Global Forensic Imaging Market By Modality (CT, X-ray, Ultrasound and MRI), By Application (Death Investigations and Clinical Studies), By End-user (Forensic Institutes, Hospitals and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176272

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

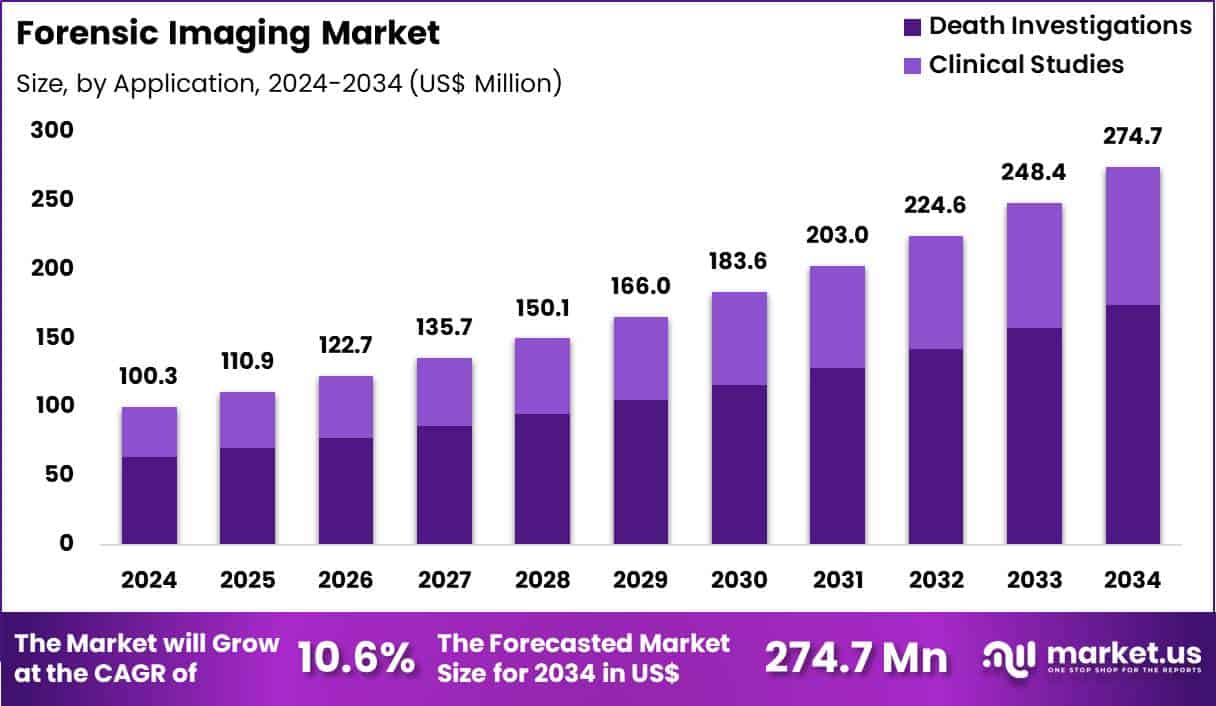

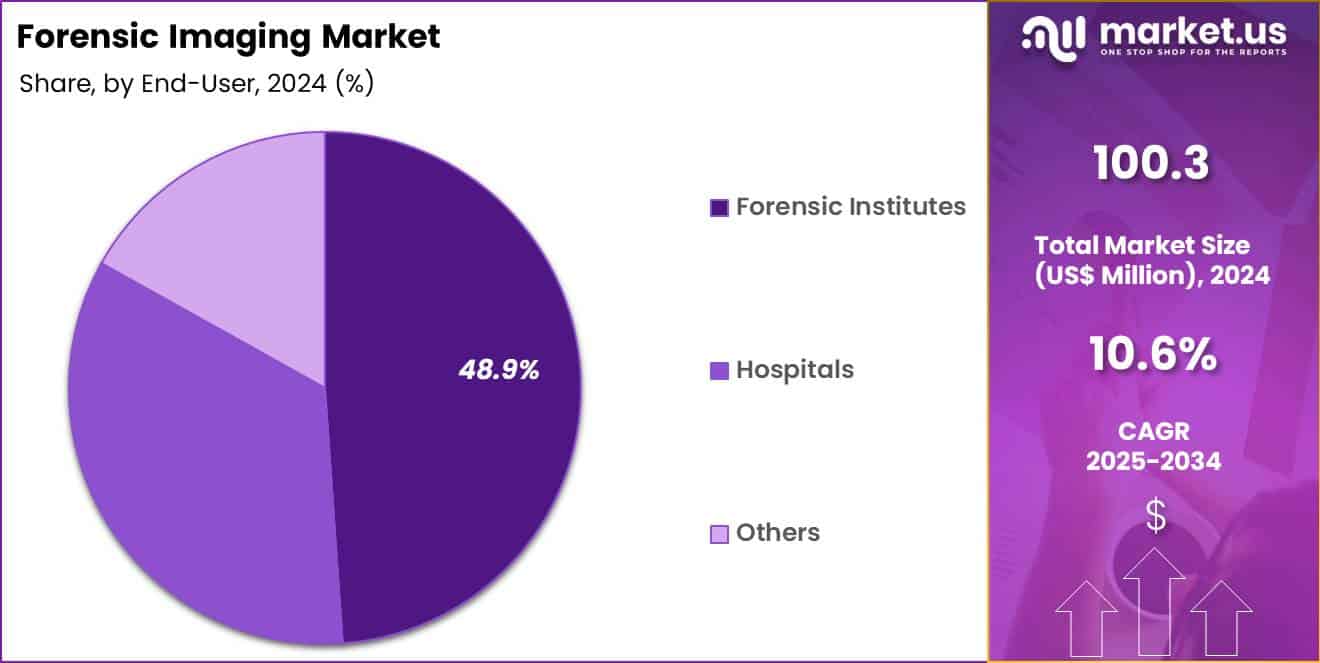

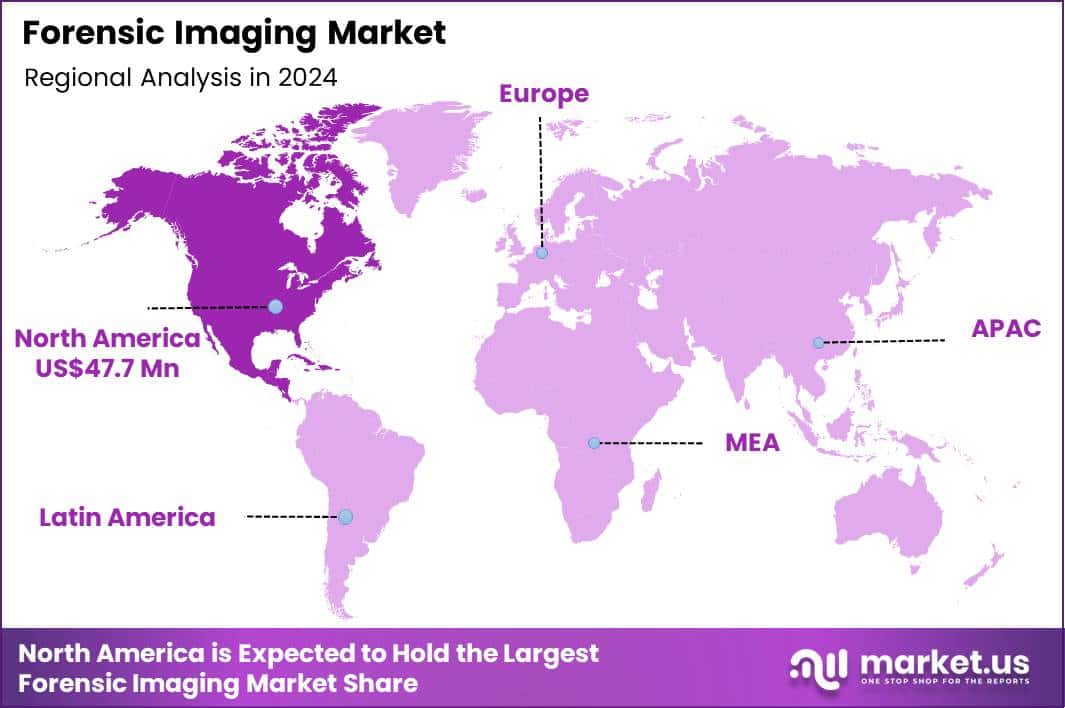

Global Forensic Imaging Market size is expected to be worth around US$ 274.7 Million by 2034 from US$ 100.3 Million in 2024, growing at a CAGR of 10.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 47.6% share with a revenue of US$ 47.7 Million.

Rising sophistication in criminal investigations and judicial requirements drives the forensic imaging market as law enforcement agencies and forensic laboratories seek advanced visualization tools that provide objective, high-resolution evidence for legal proceedings.

Forensic examiners increasingly utilize digital photography and 3D laser scanning to document crime scenes with millimeter accuracy, capturing bloodstain patterns, bullet trajectories, and footwear impressions for trajectory analysis and suspect identification. These systems support postmortem examinations by generating detailed virtual autopsies through computed tomography, revealing internal injuries, foreign objects, and cause of death without invasive procedures in cases involving blunt force trauma or gunshot wounds.

Investigators apply multispectral imaging to detect latent fingerprints, bodily fluids, and trace evidence on porous surfaces, enhancing visibility of bloodstains and semen residues under alternate light sources. Forensic odontologists employ intraoral scanners and cone-beam computed tomography to compare dental records with postmortem findings, facilitating victim identification in mass disaster or decomposed remains scenarios.

Digital microscopy and hyperspectral imaging further enable microscopic analysis of fibers, hairs, and tool marks, supporting trace evidence linkage in violent crime and arson investigations. Manufacturers pursue opportunities to integrate artificial intelligence algorithms that automate pattern recognition and anomaly detection, expanding applications in facial reconstruction from skeletal remains and age estimation from dental and skeletal imaging.

Developers advance portable 3D imaging systems that enable on-scene documentation of large crime scenes, facilitating rapid data capture in vehicle accidents and explosion sites. These innovations support virtual reality reconstructions that allow jurors to experience crime scene perspectives, strengthening courtroom presentations in homicide and assault cases.

Opportunities emerge in cloud-based platforms that enable secure sharing of forensic images among multidisciplinary teams, accelerating collaborative analysis in cold case reviews. Companies invest in non-contact imaging modalities that preserve fragile evidence integrity, such as structured light scanning for bite mark documentation and tire track impressions.

Recent trends emphasize multimodal fusion of imaging data with chemical analysis, positioning forensic imaging as a cornerstone of evidence integrity and investigative accuracy in modern criminal justice processes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 100.3 million, with a CAGR of 10.6%, and is expected to reach US$ 274.7 million by the year 2034.

- The modality segment is divided into CT, x-ray, ultrasound and MRI, with CT taking the lead with a market share of 44.2%.

- Considering application, the market is divided into death investigations and clinical studies. Among these, death investigations held a significant share of 63.4%.

- Furthermore, concerning the end-user segment, the market is segregated into forensic institutes, hospitals and others. The forensic institutes sector stands out as the dominant player, holding the largest revenue share of 48.9% in the market.

- North America led the market by securing a market share of 47.6%.

Modality Analysis

CT contributed 44.2% of growth within modality and led the forensic imaging market due to its ability to deliver rapid, high-resolution, three-dimensional visualization of internal structures. Forensic teams rely on CT to assess skeletal trauma, foreign objects, and internal injuries without invasive procedures.

The modality supports comprehensive documentation that strengthens medico-legal reporting and court admissibility. High throughput and fast scan times enable examiners to process cases efficiently, which matters for backlogged forensic workloads and time-sensitive investigations.

Growth accelerates as agencies prioritize non-invasive post-mortem imaging to preserve evidence integrity. Advances in image reconstruction and post-processing improve interpretation accuracy for complex cases. CT integrates well with digital archiving and case management systems, supporting long-term data retention. Training programs increasingly standardize CT-based protocols for forensic use. The segment is projected to remain dominant as jurisdictions expand virtual autopsy capabilities and modernize forensic infrastructure.

Application Analysis

Death investigations generated 63.4% of growth within application and emerged as the leading segment due to rising adoption of imaging to support cause-of-death determination. Authorities use forensic imaging to document trauma patterns, detect concealed injuries, and guide targeted autopsies. The approach reduces procedural ambiguity and enhances transparency in medico-legal assessments. Increased scrutiny of death investigations elevates demand for objective, reproducible imaging evidence that supports judicial processes.

Expansion of virtual autopsy programs strengthens reliance on imaging during post-mortem examinations. Imaging-based workflows improve examiner safety by minimizing exposure to biohazards. Standardized reporting frameworks increase acceptance across legal systems.

Interdisciplinary collaboration between pathologists and radiologists enhances diagnostic confidence. The segment is anticipated to sustain leadership as non-invasive investigation methods gain broader institutional endorsement.

End-User Analysis

Forensic institutes accounted for 48.9% of growth within end-user and dominated the forensic imaging market due to their central role in medico-legal case handling. These institutes manage high case volumes that require specialized imaging protocols and expert interpretation. Dedicated budgets and mandates support investment in advanced imaging systems tailored for forensic use. Centralized operations improve consistency in evidence collection and reporting standards.

Ongoing modernization initiatives drive procurement of digital imaging platforms within forensic institutes. Training and accreditation programs reinforce adoption of standardized imaging practices. Integration with national case databases improves data sharing and traceability.

Collaboration with law enforcement and judicial bodies increases utilization intensity. The segment is expected to remain the primary growth driver as forensic institutes continue to anchor death investigation services and evidentiary imaging workflows.

Key Market Segments

By Modality

- CT

- X-ray

- Ultrasound

- MRI

By Application

- Death Investigations

- Clinical Studies

By End-user

- Forensic Institutes

- Hospitals

- Others

Drivers

Increasing number of criminal offenses is driving the market.

The substantial volume of criminal offenses reported annually necessitates advanced forensic tools, including imaging technologies, to enhance investigative efficiency and accuracy. Forensic imaging aids in non-invasive examinations, reducing the need for traditional autopsies while providing detailed visual evidence for legal proceedings.

Law enforcement agencies rely on these technologies to document crime scenes and analyze injuries with high precision. The Federal Bureau of Investigation documented over 14 million criminal offenses for 2024 through its Uniform Crime Reporting program. This extensive data highlights the ongoing demand for reliable imaging solutions in managing case loads.

Healthcare and forensic collaborations promote the use of CT and MRI systems for post-mortem evaluations. Government funding for modernizing forensic infrastructure further supports market expansion. Key manufacturers are developing portable imaging devices to facilitate on-site analyses in diverse scenarios. This driver aligns with efforts to improve judicial outcomes through technological integration. Overall, the scale of criminal activity sustains investment in forensic imaging capabilities.

Restraints

High cost of advanced imaging equipment is restraining the market.

The premium pricing of sophisticated forensic imaging systems, such as high-resolution CT scanners, limits their deployment in underfunded forensic laboratories. Acquisition expenses include not only hardware but also software updates and calibration services essential for accurate results. Smaller agencies often face budgetary constraints that prevent upgrades from conventional methods.

Maintenance contracts add ongoing financial burdens, deterring widespread adoption. Regulatory compliance for equipment validation further elevates overall implementation costs. In public sectors, allocation priorities favor immediate operational needs over capital investments. This restraint affects accessibility in rural or low-resource forensic settings globally.

Collaborative leasing models aim to ease these pressures but remain limited in scope. Despite proven benefits, economic factors hinder equitable distribution of technology. Addressing procurement strategies is critical for overcoming this market challenge.

Opportunities

Growth in medical imaging revenues is creating growth opportunities.

The upward trend in revenues from medical imaging segments indicates potential for adapting these technologies to forensic applications in expanding healthcare ecosystems. Enhanced product portfolios support the transfer of innovations like high-field MRI to forensic pathology for detailed tissue analysis.

Canon Medical Systems reported net sales of ¥568.8 billion in its Medical System Business for 2024, up from ¥513.3 billion in 2023. This increase reflects robust demand that can extend to forensic uses through dual-purpose equipment. Strategic acquisitions by key players bolster capabilities in digital reconstruction for crime scene investigations.

Government initiatives for integrated health and justice systems facilitate cross-sector technology sharing. The large installed base in hospitals enables training programs for forensic specialists on existing platforms. This opportunity promotes cost-sharing models between medical and forensic entities. Prominent corporations are exploring dedicated forensic modules to capture niche markets. Focused developments can leverage revenue momentum for specialized growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the forensic imaging market through public sector budgets, law enforcement capital plans, and judicial spending discipline. Inflation and higher interest rates constrain procurement cycles for agencies, which delays upgrades of imaging systems and software licenses. Geopolitical tensions disrupt supplies of sensors, optics, GPUs, and secure storage hardware, increasing lead times and project risk.

Current US tariffs on imported electronics and precision components raise acquisition and maintenance costs, which tightens margins for vendors and stretches buyer approvals. These pressures weigh on smaller departments and slow adoption in cost sensitive regions. On the positive side, trade friction encourages domestic sourcing, trusted supply chains, and local integration partners.

Rising caseload complexity, digital evidence growth, and standards for accuracy sustain demand across policing and courts. With disciplined sourcing, software led differentiation, and service models, the market can navigate volatility and advance with confidence.

Latest Trends

Integration of large language models in crime scene image analysis is a recent trend in the market.

In 2024, researchers evaluated artificial intelligence tools like ChatGPT-4, Claude, and Gemini for supporting forensic image interpretation in simulated crime scenes. These models assist in identifying key elements such as wound patterns and environmental clues from photographic evidence. The study conducted between April 22 and April 29, 2024, demonstrated varying performance across tools in providing decision support.

Large language models enhance workflow by generating preliminary reports and highlighting anomalies for human review. Clinical validations focused on accuracy in diverse scenarios, including homicides and accidents. This trend addresses workload pressures on forensic experts through automated preliminary assessments.

Regulatory discussions emphasize validation protocols for AI outputs in legal contexts. Industry partnerships refine prompt engineering for forensic-specific applications. These advancements aim to reduce analysis time while maintaining evidentiary integrity. This evolution establishes AI as a complementary tool in modern forensic practices.

Regional Analysis

North America is leading the Forensic Imaging Market

North America holds a 47.6% share of the global Forensic Imaging market, indicating vigorous expansion in 2024 spurred by amplified utilization of multimodal scanners in autopsy suites and evidence preservation workflows. Esteemed providers such as GE Healthcare and Philips Healthcare have unveiled compact, AI-enhanced ultrasound and radiography units that facilitate real-time visualization of internal injuries without disrupting tissue samples for judicial reviews.

The territory’s integrated judicial systems have adopted these apparatuses to streamline identifications in unidentified remains cases and enhance accuracy in ballistic trajectory mappings. Programs spearheaded by the Department of Justice have underwritten validations of hyperspectral imaging for trace evidence detection, optimizing forensic workflows.

Growing incidences of mass shootings have necessitated rapid deployment of portable imagers for field triage and documentation. Federations linking state coroners with tech developers have standardized data formats, promoting interoperability across jurisdictions.

In addition, bolstered cybersecurity measures for imaging archives have safeguarded chain-of-custody integrity against tampering. The National Institute of Justice disbursed $13.6 million for 24 forensic science research endeavors in 2024, propelling innovations in digital evidence capture.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts project notable strides in the investigative visualization field across Asia Pacific throughout the forecast period, since administrations earmark resources to outfit enforcement bodies with cutting-edge capture devices. Leaders in South Korea and Taiwan engineer hybrid CT systems that merge with databases for swift suspect identifications, while experts in Myanmar calibrate tools for rugged terrain applications in border disputes.

Clinicians in Cambodia employ enhanced radiography to document abuse patterns, adapting methodologies to resource-limited settings. Donors in Laos subsidize training modules that teach precise ultrasound usage for wound assessments, elevating standards in provincial centers. Bureaucrats in Brunei enact policies that mandate digital archiving, streamlining reviews in appellate processes.

Practitioners in Bhutan fuse traditional techniques with MRI scans, refining diagnostics for environmental toxin exposures. Firms in Fiji fabricate durable cameras for underwater evidence retrieval, addressing maritime crime surges. The Australian government furnished A$2.4 million for a multi-year collaboration with Thailand on drug profiling enhancements, fortifying lab infrastructures in Southeast Asia.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the forensic imaging market build growth momentum by investing heavily in advanced imaging technologies such as high-resolution CT and MRI systems that support virtual autopsy and detailed crime scene analysis, meeting the rising demand for precise evidence capture. They advance software platforms that integrate artificial intelligence and 3D reconstruction to enhance image interpretation and workflow efficiency for law enforcement agencies and forensic labs.

Firms also form strategic collaborations with government forensic institutes and academic research centers to expand adoption and align solutions with procedural standards. Geographic expansion into Europe, North America, and fast-growing regions like Asia Pacific fortifies their customer reach and diversifies revenue streams.

Siemens Healthineers exemplifies a major medical imaging and diagnostic company with a comprehensive portfolio of radiology solutions, extensive service infrastructure, and a focused strategy to support medico-legal and investigative imaging needs. The company reinforces its competitive edge through targeted innovation, robust channel networks, and sustained engagement with forensic practitioners to translate emerging requirements into product enhancements.

Top Key Players

- GE HealthCare

- Siemens Healthineers

- Canon Medical Systems

- Philips Healthcare

- Fujifilm Holdings

- Esaote

- Carestream Health

- Agfa-Gevaert

- Hitachi Healthcare

- Neusoft Medical Systems

Recent Developments

- In December 2024, Canon Medical Systems USA introduced additional artificial intelligence functions across its CT systems. The upgrade focuses on automating scan setup, protocol selection, and image handling for neuro and chest examinations. These changes reduce operator workload and support more consistent imaging workflows across clinical settings.

- In March 2024, General Atomics Electromagnetic Systems released the FSIS-CSE, a compact imaging solution designed for forensic field use. The tablet-based device combines high-resolution capture with integrated illumination and filtering to document trace, biological, and chemical evidence. The system supports rapid on-scene collection and aligns with AFIS requirements used by forensic laboratories.

Report Scope

Report Features Description Market Value (2024) US$ 100.3 Million Forecast Revenue (2034) US$ 274.7 Million CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Modality (CT, X-ray, Ultrasound and MRI), By Application (Death Investigations and Clinical Studies), By End-user (Forensic Institutes, Hospitals and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GE HealthCare, Siemens Healthineers, Canon Medical Systems, Philips Healthcare, Fujifilm Holdings, Esaote, Carestream Health, Agfa-Gevaert, Hitachi Healthcare, Neusoft Medical Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GE HealthCare

- Siemens Healthineers

- Canon Medical Systems

- Philips Healthcare

- Fujifilm Holdings

- Esaote

- Carestream Health

- Agfa-Gevaert

- Hitachi Healthcare

- Neusoft Medical Systems