Global Gaming Console Market By Product (Nintendo, PlayStation, Xbox, Others), By Application (Gaming, Non-gaming), By Distribution Channel (Online Distribution Channel, Offline Distribution Channel), By Type (Home Video Game Console, Handheld Game Console (Portable, Non-Portable), Hybrid Video Game Console, Plug and Play/Retro Console), By Component (Console Unit, Controller (Paddle, Joystick, Gamepad), Game Media (Game Cartridge, Optical Media, Digital Distribution, Cloud Gaming), External Storage), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 15157

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

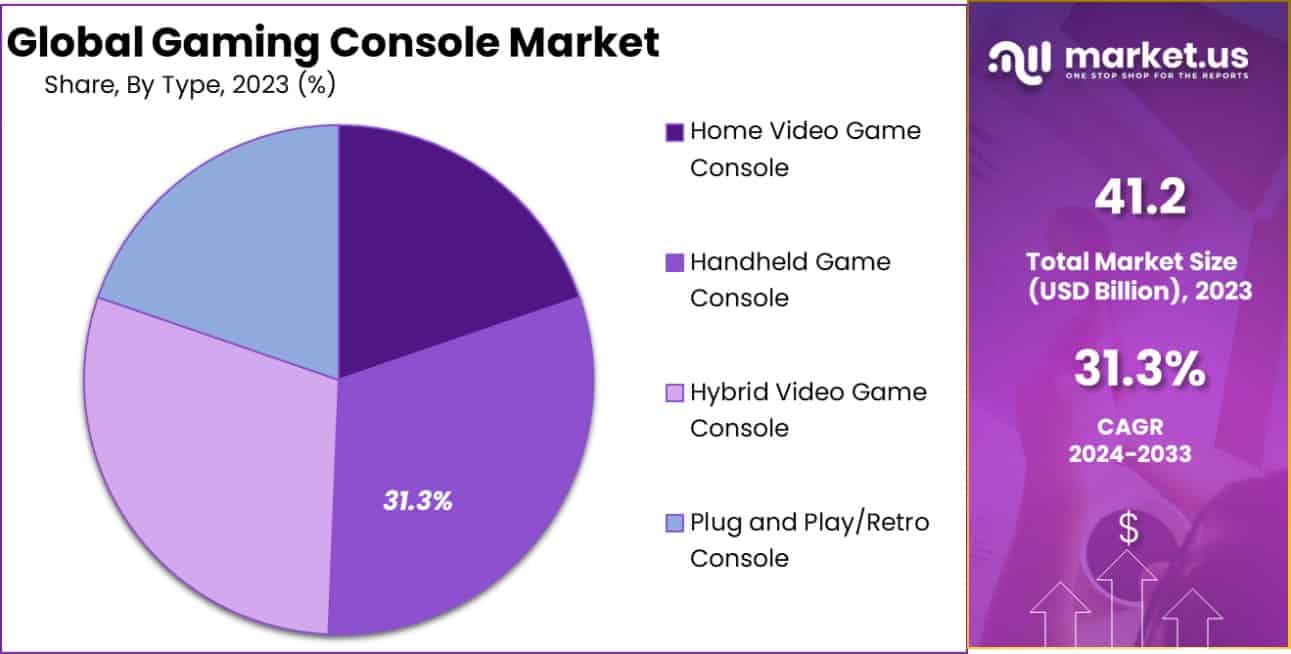

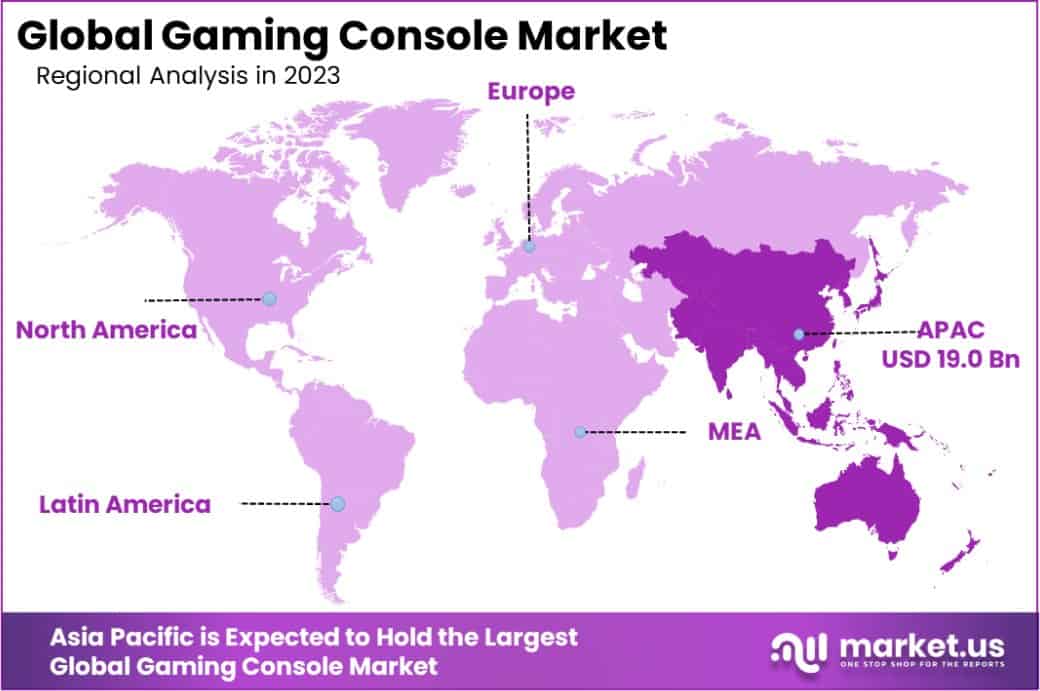

The Global Gaming Console Market size is expected to be worth around USD 69.7 Billion by 2033, from USD 41.2 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033. Asia Pacific dominated a 46.2% market share in 2023 and held USD 19.0 Billion revenue of the Gaming Console Market.

A gaming console is a specialized computer system specifically designed for playing video games, offering gameplay through user-friendly interfaces, typically connecting to a television or other display for video and audio output.

The gaming console market refers to the industry involved in the development, manufacturing, and sale of these gaming systems. It tracks the sales of consoles, the games for these platforms, and the growth trends related to consumer demand and technology advancements.

Advances in technology, such as enhanced graphics and faster processors, continually improve the gaming experience, attracting a broader audience. Integration with other entertainment systems and virtual reality capabilities further stimulates market growth.

The surge in demand for home entertainment solutions, especially during periods like the pandemic lockdowns, significantly boosted gaming console sales. Ongoing innovations and game releases keep consumer interest high.

The market sees significant opportunities in cloud gaming, reducing the need for expensive hardware and allowing games to be streamed directly to consoles. Expansion into emerging markets with rising disposable incomes also presents substantial growth potential.

The gaming console market is currently navigating a dynamic landscape, characterized by significant energy consumption and a predominant market leader. In the United States, gamers’ consoles are responsible for approximately 34 terawatt-hours of electricity usage annually, which translates into an estimated 24 million metric tons of CO2 emissions.

This substantial environmental impact underscores a growing consumer awareness and demand for more energy-efficient gaming solutions. Moreover, the financial implications are considerable, with gamers in the U.S. spending around $5 billion annually on energy costs to power their consoles and PCs.

Currently, a single console brand dominates the market, holding a 54% market share as of 2023 and achieving global sales exceeding 45.4 million units. This dominance not only highlights the brand’s significant impact on market trends and consumer preferences but also underscores the competitive landscape where other manufacturers are challenged to innovate or capture market share.

The convergence of high energy costs, environmental impacts, and concentrated market dominance presents both challenges and opportunities. Companies are now poised to invest in sustainable, energy-efficient technologies and explore strategic partnerships to expand their market presence, ensuring long-term growth and sustainability in the evolving digital landscape.

Key Takeaways

- The Global Gaming Console Market size is expected to be worth around USD 69.7 Billion by 2033, from USD 41.2 Billion in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

- In 2023, PlayStation held a dominant market position in the By Product segment of the Gaming Console Market, with a 25.3% share.

- In 2023, Gaming held a dominant market position in the By Application segment of the Gaming Console Market, with a 56.6% share.

- In 2023, The Online Distribution Channel held a dominant market position in the By Distribution Channel segment of the Gaming Console Market, with a 46.1% share.

- In 2023, Handheld Game Consoles held a dominant market position in the By Type segment of the Gaming Console Market, with a 31.3% share.

- In 2023, Console Units held a dominant market position in the By Component segment of the Gaming Console Market, with a 36.4% share.

- Asia Pacific dominated a 46.2% market share in 2023 and held USD 19.0 Billion in revenue from the Gaming Console Market.

Product Analysis

PlayStation dominates with 25.3% due to its superior gaming library and brand loyalty.

In 2024, PlayStation held a dominant market position in By Product Analysis segment of Gaming Console Market, with a 25.3% share. This leadership position reflects Sony’s strategic focus on exclusive game titles and cutting-edge hardware technology that continues to attract dedicated gaming enthusiasts worldwide.

Nintendo maintains a competitive presence in the market, leveraging its unique gaming ecosystem and beloved franchises that appeal to diverse age groups. The company’s innovative approach to portable and home gaming experiences has secured a loyal customer base.

Xbox represents Microsoft’s strong commitment to the gaming industry, offering comprehensive gaming solutions including cloud gaming services and subscription-based models. The brand continues to evolve with technological advancements and strategic partnerships.

Other gaming platforms collectively represent emerging competitors and niche players who contribute to market diversification. These alternatives provide specialized gaming experiences and cater to specific consumer preferences, ensuring healthy competition within the industry.

Application Analysis

Gaming dominates with 56.6% due to its widespread entertainment appeal and technological advancement.

In 2024, Gaming held a dominant market position in By Application Analysis segment of Gaming Console Market, with a 56.6% share. This substantial market leadership demonstrates the gaming industry’s evolution from a niche entertainment medium to a mainstream cultural phenomenon that transcends traditional demographic boundaries.

The gaming segment’s dominance stems from continuous technological innovations, including enhanced graphics, immersive virtual reality experiences, and sophisticated artificial intelligence integration. These advancements have elevated gaming from simple entertainment to complex interactive experiences.

Non-gaming applications represent a significant complementary market segment that includes educational software, productivity tools, and professional simulation programs. This category serves specialized markets and demonstrates the versatility of gaming technology platforms.

The balance between gaming and non-gaming applications reflects the industry’s maturation and diversification. As technology continues advancing, the boundaries between entertainment and practical applications become increasingly blurred, creating new opportunities for market expansion.

Distribution Channel Analysis

Online Distribution Channel dominates with 46.1% due to its convenience and global accessibility.

In 2024, Online Distribution Channel held a dominant market position in By Distribution Channel Analysis segment of Gaming Console Market, with a 46.1% share. This digital-first approach reflects changing consumer behavior and the industry’s adaptation to modern purchasing preferences that prioritize convenience and instant access.

Online distribution channels have revolutionized the gaming industry by eliminating physical inventory constraints and enabling global reach. Digital platforms provide immediate game downloads, automatic updates, and seamless integration with gaming ecosystems, enhancing user experience significantly.

Offline Distribution Channels maintain substantial market relevance, serving consumers who prefer physical media ownership and traditional retail experiences. Physical stores continue providing tangible product interaction and personalized customer service that certain demographics value highly.

The distribution landscape demonstrates a hybrid approach where both online and offline channels complement each other. This dual-channel strategy ensures comprehensive market coverage while accommodating diverse consumer preferences and technological comfort levels across different regions and age groups.

Type Analysis

Handheld Game Console dominates with 31.3% due to its portability and versatile gaming experience.

In 2024, Handheld Game Console held a dominant market position in By Type Analysis segment of Gaming Console Market, with a 31.3% share. This leadership position reflects consumers’ increasing preference for portable gaming solutions that offer flexibility and convenience in modern lifestyles.

Home Video Game Console represents the traditional gaming experience, providing high-performance gaming capabilities and superior graphics quality. These systems continue attracting serious gamers who prioritize immersive experiences and cutting-edge technology in dedicated gaming environments.

Hybrid Video Game Console bridges the gap between portable and home gaming, offering unprecedented versatility. This innovative category appeals to consumers seeking comprehensive gaming solutions that adapt to various usage scenarios without compromising performance quality.

Plug and Play/Retro Console caters to nostalgic gamers and collectors who appreciate classic gaming experiences. This segment demonstrates the enduring appeal of retro gaming culture and serves niche markets that value gaming history and simplified, accessible gaming solutions.

Component Analysis

Console Unit dominates with 36.4% due to its widespread adoption and integrated gaming experience.

In 2024, Console Unit held a dominant market position in the By Component Analysis segment of the gaming market, commanding a substantial 36.4% share. This leadership position reflects the continued consumer preference for dedicated gaming hardware that delivers consistent performance and exclusive gaming content.

The Console Unit segment’s dominance stems from major manufacturers’ strategic focus on creating comprehensive gaming ecosystems. These units offer seamless integration between hardware and software, providing users with optimized gaming experiences that standalone components often cannot match.

Controller components represent the second significant segment, capturing meaningful market share through innovations in haptic feedback, wireless connectivity, and ergonomic design. The evolution of controller technology has become a key differentiator for gaming platforms, driving consumer purchasing decisions.

Game Media continues to maintain relevance despite the digital transformation of the industry. Physical media still appeals to collectors and regions with limited internet infrastructure, sustaining its market position through premium editions and collectible releases.

External Storage solutions have gained prominence as game file sizes continue to expand. The increasing demand for additional storage capacity, particularly for next-generation consoles, has created a robust market for high-performance external storage devices that complement the primary Console Unit offerings.

Key Market Segments

By Product

- Nintendo

- PlayStation

- Xbox

- Others

By Application

- Gaming

- Non-gaming

By Distribution Channel

- Online Distribution Channel

- Offline Distribution Channel

By Type

- Home Video Game Console

- Handheld Game Console

- Portable

- Non-Portable

- Hybrid Video Game Console

- Plug and Play/Retro Console

By Component

- Console Unit

- Controller

- Paddle

- Joystick

- Gamepad

- Game Media

- Game Cartridge

- Optical Media

- Digital Distribution

- Cloud Gaming

- External Storage

Drivers

Gaming Console Market Drivers

The Gaming Console Market is primarily driven by advancements in technology that enhance gaming experiences. As developers introduce consoles with higher graphics quality and faster processing speeds, they attract a broader audience eager for more immersive and realistic gameplay.

Another significant driver is the integration of consoles with other entertainment functions, such as streaming services and social media, making them central entertainment hubs in many households. Additionally, the rise of esports and multiplayer online games has boosted the demand for gaming consoles, as they allow for seamless, high-quality gaming interaction across global networks.

The trend towards digital downloads and cloud gaming also presents opportunities for market growth by making games more accessible without the need for physical copies, thereby simplifying logistics and reducing costs. This dynamic is further supported by the global increase in internet penetration and the expansion of digital payment methods, accommodating a wider audience for console gaming.

Restraint

Gaming Console Market Restraints

One of the main challenges facing the Gaming Console Market is the high cost of the latest gaming consoles, which can be a significant barrier for many potential consumers, particularly in emerging markets. Additionally, the rapid pace of technological advancements means that consoles can quickly become outdated, discouraging consumers who fear their new devices might soon be eclipsed by newer models.

This technological churn can lead to shorter product life cycles, requiring frequent upgrades. Moreover, the increasing popularity of mobile gaming poses a competitive threat, as smartphones and tablets offer convenient and often less expensive alternatives for gaming.

These devices continue to improve in performance, attracting gamers who prefer the accessibility and versatility of mobile games over traditional console gaming. This competition from mobile platforms could divert potential customers away from traditional consoles, impacting market growth.

Opportunities

Gaming Console Market Opportunities

The Gaming Console Market is ripe with opportunities, particularly through the expansion of cloud gaming services. Cloud gaming allows players to stream games directly to their consoles without needing expensive hardware upgrades, making high-quality gaming more accessible to a broader audience.

This technology not only broadens the market by lowering entry barriers but also encourages subscription-based models that can generate steady revenue streams for companies. Furthermore, there’s a growing trend towards integrating educational and fitness-related functionalities into gaming consoles, tapping into new consumer segments interested in more than traditional gaming.

Additionally, the global rise in esports popularity provides a lucrative avenue for console manufacturers to sponsor events and develop specialized gaming equipment, further diversifying their revenue sources. These factors present substantial growth potential, transforming how consumers interact with gaming technology.

Challenges

Gaming Console Market Challenges

The Gaming Console Market faces several challenges that could hinder its growth. One major challenge is the increasing competition from mobile gaming, which offers users a more portable and often less expensive alternative.

As smartphones and tablets become more powerful, the distinction between mobile gaming and console gaming continues to blur, attracting a segment of gamers away from traditional consoles.

Additionally, the high cost of developing cutting-edge gaming consoles can strain manufacturers, especially as consumer expectations for technological advancements and new features continue to escalate. There’s also the issue of market saturation in developed regions, where most households already own at least one console, limiting new market entries.

Regulatory hurdles, particularly concerning data privacy and cyber security, pose additional challenges, as consoles become more connected and reliant on internet-based services.

Growth Factors

Growth Factors in Console Gaming

The growth of the Gaming Console Market is propelled by several key factors. Technological advancements play a crucial role, as newer, more powerful consoles with enhanced graphics and processing capabilities continue to attract gamers seeking a high-quality gaming experience.

The trend towards multiplayer and online gaming also significantly drives the market, as these features encourage social interaction and competitive play, which are highly popular among gamers. Additionally, the integration of consoles with other media, such as streaming services and apps, transforms them into comprehensive entertainment units, increasing their appeal.

The rise of esports and professional gaming provides another substantial growth avenue, with consoles often being at the center of these events. These factors collectively contribute to the robust expansion of the gaming console market, adapting to changing consumer preferences and technological trends.

Emerging Trends

Emerging Trends in Console Gaming

Emerging trends in the Gaming Console Market are shaping the future of gaming, driven by technological innovation and changing consumer behaviors. A significant trend is the shift towards cloud gaming, which allows gamers to stream games without the need for powerful hardware, providing flexibility and reducing costs.

Virtual reality (VR) and augmented reality (AR) are also gaining traction, offering immersive gaming experiences that blur the lines between the virtual and real worlds. Additionally, there’s an increasing focus on cross-platform play, enabling gamers to play the same game across different devices, and enhancing connectivity and social interaction.

Another trend is the rise of subscription services and digital downloads, which provide gamers with a wide range of games at a fixed monthly price, reflecting a move away from physical game purchases. These trends are collectively broadening the scope and appeal of console gaming, meeting diverse consumer demands.

Regional Analysis

In 2023, the global Gaming Console Market witnessed substantial growth, with regional variations reflecting differing consumer preferences and technological adoption rates. Asia Pacific emerged as the dominating region, accounting for 46.2% of the market share and generating revenues of USD 19.0 billion.

This dominance is fueled by a robust gaming culture in countries like Japan and South Korea, coupled with rapid economic growth in China and India, which has expanded the middle-class consumer base significantly.

North America also held a significant portion of the market, driven by high consumer spending on entertainment and the presence of major industry players. Europe followed closely, with a strong market driven by advanced technology infrastructure and high consumer purchasing power.

Meanwhile, the Middle East & Africa, and Latin America showed promising growth, though they represent smaller shares of the global market. These regions are experiencing increasing penetration of the internet and mobile devices, which is gradually boosting the market for gaming consoles. The diverse cultural landscapes and economic conditions across these regions create a dynamic global market, with Asia Pacific leading the way due to its sizeable market share and revenue generation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Gaming Console Market was prominently shaped by three key players: Sony Corporation, Microsoft, and Nintendo, each contributing uniquely to the market dynamics with their strategic innovations and broad consumer appeal.

Sony Corporation has continued to lead with its PlayStation series, which has been pivotal in defining the premium segment of the market. Sony’s strength lies in its extensive library of exclusive games and its ability to integrate its gaming ecosystem with other entertainment services, enhancing the user experience. The introduction of advanced VR capabilities and continued emphasis on high-definition graphics keeps Sony at the forefront of technological innovation in gaming.

Microsoft, with its Xbox series, has effectively capitalized on its synergies with Windows operating systems and its cloud computing services to offer a more interconnected and seamless gaming experience. Microsoft’s strategy to focus on cross-platform play and subscription services like Xbox Game Pass reflects a forward-thinking approach that caters to a growing demand for value and flexibility in gaming consumption.

Nintendo stands out with its unique approach by focusing on portable and hybrid consoles like the Nintendo Switch, which have broadened the gaming console market to include casual gamers and families. Nintendo’s emphasis on fun, user-friendly, and innovative gameplay, along with strong franchise titles, has allowed it to maintain a significant impact in the market.

Collectively, these companies not only drive competition within the industry but also push the boundaries of what gaming consoles can offer. Their efforts to innovate and differentiate their product offerings have been crucial in attracting a diverse range of consumers and setting the stage for future growth and development in the Gaming Console Market.

Top Key Players in the Market

- Sony Corporation (Japan)

- Microsoft (U.S.)

- Nintendo (Japan)

- Logitech (Switzerland)

- Valve Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Sega (Japan)

- IBM (U.S.)

- Tencent (China)

- Paperspace (U.S.)

- Other Key Players

Recent Developments

- In August 2023, NVIDIA ventured deeper into the gaming console market by partnering with several game developers to optimize their new AI-driven graphics technology for consoles. This collaboration is set to revolutionize game visuals and performance, making NVIDIA a critical player in gaming hardware innovation.

- In July 2023, Logitech launched a new gaming console accessory designed to enhance user experience. This product features advanced ergonomic designs and aims to increase the console’s usability and comfort during extended gaming sessions.

- In May 2023, Valve Corporation expanded its gaming reach by introducing a new version of its popular Steam Deck console. The updated model boasts increased storage capacity and improved battery life, addressing key consumer demands and enhancing mobile gaming experiences.

Report Scope

Report Features Description Market Value (2023) USD 41.2 Billion Forecast Revenue (2033) USD 69.7 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Nintendo, PlayStation, Xbox, Others), By Application(Gaming, Non-gaming), By Distribution Channel(Online Distribution Channel, Offline Distribution Channel), By Type(Home Video Game Console, Handheld Game Console(Portable, Non-Portable), Hybrid Video Game Console, Plug and Play/Retro Console), By Component(Console Unit, Controller(Paddle, Joystick, Gamepad), Game Media(Game Cartridge, Optical Media, Digital Distribution, Cloud Gaming), External Storage) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony Corporation (Japan), Microsoft (U.S.), Nintendo (Japan), Logitech (Switzerland), Valve Corporation (U.S.), NVIDIA Corporation (U.S.), Sega (Japan), IBM (U.S.), Tencent (China), Paperspace (U.S.), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sony Corporation (Japan)

- Microsoft (U.S.)

- Nintendo (Japan)

- Logitech (Switzerland)

- Valve Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Sega (Japan)

- IBM (U.S.)

- Tencent (China)

- Paperspace (U.S.)

- Other Key Players