Global Freeze Dried Dog Food Market Size, Share, And Business Benefits By Type (Chicken, Fish, Duck, Cattle, Pig, Others), By Life Stage (Senior,Adult, Puppy), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159121

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

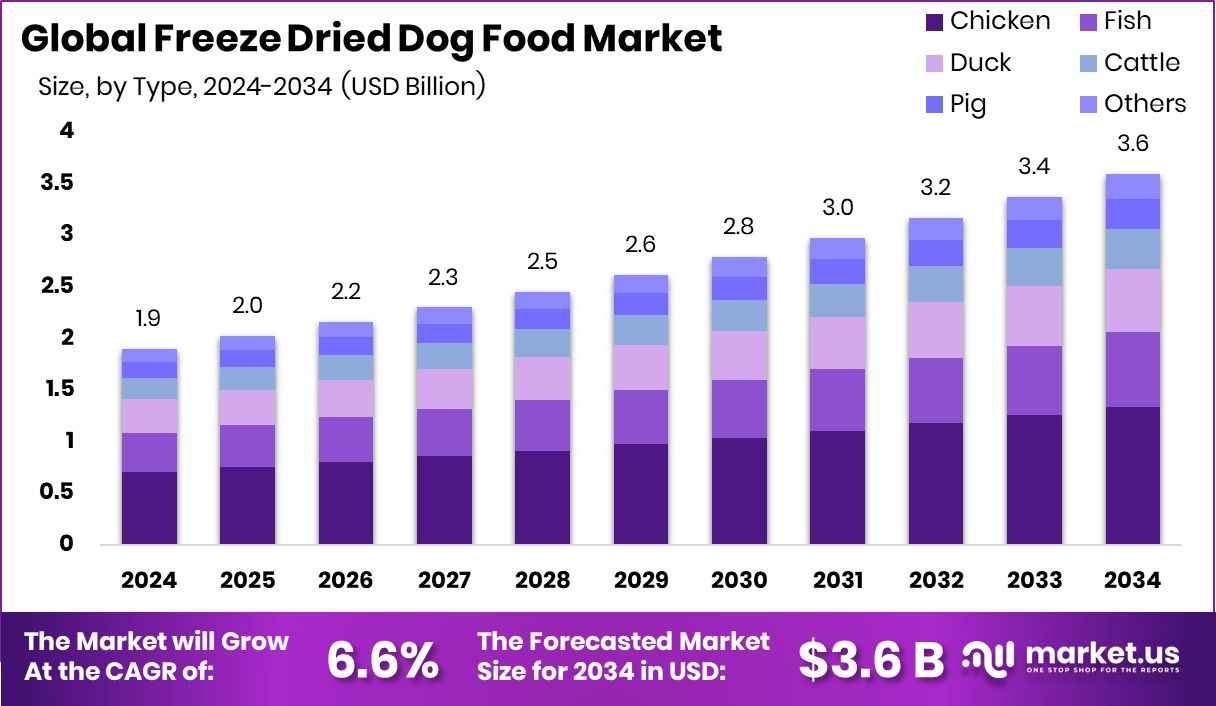

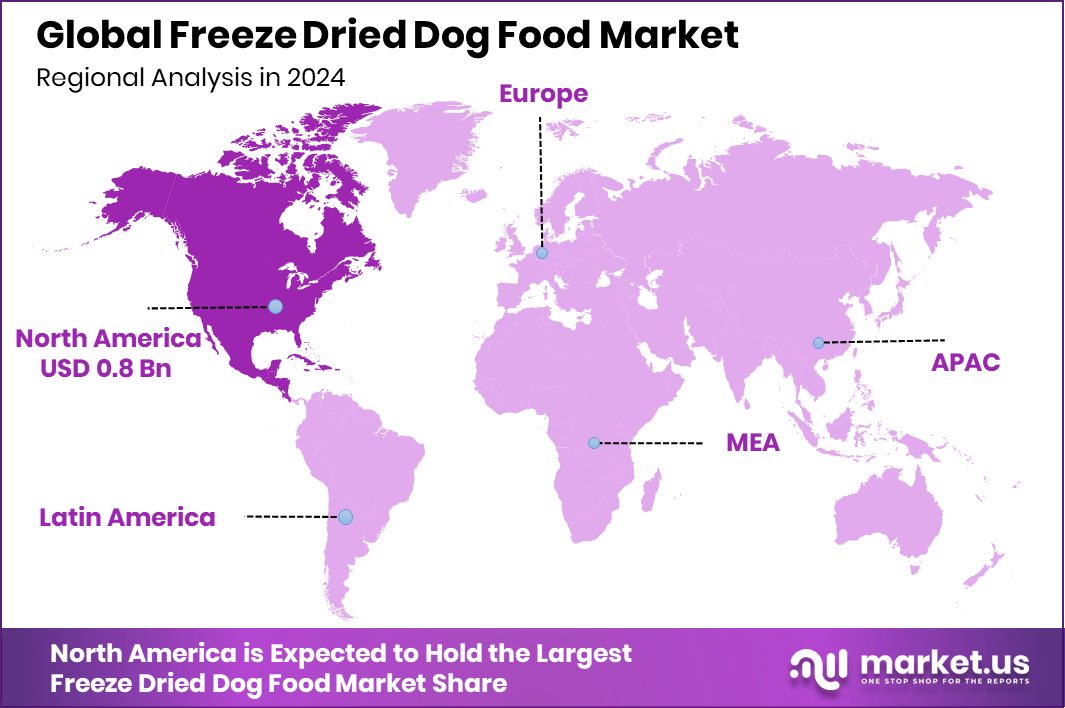

The Global Freeze Dried Dog Food Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. The North America Freeze-Dried Dog Food Market is projected to maintain a 44.2% share, valued at USD 0.8 Bn.

Freeze-dried dog food is a type of pet food that undergoes a preservation process where moisture is removed from raw ingredients through freezing and sublimation. This method retains the nutritional integrity, flavor, and texture of the food, offering a lightweight, shelf-stable alternative to traditional pet food. It typically contains high-quality proteins, vegetables, and fruits, making it a convenient option for pet owners seeking minimally processed, nutrient-dense meals for their dogs.

The freeze-dried dog food market refers to the commercial sector involved in producing and selling freeze-dried pet food products. This market has been expanding due to increasing pet ownership, rising awareness about pet health, and a growing demand for natural and premium pet food options. The market encompasses various product types, including meal toppers, complete meals, and treats, and is distributed through specialty stores, online platforms, and pet retailers.

Several factors contribute to the growth of the freeze-dried dog food market. One significant driver is the increasing humanization of pets, leading owners to seek higher-quality, nutritious food options. Additionally, advancements in freeze-drying technology have improved product quality and shelf life, making it more appealing to consumers. The growing trend towards natural and organic products also aligns with the offerings of freeze-dried dog food, further boosting its popularity among health-conscious pet owners.

The demand for freeze-dried dog food is primarily driven by pet owners’ desire to provide their dogs with healthier, more natural diets. As awareness about the benefits of minimally processed foods grows, more consumers are opting for freeze-dried options. Moreover, the convenience of shelf-stable products that require no refrigeration appeals to busy pet owners and those with limited storage space, increasing the overall demand for these products.

London’s FoodTech startup Better Nature has secured a €1.2 million funding boost to expand its presence in the UK’s €3.7 billion chicken market. This investment aims to support the company’s growth and innovation in the plant-based food sector.

Rebellyous Foods, a plant-based chicken maker, has raised $2.4 million in funding to further develop its products and expand its market reach. This investment will help the company meet the growing demand for plant-based alternatives in the food industry. In the sports sector, a $3 billion chicken farm guru is funding Arkansas’ March Madness run with a $5 million NIL budget, highlighting the intersection of agriculture and sports sponsorships.

Key Takeaways

- The Global Freeze Dried Dog Food Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- Chicken accounts for 37.2% of the freeze-dried dog food market, showing a strong preference.

- Adult dogs represent 56.8% of the freeze-dried dog food market demand globally.

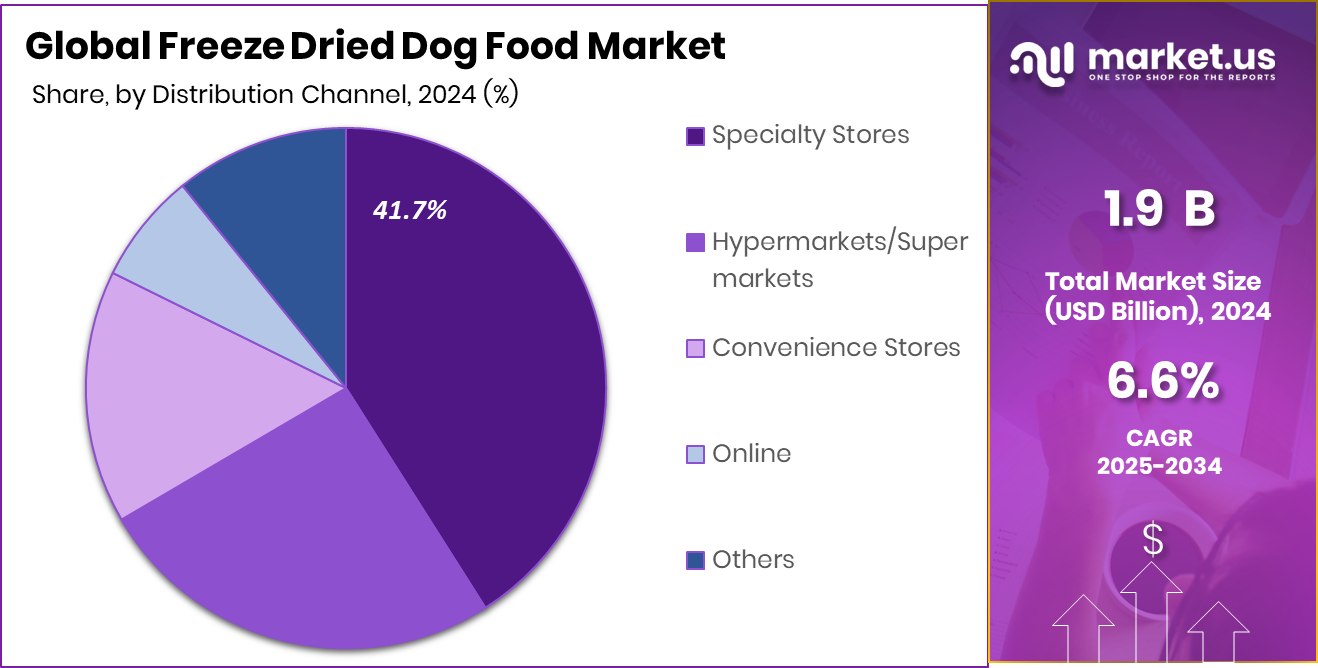

- Specialty stores cover 41.7% of the freeze-dried dog food market sales worldwide.

- In North America, growing pet health awareness drives demand for freeze-dried dog food, reaching USD 0.8 Bn.

By Type Analysis

Chicken-based recipes dominate the Freeze-Dried Dog Food Market with a 37.2% share.

In 2024, chicken held a dominant market position in the By Type segment of the Freeze-Dried Dog Food Market, with a 37.2% share. This strong performance can be attributed to pet owners’ preference for high-protein, natural, and easily digestible ingredients that support overall canine health. Chicken-based freeze-dried dog food offers a rich source of essential amino acids and nutrients, making it a preferred choice for dogs of all breeds and ages.

The segment benefits from ongoing trends toward premium and minimally processed pet food, as well as the convenience of shelf-stable products. With increasing awareness about pet nutrition, the chicken type segment is expected to maintain its leading position and continue driving market growth.

By Life Stage Analysis

Adult dogs drive 56.8% of demand in the Freeze-Dried Dog Food Market.

In 2024, adults held a dominant market position in the By Life Stage segment of the Freeze-Dried Dog Food Market, with a 56.8% share. This leadership reflects the growing focus of pet owners on providing balanced nutrition tailored to adult dogs’ specific dietary needs. Freeze-dried formulations for adult dogs are designed to support healthy digestion, maintain lean muscle mass, and promote overall vitality, making them highly preferred among owners seeking long-term health benefits for their pets.

The segment’s prominence is further supported by the convenience of shelf-stable products that retain nutritional value without refrigeration. With rising awareness about canine wellness, the adult life stage segment continues to drive growth in the freeze-dried dog food market.

By Distribution Channel Analysis

Specialty stores lead distribution with 41.7% in the Freeze-Dried Dog Food Market.

In 2024, specialty stores held a dominant market position in the By Distribution Channel segment of the Freeze-Dried Dog Food Market, with a 41.7% share. This strong performance is driven by pet owners’ preference for personalized shopping experiences, where they can access expert guidance, premium products, and a wide variety of freeze-dried dog food options.

Specialty stores often provide high-quality, niche offerings that cater to health-conscious consumers seeking natural and minimally processed pet food. The availability of knowledgeable staff to advise on nutrition and product selection further enhances customer trust and loyalty. With growing awareness of pet health and the demand for premium offerings, specialty stores continue to play a pivotal role in shaping market trends and driving sales growth.

Key Market Segments

By Type

- Chicken

- Fish

- Duck

- Cattle

- Pig

- Others

By Life Stage

- Senior

- Adult

- Puppy

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Driving Factors

Rising Pet Health Awareness Boosts Market Growth

One of the main driving factors for the Freeze-Dried Dog Food Market is the increasing awareness among pet owners about the importance of proper nutrition for their dogs. Consumers are now seeking high-quality, minimally processed food that retains natural nutrients, vitamins, and proteins.

Freeze-dried dog food meets these demands by providing convenient, nutrient-rich meals that support overall canine health, digestion, and immunity. As more pet owners prioritize wellness and longevity for their pets, the demand for premium freeze-dried options continues to rise.

Additionally, government and institutional support for animal nutrition and sustainable practices, such as the DEC’s $100 million Fish Hatchery Modernization, £1 million funding for Welsh aquaculture, and $55 million to partner with fish and wildlife agencies for species conservation, reflect broader investments in animal welfare and sustainable food sources, indirectly supporting market growth.

Restraining Factors

High Cost Limits Consumer Adoption and Growth

One of the main restraining factors for the Freeze-Dried Dog Food Market is its relatively high cost compared to conventional dog food. The freeze-drying process, which preserves nutrients and extends shelf life, involves advanced technology and higher production expenses. As a result, the final products are priced at a premium, which can deter price-sensitive pet owners from purchasing regularly.

While many consumers recognize the health benefits, not all households are willing to pay extra for freeze-dried options, limiting widespread adoption. This cost barrier is particularly significant in regions with lower disposable incomes or where conventional dog food dominates. Until production efficiencies improve or prices become more competitive, the high cost remains a key challenge for market expansion.

Growth Opportunity

Innovation in Premium Pet Nutrition Expands Market

A major growth opportunity in the Freeze-Dried Dog Food Market lies in the rising demand for innovative, premium, and functional pet food products. Pet owners are increasingly seeking formulations that cater to specific dietary needs, such as grain-free, hypoallergenic, or breed-specific options. Freeze-dried dog food allows manufacturers to create nutrient-dense meals while maintaining natural flavors and proteins, meeting these evolving consumer preferences.

Technological advancements and investments in pet care innovation further support this opportunity, as seen with Nofence securing £26 million Series B funding to expand virtual fencing technology, and Halter raising $100 million in Series D funding for smart solar-powered collars for cattle. These trends reflect growing interest in high-tech, health-focused solutions for animals, opening new avenues for market growth.

Latest Trends

Shift Towards Natural and Organic Ingredients Dominates

A key latest trend in the Freeze-Dried Dog Food Market is the growing consumer preference for natural and organic ingredients. Pet owners are increasingly seeking foods free from artificial additives, preservatives, and fillers, aiming to provide healthier and more wholesome meals for their dogs.

Freeze-dried dog food is well-positioned to meet this demand, as it preserves the natural nutrients and flavors of high-quality proteins, vegetables, and fruits. This trend is fueled by the broader movement toward clean-label and sustainable products, where transparency in sourcing and production matters to consumers. As awareness about pet wellness continues to rise, manufacturers are adapting by offering organic, minimally processed freeze-dried options, making this trend a driving force in shaping the market’s future.

Regional Analysis

North America accounted for 44.2% of the Freeze-Dried Dog Food Market, valued at USD 0.8 Bn.

In 2024, the Freeze-Dried Dog Food Market shows significant regional variation, with North America emerging as the dominating region, holding a 44.2% share and valued at USD 0.8 billion. The strong performance in North America is driven by high pet ownership rates, increasing consumer awareness of pet health, and the growing demand for premium, minimally processed dog food.

Specialty retail channels and e-commerce platforms further support market penetration, offering convenient access to freeze-dried products. Europe also represents a key market, with rising interest in natural and organic pet food, coupled with regulatory support for animal nutrition and wellness initiatives. In the Asia Pacific region, rapid urbanization, growing disposable incomes, and the expanding pet population are fueling demand for high-quality dog food, though awareness of freeze-dried options is still developing.

The Middle East & Africa and Latin America markets are witnessing gradual adoption, primarily driven by increasing urban pet ownership and exposure to international pet food trends. Overall, North America leads the global market in both revenue and share, while other regions present strong growth potential as pet health consciousness and premium product adoption continue to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Mars Petcare, a division of Mars, Inc., is a leading provider of high-quality, science-backed nutrition and therapeutic health products. Their portfolio includes a range of pet food, care, and treats designed to meet the individual needs of pets across the world. Mars Petcare’s commitment to innovation and quality positions them as a significant player in the freeze-dried dog food segment.

Stella & Chewy’s specializes in raw and minimally processed nutrition, using human-grade meats, organic fruits and vegetables, and unrefined vitamins and minerals. Their freeze-dried raw dog food and toppers deliver premium, whole-food nutrition without anything synthetic in a range of recipes to suit every pup’s palate. Stella & Chewy’s focus on quality ingredients and transparency resonates with health-conscious pet owners.

Primal Pet Foods offers freeze-dried raw dog food and toppers that provide premium, synthetic-free, whole-food nutrition. Their products are formulated using human-grade meats, organic fruits and vegetables, and unrefined vitamins and minerals. Primal’s commitment to raw feeding and high-quality ingredients appeals to pet owners seeking natural diets for their dogs.

Top Key Players in the Market

- Mars

- Stella & Chewy’s

- PRIMAL PET GROUP, INC.

- Merrick

- Northwest Naturals

- Instinct

- Dr. Harvey’s

- Open Farm Inc.

- Nulo

- Dr. Marty Pets

Recent Developments

- In June 2025, Mars Petcare, in collaboration with Big Idea Ventures and Bühler Group, launched the 2025 Global Pet Food Innovation Program. This initiative aims to accelerate sustainable innovation in the pet food sector by supporting start-ups with novel ingredients, sustainable fats and proteins, and advanced processing technologies. This program reflects Mars Petcare’s commitment to exploring alternative ingredients and creating more sustainable, future-ready nutrition options for pets.

- In April 2025, Stella & Chewy’s entered into a partnership with Meijer, a regional grocery retailer, to offer a selection of its freeze-dried raw dog and cat food products, treats, and wet cat food both in-store and online. This move aimed to increase accessibility to their premium pet food offerings for a broader customer base.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chicken, Fish, Duck, Cattle, Pig, Others), By Life Stage (Senior,Adult, Puppy), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mars, Stella & Chewy’s, PRIMAL PET GROUP, INC., Merrick, Northwest Naturals, Instinct, Dr. Harvey’s, Open Farm Inc., Nulo, Dr. Marty Pets Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Freeze Dried Dog Food MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Freeze Dried Dog Food MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mars

- Stella & Chewy's

- PRIMAL PET GROUP, INC.

- Merrick

- Northwest Naturals

- Instinct

- Dr. Harvey's

- Open Farm Inc.

- Nulo

- Dr. Marty Pets