Global Foundry Coke Market By Type (Ash Content <8%, 8% ≤ Ash Content <10%, and Ash Content ≥10%) By Application (Automotive Parts Casting, Machinery Casting, and Material Treatment), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 16586

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

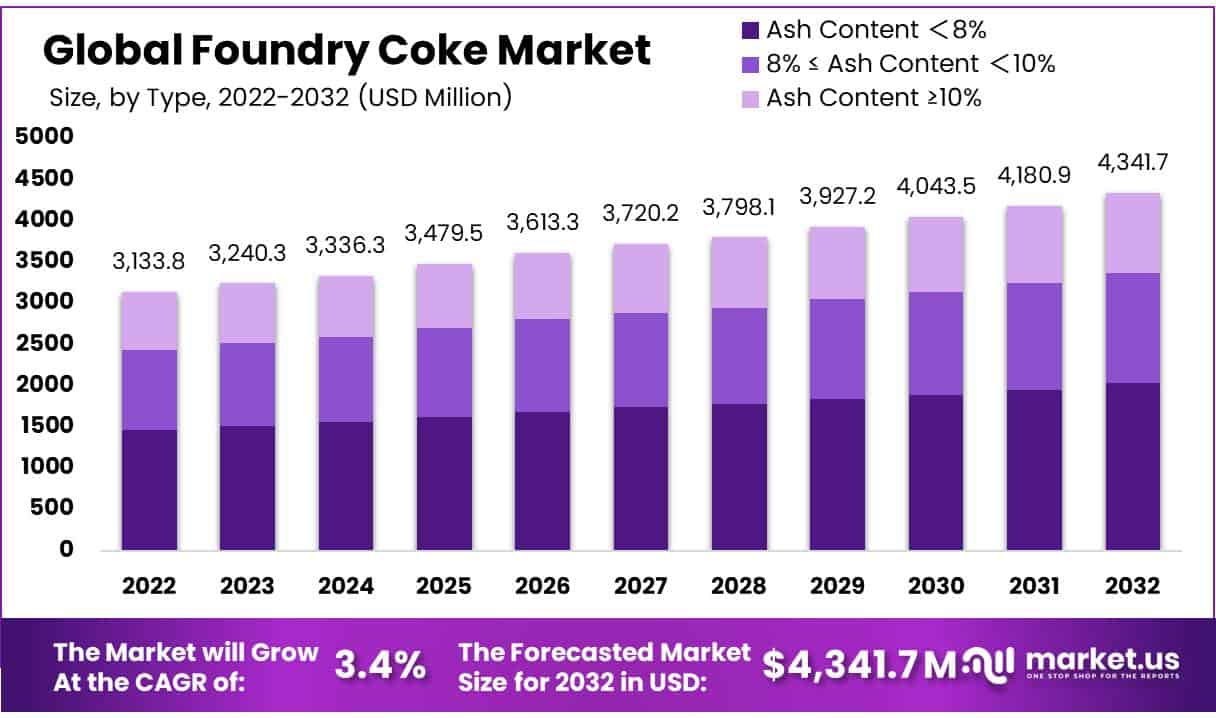

In 2022, the Foundry Coke Market was valued at USD 3,133.8 Million and is expected to reach USD 4,341.7 Million by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 3.4%.

Foundry coke, also known as hard coal coke, is produced in non-recyclable coke ovens and is used in foundries to melt iron and various metals like lead, tin, copper, and zinc. It has a dense structure, high carbon content, low ash, and generates high heat.

Foundry Coke is larger than metallurgical Coke, and its dimensions depend on the cupola size. Foundry coke has various applications in the manufacturing process of crude iron and acts as a reducing agent, support matrix, and energy carrier.

It is primarily used in blast furnaces and smelting nonferrous metals such as copper, lead, zinc, titanium, antimony, and mercury. As a reducing agent, it helps maintain the necessary carbon content in metal products and acts as a framework for bauxite and material columns. The demand for foundry coke is expected to be driven by downstream foundry products, and government initiatives aimed at developing the automotive sector are contributing to the growth of the global foundry coke market in developed and emerging economies.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth: The Foundry Coke Market was valued at USD 3,133.8 Million in 2022 and is projected to reach USD 4,341.7 Million by 2032, with an estimated Compound Annual Growth Rate (CAGR) of 3.4%.

- Foundry Coke Definition: Foundry coke, also known as hard coal coke, is produced in non-recyclable coke ovens and is used in foundries for melting various metals like iron, lead, tin, copper, and zinc. It is known for its dense structure, high carbon content, low ash content, and high heat generation.

- Applications of Foundry Coke: Foundry Coke plays a crucial role in the manufacturing of crude iron, acting as a reducing agent, support matrix, and energy carrier. It is used in blast furnaces and smelting nonferrous metals like copper, lead, zinc, titanium, antimony, and mercury.

- Demand Drivers: The demand for foundry coke is primarily driven by downstream foundry products, as well as government initiatives aimed at developing the automotive sector in both developed and emerging economies.

- End-Use Sectors: The global foundry coke market benefits from increased demand from various end-use sectors, including automotive, construction, machinery, and pipe and fitting industries. This growth is further fueled by infrastructure expenditure and the adoption of modern technologies.

- Challenges: The industry faces challenges due to the adoption of advanced technologies like electrical induction furnaces and the availability of alternative materials for foundry coke, such as aluminum replacing iron in some applications.

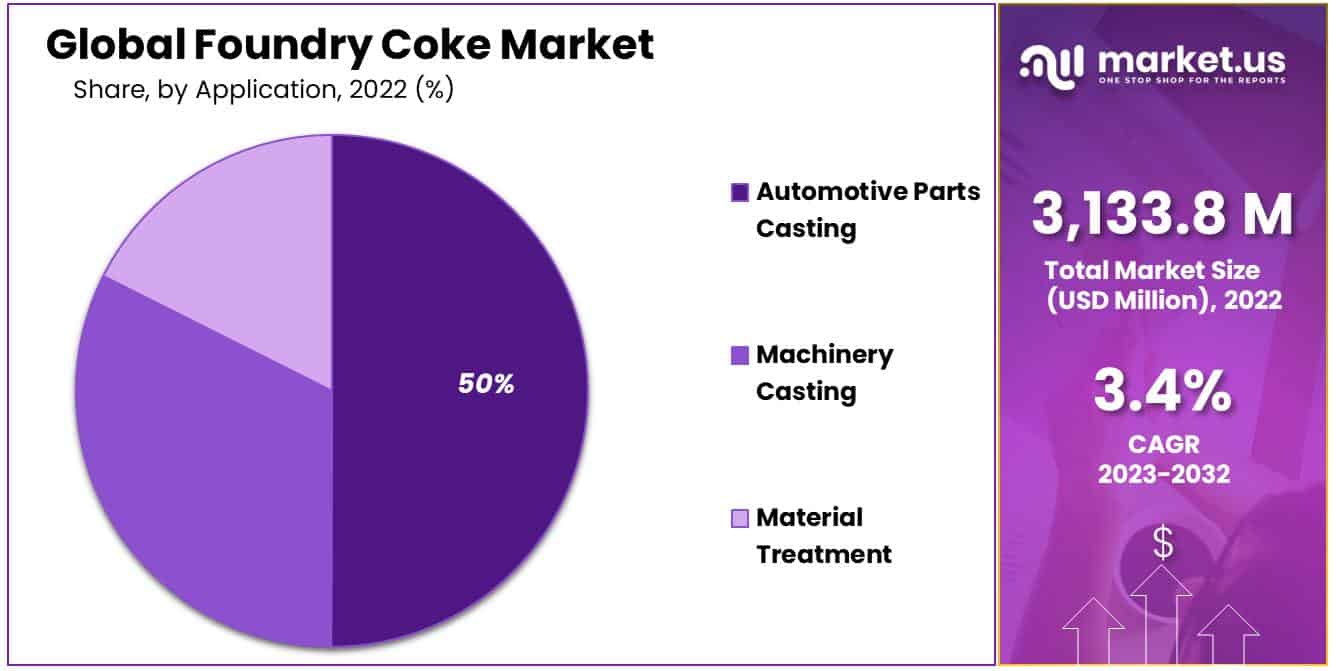

- Market Segmentation: By Type, The Ash Content <8% segment dominated the market in 2022, with a market share of 46.7%, owing to its higher quality and lower impurities. By Application Automotive parts casting held the largest market share in 2022, accounting for 50.1%, driven by the growth in the automotive industry. Machinery casting is also a significant segment.

- Growth Opportunities: The increasing demand for foundry coke in the manufacturing sector, especially in steel production, offers growth opportunities. Industrialization in developing economies, such as China, presents growth prospects.

- Sustainability Focus: The foundry coke industry is increasingly focusing on sustainable practices, including reducing carbon emissions and improving energy efficiency to comply with stricter environmental regulations.

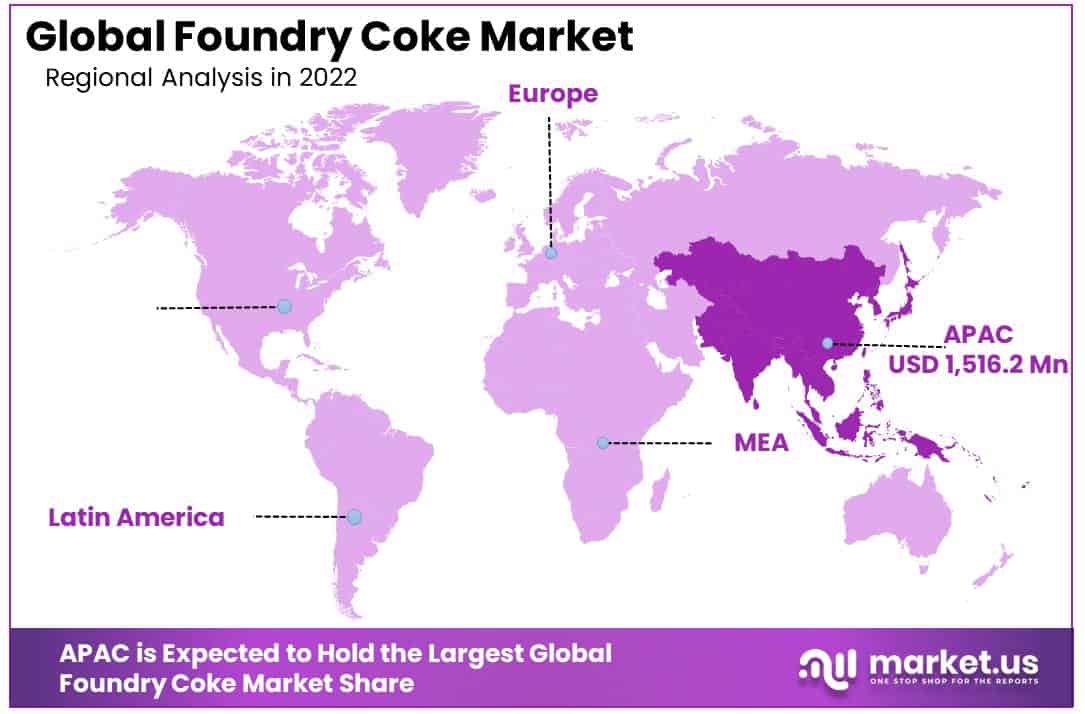

- Regional Dominance: The Asia-Pacific (APAC) region, including countries like China, Japan, and India, holds a dominant position in the global foundry coke market due to rapid industrialization and an expanding automotive sector.

- Key Players: Prominent players in the industry include ArcelorMittal, Vedanta Resources Limited, Drummond Company Inc., Nippon Coke & Engineering Company Limited, Hickman Williams & Company, Jiangsu Surun High Carbon Co. Ltd., Italiana Coke S.R.L., OKK Koksovny, and CARBO-KOKS.

Driving Factors

Demand from End-Use Sectors Drives Global Foundry Coke Market Growth

The global foundry coke market is experiencing robust growth due to increased demand from various end-use sectors such as automotive, construction, machinery, and pipe and fitting industries. The growing infrastructure expenditure and the adoption of modern technologies, such as the byproduct recovery process, further fuel this surge in demand. Government initiatives aimed at boosting the automotive sector in developed and developing countries contribute significantly to the market’s expansion.

The flourishing iron industry, driven by its diverse and expanding applications, is vital in augmenting the global foundry coke market. Furthermore, the rise in disposable income among consumers is expected to drive demand for automotive and residential properties, further supporting the increased need for foundry coke.

Restraining Factors

Shifting Technologies and Regulations Impact Growth of Foundry Coke Market

The foundry coke market is facing potential challenges due to the adoption of advanced technologies, such as the shift from cupola furnaces to electrical induction furnaces, to reduce emissions and enhance energy efficiency. Additionally, the availability of alternative materials for foundry coke, like aluminum products replacing iron products, may hinder market growth.

The substitutions offer potential benefits but could also limit the demand for traditional foundry coke, affecting the market’s expansion. Additionally, as concerns about pollution and health hazards grow, some consumers and industries might seek more eco-friendly and safer alternatives, potentially affecting the demand for foundry coke.

Market Scope

By Type Analysis

The Ash Content <8% Segment was Dominant in 2022 Due to Its Higher Quality and Applications in the Manufacturing Industry.

Based on type, the market for foundry cokes is segmented into Ash Content <8%, 8% ≤ Ash Content <10%, and Ash Content ≥10%. Among these, the ash content <8% segment dominates the market, with a market share of 46.7% in 2022 and a forecasted CAGR of 3.6% in the upcoming period. Due to the foundry, coke with ash content <8% is considered to be of higher quality.

It has lower impurities, crucial for efficient and consistent performance in the foundry industry. Manufacturers and foundries prefer this type of coke as it ensures better metallurgical properties in the casting process. The 8% ≤ Ash Content <10% segment is the second largest segment, with a 30.9% market share in 2022. This can be attributed to its cost-effectiveness, versatility, and demand from various industries.

By Application Analysis

The Automotive Parts Casting Segment is Dominant in the Global Foundry Coke Market Due to its Wide Use in the Manufacturing of Automotive Parts

By applications, the market is further divided into automotive parts casting, machinery casting, and material treatment. Among these, automotive parts casting is the most lucrative segment in the market. In 2022 automotive parts casting has a market share of 50.1%. The automotive industry has been experiencing steady growth, leading to an increased demand for automotive parts.

As casting is a widely used method in manufacturing these parts, it drives the demand for foundry coke. Foundry coke can be used in various casting processes, making it suitable for a wide range of automotive parts, including engine blocks, transmission components, and brake systems.

Machinery casting holds a significant market share in the global foundry coke market. With the growing industrialization and infrastructure development across the globe, the demand for machinery and equipment has significantly increased. Machinery casting utilizes foundry coke as a crucial material in production, leading to a higher demand for foundry coke in this sector.

Key Market Segments

Based on Type

- Ash Content <8%

- 8% ≤ Ash Content <10%

- Ash Content ≥10%

Based on Application

- Automotive Parts Casting

- Machinery Casting

- Material Treatment

Growth Opportunities

The Increasing Demand for Foundry Coke in the Manufacturing Sector

The global foundry coke market presents various opportunities for growth and development. One of the key opportunities in this industry is the increasing demand for foundry coke in the manufacturing sector, particularly in steel production. As the construction and automotive industries continue to thrive, the need for high-quality steel will rise, further fueling the demand for foundry coke.

Moreover, Promising industrialization in developing economies in the Asia Pacific region, such as China, is expected to provide opportunities for players to increase penetration in these markets; also, the majority of new content development and smart initiatives in the automobile and casting industry are coming from the regions that provide numerous opportunities for the foundry coke market.

Latest Trends

Foundry Coke Industry Amplifies Focus on Sustainable Practices and Environmental Compliance

The foundry coke industry has been increasingly focused on adopting more sustainable practices. This includes reducing carbon emissions, improving energy efficiency, and exploring alternative raw materials and processes with a lesser environmental impact. Stricter environmental regulations and emissions standards have prompted the foundry coke industry to invest in technologies and processes that minimize environmental impact. This includes reducing emissions of pollutants and greenhouse gases. The foundry coke industry has been increasingly focused on adopting more sustainable practices.

Regional Analysis

APAC is Dominant Region in the Global Foundry Coke Market due to Rapid Industrialization and Expanding Automotive Sector

In 2022, APAC held the leading position in the global market, with a market share of 48.4% and a CAGR of 3.8% in the projected period. Rapid industrialization in countries such as China, Japan, and India increased the demand for foundry coke as a key raw material in iron and steel production. The expanding construction and automotive sectors also contribute to APAC’s dominance, as they rely heavily on foundry coke for manufacturing.

North America holds a significant market share in the global foundry coke market due to abundant reserves of high-quality metallurgical coal, a well-established steel industry, advanced technology, and a strategic geographical location for trade and export opportunities.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Several key players who hold significant influence in the industry drive the global foundry coke market. ArcelorMittal is a major player known for its diversified steel production and supply chain network. Vedanta Resources Limited is another prominent name renowned for its large-scale metal and mining operations.

These key players and other industry participants collectively influence the foundry coke market’s growth, supply, and demand dynamics. Their continuous innovation, expansion, and market strategies contribute significantly to the industry’s development.

Market Key Players

- ArcelorMittal

- Vedanta Resources Limited

- Drummond Company Inc.

- Nippon Coke & Engineering Company Limited

- Hickman Williams & Company

- Jiangsu Surun High Carbon Co. Ltd.

- Italiana Coke S.R.L.

- OKK Koksovny

- CARBO-KOKS

- Other Key Players

Recent Developments

- Anglo-American announced in January 2023 that it would invest $100 million to increase South African foundry coke production capacity by 50%; construction for this expansion should begin sometime during 2025 and is scheduled for completion.

- JSW Steel announced in February 2023 that they planned on building a foundry coke plant in India with an expected capacity of 1 million tonnes per annum, to be opened sometime before 2025.

- ArcelorMittal announced in March 2023 that it was investing $50 million to increase foundry coke production capacity by 30% by investing $50 million over two years to increase it from 2024-2025. This expansion should take effect and provide ArcelorMittal with greater market access in Brazil for production growth.

Report Scope

Report Features Description Market Value (2022) USD 3,133.8 Mn Forecast Revenue (2032) USD 4,341.7 Mn CAGR (2023-2032) 3.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Ash Content <8%, 8% ≤ Ash Content <10%, and Ash Content ≥10%) By Application (Automotive Parts Casting, Machinery Casting, and Material Treatment) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America – Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape ArcelorMittal, Vedanta Resources Limited, Drummond Company Inc., Nippon Coke & Engineering Company Limited, Hickman Williams & Company, Jiangsu Surun High Carbon Co. Ltd., Italiana Coke S.R.L., OKK Koksovny, CARBO-KOKS, and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is foundry coke Market?Foundry coke, also known as metallurgical coke or blast furnace coke, is a type of carbon-rich material produced by heating coal in the absence of air. It is primarily used as a fuel and reductant in the iron and steel industry.

What is the size of the Foundry Coke market?In 2022, the Foundry Coke Market was valued at USD 3,133.8 Million and is expected to reach USD 4,341.7 Million by 2032. Between 2022 and 2032.

What is the projected CAGR at which the Foundry Coke market is expected to grow at?The Foundry Coke market is expected to grow at a CAGR of 3.04% (2022-2032).

List the key industry players of the Foundry Coke Market?ArcelorMittal, Vedanta Resources Limited, Drummond Company Inc., Nippon Coke & Engineering Company Limited, Hickman Williams & Company, Jiangsu Surun High Carbon Co. Ltd., Italiana Coke S.R.L., OKK Koksovny, CARBO-KOKS, Other Key Players

-

-

- ArcelorMittal

- Vedanta Resources Limited

- Drummond Company Inc.

- Nippon Coke & Engineering Company Limited

- Hickman Williams & Company

- Jiangsu Surun High Carbon Co. Ltd.

- Italiana Coke S.R.L.

- OKK Koksovny

- CARBO-KOKS

- Other Key Players