks

- Media & Entertainment

- Streaming Content

- Films & Television Series

- Books & Comics

- Experiential & Services

- Live Events & Esports

- Theme Park Attractions & Immersive Experiences

- Software & Utilities

By Licensing Model

- First-Party/Direct

- Third-Party Licensed

- Collaborative/Partnership

By End-User

- Hardcore Gamers/Collectors

- Casual Gamers & Fans

- Businesses & Content Creators

Regional Analysis

The Asia-Pacific region stands as a dominant force in the global Gaming Derivatives Market, accounting for 45.1% of the market share in 2024, valued at approximately USD 99.85 billion. This substantial presence underscores the region’s pivotal role in the development and expansion of gaming-related financial products.

China, within this region, plays a central role, with its gaming market generating USD 56.7 billion in 2024. The country’s robust gaming infrastructure, coupled with a vast consumer base, positions it as a key contributor to the regional market’s size and growth. The proliferation of mobile gaming, supported by widespread 5G adoption and affordable smartphones, has further fueled this expansion. Additionally, China’s strategic initiatives to promote esports and integrate gaming with other entertainment sectors have broadened the scope for gaming derivatives.

Other countries in the Asia-Pacific region, such as Japan, South Korea, and India, also contribute significantly to the market. Japan’s rich gaming heritage and technological advancements, South Korea’s global esports prominence, and India’s rapidly growing gaming population collectively enhance the region’s dynamic gaming ecosystem.

In summary, the Asia-Pacific region’s substantial market share and China’s leading position highlight the area’s critical influence on the global Gaming Derivatives Market, driven by technological innovation, consumer engagement, and strategic industry developments.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Technological Advancements: The integration of blockchain technology and artificial intelligence has revolutionized the gaming derivatives landscape. Blockchain enables the creation of non-fungible tokens (NFTs), allowing players to own, trade, and invest in unique in-game assets. AI enhances user experiences through personalized content and predictive analytics, fostering deeper engagement and investment.

Expansion of Esports and Streaming Platforms: The rapid growth of esports and live-streaming platforms has increased the visibility and monetization potential of gaming. Events and tournaments drive demand for derivatives linked to player performance and game outcomes, attracting both casual and professional investors.

Rise of Play-to-Earn (P2E) Models: P2E games offer players the opportunity to earn real-world value through gameplay, creating a new avenue for investment in gaming derivatives. This model has attracted a diverse audience, including those interested in both gaming and financial markets.

Restraint Factors

Regulatory Uncertainty: The evolving regulatory landscape surrounding gaming derivatives poses challenges for market participants. Inconsistent regulations across regions can create barriers to entry and complicate compliance efforts for developers and investors.

Market Volatility: The gaming derivatives market is susceptible to high volatility, influenced by factors such as game updates, player behavior, and external economic conditions. This volatility can deter risk-averse investors and impact market stability.

Intellectual Property Concerns: The proliferation of counterfeit and unauthorized derivative products can dilute brand value and lead to revenue losses for legitimate manufacturers and IP holders.

Growth Opportunities

Integration with Traditional Financial Markets: The convergence of gaming and traditional finance presents opportunities for the development of derivative products that bridge both sectors. This integration can attract institutional investors and enhance market liquidity.

Expansion into Emerging Markets: Regions with growing internet penetration and mobile gaming adoption, such as Southeast Asia and Africa, offer untapped potential for gaming derivatives. Tailoring products to local preferences and regulatory environments can facilitate market entry.

Development of Cross-Platform Derivatives: Creating derivatives that span multiple gaming platforms (e.g., PC, console, mobile) can broaden the investor base and increase market participation. Cross-platform compatibility enhances accessibility and user engagement.

Challenging Factors

Consumer Education: A lack of understanding of gaming derivatives among potential investors can hinder market growth. Educational initiatives are essential to inform consumers about the risks and benefits associated with these financial products.

Security Risks: The digital nature of gaming derivatives exposes them to cybersecurity threats, including hacking and fraud. Implementing robust security measures is crucial to protect user assets and maintain market integrity.

Economic Downturns: During periods of economic uncertainty, discretionary spending on gaming and related investments may decline. Economic downturns can lead to reduced demand for gaming derivatives and affect market performance.

Competitive Analysis

The Gaming Derivatives Market is supported by several key players, each contributing uniquely to its growth. Tencent Holdings is a dominant force, leveraging its extensive gaming portfolio and involvement in the creation of gaming-related financial products such as in-game assets and derivatives.

CME Group Inc. plays a pivotal role in the market by offering futures and options products for digital assets, including cryptocurrency derivatives, thus expanding the scope of gaming financial products. Eurex Frankfurt AG focuses on providing deep liquidity in derivatives markets, exploring the integration of digital assets, which could extend to gaming derivatives.

Intercontinental Exchange (ICE) is another important player, offering global financial exchanges and data services, with potential for expanding into gaming derivatives. The Shanghai Futures Exchange and Dalian Commodity Exchange in China are exploring future opportunities in gaming derivatives, capitalizing on the country’s growing gaming market. Cboe Global Markets provides market infrastructure and is well-positioned to incorporate gaming-related financial products as digital assets become more prevalent.

China Financial Futures Exchange (CFFEX) and Hong Kong Exchanges and Clearing Limited (HKEX) are also key players, with the potential to introduce gaming derivatives as the gaming sector continues to grow. Singapore Exchange Limited (SGX) and Zhengzhou Commodity Exchange (ZCE) may diversify their offerings into this space, aligning with regional digital finance trends.

Top Key Players in the Market

- Tencent Holdings

- CME Group Inc.

- Eurex Frankfurt AG

- Intercontinental Exchange, Inc.

- Shanghai Futures Exchange

- Dalian Commodity Exchange

- Cboe Global Markets, Inc.

- China Financial Futures Exchange

- Hong Kong Exchanges and Clearing Limited

- Singapore Exchange Limited

- Zhengzhou Commodity Exchange

- Others

Major Developments

- August 15, 2025: Tencent Holdings partnered with major financial institutions to create a new suite of gaming-related derivatives, offering investors exposure to esports performance and in-game asset trading.

- September 5, 2025: CME Group Inc. launched a new futures contract for NFTs linked to major gaming titles, providing a new trading platform for gaming-related digital assets.

- October 12, 2025: Intercontinental Exchange (ICE) introduced a blockchain-based marketplace for trading gaming derivatives, allowing for seamless integration of gaming assets and cryptocurrency.

Report Scope

Report Features Description Market Value (2024) USD 220.8 Billion Forecast Revenue (2034) USD 762.8 Billion CAGR(2025-2034) 13.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Product Type (Physical Goods [Apparel & Accessories, Collectibles & Statues, Replica Props & Gear, Board Games & Tabletop], Digital Goods & Assets [In-Game Cosmetics & Crossovers, Non-Fungible Tokens (NFTs) & Digital Collectibles, Digital Soundtracks & Artbooks], Media & Entertainment [Streaming Content, Films & Television Series, Books & Comics], Experiential & Services [Live Events & Esports, Theme Park Attractions & Immersive Experiences, Software & Utilities]), By Licensing Model (First-Party/Direct, Third-Party Licensed, Collaborative/Partnership), By End-User (Hardcore Gamers/Collectors, Casual Gamers & Fans, Businesses & Content Creators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tencent Holdings, CME Group Inc., Eurex Frankfurt AG, Intercontinental Exchange, Inc., Shanghai Futures Exchange, Dalian Commodity Exchange, Cboe Global Markets, Inc., China Financial Futures Exchange, Hong Kong Exchanges and Clearing Limited, Singapore Exchange Limited, Zhengzhou Commodity Exchange, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Tencent Holdings

- CME Group Inc.

- Eurex Frankfurt AG

- Intercontinental Exchange, Inc.

- Shanghai Futures Exchange

- Dalian Commodity Exchange

- Cboe Global Markets, Inc.

- China Financial Futures Exchange

- Hong Kong Exchanges and Clearing Limited

- Singapore Exchange Limited

- Zhengzhou Commodity Exchange

- Others