Global Gamefi Market Size, Share, Statistics Analysis Report By Business Model (Free-2-Play, Play-2-Earn), By Technology (NFT, Crypto), By Operating System (Android, Windows, iOS), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144737

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analyst’s Viewpoint

- U.S. Gamefi Market

- Business Model Analysis

- Technology Analysis

- Operating System Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Growth Factors

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

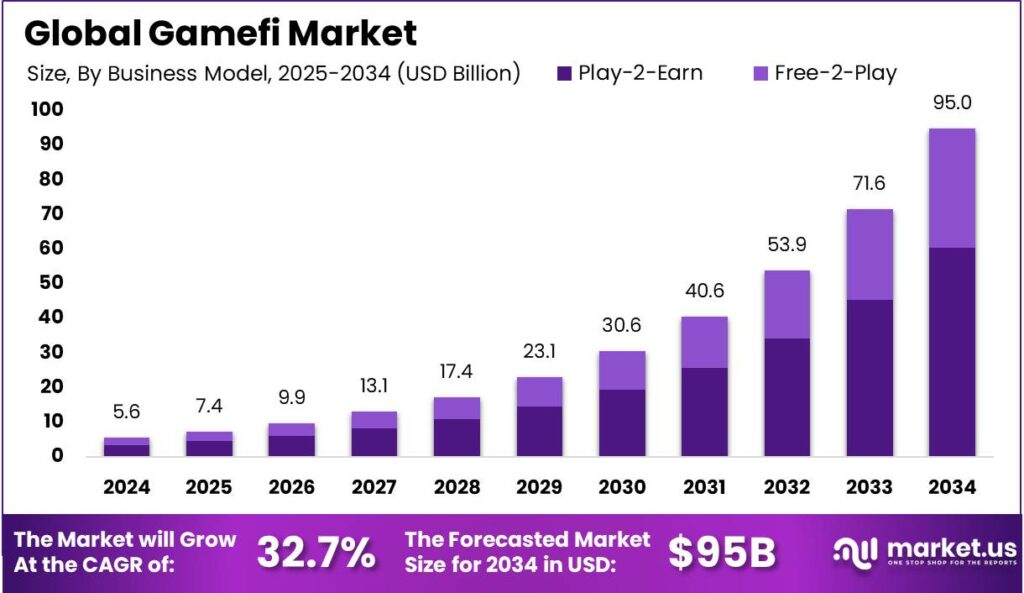

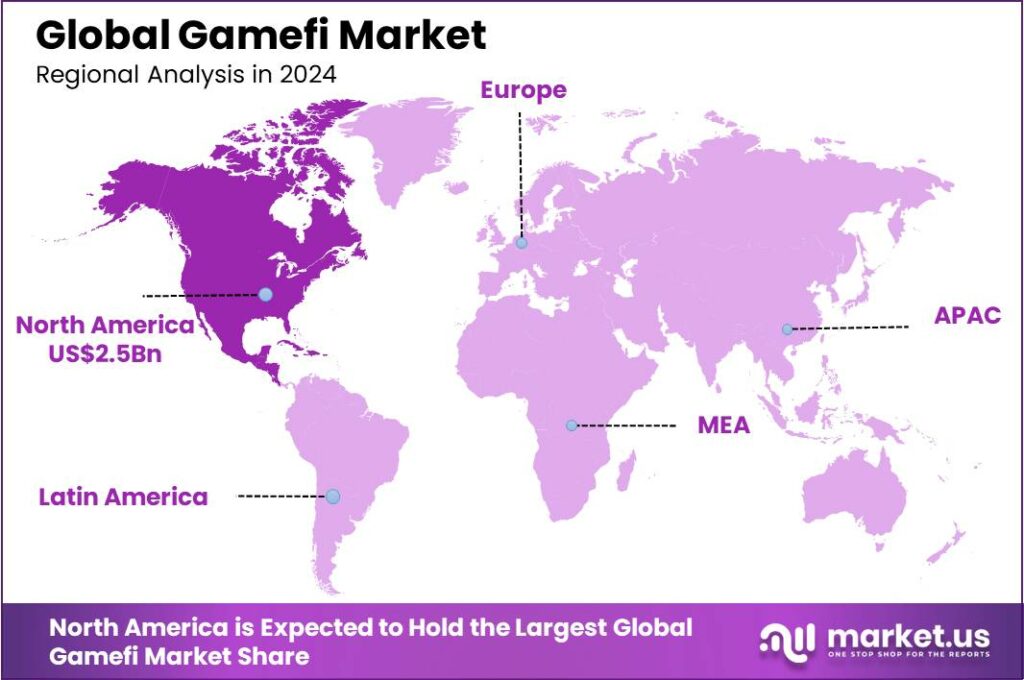

The Global Gamefi Market size is expected to be worth around USD 95 Billion By 2034, from USD 5.61 Billion in 2024, growing at a CAGR of 32.70% during the forecast period from 2025 to 2034. North America held a dominant position in the GameFi market in 2024, representing more than 45.1% of the global market share, with revenues reaching USD 2.5 billion.

The GameFi sector combines gaming and finance through blockchain technology, creating a dynamic segment of the digital economy. By integrating traditional gaming with financial tools like cryptocurrency and NFTs, it offers players monetization opportunities via play-to-earn models. As blockchain evolves, GameFi offers innovative engagement and ownership, attracting gamers and investors.

The GameFi market is distinguished by its rapid growth, driven by the increasing allure of monetizing gaming experiences. This sector’s expansion is propelled by technological advancements and the broadening acceptance of blockchain and NFTs within gaming communities. As of mid-2021, the sector witnessed a significant surge in participation, reflecting a burgeoning interest among players and investors alike.

The primary catalysts for the GameFi market include the integration of blockchain technology which ensures security and transparency, the unique economic benefits offered through play-to-earn models, and the global rise in digital asset trading. These factors collectively foster a conducive environment for GameFi’s expansion by attracting a diverse player base seeking both entertainment and financial returns.

Blockchain, NFTs, and smart contracts are central to the GameFi ecosystem, enhancing the security and efficacy of transactions and asset management within games. These technologies ensure that players have true ownership of their digital assets, which can be securely traded or leveraged for additional income.

According to ChainPlay, 3 in 4 global investors entered the crypto space driven by GameFi, with 68% joining the market within the last year. Profitability remains a key motivator, as noted by 51% of respondents, while 43% of female investors cited curiosity as their main reason for participation.

Gen Z investors are particularly active, allocating an average of 52% of their net worth to GameFi. However, challenges persist: 89% of investors reported a decline in GameFi profits over the past six months, with 62% losing more than half of their returns – primarily due to poor in-game economy design (58%). Daily engagement has also dropped to 2.5 hours, down 43% from 2021 levels.

Investor caution is rising, as 73% avoid GameFi due to fears of rug pulls and scams, while 81% now prioritize gameplay enjoyment over profit. Notably, 44% believe that the involvement of traditional gaming companies will be key to GameFi’s long-term growth.

Players are increasingly drawn to GameFi due to the financial autonomy and potential profits it offers. Unlike traditional games, where in-game purchases often result in sunk costs, GameFi allows players to recoup their investments and potentially profit by trading their assets on open markets.

The demand within the GameFi market is driven by the continuous introduction of innovative games offering varied and rich play-to-earn mechanisms. This demand is amplified by the growing blockchain and cryptocurrency adoption, which aligns with the broader trends of digital finance.

Key Takeaways

- The Global GameFi Market size is projected to reach USD 95 Billion by 2034, growing from USD 5.61 Billion in 2024, at a CAGR of 32.70% during the forecast period from 2025 to 2034.

- In 2024, the Play-2-Earn (P2E) segment held a dominant market position within the GameFi industry, capturing more than a 63.6% share.

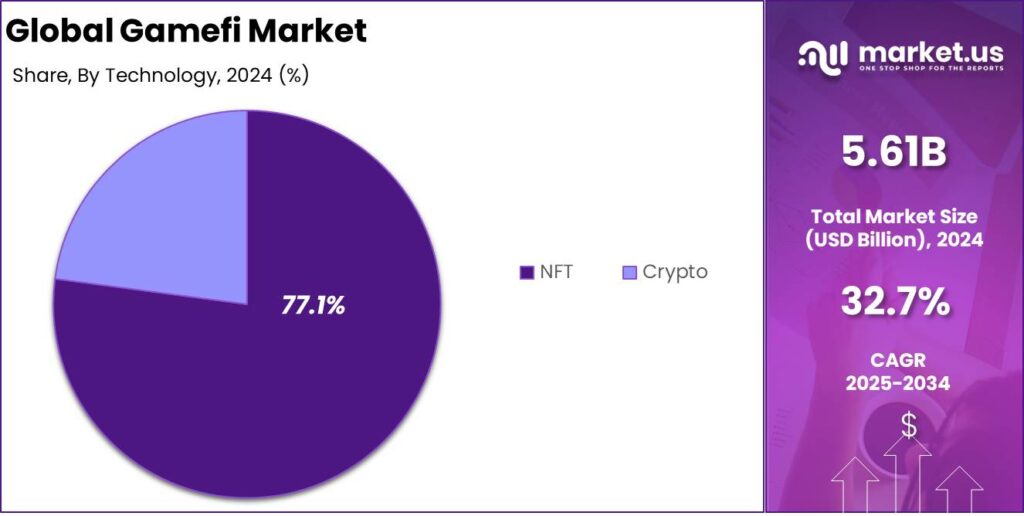

- The NFT (Non-Fungible Token) segment also held a dominant position in the GameFi market in 2024, securing over 77.1% share.

- The Windows segment dominated the GameFi sector in 2024, capturing more than 49.4% share of the market.

- North America held a dominant position in the GameFi market in 2024, representing more than 45.1% of the global market share, with revenues reaching USD 2.5 billion.

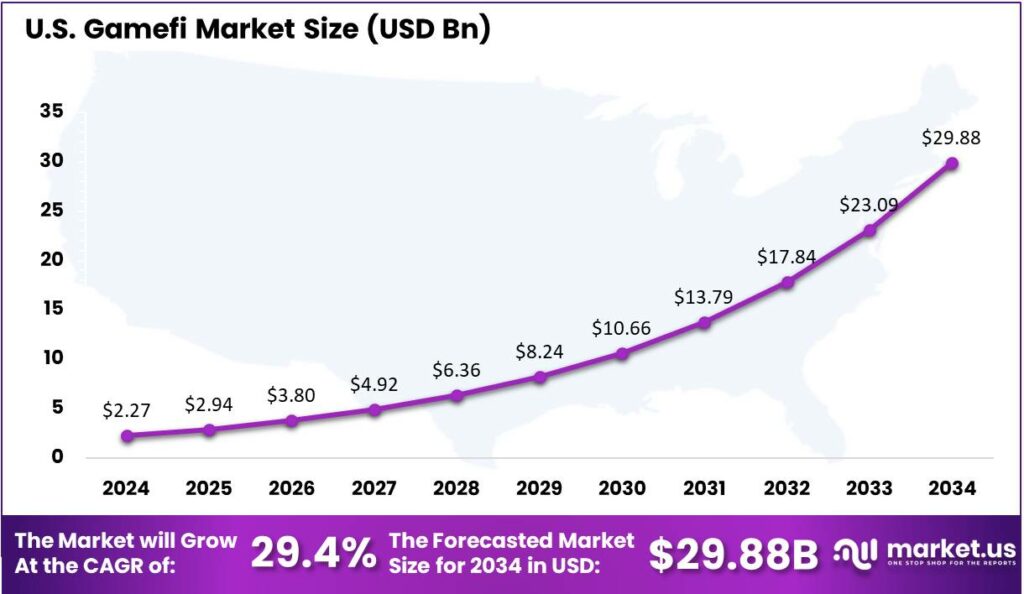

- The U.S. GameFi market was estimated at a value of USD 2.27 billion in 2024 and is projected to grow at a CAGR of 29.4% over the forecast period.

Analyst’s Viewpoint

GameFi combines gaming and decentralized finance, using blockchain technology to allow players to earn real-world value through in-game activities, revolutionizing traditional gaming. GameFi is leading innovation in gaming by leveraging blockchain to build decentralized economies. Cross-chain functionality enables smooth asset transfers across blockchains, improving user experience and market reach.

The evolution of play-to-earn models, which reward players with real-world value for in-game achievements, bolsters game economies for long-term sustainability. GameFi projects that promote player involvement in game development and governance are witnessing increased retention and growth. This trend underscores the shift toward more immersive and interactive gaming experiences that prioritize player input.

The regulatory landscape for GameFi is still evolving, with significant variations across different regions. In the U.S., growing interest in cryptocurrencies and blockchain games has sparked regulatory scrutiny, calling for clearer digital asset guidelines. The lack of uniform regulation creates challenges, especially in markets where digital asset transactions remain unregulated.

U.S. Gamefi Market

In 2024, the U.S. GameFi market was estimated at a value of USD 2.27 billion. It is projected to grow at a compound annual growth rate (CAGR) of 29.4% over the forecast period. This robust growth trajectory underscores the burgeoning interest and investment in the intersection of gaming and decentralized finance (DeFi), which collectively embody the GameFi sector.

The substantial growth in the GameFi market can be attributed to several key factors. The increasing adoption of blockchain technologies and cryptocurrencies in mainstream gaming enhances the appeal of GameFi platforms. These platforms offer players not only entertainment but also opportunities for earning through play-to-earn models, staking, and digital asset trading.

As this market continues to evolve, it is expected to significantly influence the broader gaming industry, shifting traditional business models towards more decentralized and player-centric approaches. This shift not only promises to increase player engagement through financial incentives but also fosters a new ecosystem of game development and asset trading.

In 2024, North America held a dominant position in the GameFi market, capturing more than 45.1% of the global market share with revenues reaching USD 2.5 billion. This significant market presence can be attributed to a confluence of technological advancement, robust regulatory frameworks, and a vibrant gaming culture which is more pronounced in this region compared to others.

The leadership of North America in the GameFi sector is further reinforced by the high penetration rate of advanced digital infrastructures and the widespread adoption of blockchain technologies. Home to numerous tech giants and innovative startups, the region boasts a fertile ground for the development and rapid adoption of GameFi platforms.

Furthermore, North American consumers are typically early adopters of new technologies, including blockchain and cryptocurrencies, which are integral to GameFi ecosystems. This openness has fostered innovation in GameFi, with regulatory clarity in countries like the U.S. and Canada providing a secure environment for investors and users.

Business Model Analysis

In 2024, the Play-2-Earn (P2E) segment held a dominant market position within the GameFi industry, capturing more than a 63.6% share. This substantial market share is primarily due to the segment’s direct alignment with the burgeoning interest in digital asset ownership and the monetization of gaming experiences.

The Play-2-Earn model appeals to tech-savvy, financially motivated individuals, often younger players familiar with cryptocurrencies. It turns gaming from a recreational activity into a potential income source, making it especially attractive in regions with limited job opportunities or where extra income is valued.

The P2E model utilizes blockchain technology to grant true ownership of in-game assets, enabling players to trade or convert them into real-world currency. This creates a dynamic secondary market for items like characters, equipment, and virtual land, adding an economic layer that traditional gaming lacks, which boosts player engagement and retention.

The success of the P2E model is fueled by its community-driven approach. Many P2E games include social interaction and collaboration, helping build strong, loyal communities. This fosters player loyalty and drives viral growth through word-of-mouth and social media, expanding the user base and enhancing the platform’s financial stability.

Technology Analysis

In 2024, the NFT (Non-Fungible Token) segment held a dominant position in the GameFi market, capturing more than a 77.1% share. This substantial market share is primarily attributed to the unique value proposition that NFTs offer within the gaming sector.

NFTs enable the tokenization of in-game assets, allowing players to own, buy, and sell their gaming items as unique digital properties. This capability has revolutionized player engagement and investment, making NFTs a central component of the GameFi ecosystem.

The appeal of NFTs extends beyond simple ownership to include the authenticity and scarcity of digital assets, which are critical selling points for gamers seeking collectibles and rare items. This demand for exclusive in-game assets has propelled the NFT segment to outpace other technological implementations within the GameFi market.

The success of the NFT segment is boosted by its integration with blockchain platforms like Ethereum, which support smart contracts. These platforms enable seamless creation and trading of NFTs, improving user experience and security. This technical infrastructure allows GameFi developers to innovate, leading to a richer, more diverse gaming environment.

Operating System Analysis

In 2024, the Windows segment held a dominant market position in the GameFi sector, capturing more than a 49.4% share. Windows’ dominance is driven by its large global user base and strong ties to the gaming industry. Known for superior processing power, graphics, and compatibility with various gaming software, Windows PCs are an ideal platform for GameFi applications.

The leadership of the Windows segment is further bolstered by the robust development environment it offers. Developers find Windows to be a highly versatile operating system for creating and testing complex GameFi environments, which often require significant computational resources and stability. The availability of advanced development tools and a supportive ecosystem for developers enhances the creation and deployment of GameFi solutions on Windows.

Additionally, Windows-based systems are prevalent in both consumer and professional markets, ensuring a larger potential user base for GameFi products. The operating system’s widespread use in areas with high gaming demand, such as North America, Europe, and parts of Asia, contributes to its dominance in the GameFi market.

Furthermore, the integration capabilities of Windows with emerging technologies like VR and AR are superior, which are increasingly being utilized in GameFi platforms to deliver immersive gaming experiences. This technological edge facilitates the adoption and growth of GameFi innovations on Windows, maintaining its lead in the market.

Key Market Segments

By Business Model

- Free-2-Play

- Play-2-Earn

By Technology

- NFT

- Crypto

By Operating System

- Android

- Windows

- iOS

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Play-to-Earn Models

The integration of play-to-earn (P2E) models has significantly propelled the growth of the GameFi market. These models enable players to earn real-world value through in-game activities, fostering increased engagement and attracting a diverse player base.

By offering tangible rewards, P2E models have transformed gaming from a mere entertainment activity into a potential income source, particularly in regions with limited economic opportunities. This shift has led to a surge in user adoption and investment within the GameFi ecosystem.

The decentralized nature of blockchain technology further enhances this model by ensuring transparency and security in transactions, thereby building trust among participants. As more developers incorporate P2E mechanics into their games, the GameFi market is poised for sustained expansion.

Restraint

Regulatory Uncertainty

Regulatory uncertainty poses a significant challenge to the GameFi market. The intersection of gaming and decentralized finance introduces complexities that often fall into ambiguous legal territories. Different jurisdictions have varying stances on cryptocurrencies and digital assets, leading to potential legal hurdles for GameFi projects.

This lack of clear regulatory frameworks can deter investment, hinder innovation, and create an environment of caution among developers and players alike. Establishing comprehensive and consistent regulations is essential to mitigate these challenges and foster a conducive environment for the growth of the GameFi market.

Additionally, the rapid evolution of blockchain technology and decentralized finance (DeFi) can outpace the ability of regulators to keep up, further contributing to an environment where rules are unclear or constantly changing.

Opportunity

Integration of Virtual and Augmented Reality

The integration of Virtual Reality (VR) and Augmented Reality (AR) technologies presents a significant opportunity for the GameFi market. By incorporating VR and AR, GameFi platforms can offer immersive and interactive experiences that enhance player engagement and attract a broader audience.

These technologies enable players to experience in-game environments and assets in a more tangible and realistic manner, potentially increasing the perceived value of digital assets and in-game economies. As VR and AR technologies continue to advance and become more accessible, their adoption within the GameFi sector can drive innovation, create new revenue streams, and solidify the market’s position within the broader gaming industry.

Challenge

Security Vulnerabilities

Security vulnerabilities present a significant challenge to the GameFi market. The reliance on blockchain technology and smart contracts, while offering transparency and decentralization, also exposes platforms to potential exploits and hacking incidents.

Unauthorized access, theft of digital assets, and manipulation of in-game economies can erode player trust and result in substantial financial losses. Addressing these security concerns requires continuous investment in robust security protocols, regular audits, and the development of resilient smart contract architectures. Ensuring a secure environment is crucial for the sustainability and credibility of the GameFi ecosystem.

Emerging Trends

One significant trend is the evolution from basic play-to-earn (P2E) models to more sophisticated play-and-earn (P&E) frameworks. Early P2E games prioritized financial rewards over gameplay, but the P&E model focuses on creating immersive, enjoyable experiences where earning mechanisms enhance, not overshadow, core gameplay. This approach fosters long-term retention and a sustainable economy.

Another notable development is the rise of AAA-quality blockchain games. Blockchain-based games once struggled with production quality compared to traditional games. However, developers are now using advanced technologies like Unreal Engine 5 and AI to create high-fidelity, immersive experiences that rival mainstream titles.

Cross-chain interoperability is also gaining momentum within the GameFi sector. Players increasingly expect their in-game assets to be transferable across different games and blockchain networks. Developers are responding by implementing cross-chain functionalities, enabling assets like non-fungible tokens (NFTs) to be utilized seamlessly across various platforms.

Key Growth Factors

- True Ownership of In-Game Assets: Blockchain technology enables players to have genuine ownership of in-game items through non-fungible tokens (NFTs). This innovation allows gamers to trade, sell, or utilize their assets across various platforms, enhancing the gaming experience and providing real-world value.

- Integration of Play-to-Earn Models: GameFi introduces play-to-earn mechanisms, rewarding players with cryptocurrency or NFTs for their in-game achievements. This model not only incentivizes engagement but also offers financial benefits, attracting a broader audience to the gaming ecosystem.

- Advancements in Blockchain Technology: The development of specialized blockchains for gaming has improved scalability and reduced transaction fees. For instance, platforms like Polygon have introduced solutions tailored for GameFi applications, facilitating smoother and more cost-effective gaming experiences.

- Entry of Established Gaming Companies: Major traditional gaming developers are venturing into the GameFi space, recognizing its potential. Companies such as Ubisoft and Square Enix are exploring blockchain-based games, lending credibility and attracting investment to the industry.

- Growing Popularity of the Metaverse: The expansion of virtual worlds, or metaverses, has created new opportunities for GameFi. Players can engage in immersive environments where they earn rewards, trade assets, and participate in virtual economies, further driving the sector’s growth.

Business Benefits

GameFi introduces new revenue streams through in-game token economies and NFTs, unlike traditional models that rely on one-time purchases or subscriptions. This model generates ongoing income via transaction fees, secondary sales, and marketplaces, aligning the interests of developers and players for a thriving economy.

Enhanced player engagement is another significant advantage. By offering tangible rewards and true ownership of in-game assets, GameFi incentivizes players to invest more time and effort into the game. This increased engagement can lead to a more vibrant and active community, fostering a loyal player base and reducing churn rates.

GameFi also promotes financial inclusion by providing players with opportunities to earn income through gameplay. In regions with limited economic opportunities, individuals can earn, trade, and sell in-game assets, enabling participation in the global digital economy. This fosters economic empowerment and inclusion, with broader societal benefits.

Key Player Analysis

Several prominent companies have shaped Gamefi Market space with innovative games and decentralized financial structures.

Axie Infinity, developed by Sky Mavis, has been a pioneer in the GameFi sector. It is a blockchain-based game that allows players to collect, breed, and battle creatures known as Axies. The game’s play-to-earn model allows users to earn cryptocurrency by playing, which has made it particularly popular in countries like the Philippines.

Yield Guild Games (YGG) operates as a decentralized autonomous organization (DAO) that invests in virtual assets and play-to-earn games. By owning in-game assets and renting them out to players, YGG provides a platform for individuals to earn from gaming, even if they can’t afford to buy assets themselves.

Ember Sword is a cross-platform fantasy MMORPG (Massively Multiplayer Online Role-Playing Game) that incorporates blockchain technology to give players true ownership of in-game assets. Unlike traditional games, where players’ assets are controlled by the game developer, Ember Sword’s use of NFTs allows players to trade, sell, or use their in-game items in a decentralized economy.

Top Key Players in the Market

- Axie Infinity

- Yield Guild Games

- Ember Sword

- Gala Games

- Animoca Brands

- The Sandbox

- Decentraland

- My Neighbor Alice

- Gods Unchained

- Sorare

- Others

Top Opportunities for Players

The GameFi market is rapidly evolving, offering substantial opportunities for industry players and investors alike.

- Enhanced Player Engagement and Retention: Games like “SERAPH: In The Darkness” have shown that strong narratives and immersive gameplay are key to maintaining a loyal player base. Successful GameFi projects are increasingly focusing on creating user-centric experiences that offer more than just financial incentives, thus ensuring long-term engagement.

- Innovative Use of NFTs: Non-fungible tokens (NFTs) are playing a pivotal role in GameFi by enabling true ownership of in-game assets. This not only enhances the gaming experience but also adds a layer of investment potential as these assets can appreciate in value. NFTs are crucial for developing in-game marketplaces that attract both gamers and investors.

- Sustainable Economic Models: The stability of a game’s economy is critical for its longevity. Implementing dynamic loot distributions, staking-based rewards, and economic strategies controlled by decentralized autonomous organizations (DAOs) are emerging as best practices. These mechanisms help manage in-game inflation and reward contributions in a way that supports sustainable growth.

- Cross-Platform Playability: Integrating blockchain technology allows for seamless cross-platform playability, enhancing accessibility and user base expansion. This interoperability also extends to the use of blockchain for secure, transparent transactions and improved gameplay mechanics.

- Strategic Investment and Partnership Opportunities: As the GameFi sector grows, there are increasing opportunities for strategic investments and partnerships. Investors can explore opportunities in GameFi startups or develop platforms that integrate gaming with decentralized finance (DeFi), unlocking new revenue streams and driving innovation in both gaming and finance.

Recent Developments

- March 2025: The9 is set to receive an $8 million investment from leading crypto funds, marking a significant milestone in its journey to establish a global GameFi platform. This strategic partnership paves the way for The9 to make a strong entrance into the expanding GameFi industry worldwide.

- September 2024: EveryMatrix, a prominent iGaming software provider, acquired Fantasma Games, a Swedish game development studio. This acquisition is part of EveryMatrix’s strategy to enhance its gaming portfolio and expand its market presence.

- September 2024: Playtika, a mobile games developer, announced its plan to acquire SuperPlay, the creator of the popular game Dice Dreams, in a deal valued up to $1.95 billion.

Report Scope

Report Features Description Market Value (2024) USD 5.61 Bn Forecast Revenue (2034) USD 95 Bn CAGR (2025-2034) 32.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Business Model (Free-2-Play, Play-2-Earn), By Technology (NFT, Crypto), By Operating System (Android, Windows, iOS) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Axie Infinity, Yield Guild Games, Ember Sword, Gala Games, Animoca Brands, The Sandbox, Decentraland, My Neighbor Alice, Gods Unchained, Sorare, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axie Infinity

- Yield Guild Games

- Ember Sword

- Gala Games

- Animoca Brands

- The Sandbox

- Decentraland

- My Neighbor Alice

- Gods Unchained

- Sorare

- Others