Global Fraud Detection and Prevention (FDP) Market By Component (Solutions (Fraud Analytics, Governance, Risk and Compliance, Authentication), Services (Managed Services and Professional Services)), By Application (Payment Fraud, Money Laundering, Identity Theft, Other Applications), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By End-Use Industry (IT & Telecommunications, BFSI, Healthcare, Retail & E-commerce, Manufacturing, Government, Other End-Use Industries), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 67821

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

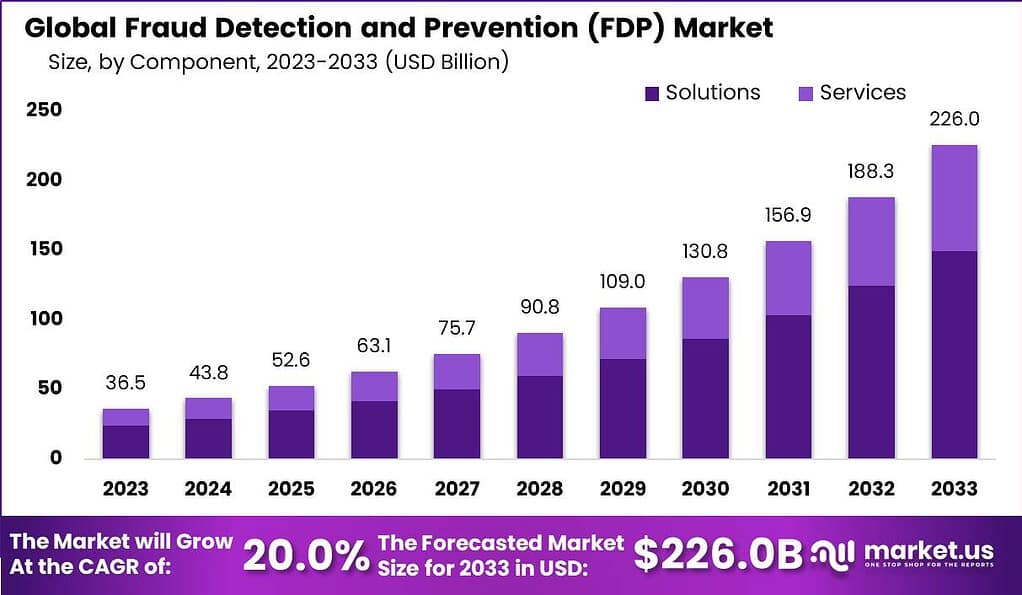

The Global Fraud Detection and Prevention Market size is expected to be worth around USD 226.0 Billion by 2033, from USD 36.5 Billion in 2023, growing at a CAGR of 20.0% during the forecast period from 2024 to 2033.

Fraud Detection and Prevention (FDP) has become a critical aspect of business operations in today’s digital world. FDP refers to the set of technologies, strategies, and processes designed to identify, prevent, and mitigate fraudulent activities within an organization. With the rapid growth of online transactions, cybercrime, and sophisticated fraud schemes, the FDP market has witnessed significant expansion.

The Fraud Detection and Prevention (FDP) market is rapidly expanding due to the increasing number of fraudulent activities across various sectors. The rise in online transactions, coupled with the adoption of digital payment methods, has made businesses more vulnerable to fraud. Growth in the market can be attributed to the widespread adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML), which enhance the ability to detect and prevent fraud in real-time.

Moreover, stringent government regulations aimed at safeguarding consumer data and increasing awareness among businesses about the importance of fraud prevention are driving the market forward. Despite these growth factors, the FDP market faces several challenges. The primary challenge is the high cost of implementing advanced fraud detection systems, which can be a significant barrier for small and medium-sized enterprises (SMEs).

Several factors contribute to the growth of the FDP market. Firstly, the increasing adoption of digital payment systems, e-commerce platforms, and online banking has created a larger attack surface for fraudsters. Consequently, organizations are investing in robust FDP solutions to safeguard their financial transactions, customer data, and brand reputation.

Moreover, the advancements in technology, such as artificial intelligence (AI) and machine learning (ML), have revolutionized fraud detection capabilities. These technologies enable businesses to analyze vast amounts of data in real-time, detect patterns, and identify anomalies that indicate fraudulent behavior. The integration of AI and ML algorithms into FDP systems has significantly improved their accuracy and efficiency.

Additionally, regulatory compliance requirements have played a crucial role in driving the FDP market. Governments and industry regulators are imposing stringent regulations to combat money laundering, fraud, and financial crimes. Organizations are compelled to implement comprehensive FDP solutions to comply with these regulations, thereby driving the market growth.

Despite the growth opportunities, the FDP market also faces several challenges. The evolving nature of fraud techniques and the constant emergence of new threats pose a significant hurdle. Fraudsters continuously adapt their methods to exploit vulnerabilities, making it essential for FDP solutions to stay ahead of the curve.

Furthermore, the complexity of integrating FDP systems into existing IT infrastructure and business processes can be a challenge. Organizations often struggle with the seamless implementation of FDP solutions, requiring significant investments in resources, personnel, and training.

Nevertheless, the FDP market presents ample opportunities for vendors and service providers. The increasing demand for cloud-based FDP solutions allows organizations to leverage scalable and cost-effective fraud prevention technologies. Additionally, the expansion of mobile and digital channels provides opportunities for FDP solutions tailored to these platforms.

Key Takeaways

- The Fraud Detection and Prevention (FDP) Market is projected to reach USD 226.0 billion by 2033, with a remarkable CAGR of 20.0% from 2024 to 2033, compared to USD 36.5 billion in 2023.

- Solutions, including fraud analytics, governance, risk and compliance (GRC), and authentication systems, dominate the FDP market with over 66.1% market share in 2023.

- Payment Fraud leads the FDP market with a share of more than 47.5% in 2023, driven by the surge in online banking, e-commerce, and digital wallets.

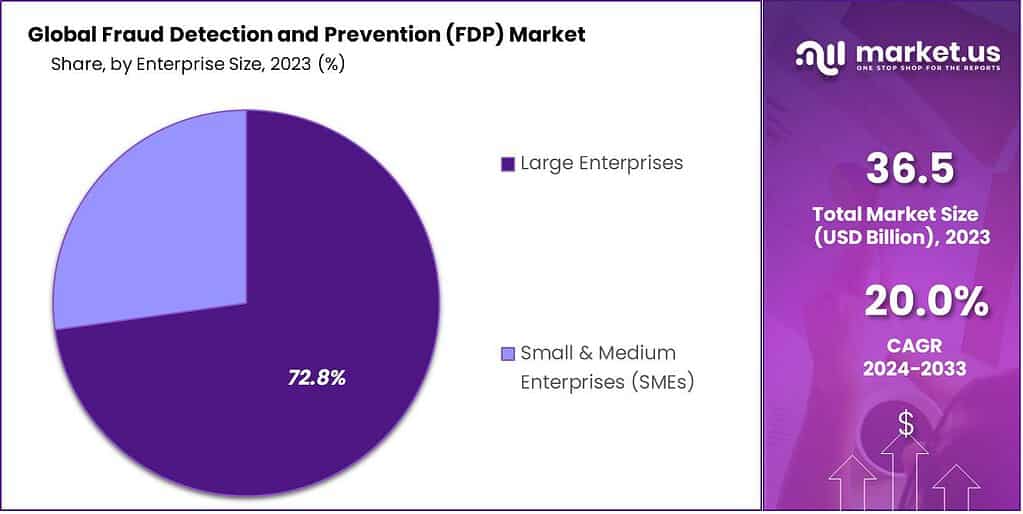

- Large Enterprises hold a significant market share (72.8%) in 2023 due to their resources and need for comprehensive FDP solutions, given their complexity and susceptibility to fraud.

- The Banking, Financial Services, and Insurance (BFSI) sector accounted for over 27.6% of the market share in 2023, primarily because of the high volume of monetary assets managed within this sector.

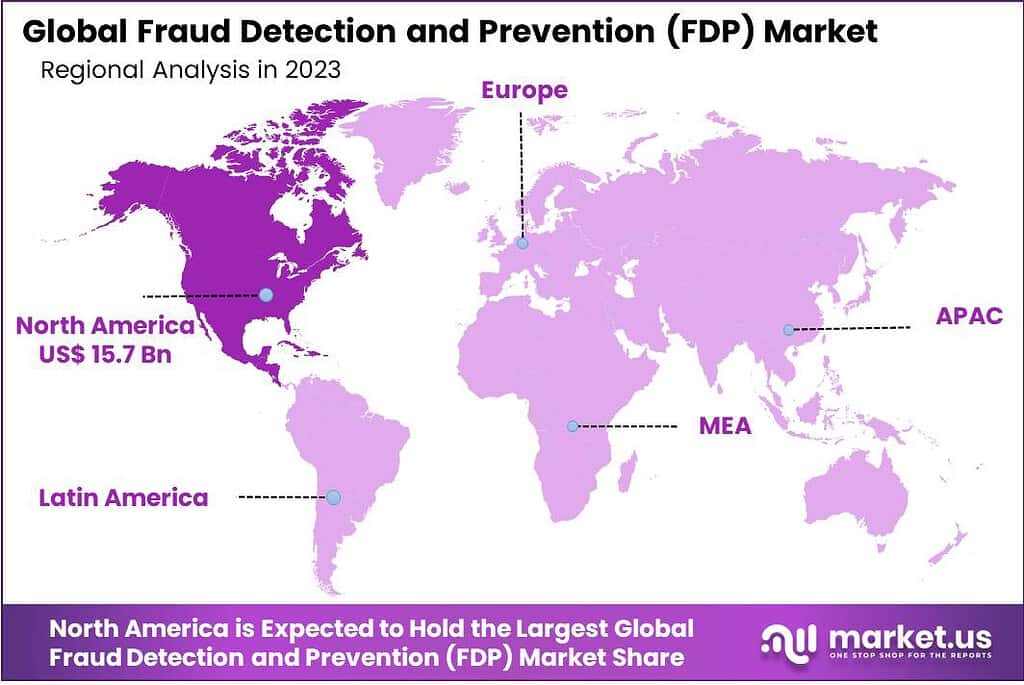

- North America held a dominant market position in 2023, with a share of 43.1%, driven by its technological hubs, regulatory framework, and digitalization.

Component Analysis

In 2023, the Solutions segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 66.1% share. This segment’s dominance can be attributed to several key factors that contribute to its strong market presence.

Fraud Detection and Prevention solutions encompass a range of technologies and tools designed to detect, prevent, and mitigate fraudulent activities across various industries. These solutions typically include fraud analytics, governance, risk and compliance (GRC) platforms, and authentication systems.

The dominance of the Solutions segment can be attributed to the increased demand for robust and comprehensive fraud prevention measures. Organizations across sectors are recognizing the need to deploy advanced technologies and analytics to proactively detect and prevent fraud incidents. Fraud analytics solutions enable organizations to identify patterns, anomalies, and suspicious activities within large volumes of data. These solutions leverage machine learning algorithms and advanced analytics techniques to improve detection accuracy and reduce false positives.

Governance, Risk and Compliance (GRC) platforms are another critical component of Fraud Detection and Prevention solutions. These platforms help organizations establish effective fraud prevention strategies by ensuring compliance with regulatory requirements and industry standards. GRC solutions provide frameworks for risk assessment, policy management, and fraud detection workflows, enabling organizations to implement robust fraud prevention measures and maintain regulatory compliance.

Authentication systems are essential for verifying the identities of individuals and ensuring secure access to systems and sensitive information. With the increasing sophistication of fraudsters, organizations are investing in authentication solutions that leverage multi-factor authentication, biometrics, and behavioral analysis to strengthen identity verification processes.

The dominance of the Solutions segment can also be attributed to the growing complexity and diversity of fraud techniques. Organizations require comprehensive solutions that address various types of fraud, including payment fraud, identity theft, account takeover, and insider threats. The Solutions segment offers a wide range of tools and technologies that can be customized and integrated into existing systems to provide holistic fraud detection and prevention capabilities.

Overall, the dominance of the Solutions segment in the FDP market is driven by the increasing demand for advanced fraud prevention technologies, the need for regulatory compliance, and the evolving nature of fraud threats. As organizations strive to combat fraud effectively, the Solutions segment is expected to continue its dominance and witness further innovation to address emerging fraud challenges.

Application Analysis

In 2023, the Payment Fraud segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 47.5% share. This prominence can be primarily attributed to the increasing digitalization of financial transactions globally. With the rise of online banking, e-commerce, and digital wallets, there has been a corresponding surge in fraudulent activities targeting these platforms. Payment fraud encompasses a wide range of illicit activities, including credit card fraud, wire transfer fraud, and fraudulent transactions in online retailing.

The exponential growth in online transactions, driven by the convenience and accessibility of digital payment methods, has inadvertently expanded the attack surface for cybercriminals. This has necessitated the adoption of sophisticated FDP solutions by businesses and financial institutions to protect against financial losses. The integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics in FDP systems has significantly enhanced their effectiveness in identifying and preventing fraudulent transactions in real-time.

Additionally, regulatory bodies across various regions have implemented stringent regulations to combat payment fraud, further driving the demand for FDP solutions. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) requires robust fraud detection mechanisms, contributing to this segment’s growth.

By Enterprise Size

In 2023, the Large Enterprises segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 72.8% share. This substantial market share is primarily attributed to the higher financial resources and infrastructural capabilities of large enterprises to invest in advanced FDP systems.

Large enterprises often operate across multiple geographies and have a diverse range of operations, making them more susceptible to sophisticated fraud schemes. This complex business structure necessitates robust and comprehensive FDP solutions to safeguard against a wide spectrum of fraudulent activities.

The scale of operations in large enterprises also results in vast amounts of data generation, which requires advanced analytics tools for effective fraud detection. These organizations are thus more likely to invest in cutting-edge technologies such as artificial intelligence, machine learning, and big data analytics, which are integral components of modern FDP systems. These technologies enable real-time analysis and detection of fraudulent activities, thereby reducing potential financial losses and maintaining the integrity of business operations.

Additionally, large enterprises are often subject to stricter regulatory compliance requirements in various jurisdictions. Regulatory frameworks like the General Data Protection Regulation (GDPR) in Europe and similar laws in other regions mandate stringent data protection and fraud prevention measures. Compliance with these regulations is a critical driver for the adoption of FDP solutions in large enterprises.

End-Use Industry

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 27.6% share. This significant share is primarily due to the inherent nature of financial transactions and the high volume of monetary assets managed within this sector, making it a prime target for fraudulent activities. The BFSI sector encompasses banks, insurance companies, credit unions, investment funds, and other financial institutions, all of which require robust security measures to protect against fraud.

One key driver for the adoption of FDP solutions in the BFSI sector is the escalating rate of financial crimes, including credit card fraud, identity theft, money laundering, and insurance fraud. These institutions manage sensitive customer information and large-scale financial transactions, necessitating advanced and reliable fraud detection systems to ensure security and trust.

The digital transformation in the BFSI sector, marked by the shift towards online banking, digital payments, and virtual customer service, has further amplified the need for effective fraud prevention measures. With an increase in online transactions, there is a corresponding rise in cyber fraud risks, which FDP systems are equipped to mitigate. Technologies such as AI and machine learning are particularly valuable in this context, offering real-time monitoring and predictive analysis to identify and prevent fraudulent activities.

Moreover, regulatory compliance is a critical factor driving the BFSI sector’s investment in FDP solutions. Financial institutions are subject to stringent regulatory requirements designed to prevent fraud and protect consumer data. Compliance with regulations such as the Anti-Money Laundering (AML) directives and the Payment Card Industry Data Security Standard (PCI DSS) necessitates the implementation of comprehensive FDP strategies.

Key Market Segments

Component

- Solutions

- Fraud Analytics

- Governance, Risk, and Compliance

- Authentication

- Services

- Managed Services

- Professional Services

Application

- Payment Fraud

- Money Laundering

- Identity Theft

- Other Applications

Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Government

- Other End-Use Industries

Driver

Growing Need for Digital Technologies and IoT Across Industries

The Fraud Detection and Prevention (FDP) market is being driven significantly by the burgeoning need for digital technologies and the Internet of Things (IoT) across varied industries. This driver is rooted in the rapid digital transformation that industries are undergoing, manifesting in the increased reliance on online platforms, cloud-based services, and IoT devices. These technologies have revolutionized business operations, enabling greater efficiency, connectivity, and data-driven decision-making.

However, this digital shift has also opened up new avenues for cybercriminals. IoT devices, in particular, often have inherent security vulnerabilities, making them susceptible to hacking and unauthorized access. The vast network of connected devices generates a colossal amount of data, often including sensitive personal and financial information. This proliferation of data points creates multiple opportunities for cyber fraudsters to exploit security weaknesses.

Moreover, as industries become more interconnected through digital technologies, the potential impact of cyber fraud escalates. A breach in one part of the network can have cascading effects, leading to significant financial and reputational damage. For instance, in the financial sector, the shift towards online banking and digital transactions has increased the incidence of cyber fraud, necessitating advanced FDP solutions.

Restraint

Growing Fraud Complexity and Insufficient Availability of Skilled Security Personnel

A major restraint in the growth of the Fraud Detection and Prevention (FDP) market is the dual challenge of increasing fraud complexity and the insufficient availability of skilled security personnel. As digital platforms and technologies become more intricate and pervasive, the methods employed by cybercriminals have also become more sophisticated and harder to detect. This complexity ranges from advanced phishing scams to intricate malware attacks, requiring specialized knowledge and tools for effective detection and prevention.

The complexity of modern fraud schemes necessitates advanced skill sets in cybersecurity, data analysis, and fraud detection technologies. However, there is a noticeable gap in the market when it comes to professionals equipped with these skills. The shortage of trained security personnel is a significant challenge, as the effectiveness of FDP systems heavily relies on the capabilities of the individuals operating them. This gap not only hampers the immediate response to fraud incidents but also affects the strategic planning and implementation of FDP measures.

Opportunity

Increased Adoption of Advanced Technologies

The Fraud Detection and Prevention (FDP) market is presented with a significant opportunity through the increased adoption of advanced technologies. As the landscape of digital fraud evolves, the incorporation of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), Big Data analytics, and blockchain into FDP systems is becoming increasingly vital. These technologies offer enhanced capabilities for detecting and preventing fraud in a more efficient, accurate, and automated manner.

AI and ML, in particular, are revolutionizing FDP solutions by providing the ability to analyze large datasets quickly and identify patterns indicative of fraudulent activity. AI algorithms can learn from historical data, enabling them to predict and flag potential frauds before they occur. This predictive capability is crucial in proactive fraud prevention, as it allows organizations to intervene and mitigate risks early.

Big Data analytics plays a pivotal role in enhancing the effectiveness of FDP systems. With the exponential increase in data generation, especially in sectors like banking, e-commerce, and telecommunications, analyzing this vast amount of data for signs of fraud is a daunting task. Big Data analytics tools can process and analyze these large datasets to extract meaningful insights, detect anomalies, and provide actionable intelligence for fraud prevention.

Challenge

Lack of Trained Professionals to Analyze Fraud Attacks

A critical challenge facing the Fraud Detection and Prevention (FDP) market is the lack of trained professionals capable of effectively analyzing and responding to fraud attacks. This challenge stems from the rapidly evolving nature of cyber threats and the sophisticated skills required to identify and mitigate these threats. The current demand for professionals with expertise in cybersecurity, data analytics, and advanced FDP technologies far exceeds the supply, creating a significant skills gap in the market.

This shortage of skilled professionals is a multifaceted problem. First, the complexity and variety of modern fraud attacks require a deep understanding of both the technical aspects of FDP systems and the evolving tactics used by cybercriminals. Professionals in this field need to possess a unique blend of technical expertise, analytical skills, and continuous learning ability to adapt to new threats and technologies.

According to a survey conducted by the non-profit professional association for Cybersecurity (ISC), 51% of cybersecurity professionals have acknowledged the exposure of their companies to significant risks owing to a shortage of skilled cybersecurity personnel.

Secondly, the training and development of such professionals are challenging due to the rapid pace of technological advancement in the field of cybersecurity and fraud detection. Educational and training programs often struggle to keep up with the latest developments, resulting in a workforce that may not be fully prepared to handle the latest types of cyber fraud.

Regional Analysis

In 2023, North America held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 43.1% share. This significant market share can be attributed to several factors that are characteristic of the region. Firstly, North America, particularly the United States, is home to many leading financial and technological hubs. These hubs are not only centers of innovation in digital technologies but also prime targets for sophisticated fraud schemes, driving the demand for advanced FDP solutions.

Furthermore, the region has a well-established regulatory framework that mandates stringent data protection and fraud prevention measures, especially in sectors like banking, healthcare, and e-commerce. Laws such as the Sarbanes-Oxley Act in the U.S. and the Personal Information Protection and Electronic Documents Act (PIPEDA) in Canada require organizations to implement robust security measures, thereby fueling the adoption of FDP systems.

Another contributing factor is the high level of digitalization and the widespread adoption of eCommerce and online banking services in North America. This digital landscape, coupled with the prevalence of IoT devices, generates massive amounts of data, making it imperative for businesses to employ sophisticated FDP solutions to safeguard against data breaches and cyber fraud.

Moreover, the presence of several leading FDP solution providers in North America, along with continuous investments in research and development in cybersecurity technologies, further strengthens the region’s position in the global market. These companies are at the forefront of developing innovative FDP technologies, such as AI and machine learning-based systems, which are essential in combating the increasingly complex and evolving nature of fraud.

Frequently Asked Questions (FAQ)

How big is the Fraud Detection and Prevention Market?The Global Fraud Detection and Prevention (FDP) Market size is expected to be worth around USD 226.0 Billion by 2033, from USD 36.5 Billion in 2023, growing at a CAGR of 20.0% during the forecast period from 2024 to 2033.

What is the current Fraud Detection and Prevention Market size?In 2024, the Fraud Detection and Prevention Market size is expected to reach USD 43.8 billion.

Which component led the fraud detection and prevention market?The solutions segment dominated the global fraud detection & prevention market held the largest revenue share of more than 66.1% in 2023.

Who are the key players in the fraud detection and prevention market?Some key players operating in the fraud detection & prevention market include IBM Corporation, SAP SE, SAS Institute Inc., Experian plc, FICO, Oracle Corporation, Software AG, LexisNexis, RSA Security LLC, Fiserv Inc., NICE Systems Ltd., ACI Worldwide Inc., Other Key Players

Which application segment led the fraud detection and prevention market?In 2023, the Payment Fraud segment held a dominant market position in the Fraud Detection and Prevention (FDP) market, capturing more than a 47.5% share.

Which region accounted for the largest fraud detection and prevention market share?North America dominated the fraud detection & prevention market with a share of approx. 43.1% in 2023.

Fraud Detection and Prevention MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Fraud Detection and Prevention MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- SAP SE

- SAS Institute Inc.

- Experian plc

- FICO

- Oracle Corporation

- Software AG

- LexisNexis

- RSA Security LLC

- Fiserv, Inc.

- NICE Systems Ltd.

- ACI Worldwide Inc.

- Other Key Players