Global Food Waste Disposer Market Size, Share, Growth Analysis Type (Shattered Type Disposers, Dry Type Disposers, Grinding Type Disposers), Technology (Electric Disposers, Non-electric Disposers, Biodegradable), Application (Commercial, Residential), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177197

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

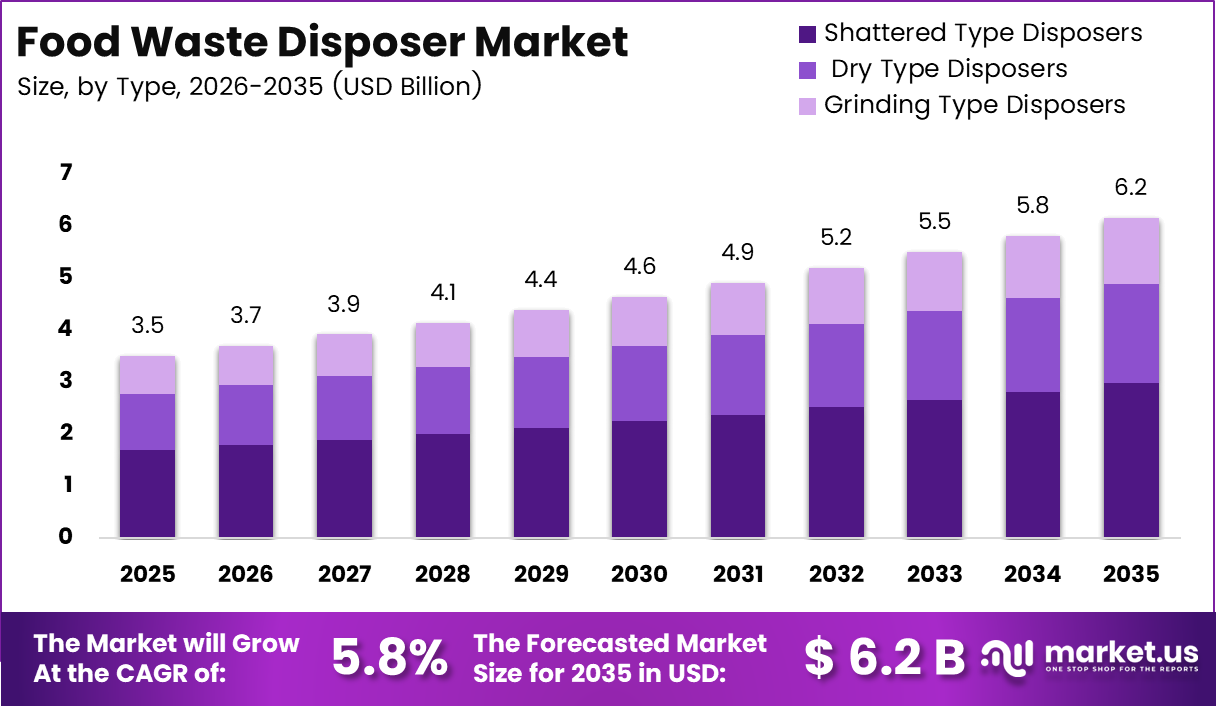

Global Food Waste Disposer Market size is expected to be worth around USD 6.2 Billion by 2035 from USD 3.5 Billion in 2025, growing at a CAGR of 5.8% during the forecast period 2026 to 2035.

Food waste disposers are kitchen appliances installed beneath sinks that grind organic food waste into fine particles. These devices facilitate direct disposal through plumbing systems, eliminating manual waste segregation. They offer convenient solutions for managing kitchen waste efficiently while reducing odor and hygiene concerns.

The market experiences robust expansion driven by urbanization and modern lifestyle adoption. Consumers increasingly prioritize convenience-oriented kitchen solutions that streamline household management. Moreover, growing environmental consciousness encourages sustainable waste management practices, positioning disposers as practical alternatives to traditional landfill disposal methods.

Residential adoption continues accelerating as housing infrastructure integrates advanced plumbing systems. Commercial establishments, particularly foodservice operations, recognize operational efficiency benefits. Additionally, regulatory frameworks increasingly mandate organic waste diversion from landfills, creating favorable market conditions for disposer adoption across multiple sectors.

Technological innovation focuses on energy efficiency and water conservation features. Manufacturers develop compact, noise-reduced models suitable for apartment living. Furthermore, smart home integration capabilities attract tech-savvy consumers seeking connected kitchen ecosystems. These advancements broaden market appeal beyond traditional single-family homes.

Regional variations reflect infrastructure maturity and regulatory environments. North America maintains market leadership due to established plumbing standards and environmental regulations. However, emerging economies present substantial growth potential as urban development accelerates. Consequently, manufacturers adapt product designs to accommodate diverse regional requirements and preferences.

According to Grand Designs Magazine, waste disposal unit installation increases water use by 3-4.5 litres per person daily. According to the Office for National Statistics, nearly ten million tonnes of food waste was produced in the UK in 2018, representing 143kg per person annually.

Key Takeaways

- Global Food Waste Disposer Market projected to reach USD 6.2 Billion by 2035 from USD 3.5 Billion in 2025

- Market expected to grow at a CAGR of 5.8% during the forecast period 2026-2035

- Shattered Type Disposers dominate the Type segment with 48.5% market share

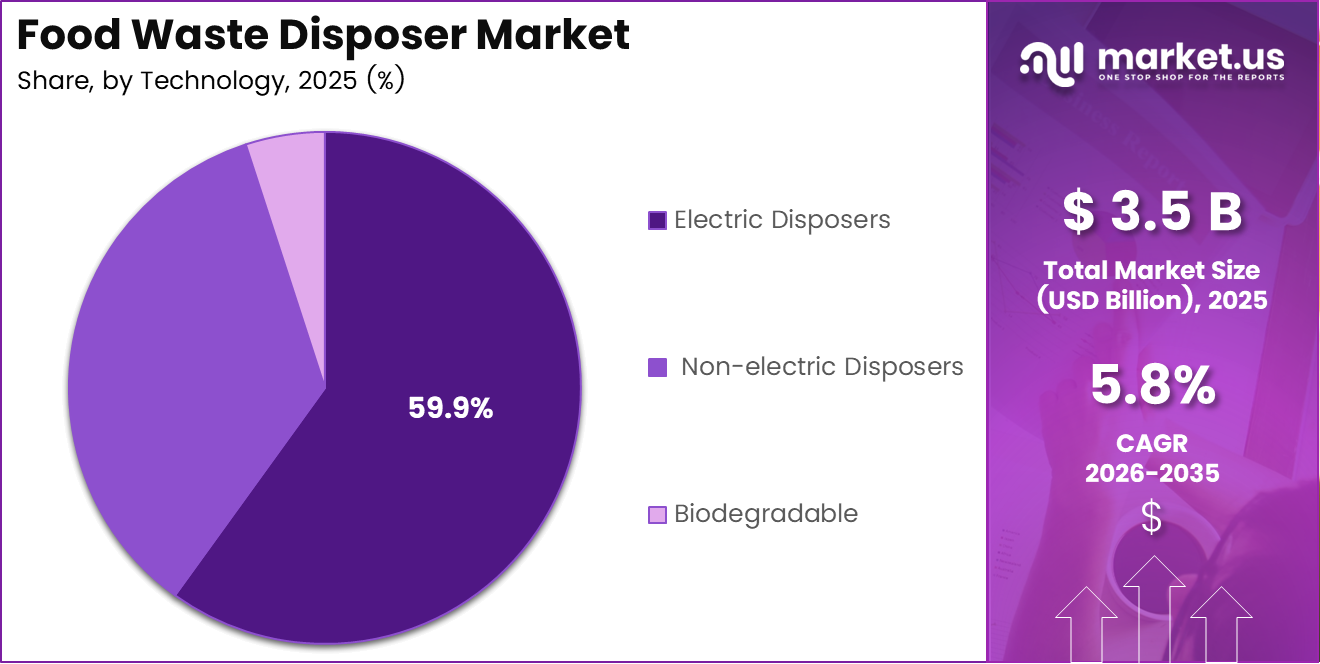

- Electric Disposers lead the Technology segment, capturing 59.9% market share

- Residential application holds dominant position with 68.9% market share

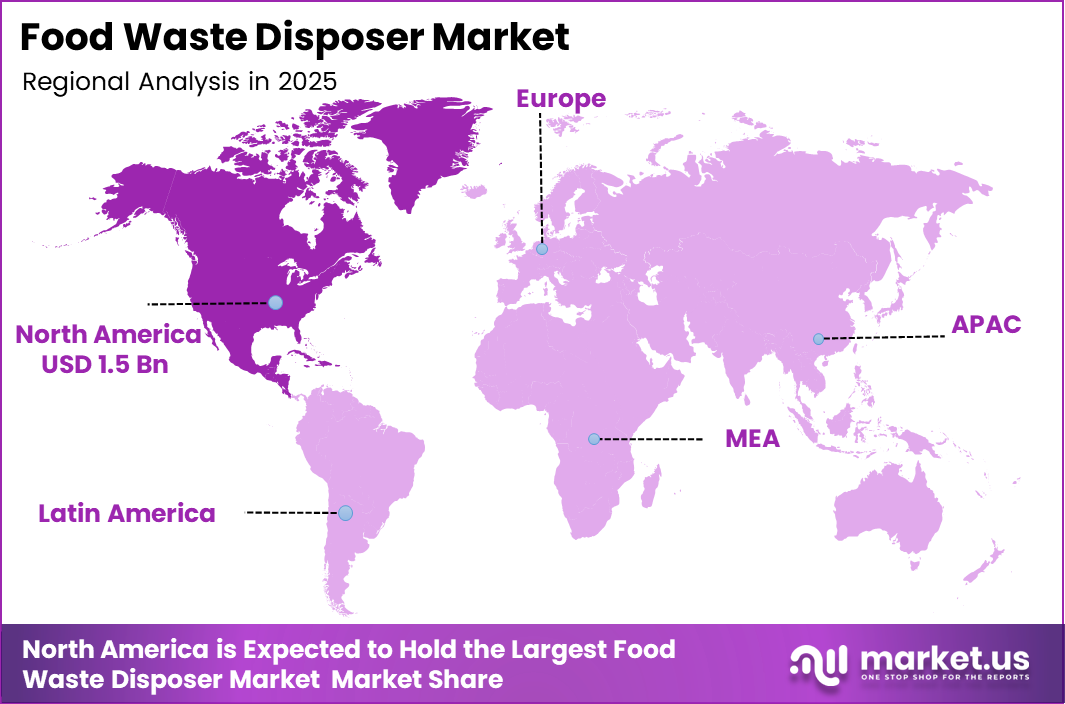

- North America dominates regional market with 45.30% share, valued at USD 1.5 Billion

Type Analysis

Shattered Type Disposers dominate with 48.5% due to superior grinding efficiency and versatile food waste processing capabilities.

In 2025, Shattered Type Disposers held a dominant market position in the Type segment of Food Waste Disposer Market, with a 48.5% share. These units utilize multi-stage grinding mechanisms that effectively pulverize diverse food waste materials. Their robust construction handles fibrous vegetables, bones, and shells efficiently. Consequently, they appeal to households and commercial kitchens requiring reliable, high-performance waste management solutions.

Dry Type Disposers represent an alternative technology focusing on dehydration-based waste reduction. These systems minimize water consumption during operation, appealing to environmentally conscious consumers. They compact organic waste into manageable volumes for composting or disposal. However, their adoption remains limited compared to traditional grinding mechanisms due to higher initial investment requirements and longer processing times.

Grinding Type Disposers employ continuous-feed operation for convenient waste disposal during meal preparation. Users simply activate the unit while running water, feeding waste materials gradually. These models prioritize ease of use and affordability, making them accessible to budget-conscious consumers. Nevertheless, they may struggle with harder materials, requiring careful user attention regarding acceptable waste types.

Technology Analysis

Electric Disposers dominate with 59.9% due to consistent power delivery, ease of installation, and widespread electrical infrastructure availability.

In 2025, Electric Disposers held a dominant market position in the Technology segment of Food Waste Disposer Market, with a 59.9% share. These units connect directly to standard household electrical systems, providing reliable grinding power. Their motor-driven mechanisms ensure consistent performance across various waste types. Additionally, manufacturers continuously enhance energy efficiency, addressing consumer concerns regarding operational costs and environmental impact.

Non-electric Disposers utilize mechanical activation through water pressure or manual operation. These systems eliminate electrical consumption entirely, appealing to sustainability-focused consumers and off-grid applications. They function reliably without motor components, reducing maintenance requirements. However, their processing capacity typically falls below electric alternatives, limiting commercial viability and suitability for high-volume waste generation scenarios.

Biodegradable technology represents emerging solutions incorporating biological decomposition processes. These advanced systems combine mechanical grinding with enzymatic treatment, accelerating organic breakdown. They reduce environmental impact by facilitating rapid composting or safe drainage disposal. Nevertheless, market penetration remains nascent due to higher costs and consumer unfamiliarity with hybrid waste management technologies.

Application Analysis

Residential applications dominate with 68.9% due to widespread household adoption driven by convenience, hygiene benefits, and modern kitchen standards.

In 2025, Residential held a dominant market position in the Application segment of Food Waste Disposer Market, with a 68.9% share. Homeowners increasingly prioritize kitchen convenience and waste management efficiency. Disposers eliminate manual garbage handling, reducing odor and pest attraction. Moreover, modern housing developments integrate these appliances as standard features, normalizing their presence in contemporary kitchens globally.

Commercial applications encompass restaurants, hotels, institutional cafeterias, and foodservice establishments. These high-volume environments generate substantial organic waste requiring efficient disposal solutions. Disposers streamline kitchen operations by minimizing trash accumulation and reducing collection frequency. Furthermore, regulatory compliance regarding waste separation drives commercial adoption, particularly in jurisdictions mandating organic waste diversion from landfills.

Key Market Segments

By Type

- Shattered Type Disposers

- Dry Type Disposers

- Grinding Type Disposers

By Technology

- Electric Disposers

- Non-electric Disposers

- Biodegradable

By Application

- Commercial

- Residential

Drivers

Rising Urban Household Adoption Driven by Convenience-Oriented Kitchen Appliances

Modern consumers increasingly demand time-saving kitchen solutions that simplify daily routines. Food waste disposers eliminate manual waste handling, reducing unpleasant odors and hygiene concerns. Urban households particularly value convenience features that streamline kitchen cleanup processes. Consequently, disposers transition from luxury items to expected amenities in contemporary residential construction.

Regulatory frameworks increasingly mandate organic waste reduction from municipal landfills. Governments implement stricter environmental policies encouraging household-level waste diversion practices. Food waste disposers facilitate compliance by processing organic materials directly through wastewater systems. Therefore, policy-driven adoption accelerates in regions prioritizing sustainable waste management infrastructure development.

Growing consumer awareness regarding kitchen hygiene drives disposer adoption. Traditional waste storage attracts pests and generates offensive odors, particularly in warm climates. Disposers provide immediate waste elimination, maintaining cleaner kitchen environments. Additionally, modern housing infrastructure incorporates compatible plumbing systems, removing installation barriers that previously limited market penetration across diverse residential segments.

Restraints

High Installation and Maintenance Costs Limit Mass-Market Penetration

Initial purchase prices for quality disposer units represent significant household expenditures. Professional installation requirements add substantial costs, particularly in homes lacking compatible plumbing infrastructure. Many budget-conscious consumers prioritize essential appliances over convenience features. Consequently, price sensitivity restricts adoption in middle and lower-income demographic segments globally.

Technical concerns regarding plumbing compatibility create adoption hesitation among potential users. Municipal sewer systems vary significantly in capacity to handle ground organic waste. Older plumbing infrastructure may experience blockages from disposer discharge, requiring costly repairs. Additionally, some regions prohibit disposer installation due to wastewater treatment limitations, creating regulatory barriers that fragment market accessibility.

Maintenance requirements and potential malfunction risks deter some consumers from adoption. Disposer units require periodic cleaning and occasional repair to maintain optimal performance. Component failures necessitate professional service calls, adding long-term ownership costs. Furthermore, improper use causes jams and motor damage, creating negative user experiences that discourage widespread acceptance in markets unfamiliar with proper operation protocols.

Growth Factors

Increasing Demand from Commercial Kitchens and Foodservice Establishments

Commercial foodservice operations generate substantial organic waste volumes requiring efficient management solutions. Restaurants and hotels prioritize disposers for streamlining kitchen workflows and reducing labor costs. These establishments benefit from decreased trash collection frequency and improved sanitation standards. Moreover, corporate sustainability initiatives drive adoption as businesses seek measurable environmental impact reductions.

Manufacturers increasingly focus on developing energy-efficient models with reduced water consumption. Advanced grinding technologies minimize operational costs while maintaining performance standards. Low-water designs address environmental concerns and regulatory requirements in water-scarce regions. Additionally, energy-efficient motors lower electricity consumption, improving total cost of ownership and appealing to environmentally conscious consumers seeking sustainable appliance options.

Emerging economies experiencing rapid urbanization present substantial untapped market potential. Rising middle-class populations adopt Western lifestyle standards, including modern kitchen appliances. Infrastructure development in Asia Pacific and Latin America creates favorable conditions for disposer adoption. Furthermore, increasing disposable incomes enable consumers to invest in convenience-oriented home improvements, expanding addressable market segments beyond traditional developed regions.

Emerging Trends

Digital Transformation Reshapes Market Landscape Through Connected Kitchen Solutions

Manufacturers integrate smart connectivity features enabling remote monitoring and diagnostic capabilities. Internet-of-Things enabled disposers communicate maintenance needs and operational status to users. Smart home ecosystem compatibility attracts tech-savvy consumers seeking integrated kitchen management solutions. Additionally, voice-activated controls through virtual assistants enhance user convenience, positioning disposers as components within broader home automation strategies.

Urban apartment living drives demand for compact, noise-reduced disposer designs. Space-constrained kitchens require smaller footprint appliances without sacrificing grinding performance. Advanced sound-dampening technologies address noise concerns in multi-unit residential buildings. Moreover, continuous-feed models suit apartment dwellers seeking convenient operation during meal preparation, making disposers practical for high-density housing environments.

Premium disposer models increasingly incorporate stainless steel grinding components for enhanced durability. Corrosion-resistant materials extend product lifespan, justifying higher initial investment costs. Consumers prioritize long-term reliability over budget alternatives requiring frequent replacement. Furthermore, environmental certifications and eco-labels influence purchasing decisions as sustainability consciousness permeates consumer appliance selection criteria, rewarding manufacturers demonstrating environmental responsibility.

Regional Analysis

North America Dominates the Food Waste Disposer Market with a Market Share of 45.30%, Valued at USD 1.5 Billion

North America maintains market leadership driven by established plumbing infrastructure and favorable regulatory environments. The region exhibits high disposer penetration rates in residential construction, with 45.30% market share valued at USD 1.5 Billion. Environmental regulations encourage organic waste diversion, supporting continued adoption. Moreover, consumer familiarity with disposer technology creates stable demand across residential and commercial segments.

Europe Food Waste Disposer Market Trends

European markets demonstrate growing acceptance despite historical infrastructure concerns. Progressive environmental policies mandate waste reduction, driving commercial and residential adoption. However, regulatory variations across countries create fragmented market conditions. Northern European nations lead adoption rates, while Mediterranean regions exhibit slower uptake due to plumbing compatibility issues and traditional waste management preferences.

Asia Pacific Food Waste Disposer Market Trends

Asia Pacific represents the fastest-growing regional market driven by rapid urbanization and rising incomes. China, Japan, and South Korea demonstrate increasing disposer adoption in modern housing developments. Infrastructure modernization supports installation compatibility in new construction projects. Additionally, growing environmental awareness among urban middle-class populations drives demand for convenient, sustainable waste management solutions.

Latin America Food Waste Disposer Market Trends

Latin American markets exhibit emerging potential as urban development accelerates. Brazil and Mexico lead regional adoption, particularly in premium residential segments. However, price sensitivity and infrastructure limitations constrain mass-market penetration. Increasing middle-class populations and improving plumbing standards create favorable long-term growth conditions for market expansion.

Middle East & Africa Food Waste Disposer Market Trends

Middle East and Africa demonstrate nascent market development concentrated in affluent urban centers. GCC countries exhibit higher adoption rates driven by modern construction standards and Western lifestyle preferences. However, water scarcity concerns limit broader acceptance in arid regions. South African markets show gradual growth as infrastructure development progresses.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Anaheim Manufacturing Co. maintains a prominent position through decades of disposer manufacturing expertise and innovation. The company emphasizes durable construction and reliable grinding performance across residential and commercial product lines. Their extensive distribution networks ensure broad market accessibility throughout North America. Additionally, Anaheim focuses on energy-efficient designs that reduce operational costs while maintaining superior waste processing capabilities.

Emerson Electric Co. leverages its diversified industrial portfolio to deliver advanced disposer technologies. The company integrates smart connectivity features and IoT capabilities into premium product offerings. Their research and development investments prioritize noise reduction and compact designs suitable for modern kitchens. Moreover, Emerson’s global manufacturing footprint enables competitive pricing and rapid market responsiveness across diverse geographical regions.

Franke Management positions itself as a premium kitchen solutions provider with integrated waste management systems. The company emphasizes aesthetic design integration that complements contemporary kitchen environments. Their disposer product lines feature Swiss engineering quality and sophisticated grinding mechanisms. Furthermore, Franke targets high-end residential and commercial segments willing to invest in superior performance and extended product lifespans.

Haier Group Corporation expands its appliance ecosystem through affordable, feature-rich disposer offerings targeting emerging markets. The company leverages manufacturing scale to deliver competitive pricing without compromising essential performance standards. Their distribution networks penetrate rapidly urbanizing regions in Asia Pacific and Latin America. Additionally, Haier develops products specifically addressing regional preferences and infrastructure compatibility requirements.

Key players

- Anaheim Manufacturing Co.

- Emerson Electric Co.

- Franke Management

- Haier Group Corporation

- The Hobart Corporation

- Whirlpool Corporation

- Jas Enterprise

- WasteCare Corporation

- Komptech Americans LLC

- Delitek AS

Recent Developments

- November 2025 – Denali, the nation’s largest food and organic materials recycler, acquired SMART Recycling, a Charleston-based company providing food waste collection and recycling services across South Carolina and North Carolina. This acquisition reinforces Denali’s position as the leading sustainable food recycling solutions provider across the Carolinas.

- August 2025 – LRS, one of the nation’s leading independent waste diversion, recycling, and environmental solutions providers, announced the acquisition of GHW, a locally owned and operated waste company based in Indianapolis. This strategic move expands LRS’s footprint in the Indianapolis market.

Report Scope

Report Features Description Market Value (2025) USD 3.5 Billion Forecast Revenue (2035) USD 6.2 Billion CAGR (2026-2035) 5.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (Shattered Type Disposers, Dry Type Disposers, Grinding Type Disposers), Technology (Electric Disposers, Non-electric Disposers, Biodegradable), Application (Commercial, Residential) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Anaheim Manufacturing Co., Emerson Electric Co., Franke Management, Haier Group Corporation, The Hobart Corporation, Whirlpool Corporation, Jas Enterprise, WasteCare Corporation, Komptech Americans LLC, Delitek AS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anaheim Manufacturing Co.

- Emerson Electric Co.

- Franke Management

- Haier Group Corporation

- The Hobart Corporation

- Whirlpool Corporation

- Jas Enterprise

- WasteCare Corporation

- Komptech Americans LLC

- Delitek AS